On December 15, 2016, USDA published in the Federal Register a final rule, "Enhancing Retailer Standards in the Supplemental Nutrition Assistance Program (SNAP)."1 This final rule followed USDA-FNS's proposed rule earlier in the year:

- On February 17, 2016, the U.S. Department of Agriculture's (USDA's) Food and Nutrition Service (USDA-FNS) published the proposed rule.2

- On April 5, 2016, USDA-FNS published a clarification of the proposed rule and extended the comment period to May 18, 2016.3

SNAP, the largest of USDA's domestic food assistance programs, provides benefits to eligible participants; these benefits are redeemable for SNAP-eligible foods at SNAP-authorized retailers. SNAP-authorized retailers are stores and other food sellers that are allowed to accept SNAP benefits. In FY2015, SNAP had an average monthly participation of 45.8 million individuals, $74.0 billion was obligated for the program (most of the funding is for benefits themselves), and nearly 259,000 firms were authorized to accept benefits.4

The final rule implements provisions of the Agriculture Act of 2014 ("2014 farm bill," P.L. 113-79) that made changes to inventory requirements for SNAP-authorized retailers and also addressed other USDA-FNS policy objectives. The proposed rule had been controversial, particularly the provisions not explicitly required by the farm bill.

Changes in retailer authorization policy can impact a range of SNAP program stakeholders—not only retailers, but also food manufacturers and program participants. Driving the debate over these changes has been the potential impact on smaller retailers. This report will present a brief background on SNAP retailer authorization and related administrative data, a summary of prior regulations, the statutory changes enacted in the 2014 farm bill, and the final rule's changes to the current regulations (including comparisons to the proposed rule).

|

FY2017 Appropriations Policy Provision PLEASE NOTE: This report focuses on the final rule as published December 15, 2016, but a number of these policies will not go into effect due to intervening appropriations law. Congress passed the FY2017 Consolidated Appropriations Act (P.L. 115-31, enacted May 5, 2017), which directed USDA to change substantially its implementation of the final rule, particularly the retailer inventory requirements of the 2014 farm bill. The report currently reflects USDA-FNS implementation plans as of August 4, 2017, but may not reflect policy developments since then. For the most current information on the implementation of retailer standards, see USDA-FNS's website, "Enhancing Retailer Standards in the Supplemental Nutrition Assistance Program (SNAP)," https://www.fns.usda.gov/snap/enhancing-retailer-standards-supplemental-nutrition-assistance-program-snap. |

Background: SNAP-Authorized Retailers and Related Data

SNAP benefits may be redeemed only for eligible foods at authorized retailers.5 The SNAP program authorizes retailers based, in part, on the retailer's inventory or sales. In order to be authorized, a retailer is generally required to (1) apply for authorization, and (2) pass a USDA-FNS administered inspection and authorization process.6 A wide range of retailers are authorized to accept SNAP, including supermarkets, farmers' markets, and convenience stores.

Inventory requirements for SNAP retailers are based on stock or sales of "staple foods," defined in statute as four categories: (1) meat, poultry, or fish; (2) bread or cereals; (3) vegetables or fruits; and (4) dairy products.7 Although SNAP participants can buy foods that are not in staple food categories, required staple food inventory or sales is one of the bases for authorizing a retailer to accept SNAP benefits.

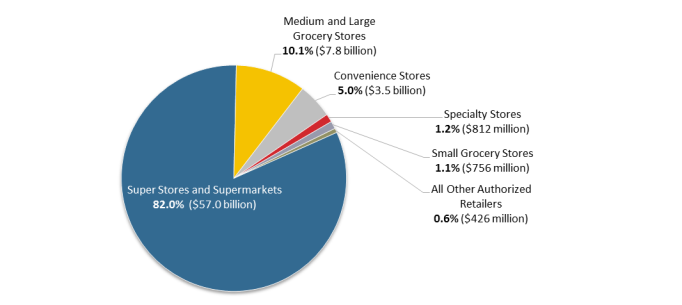

Though many different types of retailers are authorized to accept benefits, data show that the majority of SNAP benefits are redeemed at supermarkets and superstores. In FY2015, approximately 82% of benefits were redeemed in supermarkets and superstores.8 Although convenience stores make up over 41% of SNAP-authorized retailers, they redeemed approximately 5% of SNAP benefits in FY2015.9 Figure 1 displays the share of SNAP benefits redeemed by different categories of retailers, with further detail on authorizations and redemptions shown in Table 1. Retailer data also indicate that smaller retailers (convenience stores, small grocery stores, medium grocery stores) received the bulk of sanctions from USDA-FNS in FY2015; sanctions include time-limited or permanent disqualifications from SNAP.10

|

Figure 1. Share of SNAP Dollars Redeemed by Store Type, FY2015 |

|

|

Source: Prepared by CRS based on USDA-FNS, 2015 Retailer Management Year End Summaries, p. 2, http://www.fns.usda.gov/sites/default/files/snap/2015-SNAP-Retailer-Management-Year-End-Summary.pdf. Notes: In order to more clearly highlight small grocery stores and convenience stores, CRS collapsed categories of retailer types. See 2015 Retailer Management Year End Summaries for narrower category data. |

|

Retailers Authorized |

Amount of SNAP Benefits Redeemed |

|||

|

Retailer Typesa |

# |

% |

$ |

% |

|

Superstores and supermarkets |

37,868 |

14.7% |

$57,014,276,433 |

82.0% |

|

Medium, large, and combination grocery stores |

81,345 |

31.5% |

$7,004,784,308 |

10.1% |

|

Convenience stores |

106,531 |

41.2% |

$3,494,342,918 |

5.0% |

|

Specialty stores |

8,594 |

3.3% |

$811,794,376 |

1.2% |

|

Small grocery stores |

12,277 |

4.8% |

$755,975,667 |

1.1% |

|

All other authorized retailer types |

12,017 |

4.6% |

$425,971,246 |

0.6% |

|

TOTAL |

258,632 |

100% |

$69,507,144,948 |

100% |

Source: Prepared by CRS based on USDA-FNS, 2015 Retailer Management Year End Summaries, p. 2, http://www.fns.usda.gov/sites/default/files/snap/2015-SNAP-Retailer-Management-Year-End-Summary.pdf.

a. In order to more clearly highlight small grocery stores and convenience stores, CRS collapsed categories of retailer types. See 2015 Retailer Management Year End Summaries for narrower category data.

Prior SNAP Retailer Inventory Regulations

This section summarizes standards for SNAP retailer authorization prior to the final rule ("prior regulations").

Under the prior regulations, a SNAP-eligible retailer had to meet one of two tests: criterion A (based on store inventory) or criterion B (based on store sales).11 These rules are displayed in Table 2.

Table 2. Prior Regulations for SNAP Retailer Authorization

Retailers Apply via Criterion A or Criterion B

|

Criterion A—Based on Inventory |

OR |

Criterion B—Based on Sales |

|

Offer, on a continuous basis, three varieties of qualifying foods in each of the four staple food categories, AND |

More than 50% of the retailer's total sales must be from the sale of eligible staple foods |

|

|

Offer, on a continuous basis, perishable foods in at least two of the four staple food categories. |

Source: Based on 7 C.F.R. 278.1(a) (prior to final rule) and USDA-FNS website, http://www.fns.usda.gov/snap/retailers/store-eligibility.htm (accessed December 13, 2016).

Specialty stores, such as fruit and vegetable or seafood markets, tend to apply under criterion B because they carry a limited number of staple food categories.

As noted above, SNAP's authorizing law defines "staple foods" as foods in the following categories: meat, poultry, or fish; bread or cereals; vegetables or fruits; and dairy products.12 The law further provides that staple foods "do not include accessory food items, such as coffee, tea, cocoa, carbonated and uncarbonated drinks, candy, condiments, and spices."13 Under prior regulations, foods with multiple ingredients were counted in a staple food group based on the "main ingredient" as determined by USDA-FNS. For example, a box of macaroni and cheese might be classified as a variety within a staple food category but in the bread or cereal category (despite containing dairy). Prior regulation also defined perishable staple food items as "items which are either frozen staple food items or fresh, unrefrigerated or refrigerated staple food items that will spoil or suffer significant deterioration in quality within 2-3 weeks."14 Regulation specified that a "variety" of qualifying foods in a particular category means different types of foods, not different brands, different nutrient values, different varieties of packaging, or different package sizes; the example was given that apples, cabbage, and tomatoes are varieties in the fruit or vegetable staple food category.15

Although retailers must offer these particular types of foods to qualify as a SNAP-eligible retailer, SNAP participants may redeem their benefits for generally any foods for home preparation and consumption whether they are staple foods or not. SNAP benefits may not be redeemed for alcohol; tobacco; or hot, prepared foods intended for immediate consumption (e.g., a rotisserie chicken). Prior regulations also made ineligible "firms that are considered to be restaurants, that is, firms that have more than 50 percent of their total gross retail sales in hot and/or cold prepared foods not intended for home preparation and consumption."16 Restaurants authorized to participate under certain states' restaurant option (an option to assist homeless, elderly, and disabled individuals who may have difficulty preparing food) are an exception to this 50% rule.17

2014 Farm Bill (P.L. 113-79) Amendments to Retailer Inventory Requirements

The 2014 farm bill (enacted February 7, 2014) amended many different aspects of SNAP law, including changes to the authorization of SNAP retailers.18 Section 4002 of P.L. 113-79 required that retailers seeking authorization based on inventory (i.e., criterion A) will have to increase their variety of stock. Namely, the law was amended to require stores to stock at least seven varieties of staple foods in each of the four staple food categories and to stock perishable foods in at least three categories. Section 4002, which includes other requirements for retailers, also amended the authorizing law to require a review of retailer applications to consider "whether the [retailer] applicant is located in an area with significantly limited access to food." The law's conference report included further information on the decision to craft this policy change.19

In a March 2014 policy memorandum, USDA-FNS said that the 2014 farm bill changes to inventory requirements would require rulemaking to implement.20

Final Rule's Changes to SNAP Retailer Standards

This section summarizes the USDA-FNS final rule's changes to prior regulations and includes comparison to the proposed rule. This section has also been amended to reflect changes made by the FY2017 appropriations law, which limits some of the final rule's provisions.

As a basis for rulemaking, in the February 2016 proposed rule, USDA-FNS explained that the proposed rule was "the result of two separate developments": (1) the 2014 farm bill's statutory changes, and (2) "the effort initiated by FNS in 2013 to look at enhancing the eligibility standards for SNAP retailers to better enforce the intent of the [Food and Nutrition Act of 2008] to permit low-income individuals to purchase more nutritious foods for home preparation and consumption." Related to the latter development, USDA-FNS cited findings from an August 2013 Request for Information (RFI), which posed 14 questions to the public on SNAP retailer eligibility and authorization.21 USDA-FNS stated that they received from the RFI over 200 comments "from a diverse group, including retailers, academics, trade associations, policy advocates, professional associations, government entities, and the general public." The agency also cited related listening sessions.

Before issuing the final rule, FNS reviewed 1,260 germane, nonduplicative comments on the proposed rule. About 72% of comments came from retail food store representatives, owners, managers, or employees, most of whom submitted template or form letters.22 Some Members of Congress and other stakeholders had voiced strong opposition to aspects of the proposed rule.23

As the proposed rule would have, the final rule made changes to 7 C.F.R. Part 271 and Part 278 in five areas of retailer authorization policy: (1) sales of hot, prepared foods; (2) definition of staple foods; (3) inventory and depth of stock; (4) access-related exceptions to the rules; and (5) disclosures of retailer information. The final rule's ultimate changes in some ways vary notably from those in the proposed rule.

These areas are briefly discussed in the sections to follow. The final rule is presented "at-a-glance"—as compared to the proposed rule and the prior regulations—in Table 4 at the end of this section.

Throughout the proposed and final rules, USDA-FNS expressed the objectives of improving access to healthy foods and preserving the integrity of the program. The statute as amended by the farm bill explicitly requires

- an increase in the minimum number of food varieties and perishable varieties for retailers authorized under criteria A (discussed further below in "Inventory"); and

- access-related exceptions to retailer authorization (discussed further below in "Access-Related Exceptions to the Rules").

USDA-FNS acknowledged throughout the final rule's preamble that the regulatory changes in other areas are discretionary.

|

Note: Neither the 2014 farm bill nor the proposed or final rules make changes to foods eligible for purchase by SNAP participants. Although the rule would place more stringent requirements on the foods stocked by authorized retailers, it does not change what customers may purchase with their SNAP benefits. In general, SNAP benefits may be redeemed for any foods for home preparation and consumption. SNAP benefits may not be redeemed for alcohol, tobacco, or hot foods intended for immediate consumption. (More details about SNAP-eligible foods are available in CRS Report R42505, Supplemental Nutrition Assistance Program (SNAP): A Primer on Eligibility and Benefits.) |

Section 765 of P.L. 115-31, Effective Dates

Subsequent to the promulgation of this final rule, Congress passed the FY2017 Consolidated Appropriations Act (P.L. 115-31, enacted May 5, 2017), which directed USDA to change substantially its implementation of the final rule, particularly variety and breadth of stock requirements. Section 765 of Title VII, the General Provisions for the Department of Agriculture appropriation, in P.L. 115-31 (referred to throughout the remainder of this report as Section 765) required USDA to change how "variety" is defined in the final rule and to implement the "acceptable varieties and breadth of stock" that were in place prior to enactment of the 2014 farm bill until such regulatory amendments are made. For the most current information on the implementation of retailer standards, see USDA-FNS's website, "Enhancing Retailer Standards in the Supplemental Nutrition Assistance Program (SNAP)," https://www.fns.usda.gov/snap/enhancing-retailer-standards-supplemental-nutrition-assistance-program-snap.

As published, the effective date for the final rule was January 17, 2017, but most aspects of the rule were to take effect in subsequent months. Since enactment of P.L. 115-31, USDA-FNS has changed some effective dates from those published in the final rule. The sections that follow note effective dates published on the USDA-FNS website (as of the date of this report).

Sales of Hot, Prepared Foods

Hot, prepared foods are not eligible for purchase with SNAP benefits, and prior regulations required Criteria A and B retailers to have no more than 50% of their sales in hot or cold prepared foods. Ultimately, the final rule kept this 50% threshold in place but specified that it applies to "foods cooked or heated on-site by the retailer before or after purchase."24 Under prior regulations, there had been a loophole apparently exploited by some retailers who sell uncooked foods for SNAP purchase and then offer to heat or cook those foods for customers (for free or for a small fee).25

The final rule did not adopt the proposed rule's proposal to require that at least 85% of an authorized entity's total food sales must be for items that are not cooked or heated onsite before or after purchase. (In other words, the proposed rule would have required that no more than 15% of total food sales may be from these foods cooked or heated on-site.) In the final rule's preamble, USDA-FNS expressed particular concern that comments and data subsequently reviewed showed that the 85/15% threshold would make most convenience stores ineligible for SNAP authorization.26

The proposed rule also would have added measures aimed at preventing one business from splitting into two to circumvent these restaurant-related SNAP rules. In the final rule, USDA-FNS clarified that it will consider separate businesses to be one if the colocated businesses share ownership, sale of similar or same food products, and inventory.27

Implementation of the final rule's hot, prepared foods provisions will take effect for all retailers beginning on October 16, 2017.28 Section 765 did not otherwise change the implementation of this policy.

Definition of Staple Foods

The final rule changed the regulatory definition of staple foods in several respects.

Accessory Foods

Under prior regulation, accessory foods were not counted as staple foods. This is maintained and expanded in the final rule.

Prior regulations had been interpreted by USDA-FNS to define "accessory foods" as the specific foods listed in the statute: "coffee, tea, cocoa, carbonated and un-carbonated drinks, candy, condiments, and spices."29

The final rule expanded this regulatory definition, but in a way that is more narrowly tailored than the proposed rule's approach.30 The final rule expanded the list of accessory food items as follows:

Accessory food items include foods that are generally considered snacks or desserts such as, but not limited to, chips, ice cream, crackers, cupcakes, cookies, popcorn, pastries, and candy, and food items that complement or supplement meals such as, but not limited to, coffee, tea, cocoa, carbonated and uncarbonated drinks, condiments, spices, salt, and sugar.31

The final rule also established that "[i]tems shall not be classified as accessory food exclusively based on packaging size," and "[a] food product containing an accessory food item as its main ingredient shall be considered an accessory food item."32 In addition, the final rule's preamble, as guidance, included a list of accessory food items, beyond the list above.33 Section 765 did not change the implementation of this policy. Per the USDA-FNS website, the accessory food changes will take effect for all stores on January 17, 2018.34

Multiple Ingredient Foods

Under prior regulation, foods with multiple ingredients were only counted in one staple food category based on the item's main ingredient. For example, as mentioned above, a box of macaroni and cheese, with pasta as the main ingredient, would be counted as "bread or cereal" for retailer authorization purposes.

In the final rule, USDA-FNS maintained this multiple ingredient policy, taking into account many related comments on the proposed rule.35 The final rule rejected the proposed rule's policy that commercially processed foods and prepared mixtures would not have been counted in any staple food category for retailer authorization.36 For example, inventory of TV dinners, macaroni and cheese, and canned soups would not have counted toward a store's inventory (or sales) requirements for authorization under the proposed rule. (Such foods would have remained eligible for SNAP purchase.) However, due to changes in the definition of accessory foods in the final rule, if the first ingredient of a multi-ingredient food is an accessory food, the food will not be considered a staple food in the retailer authorization process.

Section 765 did not change the implementation of the final rule's multi-ingredient policy, and, per the USDA-FNS website, will take effect for all stores on January 17, 2018.37

Varieties

Criterion A authorization is based, in part, on a retailer's stocking a certain number of varieties in each staple food category. The 2014 farm bill required an increase in varieties offered (implementation discussed in "Inventory"). The final rule included increased flexibility to help stock the required number of varieties. In particular, the regulations were amended to count plant-based sources as varieties for the "meat, poultry, or fish" and "dairy products" staple food groups.38 For instance, nuts, seeds, and beans can now be varieties of "meat, poultry, and fish." In addition, the final rule's preamble, as guidance, includes a list of examples of varieties in each staple food category.39

Due to the requirements of Section 765, USDA-FNS will not implement the final rule's broader variety definition (e.g., inclusion of plant-based proteins).

Inventory40

Section 765 impacted implementation of the farm bill's inventory provisions, but not the depth of stock changes proposed.

The final rule codified in the regulations the 2014 farm bill's mandatory changes for retailers applying for authorization under criterion A (inventory-based) by

- increasing the required minimum variety of foods in each staple food category from three to seven varieties, and

- increasing the perishable foods requirement from two staple food categories to three staple food categories.

The final rule also added specifications on the depth of stock; that is, how many of each item are for sale. Under prior regulations, a retailer could be authorized with a minimum stock of at least 12 food items (one item each of three varieties in each of the four staple food categories, including perishable requirements); proposed and final rules sought to change that. Incorporating the requirements of Section 765, at this time USDA-FNS is neither requiring retailers to increase the number of varieties in each staple food category nor requiring them to increase the categories of perishable foods.

The final rule not only implemented the farm bill's staple food changes to 28 varieties (seven varieties in each of the four categories, including perishable requirements), but it added a numeric depth of stock requirement of three stocking units per variety.41 Under this requirement, a store is required to keep in stock a minimum of 84 staple food items. In the final rule, USDA-FNS halved the proposed rule's depth of stock policy, which would have required six-item depth of stock, requiring a minimum of 168 items. The final rule also added some language to specify that documentation may be provided in cases where it is not clear that the sufficient stocking requirement has been met. While Section 765 required USDA-FNS to maintain three varieties per staple food category, the USDA-FNS rule's change to three stocking units per variety stands.

Table 3 summarizes the inventory requirements for criterion A retailers under prior, proposed, and final regulations and implementation under the requirements of Section 765.

|

Prior Regulations |

Proposed Rule |

Final Rule |

Final Rule, After §765 of P.L. 115-31 |

|

|

Staple food categories |

4 |

4 |

4 |

4 |

|

Varieties in each category |

3 |

7 |

7 |

3 |

|

Minimum number of categories that must include perishable foods |

2 |

3 |

3 |

2 |

|

Depth of stock for each variety |

1 item of each qualifying variety |

6 items of each qualifying variety |

3 items of each qualifying variety |

3 items of each qualifying variety |

|

Minimum stocking total (considering staple food categories, varieties, and depth of stock) |

12 items |

168 items |

84 items |

36 items |

Source: Prepared by CRS, based on unamended 7 C.F.R. 278.1, the proposed rule, clarification of proposed rule, final rule, P.L. 115-31, and USDA-FNS website.

Access-Related Exceptions to the Rules

Prior to the 2014 farm bill, a community's access to a SNAP-authorized retailer was not a consideration in granting or denying a retailer's application for authorization. Implementing the 2014 farm bill language, the proposed rule, as described in its preamble, would have allowed USDA-FNS to consider need for access "when a retailer does not meet all of the requirements for SNAP authorization." USDA-FNS proposed a list of factors that they may consider in making this access determination.42

The final rule implemented the access-related exceptions with some additional details. It included a more inclusive list of factors to be considered: "access factors such as, but not limited to, the distance from the applicant firm to the nearest currently SNAP authorized firm and transportation options ... FNS will also consider factors such as, but not limited to, the extent of the applicant firm's stocking deficiencies in meeting Criterion A and Criterion B and whether the store furthers the purposes of the Program." The final rule also clarified that FNS's considerations will occur during the application process.43 Section 765 of P.L. 115-31 did not change the implementation of this policy; it will go into effect starting January 17, 2018.

Public Disclosure of Retailer Information

The final rule allowed USDA-FNS to disclose to the public specific information about retailers that have been disqualified or otherwise sanctioned for SNAP violations. The agency argued, in the proposed rule, that this information would assist in the agency's efforts "to combat SNAP fraud by providing an additional deterrent" and would "provide the public with valuable information about the integrity of these businesses and individuals for future dealings."44 The final rule clarifies that disclosure of these sanctions will only be for the duration of the sanction.

This policy took effect on January 17, 2017.

Table 4. Revision of SNAP Retailer Standards At-a-Glance

Comparison of Prior SNAP Regulations with USDA-FNS's Proposed and Final Rules

|

Topic |

Prior SNAP Retailer Standards Regulationsa |

USDA-FNS Proposed Rule on Retailer Standardsb |

USDA-FNS Final Rule on Retailer Standardsc |

Final Rule with §765 Requirementsd |

|

Sales of hot, prepared foods (not paid for with SNAP benefits) |

Applicant retailers with 50% or greater of sales in hot or cold prepared foods are ineligible to be SNAP authorized (with the exception of the restaurant option operating in some states to serve elderly, disabled, and homeless individuals). |

In addition, to be SNAP-authorized, a retailer must have 85% (or more) of its sales in foods that are not cooked or heated on-site (before or after purchase). In other words, a retailer must not have more than 15% of its sales in these foods (with the exception of the restaurant option operating in some states to serve elderly, disabled, and homeless individuals). |

Same as prior regulations, but now retailers cannot have 50% or greater of sales in hot or cold prepared foods and foods cooked or heated on-site by the retailer before or after purchase. |

Same as final rule. |

|

Multi-ingredient foods' categorization as staple foods |

Counted in the staple food category based on the main ingredient. |

Would not be counted as a staple food. |

Same as prior regulations. |

Same as final rule. |

|

Accessory foods' categorization as staple foods |

A short list of accessory foods are not counted as staple foods. |

A longer list of foods would be considered accessory foods, not counted as staple foods. |

Similar to proposed rule. |

Same as final rule. |

|

Defining a variety |

Varieties are different types of foods within each staple food category (examples listed in regulation); different brands, nutrient values, packaging sizes do not constitute a different variety. |

Similar to prior regulations. |

Changes examples listed to provide increased flexibility in certain staple food categories. |

Same as prior regulations. |

|

Requirements for stocking varieties for criterion A applications (see also Table 3 above) |

3 varieties in each of the 4 staple food categories. Including perishable items in 2 of the 4 staple food categories. A total of 12 staple food items required. |

7 varieties in each of the 4 staple food categories. Including perishable items in 3 of the 4 staple food categories. Depth of stock requirement of 6 items, for a total of 168 staple food items required. |

Same as proposed rule, but |

Same as prior regulations, but depth of stock requirement of 3 items, for a total of 36 required items. |

|

USDA-FNS consideration of community's need for access |

Not explicitly in retailer regulation. |

FNS would consider "whether the applicant is located in an area with significantly limited access to food." |

Similar to proposed rule. |

Same as final rule. |

|

Public disclosure of disqualified or sanctioned retailers' information |

Not explicitly in regulation. |

Would allow FNS to disclose this information to public. |

Similar to proposed rule. |

Same as final rule. |

Source: Summary prepared by CRS, using regulations and Federal Register publications listed.

b. Based on USDA Food and Nutrition Service, "Enhancing Retailer Standards in the Supplemental Nutrition Assistance Program (SNAP)," 81 Federal Register 8015-8021, February 17, 2016; and "Enhancing Retailer Standards in the Supplemental Nutrition Assistance Program (SNAP) Clarification of Proposed Rule and Extension of Comment Period," 81 Federal Register 19500-19502, April 5, 2016.

c. Based on USDA Food and Nutrition Service, "Enhancing Retailer Standards in the Supplemental Nutrition Assistance Program (SNAP)," 81 Federal Register 90675-90699, December 15, 2016.

d. P.L. 115-31, §765; USDA-FNS website, "Enhancing Retailer Standards in the Supplemental Nutrition Assistance Program" (accessed August 4, 2017).

Overview of Final Rule's Regulatory Impact Analysis45

As with the proposed rule, within the final rule's preamble, USDA-FNS included a summary of its Regulatory Impact Analysis (RIA).46 The RIA included qualitative benefits of the final rule such as improving SNAP recipients' access to a variety of healthy food options and authorizing retailers in a way that is consistent with the purposes of SNAP. The analysis estimated that the total cost to the federal government for the agency's increased store inspections would be approximately $3.7 million in FY2018 and $15 million over five years.

Under the agency's Regulatory Flexibility Act (RFA) analysis, also referenced in the RIA, USDA-FNS focused on the impacts for small businesses.47 As USDA-FNS acknowledged in the final rule's preamble, some of the opposition to the proposed rule criticized the agency's analysis, arguing that the analysis had underestimated the financial impact on small retailers. The final rule's RIA and RFA analysis reflect a revised methodology (that now includes opportunity costs and administrative costs) and the final rule's differing policy.

The analysis estimated that the inventory changes in the final rule would impact approximately 187,000 smaller retailers (this is 70% of all SNAP-authorized retailers in July 2016).48 Based on a sample of small SNAP retailers' inventory checklists, USDA-FNS estimated an average cost per retailer of $245 in the first year and about $620 over five years.49 The analysis estimated that over 87% of the currently participating small retailers would not meet the increased variety requirements, but that most would meet the new perishable requirements.50 (Under the requirements of Section 765, retailers do not currently face this full burden.)

Conclusion

With the final rule's December 2016 publication, implementation of the 2014 farm bill provisions appeared imminent. However, following the May 2017 enactment of the appropriations law policy provision, implementation of new variety and breadth of stock requirements may see further rulemaking. During the 115th Congress, SNAP retailers will be implementing some new requirements while waiting for others to be proposed and implemented. Because the variety-related requirements originate from a 2014 change in authorizing law, Congress may have an interest in changing the statute again, and related issues may come up in the formulation of the next farm bill.