Congress made COVID-19-related economy injury an eligible expense for the Small Business Administration's (SBA) Economic Injury Disaster Loans (EIDL) in the Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020 (P.L. 116-123). It also expanded EIDL eligibility for certain businesses and organizations, and it established an Emergency EIDL Grant program as part of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act; P.L. 116-136).

COVID-19-related EIDL and Emergency EIDL grants are available to all 50 states, U.S. territories, and Washington DC.

This Insight provides:

- a general overview of SBA EIDL (including eligibility) and the Emergency EIDL Grant program;

- SBA EIDL data by the number and amount of loans approved by state; and

- Emergency EIDL Grant program (also referred to as EIDL advance) data by the number and amount of grants approved by state.

EIDL Overview

EIDLs provide up to $2 million, with a loan term of up to 30 years that can be used to pay for expenses that could have been met had the disaster not occurred, including working capital needs such as fixed debt and payroll and other operating expenses. COVID-19-related EIDLs have an interest rate of 3.75% for businesses and 2.75% for nonprofits. EIDLs also have an automatic one-year deferment on repayment (the first payment is not due for one full year, although interest does accrue). Because of high demand, the SBA is limiting COVID-19-related EIDLs to $15,000 and, as discussed below, Emergency EIDL grants to $1,000 per employee, up to the statutory cap of $10,000.

EIDL Eligibility

The CARES Act expanded COVID-19-related EIDL eligibility, through December 31, 2020, to include

- businesses with 500 or fewer employees,

- sole proprietorships (with or without employees),

- independent contractors,

- cooperatives,

- employee-owned businesses,

- tribal businesses, and

- agricultural enterprises with 500 or fewer employees.

EIDL eligibility also includes small agricultural cooperatives, small aquaculture businesses, and nurseries deriving more than 50% of their annual receipts from the production of nursery or other agricultural products.

Private nonprofit organizations of any size are also eligible, if they have a ruling letter from the IRS granting tax exemption under sections 501(c), (d), or (e) of the Internal Revenue Code of 1954 or satisfactory evidence from the state that the nonrevenue producing organization or entity is a nonprofit organization or doing business under state law.

Public nonprofit organizations and several specific business types, such as political and lobbying businesses and government-owned businesses, are not eligible for EIDL assistance.

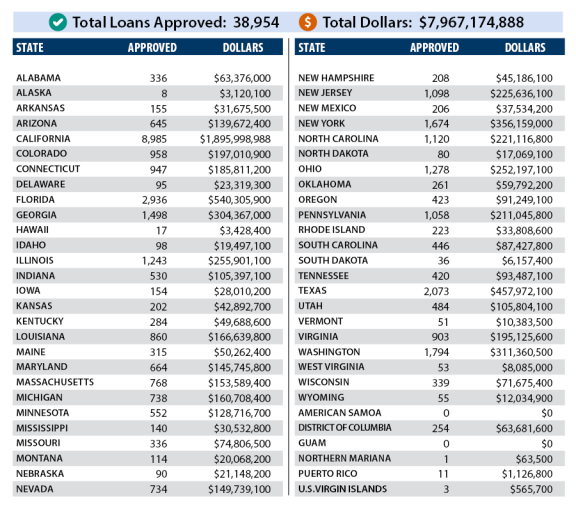

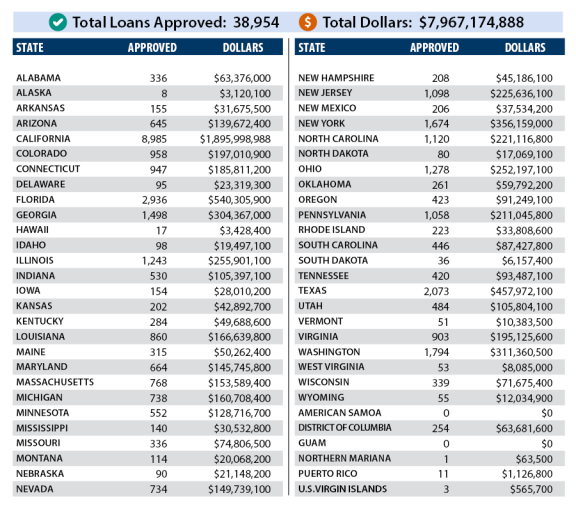

Figure 1 shows the number of EIDLs approved and the cumulative loan amount by state as of April 24, 2020.

|

Figure 1. Small Business Administration: Disaster Assistance Update, Nationwide Economic Injury Disaster Loans COVID-19

Cumulative Loan Amounts by State as of April 24, 2020

|

|

|

Source: U.S. Small Business Administration: https://www.sba.gov/document/report—covid-19-eidl-loans-report.

Note: Not all applicants accept approved loans.

|

Emergency EIDL Grants

The CARES Act established the Emergency EIDL Grant program to provide EIDL advance payments of up to $10,000. The advance payment does not need to be repaid, even if the borrower is later denied the EIDL. Because of high demand, the SBA is limiting the grant to $1,000 per employee, up to the statutory cap of $10,000. The Emergency EIDL grant (also referred to as an EIDL advance) may be used to keep employees on payroll, pay for sick leave, meet increased production costs caused by supply chain disruptions, or pay business obligations, including debts, rent, and mortgage payments. The applicant must request the advance when applying for an SBA EIDL.

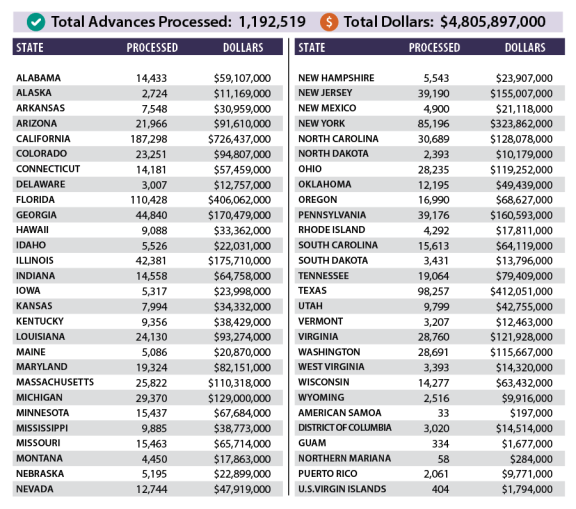

Figure 2 shows the number of EIDL advances by number processed and total dollar amount by state as of April 24, 2020.