Federal assistance to state and local governments has been a central part of the fiscal policy discussion surrounding the COVID-19 pandemic. Economic downturns tend to depress the tax bases of federal, state, and local governments, and may also increase demands for certain spending programs. Unlike at the federal level, however, most states and localities have statutory requirements to balance their budgets every one or two years. Absent other measures, these balanced budget requirements can necessitate tax rate increases or spending cuts that could exacerbate economic distress.

Evidence from the Great Recession

The Great Recession, which lasted from December 2007 to June 2009 as measured by the National Bureau of Economic Research (NBER), was considered the largest U.S. economic shock since the Great Depression, as significant disruption in the housing and financial markets generated adverse conditions throughout the economy. At its peak, quarterly real gross domestic product (GDP) declined by 8.4% (in the second quarter of 2008), and federal deficits averaged 9.0% of GDP from FY2009 through FY2011, their largest values since World War II.

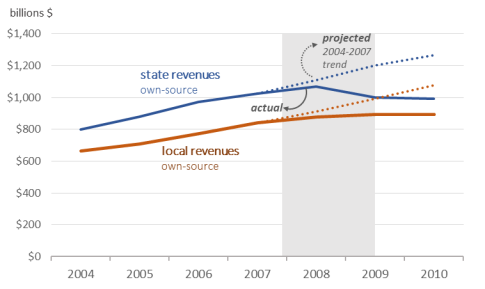

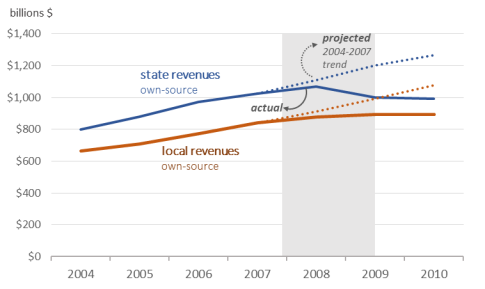

Trends in revenues, the portion of the budget typically most affected by recessions, may offer some perspective on the Great Recession's effect on state and local budgets. Figure 1 shows the actual state and local own-source revenues in FY2008-FY2010 relative to levels consistent with FY2004-FY2007 growth trends. Relative to FY2004-FY2007 revenue trends, the cumulative combined state and local revenue gap from FY2008 to FY2010 was $838 billion.

|

Figure 1. Actual and Projected State and Local Own-Source Revenues, 2004-2010

|

|

|

Source: U.S. Census Bureau, Annual Survey of State & Local Finances, 2004-2010.

Notes: State and local revenues are own-source revenues, which exclude transfers from other governments. Shaded area indicates recession as measured by the NBER.

|

Cumulative declines in revenues from trend levels were larger for state governments ($520 billion, 62% of the total) than for local governments ($319 billion, 38% of the total). This effect was partly due to larger state budgets prior to the Great Recession. But it was also due to declines in consumption taxes—a major source of revenue for many states—that are more sensitive to economic downturns. That local revenues were steadier despite a greater reliance on property taxes (46% of own-source revenues in FY2004-FY2010, versus 1% for states) during a recession with especially high housing market disruption tends to suggest a relative insensitivity of property taxes to business cycle effects.

Projections of Effects from COVID-19

Early projections of the economic effects associated with the COVID-19 crisis have suggested declines in activity larger than the experience in the Great Recession: the Congressional Budget Office projected that real GDP would decline by 12% in the second quarter of FY2020. Business closures and social distancing measures are expected to have particularly strong effects on retail businesses, restaurants, and other types of service consumption.

The Federation of Tax Administrators has estimated near-term effects on state revenues through the remainder of the fiscal year (generally ending June 30, 2020). This study estimated a decline in state revenues of $152 billion between April and June. Some of that shortfall is from delayed payments due to late tax filing. Adjusting for the shortfall would yield a decline of $91 billion from April through July. The largest source of revenue shortfalls from April through June is from individual income taxes ($83 billion), followed by $38 billion in sales tax revenue, $2 billion in corporate revenue, and $5 billion in motor fuel taxes. The study estimates states have about $90 billion in rainy day funds.

Moody's Analytics has estimated shortfalls for states through FY2021 (ending June 30, 2021) from revenue declines and increased Medicaid payments of $158 billion to $203 billion, depending on the severity of the recession. These amounts are estimated to be 17.9% to 23.0% of general fund budgets, with the majority (14.8% to 19.5% of general fund budgets) due to revenue shortfalls. This study also indicates that states with the largest shortfalls are those with volatile sources of revenue (severance taxes on oil or very progressive income taxes) or with industries that are most affected (tourism, finance, and energy). The states with the largest relative shortfalls (i.e., as a share of their general budgets) are Alaska, Louisiana, and North Dakota. States are generally well prepared for a normal setback with rainy day funds, but most do not have sufficient reserves to address a crisis of the current magnitude. States with the largest relative shortfalls net of reserves are Louisiana, New Jersey, and New York. States will also increase direct spending due to the demands of COVID-19 (estimated at $150 billion in the analysis), offset by funds from already enacted federal legislation—$35 billion from the Families First Coronavirus Response Act (P.L. 116-127) and $110 billion from the Coronavirus Aid, Relief, and Economic Security (CARES) Act (P.L. 116-136).

The Center on Budget Policies and Priorities has estimated effects for states through the following fiscal year (FY2022). It estimates total costs at $500 billion, with $360 billion remaining after rainy day funds and federal aid are taken into account, but not including additional costs states will incur from combatting COVID-19. It also asserts that local governments (who receive about a third of funds from state governments), territories, and tribes will need assistance.

Recent Federal Activity

The federal government has already enacted some measures to address state and local fiscal conditions. The Coronavirus Relief Fund, established by the CARES Act, enacted on March 27, 2020, provided $150 billion in direct federal payments to state and local governments, with roughly 20% distributed to large local governments and the remaining 80% disbursed at the discretion of state governments. The CARES Act also created a Municipal Lending Facility that can provide up to $500 billion in direct financing for state and local debt, though access is restricted to large localities and states and such debt is often not included in operating budgets. Among the active legislative proposals that would provide further direct state and local assistance, the HEROES Act (H.R. 6800), which passed the House on May 15, would direct a total of $915 billion in payments within one year of enactment ($540 billion to states, territories, and tribes, and $375 billion to localities).