The Health and Economic Recovery Omnibus Emergency Solutions Act (HEROES Act; H.R. 6800), as passed by the House on May 15, 2020, proposes new direct payments to individuals, which the bill text refers to as "additional recovery rebates to individuals." Direct payments were included in the Coronavirus Aid, Relief, and Economic Security Act (CARES Act; P.L. 116-136), which was signed into law on March 27, 2020. This Insight provides a brief overview of the additional direct payments included in the HEROES Act. (The HEROES Act would also modify the direct payments in the CARES Act. These changes are summarized in a companion Insight).

The HEROES Act direct payments would equal $1,200 per eligible individual ($2,400 for married taxpayers filling a joint return). Taxpayers would also receive $1,200 for each dependent, up to three dependents. Hence, the largest payment would be $6,000 for a married couple with three or more dependents. These payments are in addition to the CARES Act direct payments.

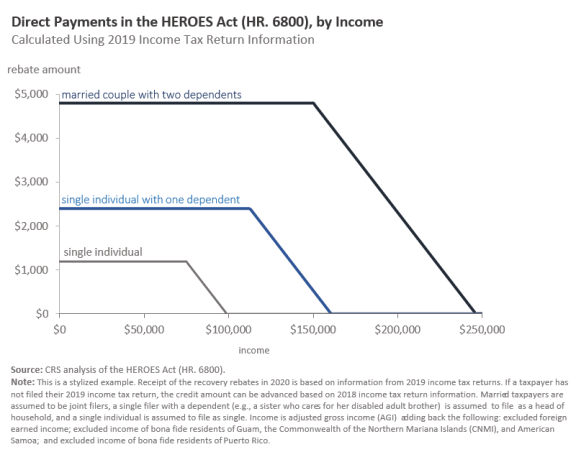

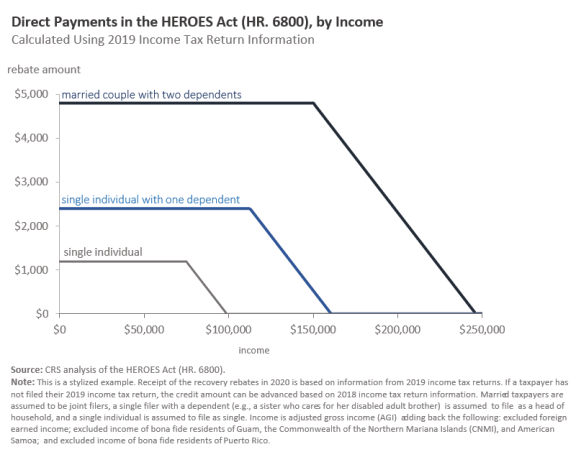

The payment amount would phase out at a rate of 5% of adjusted gross income (AGI) above $75,000 ($112,500 for head of household filers and $150,000 for married joint returns). An illustration of the amount of the rebate by income level is provided in the figure below

|

Generally, an eligible individual would be any individual except

While a dependent would be ineligible for the payment themselves, the taxpayer who claims them as a dependent would be eligible for an additional $1,200. Dependents are often children who live with the taxpayer, but also can include college students, disabled relatives, or a taxpayer's parent(s). An eligible dependent would fulfill the requirements set forth in Internal Revenue Code (IRC) Section 152.

Taxpayers would be required to provide a taxpayer ID for themselves, their spouse (if married filing jointly), and any dependents in order to receive the $1,200 payment associated with that individual. For most individuals, their taxpayer ID is their Social Security number (SSN). Individuals without an SSN would be required to provide an individual taxpayer identification number (ITIN). ITINs are issued by the Internal Revenue Service (IRS) to enable noncitizens without SSNs to file tax returns, pay taxes, and otherwise comply with federal tax law.

As with the CARES Act payments, the HEROES Act payments would be structured as new one-time refundable tax credits for 2020 that would be advanced, so that payments could be received this year. To facilitate implementation, the bill would direct the IRS to use information from a 2019 income tax return, or if not available, a 2018 income tax return, to calculate the payment amount (with certain exceptions described below) and automatically issue the payments.

Receiving a HEROES Act direct payment in 2020 would not affect a taxpayer's 2020 federal income tax liability (i.e., it would not be subject to taxation) or tax refund.

In addition, if, when taxpayers file their 2020 income tax returns in 2021, they find that the direct payment is greater than the credit they are eligible for, then they will not be required to repay the excess amount. In contrast, if the direct payment is less than the actual credit, then taxpayers will be able to claim the difference on their 2020 income tax returns.

As with any tax credit, these payments do not count as income or resources for a 12-month period in determining eligibility for, or the amount of assistance provided by, any federally funded public benefit program.

Under current law, individuals with gross income less than the standard deduction amount are not required to file a federal income tax return. For eligible individuals who did not file a 2019 or 2018 income tax return and who were recipients of Social Security, Supplemental Security Income (SSI), Railroad Retirement, or certain Department of Veterans Affairs (VA) benefits prior to enactment, Treasury would be directed to automatically issue payments based on information provided by the Social Security Administration (SSA), Railroad Retirement Board (RRB), or VA.

If a direct payment for a specified Social Security, SSI, Railroad Retirement, or VA beneficiary was issued to a payee or fiduciary, it would be provided to the entitled beneficiary or used only for the benefit of the entitled beneficiary. Payees and fiduciaries who manage the direct payment would be subject to the same enforcement provisions that apply to SSA, RRB, or VA benefits.

Low-income individuals and families, especially workers without children, may not have filed a 2018 or 2019 income tax return and thus would not automatically receive a direct payment. The bill would instruct the Treasury to coordinate "a robust and comprehensive" outreach campaign coordinated with other agencies and stakeholders to ensure eligible nonfilers received these direct payments.

The Joint Committee on Taxation (JCT) estimates that the HEROES Act payments would cost $412.5 billion.