Introduction

After rebounding from the 2007-2009 recession, U.S. manufacturing output has grown little since the second half of 2014. Over the same period, employment in the U.S. manufacturing sector has been flat. These trends defy expectations that forces such as higher labor costs in the emerging economies of Asia, heightened concern about the risk of disruptions to long, complex supply chains, and the development of inexpensive domestic supplies of natural gas would bring a surge of factory production in the United States.

The health of U.S. manufacturing is a subject of ongoing interest in Congress. Numerous bills are introduced in each session to encourage capital investment, support training of workers for manufacturing jobs, increase research and development related to manufacturing, and strengthen mandates for the use of domestic goods in federally funded projects and programs. Proponents of such efforts often associate increased factory activity with the creation of jobs for workers without higher education. Evidence suggests, however, that even strong growth in manufacturing output could well have only modest impact on job creation, and is unlikely to increase demand for workers with lower levels of education.

Employment in the Manufacturing Sector

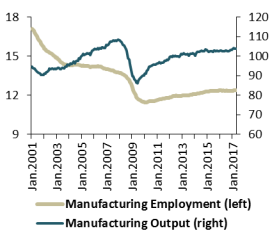

At the start of the 21st century, 17.1 million Americans worked in manufacturing. This number declined during the recession that began in March 2001, in line with the historic pattern. In a departure from past patterns, however, manufacturing employment failed to recover after that recession ended in November 2001 (see Figure 1). By the time the most recent recession began, in December 2007, the number of manufacturing jobs in the United States had fallen to 13.7 million. Currently, 12.4 million workers are employed in the manufacturing sector.

The output of U.S. manufacturers hit a cyclical bottom in June 2009. Since that time, a 21% increase in manufacturing output has been accompanied by only a 6% increase in manufacturing employment (see Figure 2). The low point in manufacturing employment was reached in February 2010. Since that time the manufacturing job count has risen 8%.1 The employment recovery in manufacturing lags far behind the cyclical norm following past recessions.

There is no single cause of the weakness in manufacturing employment. A sharp increase in the bilateral U.S. trade deficit with China following that country's accession to the World Trade Organization in 2001 contributed importantly to manufacturing job loss in the first half of the last decade, but changes in the bilateral balance in goods trade since 2006 are not associated with changes in employment of factory workers in the United States.2 Cyclical forces aside, at least three distinct factors limit the prospects for job creation in the manufacturing sector, even if domestic production gains market share from imports.

- Some manufacturing industries, notably apparel and footwear, are tied to labor-intensive production methods that have proven difficult to automate. With labor costs accounting for a much higher share of value added in these industries than in manufacturing as a whole, declining import barriers allowed imports from low-wage countries to displace domestic production. From 1.3 million workers as recently as 1980, U.S. employment in apparel manufacturing has fallen to 126,000. Leather manufacturing has seen a similar employment decline. Over the same period, U.S. output of apparel fell by 84%, and output of leather products fell by 78%.

- In other industries, technological improvements have led to large increases in labor productivity that have reduced the need for workers. Steelmaking offers such an example: the 84,000 people working in the industry in 2016 produced 3% more steel than nearly 400,000 workers did in 1980.3

- Secular shifts in demand have dimmed employment prospects in some industries despite the general recovery in manufacturing output. Paper consumption, for example, was once closely associated with economic growth, but no longer; as electronic communication supplants print in many uses, paper output is down 20% from its peak in 1999, contributing to a 61% drop in industry employment over the same period. As cigarette consumption has waned, output in tobacco products manufacturing is down by 54% since the most recent peak in 1996, while employment has fallen by nearly two-thirds.

These changes have resulted in a significant shift in the composition of manufacturing employment even as all manufacturing industries have experienced declining employment. Food manufacturing, which two decades ago accounted for 1 in 11 manufacturing jobs, now accounts for 1 in 8; it is one of the few manufacturing sectors in which employment has grown. Transportation equipment, fabricated metal products, machinery, and chemicals manufacturing have become more important parts of manufacturing—although these sectors have not been immune from the decline in employment. Apparel, textiles, printing, and computers and electronic products now account for substantially smaller shares of manufacturing employment than was formerly the case (see Table 1).

Table 1. Manufacturing Employment by Industry, 2001-2017

Shares of total manufacturing employment and thousands of workers

|

Industry |

2001 Share |

2001 Employment |

2017 Share |

2017 Employment |

|||||

|

Transportation Equipment |

|

1,992 |

13.15% |

1,625 |

|||||

|

Food |

|

1,554 |

12.72% |

1,575 |

|||||

|

Fabricated Metal Products |

|

1,759 |

11.49% |

1,420 |

|||||

|

Machinery |

|

1,453 |

8.71% |

1,076 |

|||||

|

Computers and Electronic Products |

|

1,871 |

8.39% |

1,036 |

|||||

|

Chemicals |

|

977 |

6.57% |

812 |

|||||

|

Plastics and Rubber |

|

932 |

5.66% |

699 |

|||||

|

Misc. Durables Manufacturing |

|

728 |

4.79% |

592 |

|||||

|

Printing |

|

798 |

3.57% |

441 |

|||||

|

Nonmetallic Mineral Products |

|

556 |

3.35% |

414 |

|||||

|

Furniture |

|

677 |

3.19% |

394 |

|||||

|

Electrical Equipment |

|

583 |

3.12% |

385 |

|||||

|

Primary Metals |

|

608 |

3.05% |

377 |

|||||

|

Paper |

|

599 |

2.99% |

369 |

|||||

|

Apparel |

|

457 |

1.02% |

126 |

|

||||

|

Textiles |

|

364 |

0.91% |

112 |

|

||||

Source: Bureau of Labor Statistics, Current Employment Statistics for January of respective year.

Note: Not all manufacturing industries are included.

The Changing Character of Manufacturing Work

In the public mind, the word "factory" is associated with the concept of mass production, in which large numbers of workers perform repetitive tasks. While mass production is still an important aspect of manufacturing, routine production functions, from welding joints in truck bodies to removing plastic parts from a molding machine, have proven susceptible to automation. This has had important consequences for the nature of work in manufacturing establishments and for the skill requirements of manufacturing workers.4

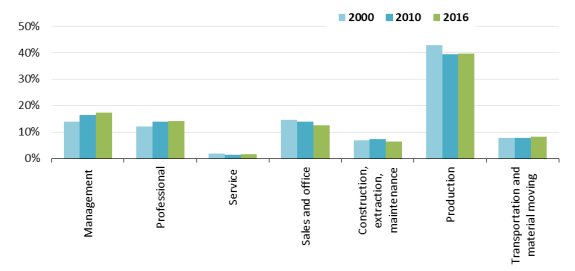

Goods production is no longer the principal occupation of workers in the manufacturing sector. Only two in five manufacturing employees are directly involved in making things. That proportion fell 3.3 percentage points between 2000 and 2016. Employment in other occupations within the manufacturing sector, notably office clerical work, has also declined (see Figure 3). As of 2017, 32% of all manufacturing workers held management and professional jobs.5

|

Figure 3. Manufacturing Employment by Occupation Percentage of manufacturing workforce |

|

|

Source: Bureau of Labor Statistics, Current Population Survey, Table 17, http://www.bls.gov/cps/cpsaat17.htm. |

In many manufacturing sectors, the shift to higher skill requirements is even more pronounced. Total employment in the U.S. computer and electronic product manufacturing subsector has declined due to automation, sharp falls in demand for certain products once produced in the United States (notably television tubes and audio equipment), and changed production economies that cause manufacturers to concentrate worldwide production in a small number of locations. Of the 1.05 million people employed in this subsector in 2015, 28% were engaged in production work, for which a high school education may be sufficient and for which workers received median annual pay of $37,220. Some 22% of the subsector's workers were in architecture and engineering occupations paying a median annual wage of $90,210, and another 13% were in computer and mathematical occupations with a median annual wage of $104,870; the latter two occupational categories require much higher education levels than production work. Similarly, some 33% of the workers in the pharmaceutical manufacturing subsector are involved with production. Many of the rest have scientific skills associated with higher education levels.6

The increasing demand for skills in manufacturing is most visible in the diminished use of "team assemblers"—essentially, line workers in factories and warehouses. In May 2016, employment in this occupation, which typically requires little training and no academic qualifications, was 1.1 million, down 15% since 2000. Some 862,300 team assemblers worked in manufacturing in 2016, representing less than 7% of manufacturing jobs. This type of job, once the core of manufacturing, has decreased in importance to many manufacturers and warehouse operators to the extent that 19% of all team assemblers work for employment agencies, which furnish workers to other companies on an as-needed basis. Team assemblers working for employment agencies earn an average of $12.43 per hour, some 21% less than those employed directly by manufacturing companies.7

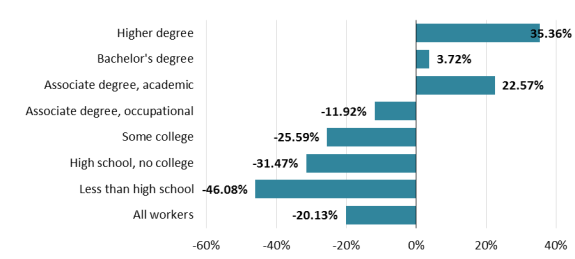

The changing occupational mix within the manufacturing sector is mirrored by changing educational requirements. In 2000, 53% of all workers in manufacturing had no education beyond high school. Between 2000 and 2016, that share dropped by 11 percentage points, even as the proportion of manufacturing workers with bachelor's degrees or graduate degrees rose by 9 percentage points, to 31%. Given that college-educated workers generally command significantly higher pay in the labor market than high-school dropouts and high-school graduates, it is unlikely that manufacturers would willingly hire more-educated workers unless there is a payoff in terms of greater productivity.

It is noteworthy that, despite the significant loss of manufacturing jobs between 2000 and 2016, the number of manufacturing workers with graduate degrees increased by 35% (see Figure 4). Demand for workers with associate (community college or proprietary school) degrees in academic fields, which qualify the recipient to pursue education to the bachelor's degree level, rose 23%, even as the total number of manufacturing workers without degrees beyond high school fell by more than one-third. Workers with academic-track associate degrees fared much better than those with associate degrees in occupational fields, which prepare students for immediate vocational entry and typically require less coursework in English, mathematics, and science. As manufacturing employment has recovered from its cyclical low in January 2010, manufacturers have shown a preference for workers with academic-track associate degrees; from 2010 to 2016, the manufacturing sector added 189,000 workers with academic-track associate degrees, while the number of manufacturing jobs held by workers with occupational degrees rose by 58,000.8

|

Figure 4. Manufacturing Employment by Worker Education Percentage change, 2000-2016 |

|

|

Source: Bureau of Labor Statistics, Current Population Survey. |

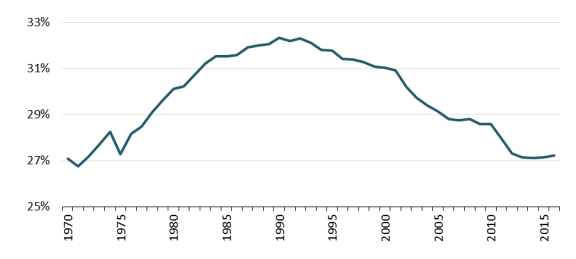

The proportion of manufacturing workers who are female has fallen from 32% as recently as 1993 to 27% currently (see Figure 5). Women have long accounted for a large share of employment in some of the industries that have experienced the steepest drops in employment, notably apparel, textiles, and electrical manufacturing. The female workforce was significantly less educated than the male workforce in manufacturing: in 2000, only 41% of female manufacturing workers had any education beyond high school, compared with 61% of their male counterparts.

This gender gap in education has closed since 2000, due largely to the departure of these less educated women from the manufacturing workforce. The number of female manufacturing workers with no education beyond high school fell 47% from 2000 to 2016. As a result, the number of years of schooling of female manufacturing workers is now very similar to that of males in manufacturing. Some 31% of women workers in manufacturing in 2016 held four-year college degrees or higher degrees, whereas 11% had not completed high school.

Female employment in manufacturing has risen by approximately 400,000 jobs since 2010, even as male employment has increased by 700,000 jobs. The main reason for this is that within the overall manufacturing workforce, women are less likely than men to work in some of the highly cyclical durable goods industries that have experienced the largest increases in employment, such as fabricated metal products and transportation equipment manufacturing.

|

Figure 5. Manufacturing Employment by Gender Percentage of manufacturing workforce that is female |

|

|

Source: Bureau of Labor Statistics, Current Employment Statistics. Note: Data are for January of each year and are not seasonally adjusted. |

The Shrinking Wage Premium

Policymakers traditionally have attached special importance to manufacturing because manufacturers appear to pay a wage premium, compared to employers in other industries. Based on pay, a 2012 U.S. Department of Commerce publication asserted, "manufacturing jobs are good jobs." According to that source, manufacturing jobs offered average hourly pay of $29.75 in 2010, compared to $27.47 for nonmanufacturing jobs. Including employer-provided benefits, the Commerce Department reported, manufacturing workers earned 17% more per hour than workers in other industries.9 Those other industries, it should be noted, include the low-paying retailing and leisure and hospitality industries, which jointly account for 22% of nonfarm employment.

Such comparisons, however, are not as straightforward as they may appear. At least some of the purported manufacturing wage premium exists because manufacturers employ far fewer young workers than industries with lower pay. In the lowest-paid sectors of the economy, a large share of the workforce—14% in leisure and hospitality, 7% in retailing—is under age 20, compared with only 1% of manufacturing workers.10 Also, large numbers of workers in those two relatively low-paid industries are employed part time; the average work week is around 25 hours in leisure and hospitality and 30 hours in retailing, versus 42 hours in manufacturing.11 Full-time workers in any industry are more likely to receive benefits than part-time workers.

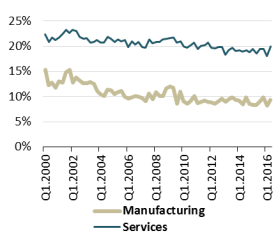

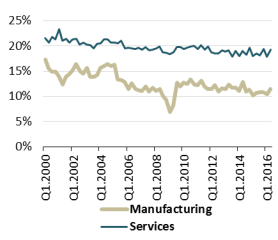

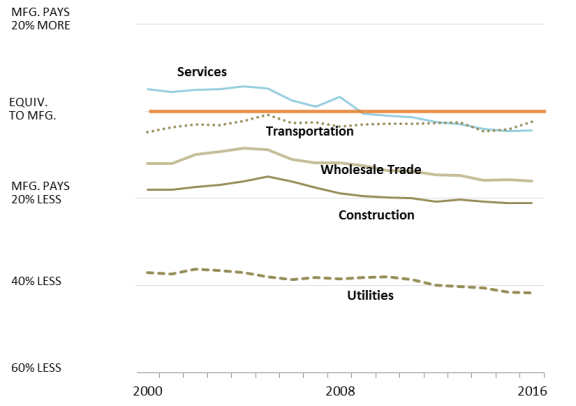

Contrary to the popular perception, manufacturing workers, on average, earn significantly less per hour than workers in industries that do not employ large numbers of teenagers, that have average workweeks of similar length, and that have similar levels of worker education. For example, nonsupervisory workers in manufacturing earned an average hourly wage of $21.54 in 2016, compared with $25.97 for construction workers and $37.12 for workers in the electric utility industry. Moreover, average manufacturing wages have declined over time, compared to those in other industries, with the exceptions of retailing and transportation (see Figure 6). In 2000, for example, nonsupervisory workers in manufacturing earned 5.1% more, on an hourly basis, than workers in the services sector; in 2016, they earn 4.3% less than services workers, on average. These trends reflect both competitive pressures on employers and the diminished bargaining power of workers in a sector with comparatively few employment opportunities.12

|

Figure 6. Wage Trends in Selected Industries Relative Hourly Pay of Nonsupervisory Workers in Manufacturing |

|

|

Source: Bureau of Labor Statistics, Current Employment Statistics. |

According to Bureau of Labor Statistics data, 2.9% of jobs in manufacturing were unfilled in January 2017, up from 2.7% one year earlier. The number of unfilled jobs rose by 16,000. However, all of that increase occurred in nondurables industries, where the average wage of production workers, $18.99 per hour, was well below the $21.64 average in durable-goods manufacturing.13 Manufacturers responded to the rising number of openings by increasing production workers' wages in nondurables much faster over the year to January 2017 (3.3%) than in durables (2.1%).

Traditionally, manufacturing employers have tended to offer more generous employee benefits than those in other industries. This may no longer be the case. Data from the Bureau of Labor Statistics compensation survey, which takes the cost of insurance, pensions, and other employee benefits into account, show that manufacturing workers experienced a decline in benefits relative to workers in other industries between 2006 and 2016.14

On balance, then, modest job creation in manufacturing has not been accompanied by an improvement in the position of manufacturing workers, relative to those in other sectors. Although workers in some manufacturing industries earn relatively high wages, the assertion that manufacturing as a whole provides better jobs than the rest of the economy is increasingly difficult to defend.

Manufacturing-Related Work in Other Sectors

Under current statistical practices, whether an activity is classified as manufacturing depends largely on where it is conducted. Government statistical agencies track most types of economic activity at the level of the establishment—that is, a single facility or business location—rather than at the level of a firm that may own multiple establishments or an enterprise that may own many firms. As a general rule, if an establishment is "primarily engaged" in transforming or assembling goods, then all output from that establishment is considered output of the manufacturing sector, and all workers (except those employed by outside contractors) are considered manufacturing workers.

Thus, if a firm locates its product design employees at a U.S. facility that is primarily engaged in producing goods, those designers will likely be counted as working in a manufacturing establishment, and their work will add to the total value added created in U.S. manufacturing. If, however, the product designers work at a separately located design center, they will probably be considered to work in an industrial design establishment, not a manufacturing establishment. In that case, they will be counted as industrial design workers, and their value added will be attributed to the professional, scientific, and technical services sector, not to the manufacturing sector.15 The same will be true if the product designers are employed by a separate firm rather than by the firm that owns the manufacturing establishment.

One might identify four separate groups of U.S. workers whose jobs are related to manufacturing:

- Production employees of manufacturing establishments: approximately 8.6 million workers at the end of 2016.

- Nonproduction employees of manufacturing establishments: approximately 3.7 million workers.

- Workers producing manufactured goods but employed by nonmanufacturing establishments: number unknown.

- Workers producing services and software used in manufacturing but employed by nonmanufacturing establishments: number unknown.

Data related to the first two groups are generally captured by government statistics depicting the manufacturing sector. Data related to the roles of workers in the last two groups are far more tenuous.

Information Technology

Establishments in the computer systems design and related services industry employed a total of 1.9 million Americans in 2015. Rough calculations suggest that perhaps 23% of the work hours in this industry, equivalent to 447,000 jobs, might be considered manufacturing work if the workers were employed by manufacturing establishments (Table 2).16

Table 2. Manufacturing Employment Potentially Attributable to the

Computer Systems Design and Related Services (CSD) Industry, 2015

|

Line |

Statistic |

Output |

Employment |

|

A |

CSD direct employment in 2015 |

1,911,400 |

|

|

B |

CSD total output in 2015 |

$462,737,000,000 |

|

|

C |

CSD sales to manufacturers |

$16,565,000,000 |

|

|

D |

CSD sales to manufacturers as share of CSD output (C/B) |

3.58% |

|

|

E |

CSD employment attributable manufacturing inputs (D*A) |

68,424 |

|

|

F |

CSD sales for private nonresidential investment in IP |

$236,479,000,000 |

|

|

G |

Total private nonresidential investment in IP |

$717,900,000,000 |

|

|

H |

Investment by manufacturers in IP |

$278,000,000,000 |

|

|

I |

Manufacturers' investment in IP as share of total (H/G) |

38.72% |

|

|

J |

CSD output possibly attributable to manufacturers' investment in IP (F*I) |

$91,574,261,039 |

|

|

K |

CSD sales of IP to manufacturers as share of output (J/B) |

19.79% |

|

|

L |

CSD employment possibly attributable to manufacturers' investment in CSD IP (K*A) |

378,260 |

|

|

M |

Manufacturing-like employment in CSD (E+L) |

446,684 |

Source: CRS. See note 16.

Note: IP=intellectual property.

Another 360,000 U.S. workers are employed in software publishing, an industry in which employment has been rising approximately 6% annually. An unknown number of these workers are involved in writing and testing computer software that is eventually embedded in manufactured goods. However, in government statistics these workers are allocated to the information sector, and they are not counted as part of the manufacturing workforce.

Bundled Services

Anecdotal evidence suggests that a growing proportion of manufactured goods are sold in conjunction with after-sale services. For example, Boeing Corp., an aircraft manufacturer, recently set a goal of $50 billion of annual revenue from services such as supplying spare parts, modifying and repairing aircraft, training pilots, and monitoring aircraft systems during flights.17 Many other manufacturers are reshaping themselves to be service providers as well, attracted by the prospect of continuing revenue streams from customers rather than one-time payments.18

It is possible that a manufacturer might demand a different price for a good sold as a stand-alone product than for the same good when bundled with a service contract. In such a case, the amount of the product's value to attribute to the manufacturing sector rather than the "other services" sector, which includes machinery and equipment repair and maintenance, may be arbitrary.19 Government data collectors may not be able to capture the value of the good separately from the value of the bundled services, and may not be able to distinguish the workers involved in the original production process from those providing related services.

Factoryless Goods Production/Contract Manufacturing

Factoryless goods producers are firms that design products to be manufactured and own the finished goods but do not engage directly in physical transformation. The transformation or assembly of the goods they sell is done by external suppliers, known as contract manufacturers, in the United States or abroad, although the factoryless goods producer may be closely involved in its contract manufacturers' operations. Examples might include a U.S.-based footwear company that engages other firms to produce the shoes it designs and markets,20 and a "fabless" semiconductor company that contracts with an unrelated "foundry" to manufacture its chips.21

It is impossible to identify factoryless goods producers with certainty; responses to related questions on government surveys are confidential, and companies' annual reports filed with the Securities and Exchange Commission may not provide sufficient detail to determine whether they own manufacturing establishments. However, Alphabet Inc., parent of Google Inc., appears to meet the definition. Alphabet generated more than 90% of its revenue in 2015 from delivering online advertising. However, the company sells computers and telephones to consumers, and designs and oversees production of computer servers used in its data centers. In 2012 a company official referred to Google as "probably ... one of the largest hardware manufacturers in the world." However, according to Alphabet's 2015 annual financial report, "We rely on third parties to manufacture many of our assemblies and finished products," leaving the question of whether Alphabet owns and operates its own manufacturing facilities unanswered. It is unclear whether any Alphabet employees are categorized as manufacturing workers and whether any of the company's sales are registered as manufacturing output.22

According to Census Bureau estimates, at least 54,000 nonmanufacturing firms employing 3.4 million workers purchased contract manufacturing services in 2012.23 Many of the tasks performed by the employees of the purchaser firms may be identical to those performed by employees of manufacturing establishments in management, professional, sales, office, and transportation occupations. However, as the facilities owned by factoryless goods producers are usually classified as wholesale, retail, or professional, scientific, and technical service establishments rather than manufacturing establishments, it is likely that few if any of their workers are counted as manufacturing workers.

Most contract manufacturing services are provided by establishments in the manufacturing sector, either in the United States or abroad. At the same time, however, more than 20,000 U.S. enterprises whose primary business is not manufacturing reported providing contract manufacturing services in 2012. These enterprises—an "enterprise" may own one or many establishments or firms—collectively employed 1.5 million workers (Table 3). The number of those 1.5 million workers who were engaged in manufacturing-related work cannot be determined from published data.24

Table 3. Characteristics of U.S. Enterprises Providing Contract Manufacturing

Ranked by number of contract manufacturers

|

Sector |

Number of Contract Manufacturers in Sector |

Total Employment of Contract Manufacturers in Sector |

||

|

Manufacturing |

14,683 |

2,372,674 |

||

|

Professional, scientific, and technical services |

5,042 |

230,648 |

||

|

Wholesale trade |

4,699 |

156,276 |

||

|

Construction |

2,244 |

67,355 |

||

|

Retail trade |

2,130 |

659,501 |

||

|

Accommodation and food services |

1,686 |

73,965 |

||

|

Other |

4,332 |

347,253 |

||

Source: U.S. Census Bureau, Enterprise Statistics: 2012 Enterprise Tables, Table 7.

Notes: An enterprise may have establishments in multiple sectors and may control more than one firm.

The definitional questions associated with factoryless goods producers have proven controversial. In 2010, U.S. statistical agencies proposed to categorize factoryless goods producers as manufacturers from 2017.25 This change would have greatly increased both the number of individuals counted as manufacturing workers and the reported value added of the manufacturing sector.26 The proposal met with strong objections. In 2014, the Office of Management and Budget ordered the change postponed, citing the poor quality of statistical data about factoryless producers.27 As a result, a significant amount of manufacturing-like work and value added is not attributed to manufacturing in government statistics.

Employment Services Firms

Manufacturers make significant use of workers employed by employment services firms in addition to their own employees. According to Bureau of Labor Statistics data, 755,650 people in typical manufacturing production occupations worked for employment services firms in May 2015 (Table 4). That number has not changed significantly since 2000, while the number of production and nonsupervisory workers employed by manufacturers has fallen by nearly 4 million.28

|

Occupation |

Number of Workers |

|

|

First-line supervisors of production and operating workers |

5,790 |

|

|

Assemblers and fabricators |

276,450 |

|

|

Food processing workers |

12,120 |

|

|

Metal and plastic workers |

92,340 |

|

|

Printing workers |

5,910 |

|

|

Textile, apparel, and furnishing workers |

7,770 |

|

|

Woodworkers |

3,830 |

|

|

Plant and system operators |

1,270 |

|

|

Other production occupations |

350,170 |

|

|

Total |

755,650 |

|

Source: Bureau of Labor Statistics, Occupational Employment Statistics Query System, http://data.bls.gov/oes.

It is likely that many nonproduction workers in manufacturing establishments are employed by employment services as well. This includes workers in office, maintenance, and food service occupations. The number of individuals in those categories who work within manufacturing establishments as employees of employment services cannot be ascertained. Nor is it known how much value added by the employment services sector stems from manufacturing-related work.

The Decline of the Large Factory

The stereotypic U.S. manufacturing plant has thousands of employees filling a cavernous factory hall. This stereotype is outdated. While the number of factories in all size categories has fallen in recent decades, the decline has been steepest among factories with large employment. Of more than 292,000 manufacturing establishments29 counted by the Census Bureau in March 2015, only 863 employed more than 1,000 workers (see Table 5). The number of large factories has risen slightly since reaching a modern low of 795 in 2010, but remains far below the level of the 1990s. Those large factories, the ones most prominent in public discussion of manufacturing, collectively employ 1.8 million workers, 15% of the manufacturing workforce and slightly more than 1% of the U.S. labor force.30

As the number of large factories has plummeted since the late 20th century, the number of small factories, those with fewer than 100 workers, has declined far more slowly. Most of the plants in the latter category are extremely small, with 59% of them having fewer than 10 workers. The growing prominence of small factories contributed to a decline in mean employment in U.S. manufacturing establishments, from 46.3 workers in 1998 to 36.2 in 2010. Since then, mean employment size has risen to 39.6 workers, due mainly to employment increases at large establishments in aircraft and automobile manufacturing.

|

99 or fewer |

100-249 |

250-499 |

500-999 |

1,000 or more |

|

|

1998 |

330,956 |

22,499 |

7,968 |

3,322 |

1,504 |

|

2003 |

312,056 |

19,548 |

6,574 |

2,531 |

1,140 |

|

2008 |

298,223 |

18,694 |

5,957 |

2,340 |

1,002 |

|

2011 |

272,396 |

15,575 |

4,986 |

1,871 |

815 |

|

2014 |

268,096 |

16,295 |

5,293 |

2,013 |

846 |

|

2015 |

267,969 |

16,430 |

5,491 |

2,072 |

863 |

|

Change, 1998-2015 |

-19% |

-27% |

-31% |

-38% |

-43% |

Source: Census Bureau, County Business Patterns, various years.

The decline in the number of large factories has been widespread across the manufacturing sector, with the exception of the food processing industry. Four industries—chemicals, computers and electronic products, machinery, and transportation equipment—accounted for more than half the decline in the number of factories with more than 1,000 workers between 1998 and 2010. Since then, the number of large factories has increased in primary metals, electrical equipment, machinery, and transportation equipment (see Table 6).31 These are among the most cyclical manufacturing industries, and the renewed growth in the number of large factories suggests that existing plants have added workers as business conditions have improved. The number of food plants with 1,000 or more workers grew in 2015 after several years of decline, but the number of large factories in computer and electronic products manufacturing continued to fall.

|

Industry |

1998 |

2003 |

2008 |

2011 |

2015 |

|||

|

Food |

|

|

|

168 |

175 |

|||

|

Chemicals |

|

|

|

57 |

56 |

|||

|

Primary Metals |

|

|

|

33 |

34 |

|||

|

Computers and Electronic Products |

|

|

|

123 |

95 |

|||

|

Electrical Equipment |

|

|

|

22 |

31 |

|||

|

Machinery |

|

|

|

71 |

80 |

|||

|

Transportation Equipment |

|

|

|

177 |

219 |

Source: Census Bureau, County Business Patterns, various years.

The recent economic literature on the causes of changes in factory size is scant, but evidence suggests two principal causes. One is automation: as firms substitute capital for labor, fewer workers are required to produce a given quantity of output. The other is the increase in what economists refer to as "vertical specialization," with individual plants making a narrow range of the components required for a finished product, and those partially finished goods, known as "intermediate products," being shipped from one location to another through sometimes complex production networks before the final good is manufactured.32 Much of the growth in international trade in recent years has involved intermediate products in international production networks, and one logical—although undocumented—corollary of that growth would be that large factories reduce the scope of their activities and shed workers who formerly made inputs that are now obtained elsewhere.

Among the remaining factories with more than 1,000 workers, average employment size has held steady since 2004. In aggregate, however, large factories account for a diminishing share of manufacturing employment (see Table 7). Approximately 15% of manufacturing workers are employed in plants with more than 1,000 workers, down from 19% in 1998.

Table 7. Manufacturing Employment by Establishment Size

Percentage of manufacturing employment in employment size category in given year

|

99 or fewer |

100-249 |

250-499 |

500-999 |

1,000 and over |

|||||||||||

|

1998 |

|

|

|

|

|

||||||||||

|

2003 |

|

|

|

|

|

||||||||||

|

2008 |

|

|

|

|

|

||||||||||

|

2011 |

36.2% |

21.6% |

15.6% |

11.4% |

15.1% |

||||||||||

|

2015 |

34.5% |

21.7% |

16.3% |

12.1% |

15.4% |

Source: CRS, computed from Census Bureau, County Business Patterns by Employment Size Class, various years.

Start-Ups and Shutdowns

The employment dynamics of the factory sector differ importantly from those in the rest of the economy. In other economic sectors, notably services, business start-ups and shutdowns account for a large proportion of job creation and job destruction. In manufacturing, by contrast, employment change appears to be driven largely by the expansion and contraction of existing firms, with entrepreneurship and failure playing lesser roles. This may be due to obvious financial factors: the large amounts of capital needed for manufacturing equipment may serve as a deterrent to opening a factory, and the highly specialized nature of manufacturing capital may make it difficult for owners to recover their investment if an establishment shuts down entirely rather than reducing the scope of its production activities.

The dynamics of employment change in manufacturing can be seen in two different government databases. The Bureau of Labor Statistics' Business Employment Dynamics database, which is based on firms' unemployment insurance filings, offers a quarterly estimate of gross employment gains attributable to the opening of new establishments and to the expansion of existing ones, and of the gross job losses attributable to the contraction or closure of establishments.33 In manufacturing, BLS finds, less than 10% of gross job creation since 2005 is attributable to new establishments, and more than 90% to the expansion of existing establishments. This is quite a different picture from that offered by the service sector, in which openings routinely account for more than 20% of all new jobs (see Figure 7).

Similarly, while plant closings are frequently in the headlines, closings are responsible for less than 12% of the manufacturing jobs lost since 2005, according to BLS data. The vast bulk of manufacturing job losses occur at establishments that remain in operation. Closure is far less likely to be the cause of job loss in the manufacturing sector than in the service sector, where 19% of job losses are due to establishments closing (see Figure 8).34

|

|

|

The other source of data on the connection between new factories and manufacturing job creation is the longitudinal business database maintained by the Census Bureau's Center for Economic Studies. This database, which contains data since 1976, covers some establishments (notably certain public sector employers) not included in the BLS database and links individual firms' records from year to year in an attempt to filter out spurious firm openings and closings.35 The Census database has different figures than the BLS database, but identifies similar trends, in particular that establishments open and close at far lower rates in the manufacturing sector than in other sectors of the economy.

The Census Bureau data make clear that the rate at which new business establishments of all sorts were created fell significantly during the 2007-2009 recession.36 As of 2014, the business creation rate had not recovered to prerecession levels. The data also show that 12,383 manufacturing establishments employing 201,887 workers opened their doors in the year to May 2014. This represents an increase in the number of new plants over 2013, but fewer than in any other year since 1977, the year for which the data were first collected. The number of new manufacturing establishments opened each year from 2010 through 2014, on average, was only 40% the annual average during the 1980s.37

These two data sources on business dynamics thus support similar conclusions about the role of plant openings and closings in manufacturing employment. Only a small share of the jobs that are created in the manufacturing sector comes from new factories, largely because factories typically expand slowly in their early years.38 The average new manufacturing establishment provides 16 jobs during its first year in operation.39 Conversely, a minority of the jobs lost come from the closure of existing factories, perhaps because factories shrink over a period of years before closing. The rate of job loss due to factory closures has fallen significantly over time. These facts indicate that marginal employment change in manufacturing depends more heavily on staffing decisions at existing factories than on the creation of new factories.

Is There a Chemical Comeback?

The chemical industry figures prominently in discussions of a possible revival in U.S. manufacturing. The production of large amounts of natural gas from shale formations in several states has lowered the domestic price and provided some assurance of long-term availability, making the United States a more attractive location for producing nitrogen fertilizers and other chemical products that make intensive use of natural gas. Additionally, large-scale production of oil from shale formations in North Dakota and Texas has raised the prospect of increased petrochemical manufacturing.40

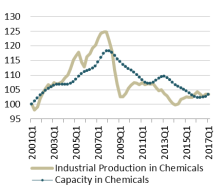

The chemical industry's investment in U.S. fixed assets, such as machinery and structures, averaged $97 billion annually from 2007 through 2012, but then moved sharply higher. In 2015, according to government data, the industry's fixed investment reached $124 billion.41 Many corporate announcements and news reports have pointed to substantial new investment in the sector. In March 2017, a report published for the American Chemistry Council, an industry group, declared that "chemical manufacturing is on the verge of a renaissance." The report forecast that the industry's capital spending would increase 65% by 2020, raising production capacity by 18%. Most of the new capacity is being added in Texas and Louisiana.42

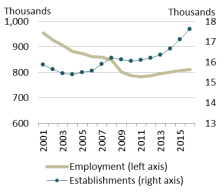

In contrast to other manufacturing industries, where the number of plants has been in decline, the number of chemical industry establishments appears to have reached the highest level on record.43 Yet with the average chemical plant employing only 46 workers—down from 60 in 2001—employment growth has been modest (see Figure 9). This is due principally to the shrinkage or closure of extremely large plants producing basic chemicals, as the number of plants employing fewer than 1,000 workers has changed little over the past two decades.

As large commodity chemical plants have closed, chemical production has generally shifted to smaller, more specialized facilities. In consequence, the industry's total production capacity has shrunk. As of the first quarter of 2017, industry-wide production capacity was 13% below its 2007 peak, and industry output was just higher than at the trough of the most recent recession, in 2009 (see Figure 10). The industry had $1.18 million of plant and equipment for each employee in 2015,44 implying that even very large capital investments will lead to comparatively little direct employment, at least in the near term.

|

|

|

Selected Policy Issues for Congress

In recent years, Congress has considered a large amount of legislation intended to strengthen the manufacturing sector. Bills introduced in the 115th Congress take extremely diverse approaches, ranging from providing financial and technical assistance to designed manufacturing communities (H.R. 1672; Make It In America Manufacturing Communities Act) to requiring that construction and repairs funded by the drinking water treatment revolving loan program use only iron and steel products made in the United States (H.R. 939; Buy America for Drinking Water Extension Act of 2017) to directing the President to appoint a Chief Manufacturing Officer (S. 399; Chief Manufacturing Officer Act) to providing a tax credit for 25% of the cost of new manufacturing facility built by a U.S.-based start-up company (H.R. 340; Next Generation American Manufacturing Act of 2017).

These proposals, and many others, are typically advanced with the stated goal of job creation, and often with the subsidiary goals of improving employment opportunities for less educated workers or reversing employment decline in communities particularly affected by the loss of manufacturing jobs. The available data suggest, however, that these goals may be difficult to achieve. In particular:

- Even large increases in manufacturing activity are likely to translate into relatively modest gains in manufacturing employment due to firms' preference to use U.S. facilities for highly capital-intensive production. After adjusting for inflation, U.S. manufacturers' fixed assets per full-time-equivalent employee rose 54% from 2006 to 2015.45 With the average manufacturing worker making use of more than $300,000 worth of fixed assets, even large investments are likely to lead to relatively little manufacturing employment, although they may create demand for workers in other sectors, such as construction or information services.

- The decline in energy costs due to the development of shale gas, strongly encouraged by federal policy, is having only relatively modest effects on manufacturing employment in the United States. The three sectors that jointly account for about 65% of natural gas consumption in manufacturing—chemicals, petroleum refining, and primary metals—are the three most capital-intensive sectors of U.S. manufacturing; refineries and chemical plants produce far more value added per employee than other manufacturing establishments. To the extent that expansion in these industries creates jobs, those are more likely to be in supplier industries than in their own facilities.

- Changes in methods, products, and materials may transform some manufacturing industries over the next few years. Some of these changes have been supported by the federal government. For example, the Revitalize American Manufacturing and Innovation Act of 2014, part of the Consolidated and Further Appropriations Act, 2015 (P.L. 113-235, Division B, Title VII), enacted an Obama Administration proposal to establish a Network for Manufacturing Innovation "to improve the competitiveness of United States manufacturing and to increase the production of goods manufactured predominantly within the United States." The act authorizes up to seven years of federal support for centers of manufacturing innovation seeking to improve manufacturing technology.46 Such improvements may lead to greater manufacturing output, but technological advances in manufacturing are likely to further reduce the need for production workers.

- Increases in manufacturing employment are unlikely to result in significant employment opportunities for workers who have not continued their educations beyond high school, as the sorts of tasks performed by manufacturing workers increasingly require higher levels of education and training. This suggests that government-supported training efforts, while potentially helpful in preparing individuals for specific manufacturing jobs, should not be expected to lead to an increase in total manufacturing employment.

- To the extent that federal policies lead to the establishment of new manufacturing facilities in the United States, those facilities are likely to provide only limited employment opportunities in the locations where they are built. Plants with more than 1,000 workers are much less common than they once were, and nearly three in five manufacturing workers are employed in establishments with fewer than 250 workers. This suggests that there will be relatively few instances in which the siting of a new plant, by itself, will suffice to revitalize a community with a struggling economy.

- Policies that promote construction of new facilities for manufacturing may be less effective ways of preserving or creating jobs than policies aimed at existing facilities, as new establishments appear to be relatively unimportant as drivers of employment in manufacturing.

It is important to note that increased manufacturing activity may lead to job creation in economic sectors other than manufacturing. For example, the professional services, information, and finance industries provide about 8% of all inputs into manufacturing, and the transportation and warehousing industry furnishes about 5%, so expansion of manufacturing is likely to stimulate employment in those sectors.47 To the extent that increased domestic production of manufactured goods supplants imports, however, any increases in ancillary employment related to domestic manufacturing may be counterbalanced by reduced employment related to the transportation and processing of imported goods, leaving the net employment effect uncertain.