Introduction

A pension is a voluntary benefit offered by employers to assist employees in preparing for retirement. Pension plans may be classified according to whether they are (1) defined benefit (DB) or defined contribution (DC) plans and (2) sponsored by one or more than one employer. In DB plans, participants typically receive regular monthly benefit payments in retirement (which some refer to as a "traditional" pension).1 In DC plans, of which the 401(k) plan is the most common, participants have individual accounts that can provide a source of income in retirement. This report focuses on DB plans.

Pension plans are also classified by whether they are sponsored by one employer (single-employer plans) or by more than one employer (multiemployer and multiple-employer plans). Multiemployer pension plans are sponsored by more than one employer (often, though not required to be, in the same industry) and maintained as part of a collective bargaining agreement. Multiple-employer plans are sponsored by more than one employer but are not maintained as part of collective bargaining agreements.2 Multiple-employer plans follow the same funding rules as single-employer plans and are generally not reported separately. This report focuses on single-employer plans. Except where noted, references to single-employer plans in this report include multiple-employer plans.

To protect the interests of pension plan participants and beneficiaries, Congress enacted the Employee Retirement Income Security Act of 1974 (ERISA; P.L. 93-406). The law is codified in the Internal Revenue Code (26 U.S.C.) and Labor Code (29 U.S.C.). ERISA sets standards that private-sector pension plans must follow with regard to plan participation (who must be covered); minimum vesting requirements (how long a person must work for an employer to be covered); fiduciary duties (how individuals who oversee the plan must behave); and plan funding (how much employers must set aside to pay for future benefits). In addition, ERISA established the Pension Benefit Guaranty Corporation (PBGC), which is a government corporation that insures DB pension plans covered by ERISA in the case of plan termination. ERISA covers only private-sector pension plans and plans established by nonprofit organizations. It exempts pension plans established by the federal, state, and local governments and by churches. The funding relief provisions discussed in this report generally apply only to plans covered by ERISA.

Basics of Single-Employer Defined Benefit Pension Plan Funding

Pension funding consists of several elements. These include the value of plan benefits that participants will receive in the current and in future years; the amount a plan has set aside to pay for these benefits; and the employer contributions required each year to ensure the plan has sufficient funds to pay benefits when participants retire.

The amount of a participant's benefit in a single-employer DB plan is based on a formula that typically uses a combination of length of service, accrual rate, and average of final years' salary. For example, a plan might specify that retirees receive an amount equal to 1.5% of their pay for each year of service, where the pay is the average of a worker's salary during his or her highest-paid five years.3

In general, ERISA requires DB plans to have enough assets set aside to pay the benefits owed to participants. For various reasons, plans may have less or more than this amount. Employers that sponsor DB plans are required to make annual contributions to their plans to ensure they ultimately reach that 100% funding goal.4

Typical Defined Benefit Plan Balance Sheet

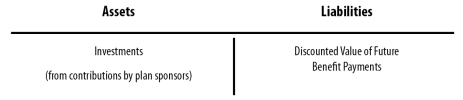

Figure 1 depicts a typical DB pension plan's balance sheet. It consists of (1) plan assets, which are the value of the investments made with accrued employer (and employee, if any) contributions to the plan, and (2) plan liabilities, which are the value of participants' benefits earned under the terms of the plan.5 Plan assets are invested in equities (such as publicly-traded stock), debt (such as the U.S. Treasury and corporate bonds), private equity, hedge funds, and real estate.

Plan Assets

Pension plans are required to report the value of plan assets using two methods: (1) market values (the value at which assets can be sold on a particular date) and (2) smoothed, or actuarial, values (the average of the past, and sometimes expected future, market values of each asset). Actuarial values are used to determine the 100% funding goal and any additional employer contributions necessary to achieve that goal. The smoothing of asset values prevents large swings in asset values and creates a more predictable funding environment for plan sponsors.

Some advocates of reporting market values note that smoothed values are often higher than market values (particularly during periods of market declines), which could overstate the financial health of some pension plans. Some advocates of smoothing argue that market values are useful only if a plan needs to know its liquidated value (e.g., if the plan had to pay all of its benefit obligations at one point in time), which is unlikely to be the case as most employers sponsoring pension plans are unlikely to enter bankruptcy.

Plan Liabilities

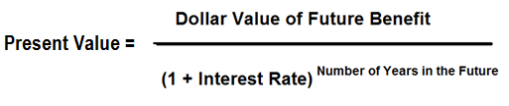

A pension plan's benefits are a plan liability spread out over many years in the future.6 These future benefits are calculated and reported as present values (also called current values). Using a formula, benefits that are expected to be paid in a particular year in the future are calculated so they can be expressed as a present value. This process is called discounting, and it is the reverse of the process of compounding, which projects how much a current dollar amount will be worth at a point in the future. The formula by which future values are calculated as present values is shown in Figure 2.7

|

|

Source: Congressional Research Service (CRS). |

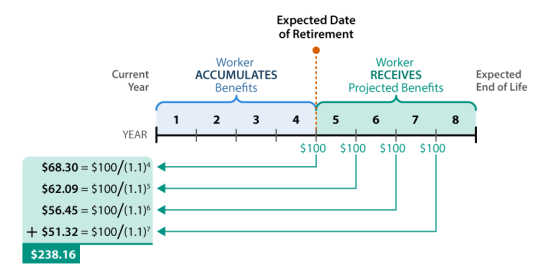

Figure 3 shows a simplified example of a DB pension benefit calculation. In this example, it is assumed that at the beginning of year 1, the worker has already earned a benefit of $100 per year in retirement, which is expected to begin in year 5. Retirement is expected to last four years. Each of the payments is made at the beginning of the year and is discounted using the present value formula in Figure 2 and assuming an interest rate of 10%. In this example, the first benefit is received at the beginning of year 5, so that benefit payment is discounted over four years. The benefits for the following three years are also discounted to beginning of year 1 dollar amounts and are then summed, resulting in a benefit value of $238.16 at the beginning of year 1.

|

|

Source: Congressional Research Service (CRS). Notes: This example assumes four yearly benefits of $100 per year, beginning in year 5 and discounted at an interest rate of 10%. |

The calculated present value of the benefit payments depends on the year in which the benefit is calculated. For example, as a worker moves closer to the expected date of retirement and recalculates the present value of the benefit, the calculated value of the obligation increases. For example, when calculated at the beginning of year 2, the simplified pension benefit has a present value of $261.97 in year 2 dollars. When calculated at the beginning of year 3, the benefit has a present value of $288.17 in year 3 dollars.8

Defined Benefit Plan Funding Ratio

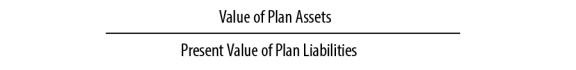

The DB plan funding ratio compares the value of a plan's assets with the present value of a plan's liabilities and is often used as an indicator of the financial health of a plan. The DB plan funding ratio is calculated as

A funding ratio of 100% indicates that the DB plan has set aside enough funds to pay the present value of the plan's future benefit obligations. Funding ratios that are less than 100% indicate that the DB plan has not set aside enough to meet the calculated value of its future benefit obligations.9 Because benefit obligations are typically paid out over a period of 20 to 30 years, participants in even an underfunded plan will likely receive their promised benefits in the near term. However, if the underfunding persists without additional contributions or higher investment returns, plan participants in an underfunded plan might not receive 100% of their promised benefits in the future.

Returning to the example above, setting aside $238.16 at the beginning of year 1 would fund the year 1 value of the benefit. At the beginning of year 2, the benefit has a recalculated value of $261.97 in year 2 dollars.10 Because $238.16 was set aside at the beginning of year 1—and assuming no investment gains or losses and no additional pension benefits—an additional contribution of $23.81 ($261.97 - $238.16) is needed to fund the value of the benefit as calculated at the beginning of year 2.

Likewise, at the beginning of year 3, the benefit has a recalculated value of $288.17 in year 3 dollars. Because $238.16 was set aside at the beginning of year 1, and $23.81 more was contributed at the beginning of year 2—and assuming no investment gains or losses and no additional pension benefits—an additional contribution of $26.20 ($288.17 - $261.97) is needed to fund the value of the benefit as calculated at the beginning of year 3.11 This discussion of the example in Figure 3 has reviewed the funding ratio and required payments for only the first three years displayed. In practice, the DB plan funding ratio would continue to be recalculated and payments necessary to satisfy any DB plan funding ratio shortfalls would continue to be required each year to ensure the DB plan funding obligation is fully satisfied.

The present value of a dollar amount is inversely related to the assumed interest rate. As the interest rate increases, present value decreases; as the interest rate decreases, present value increases. In the above example, if the interest rate is 15%, then the pension benefit has a value of $187.72 calculated at the beginning of year 1, $215.88 calculated at the beginning of year 2, and $248.26 calculated at the beginning of year 3.12

In this modification of the simplified example, with the only difference being a 15% interest rate, the pension benefit would be funded—and assuming no investment gains or losses and no additional pension benefits—with contributions of $187.72 at the beginning of year 1; $215.88 - $187.72 = $28.16 at the beginning of year 2; and $248.26 - $215.88 = $32.38 at the beginning of year 3.13 This example shows payments for the first three years; in practice, contributions would continue until the obligation is fully satisfied.

Note that the amounts of the yearly payments differ depending on the interest rate used. Compared with the payments in the 10% interest rate example, the initial payment in the 15% example is lower ($187.72 versus $238.16) but subsequent payments are higher (e.g., year 2 payments are $28.16 using the 15% interest rate and $23.81 using the 10% interest rate). Over time, the required payments in both cases—assuming no investment gains or losses and no additional pension benefits—sum to the total benefits received in retirement. The interest rate used by single-employer DB plans is discussed later in this report.

Annual Employer Contributions to Defined Benefit Plans

ERISA sets out requirements for the minimum required contribution, which is amount of money that must be contributed each year to a DB pension plan.14 In general, the minimum required contribution is the sum of (1) the value of benefits earned by participants in the plan year (the target normal cost), (2) installment payments resulting from plan underfunding in previous years (the shortfall amortization charge), and (3) installment payments resulting from Internal Revenue Service- (IRS-) approved waived required contributions in previous years (the waiver amortization charge).

Target Normal Cost

The target normal cost represents the value of pension benefits that are earned or accrued by employees in a plan year and the cost to administer these benefits (minus any mandatory employee contributions).

Amortization Charges

A DB plan's funding can change in a given year as a result of changes to participants' benefits, employer contributions, and circumstances or events outside the plan's control. Plan underfunding could increase from events such as a decrease in plan assets due to declines in the stock market or an increase in plan liabilities due to decreases in interest rates. In order for a plan to remain fully funded, employers must increase their plan contributions to make up for losses that are outside the plan's control. Employers are not required to make up for the losses all at once. Rather, they may make installment payments to make up for plan losses over a number of years.15

Plan underfunding is paid off in installment payments via amortization. The amortization period is the length of time over which a plan can spread the installment payments.

Shortfall Amortization Charge

A plan's funding target is the present value of all benefits earned by participants as of the beginning of the year. A plan's funding shortfall is the amount by which the funding target is greater than the value of plan assets. Various factors can cause funding shortfalls, such as investment losses and decrease in interest rates. In general, PPA required plan underfunding resulting from funding shortfalls to be amortized over a period of seven years.16

Waiver Amortization Charge

Employers that face a temporary substantial business hardship can apply to the IRS for a funding waiver.17 Missed minimum required contributions as a result of receiving an IRS funding waiver must be amortized over five years. The waiver amortization charge is the amount of a plan's installment payment that amortizes the missed contributions.18

Single-Employer Defined Benefit Pension Plan Data

Table 1 provides data on single-employer DB pension plans. In 2018, there were over 23,000 of such plans with 26.2 million participants.

|

Number of Pension Plans (2018) |

23,371 |

|

Number of Participants (2018) |

26.2 million |

|

Total Assets (2016) |

$2.2 trillion |

|

Total Benefit Obligations (2016) |

$2.8 trillion |

|

Total Underfunding (Assets – Benefit Obligations) (2016) |

$0.6 trillion |

|

Unfunded Vested Benefits (based on PBGC Premium Filings) (2016) |

$234.4 billion |

Source: Pension Benefit Guaranty Corporation (PBGC), 2017 Pension Insurance Data Tables, at https://www.pbgc.gov/sites/default/files/2017_pension_data_tables.pdf.

Notes: Single-employer plan data include multiple-employer plans. A benefit is vested when a participant has a legal right to the benefit. The Employee Retirement Income Security Act of 1974 (P.L. 93-406) requires that benefits become vested within a specified number of years. Plan participants can lose non-vested benefits (e.g., by leaving the employer that sponsors a plan).

According to PBGC, 81.4% of plans (containing 95.2% of plan participants) were underfunded in 2016.19 The total amount of underfunding in these plans was $625.4 billion. In addition, 18.6% of plans (containing 4.8% of participants) were overfunded in 2016. The total amount of overfunding in these plans was $15.3 billion.

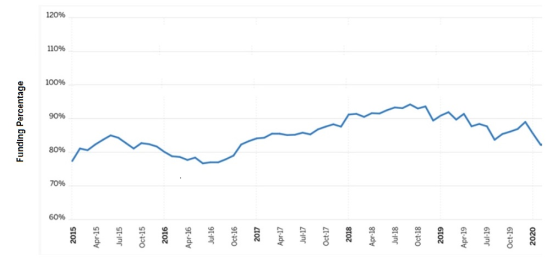

Figure 4 shows the funding percentage of the 100 largest corporate DB pension plans from 2015 to 2020. The most recent data show that in February 2020, these plans had $1.6 trillion in assets and $1.9 trillion in projected benefit obligations.20 The funding percentage (assets as a percentage of benefit obligations) was 82.2%, and total underfunding was $0.3 trillion.

|

Figure 4. Funding Percentage of the 100 Largest Corporate Defined Benefit Pension Plans |

|

|

Source: Adapted from Milliman, "Milliman 100 Pension Funding Index," 2019, at https://milliman-cdn.azureedge.net/-/media/milliman/importedfiles/uploadedfiles/insight/periodicals/pension-funding-index/pension-funding-index-march-2019.ashx. |

The Pension Protection Act of 2006

The Pension Protection Act of 2006 (PPA; P.L. 109-280) was the most recent major legislation to affect pension plan funding.21 Among other provisions, PPA established new funding rules for single- and multiple-employer plans and required that plans become 100% funded over a certain time period. PPA specified interest rates and other actuarial assumptions that plans must use to calculate their funding targets and target normal costs. PPA gave plans three years to transition to the new funding requirements. PPA also created special rules for certain types of plans, including those sponsored by certain government contractors, commercial airlines, and rural cooperatives.

Pension Protection Act Interest Rates

PPA specified that pension plans discount their future benefit obligations using three different interest rates.22 The rates, called segment rates, used in the calculation depend on the date on which benefit obligations are expected to be paid and the corresponding rates on the corporate bond yield curve.23 The segment rates are calculated as the average of the corporate bond yields within the segment for the preceding 24 months.24 The IRS publishes the segment rates on a monthly basis.25

The first segment is for benefits payable within five years. The first segment rate is calculated as the average of short-term bond yields (with a maturity less than five years) for the preceding 24 months. Likewise, the second and third segments are for benefits payable after 5 years to 20 years and after 20 years, respectively. The second and third segment rates are calculated similarly to the first segment rates, using bonds of appropriate maturities.

Pension Protection Act Amortization Periods

PPA required that shortfall amortization charges (funding shortfalls as a result of, for example, investment losses) be amortized over seven years and waiver amortization charges (from missed required minimum contributions) be amortized over five years. Amortization payments include interest.

Pension Protection Act Special Rules for Certain Plans

PPA outlined special rules for certain pension plans. Some of the rules have expired; others have been extended or expanded by subsequent legislation.

Special Rules for Certain Commercial Airline Industry Plans

PPA provided special funding rules for certain eligible plans maintained by (1) a commercial passenger airline or (2) an employer whose principal business is providing catering services to a commercial passenger airline.26 Eligible plans that met certain benefit accrual and benefit increase restrictions could (1) use a 17-year amortization period, instead of the seven years required by PPA, beginning in 2006 or 2007 and (2) use an 8.85% interest rate, instead of the required segment rates, for the purposes of valuing benefit obligations. Eligible plans that did not meet certain benefit accrual and benefit increase restrictions could choose to use a 10-year amortization period for the first taxable year, beginning in 2008.

Special Rules for Certain Government Contractor Plans

PPA delayed the date for certain government contractor plans to adopt the new funding rules to the 2011 plan year.27 Eligible plans were defense industry contractors whose primary source of revenue was derived from business performed under government contracts that exceeded $5 billion in the prior fiscal year.28

Special Rules for Certain Pension Benefit Guaranty Corporation Settlement Plans

PPA delayed the date for certain PBGC settlement plans to adopt the new funding rules to the 2014 plan year. Eligible plans were those in existence as of July 26, 2005, and (1) sponsored by an employer in bankruptcy proceedings giving rise to a claim of $150 million or less, and the sponsorship of which was assumed by another employer, or (2) that, by agreement with PBGC, were spun off from plans that were subsequently terminated by PBGC in involuntary terminations.

Funding Relief and Other Modifications for Single-Employer Plans

Since PPA's enactment in 2006, Congress has modified funding rules for pension plans several times. Funding relief provisions have delayed the implementation dates of some PPA provisions, extended amortization periods, or changed interest rates. Some funding relief has been directed toward all single-employer DB plans; other modifications of funding rules have been targeted to specific types of pension plans, such as plans for certain cooperative and charitable organizations and for community newspapers.

An extension of amortization periods allows plans a greater amount of time to pay off unfunded liabilities, meaning that plans can contribute less money per year over a greater number of years.

Changes in interest rates modify the timing of required employer contributions. As previously mentioned, a higher interest rate decreases the present value of plan liabilities, which means employers can contribute less today to fund a future benefit. The dollar amount of the benefit that a participant will receive in the future remains unchanged. Relative to a lower interest rate, a higher interest rate allows plans to contribute relatively smaller amounts in the near term but will have to be made up with higher contributions in the longer term. A lower interest rate does the opposite—it increases the present value of plan liabilities, requiring more employer contributions in the near term (and fewer in the long term).

Funding Relief and Other Modifications Since the Pension Protection Act

The following sections describe funding relief provisions and other funding rule modifications in chronological order, where feasible, since PPA.

Special Rules for Certain Plans in the Commercial Airline Industry

The U.S. Troop Readiness, Veterans' Care, Katrina Recovery, and Iraq Accountability Appropriations Act, 2007 (P.L. 110-28) provided funding relief for plans operated by certain commercial airlines and airline catering companies. As described above, PPA had extended the amortization period to either 10 or 17 years for these plans. P.L. 110-28 specified that eligible plans that had chosen the 10-year amortization period could use an interest rate of 8.25% for purposes of calculating the funding target for each of those 10 years.

Delay of Certain Pension Protection Act Rules

The Worker, Retiree, and Employer Recovery Act of 2008 (WRERA; P.L. 110-458) delayed the implementation of the PPA transition rules, giving plans additional time to become fully funded (given the decline in asset values due to the 2007-2009 economic downturn).29

Extended Amortization Periods

The Preservation of Access to Care for Medicare Beneficiaries and Pension Relief Act of 2010 (P.L. 111-192) allowed plans to amortize underfunding resulting from the 2007-2009 market downturn using one of two alternative amortization schedules.30 Pension plan sponsors could amortize their funding shortfalls over either (1) 9 years, with the first 2 years of payments consisting of interest only on the amortization charge and the next 7 years consisting of interest and principal, or (2) 15 years. Plan sponsors that chose one of these amortization schedules were required to make additional contributions to the plan if the plan sponsors paid excess compensation or declared extraordinary dividends, as defined in P.L. 111-192.

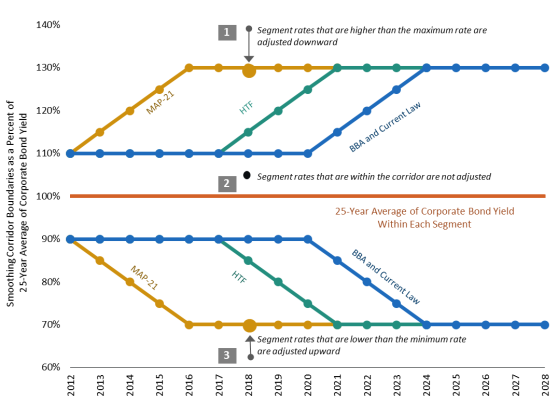

Interest Rate Corridors

The Moving Ahead for Progress in the 21st Century Act (MAP-21; P.L. 112-141) established a funding corridor to provide minimum and maximum interest rates used in calculating plan liabilities. The minimum and maximum rates were initially calculated as 90% and 110%, respectively, of the average of corporate bond yields for the segment over the prior 25-year period. If the 24-month segment interest rate as calculated under PPA is below the minimum percentage of the funding corridor, the interest rate is adjusted upward to the minimum. If the 24-month segment interest rate is higher than the maximum, it is adjusted downward to the maximum.

MAP-21 adjusted the minimum and maximum percentages surrounding the baseline rate over time to become 70% and 130%, respectively, by 2016 (essentially widening the corridor). When interest rates increase (which occurs when the 24-month rate is adjusted upward to the minimum rate), the present value of future benefit obligations decreases, and required plan contributions decrease. When companies contribute less to their pension plan, lower plan contributions increase companies' taxable income, which results in increased Treasury revenue.

Since MAP-21, provisions in enacted legislation twice delayed the beginning of the widening of the funding corridor. First, the Highway and Transportation Funding Act of 2014 (HTF; P.L. 113-159) delayed the beginning of widening of the funding corridor until 2018. Later, the Bipartisan Budget Act of 2015 (BBA; P.L. 114-74) delayed it until 2021. Table 2 shows the applicable minimum and maximum percentages under MAP-21, HTF, and BBA.

Table 2. Applicable Minimum and Maximum Interest Rate Percentages Applied to 25-Year Averages of Segment Corporate Bond Yields, as Specified in MAP-21, HTF, and BBA

|

MAP-21 |

HTF |

BBA |

||||

|

Calendar Year |

Applicable Minimum Percentage |

Applicable Maximum Percentage |

Applicable Minimum Percentage |

Applicable Maximum Percentage |

Applicable Minimum Percentage |

Applicable Maximum Percentage |

|

2012 |

90% |

110% |

90% |

110% |

90% |

110% |

|

2013 |

85% |

115% |

90% |

110% |

90% |

110% |

|

2014 |

80% |

120% |

90% |

110% |

90% |

110% |

|

2015 |

75% |

125% |

90% |

110% |

90% |

110% |

|

2016 |

70% |

130% |

90% |

110% |

90% |

110% |

|

2017 |

70% |

130% |

90% |

110% |

90% |

110% |

|

2018 |

70% |

130% |

85% |

115% |

90% |

110% |

|

2019 |

70% |

130% |

80% |

120% |

90% |

110% |

|

2020 |

70% |

130% |

75% |

125% |

90% |

110% |

|

2021 |

70% |

130% |

70% |

130% |

85% |

115% |

|

2022 |

70% |

130% |

70% |

130% |

80% |

120% |

|

2023 |

70% |

130% |

70% |

130% |

75% |

125% |

|

After 2023 |

70% |

130% |

70% |

130% |

70% |

130% |

Source: Congressional Research Service (CRS).

Notes: MAP-21 = Moving Ahead for Progress in the 21st Century Act (MAP-21; P.L. 112-141); HTF = Highway and Transportation Funding Act of 2014 (HTF; P.L. 113-159); BBA = Bipartisan Budget Agreement of 2015 (BBA, P.L. 114-74). Bold text indicates the year at which the funding corridor was set to begin widening under each law.

Figure 5 shows a hypothetical example of how segment rates are determined using the funding corridors.

- The red line shows the average of a segment's interest rates for the prior 25 years.

- The yellow and gold lines indicate the minimum and maximum rates around the 25-year average under the MAP-21 provisions.

- The light green and dark green lines indicate the widening of the corridors around the 25-year average under the HTF provisions (starting in 2018).

- The light blue and dark blue lines are the minimum and maximum rates around the 25-year averages in current law, as passed in the BBA (starting in 2021).

Because of the HTF and BBA extensions, the minimum and maximum corridors have remained at 90% and 110%, respectively, since 2012.

The following example demonstrates how segment rates are adjusted.

- If Treasury determines that the segment rate is above the maximum segment rate—point (1) in Figure 5—then Treasury adjusts the segment rate downward until it equals the proposed maximum segment rate.

- If Treasury determines that the segment rate is at or below the maximum segment rate and at or above the minimum segment rate—point (2) in Figure 5—Treasury does not adjust the segment rates.

- If Treasury determines that the segment rate is below the minimum segment rate—point (3) in Figure 5—then Treasury adjusts the interest rate upward until it equals the proposed minimum segment rate.

For example, in April 2020, the first segment rate before adjustment was 2.68%. Adjusted for the 25-year average bond yields, the first segment rate was 3.64%.31

|

Figure 5. Hypothetical Application of Segment Rate Stabilization Provision, as Found in MAP-21, HTF, and BBA |

|

|

Source: Congressional Research Service (CRS). Notes: MAP-21 = Moving Ahead for Progress in the 21st Century Act (MAP-21; P.L. 112-141); HTF = Highway and Transportation Funding Act of 2014 (HTF; P.L. 113-159); BBA = Bipartisan Budget Agreement of 2015 (BBA, P.L. 114-74). The segment rates are calculated as the average of the corporate bond yields within the segment for the preceding 24 months. The first segment rate is calculated as the average of short-term bond yields (with a maturity less than five years) for the preceding 24 months. Likewise, the second and third segments are for benefits payable after 5 years to 20 years and after 20 years, respectively. The second and third segment rates are calculated similarly to the first segment rates, using bonds of appropriate maturities. |

Special Rules for Certain Cooperative and Charity Pension Plans

Congress has authorized special funding rules for plans sponsored by specific types of employers, such as rural cooperatives and certain charities. PPA delayed the implementation of funding rules for certain cooperatives. Subsequent legislation expanded this delayed effective date to certain charities. Later legislation modified funding rules for these plans, referred to as Cooperative and Small Employer Charity (CSEC) pension plans. With two exceptions, CSEC plans are multiple-employer pension plans established by eligible cooperatives and certain charitable organizations to provide retirement benefits for their employees.32

Delay of PPA Funding Rules

PPA provided a delayed effective date of January 1, 2017, for certain multiple-employer cooperative plans—such as pension plans for agriculture, electric, and telephone cooperatives—to adopt the new funding rules.33

The Preservation of Access to Care for Medicare Beneficiaries and Pension Relief Act of 2010 (P.L. 111-192) extended PPA's delayed effective date to apply to certain charitable organizations' pension plans—multiple-employer plans whose employers are charitable organizations described in 26 USC §501(c)(3).

Establishment of CSEC Funding Rules

The Cooperative and Small Employer Charity Pension Flexibility Act of 2013 (P.L. 113-97) established funding rules for and provided a definition of CSEC pension plans. Among other provisions, this act permanently exempted these plans from PPA's funding rules and outlined minimum funding standards for CSEC plans. Plans must indicate if they use the CSEC-specific funding rules in their required annual reporting to the Department of Labor (DOL).34 Table A-1 provides a list of CSEC plans and funded status in the 2017 plan year.

Expanded Definition of CSEC Plans in 2015

Section 3 of Division P of the Consolidated and Further Continuing Appropriations Act, 2015 (P.L. 113-235) expanded the definition of CSEC plans to include plans maintained by an employer that meet several criteria. It appears that the Boy Scouts of America Master Pension Trust is the only plan that meets these expanded criteria.

Expanded Definition of CSEC Plans in 2020

Section 3609 of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act; P.L. 116-136) applies CSEC funding rules to plans sponsored by certain charitable employers "whose primary exempt purpose is providing services with respect to mothers and children," among other criteria. It appears that the pension plan sponsored by March of Dimes is the only plan that meets these expanded criteria.35

Special Rules for Community Newspaper Plans

Section 115 of the Setting Every Community up for Retirement Enhancement Act of 2019 (SECURE Act, enacted as Division O of the Further Consolidated Appropriations Act of 2020; P.L. 116-94) provided special funding rules for pension plans operated by certain community newspapers that had no benefit increases for participants after December 31, 2017. Community newspaper plans are those maintained by certain private community newspaper organizations that are family-controlled and have been in existence for 30 or more years.36

For these plans, the SECURE Act

- increased the interest rate to 8%, and

- extended the amortization period from 7 to 30 years.

Delayed Due Date for 2020 Plan Contributions

Section 3608 of the CARES Act (P.L. 116-136) allows contributions that are due in calendar year 2020 to be made, with interest, on January 1, 2021. Section 3608 also allows plans to use the funding percentage for the 2019 plan year, rather than the 2020 plan year (which would likely be lower), in determining whether plans must impose benefit restrictions.37

Policy Considerations

Policymakers and stakeholders might consider some of the policy implications of single-employer DB pension plan funding relief. The considerations include the rationale for providing relief, the effects of lower levels of plan assets on participant benefits and PBGC, and the effect on the federal budget.

Funding relief results in lower employer contributions to DB plans in the near term. Among the rationales for funding relief is that it allows employers the flexibility to use funds for other priorities (such as retaining or hiring employees).38 For example, 74 trade associations said in a 2009 letter to policymakers that, "[P]roviding defined benefit funding relief is directly related to improving the economy and employment."39 On the other hand, some policymakers oppose funding relief to specific industries or companies because they provide "a special-interest bailout" and set both "bad policy and bad precedent."40

Some stakeholders have expressed concern that employers adopting funding relief measures might use the funds saved via reduced contributions for non-core business activities. For example, the Preservation of Access to Care for Medicare Beneficiaries and Pension Relief Act of 2010 (P.L. 111-192) limited the ability of employers that adopted funding relief measures to provide excess employee compensation or extraordinary dividends.

Although employer contributions and plan assets are lower following funding relief, participants' benefits are not necessarily at risk—although they may be under certain circumstances.

Participants in DB plans that receive funding relief remain entitled to their benefits; funding relief does not reduce these benefits. For employers that do not become bankrupt, modifying the timing of contributions generally would not be problematic—over time, the employer would need to make all required contributions for participants to receive their full benefits.

However, in the case of employer bankruptcy, the timing of contributions may negatively affect both participants' benefits and PBGC.41 Participants with benefits greater than the PBGC maximum guarantee or with non-guaranteed benefits might see reduced benefits when PBGC becomes trustee of their plan.42 Following funding relief, there are fewer plan assets available from which to pay non-guaranteed benefits because funding relief lowers employer contributions to DB plans in the short term. In addition, PBGC receives fewer assets from the plans that it trustees, which harms its financial position.

ERISA requires PBGC to be self-supporting and receives no appropriations from general revenue. ERISA states that the "United States is not liable for any obligation or liability incurred by the corporation."43 Increasingly large amounts of unfunded liabilities in terminated plans may burden PBGC's single-employer insurance program. Although PBGC ended FY2019 with a surplus of $8.6 billion,44 the effects of (1) the Coronavirus Disease 2019 (COVID-19) pandemic on the financial health of employers and (2) the market downturn in early 2020 on the value of DB plan assets will likely worsen the funding position of single-employer pension plans and PBGC's financial position.

Funding relief can result in short-term revenue for Treasury and PBGC. Because employer contributions to pension plans are generally tax deductible, decreasing a plan's required contributions for a year (either through increasing the interest rate or extending the amortization period) increases the plan's taxable income. Some stakeholders point out that because funding relief provides revenue to Treasury, it has been used for budgetary offsets without regard to the policy justifications.45 Funding relief can positively affect PBGC finances because greater DB plan underfunding results in higher variable-rate premiums (premiums based on the amount of plan underfunding) paid by employers to PBGC.

Appendix. Data on CSEC Plans in 2017

Table A-1 provides data on Cooperative and Small Employer Charity (CSEC) plans in the 2017 plan year (the most recent year for which complete data are available). In total, CSEC plans had about 239,000 participants, $19.6 billion in assets, and a total funding target of $20.7 billion in 2017. The largest plan by number of participants in 2017 was the Retirement Security Plan, which had assets of $8.6 billion and a total funding target of $9.2 billion in that year.

To determine which plans use CSEC funding rules, the Congressional Research Service (CRS) analyzed public-use Form 5500 data from the Department of Labor (DOL) for the 2014 to 2017 plan years. 2014 is the first year that Form 5500 includes an option to indicate the use of CSEC funding rules (following P.L. 113-97), and 2017 is the most recent year for which complete data are available.

Most private-sector pension plans are required to submit annual forms to the Internal Revenue Service (IRS), DOL, and the Pension Benefit Guaranty Corporation (PBGC). These forms generally include information about the plan, such as the number of participants, financial information, and the companies that provide services to the plan. In addition to Form 5500, pension plans are generally required to file information in specific schedules. For example, most single-employer and multiple-employer plans are required to file Schedule SB, which contains information specific to these plans. Each pension plan's Form 5500 and required schedules are available by search on DOL's website. Because data are self-reported, Table A-1 may not capture all plans that used CSEC funding rules or may include non-CSEC plans that erroneously identified as CSEC plans.

Table A-1 provides data on private-sector defined benefit (DB) pension plans that indicated using CSEC funding rules on their 2014, 2015, 2016, or 2017 Schedule SB filings. Twenty-eight plans indicated using CSEC funding rules in multiple years. One plan, the Johns Hopkins Health System Corporation Plan, appeared to start using CSEC funding rules in 2017. Table A-1 provides the total number of participants, actuarial value of assets, total funding target, and funding target attainment percentage for the 29 plans (including the Johns Hopkins plan).

In addition to the Johns Hopkins plan, 10 plans indicated using CSEC funding rules in a single year but not in other years. An examination of individual plan filings from the Employee Benefits Security Administration (EBSA) showed that these plans did not use CSEC funding rules in the year they indicated having done so and are not included in this analysis. The Employee Benefit Plan of Jewish Community of Louisville, Inc., indicated using CSEC funding rules in 2014, 2015, and 2016, but a Form 5500 for the 2017 plan year is not available and is not included in Table A-1. In 2016, this plan had 110 participants.

|

Plan Name |

Total Participants in 2017 |

Actuarial Value of Assets in 2017 |

Total Funding Target in 2017 |

Funding Target Attainment Percentage in 2017 |

|

Retirement Security Plan |

66,901 |

$8,649,395,416 |

$9,163,891,430 |

94.4% |

|

Co-op Retirement Plan |

35,485 |

$2,237,731,641 |

$2,295,461,588 |

97.5% |

|

Johns Hopkins Health System Corporation Pension Plan |

23,381 |

$1,371,796,281 |

$1,329,179,823 |

103.2% |

|

Retirement & Security Program for Employees of NTCA and its Members |

16,984 |

$2,010,389,316 |

$2,015,608,724 |

99.7% |

|

Boy Scouts of America Master Pension Trust – Boy Scouts of America Retirement Plan for Employeesa |

14,514 |

$1,174,205,968 |

$1,332,527,071 |

88.1% |

|

Retirement Plan for Employees of United Jewish Appeal-Federation of NY and Affiliated Agencies and Institutions |

12,409 |

$432,735,291 |

$547,653,405 |

79.0% |

|

Christian School Pension Plan and Trust Fund |

11,733 |

$688,301,967 |

$1,025,792,451 |

67.1% |

|

Young Women's Christian Association Retirement Fund, Inc. |

11,186 |

$417,402,683 |

$298,119,903 |

140.0% |

|

National Girl Scout Council Retirement Plan |

7,860 |

$412,796,447 |

$538,559,819 |

76.6% |

|

Cooperative Pension Plan |

7,105 |

$236,915,824 |

$273,461,672 |

80.2% |

|

Group Retirement Income Plan No. 16 |

6,216 |

$672,566,050 |

$519,238,041 |

107.2% |

|

Retirement Plan for Employees of Southern States |

3,935 |

$212,500,654 |

$226,476,937 |

93.8% |

|

MFA Incorporated Retirement Plan |

2,663 |

$152,579,033 |

$160,173,670 |

95.3% |

|

Massachusetts Eye and Ear Infirmary Pension Plan |

2,373 |

$111,283,438 |

$108,787,102 |

102.3% |

|

Sunkist Retirement Plan - A |

2,146 |

$183,554,892 |

$185,554,231 |

98.9% |

|

MFA Employees Retirement Plan |

2,072 |

$98,309,826 |

$106,335,618 |

92.5% |

|

Pension Plan for Employees of the Member Co-ops of CHS Inc. |

1,622 |

$72,360,000 |

$66,369,781 |

109.0% |

|

The Defined Benefit Pension Plan of United Way of Greater Toledo and Affiliated Agencies |

1,432 |

$44,240,037 |

$41,465,541 |

106.7% |

|

Federation Employees' Retirement Income Plan |

1,346 |

$88,815,743 |

$96,118,923 |

92.4% |

|

United Way of Central Iowa Retirement Plan |

1,204 |

$61,269,647 |

$51,774,579 |

94.8% |

|

The Defined Benefit Pension Plan of United Way of Greater Richmond & Petersburg and Affiliated Agencies |

1,160 |

$32,163,573 |

$33,119,924 |

82.5% |

|

Lincoln Center Pension Plan |

1,101 |

$66,181,534 |

$94,774,799 |

69.8% |

|

Twin Cities Nonprofit Partners Pension Plan |

1,077 |

$42,798,784 |

$42,626,771 |

100.4% |

|

Hawkeye Pension Planb |

815 |

$89,478,913 |

$120,621,070 |

74.2% |

|

Employee Benefit Plan of the United Way of the Greater Dayton Area and Affiliated Agencies |

678 |

$18,206,783 |

$23,739,947 |

76.7% |

|

Pension Plan for Employees of United Way of Greater Cincinnati, Inc. and Affiliated Agenciesb |

566 |

$31,652,806 |

$30,781,835 |

102.8% |

|

Sunkist Retirement Plan - N |

341 |

$11,277,683 |

$12,357,433 |

91.3% |

|

Sunsweet Hourly Pension Planb |

225 |

$7,574,627 |

$7,152,291 |

95.3% |

|

Defined Benefit Plan of Greater Miami Jewish Federation, Inc. |

39 |

$1,932,569 |

$2,200,243 |

87.8% |

|

TOTAL |

238,569 |

$19.6 billion |

$20.7 billion |

94.6% |

Source: CRS analysis of Form 5500 datasets available from Department of Labor, Employee Benefits Security Administration (EBSA), "Form 5500 Datasets," at https://www.dol.gov/agencies/ebsa/about-ebsa/our-activities/public-disclosure/foia/form-5500-datasets.

Notes: Actuarial value of assets is the value of plan investments averaged over several years to remove short-term fluctuations in value. Total funding target is the present value of all benefits under the plan that have been accrued or earned. The funding target attainment percentage is the ratio (expressed as a percentage) of a plan's actuarial value of assets to the total funding target, which is a general measure of a plan's current ability to pay benefits owed.

a. This plan is a single-employer plan and appears to be the only single-employer plan that indicated using Cooperative and Small Employer Charity (CSEC) funding rules.

b. These plans indicated using CSEC funding rules in years prior to 2017 but not in 2017. An examination of individual plan filings from EBSA revealed that these plans did use CSEC funding rules in 2017 and so are included above. For example, each plan provided the required attachment stating that it had used pre-Pension Protection Act of 2006 (P.L. 109-280) funding rules or described using a funding method under 26 U.S.C. §433, which governs CSEC plan funding.