Overview1

Congress established the Small Business Innovation Research (SBIR) program in 1982 to expand the role of small businesses in federal research and development (R&D). When establishing the program, Congress declared that technological innovation plays an important role in job creation, productivity improvements, and U.S. competitiveness; that small businesses are among the most cost-effective performers of R&D and particularly capable of bringing R&D results to market in the form of new products; and that, despite the role of small businesses as "the principal source of significant innovations in the Nation," the vast majority of federally funded R&D is performed by large businesses, universities, and federal laboratories.2 With this in mind, Congress established the SBIR program to advance four objectives:

- to stimulate innovation,

- to use small businesses to meet federal R&D needs,

- to foster and encourage the participation of minority and disadvantaged persons in technological innovation, and

- to increase private sector commercialization of innovations derived from federally funded R&D.3

In 1992, Congress established the Small Business Technology Transfer (STTR) program.4 Similar in design to the SBIR program, STTR was created to facilitate the commercialization of university and federal R&D by small companies.

Execution of the SBIR and STTR programs is decentralized. Both the SBIR and STTR statutes require that federal agencies with extramural R&D budgets in excess of specified amounts set aside a percentage of such funds to conduct their own SBIR and STTR programs.5 Currently, 11 federal departments and agencies operate SBIR programs and 5 operate STTR programs. The Small Business Administration (SBA) helps to coordinate the SBIR and STTR programs, establishes overall policy guidance, reviews agencies' progress, and reports annually to Congress on the operation of the programs.

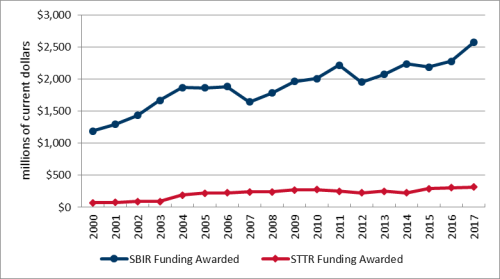

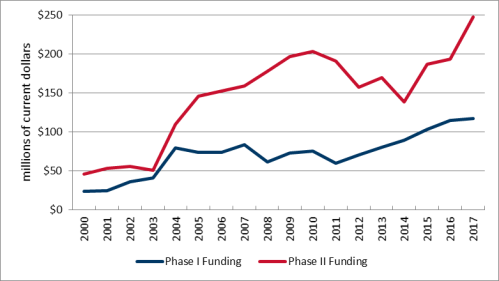

Through FY2017, the most recent year with complete data, federal agencies had made more than 166,000 SBIR and STTR awards to small businesses to develop and commercialize innovative technologies. The total amount awarded was $47.9 billion. Figure 1 shows SBIR and STTR funding for FY2000-FY2017.

This report provides information on the legislative foundations, structure, operation, and current and historical funding levels of the SBIR and STTR programs; provides highlights of external reviews of the programs; and identifies and discusses selected policy issues.

|

Figure 1. SBIR and STTR Funding, FY2000-FY2017 Total of Phase I and Phase II Awards for SBIR and STTR programs |

|

|

Sources: CRS analysis of data. Data for FY2000-FY2008 from SBA, Small Business Innovation Research Program (SBIR) Annual Report for each fiscal year; data for FY2009-FY2011 from SBA, The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Program Annual Report Fiscal Year 2009-2011; data for FY2012-FY2017 from SBA, Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Programs Annual Report for each fiscal year. Annual reports available at https://www.sbir.gov/annual-reports-files. Note: Source tables are not consistently labeled from year to year. |

Data Sources and Limitations

This report uses the data reported to SBA and included in the required annual reports to Congress for the information and analysis presented below. The latest annual report data available to CRS is for FY2017. While the SBA, through its SBIR.gov website, does makes available certain data on SBIR and STTR awards from the inception of the SBIR and STTR programs through the current fiscal year, the award database is considered "live data" and open for continuous revision throughout the year.6 Additionally, as of the date of this report, the award database for FY2019 and FY2020 is incomplete (i.e., one agency has not posted data for FY2019 and nine agencies have not posted data for FY2020). While the award database for FY2018 is complete (i.e., each of the agencies with SBIR and STTR programs has posted its data), SBA does not independently review such data for quality or accuracy until the data is used as part of the required annual report. According to SBA, "the review process does identify places where data is inaccurate," and "after the agencies and SBA work to ensure the data is accurate it goes through a formal OMB [Office of Management and Budget] review."7 As of the date of this report, SBA has not completed the FY2018 annual report, however, SBA has indicated that "once the annual report is complete the number of changes to the award database are minimal."8 (See "SBA Delays in Meeting Statutory Reporting Requirements" herein for related discussion.)

Small Business Innovation Research

SBIR Overview

The Small Business Innovation Research (SBIR) program was established under the Small Business Innovation Development Act of 1982 (P.L. 97-219) and has subsequently been reauthorized or extended multiple times, most recently in 2016 when the program was extended through September 30, 2022.9 Under the program, each federal agency with an extramural R&D budget greater than $100 million is required to allocate a portion of that funding to conduct a multi-phase R&D grant program for small businesses. The objectives of the SBIR program include stimulating technological innovation, increasing the use of the small business community to meet federal R&D needs, fostering and encouraging participation in innovation and entrepreneurship by minorities and socially and economically disadvantaged individuals, and expanding private sector commercialization of innovations resulting from federally funded R&D.

Currently, 11 federal agencies participate in the SBIR program: the Departments of Agriculture (USDA), Commerce (DOC), Defense (DOD), Education (ED), Energy (DOE), Health and Human Services (HHS), Homeland Security (DHS), and Transportation (DOT); the Environmental Protection Agency (EPA); the National Aeronautics and Space Administration (NASA); and the National Science Foundation (NSF).

Each participating agency operates its own SBIR program under the provisions of the law and regulations, as well as with guidance issued by the U.S. Small Business Administration in its Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Program Policy Directive (referred to hereinafter as the Policy Directive).10 According to some analysts, this approach allows for general consistency across SBIR programs, while allowing each agency a substantial degree of control and flexibility in the execution of its program in alignment with its overall mission and priorities.11 (See "Improving Technology Commercialization and Trade-Offs Among Program Objectives" herein for related discussion.)

In FY2017 and later years, federal agencies participating in the SBIR program are required to set aside at least 3.2% of their extramural R&D funds for the SBIR program. In FY2017, the aggregate level of SBIR funding for all federal agencies was $2.673 billion ($1.520 billion for the 10 participating civilian agencies and $1.153 billion for DOD). The aggregate level of SBIR funding for the civilian agencies ($1.520 billion) accounted for approximately 3.3% of the participating agencies' aggregate extramural R&D funding, as reported to SBA. The percentage of SBIR funding set aside from DOD's extramural R&D funds cannot be determined as not all DOD components reported their extramural R&D funding to SBA. However, previous reports by the Government Accountability Office (GAO) and SBA found that some agencies did not comply with the SBIR and STTR spending requirements.12 (See "Agency Compliance with Mandatory Minimum Expenditures" herein for related discussion.)

SBIR Phases

The SBIR program is a three-phase program. The purposes and parameters of each phase are discussed below.

Phase I

In Phase I, an agency solicits contract proposals or grant applications to conduct feasibility-related experimental or theoretical research or research and development (R/R&D) related to agency requirements. The scope of the topic(s) in the solicitation may be broad or narrow, depending on the needs of the agency. Phase I grants are intended to determine "the scientific and technical merit and feasibility of ideas that appear to have commercial potential."13 Generally, SBIR Phase I awards are not to exceed $150,000, adjusted for inflation, though the law provides agencies with the authority to issue awards that exceed this amount (the Phase I award guideline) by as much as 50%.14 In addition, agencies may request a waiver from the SBA to exceed the award guideline by more than 50% for a specific topic.15 In general, the period of performance for Phase I awards is up to six months, though agencies may allow for a longer performance period for a particular project.

Phase II

Phase II grants are intended to further R/R&D efforts initiated in Phase I that meet particular program needs and that exhibit potential for commercial application. In general, only Phase I grant recipients are eligible for Phase II grants. There are two exceptions to this guideline: (1) a federal agency may issue an SBIR Phase II award to a Small Business Technology Transfer (STTR) Phase I awardee to further develop the work performed under the STTR Phase I award;16 and (2) through FY2022, the National Institutes of Health (NIH), DOD, and ED are authorized to make Phase II grants to small businesses that did not receive Phase I awards. Exercise of either of these exceptions requires a determination from the agency head that the small business has demonstrated the scientific and technical merit and feasibility of the ideas and that the ideas appear to have commercial potential.17

Phase II awards are to be based on the results achieved in Phase I (when applicable) and the scientific and technical merit and commercial potential of the project proposed in Phase II as evidenced by: the small business concern's record of successfully commercializing SBIR or other research; the existence of second phase funding commitments from private sector or non-SBIR funding sources; the existence of third phase, follow-on commitments for the subject of the research; and the presence of other indicators of the commercial potential of the idea.18

The Policy Directive generally limits SBIR Phase II awards to $1 million, adjusted for inflation, (the Phase II award guideline), though the directive provides agencies with the authority to issue an award that exceeds this amount by as much as 50%. As with Phase I grants, agencies may request a waiver from the SBA to exceed the Phase II award guideline by more than 50% for a specific topic.19 In general, the period of performance for Phase II awards is not to exceed two years, though agencies may allow for a longer performance period for a particular project. Agencies may make a sequential Phase II award to continue the work of an initial Phase II award. The amount of a sequential Phase II award is subject to the same Phase II award guideline and agencies' authority to exceed the guideline by up to 50%. Thus, agencies may award up to $3 million, adjusted for inflation, in Phase II awards for a particular project to a single recipient at the agency's discretion, and potentially more if the agency requests and receives a waiver from the SBA. For sequential Phase II awards, some agencies require third party matching of the agency's SBIR funds.

Phase III

Phase III of the SBIR program is focused on the commercialization of results achieved with Phase I and Phase II SBIR funding. The SBIR program does not provide funding in Phase III. Phase III funding is expected, generally, to be generated in the private sector. However, some agencies may use non-SBIR funds for Phase III funding to support additional R&D or contracts for products, processes, or services intended for use by the federal government. In addition, the law directs agencies and prime contractors "to the greatest extent practicable," to facilitate the commercialization of SBIR and STTR projects through the use of Phase III awards, including sole source awards.20

Technical Assistance

In addition to funding provided in Phases I-III, the law also allows agencies to award SBIR Phase I recipients up to $6,500 per year, and Phase II award recipients up to $50,000 per project, for technical and business assistance, in addition to the amount of the base award, or to provide such assistance through an agency-selected vendor.21 This funding is intended to provide SBIR recipients with services such as access to a network of scientists and engineers engaged in a wide range of technologies; assistance with product sales, intellectual property protections, market research, market validation, and development of regulatory plans and manufacturing plans; or access to technical and business literature available through online databases. These services are provided to help SBIR awardees make better technical decisions, solve technical problems, minimize technical risks, and develop and commercialize new commercial products and processes.22

SBIR Eligibility

A small business's eligibility for the SBIR program is contingent on its location, number of employees, ownership characteristics, and other factors. Eligibility to participate in the SBIR program is limited to for-profit U.S. businesses with a location in the United States. Eligible companies must have 500 or fewer employees, including employees of affiliates. The small business must be

(1) more than 50% directly owned and controlled by one or more citizens or permanent resident aliens of the United States, other small business concerns (each of which is more than 50% directly owned and controlled by individuals who are citizens or permanent resident aliens of the United States), an Indian tribe, Alaskan Native Corporation (ANC) or Native Hawaiian organization (NHO) (or a wholly owned business entity of such tribe, ANC or NHO), or any combination of these; or

(2) more than 50% owned by multiple venture capital operating companies, hedge funds, private equity firms,23 or any combination of these, with no single such firm owning more than 50% of the small business;24 or

(3) a joint venture in which each entity to the joint venture meets the requirements in paragraphs (1) and (2) above.25

Agencies are restricted on how much of their SBIR funds they can make available for awards to small businesses that are more than 50% owned by venture capital operating companies, hedge funds, or private equity firms. The NIH, DOE, and NSF may award no more than 25% of their SBIR funds to such small businesses; all other SBIR agency programs are limited to using 15% of their SBIR funds for such awards.26

Small businesses that have received multiple prior SBIR/STTR awards must meet certain bench-mark requirements for progress toward commercialization to be eligible for a new Phase I award (see "Improving Technology Commercialization and Trade-Offs Among Program Objectives" herein for related discussion). For both Phase I and Phase II, the principal investigator's primary employment must be with the small business applicant at the time of award and during the conduct of the proposed project.27

Generally, R/R&D work under an SBIR award must be performed in the United States, though agencies may allow a portion of the work to be performed or obtained outside of the United States under "rare and unique" circumstances.28

Recent and Historical SBIR Awards Data29

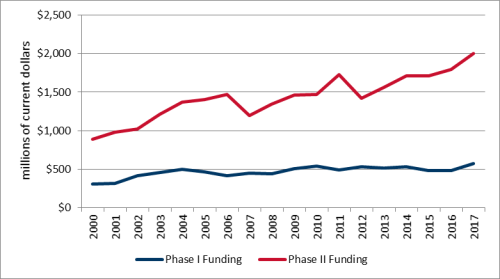

In FY2017, the most recent year for which the SBA has published annual report data on SBIR awards, agencies made awards for $2.572 billion, including 3,223 Phase I awards totaling $568.0 million and 1,871 Phase II awards totaling $2.004 billion. The success rate30 was 17% for Phase I SBIR proposers and 60% for Phase II proposers.

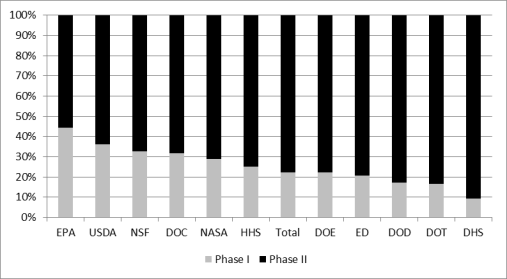

While more than half of SBIR awards made in FY2017 were Phase I awards (63%), more than three-fourths of SBIR funding went to Phase II awards (78%).31 Between FY2000 and FY2017, funding for both Phase I and Phase II generally increased. See Figure 2.

|

|

Sources: CRS analysis of data. Data for FY2000-FY2008 from SBA, Small Business Innovation Research Program (SBIR) Annual Report for each fiscal year; data for FY2009-FY2011 from SBA, The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Program Annual Report Fiscal Year 2009-2011; data for FY2012-FY2017 from SBA, Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Programs Annual Report for each fiscal year. Annual reports available at https://www.sbir.gov/annual-reports-files. Note: Source tables are not consistently labeled from year to year. |

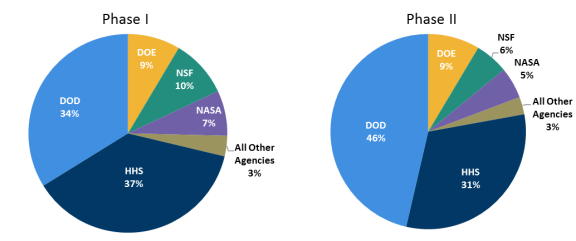

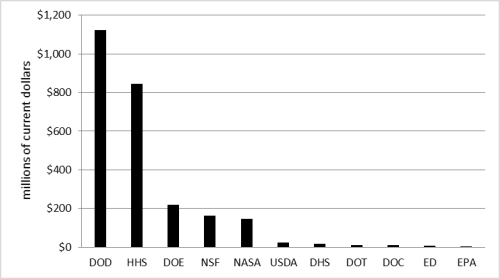

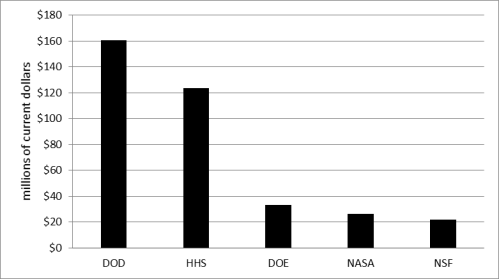

Two agencies accounted for more than three-fourths of total SBIR funding in FY2017: DOD ($1.121 billion, 43%) and HHS ($843.4 million, 33%). The next three highest SBIR funding agencies (DOE, NSF, and NASA) together accounted for 21%. The remaining agencies accounted for 3%. See Figure 3.

|

|

Source: CRS analysis of data from SBA, Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Program Annual Report Fiscal Year 2017, Tables 2, 3, and 7. |

The allocation of SBIR funding between Phase I and Phase II awards varies among agencies. Agencies that allocated the largest share of their SBIR funding to Phase I awards in FY2017 were EPA (44%), USDA (36%), and NSF (33%). Agencies that allocated the largest share of their SBIR funding to Phase II awards in FY2017 were DHS (91%), DOT (84%), and DOD (83%). Figure 4 illustrates each SBIR agency's distribution of FY2017SBIR funding between phases.

Agency shares of aggregate Phase I and Phase II SBIR funding are shown in Figure 5. The agencies with the highest share of total Phase I funding in FY2017 were HHS (37%), DOD (34%), and NSF (10%). The agencies with the highest share of total Phase II funding in FY2017 were DOD (46%), HHS (31%), and DOE (9%).

In FY2017, women-owned small businesses received 456 Phase I awards (14.1% of all Phase I SBIR awards) totaling $70.8 million (12.5% of total Phase I funding), and 239 Phase II SBIR awards (12.8%) totaling $174.5 million (8.5%).32 Socially and economically disadvantaged businesses received 215 Phase I awards (6.7% of all Phase I SBIR awards) totaling $35.1million (6.2% of total Phase I funding), and 89 Phase II SBIR awards (4.8%) totaling $63.3 million (3.2%).33 Companies in Historically Underutilized Business Zones (HUBZones) received 76 Phase I awards (2.4% of all Phase I awards) totaling $11.2 million (2.0% of total Phase I funding) and 45 Phase II awards (2.4%) totaling $34.6 million (1.7%).34

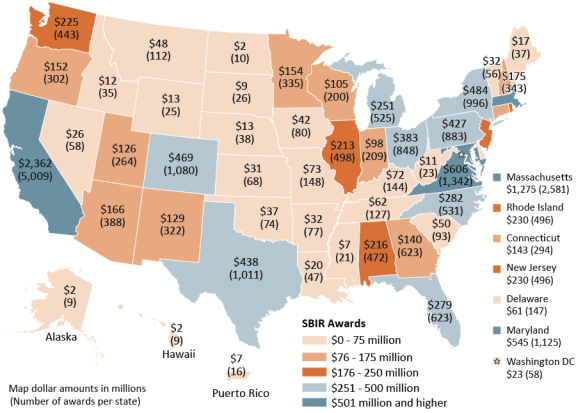

Figure 6 shows the aggregate funding level and number of SBIR awards by state for FY2013-FY2017 (the latest five-year period for which annual report award data by state are available). Although every state, the District of Columbia, and Puerto Rico received awards during this period, SBIR funding was concentrated among certain states. The two states that received the largest number and amount of SBIR awards during this period—California (5,009 awards totaling $2.362 billion) and Massachusetts (2,581 awards totaling $1.275 billion)—accounted for 33% of the total number of SBIR awards and 34% of the total funding for this period.

The top ten states—California, Massachusetts, Virginia, Maryland, Colorado, Texas, New York, Pennsylvania, Ohio, and Florida—accounted for more than two-thirds of SBIR awards and funding. This concentration mirrors overall federal R&D funding for FY2017. Eight of the top ten states in SBIR funding are also among the top ten states in overall federal R&D funding in FY2017 (which accounted for 64% of total federal R&D funding).35 In contrast, the ten states with the fewest number of SBIR awards and lowest aggregate award amounts—Alaska, North Dakota, Puerto Rico, Mississippi, West Virginia, Wyoming, South Dakota, Idaho, Maine, and Nebraska—accounted for about 1% of awards and total funding during this period. The ten states with the least federal R&D funding in FY2017 (six of which are among the bottom ten states in SBIR funding) also accounted for about 1% of total federal R&D funding.36

|

Figure 6. SBIR Aggregate Funding Level and Awards by State, FY2013-2017 |

|

|

Source: CRS analysis of data from SBA, Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Programs Annual Report for each fiscal year (FY2013-FY2017), "SBIR/STTR Awards by U.S. State and Territory" Table. Annual reports available at https://www.sbir.gov/annual-reports-files. |

Table 1 provides information on overall agency SBIR obligations for FY2017, as well as the number and aggregate amounts of Phase I and Phase II SBIR awards.

|

Phase I |

Phase II |

||||

|

Department/Agency |

Total Awarded, Phase I and Phase II |

Number of Awards |

Total Awarded |

Number of Awards |

Total Awarded |

|

Department of Agriculture |

$24.2 |

88 |

$8.7 |

26 |

$15.5 |

|

Department of Commerce |

$11.0 |

31 |

$3.5 |

21 |

$7.5 |

|

Department of Defense |

$1,121.4 |

1,440 |

$192.1 |

938 |

$929.3 |

|

Department of Education |

$7.9 |

11 |

$1.6 |

7 |

$6.3 |

|

Department of Energy |

$220.1 |

292 |

$48.6 |

170 |

$171.6 |

|

Dept. of Health and Human Services |

$843.4 |

738 |

$212.7 |

427 |

$630.7 |

|

Department of Homeland Security |

$19.0 |

16 |

$1.7 |

22 |

$17.3 |

|

Department of Transportation |

$11.3 |

14 |

$1.9 |

15 |

$9.4 |

|

Environmental Protection Agency |

$3.6 |

16 |

$1.6 |

6 |

$2.0 |

|

Nat'l Aeronautics and Space Admin. |

$145.6 |

338 |

$41.8 |

132 |

$103.8 |

|

National Science Foundation |

$164.1 |

239 |

$53.8 |

107 |

$110.3 |

|

$2,571.6 |

3,223 |

$568.0 |

1,871 |

$2,003.6 |

|

Source: CRS analysis of data from SBA, Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Program Annual Report Fiscal Year 2017, Tables 2, 3, and 7.

Notes: Award amounts many not sum to totals due to rounding. Amounts include obligations for new awards in FY2017 and FY2017 obligations on prior year awards.

Table 2 provides historical data on the number and amount of Phase I and Phase II SBIR awards from the program's inception through FY2017.

|

Fiscal Year |

Total Amounts Awarded |

Number of Awards |

||||||

|

Phase I |

Phase II |

Total |

||||||

|

FY1983 |

$44.5 |

686 |

74 |

760 |

||||

|

FY1984 |

$108.4 |

999 |

338 |

1,337 |

||||

|

FY1985 |

$199.1 |

1,397 |

407 |

1,804 |

||||

|

FY1986 |

$297.9 |

1,945 |

564 |

2,509 |

||||

|

FY1987 |

$350.5 |

2,189 |

768 |

2,957 |

||||

|

FY1988 |

$389.1 |

2,013 |

711 |

2,724 |

||||

|

FY1989 |

$431.9 |

2,137 |

749 |

2,886 |

||||

|

FY1990 |

$459.9 |

2,346 |

837 |

3,183 |

||||

|

FY1991 |

$463.7 |

2,553 |

788 |

3,341 |

||||

|

FY1992 |

$499.1 |

2,559 |

916 |

3,475 |

||||

|

FY1993 |

$644.7 |

2,898 |

1,141 |

4,039 |

||||

|

FY1994 |

$694.0 |

3,102 |

928 |

4,030 |

||||

|

FY1995 |

$834.1 |

3,085 |

1,263 |

4,348 |

||||

|

FY1996 |

$874.7 |

2,841 |

1,191 |

4,032 |

||||

|

FY1997 |

$1,066.8 |

3,371 |

1,404 |

4,775 |

||||

|

FY1998 |

$1,066.7 |

3,022 |

1,320 |

4,342 |

||||

|

FY1999 |

$1,096.5 |

3,334 |

1,256 |

4,590 |

||||

|

FY2000 |

$1,190.2 |

3,166 |

1,330 |

4,496 |

||||

|

FY2001 |

$1,294.4 |

3,215 |

1,533 |

4,748 |

||||

|

FY2002 |

$1,434.8 |

4,243 |

1,577 |

5,820 |

||||

|

FY2003 |

$1,670.1 |

4,465 |

1,759 |

6,224 |

||||

|

FY2004 |

$1,867.4 |

4,638 |

2,013 |

6,651 |

||||

|

FY2005 |

$1,865.9 |

4,300 |

1,871 |

6,171 |

||||

|

FY2006 |

$1,883.2 |

3,836 |

2,026 |

5,862 |

||||

|

FY2007 |

$1,644.8 |

3,814 |

1,542 |

5,356 |

||||

|

FY2008 |

$1,783.7 |

3,626 |

1,771 |

5,397 |

||||

|

FY2009 |

$1,965.1 |

4,007 |

1,793 |

5,800 |

||||

|

FY2010 |

$2,011.1 |

4,045 |

1,846 |

5,891 |

||||

|

FY2011 |

$2,221.7 |

3,739 |

1,759 |

5,498 |

||||

|

FY2012 |

$1,955.6 |

3,528 |

1,982 |

5,510 |

||||

|

FY2013 |

$2,075.7 |

3,011 |

1,474 |

4,485 |

||||

|

FY2014 |

$2,238.3 |

3,162 |

1,513 |

4,675 |

||||

|

FY2015 |

$2,188.7 |

2,870 |

1,454 |

4,324 |

||||

|

FY2016 |

$2,279.7 |

2,909 |

1,592 |

4,501 |

||||

|

FY2017 |

$2,571.6 |

3,223 |

1,871 |

5,094 |

||||

Sources: Data for FY1983-FY1989 from SBA, The Small Business Economy: A Report to the President, 2010, Table 1.16, pp. 51-52; Data for FY1990-FY2008 from SBA, Small Business Innovation Research Program (SBIR) Annual Report for each fiscal year; data for FY2009-FY2011 from SBA, The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Program Annual Report Fiscal Year 2009-2011; data for FY2012-FY2017 from SBA, Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Programs Annual Report for each fiscal year. Annual reports available at https://www.sbir.gov/annual-reports-files.

Notes: Source tables are not consistently labeled from year to year.

Small Business Technology Transfer

STTR Overview

The Small Business Technology Transfer program was created by the Small Business Research and Development Enhancement Act of 1992 (P.L. 102-564) and has been reauthorized several times, most recently in 2016 when the program was extended through September 30, 2022.37 Modeled largely after the SBIR program, the STTR program seeks to facilitate the commercialization of university and federal R&D by small companies. Under the program, each federal agency with an extramural R&D budget of $1 billion or more is required to allocate a portion of its R&D funding to conduct a multi-phase R&D grant program for small businesses. The STTR program provides funding for research proposals that are developed and executed cooperatively between a small firm and a scientist in an eligible research institution38 and that are aligned with the mission requirements of the federal funding agency.

Currently, five agencies participate in the STTR program: DOD, DOE, HHS, NASA, and NSF. In FY2017 and later years, federal agencies participating in the STTR program are required to set aside at least 0.45% in funding for the program. In FY2017, total STTR award funding among all STTR-participating federal agencies was $365.3 million ($204.8 million for the four participating civilian agencies and $160.5 million for DOD). The aggregate level of STTR funding for the civilian agencies accounted for 0.48% of the participating agencies' aggregate extramural R&D funding, as reported to SBA. The percentage of STTR funding set aside from DOD's extramural R&D funds cannot be determined as not all DOD components reported their extramural R&D funding to SBA.

The SBA emphasizes three principal differences between the STTR and SBIR programs:

- Under STTR, the small business and its partnering research institution must establish an intellectual property agreement detailing the allocation of intellectual property rights and rights to carry out follow-on research, development, or commercialization activities.

- Under STTR, the small business partner must perform at least 40% of the R&D, and the research institution partner must perform at least 30% of the R&D.

- The STTR program does not require the principal investigator to be primarily employed by the small business, a requirement of the SBIR program.39

As with the SBIR program, each participating agency operates its own STTR program under the provisions of the law and regulations, as well as with guidance issued by the SBA in its Policy Directive. According to some analysts, this approach allows for general consistency across STTR programs, while allowing each agency a substantial degree of control and flexibility in the execution of its program in alignment with its overall mission and priorities.40 (See "Improving Technology Commercialization and Trade-Offs Among Program Objectives" herein for related discussion.)

STTR Phases

Like the SBIR program, the STTR program has three phases. The purposes and parameters of each phase are discussed below.

Phase I

In Phase I, an agency solicits contract proposals or grant applications to conduct feasibility-related experimental or theoretical research or research and development (R/R&D) related to agency requirements. The scope of the topic(s) in the solicitation may be broad or narrow, depending on the needs of the agency. Phase I grants are intended to determine "the scientific and technical merit and feasibility of the proposed effort and the quality of performance of the [small business] with a relatively small agency investment before consideration of further Federal support in Phase II."41 Generally, STTR Phase I awards are limited to the same award guideline amount as SBIR Phase I awards (see "SBIR Phases" above). Similar to SBIR Phase I awards, agencies may issue STTR Phase I awards that exceed the guideline amount by as much as 50% and may request a waiver from the SBA to exceed the award guideline by more than 50% for a specific topic.42 In general, the period of performance for Phase I awards is not to exceed one year, though agencies may allow for a longer performance period for a particular project.

Phase II

Phase II grants are intended to further R/R&D efforts initiated in Phase I that meet particular program needs and that exhibit potential for commercial application. In general, only Phase I grant recipients are eligible for Phase II grants.43 Awards are to be based on the results achieved in Phase I and the scientific and technical merit and commercial potential of the project proposed in Phase II. The Policy Directive generally limits STTR Phase II awards to $1 million, adjusted for inflation (the Phase II award guideline). As with Phase I grants, agencies may issue awards that exceed this guideline by as much as 50% and may request a waiver from the SBA to exceed the guideline by more than 50% for a specific topic.44 In general, the period of performance for Phase II awards is not to exceed two years, though agencies may allow for a longer performance period for a particular project. Agencies may make a sequential Phase II award to continue the work of an initial Phase II award. This sequential Phase II award is also subject to the Phase II award guideline amount and agencies' authority to exceed the guideline by up to 50%. Thus, agencies may award up to $3 million, adjusted for inflation, in Phase II awards for a particular project to a single recipient at the agency's discretion, and potentially more if the agency requests and receives a waiver from the SBA. For sequential Phase II awards, some agencies require third-party matching of the agency's STTR funds.

Phase III

Phase III of the STTR program is focused on the commercialization of the results achieved through Phase I and Phase II STTR funding. The STTR program does not provide funding in Phase III. Phase III funding is expected, generally, to be generated in the private sector. However, some agencies may use non-STTR funds for Phase III funding to support additional R&D or contracts for products, processes, or services intended for use by the federal government. In addition, the law directs agencies and prime contractors "to the greatest extent practicable," to facilitate the commercialization of SBIR and STTR projects through the use of Phase III awards, including sole source awards.45

Technical Assistance

The law also allows agencies to award STTR Phase I recipients up to $6,500 per year, and Phase II award recipients up to $50,000 per project, for technical and business assistance, in addition to the amount of the base award, or to provide such assistance through an agency-selected vendor. This funding is intended to provide STTR recipients with services such as access to a network of scientists and engineers engaged in a wide range of technologies; assistance with product sales, intellectual property protections, market research, market validation, and development of regulatory plans and manufacturing plans; or access to technical and business literature available through online databases. These services are provided to help STTR awardees make better technical decisions, solve technical problems, minimize technical risks, and develop and commercialize new commercial products and processes.46

STTR Eligibility

A small business' eligibility for the STTR program is contingent on its location, number of employees, ownership characteristics, and other factors. The partnering research institution must meet eligibility qualifications as well. Eligibility to participate in the STTR program is limited to for-profit U.S. businesses with a location in the United States. Eligible companies must have 500 or fewer employees, including employees of affiliates.

The small business must be

(1) more than 50% directly owned and controlled by one or more citizens or permanent resident aliens of the United States, other small business concerns (each of which is more than 50% directly owned and controlled by individuals who are citizens or permanent resident aliens of the United States), an Indian tribe, Alaskan Native Corporation (ANC), or Native Hawaiian Organization (NHO), a wholly owned business entity of such tribe, ANC, or NHO, or any combination of these; or

(2) a joint venture in which each entity to the joint venture meets the requirements in paragraph (1) above.47

Unlike the SBIR program, the STTR program does not have authority to make awards to small businesses that are more than 50% owned by multiple venture capital (VC) operating companies, hedge funds, private equity firms, or any combination of these. However, as with SBIR, the STTR program may make awards to companies that are majority-venture capital backed if the VC firm is itself more than 50% directly owned and controlled by one or more individuals who are citizens or permanent resident aliens of the United States. In such a case, that VC is allowed to have majority ownership and control of the awardee; however, the VC and the awardee, and all other affiliates, must have a total of 500 employees or less.48

In addition, small businesses that have received multiple prior SBIR/STTR awards must meet certain benchmark requirements for progress toward commercialization to be eligible for a new Phase I award. For both Phase I and Phase II, the principal investigator's primary employment must be with either the small business or the partnering research institution at the time of award and during the conduct of the proposed project. Generally, R/R&D work under the STTR must be performed in the United States, though agencies may allow a portion of the work to be performed or obtained outside of the United States under "rare and unique" circumstances.49

The partnering research institution must be located in the United States, and be either a nonprofit college or university, a domestic nonprofit research organization,50 or a federally funded research and development center (FFRDC).51

For both Phase I and Phase II, not less than 40% of the R/R&D work must be performed by the small business, and not less than 30% of the R/R&D work must be performed by the single, partnering research institution. Agencies may choose whether to determine these percentages using either contract dollars or labor hours, but must explain this in the solicitation.52

Recent and Historical STTR Awards Data53

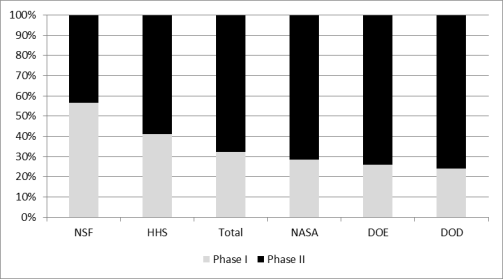

In FY2017, the most recent year for which the SBA has published annual report data on STTR awards, agencies made awards for $365.3 million, including 613 Phase I STTR awards totaling $117.6 million and 234 Phase II STTR awards totaling $247.7 million. The success rate was 22% for Phase I STTR proposers and 57% for Phase II proposers. While 72% of STTR grants made in FY2017 were for Phase I awards, more than 68% of STTR funding went to Phase II awards.

Figure 7 shows Phase I and Phase II STTR funding for FY2000-2017. In FY2004, the minimum percentage that participating agencies were required to set aside for the STTR program doubled from 0.15% to 0.30%. The STTR set-aside remained at 0.30% through FY2011. In the first year the set-aside doubled (FY2004), total funding for STTR approximately doubled. However, from FY2004 to FY2011, Phase I aggregate funding fell by about 25% while Phase II aggregate funding increased by about 74%. From FY2012 to FY2016 the STTR set-aside increased in steps from 0.30% to 0.45% (to 0.35% in FY2012, to 0.40% in FY2014, and to 0.45% in FY2016). Between FY2012 and FY2017 total funding for STTR increased by 60%. Aggregate funding for Phase I increased by 66% while aggregate funding for Phase II increased by 57% over the same time period.

|

|

Sources: CRS analysis of data. Data for FY2000-FY2008 from SBA, Small Business Technology Transfer Program (STTR) Annual Report for each fiscal year; data for FY2009-FY2011 from SBA, The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Program Annual Report Fiscal Year 2009-2011; data for FY2012-FY2017 from SBA, Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Programs Annual Report for each fiscal year. Annual reports available at https://www.sbir.gov/annual-reports-files. Notes: Source tables are not consistently labeled from year to year. |

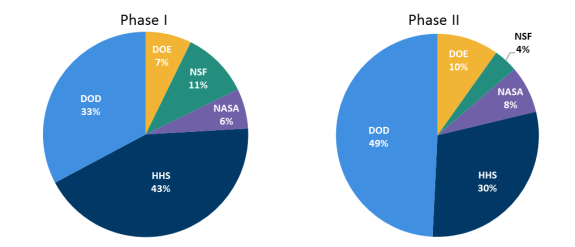

Like SBIR funding, STTR funding was highly concentrated during this period. Two agencies—DOD ($160.5 million, 44%) and HHS ($123.8 million, 34%)—accounted for nearly four-fifths of STTR funding in FY2017. DOE accounted for 9%, NASA for 7%, and NSF for 6%. See Figure 8.

|

|

Source: CRS analysis of data from SBA, Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Program Annual Report Fiscal Year 2017, Tables 10 and 13. |

The allocation of STTR funding to Phase I and Phase II awards varies among agencies. NSF allocated the largest share (57%) of its STTR funding to Phase I awards in FY2017; DOD allocated the largest share (76%) of its funding to Phase II awards. See Figure 9.

The agencies with the highest share of total Phase I funding in FY2017 were HHS (43%) and DOD (37%). The agencies with the highest share of total Phase II funding in FY2017 were also DOD (49%) and HHS (30%). See Figure 10.

In FY2017, women-owned small businesses received 74 Phase I STTR awards (12.1% of all Phase I STTR awards) totaling $14.7 million (12.5% of total Phase I funding), and 29 Phase II STTR awards (12.4%) totaling $20.3 million (8.2%). Socially and economically disadvantaged businesses received 49 Phase I awards (8.0% of all Phase I STTR awards) totaling $7.9 million (6.7% of total Phase I funding), and 18 Phase II awards (7.7%) totaling $12.2 million (4.9%). Companies in Historically Underutilized Business Zones (HUBZones) received 18 Phase I awards (2.9% of all Phase I awards) totaling $3.7 million (3.1% of total Phase I funding) and 8 Phase II awards (3.4%) totaling $7.5 million (3.0%).

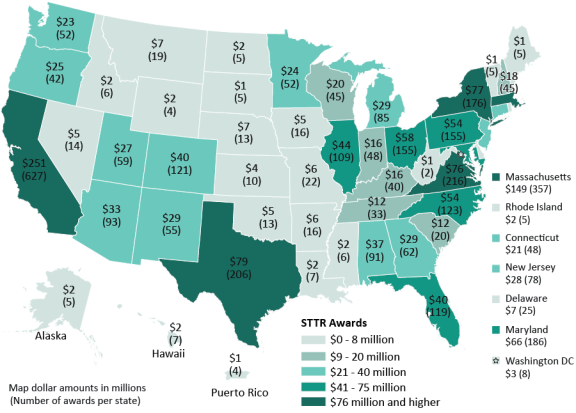

Figure 11 shows the aggregate funding level and number of STTR awards by state for FY2013-FY2017 (the latest five-year period for which annual report award data by state are available). STTR funding was concentrated in certain states. The three states that received the largest number and amount of STTR awards during this period—California (627 awards totaling $250.6 million), Massachusetts (357 awards totaling $149.0 million), and Virginia (216 awards totaling $75.5 million)—accounted for 32% of the total number of STTR awards and 33% of the total funding for this period. The top ten states—California, Massachusetts, Virginia, Texas, Maryland, New York, Ohio, Pennsylvania, North Carolina, and Colorado—accounted for about 62% of awards and funding. In contrast, the ten states with the fewest awards and lowest aggregate award amounts—Mississippi, Alaska, Maine, North Dakota, Rhode Island, South Dakota, Vermont, Puerto Rico, Wyoming, and West Virginia—accounted for about 1% of awards and total funding during this period.

|

Figure 11. STTR Aggregate Funding Level and Awards by State, FY2013-2017 |

|

|

Source: CRS analysis of data from SBA, Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Programs Annual Report for each fiscal year (FY2013-FY2017), "SBIR/STTR Awards by U.S. State and Territory" Table. Annual reports available at https://www.sbir.gov/annual-reports-files. |

Table 3 provides information on overall agency STTR obligations for FY2017, as well as the number and aggregate amounts of Phase I and Phase II awards.

|

Phase I |

Phase II |

||||

|

Department/Agency |

Total Amount Awarded, Phase I and Phase II |

Number of Awards |

Total Amount Awarded |

Number of Awards |

Total Amount Awarded |

|

Department of Defense |

$160.5 |

266 |

$38.6 |

126 |

$121.9 |

|

Department of Energy |

$33.0 |

50 |

$8.5 |

25 |

$24.4 |

|

Dept. of Health and Human Services |

$123.8 |

184 |

$50.7 |

47 |

$73.1 |

|

Nat'l Aeronautics and Space Admin. |

$26.1 |

60 |

$7.4 |

23 |

$18.7 |

|

National Science Foundation |

$21.9 |

53 |

$12.4 |

13 |

$9.5 |

|

Total, All Agencies |

$365.3 |

613 |

$117.6 |

234 |

$247.7 |

Source: CRS analysis of data from SBA, Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Program Annual Report Fiscal Year 2017, Tables 10 and 13.

Notes: Award amounts many not sum to totals due to rounding. Amounts include obligations for new awards in FY2017 and FY2017 obligations on prior year awards.

Table 4 provides historical information on the number of Phase I and Phase II STTR awards and total annual STTR funding from the program's inception through FY2017.

|

Fiscal Year |

Total Amounts Awarded |

Number of Awards |

||

|

Phase I |

Phase II |

Total |

||

|

FY1994 |

$18.9 |

198 |

— |

198 |

|

FY1995 |

$33.7 |

238 |

22 |

260 |

|

FY1996 |

$64.5 |

238 |

88 |

326 |

|

FY1997 |

$69.0 |

260 |

89 |

349 |

|

FY1998 |

$64.8 |

208 |

109 |

317 |

|

FY1999 |

$64.8 |

251 |

78 |

329 |

|

FY2000 |

$69.8 |

233 |

95 |

328 |

|

FY2001 |

$77.5 |

224 |

113 |

337 |

|

FY2002 |

$91.8 |

356 |

114 |

470 |

|

FY2003 |

$91.8 |

397 |

111 |

508 |

|

FY2004 |

$190.0 |

674 |

195 |

869 |

|

FY2005 |

$220.3 |

611 |

221 |

832 |

|

FY2006 |

$226.2 |

644 |

234 |

878 |

|

FY2007 |

$242.9 |

634 |

213 |

847 |

|

FY2008 |

$239.6 |

483 |

251 |

734 |

|

FY2009 |

$269.6 |

588 |

242 |

830 |

|

FY2010 |

$279.3 |

625 |

256 |

881 |

|

FY2011 |

$251.2 |

482 |

238 |

720 |

|

FY2012 |

$228.2 |

492 |

168 |

660 |

|

FY2013 |

$250.4 |

476 |

193 |

669 |

|

FY2014 |

$228.0 |

492 |

213 |

705 |

|

FY2015 |

$289.9 |

553 |

173 |

726 |

|

FY2016 |

$308.3 |

595 |

200 |

795 |

|

FY2017 |

$365.3 |

613 |

234 |

847 |

Sources: Data for FY1994-FY2008 from SBA, Small Business Technology Transfer Program (STTR) Annual Report for each fiscal year; data for FY2009-FY2011 from SBA, The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Program Annual Report Fiscal Year 2009-2011; data for FY2012-FY2017 from SBA, Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Programs Annual Report for each fiscal year. Annual reports available at https://www.sbir.gov/annual-reports-files.

Note: Source tables are not consistently labeled from year to year.

Issues for Consideration

Since establishing the SBIR and STTR programs, Congress has sought to better understand and address challenges to the programs' effectiveness. The following section provides an overview of selected ongoing issues that Congress may consider.

Eligibility of Venture Capital-Backed Small Businesses

Much of the debate over the reauthorization of the SBIR and STTR programs in 2011 revolved around a regulation that required at least 51% ownership by an individual or individuals to be eligible for participation in the programs.54 Some experts argued that participation by small firms that are majority-owned by venture capital companies, hedge funds, and private equity firms should be permitted. Proponents of this change maintained that, particularly in the biotechnology sector, the most innovative companies were not able to use the SBIR program because they did not meet these ownership criteria. Opponents of altering the eligibility requirements argued that the program is designed to provide financial assistance where venture capital is not available. They asserted that the program's objective is to bring new concepts to the point where private sector investment is feasible.

The SBIR/STTR Reauthorization Act of 2011 (enacted as Division E of the National Defense Authorization Act for Fiscal Year 2012, P.L. 112-81) authorized NIH, DOE, and NSF to award up to 25% of their SBIR funds to small firms that are majority-owned by venture capital (VC) companies, hedge funds, or private equity firms. The law also authorized all other SBIR participating agencies to award up to 15% of their SBIR funds to such small firms. Prior to the use of this authority, an agency must submit a written determination to SBA and Congress that explains how including such firms in the SBIR program will

- induce additional venture capital, hedge fund, or private equity firm funding of small business innovations;

- substantially contribute to the mission of the federal agency;

- demonstrate a need for public research; and

- otherwise fulfill the capital needs of small business concerns for additional financing for SBIR projects.55

P.L. 112-81 also required the Government Accountability Office (GAO) to conduct a study every three years on the impact of allowing small firms majority-owned by venture capital companies, hedge funds, and private equity firms to participate in the SBIR program.56 In 2018, GAO released its most recent report examining federal agencies' use of the authority.57 GAO found that four agencies—NIH, ED, DOE's Advanced Research Projects Agency-Energy (ARPA-E), and DOD—submitted written determinations to SBA for the use of the authority between FY2015 and FY2018; only NIH, ED, and ARPA-E actually made awards using the authority.58 According to GAO, NIH made 60 awards totaling $43.2 million, ED made one award for $200,000, and ARPA-E made one award for $250,000. The funds provided to small firms majority-owned by venture capital companies, hedge funds, and private equity firms accounted for between 0.1% and 2.7% of each agency's SBIR funding in a given fiscal year. As reported by GAO, the other seven federal agencies with SBIR programs decided not to use the authority provided by P.L. 112-81 for reasons that included

- the level of interest by small firms majority-owned by venture capital companies, hedge funds, and private equity firms was unknown or anticipated to be small;

- the agency believed that small firms majority-owned by venture capital companies, hedge funds, and private equity firms were not in need of SBIR funds;

- the agency's SBIR program was focused on early-stage research and small firms majority-owned by venture capital companies, hedge funds, and private equity firms focus on later stage R&D;

- given limited funding, the agency had an adequate number of qualified SBIR applicants without expansion of the program to small firms majority-owned by venture capital companies, hedge funds, and private equity firms; and

- the agency desired more information on the use of the authority by other agencies.59

In a previous report, GAO found that some federal agencies viewed the required written determination as "potentially stringent," necessitating rigorous analysis and evidence to support the use of the authority.60 However, according to GAO, SBA officials do not approve or deny a written determination and instead view it as "a notification letter, serving to inform SBA and Congress of the agency's plans."61

The National Defense Authorization Act for Fiscal Year 2020 (P.L. 116-92) included a provision establishing a pilot program under DOD's SBIR program that would allow DOD to allocate up to 10% of its SBIR funding in a given fiscal year to small firms majority-owned by venture capital companies, hedge funds, and private equity firms without making a written determination to SBA or Congress. P.L. 116-92, however, limits the pilot program to entirely domestic majority-owned small firms or those that meet certain requirements related to foreign ownership. In July 2019, the chairman of the Senate Small Business and Entrepreneurship Committee released the chairman's mark of the SBA Reauthorization and Improvement Act of 2019 which proposed eliminating the written determination for all federal agencies participating in the SBIR program and would have authorized such agencies to allocate up to 25% of their SBIR funding to small firms majority-owned by venture capital companies, hedge funds, and private equity firms.62 The Senate Committee on Small Business and Entrepreneurship has not taken action on the SBA Reauthorization and Improvement Act of 2019.63

|

Congressionally Mandated Studies by National Academies of Sciences, Engineering, and Medicine Over 20 years, the National Academies of Sciences, Engineering, and Medicine has issued 19 consensus studies assessing the SBIR and STTR programs of the five largest agencies with such programs—DOD, NIH, DOE, NSF, and NASA—in addition to examining the overall effectiveness of the SBIR and STTR programs. Additionally, the National Academies has issued three reports summarizing the proceedings of symposia and workshops focused on the goals of the SBIR and STTR program to encourage the participation of minority and disadvantaged persons in technological innovation and to foster the commercialization of federally funded R&D. P.L. 106-554 mandated that federal agencies with an SBIR program budget over $50 million in FY1999 (i.e., DOD, NIH, DOE, NSF, and NASA) enter into a cooperative agreement with the National Academies to

The study was directed to include a review of the quality of research being conducted under the program, an evaluation of the economic and noneconomic benefits achieved by the SBIR program, and an analysis of whether federal agencies, in fulfilling their procurement needs, are making sufficient effort to use small businesses that have completed a Phase II award, among other areas.

|

Improving Technology Commercialization and Trade-Offs Among Program Objectives

A statutory goal of the SBIR and STTR programs is to foster the development and commercialization of new technologies. Success in achieving this goal can take different forms. For example, a technology could meet an agency need and be procured by that agency (e.g., a specialized component or material for a NASA spacecraft), or a technology could fill a need in the commercial marketplace (e.g., a biological process for producing enzymes and specialty chemicals, including fragrances) or both. Over the years, Congress has included a number of provisions focused on improving commercialization. For example, P.L. 112-81 made DOD's commercialization pilot program permanent (renaming it the Commercialization Readiness Program) and P.L. 115-232 required all other agencies participating in the SBIR and STTR programs to establish a Commercialization Assistance Pilot Program (the authority for the pilot program expires on September 30, 2022). Activities under DOD's Commercialization Readiness Program increase connectivity between SBIR and STTR awardees, prime contractors, and DOD acquisition officials while the Commercialization Assistance Pilot programs of other agencies provide subsequent Phase II awards to select firms.

Some analysts have cautioned against placing too much emphasis on commercialization for evaluating the success of the SBIR and STTR programs. These analysts argue that commercialization is only one of the four overarching SBIR/STTR program goals, so too strong of a focus on this one goal might diminish the emphasis on the others.64 A report by the National Academies underscored how the SBIR/STTR program goals of stimulating innovation, meeting federal research needs, increasing commercialization, and fostering diversity in innovation and entrepreneurship "appear to be in conflict":

A well-known challenge of innovation processes, however, is the gap between research and commercialization. Individuals skilled at research tend to have much lower capability for translating their research into products and then commercializing them, and vice versa…. Many expressions of the program's goals emphasize commercialization, which could lead to a funding prioritization of projects that promise short-term commercialization potential over those with potential for longer-term innovation potential…. Essentially the program asks that agencies and awardees solve research problems, solve commercialization problems, and diversify participation at the same time as a means to address the overall societal mission of their agencies.65

Given SBIR/STTR agencies' wide range of missions—from general missions, such as advancing fields of science, to more specific missions, such as providing for the national defense—some analysts have recommended that Congress continue to provide flexibility to agencies in the operation of their programs.66 Other analysts have suggested that agencies should reorient their SBIR and STTR programs "to focus more sharply on one of the program's objectives: commercializing innovations derived from federal R&D."67 Such proponents and others have offered a number of recommendations for increasing the commercialization success of agency SBIR and STTR programs, including (1) requiring agencies to increase the weight of a project's commercialization potential in funding decisions; (2) increasing the recruitment of peer reviewers with product and business development expertise; (3) allowing firms to use technical and business assistance funds to hire in-house marketing and business expertise instead of requiring assistance be provided by third party vendors; (4) centralizing management of an agency's SBIR and STTR programs; and (5) increasing topic flexibility in solicitations (i.e., ensuring that agencies include a broad or "other" category in solicitations).68

Congress might consider statutory changes that alter or clarify the priority of commercialization relative to the other goals of the SBIR and STTR programs (i.e., stimulating innovation, meeting federal R&D needs, and fostering diversity). Based on recent academic studies, if Congress is concerned with driving economic growth through the SBIR and STTR programs (as opposed to supporting small businesses generally) it might consider changes that place more emphasis on indicators of likely success such as firm age and growth potential as part of the application process.

Tracking Commercialization

Data collection has been and remains an issue for the SBIR and STTR programs according to several reports. Federal agencies with SBIR and STTR programs are required to submit a variety of data to SBA related to each small business that applies for or receives a Phase I or Phase II award. SBA is required to collect this data and maintain it in a database for use in evaluating the programs. Two data elements are relevant to assessing the transition of a Phase II award to Phase III (i.e., commercialization).69 At the end of each Phase II award, the recipient is required to report the following: (1) data on revenue from the sale of new products or services resulting from R&D under the award; and (2) data on investments from any source other than the SBIR and STTR programs to further the R&D conducted under the award.70 Additionally, recipients are asked to voluntarily update the database annually for a period of five years after completion of the Phase II award.71 Furthermore, when a small business applies for a new Phase II award, the small business is required to update the database for any prior Phase II awards. According to the SBA, they have a web-based portal where small businesses can submit relevant Phase III data to the database; however, "because SBA cannot require companies to provide this information to the site, this data has limited use in providing meaningful information regarding commercialization success of Phase II awards."72

The most common metric for assessing whether a Phase II award has been commercialized or transitioned to Phase III is the sale of products, processes, or services resulting from the award.73 In general, participating federal agencies appear to view any sales as an indication that a Phase II award has been successfully commercialized. However, the National Academies has raised questions on what constitutes commercial success as indicated by sales:

What is the appropriate benchmark for sales? Is it any sales whatsoever, sufficient sales to cover the costs of awards, sales that lead to breaking even on a project, or sales that reflect a commercial level of success and viability? The latter at least would likely be different for each project in each company.74

In 2016, the National Academies stated the following regarding the need for new data sources to assess the SBIR and STTR programs:

Congress often seeks evidence about the effectiveness of programs or indeed about whether they work at all. This interest has in the past helped to drive the development of tools such as the Company Commercialization Record database at DOD. However, in the long term the importance of tracking lies in its use to support program management. By carefully analyzing outcomes and associated program variables, program managers should be able to manage more successfully. We have seen significant limitations to all of the available data sources.75

Additionally, the National Academies noted that one of the primary means of collecting information—surveying firms that received SBIR and STTR awards—"involve[s] multiple sources of potential bias that can skew results in different directions."76 These potential biases include the following: (1) successful and more recently funded firms are more likely to respond; (2) success is self-reported; (3) failed firms are difficult to contact; (4) not all successful projects are captured; (5) some firms are unwilling to fully acknowledge the SBIR and STTR contribution to project success; and (6) a lag time in commercialization.77 Regarding lag time, the National Academies added

Not only do outcomes lag awards by a number of years, but also the lag itself is highly variable. Some companies have sales within 6 months of award conclusion; others take decades. In addition, often the biggest impacts take many years to peak even after products have reached markets.78

With these caveats about data collection, the National Academies and others have found that about half of SBIR and STTR awards at DOD, NIH, DOE, NSF, and NASA are commercialized as measured by the generation of any sales. For example:

- A 2019 study of DOD's SBIR and STTR programs found that 58% of recipients of DOD Phase II SBIR/STTR awards made between FY1995 and FY2012 had been successfully commercialized by 2018. The study surveyed more than 4,400 companies that had received nearly 17,000 awards. The small businesses surveyed reported $121 billion in total combined sales.79

- In 2018, the National Cancer Institute (NCI), an institute of the National Institutes of Health, released a study examining outcomes associated with all Phase II SBIR/STTR awards made by the NCI between FY1998 and FY2010. Of the 648 awards examined, 53% were commercialized as measured by the generation of any sales. The small businesses surveyed reported combined total sales of $9.1 billion.80

- A 2016 report by the National Academies assessed outcomes associated with DOE Phase II SBIR/STTR awards made between FY2001 and FY2010. According to the report, 49% of the 269 Phase II awards examined generated revenue from the sale of products or services associated with the SBIR/STTR award. Additionally, 78% of the 269 Phase II awards attracted additional investment.81

Multiple Award Recipients and Role in Commercialization

Another topic that has received attention from Congress and others is the role of multiple award recipients (i.e., small firms that receive multiple SBIR and STTR awards) in the SBIR and STTR programs. Some experts express concern that such firms depend on the SBIR and STTR programs for a disproportionate share of their revenue, that they may not seek revenue outside of the programs, and that they have a poor track record of commercialization. According to the National Academies, studies examining the commercialization record of multiple award recipients "present conflicting evidence" and do not assess the performance of these firms in "important non-commercial outcomes such as procurement and basic research."82 Further, the National Academies stated

Firms that win multiple awards may differ from one another in several important ways. For instance, a frequent winner that is struggling to commercialize due to the non-incremental nature of its technology is quite different from one that acquires frequent grants as part of its business model. Second, firms may establish long SBIR/STTR track records as part of a mutually symbiotic relationship with the funding agency, especially in cases in which SBIR/STTR winners are uniquely equipped to meet specific procurement needs. These firms develop deep relationships with their funders over years of SBIR/STTR activity within a single agency. This vertical accumulation of awards within a single agency may lead firms to help expand agency capacities well beyond what a typical SBIR/STTR awardee can accomplish. On the other hand, more horizontally oriented firms may be searching for awards across multiple agencies to match their own specific technologies or to take advantage of an established familiarity with the application process.83

For some who view the SBIR and STTR programs primarily as a means to stimulate economic growth, multiple award recipients should not be the focus of the programs. Instead, such advocates argue that the SBIR and STTR programs should be focused on growth-oriented small firms, which typically are younger firms or start-ups.84 According to the National Academies

While the barriers and transactions costs facing small businesses are well understood as justifications for government intervention, it has become clear that younger small businesses are the dominant drivers of traditional metrics of economic growth (Haltiwanger, Jarmin, and Miranda, 2013). Firm age, therefore, is an important moderating variable in assessments of any program that aims to support small firms.85

In 2011, Congress responded to concerns over multiple award recipients by requiring each federal agency with an SBIR or STTR program to establish a system for measuring the success of a small business in commercializing its SBIR/STTR-funded research.86 To address the requirement, SBA, in conjunction with federal agencies, created a commercialization benchmark for the purpose of determining eligibility for additional SBIR and STTR awards.87 According to SBA, the commercialization benchmark applies to SBIR and STTR Phase I applicants that have received 16 or more Phase II awards over the past 10 fiscal years, excluding the last two fiscal years. To be eligible for a new Phase I award, such small businesses are required to have achieved a minimum level of commercialization activity resulting from work performed under their past Phase II awards. Specifically, the small business "must have received, to date, an average of at least $100,000 of sales and/or investments per Phase II award received, or have received a number of patents resulting from the SBIR work equal to or greater than 15% of the number of Phase II awards received [by the company] during the period."88 However, according to GAO, "SBA and the participating agencies have assessed small businesses against the Commercialization Benchmark only once, in 2014, because of challenges in collecting and verifying the accuracy of data."89 GAO recommended that SBA work with participating agencies to (1) to improve the reliability of its SBIR and STTR award data; and (2) implement the Commercialization Benchmark or, if that is not feasible, revise the benchmark so that it can be implemented.90

Fostering Diversity in Technological Innovation

Another statutory goal of the SBIR and STTR program is to foster and encourage the participation of minority and disadvantaged persons in technological innovation. Assessments of agency SBIR and STTR programs by the National Academies and others have consistently found that federal agencies are not effectively increasing the number of women-owned or minority-owned small businesses applying for the SBIR or STTR programs and that women-owned or minority-owned small businesses that have applied, in general, have been less successful in the application process.91 Some Members of Congress have also been concerned about the geographic diversity of small businesses participating in the programs (i.e., ten states received the majority of SBIR and STTR awards and funding). Congressional efforts have focused primarily on increasing outreach efforts associated with the SBIR and STTR programs. For example, the Federal and State Technology (FAST) Partnership Program provides outreach, financial support, and technical assistance to small businesses with a "particular emphasis on helping women, socially/economically disadvantaged individuals, and applicants from underrepresented or rural areas compete in the SBIR and STTR programs."92

In 2013, the National Academies hosted a workshop to examine the diversity and inclusion challenges associated with the SBIR and STTR programs. Individuals participating in the workshop offered a number of suggestions which fell into three broad categories—expanding the pool of applicants, eliminating barriers in award applications and selection, and providing greater education and support for entrepreneurship training and commercialization efforts.93 Examples of the suggestions offered include the following:

- Improve outreach through existing programs and partnerships that serve disadvantaged populations.

- Use the funds from the administrative pilot program for enhancing program management, improving outreach, and reducing barriers to completing applications.

- Focus on the increasing the pipeline of talented women and minorities to advance program diversity.

- Institute a federal "phase zero" program similar to programs in Florida, Vermont, and other states that award applicants funds to hire consultants to help prepare stronger proposals, including technology development and commercialization strategies.

- Require a one-page commercialization plan for Phase I applications except for applications focused on basic research.94

Agency Compliance with Mandatory Minimum Expenditures

Federal agencies participating in the SBIR and STTR programs are required to expend at least a statutorily defined minimum percentage of their extramural research funding annually. While agency compliance has improved over the years, some issues remain.

In a September 2013 report, GAO found that 8 of the 11 agencies participating in the SBIR program and 4 of the 5 agencies participating in the STTR program failed to consistently comply with spending requirements for FY2006-FY2011.95 In June 2014, GAO reported that three agencies failed to comply with the SBIR requirement and three failed to comply with the STTR requirement in FY2012.96 In May 2017, GAO found that 2 of the 11 SBIR agencies and 1 of the 5 STTR agencies failed to meet their spending requirements for FY2015 or their compliance could not be determined.97 And in its FY2017 annual report SBA reported that 4 of the 11 agencies participating in the SBIR program and 2 of the 5 agencies participating in the STTR program either failed to comply with the mandatory minimum expenditure levels or compliance could not be determined.98

Among the factors affecting agencies' failure to comply with the mandatory minimum expenditure levels are challenges in calculating the amount to be set aside; the enactment of appropriations after the start of the fiscal year; and differing agency interpretations of the statutory requirement for "expended."

Calculation of Extramural Research Funding and Set-Aside

The SBIR and STTR set-asides are based on an agency's extramural budget for research or research and development.99 The calculation of the amount of this budget can be complex for some agencies. For example, several agencies support extramural R/R&D funding through multiple subunits.100 In addition, agency extramural R/R&D funding can come from more than one appropriations account, and such accounts can include activities and programs that are not extramural R/R&D.101 Accordingly, each agency must determine its extramural R/R&D budgets using a methodology that identifies extramural R/R&D funding as well as what is to be excluded from this amount.102

Given the complexity of this challenge, Congress required each agency to report its methodology to SBA annually within four months of enactment of its appropriation.103 The Policy Directive states

If the minimum amount was not met, the agency must provide the reasons why and an explanation of how the agency plans to meet the requirement in the future. Agencies may provide an explanation of the specific budgeting process their agency uses to allocate funds for the SBIR/STTR programs and describe any issues they may see with the compliance determination procedure. Agencies may also indicate obligations made in the reporting year using prior fiscal years of appropriation within available funding obligation periods.104

According to GAO, over the years, many agencies have submitted these reports to SBA too late for SBA to provide timely feedback to the agencies after reviewing their methodologies and exclusions. For example, in 2017 GAO found that 5 of the 11 agencies participating in the SBIR and STTR programs submitted their required methodology reports on time.105 Additionally, in 2019, SBA reported that DOD had not provided SBA with the total R/R&D extramural funds the agency obligated in FY2017 and that some DOD components had not submitted the required reporting methodology.106

Another factor affecting the calculation of SBIR funding is that, in practice, agencies generally calculate their SBIR set-asides based on their extramural R/R&D budgets and not on their extramural R/R&D obligations as required by statute.107 An agency's extramural R/R&D budget reflects its spending plans for a fiscal year, whereas an agency's extramural R/R&D obligations reflect the amount of funds an agency actually obligates108 to spending in a fiscal year; a final obligation figure for extramural R/R&D may not be calculable until the end (or very close to the end) of a fiscal year. Thus, an agency's extramural R/R&D obligations (and the minimum SBIR set-aside amount) may be higher or lower than the level the agency anticipated in its extramural R/R&D budget.

Enactment of Appropriations after Start of Fiscal Year

Enactment of appropriations after the start of a fiscal year may also affect the ability of agencies to expend SBIR/STTR funds at the required level in that fiscal year. For example, if an agency plans its expenditures around a level specified in a continuing resolution but then receives a higher final appropriations, then expenditure of the additional amount to be set aside for SBIR/STTR in that fiscal year may be difficult.

Agency Views of Requirement to "Expend" Funds

Some agencies participating in the SBIR and STTR programs receive multiyear appropriations that allow funds to be carried over from one year to the next. Some program managers at such agencies have indicated that they "may choose to spend their SBIR funds over multiple fiscal years to help spend the funds properly and efficiently." Others have indicated that they "might not spend enough to meet the spending requirement in the current fiscal year, although the carried-over funds may help the agency meet or exceed the spending requirement in the following year."109

Congress might consider statutory changes that alter or clarify how agencies are to determine the amount to be set aside each year for SBIR and STTR, and whether those amounts must be spent in the same fiscal year; obligated, in whole or in part, for expenditure over multiple fiscal years; or expended without restriction to any given period.

SBA Delays in Meeting Statutory Reporting Requirements

The Small Business Act has required the SBA to report annually to Congress on the SBIR and STTR programs since the inception of these programs. SBA compliance with this requirement has been an ongoing issue. According to GAO, SBA issued its FY2012 report to Congress in November 2014 and its FY2013 report in March 2016.110 The annual reports for FY2016 and FY2017 were submitted in 2019. As of the date of this report, the SBA had not yet delivered its FY2018 report. Failure to produce these reports on a timely basis may impede Congress's exercise of its oversight responsibilities.

Among the issues that may affect the timeliness of SBA reporting are SBIR/STTR agencies' delays in providing data to the SBA and adequate staffing levels at SBA devoted to producing the report.111 For example, in the FY2017 SBIR/STTR annual report SBA stated

SBA received the DOD's last FY17 Annual Report data upload on December 19, 2018, which is over nine months late. As such, this limited the amount of time available to analyze and validate the DOD data. It should be noted, the other 10 Participating Agencies submitted the Annual Report information (including the methodology report) to SBA in a timely fashion.112

Concerns About Fraud, Waste, and Abuse

Identification and elimination of fraud, waste, and abuse in the SBIR and STTR programs have been abiding concerns of Congress. In 2011, Congress sought to address such concerns by directing SBA to amend its Policy Directive to include measures to prevent fraud, waste, and abuse.113 The Policy Directive requires federal agencies with SBIR or STTR programs to implement the following minimum requirements:

- Require certifications from awardees at the time of award, after the award period, and during the award funding lifecycle.

- Include on the agency's SBIR and STTR program webpage, and in program solicitations, information explaining how an individual can report fraud, waste, and abuse.

- Designate at least one individual in the agency to serve as the liaison between the SBIR and STTR program, the agency's Office of Inspector General (OIG), and the agency's Suspension and Debarment Official (SDO) and ensure that inquiries regarding fraud, waste, and abuse are referred to the OIG and, if applicable, the SDO.

- Include on the agency's SBIR and STTR program web page information concerning successful prosecutions of fraud, waste, and abuse in the programs.

- Establish a written policy requiring all personnel involved with the SBIR and STTR programs to notify the OIG if they suspect fraud, waste, and abuse and ensure this policy is communicated to all SBIR and STTR personnel.

- Create or maintain an adequate system to enforce accountability through suspension and debarment, fraud referrals, or other efforts to deter wrongdoing and promote integrity.

- Ensure compliance with the eligibility requirements of the programs and the terms of SBIR and STTR funding agreements.

- Work with the agency's OIG with regard to its efforts to establish fraud detection indicators, coordinate the sharing of information between federal agencies, and improve education and training to SBIR and STTR program officials, applicants, and awardees.