Introduction

This report provides a detailed description of five of the six educational assistance programs (GI Bills®)1 that are currently available to veterans or other eligible individuals through the U.S. Department of Veterans Affairs (VA). The GI Bills provide financial assistance while enrolled in approved programs of education or training programs to individuals whose eligibility is based on a qualifying individual's service in the uniformed services. The sixth program, which is the most recently enacted, is the Post-9/11 GI Bill (Title 38 U.S.C., Chapter 33). It is described in CRS Report R42755, The Post-9/11 Veterans' Educational Assistance Act of 2008 (Post-9/11 GI Bill): A Primer. Congress regularly considers potential operational and benefit improvements for these programs and enacts legislation accordingly.

Over the decades since 1944, during which the GI Bill programs have been in existence, two themes have been emphasized. The benefits promote development of work-related skills to facilitate entry or re-entry into the civilian workforce, and the base benefit is equitable regardless of rank or military occupation specialty. All of the educational assistance programs administered by the VA require some period of military service before benefits can be received. The most salient ongoing discussions have been related to how much eligible individuals should contribute to their education in time or money, which types of service warrant a benefit, and how liberal (i.e., valuable) the benefit should be.

All of the benefit programs provide eligible persons an entitlement to educational assistance. This entitlement, usually 36 months, is measured in months and days. A dollar value is also associated with each month and day of entitlement. Educational assistance payments reduce the entitlement period based on the training period for which the payment was made or in proportion to the dollar value associated with each month and day of entitlement. In general, once the entitlement is exhausted eligible persons continue receiving educational assistance through the end of the academic term if more than halfway through, or for up to a 12-week period if not on an academic term schedule. The entitlement period is not reduced if an individual is called to active duty and if, as a result, the individual must discontinue studies and fails to receive credit or training time.2 Entitlement is restored for an incomplete course or program

- for which the individual is unable to receive credit or lost training time as a result of an educational institution closing;

- for a course or program if a necessary course is disapproved by a subsequently established or modified policy, regulation, or law; and

- for the interim (through the end of the academic term but no more than 120 days) housing allowance paid following either a closure or disapproval.3

This report describes the five GI Bills enacted prior to 2008 and related veterans' educational assistance programs. It is organized into five sections. The first section provides an explanation of the rationale and impetus behind veterans' educational assistance programs. The second section describes the eligibility requirements and benefits of the GI Bills. The GI Bills are discussed in descending order based on the number of current participants. The third section reviews the linkages and commonalities between the programs. A summary of selected characteristics of the various programs is presented in Table 2. The fourth section provides a brief overview of related VA programs. The final section provides information on participation and expenditures for the programs. A detailed look at earlier GI Bills that are no longer available to participants and the lessons learned is available in the appendices.

History of the Programs

Since the Revolutionary War, the United States has provided benefits to injured or disabled war veterans; however for much of this period, benefits were not provided to the same extent to able-bodied veterans. Prior to World War II (WWII), "poor, jobless, and disgruntled veterans … had led to unrest and fear of revolt throughout American history." In 1932, after World War I, the military was called in to forcibly remove 20,000 still unemployed and often homeless veterans and burn their encampment near the Capitol and White House.4

In early U.S. history, military service was thought of as "a fundamental obligation of [male] citizenship."5 Because the 16.1 million personnel6 who served in the U.S. Armed Forces7 during WWII accounted for over one-third of the 41.1 million8 working-age males (between 20 and 64 years of age) in 1947, the consequences of mass unemployment were feared. Before the end of WWII, Congress and the American Legion9 worked together to pass the original GI Bill, or Serviceman's Readjustment Act of 1944 (P.L. 78-346).10 The act provided a full range of resources to veterans including the construction of additional hospitals; educational assistance to non-disabled veterans; home, business, and farm loans; job counseling and employment placement services; and an unemployment benefit.

The original GI Bill was generally considered successful in averting unemployment, raising the educational level and thus the productivity of the U.S. workforce, and confirming the value that Americans place on those that provide military service.11 Subsequent GI Bills providing educational assistance have been passed (Table 1).12

|

Year Enacted |

Common Name |

Establishing Legislation |

U.S. Code |

Currently Paying Benefits |

|

1944 |

Original GI Billa |

Serviceman's Readjustment Act of 1944 |

Title 38, Chapter 12 |

No |

|

1952 |

Korean Conflict GI Billa |

Veterans' Readjustment Assistance Act of 1952 |

Title 38, Chapter 33 (repealed in 1966) |

No |

|

1956 |

DEA (Survivors' and Dependents Educational Assistance)b |

War Orphans' Educational Assistance Act of 1956 |

Title 38, Chapter 35 |

Yes |

|

1966 |

Post-Korean Conflict and Vietnam Era GI Billa |

Veterans Readjustment Benefits Act of 1966 |

Title 38, Chapter 34 |

No |

|

1974 |

Veterans and Dependents Education Loan Programa |

Veterans' Readjustment Assistance Act of 1974 |

Title 38, Chapter 36 (repealed in 1981) |

No |

|

1976 |

VEAP (Post-Vietnam Era Veterans Educational Assistance)b |

Veterans' Education and Employment Assistance Act of 1976 |

Title 38, Chapter 32 |

Yes |

|

1981 |

Educational Assistance Test Program (§901)c |

Department of Defense Authorization Act, 1981 |

Title 10, Chapter 106A |

Yes |

|

1981 |

Educational Assistance Pilot Program (§903)d |

Department of Defense Authorization Act, 1981 |

Title 10 U.S.C. §2141 note |

No |

|

1983 |

Veterans' Job Training Acte |

Emergency Veterans' Job Training Act of 1983 |

Title 29 U.S.C. §1721 note (repealed in 2000) |

No |

|

1985 |

MGIB-AD (Montgomery GI Bill-Active Duty)b |

Department of Defense Authorization Act, 1985 |

Title 38, Chapter 30 |

Yes |

|

1985 |

MGIB-SR (Montgomery GI Bill-Selected Reserve)b |

Department of Defense Authorization Act, 1985 |

Title 10, Chapter 1606 |

Yes |

|

1990 |

Refunds for Certain Service Academy Graduatesf |

Department of Veterans Affairs Nurse Pay Act of 1990, §207 |

Title 38 U.S.C. §1622 note |

No |

|

1992 |

Service Members Occupational Conversion and Training Act of 1992 (SMOCTA)g |

National Defense Authorization Act for Fiscal Year 1993 (P.L. 102-484) |

Title 10 U.S.C. §1143 note |

No |

|

2005 |

REAP (Reserves Educational Assistance Program)b |

Ronald W. Reagan National Defense Authorization Act for FY2005, §527 |

Title 10, Chapter 1607 |

Yes |

|

2008 |

Post-9/11 GI Bill |

Post-9/11 Veterans Educational Assistance Act of 2008 |

Title 38, Chapter 33 |

Yes |

|

2011 |

Veterans Retraining Assistance Program (VRAP)h |

Title II-A of P.L. 112-56, the VOW to Hire Heroes Act of 2011 |

Title 38 U.S.C. §4100 note |

No |

Source: Prepared by CRS based on a review of the legislation enacted through 2016.

a. See Appendix B for a full program description.

b. For a program description, see the entitled report section.

c. Section 901 of the Department of Defense Authorization Act, 1981 (P.L. 96-342) authorized the Department of Defense to test the feasibility and effectiveness to recruitment and retention of a noncontributory educational assistance program, the Educational Assistance Test Program. The program was only eligible to individuals who enlisted or reenlisted for service on active duty after September 30, 1980, and before October 1, 1981. Certain individuals were permitted to transfer their entitlement to their spouses or children. The program is funded by DOD, but paid through the VA.

d. Section 903 of the Department of Defense Authorization Act, 1981 (P.L. 96-342) authorized the Educational Assistance Pilot Program - Noncontributory VEAP to test the feasibility and effectiveness to recruitment and retention of offering the VEAP program without requiring a monetary contribution from servicemembers. The program was only eligible to individuals who enlisted or reenlisted in the Armed Forces after September 30, 1980, and before October 1, 1981. Certain individuals were permitted to transfer their entitlement to their spouses or children. The program is funded by DOD, but paid through the VA.

e. The Emergency Veterans' Job Training Act of 1983 (P.L. 98-77) was enacted "to address the problem of severe and continuing unemployment among veterans." Unemployed Korean Conflict and Vietnam Era veterans were eligible for up to 15 months of assistance while training for high growth, high demand, or high technology occupations on or after October 1, 1983, and for programs beginning before April 1, 1990. The program paid to employers offering job training programs 50% of the veterans' wages, up to $10,000.

f. Section 207 of the Department of Veterans Affairs Nurse Pay Act of 1990 (P.L. 101-366) provided a one-year period during which eligible pre-1979 service academy graduates and Senior Reserve Officers' Training Corps completers could make an irrevocable election to disenroll from VEAP and receive the amount of educational assistance benefits the individual would have received under the Post-Korean Conflict and Vietnam Era GI Bill.

g. SMOCTA was enacted to facilitate the drawdown of the Armed Forces by providing eligible individuals not less than 6 months or more than 18 months of job training in a field of employment providing a reasonable probability of stable, long-term employment. Eligible individuals were discharged on or after August 2, 1990, and were unemployed, had an occupational specialty that did not readily transfer to the civilian workforce, or were entitled to veterans' disability compensation. The program paid to employers offering job training programs 50% of the veterans' wages, up to $12,000, and up to $500 for tools and other work-related materials. Assistance was available beginning in December 1992, and for programs beginning before October 1, 1995.

h. VRAP was created to provide employment-related training for older unemployed veterans who were no longer eligible for the GI Bill. It provided up to 12 months of training benefits to unemployed veterans who were not eligible for other VA education programs and were between the ages of 35 and 60. VRAP benefits were limited to training at community colleges or technical schools in occupations that the Department of Labor (DOL) had identified as "high demand." Monthly benefit levels were limited to the maximum amounts under the MGIB-AD program. VRAP was limited to 45,000 participants from July 1, 2012, to September 30, 2012, and 54,000 participants from October 1, 2012, to March 31, 2014.

The Korean Conflict GI Bill was enacted under the Veterans' Readjustment Assistance Act of 1952 (P.L. 82-550) and codified in Title 38, U.S.C., Chapter 33. The purpose of the program was to prepare returning veterans to enter the workforce.

In 1956, the War Orphans' Educational Assistance Act of 1956 (P.L. 84-634) was passed to provide educational assistance to the children of servicemembers who died as a result of injury or disability incurred in the line of duty. This program was later expanded to include spouses and children of servicemembers who died, became permanently or totally disabled, were missing-in-action, were captured, or were hospitalized as a result of service.

The Post-Korean Conflict and Vietnam Era GI Bill was enacted under the Veterans Readjustment Benefits Act of 1966 (P.L. 89-358) and codified in Title 38, U.S.C., Chapter 34. In addition to providing benefits to veterans, it provided benefits to active duty servicemembers to encourage retention in the Armed Forces. The Veterans' Readjustment Assistance Act of 1974 (P.L. 93-508) created a short-lived veterans and dependents education loan program to cover educational costs not provided for under the GI Bill. It was codified in Title 38, U.S.C., Chapter 36 before being repealed in 1981.

Beginning with the Korean Conflict GI Bill, there has been much debate on the level of educational assistance that should be provided to veterans and servicemembers. Some believed that requiring individuals to make a monetary contribution in addition to their military service would increase their sense of responsibility and purpose. Some believed that the educational assistance benefits were a necessary compensation for compulsory service or reimbursement for voluntary service. Some believed that high levels of assistance promote attrition from the military. And some believed that the benefits are a necessary recruitment tool.

Congress allowed the compulsory military draft to expire on June 30, 1973. The educational assistance programs enacted subsequently were designed to encourage recruitment and retention of high-quality military personnel while still providing a considerable benefit to those who choose to leave active duty military service. Since 1973 upon initial enactment of new GI Bills, Congress has generally limited the approved programs of education to a more traditional college education. As the programs mature, other types of education and training such as apprenticeships and flight training are added.

Currently, there are several educational assistance programs available to veterans, servicemembers, and their spouses and children. The oldest of these programs for veterans and servicemembers is the Post-Vietnam Era GI Bill, enacted in 1976. Fewer than 10 individuals are still receiving benefits from this program, which provides educational assistance in direct proportion to contributions deducted from servicemembers' pay while on active duty.13 The Montgomery GI Bill-Active Duty (MGIB-AD) requires most servicemembers to contribute an established amount, although the eventual benefits are not related to the contribution. The Montgomery GI Bill-Selected Reserve (MGIB-SR) only provides educational assistance to those currently serving in the Selected Reserve.14 Because reliance on the Reserves and National Guard increased after September 11, 2001, the Reserves Educational Assistance Program (REAP), enacted in 2005, allows reservists to receive an increased educational assistance benefit in comparison to the MGIB-SR after serving on active duty.15 The Survivors' and Dependents' Educational Assistance (DEA) program, previously War Orphans' Educational Assistance, provides benefits to the spouses and children of servicemembers who, as a result of service, are seriously disabled, die, or are detained. Finally in comparison to the MGIB-AD, the Post-9/11 GI Bill increased the educational assistance benefit for all individuals with active duty service after September 10, 2001, in recognition that the United States has not been at peace since 2001.

The following sections describe the active programs in greater detail, in descending order based on the number of current participants. A description of the inactive programs is provided in the appendices.

Survivors' and Dependents' Educational Assistance Program (DEA)

The Survivors' and Dependents' Educational Assistance Program (DEA) was first established by the War Orphans' Educational Assistance Act of 1956 (P.L. 84-634). The DEA program is codified under Title 38 U.S.C., Chapter 35. The benefit allows eligible individuals to attain the education they would have or maintain the standard of living they would have if the servicemember had not become disabled or delayed,16 or died as a result of military service.

Eligible Individuals

Educational assistance benefits are available to

- the children and surviving spouse of a veteran who died of a service-connected disability;

- the children of a veteran who died while having a disability evaluated as a total permanent disability resulting from a service-connected disability;17

- the children and spouse of a veteran or servicemember who has a total permanent disability resulting from a service-connected disability;18

- the children and spouse of an active duty servicemember who is, and has been for more than 90 days, listed as missing in action, captured in the line of duty by a hostile force, or forcibly detained or interned in the line of duty by a foreign government or power; and

- the surviving spouse of a veteran who died while having a disability evaluated as a total permanent disability resulting from a service-connected disability, arising out of active military, naval, or air service.

Children must be under the age of 26 at the time of the above eligibility event. The military service of the person who was disabled or delayed, or died must not have terminated under dishonorable conditions. Children include acknowledged children born out of wedlock, children adopted legally, stepchildren who are members of the eligible individual's household, and children of any marital status. Neither the spouse nor child may receive educational assistance under DEA while in the Armed Forces or if released under dishonorable conditions.

An individual who is eligible for both the Post-9/11 GI Bill Marine Gunnery Sergeant John David Fry Scholarship (Fry Scholarship) and DEA benefits based on the death of the one parent must elect the program from which to receive a benefit. The Fry Scholarship is available to the children of individuals who, on or after September 11, 2001, die in the line of duty while serving on active duty as a member of the Armed Forces.19

Eligible Programs of Education, Institutions, and Establishments

The eligible programs of education include a wide variety of types of education and training. The programs include

- courses at nonaccredited and accredited educational institutions (see below for the definition) that lead to an educational, vocational, or professional objective, including a certificate or graduate degree;

- a preparatory course for a test that is required or used for admission to an institution of higher education or a graduate school;20

- licensing or certification tests for a predetermined vocation or profession, provided such tests and the licensing or credentialing organizations or entities that offer such tests are approved;

- national tests for admission to institutions of higher learning (IHLs) or graduate schools (such as the Scholastic Aptitude Test (SAT));21

- national tests providing an opportunity for course credit at IHLs (such as the Advanced Placement (AP) exam);

- cooperative programs;22

- apprenticeship or other on-the-job training programs at a training establishment (see below for the definition);

- secondary education for those without a high school diploma or its equivalent or in preparation for postsecondary education;

- specialized vocational courses required because of a mental or physical handicap; and

- special restorative training.23

The eligible programs of education must be approved by a state approving agency (SAA) or the VA.24

Educational institutions are defined as

- public or private elementary or secondary schools;

- vocational, correspondence,25 business, normal, or professional schools;

- colleges or universities;

- scientific or technical institutions;

- other institutions offering education for adults;

- state-approved alternative teacher certification program providers;

- private entities that offer courses toward the attainment of a license or certificate generally recognized as necessary for a profession or vocation in a high technology occupation; and

- qualified providers of entrepreneurship courses.

A training establishment is defined as

- an establishment providing apprentice or other on-the-job training;

- an establishment providing self-employment on-the-job training consisting of full-time training for a period of less than six months that is needed or accepted for purposes of obtaining licensure to engage in a self-employment occupation or required for ownership and operation of a franchise that is the objective of the training;

- a state board of vocational education;

- a federal or state apprenticeship registration agency;

- the sponsor of a program of apprenticeship; and

- an agency of the federal government authorized to supervise such training.

Benefit Payments

Most DEA participants receive a monthly allowance. Special assistance is available to educationally disadvantaged individuals. Additional payments are available for tutorial assistance and qualified tests.

For those children and spouses who may also be eligible for a VA-administered pension,26 compensation,27 or dependency and indemnity compensation,28 legislation bars some recipients from accepting DEA and pension, compensation, or dependency and indemnity compensation. A spouse, a child under 18 years of age, and a helpless child may receive DEA and pension, compensation, or dependency and indemnity compensation concurrently. Once a child over 18 years of age begins receiving DEA, the child can no longer receive payment or increased rates, or additional amounts of pension, compensation, or dependency and indemnity compensation based on school attendance.29

Monthly Allowance

A monthly allowance for subsistence, tuition and fees, supplies, books, and equipment is paid directly to recipients. Maximum monthly benefit amounts may be adjusted at any time by Congress and are adjusted annually according to the consumer price index (all items, U.S. city average). For FY2018, individuals receive up to $1,041.00 monthly for full-time institutional enrollment and reduced amounts for three-quarter-time and half-time institutional enrollment. For FY2019, the maximum for full-time institutional enrollment is $1,224.30 Individuals enrolled less than half-time at an institution receive no more than actual tuition and fees. For individuals in apprenticeship or on-the-job training, the FY2018 monthly allowance is $760.00, $571.00, $375.00, and $191.00 for the first six months, second six months, third six months, and thereafter, respectively.31 Individuals receive up to $837.00 monthly for farm cooperative training in FY2018 and reduced amounts for three-quarter-time and half-time pursuit. Only spouses may pursue education exclusively by correspondence, and they receive 55% of the institution's established charges for completed courses.32

Participants may choose to receive the monthly allowance in the form of an advance payment or accelerated payment if they meet the following requirements:

Advance Payments

An advance payment is the first partial and first full month of the monthly allowance and is available to individuals who are planning to enroll more than half-time and who have not received educational assistance benefits in 30 days or more. Advance payments are sent to the educational institution for disbursal to the student within 30 days of the start of the academic term.

Accelerated Payments

An accelerated payment of the monthly allowance is available for education leading to employment in a high-technology occupation in a high-technology industry. If the costs of the program of education are more than double the monthly assistance allowance to which the individual would have been entitled, the individual may receive the lessor of 60% of the program's costs for the term or the individual's remaining dollars of entitlement. The individual's entitlement period is reduced in proportion to the amount that the payment is to the monthly assistance allowance to which the individual would have been entitled.

Special Assistance to the Educationally Disadvantaged

Special assistance to the educationally disadvantaged allows individuals who do not have a high school diploma or its equivalent and who are in need of some secondary school preparation in order to pursue a postsecondary education to receive a monthly educational assistance allowance. Benefits do not reduce the basic entitlement period for the first five months. Individuals pursuing a high school diploma may receive the lesser of actual tuition and fees or the full-time institutional monthly rate.

Special Restorative Training

Special restorative training is available to overcome, or reduce, the effects of a manifest physical or mental disability which would handicap a person (other than the spouse of a person delayed) in the pursuit of a program of education. The entitlement period may be extended to accomplish the special restorative training. For FY2018, individuals receive $1,041.00 monthly for full-time33 special restorative training and may receive an additional amount equal to the amount that the tuition and fees charges calculated on a monthly basis exceed $322.34

Tutorial Assistance

An individual is entitled to payment for tutorial assistance, not to exceed $100 monthly and up to a maximum of $1,200 over the course of the entitlement period. The individual must be enrolled at least half-time, and the educational institution must certify as to the necessity and customary nature of the cost. Entitlement is not charged for tutorial assistance under DEA.

Licensing and Certification Test Fees

A fee of up to $2,000 may be reimbursed for each approved licensing or certification test as long as the payment does not exceed the individual's remaining DEA entitlement. The benefit is available regardless of whether the individual passes the test. An individual's entitlement period is reduced one month for each amount paid that is equal to the monthly benefit otherwise payable to such individual.

National Admissions and Course Credit Tests

An individual may receive reimbursement for a national test for admissions to an IHL and a national test providing an opportunity for course credit at an IHL. An individual's entitlement period is reduced one month for each amount paid that is equal to the monthly benefit otherwise payable to such individual.

Benefit Availability and Duration

The number of full-time months (or the equivalent in part-time attendance) of educational and training benefits to which an individual is entitled is limited to

- 45 months if the individual first enrolls using DEA before August 1, 2018; and

- 36 months if the individual first enrolls using DEA on or after August 1, 2018.35

The time period during which individuals may use their entitlement differs depending on their eligibility. Educational benefits may be paid to the spouse for 10 years from the date of eligibility or from the date of VA notification of eligibility.36 If the servicemember dies on active duty, or total permanent disability as a result of a service-connected disability is determined within three years of discharge, the spouse may use the benefits for 20 years. Generally, educational benefits may be paid to children after they achieve a high school diploma or its equivalent, or after they reach 18 years of age, but before they reach 26 years of age.37 Special restorative or specialized vocational training may begin if the child is at least 14 years of age.

Montgomery GI Bill—Selected Reserve (MGIB-SR)

The Montgomery GI Bill-Selected Reserve38 (MGIB-SR), passed under Section 705 of the same legislation as the MGIB-AD, is a Title 10 U.S.C. DOD program administered by the VA.39 Each service component of the Selected Reserve is required to establish an educational assistance program to encourage membership in the Selected Reserve: Army, Navy, Air Force, Marine Corps, and Coast Guard Reserve; Army National Guard; and the Air National Guard. The benefit is an incentive to stay in the Reserves and was established in recognition of the fact that many states offer educational assistance to reservists.40

Eligible Individuals

The MGIB-SR program is available to individuals serving in the Selected Reserve, including the National Guard, who agree to a six-year service obligation. Educational assistance benefits are available to Selected Reservists who enlist, re-enlist, or extend an enlistment for six years after June 30, 1985, and reserve officers who agree to serve an additional six years above any existing obligation.41 The reservists also have to complete the initial active duty training period, have a high school diploma or its equivalent, and satisfactorily meet the necessary training requirements of the Selected Reserve. Individuals who fail to satisfactorily meet the training requirements of the Selected Reserve may be ordered to active duty or required to repay some or all of the educational assistance including interest. The service requirement excludes full-time active duty or full-time National Guard duty for the purpose of organizing, administering, recruiting, instructing, or training the reserve components in a position which is included in the end strength.42

Eligible Programs of Education, Institutions, and Establishments

MGIB-SR benefits can be used to support students pursuing approved programs of education at a variety of training establishments and educational institutions, including institutions of higher learning (IHLs). The eligible programs of education are43

- courses at nonaccredited and accredited educational institutions that lead to an educational, vocational, or professional objective, including a certificate or graduate degree;

- courses required by the Administrator of the Small Business Administration as a condition for obtaining financial assistance under the provisions of Section 7(i)(1) of the Small Business Act (15 U.S.C. 636(i)(1));

- licensing or certification tests for a predetermined vocation or profession, provided such tests and the licensing or credentialing organizations or entities that offer such tests are approved;

- courses offered by a qualified provider of entrepreneurship courses;

- national tests for admission to IHLs or graduate schools (such as the Scholastic Aptitude Test (SAT));

- national tests providing an opportunity for course credit at IHLs (such as the Advanced Placement (AP) exam);

- national tests that provide an opportunity for course credit at an IHL by evaluating prior learning and knowledge;44

- a preparatory course for a test that is required or used for admission to an institution of higher education or a graduate school;

- full-time programs of apprentice or other on-the-job training at a training establishment, for individuals not on active duty;

- cooperative programs45 for individuals not on active duty;

- a refresher, remedial, or deficiency course;46

- preparatory or special education or training courses necessary to enable the individual to pursue another approved program of education; and

- a course for which the individual is receiving Tuition Assistance from DOD (see "Tuition Assistance "Top-Up" Program").47

Benefit Payments

Most MGIB-SR participants receive a monthly allowance. Additional payments are available for certain purposes, and the monthly allowance may be increased under certain circumstances (see Table 2).

Monthly Allowance

Effective October 1, 2017, reservists receive up to $375.00 monthly for full-time enrollment and a reduced amount for three-quarter-time, half-time, and less-than-half-time enrollment. Maximum monthly benefit amounts may be adjusted at any time by Congress and are adjusted annually according to the consumer price index for all urban consumers (CPI-U). Individuals enrolled less-than-half-time who are also eligible for DOD tuition assistance cannot receive MGIB-SR benefits. For an individual in apprenticeship or on-the-job training, the monthly allowance is 75%, 55%, and 35% of the monthly benefit otherwise payable to that individual for the first six months, second six months, and thereafter, respectively.48 Individuals pursuing education exclusively by correspondence receive 55% of the institution's established charges for completed courses, and individuals pursuing education consisting exclusively of flight training receive 60% of the institution's established charges for completed courses.49 MGIB-SR participants, like DEA participants, may choose to receive the monthly allowance in the form of an advance payment or accelerated payment.

Tuition Assistance "Top-Up" Program

The Tuition Assistance "Top-Up" program was established under the Floyd D. Spence National Defense Authorization Act for Fiscal Year 2001 (P.L. 106-398) to promote retention. Through Tuition Assistance (TA) programs, military service branches may pay a certain amount of tuition and expenses for the off-duty education and training of active duty personnel. Under Tuition Assistance Top-Up, MGIB-SR servicemembers who have served for at least two years on active duty and who are approved for TA benefits may elect to receive MGIB-SR benefits to pay for tuition or expenses charges above the amount paid by their military service branch. Top-Up is limited to 36 months of payments. Use of the Top-Up benefit reduces the individuals' MGIB-SR entitlement period at a rate determined by dividing the amount of the Top-Up payment by the individuals' full-time monthly rate.

Tutorial Assistance

An individual is entitled to payment for tutorial assistance, not to exceed $100 monthly and up to a maximum of $1,200 over the course of the entitlement period. The individual must be enrolled at least half-time, and the educational institution must certify as to the necessity and customary nature of the cost. Unlike DEA, the first $600 does not reduce the entitlement period; however, any amount in excess of $600 reduces the individual's entitlement period by one month for each amount paid that is equal to the amount of monthly educational assistance the individual is otherwise eligible to receive for full-time pursuit of a residence course.

Licensing and Certification Test Fees

A fee of up to $2,000 may be reimbursed for each approved licensing or certification test as long as the payment does not exceed the individual's remaining MGIB-SR entitlement. The benefit is available regardless of whether the individual passes the test. An individual's entitlement period is reduced one month for each amount paid that is equal to the monthly benefit otherwise payable to such individual.

National Admissions and Course Credit Tests

Individuals may receive reimbursement for a national test for admission to an IHL, a national test providing an opportunity for course credit at an IHL, and a national test that evaluates prior learning and knowledge and provides an opportunity for course credit at an IHL.50 An individual's entitlement period is reduced one month for each amount paid that is equal to the monthly benefit otherwise payable to such individual.

Supplemental Assistance

Military service branches may use supplemental assistance for additional years of service and supplemental assistance for critical skills (Kickers) to recruit and retain highly capable individuals in the Armed Forces. The promised and expected benefit amount is deposited into the DOD Educational Benefits Trust Fund until the individuals take advantage of the benefit, at which time the benefit amount is transferred to the VA for payment.51 The supplemental assistance, up to $350, is added to the individuals' monthly housing allowance. The amount may be reduced in proportion to the enrollment rate and the type of training.

Supplemental assistance for additional years of service may be offered to either an individual in the active component who agrees to remain on active duty for at least five additional continuous years, or to an individual in the Selected Reserve who agrees to serve at least two additional consecutive years on active duty and at least four additional consecutive years in the Selected Reserve.52 Supplemental assistance for critical skills may be offered either to recruit an enlistee with critical skills into the regular Armed Forces or to gain agreement from an individual with critical skills to serve in the Selected Reserve after separating honorably from the regular Armed Forces. A critical skill is a skill or specialty in which there is a critical shortage or for which it is difficult to recruit or, in the case of critical units, retain personnel.

Benefit Availability and Duration

Because the obligatory service of six years is the same for all reservists, the duration of benefits under MGIB-SR is the same for all reservists—36 months (or the equivalent for part-time educational assistance).

In general, no educational benefits can be paid

- for individuals whose entitlement was established from October 1, 1992, to June 29, 2008, the earlier of 14 years after establishing eligibility or separation from the Selected Reserve; or

- for individuals whose entitlement was established after June 29, 2008, after separation from the Selected Reserve.

There are several exceptions to the availability period. Educational assistance may be extended beyond separation if the individual is prevented from pursuing a program of education for involuntary reasons such as being called to qualifying active duty service or being involuntarily separated for a disability that was not the result of the individual's own willful misconduct. If the availability period ends in the middle of an academic term or course, the availability period may be extended to allow completion of the term or course.

Transferability to Dependents

Each DOD service branch is authorized to allow eligible individuals to transfer their MGIB-SR educational assistance benefits to family members, but no branch currently offers such a program.

Montgomery GI Bill—Active Duty (MGIB-AD)

House hearings examining the possible need for a new GI Bill in the early 1980s focused on the difficulties the military was experiencing in recruiting and retaining a highly qualified all-volunteer force: active duty, Reserves, and National Guard.53 Although recruiting problems were not uniformly distributed by branch, rank, grade, or military occupational specialty (MOS), some suggested reinstating the draft. DOD was concerned about the high cost of recruiting and training new servicemembers and the loss of experience and expertise when servicemembers leave the service. Some witnesses argued for the elimination of the servicemember's monetary contribution toward educational benefits because retention rates were not appreciably increased by the prior GI Bill, the Post-Vietnam Era Veterans' Educational Assistance Program (VEAP), which required a contribution from servicemembers. Only 20%-25% of new recruits contributed to VEAP, and 40% had disenrolled from the program to recoup their contribution, which equaled 5% to 20% of the after-tax pay for some enlisted members. Despite a strong desire to increase retention by allowing universal transfer of dollars of entitlement and the entitlement period to spouses and children after 10 years of service, such a proposal was deemed too expensive.54

The Montgomery GI Bill-Active Duty (MGIB-AD)—originally called the All-Volunteer Force Educational Assistance Program—was initially enacted as Title VII of the Department of Defense Authorization Act, 1985 (P.L. 98-525), as a three-year pilot program.55 The program was finally codified in Title 38, U.S.C., Chapter 30. The original purpose of the permanent program was to provide educational readjustment assistance and to aid in the recruitment and retention of highly qualified personnel for both the active and reserve components of the Armed Forces. It was also expected to promote and assist the All-Volunteer Force program and the Total Force Concept of the Armed Forces56 based upon service on active duty or a combination of service on active duty and in the Selected Reserve, including the National Guard. To ensure the recruitment of highly capable individuals who were more likely to stay in the military, the program requires that all individuals complete a high school diploma, its equivalent, or 12 credit hours of postsecondary education in order to be eligible for benefits.57

Eligible Individuals

Educational assistance benefits are available to individuals defined in four categories.

- Category 1 individuals entered active-duty for the first time after June 30, 1985, as well as commissioned officers of the Public Health Service (PHS) and the National Oceanic Atmospheric Association (NOAA). Category 1 individuals must meet one of three service requirements. The first requires that individuals serve a minimum of three continuous years on active duty, or two continuous years if the initial obligated period of active duty was less than three years. The second requires that individuals serve a minimum of 30 months on active duty, or 20 months if the initial obligated period of active duty was less than three years, before being discharged with a service-connected disability, hardship, pre-existing condition, certain reductions-in-force, a physical or mental condition that did not result from the individual's own willful misconduct, or for the government's convenience. The third requires that Selected Reservists and National Guard members serve two continuous years of honorable active duty service upon first entry into the military after June 30, 1985, and serve a minimum of four continuous years of service in the Reserves beginning within a year of completing the active duty service. For reservists and National Guard members, the active duty service period includes only duty under Title 10 U.S.C. and certain full-time National Guard duty for the purpose of organizing, administering, recruiting, instructing, or training the National Guard under Title 32 U.S.C. However, individuals who receive an officer's commission after December 31, 1976, following graduation from one of the service academies58 or following graduation as a Reserve Officer Training Corps (ROTC) scholarship recipient are not eligible.59

- Category 2 individuals had a remaining period of entitlement under the Post-Korean Conflict GI Bill (see Appendix C) as of December 31, 1989, and were on active duty after June 30, 1985.60 Category 2 individuals exclude individuals who receive an officer's commission after December 31, 1976, following graduation from one of the service academies or following graduation as a Reserve Officer Training Corps (ROTC) scholarship recipient are not eligible.61

- Category 3 individuals elected MGIB-AD before receiving an involuntary separation, voluntary separation incentive, or special separation benefit.

- Category 4 individuals are VEAP participants who either had a remaining period of entitlement; were on active duty on October 9, 1996; or elected to transfer to the MGIB-AD by October 9, 1997; and made the requisite $1,200 contribution. VEAP participants who served on active duty from October 9, 1996, through April 1, 2000; elected to transfer to the MGIB-AD by October 31, 2001; and made a $2,700 contribution are also in Category 4. A small group of National Guard members who first served on full-time National Guard active duty under Title 32 U.S.C. between June 30, 1985, and November 29, 1989, were eligible to make the requisite $1,200 contribution during an open period from October 9, 1996, to June 8, 1997.

The active duty service period requirements exclude time assigned to an education or training program similar to those offered to civilians unless assigned by the military full-time, exclude time spent as a cadet or midshipman at one of the service academies, and exclude the initial 12-week period of active duty for training in the National Guard and the Reserves. The active duty service period requirements include time spent organizing, administering, recruiting, instructing, or training the National Guard while on full-time Army National Guard or Air National Guard duty and include time spent at a service academy or preparing to attend a service academy if the individual fails and returns to active duty. Individuals in all categories must have completed a high school diploma, its equivalent, or 12 semester hours in a program of education leading to a standard college degree. Also, all individuals must continue on active duty or in the Reserves, as appropriate; be discharged under fully honorable conditions; be placed on the retired or temporary disability retired list; or be transferred to certain reserve components.

To become eligible for MGIB-AD benefits, Category 1 individuals must not decline the benefit in writing, and must allow the first 12 months of their military pay to be reduced by $100 per month.62 In certain circumstances, servicemembers who initially declined the benefit were allowed to enroll in the program.63

Eligible Programs of Education, Institutions, and Establishments

The eligible programs of education, educational institutions, and training establishments are the same as under the MGIB-SR.

Benefit Payments

Most MGIB-AD participants receive a monthly allowance. Additional payments are available depending on decisions made while serving in the Armed Forces and for tutorial assistance, licensing or certification tests, national tests, supplemental assistance, former Post-Korean Conflict GI Bill-eligible participants, and the Buy-Up program (see the MGIB-SR section).

In-State Tuition and Fee Charges

Covered MGIB-AD participants must be charged no more than in-state tuition and fees. Covered participants are members of the Armed Forces on active duty for a period of more than 30 days in the state in which the public institution of higher education is located, and such members' spouses and dependent children.64 In addition, covered participants attending public IHLs are MGIB-AD-eligible veterans who were discharged or released from an active duty service period of not fewer than 90 days within three years of the date of enrollment.65 The public IHL may require the covered participant to demonstrate intent to establish residency, by a means other than physical presence, in order to qualify for in-state tuition. As long as a covered participant remains continuously enrolled at the institution, the participant remains eligible for in-state tuition and fee charges.

Monthly Allowance

The MGIB-AD monthly allowance is intended to support subsistence, tuition and fees, supplies, books, and equipment. Effective October 1, 2017, veterans may receive up to $1,928.00 monthly for full-time training.66 A reduced allowance is provided for less than full-time training and for those who served less than three continuous years on active duty. The monthly allowance is paid directly to recipients. Unless Congress changes the amount, the maximum monthly benefit amount is adjusted annually based on the annual percentage increase in the average cost of undergraduate tuition in the United States, as determined by the National Center for Education Statistics (NCES).67 Individuals on active duty and those training less than half-time receive actual tuition and fees or the monthly allowance, whichever is less. For an individual in apprenticeship or on-the-job training, the monthly allowance is 75%, 55%, and 35% of the monthly benefit otherwise payable to that individual for the first six months, second six months, and thereafter, respectively.68 Individuals in cooperative training receive 80% of the monthly allowance.69 Individuals pursuing education exclusively by correspondence receive 55% of the institution's established charges for completed courses, and individuals pursuing education consisting exclusively of flight training receive 60% of the institution's established charges for completed courses.70 MGIB-AD participants, like DEA participants, may choose to receive the monthly allowance in the form of an advance payment or accelerated payment.

Supplemental Assistance

For MGIB-AD, the supplemental assistance may be no more than $950.

Increase for Post-Korean Conflict GI Bill-Eligible Participants

Category 2 individuals receive an increase to the monthly allowance, depending on the type of training, rate of pursuit, and number of dependents, for as many months as the individual has remaining Post-Korean Conflict GI Bill entitlement. For example, effective October 1, 2017, an individual in full-time institutional training with two dependents may receive a total monthly allowance of $2,183.00.

Buy Up Program

Servicemembers may also contribute up to an additional $600 while on active duty in $20 monthly increments and receive up to an additional $5 monthly for each $20 contributed over the life of their entitlement period under what is known as the $600 Buy Up Program. In other words, each dollar contributed by an individual is matched by the federal government with an additional $9 in benefits. This benefit could equal up to $5,400 over 36 months for a $600 investment.

Benefit Availability and Duration

To discourage experienced personnel from leaving the military, servicemembers are eligible to receive educational benefits while serving on active duty, but only after serving two continuous years on active duty.

For members of the active component, no educational benefits under the MGIB-AD can be paid after the delimiting date─10 years after discharge or release from active duty. For members of the Selected Reserve, no educational benefits under the MGIB-AD can be paid more than 10 years after completing the required four-year Selected Reserve duty.71

Most individuals are entitled to 36 months (or the equivalent in part-time attendance) of educational assistance. Category 1 active duty servicemembers discharged or released (other than for the convenience of the government) before serving the minimum two or three years of active duty service are entitled to educational benefits for a period equal to one month for each month of active duty service, but no more than 36 months. Reservists are entitled to one month for each month of active duty service and one month for each four months served in the Selected Reserves, but no more than 36 months.72

MGIB-AD Death Benefit

The MGIB-AD death benefit is available to certain beneficiaries of an MGIB-AD-eligible individual and to certain beneficiaries of an individual who served after June 30, 1985, and who died for service-connected reasons while on active duty or who died for service-connected reasons within one year of discharge or release from active duty. The beneficiaries are the beneficiaries of the individual's Servicemembers' Group Life Insurance policy. If the life insurance beneficiaries are no longer living, the death benefit is paid to the surviving spouse. If the spouse is no longer living, the death benefit is split between the individual's surviving children. If the children are no longer living, the death benefit is split between the individual's surviving parents. The benefit, up to $1,200, is equal to the amount the servicemember contributed in order to be eligible for the MGIB-AD less the proportion of entitlement used by the servicemember.

Transferability to Dependents

Each DOD service branch is authorized to allow eligible individuals to transfer up to 18 months of their MGIB-AD educational assistance benefits to family members. Both the Army and Air Force offered pilot programs to test how effective transferability could be in increasing the retention of highly qualified, specialized, and experienced servicemembers. Both branches have discontinued the pilots. Therefore, transferability is not currently available to new individuals under the MGIB-AD.

Reserve Educational Assistance Program (REAP)

The Reserve Educational Assistance Program (REAP) was enacted by Section 527 of the Ronald W. Reagan National Defense Authorization Act for FY2005 (P.L. 108-375). The National Defense Authorization Act for Fiscal Year 2016 (P.L. 114-92) effectively ends REAP on November 25, 2019. It is codified in Title 10 U.S.C., Chapter 1607.73 Passage of the program was a direct reaction to the increased number and length of calls to active duty of reservists that occurred as a result of operations in Afghanistan and Iraq. Reservists must serve at least two continuous years on active duty to receive the MGIB-AD, and the benefits under the MGIB-SR are lower than under the MGIB-AD. REAP sought to provide reservists with benefits proportional to their active duty service and commensurate with the benefits of the regular Armed Forces.

The purpose is to provide educational assistance to reserve components called to active duty in response to a declared call to war or national emergency. REAP, like the MGIB-SR, is a DOD program administered by the VA. Each DOD branch is required to establish and maintain a program. The program is permanently authorized.

Eligible Individuals

Educational assistance benefits are available to reservists who have served at least 90 consecutive days in qualifying duty authorization after September 10, 2001, and before November 25, 2015. A qualifying duty authorization for reservists is active duty in support of a contingency operation.74 For Army National Guard or Air National Guard members, a qualifying duty authorization is Section 502(f) of Title 32 U.S.C. when authorized by the President or Secretary of Defense for the purpose of responding to a national emergency declared by the President and supported by federal funds. The 90-day service requirement is waived for individuals released from duty because of an injury, illness, or disease incurred or aggravated in the line of duty. Increased benefits are available to individuals who serve at least one continuous year, two continuous years, or three aggregate years in a qualifying duty authorization.

Eligible Programs of Education, Institutions, and Establishments

The eligible programs of education, educational institutions, and training establishments are the same as under the MGIB-SR.75

Benefit Payments

Most REAP participants receive a monthly allowance. Similar to the MGIB-AD, additional payments are available for certain purposes, and the monthly allowance may be increased under certain circumstances (see Table 2).

The monthly educational allowance for REAP is a percentage of the allowance provided under the MGIB-AD. Reservists who serve on active duty for at least two continuous years or three aggregate years may receive 80% of the maximum MGIB-AD allowance for that type of education or training, and those serving at least one continuous year may receive 60%. Reservists serving at least 90 consecutive days or released from active duty for an injury, illness, or disease incurred or aggravated as a result of active duty service before serving 90 consecutive days may receive 40% of the maximum MGIB-AD allowance for that type of education or training. REAP participants, like DEA participants, may choose to receive the monthly allowance in the form of an advance payment or accelerated payment.

Benefit Availability and Duration

Most individuals are entitled to educational benefits for a period of up to 36 months (or the equivalent in part-time educational assistance), regardless of the active duty eligibility period.

In general, no educational benefits can be paid after November 25, 2015. However, individuals who received REAP benefits for the enrollment period immediately preceding November 25, 2015, may receive benefits through November 25, 2019, or until exhausting their entitlement.76 In addition, individuals who lost REAP eligibility as a result of the November 25, 2015, sunset date may be eligible for the Post-9/11 GI Bill by crediting REAP-qualifying active duty service toward Post-9/11 GI Bill eligibility, in accordance with VA procedures.77

In addition, no educational benefits can be paid after separation from the reserves.78 Individuals called or ordered to active service while serving in the Selected Reserve must remain in the Selected Reserve. Individuals called or ordered to active service while a member of the Ready Reserve, excluding the Selected Reserve, must remain in the Ready Reserve. The Ready Reserve is one of the three major reserve components along with the Standby Reserve and Retired Reserve. The Ready Reserve is the primary manpower pool of the Reserves. Ready Reservists will usually be called to active duty before the other components and include Selected Reservists.79 However, individuals who complete the 90-day service requirement and who complete their service contract under honorable conditions remain eligible for benefits for 10 years after separation from the Selected Reserve (separation from other reserve types does not qualify).80 Also, individuals separated from the Ready Reserve because of a disability which was not the result of the individual's own willful misconduct have 10 years from becoming eligible for benefits before the benefits expire.

Transferability to Dependents

Each service branch is authorized to allow eligible individuals to transfer their REAP educational assistance benefits to family members, but no branch currently offers such a program.

Post-Vietnam Era Veterans Educational Assistance Program (VEAP)

The Post-Vietnam Era Veterans' Educational Assistance Program (VEAP) was established under Title IV of the Veterans' Education and Employment Assistance Act of 1976 (P.L. 94-502) and codified in Title 38, U.S.C., Chapter 32. The program was established to make education affordable and recruit qualified servicemembers. VEAP was designed as a recruitment incentive for the Armed Forces during peacetime.81

Eligible Individuals

VEAP was the first GI Bill to make educational benefits available to both active duty and reserve components simultaneously from the outset.82 Under VEAP, educational assistance benefits are available to individuals who entered active duty on or after January 1, 1977, and before July 1, 1985. To be eligible for benefits, veterans must have been discharged or released other than dishonorably after meeting the active duty service requirement, or they must have been discharged or released for a service-connected disability. The active duty service requirement was a minimum of 24 continuous months or the obligated period of active duty for individuals who enlist in a regular component of the Armed Forces after September 7, 1980, or who enter on active duty after October 16, 1981,83 or a minimum of 181 days of continuous service for other individuals. Servicemembers remaining in service must have completed their first obligated period of active duty84 or six years of active duty, whichever is less. The 180-day active duty service period excludes time assigned to a civilian institution for an education or training program similar to those offered to civilians, excludes time spent as a cadet or midshipman at one of the service academies, and excludes periods of receiving an allowance from the College First Program (10 U.S.C. §511(d)) for a delayed enlistment in the Army National Guard or the Air National Guard or while a member of the Reserves.

Individuals eligible for the prior GI Bill, the Post Korean Conflict GI Bill (see Appendix C), are not eligible under VEAP, with one exception. Members of the National Guard or Reserves who participated in the College First Program and who served at least one consecutive year of active duty after completing the period of active duty for training are eligible. The individual must make an irrevocable decision to receive benefits under VEAP.

Since the benefit was established for an all-volunteer force serving during peacetime, it was deemed appropriate to require participants to contribute to their educational fund during their period of service in the military. Program participants had to agree to monthly pay deductions of at least $25, but not more than $100, during the initial tour of obligated service or six years of active duty service for a total contribution of up to $2,700.85 After making at least 12 contributions, individuals could withdraw from the program, receiving their contributions in return and making them ineligible for program benefits.86

Eligible Programs of Education, Institutions, and Establishments

The eligible programs of education are

- courses which lead to the attainment of a predetermined educational, vocational, or professional objective or objectives if related to the same career (this includes traditional undergraduate and graduate programs);

- courses which lead to a high school diploma;

- courses required by the Administrator of the Small Business Administration as a condition to obtaining financial assistance under the provisions of Section 7(i)(1) of the Small Business Act (15 U.S.C. 636(i)(1));

- licensing or certification tests for a predetermined vocation or profession, provided such tests and the licensing or credentialing organizations or entities that offer such tests are approved;

- courses offered by a qualified provider of entrepreneurship courses;

- national tests for admission to institutions of higher learning or graduate schools (such as the Scholastic Aptitude Test (SAT));

- national tests providing an opportunity for course credit at institutions of higher learning (such as the Advanced Placement (AP) exam);

- full-time programs of apprentice or other on-the-job training; and

- cooperative programs for individuals not on active duty.

Benefit Payments

Most VEAP participants receive a monthly allowance. Similar to the MGIB-SR, additional payments are available for certain purposes, and the monthly allowance may be increased under certain circumstances (see Table 2).

The VEAP benefit consists of a monthly allowance for subsistence, tuition and fees, supplies, books, and equipment paid directly to recipients while enrolled in training or a program of education. Individuals are entitled to three times their contribution plus any DOD contributions. The maximum monthly basic educational benefit may not exceed $300.87 The entitlement period of individuals taking correspondence courses is reduced one month for each month of assistance regardless of the rate of attendance. Individuals incarcerated for a felony conviction in a federal, state, local, or other penal institution or correctional facility may only receive an allowance to cover actual tuition and fees and necessary supplies, books, and equipment.88 Individuals in a program of education consisting exclusively of flight training receive 60% of the program's established charges.89 For an individual in apprentice or on-the-job training, the monthly allowance is 75%, 55%, and 35% of the monthly benefit otherwise payable to that individual for the first six months, second six months, and thereafter, respectively.90

Benefit Availability and Duration of Use

Veterans and servicemembers must use their educational assistance benefits within 10 years of discharge or release from active duty.91 Under VEAP, individuals are entitled to a maximum of 36 months (or the equivalent for part-time attendance) or the number of months in which contributions were made, whichever is less.

Combination and Comparison of GI Bill Programs

In general, veterans and servicemembers, many of whom will be eligible for more than one program, can combine benefit programs administered by the VA to receive no more than 48 months of educational benefits.92 However, a servicemember who is eligible for two or more of the GI Bill programs: VEAP, MGIB-AD, MGIB-SR, REAP, or the Post-9/11 GI Bill, based on the same period of military service must elect the program to which such service is to be credited. In addition, benefits under more than one program cannot be received concurrently.

DEA-eligible individuals can combine benefits with other VA administered educational assistance programs to receive up to 81 months of education benefits, but the eligibility events cannot be duplicative.

Table 2 provides a summary of some of the key characteristics of the active programs. Although the Post-9/11 GI Bill is not described in this report, the characteristics have been included in the table for the reader's reference. The Post-9/11 GI Bill is described in CRS Report R42755, The Post-9/11 Veterans' Educational Assistance Act of 2008 (Post-9/11 GI Bill): A Primer.

Table 2. Selected Characteristics of Veterans' Educational Assistance Programs

Sorted by participation level, in descending order

|

Characteristic |

Post-9/11 GI Billa |

MGIB-ADb |

DEAc |

MGIB-SRd |

REAPe |

VEAPf |

|

Year enacted |

2008 |

1984 |

1956 |

1984 |

2004 |

1976 |

|

Initial authorization |

P.L. 84-634 |

|||||

|

Eligible Individuals |

||||||

|

Period of qualifying service |

After 9/10/2001 to present |

Entered active duty after 6/30/1985 |

After the beginning of the Spanish American War |

7/1/1985 to present |

After 9/10/2001 to 11/24/2015 |

On or after January 1, 1977, and before July 1, 1985 |

|

Minimum required length of service |

90 aggregate days of active duty service or service-connected disability after 30 continuous days |

181 continuous days of active duty service; 24 months of active duty if enlisted after September 7, 1980 |

None |

Accepted six-year reserve obligation after June 30, 1985 |

90 days of consecutive service in a contingency operation or three aggregate years of active duty service |

181 continuous days of active duty service, or 24 continuous months of active duty service, if enlisted after September 7, 1980, or entered after October 16, 1981 |

|

Discharge status |

Honorable discharge or on active duty |

Honorable discharge or on active duty |

Other than dishonorable or on active duty |

Must remain with reserve unit |

Honorable separation or serving in the reserves |

Other than dishonorable or on active duty |

|

Monetary Contribution |

None |

Pay reduction of $100 per month for the first 12 months of pay |

None |

None |

None |

$25 to $100 per month; $2,700 maximum |

|

Benefit Availability and Duration |

||||||

|

Period of use |

8/1/2009 to present |

7/1/1985 to present |

1956 to present |

7/1/1985 to 11/25/2019 |

12/9/2001 to present |

1/1/1977 to present |

|

Duration of benefits |

36 months |

Lesser of 36 months or number of months of active duty and one-quarter number of months of reserve duty |

45 months if first used DEA before August 1, 2018 36 months if first used DEA on or after August 1, 2018 |

36 months |

36 months |

Lesser of 36 months or number of months of contributions |

|

Delimiting Date (General time limitation on use of benefits) |

Time limits vary depending on eligibility (see CRS Report R42755, The Post-9/11 Veterans' Educational Assistance Act of 2008 (Post-9/11 GI Bill): A Primer) |

Within 10 years of discharge or release from active duty or required reserve duty |

For the spouse: within 10 years of eligibility, or within 20 in some instances For the child: after finishing high school or reaching age 18, but before reaching age 26 |

While in the Selected Reserves |

While in the Ready Reserves Within 10 years of Selected Reserves separation Within 10 years of Ready Reserves separation due to certain disabilities |

Within 10 years of discharge or release from active duty |

|

Eligible Programs of Education, Institutions, and Establishments |

||||||

|

College or university |

Eligible |

Eligible |

Eligible |

Eligible |

Eligible |

Eligible |

|

High school |

Not eligible |

Not Eligible |

Eligible |

Not eligible |

Not eligible |

Eligible |

|

Apprentice and on-the-job training |

Eligible |

Eligible |

Eligible |

Eligible |

Eligible |

Eligible |

|

Entrepreneurship training |

Eligible |

Eligible |

Not Eligible |

Eligible |

Eligible |

Eligible |

|

Cooperative training |

Eligible |

Eligible |

Eligible |

Eligible |

Eligible |

Eligible |

|

Benefit Payments |

||||||

|

Maximum standard benefit for 2017-2018 |

$4,197.00 per month for housing At a public IHL,g "actual net cost for in-state tuition and fees" less certain student aid At a private or foreign IHL, up to $22,805.34 |

$1,928.00 per monthh for subsistence, tuition and fees, supplies, books, and equipment |

$1,041.00 per month for subsistence, tuition and fees, supplies, books, and equipment |

$375.00 per monthh for subsistence, tuition and fees, supplies, books, and equipment |

$1,542.40 per monthi for subsistence, tuition and fees, supplies, books, and equipment |

$300.00 per monthj for subsistence, tuition and fees, supplies, books, and equipment |

|

Books and supplies |

Up to $1,000 annually |

Not eligible |

Not eligible |

Not eligible |

Not eligible |

Not eligible |

|

Relocation allowance |

Up to $500 once |

Not eligible |

Not eligible |

Not eligible |

Not eligible |

Not eligible |

|

Maximum tutorial assistance |

$1,200 |

$1,200 |

$1,200k |

$1,200 |

Not eligiblel |

$1,200 |

|

Maximum licensing and certification test fees |

$2,000 per test |

$2,000 per test |

$2,000 per test |

$2,000 per test |

$2,000 per test |

$2,000 per test |

|

National test fees |

Eligible |

Actual cost |

Eligible |

Eligible |

Eligible |

Actual cost |

|

Advance payments |

Eligiblem |

Eligible |

Eligible |

Eligible |

Eligible |

Eligible |

|

Accelerated payments |

Not eligible |

Eligible |

Not eligible |

Eligible |

Eligible |

Not eligible |

|

Tuition Assistance Top Up Program |

Eligible |

Eligible |

Not eligible |

Eligiblen |

Eligiblen |

Not eligible |

|

$600 Buy Up Program |

Not eligible |

Eligible |

Not eligible |

Eligible |

Eligible |

Not eligible |

|

Supplemental assistance |

Up to $950 per month |

Up to $950 per month |

Not eligible |

Up to $350 per month |

Up to $350 per month |

Not eligible |

|

Transferability to Dependents |

||||||

|

Transferability to dependents |

Authorized and available |

Authorized, not availableo |

Not authorized |

Authorized, not available o |

Authorized, not available o |

Not authorized |

Source: Prepared by CRS based on data available from the VA; Title 38 U.S.C., Chapters 30, 32, 33, and 35; and Title 10 U.S.C., Chapters 1606 and 1607.

a. The Post-9/11 GI Bill is the Post-9/11 Veterans Educational Assistance Act (38 U.S.C., Chapter 33).

b. MGIB-AD is the Montgomery GI Bill-Active Duty (38 U.S.C., Chapter 30).

c. DEA is the Survivors' and Dependents' Educational Assistance program (38 U.S.C., Chapter 35).

d. MGIB-SR is the Montgomery GI Bill-Selected Reserve (10 U.S.C., Chapter 1606).

e. REAP is the Reserves Educational Assistance Program (10 U.S.C., Chapter 1607).

f. VEAP excludes data for the Section 901 program. VEAP is the Post-Vietnam Era Veterans Educational Assistance program (38 U.S.C., Chapter 32).

g. IHL is an institution of higher learning.

h. Amounts shown are for full-time institutional training, and for individuals who completed a minimum of three years of service. The amounts are less for individuals who served less than three years and who attend less than full-time. The educational benefits payment rate schedule is available at http://www.gibill.va.gov/GI_Bill_Info/rates.htm. The MGIB-AD maximum payment does not reflect the allowance received by Post-Korean Conflict GI Bill recipients who transfer to the program.

i. The monthly amount is a percentage of the MGIB-AD and is based on the number of continuous days of active duty service. The amount shown is for full-time institutional training, and for individuals who completed at least two years of active duty service. The amount is less for individuals who served two years or less, and who attend less than full-time.

j. Government matches every $1 the servicemember contributes with $2. The maximum benefit available under the program is $8,100 ($5,400 federal contribution and $2,700 individual contribution). The total contribution (servicemember contribution plus government share) is than divided by the number of months the servicemember contributed to VEAP.

k. Unlike the other GI Bills, entitlement is not charged for tutorial assistance under DEA.

l. Since May 15, 2011, the Department of Veterans Affairs, School Certifying Official Handbook, has indicated that tutorial assistance is not authorized for REAP.

m. Although regulations clarify the eligibility requirements for advance payments of the monthly housing allowance, VA guidance and policy documents indicate that advance payments are not available under the Post-9/11 GI Bill.

n. The Army and Air Force permit concurrent use but not for the same courses (Source: Department of Veterans Affairs, "AVECO 2017 New SCO Basic Training," presentation, June 2017).

o. Although the branches of the uniformed services are authorized to permit the transfer of benefits to dependents, none of the branches are currently permitting the transfer of benefits.

Related Department of Veterans Affairs Programs

High Technology Pilot Program

The Harry W. Colmery Veterans Educational Assistance Act of 2017 (P.L. 115-48) requires the VA carry out a five-year High Technology Pilot Program.93 The program is intended to provide GI Bill-eligible veterans the opportunity to enroll in high technology programs of education that the Secretary determines provide training or skills sought by employers in a relevant field or industry. The VA is authorized to expend up to $15 million annually for the pilot program.

Under the program, the VA contracts with qualified providers to provide high technology programs to GI Bill-eligible veterans. High technology programs are nondegree programs of education that provide qualifying instruction and that are offered by qualified providers. Qualifying instruction is computer programming, computer software, media application, data processing, or information sciences. Qualified providers are entities that are not IHLs, have been in operation for at least two years, have successfully provided the high technology program for at least one year, and meet VA-developed approval criteria. Qualified providers that offer tuition reimbursement to students who do not find meaningful employment in suitable fields within 180 days of program completion receive preference in contracting.

The VA reimburses the qualified provider for the cost of tuition and other fees for the high technology program. The VA pays 25% of the cost upon enrollment of an eligible veteran, 25% upon program completion by an eligible veteran, and 50% upon employment of an eligible veteran-completer in a suitable field.

GI Bill-eligible veterans enrolled full-time in the pilot program receive a monthly housing allowance. The housing allowance is based on the DOD-determined monthly basic allowance for housing (BAH) for a member of the Armed Forces with dependents in pay grade E-5 (hereinafter referred to as the E-5 with dependents BAH).94 For individuals not enrolled through distance learning,95 the monthly housing allowance is the E-5 with dependents BAH for the area in which the qualified provider is located, reduced according to the individual's enrollment rate (rounded to the nearest multiple of 10). For individuals enrolled through distance learning, the monthly housing allowance is 50% of the E-5 with dependents BAH for the area in which the qualified provider is located, reduced according to the individual's enrollment rate (rounded to the nearest multiple of 10).

Veterans Counseling

For the most part, individuals eligible for or receiving educational assistance under the VEAP, MGIBs, REAP, DEA, or Post-9/11 GI Bill may request educational and vocational counseling from the VA. The counseling may include, but is not limited to, assistance selecting a program of education, resolving personal problems, and resolving academic difficulties. Counseling was provided to all recipients of educational assistance until 1972. Counseling is still required under DEA for a child who may require specialized vocational training or special restorative training, or a child who is under 18 years of age and has not completed high school. It is also required for a spouse who desires specialized vocational training. Counseling is still required under all of the programs if the individual is rated as incompetent.

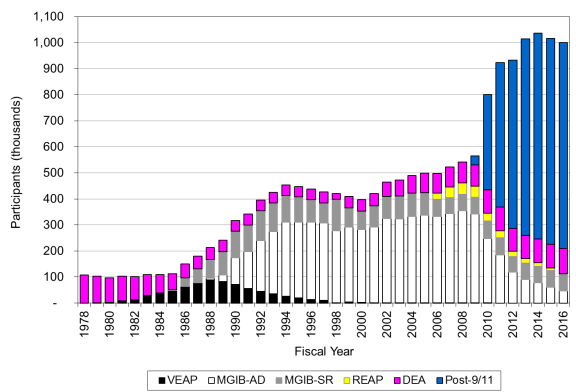

VetSuccess on Campus