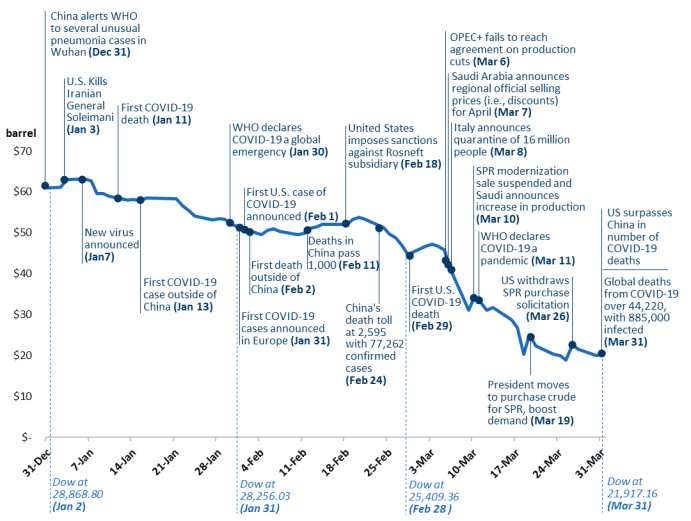

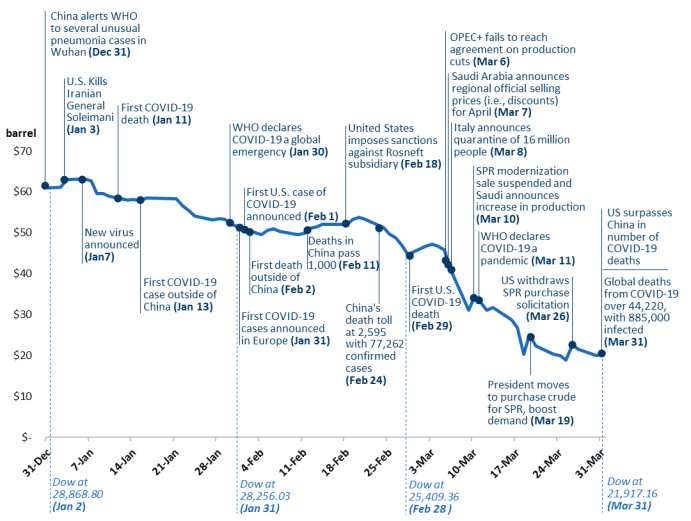

Global oil prices have declined nearly 60% since January 2020 (see Figure 1). Following a brief period of geopolitically-driven upward price pressure resulting from events in Iraq and Libya, world oil supply/demand balances were projected to be oversupplied by the second quarter of 2020. Reduced travel and other economic impacts related to the evolving COVID-19 outbreak are suppressing near-term oil demand. Oversupply expectations were amplified when the Organization of the Petroleum Exporting Countries (OPEC) and a group of non-OPEC countries (OPEC+), including Russia, failed to agree on an OPEC recommendation to reduce oil production by 1.5 million barrels per day until the end of 2020. Oil prices immediately and significantly declined. Subsequently, Saudi Arabia announced regional price discounts and plans to increase oil supplies in April. Other countries have also indicated intent to increase oil production. This combination of demand suppression and supply expansion increases short-term oversupply expectations and exerts downward pressure on oil prices. Prolonged periods of depressed prices could affect U.S. oil production (approximately 12.2 million bpd in 2019, the world's largest), exports, employment, and industry consolidation. Due to recent developments, a plan to sell crude oil—required in FY2020 by P.L. 116-94—from the Strategic Petroleum Reserve (SPR) was suspended.

|

Figure 1. West Texas Intermediate (WTI) Spot Price and Selected Events

December 31, 2019–March 31, 2020

|

|

|

Source: Compiled by CRS. WTI daily spot prices from Bloomberg. Coronavirus timeline and other announcements from media reporting.

Notes: Announcements included are not comprehensive of oil supply/demand events. Dow stands for Dow Jones Industrial Average, a stock market index that can be considered an economic indicator linked to announcements shown here and other events not included.

|

Effects on U.S. Oil Producers

While low oil prices are generally positive for consumers (i.e., lower gasoline prices), sustained low prices could result in financial stress for companies operating in the U.S. oil exploration and production (E&P) sector. The degree of financial stress will be unique to each E&P company and will depend on factors such as hedging positions, balance sheet fundamentals (e.g., debt liabilities and cash), cost structures, ability to renegotiate service contracts, and corporate finance actions (e.g., dividend adjustments and spending reductions). Companies with limited capacity to adapt could default on debt obligations, reduce employment levels, or file for bankruptcy protection. Industry consolidation through mergers, acquisitions, and distressed asset transactions is a possible outcome. Other companies that provide support to the E&P sector might also encounter challenging business conditions. Exactly how the U.S. oil sector might be affected—and the severity of these effects—is uncertain and will depend largely on the timeframe for price recovery.

Policy Options and Considerations

During previous periods of depressed oil prices, Congress has considered various policy options that might provide some degree of relief to the U.S. E&P sector. For example, in late 2014 to early 2016, OPEC did not reduce production to address oversupply, some producers increased output, and prices fell below $30/barrel. Legislation introduced in the 114th Congress (H.R. 4559) would have created a commission to investigate OPEC anticompetitive practices. Current oil market conditions are similar, but with the addition of demand weakness being magnified by COVID-19. Other previously considered policy options that might support U.S. producers include:

- SPR acquisitions: Acquiring crude oil—direct purchases or royalty-in-kind—for SPR storage could absorb a limited amount of market oversupply. Physical SPR capacity is approximately 713.5 million barrels, while actual inventories are 635 million barrels. Whether increasing SPR inventories might contribute to oil market rebalancing is uncertain. Furthermore, acquiring SPR crude oil to reduce oversupply and increase prices could conflict with statutory objectives to minimize market impacts from purchases. Citing a lack of funding, a Department of Energy solicitation to purchase 30 million barrels of crude oil was withdrawn.

- Loans and loan guarantees: Federal loans and loan guarantees could provide financing for companies adversely affected by low prices. Legislation enacted in 1999 (P.L. 106-51) created a $500 million emergency oil and gas loan guarantee program for independent oil and gas companies, as well as small businesses supporting the U.S. E&P sector, that had experienced layoffs, production declines, or financial losses due to low oil prices. There are approximately 9,000 independent U.S. oil and gas companies.

- Oil import fees, tariffs, and quotas: Currently, a two-tiered tariff system applies to crude oil imports. Other oil import restrictions have been used as policy tools to support prices for U.S. oil producers. For example, Presidential Proclamation 3279 instituted an oil import quota system in 1959 with the goal of maintaining acceptable price levels. The quota system was changed to an import fee in 1973. The President has authority under the International Emergency Economic Powers Act of 1977 (IEEPA) and other federal laws (e.g., Section 232 of the Trade Expansion Act of 1962) to prohibit imports of oil or impose import duties. Due to the globally integrated nature of current U.S. petroleum imports and exports, restricting imports could adversely affect other elements (e.g., refining) of the broader petroleum sector.

- Antidumping remedies: Antidumping and countervailing duties are trade remedies available to U.S. industries "materially injured," or threatened with injury, by comparable products sold in the U.S. market at less than fair value or subsidized by a foreign government or public entity. U.S. oil industry groups have previously petitioned the International Trade Administration to seek remedies against oil producing countries—including Iraq and Saudi Arabia—during previous low-oil-price periods. Whether or not this remedy is applicable to current market conditions is uncertain.

Concluding Remarks

Low oil prices reflect a global market that is projected to be oversupplied in the near-term. Price recovery would largely depend on market rebalancing. However, the rebalancing timeframe is uncertain as demand impacts of COVID-19 and actual oil supply increases are unknown. Rebalancing could take the form of OPEC+ supply restraint, price-induced demand increases, lower U.S. and global oil production, or a combination thereof. Existing federal policy options that might contribute to balancing near-term global markets appear limited.