The Take Responsibility for Workers and Families Act (H.R. 6379), introduced in the House on Monday, March 23, 2020, proposes direct payments to individuals and families—referred to as "2020 economic assistance payments to individuals." This Insight provides a brief overview of these proposed payments.

Generally, for individuals and families that filed an income tax return, the economic assistance payment would be an advanced refundable tax credit that they would automatically receive in 2020 as a direct deposit or check by mail. Most recipients of Social Security or Supplemental Security Income (SSI) would be eligible to receive a special $1,500 payment automatically in 2020 without needing to file a federal income tax return. Other individuals would generally not receive the payments in 2020. Instead, they could claim the benefit as a refundable tax credit when they file their 2020 income tax return next year.

Individuals and families that file federal income tax returns would generally be eligible for economic assistance payments, structured as refundable tax credits against 2020 income taxes. To expedite and automate the delivery of these credits, the Internal Revenue Service (IRS) would estimate payment amounts based on prior year tax return data and automatically send that amount to tax filers in 2020. Tax filers would receive the payment as a direct deposit or as a check by mail.

Eligible individuals would receive a credit equal to $1,500 per person ($3,000 for married taxpayers filing jointly). Generally, an eligible individual would be any individual except (1) nonresident aliens, (2) individuals who could be claimed as a dependent by another taxpayer, and (3) an estate or trust. Taxpayers would also receive $1,500 for each child that qualifies for the child tax credit, up to three children. Hence, the largest credit amount would be $7,500 for a married couple with three or more children.

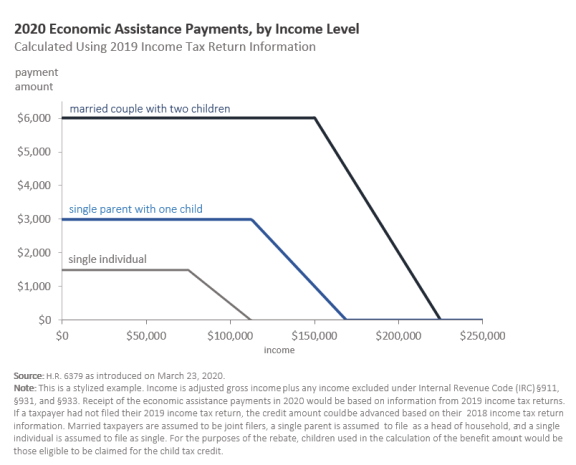

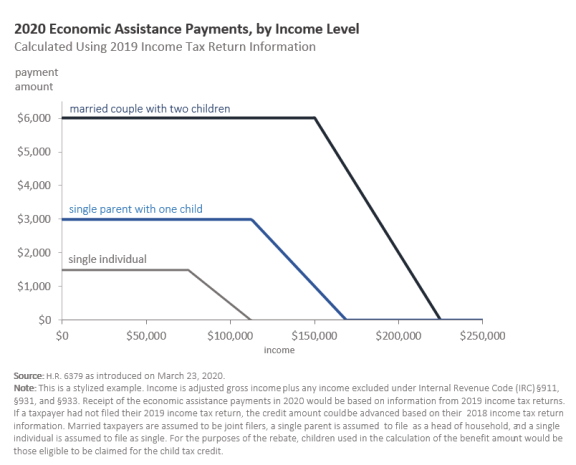

The total proposed credit would phase out ratably (i.e., proportionally) for taxpayers with incomes between $75,000 and $112,500 ($112,500-$168,750 for head of household filers and $150,000-$225,000 for married joint filers). Income for the purpose of this provision would be adjusted gross income (AGI) modified by adding back the following: excluded foreign earned income; excluded income of bona fide residents of Guam, the Commonwealth of the Northern Mariana Islands (CNMI), and American Samoa; and excluded income of bona fide residents of Puerto Rico. An illustration of the amount of the economic assistance payment by income level is provided below.

As with any tax refund, these payments would not count as income or resources for a 12-month period in determining eligibility for, or the amount of assistance provided by, any federally funded public benefit program.

The proposed credit would be a fixed amount until income reaches the phaseout level. Lower-income taxpayers with little or no income tax liability would be eligible for a tax credit equal in dollar value to that received by middle-income and upper-middle-income taxpayers for a given household size. Hence, as a percentage of income, this rebate would be largest for the lowest-income recipients. The tax credit would phase out at the upper end of the distribution, as shown in the figure above.

The bill would automatically advance the credit, which would be received as a direct deposit or a check by mail. The advancing provision would allow taxpayers to receive this credit before 2020 tax returns are filed in early 2021.

The advanced credit amount would be estimated by the IRS using the same formula as the 2020 economic assistance payments, but based on taxpayers' 2019 income tax return information (if the taxpayer has not yet filed a 2019 income tax return, 2018 income tax return information could be used instead). If, when taxpayers file their 2020 income tax returns in 2021, they find that the advanced credit was less than the actual credit amount, the taxpayer will be able to claim the difference on their 2020 income tax return. If instead, the taxpayer finds that their advance credit was greater than the actual credit amount, they would be required to pay back the difference. The taxpayer would have the option to pay back the amount over three years, as an additional tax on their income tax return that is not subject to interest.

The bill would provide a special payment of $1,500 to adult Social Security or SSI beneficiaries who did not file a federal income tax return. (If they did file a return, the amount of the payment would reduce the amount of the aforementioned tax credit.) The special payment would not be subject to federal income tax nor would it be treated as income or a resource in determining eligibility for, or the amount of assistance provided by, any federally funded public benefit program. In general, beneficiaries would be ineligible for the special payment if they are residing outside of the United States or if their benefits were recently suspended because of incarceration or certain other prohibited acts. The Social Security Administration would certify eligibility for the special payment.