Introduction

This report provides a brief overview of the FY2021 budget request for the Department of Housing and Urban Development (HUD), with links to relevant Administration budget documents and CRS reports. This report will not be updated to track legislative action.

HUD

Most of the funding for HUD's programs and activities comes from discretionary appropriations provided each year in the annual appropriations acts. HUD's annual appropriations are generally considered along with those for the Department of Transportation and several related agencies (including the Neighborhood Reinvestment Corporation, also known as NeighborWorks America) by the Transportation, HUD, and Related Agencies subcommittees of the House and the Senate appropriations committees.

- For more information about HUD's programs and activities, see CRS Report RL34591, Overview of Federal Housing Assistance Programs and Policy, by Maggie McCarty, Libby Perl, and Katie Jones.

President's FY2021 Budget Request

On February 10, 2020, the Trump Administration submitted its FY2021 budget request to Congress.

Totals

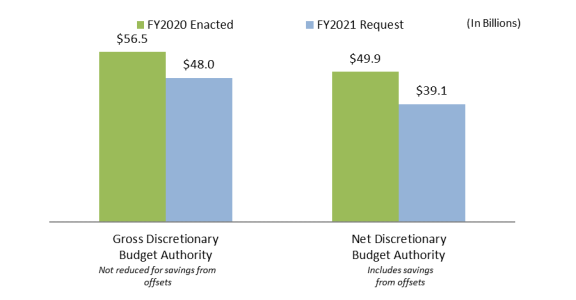

Gross Budget Authority

The President's FY2021 request proposes $48.0 billion in gross discretionary appropriations for HUD, which is the amount of new budget authority available for HUD programs and activities, not accounting for budgetary savings from offsets and other sources. This amount is about $8.5 billion (15%) less than the amount of gross discretionary appropriations provided in the FY2020 enacted appropriations law (see Figure 1).

The President's budget proposes funding reductions for most HUD programs and activities, including a number of program eliminations, which are explored later in this report (see "Funding Reductions" and "Program Eliminations"). A few accounts are slated for funding increases, the largest relative increase being for the Housing for Persons with Disabilities program (+25%; +$50 million relative to FY2020) and the largest overall increase being to renew existing subsidies under the project-based rental assistance account (+$96 million; + 1% relative to FY2020).

- For more information about HUD's budget request, see FY2021 Budget Appendix-HUD.

- For additional detail about funding levels for specific programs and activities, see HUD's FY2021 Congressional Budget Justifications.

- For a table of FY2021 requested funding levels compared to FY2020 enacted funding levels for selected HUD accounts, see Table 1.

Net Budget Authority

When looking at net discretionary budget authority—accounting for the effect of budgetary savings from offsetting collections and receipts, rescissions, and other sources—the President's budget appears to provide a larger decrease relative to FY2020 than the decrease in gross budget authority. As shown in Figure 1, accounting for these savings, the President's FY2021 budget requests $39.1 billion in net discretionary funding for HUD, a decrease of about $10.8 billion (22%) compared to the net budget authority provided in FY2020. In other words, the cuts in funding for HUD's programs and activities from FY2020 to FY2021 (as represented by gross budget authority) are smaller than they appear when accounting for budgetary savings (as represented by net budget authority). The gross budget authority generally best reflects the amount of new funding available for HUD's programs and activities in a year, whereas net budget authority is important for compliance with statutory spending limitations.

The reason that the net decrease from FY2020 enacted to FY2021 requested amounts is larger than the gross decrease is because there is more estimated to be available in offsets in FY2021 relative to FY2020. Specifically, there is an estimated $2 billion (34%) increase in budget savings available from offsetting collections and receipts for FY2021 relative to FY2020. Most of this is attributable to an estimated increase of about $2.3 billion in receipts from the Federal Housing Administration's (FHA's) single family mortgage insurance programs and an increase of about $688 million in receipts from Ginnie Mae. However, these estimates of offsetting collections and receipts for FY2021 will likely change when the Congressional Budget Office (CBO) re-estimates the President's budget for the purposes of the congressional appropriations process.

- For more information about offsetting collections and receipts and other components of the HUD budget, see CRS Report R42542, Department of Housing and Urban Development (HUD): Funding Trends Since FY2002, by Maggie McCarty.

- For more information about FHA and how it is accounted for in the budget, see CRS Report R42875, FHA Single-Family Mortgage Insurance: Financial Status of the Mutual Mortgage Insurance Fund (MMI Fund), by Katie Jones.

Program Eliminations

The bulk of the funding reduction proposed in the FY2021 budget request comes from program eliminations. The budget proposes to eliminate funding for a number of HUD grant programs, which, combined, received over $7.8 billion in FY2020. The programs slated for elimination include the following:

- Community Development Block Grants (CDBG), funded at $3.43 billion in FY2020, provide formula grants to states and localities for a variety of community and economic development activities.

- The Public Housing Capital Fund, funded at $2.84 billion in FY2020, provides grants to public housing authorities (PHAs) to fund the major modernization needs in public housing. (The President's budget proposes to rename a different account, the Public Housing Operating Fund, the Public Housing Fund and expand its purposes to include the activities typically funded by the Public Housing Capital Fund account, but without a corresponding increase in funding.)

- HOME Investment Partnerships Program grants, funded at $1.35 billion in FY2020, provide formula grants to states and localities for various housing activities targeted to low-income families.

- Choice Neighborhoods grants, funded at $175 million in FY2020, provide competitive grants to revitalize distressed public housing or other HUD assisted housing.

- The Self-Help Homeownership Opportunity Program (SHOP) account, funded at $55 million in FY2020, includes funding for grants to national and regional intermediaries (such as Habitat for Humanity) to support self-help, sweat-equity model housing programs for low-income families, and grants for capacity building activities.

- Native Hawaiian Housing Block Grants, funded at $2 million in FY2020, provide grants to Hawaii's Department of Hawaiian Home Lands (DHHL) for housing and related infrastructure for low-income Native Hawaiians on the Hawaiian home lands. (The President's budget states that DHHL has sufficient unexpended funds from prior fiscal years to continue carrying out the program in FY2021.)

Funding Reductions

Most other HUD programs are slated for funding reductions in the FY2021 request relative to FY2020 enacted appropriations. Those with the largest proposed reductions include the following:

- The Native American Programs account, proposed for a $225 million (27%) reduction relative to FY2020, funds formula and other grants to Native American tribes and Alaska Native Villages for affordable housing activities in tribal areas.

- The Public Housing Operating Fund, proposed for a $1 billion reduction relative to FY2020, provides formula grants to PHAs to fund the operating costs of public housing. (The President's budget also requests to rename this account the Public Housing Fund and expand its purposes to include those typically funded under the Public Housing Capital Fund, an account which would be zeroed out. It would also move funding for some PHAs to a new Moving to Work account.)

- Housing Opportunities for Persons with AIDS (HOPWA), proposed for an $80 million (20%) reduction relative to FY2020, primarily provides formula grants to states and localities to fund the development of housing for low-income persons living with AIDS and their families.

Funding Increases

Some HUD programs are slated for funding increases in the FY2021 request relative to FY2020 enacted appropriations. Those with the largest proposed increases include the following:

- Rental Assistance Demonstration (RAD), a new account proposed for funding of $100 million, would, for the first time, offer additional funding to supplement the cost of certain public housing properties to convert to Section 8 assistance through the Rental Assistance Demonstration.

- Housing for Persons with Disabilities, proposed for a $50 million (25%) increase relative to FY2020, provides grants and rental assistance to support the development of housing for low-income persons with disabilities and their families.

- The Office of Lead Hazard Control, proposed for a $70 million (24%) increase, generally funds grants to localities for lead-based paint hazard testing and remediation, but would be expanded to also include funding for demonstrations to install carbon monoxide alarms in high-risk units, test for and mitigate radon hazards in public housing, and experiment with more thorough lead testing in Section 8 Housing Choice Voucher units.

- Housing for the Elderly, proposed for a $60 million (8%) increase relative to FY2020, provides grants and project-based assistance to support the development of low-income housing for elderly households.

Rental Assistance

The largest share of spending in HUD's budget is attributable to the cost of maintaining HUD's largest rental assistance programs—the public housing, Housing Choice Voucher, and Section 8 project-based rental assistance programs—which provide deeply subsidized affordable housing to low-income families, seniors, and persons with disabilities. In FY2020, these programs accounted for nearly 82% of HUD's budget; in light of proposals to eliminate funding for a number of HUD's grant programs, under the President's budget request the rental assistance programs' share of HUD's budget would increase to 84%.

The amount of funding requested for these accounts for FY2021 would likely not be adequate to ensure that all currently assisted families continue to receive the same level of assistance they presently receive, given general rental inflation across the programs. The President's budget documents state that the estimates used to derive the requested funding level assume adoption of a set of reforms that would reduce subsidies and increase rents for tenants. These include the Making Affordable Housing Work Act, a legislative reform proposal announced by HUD Secretary Carson in April 2018. That proposal includes a number of statutory changes to HUD's rental assistance programs that, if enacted, would result in rent increases for assisted housing recipients, and corresponding decreases in the cost of federal subsidies, as well as options for program administrators to adopt new policies, such as work requirements for tenants.

Additionally, the budget requests several account structure changes, including moving funding for PHAs participating in the Moving to Work (MTW) demonstration into a separate account and renaming and expanding the purposes of the Public Housing Operating Fund account. These proposed restructurings create challenges in comparing account-level requests for FY2021 to enacted levels in FY2020 for the Tenant-Based Rental Assistance, Public Housing Capital Fund, and Public Housing Operating Fund accounts. Comparing combined funding for these accounts in FY2020 ($31.2 billion) to the comparable request for FY2021 ($27.5 billion, including the new MTW account) demonstrates that for the two programs funded by these accounts (public housing and the Section 8 Housing Choice Voucher program), the President's request would represent a 12% funding cut.

Legislative Proposals

The FY2021 budget request contains a number of legislative proposals that would make changes to HUD programs. Some of the general provisions being proposed include the following:

- Expansion of and modifications to the Rental Assistance Demonstration (RAD), including elimination of the cap on the number of public housing units that can convert under the program. (§222)

- Authority for the HUD Secretary to freeze rent increases in the project-based rental assistance programs to restrain cost growth. (§223)

- Broad statutory and regulatory waiver authority for the HUD Secretary in administering the public housing and Section 8 Housing Choice Voucher program. (§§224, 225, 226)

Table 1. FY2020 Enacted Funding and FY2021 Request for Selected HUD Accounts

(In billions of dollars)

|

Accounts |

FY2020 Enacted |

FY2021 Request |

% Change, FY2020 to FY2021 Request |

|

Salaries and Expenses (Mgmt. & Adm.) |

1.425 |

1.497 |

5% |

|

Tenant-Based Rental Assistance (Section 8 Housing Choice Vouchers) |

23.920 |

18.897 |

N/Aa |

|

Public Housing Capital Fund |

2.839 |

— |

-100% |

|

Public Housing Operating Fund/Public Housing Fund (renaming proposed) |

4.487 |

3.444 |

N/Aa |

|

Choice Neighborhoods |

0.175 |

— |

-100% |

|

Rental Assistance Demonstration (new account proposed) |

— |

0.100 |

100% |

|

Moving to Work (new account proposed) |

— |

5.185 |

N/Aa |

|

Self Sufficiency Program |

0.080 |

0.090 |

13% |

|

Native American Programs |

0.825 |

0.600 |

-27% |

|

Native Hawaiian Block Grant |

0.002 |

— |

-100% |

|

Housing, persons with AIDS (HOPWA) |

0.410 |

0.330 |

-20% |

|

Community Development Fund (Including CDBG) |

3.425 |

— |

-100% |

|

HOME Investment Partnerships |

1.350 |

— |

-100% |

|

Self-Help Homeownership (SHOP) |

0.055 |

— |

-100% |

|

Homeless Assistance Grants |

2.777 |

2.773 |

0% |

|

Project-Based Rental Assistance (Project-Based Section 8) |

12.610 |

12.706 |

1% |

|

Housing for the Elderly |

0.793 |

0.853 |

8% |

|

Housing for Persons with Disabilities |

0.202 |

0.252 |

25% |

|

Housing Counseling Assistance |

0.053 |

0.045 |

-15% |

|

Research and Technology |

0.098 |

0.095 |

-3% |

|

Fair Housing |

0.070 |

0.065 |

-7% |

|

Lead Hazard Control |

0.290 |

0.360 |

24% |

Source: Table prepared by the Congressional Research Service (CRS). FY2020 and FY2021 figures taken from FY2021 President's budget documents and HUD Congressional Budget Justifications.

a. FY2020 and FY2021 amounts for Tenant-Based Rental Assistance and Public Housing Operating Fund account are not fully comparable due to the creation of a separate account for Moving to Work agencies, which is why percentage changes for those accounts are not provided in this table.