Background

The Railroad Retirement Act authorizes retirement, survivor, and disability benefits for railroad workers and their families.1 The Railroad Retirement Board (RRB), an independent federal agency, administers these benefits. Workers covered by the RRB include those employed by railroads engaged in interstate commerce and related subsidiaries, railroad associations, and railroad labor organizations. These benefits are earned by railroad workers and their families in lieu of Social Security.

Railroad retirement benefits are divided into two tiers. Tier I benefits are generally computed using the Social Security benefit formula, on the basis of earnings covered by either the Railroad Retirement or Social Security programs. In some cases, RRB Tier I benefits can be higher than comparable Social Security benefits. For example, RRB beneficiaries may receive unreduced Tier I retirement benefits as early as aged 60 if they have at least 30 years of railroad service; Social Security beneficiaries may receive unreduced retirement benefits only when they reach their full retirement ages, currently rising from aged 65 to 67. RRB Tier II benefits are similar to private pension benefits and are based only on railroad work.2

The Tier I railroad retirement benefit that is equivalent to Social Security benefits is mainly finance by Tier I payroll taxes (typically the same rate as the 12.4% Social Security payroll tax) and Social Security's financial interchange transfers.3 Tier II benefits, Tier I benefits in excess of Social Security benefits, and supplemental annuities4 are mainly financed by Tier II payroll taxes (currently 13.1% on employers and 4.9% on employees) and transfers from the National Railroad Retirement Investment Trust (NRRIT; hereinafter, the Trust).

History of the Trust

Beginning in 2002, Tier II tax revenues in excess of obligatory benefits and associated administrative costs have been transferred from the Railroad Retirement Accounts to the Trust, which is invested in private stocks, bonds, and other investments. Prior to the Railroad Retirement and Survivors' Improvement Act of 2001 (RRSIA; P.L. 107-90), surplus railroad retirement assets could be invested only in U.S. government securities—just as the Social Security trust funds must be invested.5 The RRSIA established the Trust to manage and invest assets in the Railroad Retirement Account in much the same way that the assets of private-sector retirement plans are invested. The RRB also receives transfers from the Trust, as needed, to pay railroad retirement and survivor benefits. Assets in the Social Security Equivalent Benefits Account, which are used for RRB Tier I benefits that are equivalent to Social Security benefits, continue to be invested solely in U.S. government bonds, as required by law.

Since February 2002 when railroad retirement funds were first invested through the Trust, a total of $21.3 billion has been transferred to the Trust from the RRB,6 and $22.9 billion in earnings have been transferred from the Trust to the RRB to pay railroad benefits and administrative expenses.7 From its inception to the end of FY2018, the Trust has earned a total of $28.2 billion. At the end of FY2018, the market value of the Trust's managed assets was $26.6 billion.8

Structure of the Trust

Independence

Congress structured the Trust to be independent and free of political interference. As such, the Trust is a tax-exempt entity independent of the RRB and is not part of the federal government. It has no responsibilities for administering RRB benefits. The Trust's trustees are required to act solely in the interest of the RRB and the railroad retirement system participants. The fiduciary rules governing the trustees are similar to those required by the law that governs the private pension system, the Employee Retirement Income Security Act (ERISA).9

The board of the Trust is made up of seven trustees who have expertise in managing financial investments and pension plans. Three of the trustees are selected by railroad labor unions, three by railroad management, and one by the other six trustees. Each trustee serves a three-year term. A professional staff handles the Trust's day-to-day operations.

Independent investment managers invest the Trust's assets according to the investment guidelines established by the trustees. Each investment manager

- may control no more than 10% of the Trust's assets;

- must vote all proxies he or she holds in the Trust's portfolio in the sole interest of railroad retirement participants and beneficiaries;

- must certify each year that all proxies have been voted in the sole interest of railroad retirement participants and beneficiaries; and

- must record votes and provide them to the Trust upon request.10

Goals

Congress designed the Trust to increase RRB funding. Investing railroad retirement funds in private markets was expected to yield higher average annual returns than investing solely in government securities. The higher returns were intended to pay for the enhanced benefits that were established in the RRSIA and to potentially reduce future tax rates for railroad employers and employees.11

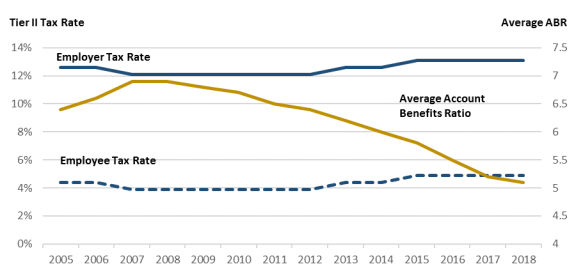

Impact on Railroad Retirement Tier II Tax Rates

Under the RRSIA, Tier II taxes on both employers and employees are automatically adjusted according to the average account benefits ratio. The average account benefits ratio (ABR) is the average of the 10 most recent annual ABRs. The ABR is the ratio of the combined fair market value of Railroad Retirement Account and Trust assets as of the close of the fiscal year to the total RRB benefits and administrative expenses paid from the Railroad Retirement Account and the Trust in that fiscal year. A higher average ABR will result in a lower Tier II tax rate and consequently lower future tax income, whereas a lower average ABR results in higher Tier II tax rates and income.

Depending on the average ABR, Tier II taxes for employers can range between 8.2% and 22.1% and the Tier II tax rate for employees is capped at 4.9%. Since the Trust's inception, Tier II tax rates have been lowered twice and increased twice (see Figure 1). In 2005, the Tier II tax rate on employers was automatically lowered from 13.1% to 12.6% and the tax rate on employees was lowered from 4.9% to 4.4%. Tier II tax rates were lowered again in 2007 to 12.1% on employers and 3.9% on employees. In 2013, tax rates were raised to 12.6% and 4.4% on employers and employees, respectively, and in 2015, the rates were raised to their current levels of 13.1% on employers and 4.9% on employees. The maximum amount of earnings subject to Tier II taxes is $102,300 in 2020.

Investment Guidelines

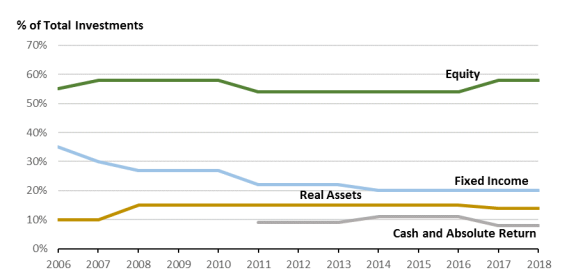

The Trust's assets are invested in a diversified portfolio, both to minimize investment risk and avoid disproportionate influence over a particular industry or firm. The investment guidelines adopted by the trustees include target asset allocations developed by the Trust's investment staff in consultation with an independent investment advisory firm. Outside investment managers hired by the Trust invest the assets according to these guidelines. The resulting investment performance is monitored by the trustees and the Trust's Chief Investment Officer.

The Trust's target asset allocations change over time to reflect current market expectation (see Figure 2).12 For example, over the past decade, the Trust has continued its effort in moving away from fixed income investment, with a decline from 35% of total investments in FY2006 to 20% in FY2018. The target proportion of total investments in equity—domestic, international, and private equity—has been relatively stable between FY2006 and FY2018, ranging from 54% to 58%. The percentage of total investments in private equity increased from 5% in FY2006 to 10% in FY2008, and remained at this level thereafter. At the same time, fixed income was reduced and investments into real assets, cash, and absolute return assets were increased. The investment in real assets, including real estate and commodities, increased from 10% of total investments in FY2006 to 15% in FY2008 and then the proportion remained relatively stable. Cash and absolute return investments were adopted in FY2011, and they have accounted for around 10% of total investments since then. The current investment guidelines are shown in detail in Table 1.

|

|

Source: National Railroad Retirement Investment Trust, Annual Management Report for Fiscal Year 2006-2018. Note: Real assets include investments in real estate and commodities. |

|

Asset Class |

Target Allocation |

Target Allocation Range |

|

Equity |

58% |

|

|

Domestic |

24% |

19%-29% |

|

International |

24% |

19%-29% |

|

Private |

10% |

5%-15% |

|

Fixed Income |

20% |

|

|

Domestic |

14% |

10%-18% |

|

International |

4% |

2%-6% |

|

Private Debt |

2% |

0%-4% |

|

Real Assets |

14% |

|

|

Commodities |

4% |

2%-6% |

|

Real Estate |

10% |

5%-15% |

|

Other |

8% |

|

|

Absolute Return |

7% |

3%-11% |

|

Cash |

1% |

0%-3% |

Source: National Railroad Retirement Investment Trust, Annual Management Report for Fiscal Year 2018, 2018, p. 16, https://www.rrb.gov/sites/default/files/2019-03/FY2018%20Report%20with%20Auditors%20Report.pdf. See pages 16-18 for detailed definitions of assets.

Oversight

The Trust is an independent nongovernmental entity, and it is not subject to the same oversight as federal agencies. The RRSIA outlines specific reporting requirements, including an annual management report to Congress. The report must include a statement of financial position, a statement of cash flows, a statement on internal accounting and administrative control systems, and any other information necessary to inform Congress about the operations and financial condition of the Trust. The financial statements must be audited by independent public accountants. A copy of the annual report and audit must be submitted to the President, the RRB, and the Director of the Office of Management and Budget (OMB). The RRB has the authority to bring a civil action to enforce provisions of the act.

Over the past decade, the RRB Office of Inspector General (OIG) has expressed concerns about the effectiveness of the oversight of the Trust. In 2008, the OIG argued that the annual financial audit required "is not adequate to support the RRB's enforcement responsibility because such audits are not intended to provide information about all areas of risk that could indicate the need for enforcement action."13 The OIG noted that there are fewer safeguards protecting the Trust than there are for the retirement investments of federal government and private-sector workers. For example, there is no requirement for performance audits of the Trust, which would assess program effectiveness, economy and efficiency, internal control, and compliance with the law.

In 2011, the OIG reiterated its concerns with the oversight of the Trust and stated,

The lack of NRRIT investment fund management accountability, transparency, and stringent financial oversight can be precursors to fraud, waste and abuse. Within the Federal agency spectrum there is no comparable example where Federal program assets are completely outside the jurisdiction of a Federal agency's appointed Inspector General. However, the NRRIT fund which supports the Railroad Retirement program remains outside the purview of those appointed to protect the interests of the program's beneficiaries and the tax-paying public.14

In a recent report in FY2018, the OIG asserted that lack of access to the Trust's auditor continued to be a concern,

This lack of cooperation and communication prevents OIG auditors from obtaining sufficient appropriate audit evidence regarding the RRB's financial statements….During fiscal year 2014, [OIG] recommended that an independent committee be established to identify a functional solution that would enable communication between OIG and NRRIT's auditors. Although RRB management did not concur with this recommendation, [OIG] will continue to cite this issue and the need for corrective action.15

Accounting in the Federal Budget

As required in the RRSIA, Trust purchases and sales initially were treated as exchanges of assets of equal value, thus did not produce direct budgetary cost or income.16 The law did not prescribe the treatment of unrealized capital gains and losses on the Trust's investments. The Congressional Budget Office (CBO) and OMB agreed that any capital loss or gain resulting from changes in market prices would be recognized in the year in which the price change occurs, and interest payments and dividends would be recorded as offsetting receipts.17 As a result, income and capital gains reduce outlays and the deficit, and losses increase them. This reflects the change in real economic resources available to the government as the value of the Trust changes. As for future performance, both CBO and OMB use risk-adjusted rate of return assumptions—that is, they assume that the Trust's investments will earn the comparable Treasury bond rate.

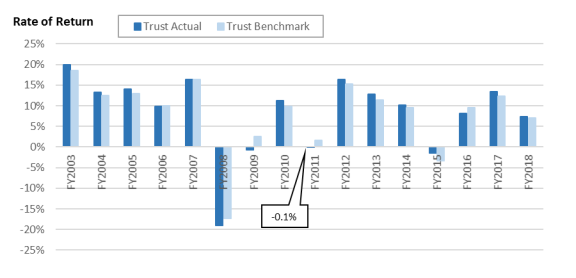

Performance of the Trust

To date, the Trust's average annual performance slightly exceeds expectations expressed by the RRSIA's drafters, which had assumed that Trust investments would earn an average annual rate of return of 8.0%.18 From FY2003 to FY2018, the Trust's annual rates of return, net of fees, have averaged 8.2%. For the first half of the Trust's existence, its returns largely exceeded expectations. Prior to FY2008, the average rate of return on Trust investments was 14.7% and the average rate of return exceeded the expected rate of 8.0% through FY2010. The Trust then had negative rates of return in FY2008 (-19.1%) and FY2009 (-0.7%) but rebounded with an 11.2% rate of return in FY2010 followed by a slightly negative rate of return of -0.1% in FY2011. The FY2012 rate of return of 16.4% brought the average annual rate of return of the Trust above the expected level of 8.0% for the first time in two years (since FY2010). The rate of return was 7.4% in FY2018.19

Comparison to Benchmarks

The Trust's annual rates of return have generally compared favorably to its benchmarks. A benchmark is a standard used for comparison when measuring investment performance, and the NRRIT strategic policy benchmark is based on a series of benchmarks corresponding to each of the major asset classes in the Trust.20 For example, the current benchmark for the Trust's investments in domestic equities is the Russell 3000 Index.21

As shown in Figure 3, in the majority of years between FY2003 and FY2018, Trust performances exceeded its strategic policy benchmarks. In FY2006 and FY2007, the Trust's performances was roughly equal to its benchmarks, whereas in FY2008, FY2009, FY2011, and FY2016, the Trust's investments had lower returns than its strategic policy benchmarks. In FY2018, the Trust's rate of return of 7.4% (net of fees) exceeded the benchmark of 7.1%.22

Administrative Expenses

The Trust's administrative expenses steadily increased through FY2011 as its investment portfolio diversified. However, as shown in Table 2, beginning in FY2012, the Trust's administrative expense ratio decreased, mirroring a national trend of decreasing expense ratios for mutual and money market funds. The Trust's administrative expenses remain low compared with industry standards. In FY2018, the Trust's expense ratio was 29 basis points (expenses were 0.29% of average net assets).23 In comparison, in 2018, average expense ratios were 55 basis points for equity funds, 48 basis points for bond funds, 66 basis points for hybrid funds, and 26 basis points for money market funds.24

|

Fiscal Year |

Basis Points |

|

2003 |

2 |

|

2004 |

4 |

|

2005 |

9 |

|

2006 |

15 |

|

2007 |

24 |

|

2008 |

25 |

|

2009 |

26 |

|

2010 |

33 |

|

2011 |

36 |

|

2012 |

30 |

|

2013 |

29 |

|

2014 |

29 |

|

2015 |

27 |

|

2016 |

28 |

|

2017 |

31 |

|

2018 |

29 |

Source: National Railroad Retirement Investment Trust, Annual Management Report for Fiscal Year 2018, p. 19; and previous editions.

Notes: One basis point is equal to 1/100th of 1% of the average net assets of a fund. For example an expense ratio of 29 basis points indicates that expenses were 0.29% of average net assets.