Introduction

Around the world, people use websites on their computers and apps on their mobile devices to access information and services. Creators of these websites and apps are known as "edge providers." The Federal Communications Commission (FCC) first used the term in 2010 to refer to individuals and entities "providing content, applications, services, and devices accessed over or connected to broadband Internet access service."1 Such activities, conducted on the "edge" of the internet—hence the name—can range from an individual creating a personal blog to a billion-dollar company creating a website. At that time, the FCC determined that it would not regulate edge provider activities. Instead, similar to other businesses, edge providers may be examined by the Department of Justice (DOJ) and Federal Trade Commission (FTC) on a case-by-case basis for potential violations of consumer protection or antitrust statutes.

Federal agencies and Congress are investigating competition among edge providers, particularly companies with large amounts of revenue. The FTC, DOJ, and at least 47 attorneys general are reportedly looking into whether select edge providers—reportedly including Google, Apple, Facebook, and Amazon—have violated antitrust laws.2 A House Judiciary Committee investigation into competition in digital markets has raised the question of whether existing antitrust laws, competition policies, and current enforcement levels are adequate to address competition issues among edge providers.3 Competition is generally viewed as a means to ensure low prices for consumers and to spur innovation. Some have raised concern that competition is being harmed by a few dominant edge providers and that regulations may be needed.

This report examines the potential effects of edge providers' expansion on competition. Due to acquisitions or growth, some edge providers now operate in multiple industries. Some companies have integrated vertically, both generating content as edge providers and delivering it to consumers as internet service providers (ISPs).4 Other companies have integrated horizontally by acquiring other edge providers, which could increase their customer base and expand the content or services offered, but also eliminate potential competitors. This report focuses on how horizontal and vertical integration may affect edge providers' relationships with ISPs and competition among edge providers.

What Are Edge Providers?

In its 2010 Open Internet Order, the FCC first referred to individuals and entities "providing content, applications, services, and devices" over the internet as "edge providers."5 These can be search engine providers, streaming video or music services, social media platforms, retailers, or other types of businesses. An edge provider can be a blog or personal website maintained by an individual, making it difficult to distinguish between edge providers and end users. It can also be a website maintained by a company that generates billions of dollars in revenue. An edge provider can serve as a conduit for content created by others instead of or in addition to content created by the company itself. Some of the content may be subject to licenses granted by copyright holders, while other content might not face any copyright restrictions. This report focuses on companies that operate at least one edge provider.

Some edge providers generate revenue by selling products or subscriptions to their content. Others offer their content for free and generate their revenue by using information provided by their users to sell advertising spaces or by selling the information itself. In the third quarter of 2019, Facebook, one of the largest edge providers as measured by market capitalization, reported $17.4 billion in revenue from advertising, which made up 98% of its total quarterly revenue.6 Google, another large edge provider, reported $33.9 billion in advertising revenue for the same quarter, which made up 84% of its total quarterly revenue.7

ISPs and mobile carriers connect edge providers with those who use their content. On mobile devices, edge providers generally provide their content over apps. Consumers typically obtain apps from online app stores such as Google Play and the Apple App Store. Browser apps—such as Chrome, Safari, and Firefox—allow users to access other edge providers' websites, similar to a browser on a computer.8 To access the content on apps, users need a data plan from their mobile carrier or a wireless connection to an ISP.9

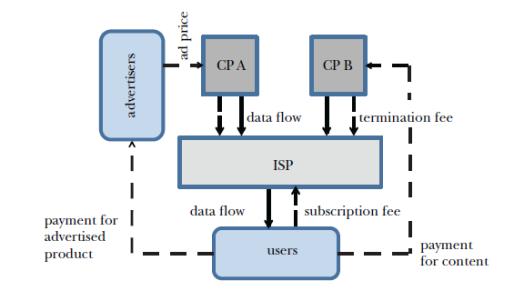

Figure 1 presents a simplified example of how edge providers interact with ISPs and users. In this example, Content Provider (CP) A relies on digital advertising for its revenue: advertisers pay CP A to place an ad, and in turn receive revenue from users who pay for the advertised product. CP B receives a direct payment for its content from users. Both edge providers pay the ISP a termination fee to bring the content to the terminal point, the user. Users pay the ISP a subscription fee to access the data provided by CP A and CP B.

In reality, the process can be more complicated. An edge provider may rely on a different ISP than its users' ISPs, in which case the content would travel through the internet backbone. The internet backbone consists of various networks linking servers and multiple ISPs together. An edge provider may also have direct connections to multiple ISPs or upload its content directly onto the internet backbone. While details on how the internet operates are beyond the scope of this report, a key factor in competition among edge providers is the role ISPs have in the relationship between edge providers and their users.

Vertical Integration of Edge Providers

Edge providers depend entirely on ISPs and mobile carriers to deliver their content to users. A growing number of companies operate both as edge providers and as ISPs, becoming vertically integrated (i.e., operating at multiple stages along a supply chain). Thus, companies that both generate content and deliver it to users are competing with others that either solely generate content or solely deliver it to users.

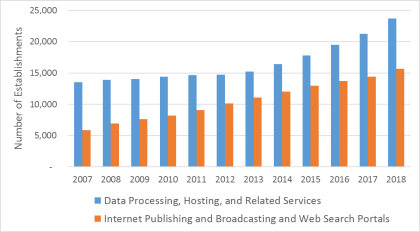

Companies that started in the telecommunications and media industries are now among the most popular edge providers. Of the 16 edge providers that attracted the largest number of users in the United States in July 2019 (Figure 2), six—Google, Facebook, Amazon, PayPal, Twitter, and the Weather Company—started as edge providers.

|

Figure 2. Most Popular Edge Providers by Number of U.S. Users (July 2019) |

|

|

Source: Statista using comScore data for July 2019, https://www.statista.com/statistics/271412/most-visited-us-web-properties-based-on-number-of-visitors/. Note: * denotes companies that started as edge providers. This data set estimates the number of users by identifying the number of unique visitors. It includes visitors from desktops and mobile devices from home and work locations. The title was adapted from its original "web properties" to "edge providers" to maintain consistency in terminology throughout the report. |

Examples of ISPs Becoming Edge Providers

AT&T. AT&T owns part of the internet backbone and is considered a Tier 1 ISP, meaning it has free access to the entire U.S. internet region.10 It is also a mobile carrier and provides voice services and video programming.11 In 2018, AT&T acquired Time Warner, a content creator that owns HBO and its affiliated edge provider HBO NOW, as well as other cable channels.12 The DOJ unsuccessfully attempted to block the merger.13 AT&T has announced plans to introduce a new edge provider—HBO Max—to stream video programming for no extra charge to AT&T customers who are also HBO subscribers; other customers will reportedly be charged a subscription fee.14

Comcast. Comcast is an ISP, a cable television service, and a voice service provider. In 2011, Comcast became the majority owner of NBCUniversal, which owns television networks and broadcast stations, and thus obtained minority ownership of Hulu, an edge provider that streams video programming to subscribers.15 In 2019, Walt Disney Company obtained "full operational control" of Hulu, but Comcast retained its 33% financial stake.16 Comcast also announced plans to launch its own video streaming service, Peacock. Comcast reportedly plans to offer three subscription options for Peacock: a free option supported by ads, a premium version with more programming for a fee, and the premium version with no ads for a higher fee.17 The premium version is to be offered for free to subscribers of Comcast and Cox Communications.

Verizon. Verizon owns part of the internet backbone and is considered a Tier 1 ISP.18 It is also a mobile carrier, and offers video, voice, and ISP services. In 2015, Verizon acquired AOL, an ISP and edge provider, and in 2016, it acquired the core business of Yahoo, an edge provider.19 It combined the edge provider products from these acquisitions—such as Yahoo Finance, Huffington Post, TechCrunch, and Engadget—in 2017 to create Oath.20

Examples of Edge Providers Becoming ISPs

Google. Google is the largest subsidiary of the company Alphabet.21 It offers multiple products, including a search engine, email server, word processing, video streaming, and mapping/navigation system.22 Google generally relies on other ISPs to deliver its content, but entered the ISP market in 2010 when it announced Google Fiber. Google Fiber provides broadband internet service and video programming.23 Beginning in 2016, it suspended or ended some of its projects; as of October 2019, it had installed fiber optic cables in 18 cities.24

Facebook. As it attracted more users, Facebook expanded from providing an online platform that connects users to an online platform suitable for various activities, including fundraising, messaging, and commerce. In 2018, a spokesman confirmed that Facebook was pursuing another project, dubbed Athena. 25 Athena is an experimental satellite that would beam internet access through radio signals. If successful, Athena would enable Facebook to become an ISP.

Amazon. In addition to being a major online retailer, Amazon offers information technology infrastructure services through Amazon Web Services.26 In 2019, Amazon confirmed plans—dubbed Project Kuiper—to launch 3,236 satellites into low-Earth orbit to provide broadband internet across the world. If successful, Project Kuiper would enable Amazon to become an ISP.27

Competition Among Edge Providers

Edge providers can compete in various ways. A few examples include offering new content or services, advertising their content, or acquiring potential competitors. Subscription-based edge providers can lower their fees, offer discounts for referrals, or use price promotions to attract new users. This report focuses on the potential effects of vertical integration (e.g., where a company operates as both an edge provider and an ISP) as well as horizontal integration (e.g., where an edge provider acquires another edge provider).

Common indicators used to determine the level of competition in a market include measuring its concentration and changes in the number of establishments. Market concentration is determined by examining whether most sales are concentrated among a few firms or dispersed among a large number of firms.28 Changes in the number of establishments can be used as an indicator as well, particularly when firm-level sales are unavailable. For example, if the total number of stores in a market is decreasing, it can suggest, but does not demonstrate, that competition is decreasing.

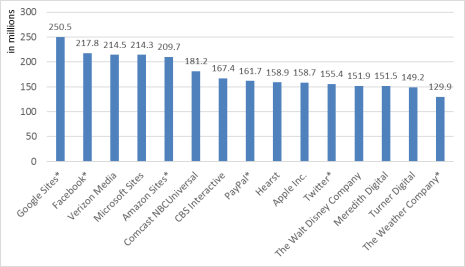

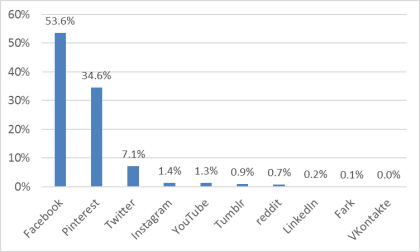

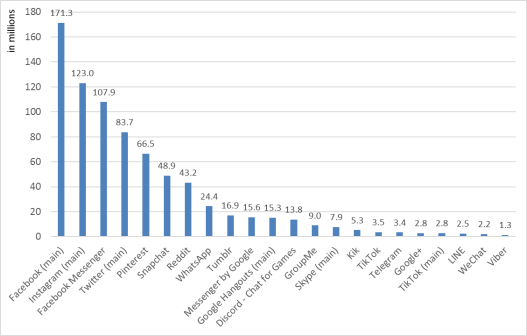

To use these indicators to measure competition in a market, one must first define its scope. A common method of defining a market's scope is to use the North American Industry Classification System (NAICS). Two industries that consist of only edge providers are "Data Processing, Hosting, and Related Services" (NAICS 519130) and "Internet Publishing and Broadcasting and Web Search Portals" (NAICS 518210).29 Figure 3 shows that the number of establishments in both industries has increased over the past decade. However, most users seeking specific types of content obtain it from only a few edge providers. For example, data from August 2019 show that among social network websites, 95% of the visits from the users in the United States went to three websites: Facebook, Pinterest, and Twitter (Figure 4). Similarly, data from June 2019 show that among mobile social networking apps, the three most popular among users in the United States were Facebook, Instagram (owned by Facebook), and Facebook Messenger (Figure 5).

|

Figure 4. Most Popular Social Network Websites by Share of U.S. User Visits (August 2019) |

|

|

Source: Statista using StatCounter data for August 2019, https://www.statista.com/statistics/265773/market-share-of-the-most-popular-social-media-websites-in-the-us/. Note: This data set estimates the share of user visits by aggregating data from the StatCounter network. The visits include website visits on desktops, mobile devices, and tablets. |

|

Figure 5. Most Popular Mobile Social Networking Apps by Number of U.S. Users (June 2019) |

|

|

Source: Statista using Verto Analytics data for June 2019, https://www.statista.com/statistics/248074/most-popular-us-social-networking-apps-ranked-by-audience/. Note: This data set estimates the number of users using data gathered from 20,000 U.S. panelists ages 18 and older. "Main" refers to main app associated with the name rather than other associated apps (e.g., Facebook (main) vs. Facebook Messenger, Instagram (main) vs. Boomerang from Instagram, and Twitter (main) vs. Friendly for Twitter). |

Edge providers compete for users based on content and quality of services offered. To increase the number of users, edge providers attempt to provide content that is in high demand and to ensure that the content is delivered as seamlessly as possible. In response to network congestion, most content used to be delivered on a "best effort" basis because most of the content was not time-sensitive (e.g., email). The "best effort" basis does not guarantee that content will be delivered by a certain time or at a certain speed. This meant that some content was held at a congestion point until a future time, while other content was dispatched in real time. While this practice was suitable for some content, it became problematic for edge providers sending time-sensitive content. Interruptions, latency, or delays in transferring data lower the value of time-sensitive content (e.g., video programming). As a result, some edge providers have been given the option to pay network managers, including ISPs, to ensure their content would be given priority, an industry practice known as paid prioritization.30

Another practice to ensure a more consistent quality of service is to avoid potential congestion points by bypassing parts of the network. For example, edge providers can pay ISPs for a direct connection to their networks, or edge providers can build their own content delivery network (CDN) or pay to use another company's CDN. Examples of CDNs include Microsoft's Azure or Amazon's CloudFront, which is available through Amazon Web Services.31 A CDN distributes online content and network services from servers located as close as possible to users' ISPs to avoid potential congestion points and reduce the bandwidth needed to send the content; a CDN may also have a direct connection to users' ISPs. As a result, CDNs can serve as a digital intermediary between users' ISPs and other edge providers.

Congress and the FCC have considered edge providers' access to end users over the internet under the rubric of "net neutrality," a term associated with the concept that ISPs should treat data in a nondiscriminatory manner, regardless of the size or type of content.32 Policy discussions on net neutrality have focused on the role of the ISP in delivering content to end users. Concerns over practices ISPs might use to manage the flow of content, such as blocking, throttling, and paid prioritization, have become major discussion points.33 Although the FCC placed a ban on such practices when it issued the 2015 Open Internet Order, the restrictions were subsequently removed by the FCC with the issuance of the 2017 Restoring Internet Freedom Order.34 Congress has considered bills both banning or removing bans on such practices.35

The ability to pay ISPs for direction connections or prioritization of content could affect competition among edge providers. Although some see paid prioritization as a management tool that ensures time-sensitive content receives priority, others view it as a means to discriminate among content. A nascent edge provider may not have the financial resources to pay for prioritization or for a direct connection, meaning its content could be delivered more slowly than content from competing edge providers that can afford these payments. The potential competitive imbalance between nascent edge providers and more established ones may be further exacerbated by the growing number of vertical mergers.

Effect of Vertical Integration on Competition

Some of the companies edge providers rely on for distribution are also their competitors because of vertical integration among edge providers and ISPs. For example, while Netflix works with Comcast to deliver its content, Comcast is also its competitor as the operator of cable systems, a partial owner of Hulu, and the owner of the planned video streaming service Peacock.

Vertical integration could affect competition among edge providers. Companies that operate as both an ISP and edge provider may have a competitive advantage with the quality of content delivery over edge providers that have not paid for a direct connection to the ISP's network. Companies that pay for a direct connection to the network may also be at a competitive disadvantage because they incur an additional cost to obtain a connection that vertically integrated edge providers do not. Edge providers that also operate as CDNs may similarly benefit from better connections to ISPs without incurring a cost borne by edge providers that are not integrated with CDNs or ISPs. For example, Netflix pays Amazon to house its content on Amazon Web Services, although it competes with Amazon Prime Video, which also offers video streaming services.36 Vertically integrated companies associated with an ISP or CDN could also potentially prioritize their own edge providers' content over rivals' content.

Similar concerns affect companies that operate as both edge providers and mobile carriers. Edge providers that are also mobile carriers can include their own apps on their customers' mobile devices for free and retain all of the profits from those apps. In contrast, competing edge providers may be charged a fee—such as an initial payment or a percentage of sales—for including their apps in the app store. In this case, nonaffiliated edge providers would face a cost that edge providers affiliated with mobile carriers do not.

Edge providers associated with mobile devices in general may also have similar advantages. For example, in 2005, Google acquired Android—an operating system for mobile devices—and further developed the software thereafter.37 Google was fined €4.34 billion ($5.05 billion)38 by the European Union (EU) for anticompetitive practices related to Android. Specifically, the European Commission determined that Google violated EU antitrust law by "bundling" its Play app store with its Search and Chrome apps (i.e., by requiring smartphone manufacturers that preinstalled the Google Play store to preinstall Google Search and Google Chrome). The ruling stated that by doing so, Google reduced the ability of rival search engines and web browsers to compete effectively, as consumers with Google Search and Google Chrome preinstalled on their devices were less likely to download competing search engines and web browsers.39

Some ISPs, particularly mobile carriers, have introduced "zero rating" or sponsored data plans. These plans allow subscribers to consume specific content or services without incurring charges against the subscriber's usage limits. For example, Facebook's Free Basics is a mobile phone app available through various mobile carriers in 65 countries. It provides free access to a limited selection of services and websites, including Facebook.40 It was banned by the Telecom Regulatory Authority of India for being anticompetitive by offering free access only to online services owned or controlled by Facebook.41 Similarly, critics claim that these plans favor edge providers affiliated with ISPs and those that are entrenched and well financed. However, supporters claim that these plans encourage consumers to try new services, particularly those that require large amounts of data.42

By combining consumer data collected by its ISP and edge provider components, a vertically integrated company may also have a competitive advantage through its ability to send targeted advertisements. In proposing to acquire Time Warner in 2018, AT&T chief executive Randall Stephenson stated that the merger would expand AT&T's access to customer and viewer data, allowing it to run targeted advertisements, which tend to be more profitable.43 Some state legislatures have passed or introduced legislation restricting how ISPs may collect or share consumer data; Congress has not passed similar legislation at the federal level.44 California has enacted data protection legislation, the California Consumer Privacy Act, which went into effect on January 1, 2020. It provides California residents the right to access, delete, and share personal information collected by businesses, including edge providers and ISPs.45

Consumers could benefit from the economic efficiencies obtained from edge providers' vertical integration with ISPs or mobile carriers by receiving content at faster speeds and lower prices. Vertically integrated edge providers could pass on to consumers the cost savings of not paying for a direct connection to the ISP network. For example, subscribers to a streaming service owned by an ISP may be able to receive its content more smoothly and at lower cost than subscribers to a streaming service not affiliated with an ISP. Free apps could benefit consumers as well.

Vertical integration may also benefit consumers by increasing competition among ISPs. Currently, individual users in many areas have access to a limited number of internet providers because of the high costs associated with broadband deployment. If edge providers enter the ISP market, consumers may benefit from an increase in provider options, potentially resulting in lower prices and/or faster speeds. For example, one study credits Google Fiber for encouraging faster speeds, lower prices, and/or network upgrades among competing ISPs.46 However, the competitive benefit of edge providers entering the ISP market may be undermined by reduced competition among edge providers.

Effect of Horizontal Integration on Competition

Through mergers and acquisitions among themselves, edge providers have integrated horizontally. Facebook has made at least 79 acquisitions, including Instagram, WhatsApp, Oculus VR, and Chai labs.47 Google has made over 200 acquisitions, including DoubleClick, Waze, Nest, and YouTube.48 In some cases, edge providers have acquired companies with unique technologies in the early stages of development, foreclosing potential competition. Whether such acquisitions should be reviewed in the context of antitrust enforcement is controversial. Some commentators advocate limiting mergers among edge providers or breaking up large edge providers to increase competition,49 while others view mergers as a natural result of a competitive market in which more successful firms acquire smaller ones.50

Edge providers can benefit from acquiring other edge providers that offer different content or services. They can participate in a diverse set of online markets, expand or improve their content, or eliminate potential competitors. Google's acquisition of YouTube enabled it to gain a stronger footing in the online video market.51 Facebook acquired Divvyshot to improve its photo-sharing platform, particularly for mobile devices.52 These acquisitions can be viewed as integrating media platforms to improve end users' experience, a positive byproduct of competition, or as reducing competition by preventing the growth of other edge providers. Some have criticized Facebook's acquisition of Instagram—a photo and video-sharing social media app—and advocate for breaking up Facebook and Instagram; critics include some Members of Congress.53

Horizontal integration may increase an edge provider's customer base, which may give it greater bargaining power with ISPs. Because edge providers rely on ISPs to deliver their content, ISPs generally have leverage over edge providers that seek access to their networks. However, edge providers with large numbers of end users may have much greater bargaining power than smaller local or regional ISPs, as they may in some cases account for a large share of an ISP's internet traffic.

By increasing their customer base through horizontal integration, edge providers can improve their market position. Edge providers that rely on digital advertising can target more individuals with digital advertisements and potentially increase the number of spaces to sell to advertisers. Edge providers can create more detailed profiles of individual users and improve their methods of targeting advertisements by combining consumer data from multiple sources. Some edge providers have acquired firms that control tools used to buy and sell digital advertising, such as advertisement servers that place spaces in auctions to determine which advertisement should be selected. By controlling such tools, an edge provider could have a competitive advantage against other edge providers that need to pay to use these tools.

Concern about control of digital advertising tools has focused on Alphabet, which has acquired and incorporated into Google several digital advertising tools, including DoubleClick, AdMob, and Admeld.54 These acquisitions helped Google become the largest seller of digital advertising. Google has reportedly waived fees for using multiple components of its advertising services, bundling them together. This could make it difficult for rivals to offer competing services. Google reportedly required advertisers to use its advertising services to purchase advertisement spaces on YouTube, and used data collected from its edge provider services (e.g., Gmail and Google maps) in its advertising server. The DOJ and state attorneys general are reportedly investigating Google's use of its advertising products.55

Oversight of Edge Providers

The vertical integration of edge providers and ISPs creates a situation in which certain activities of a company may be regulated by the FCC while closely connected activities are not. On June 15, 2015, Consumer Watchdog, a nonprofit organization that advocates for taxpayer and consumer interests, filed a petition requesting the FCC to regulate edge providers and prevent them from "tracking personal information and web activity without consumers' knowledge and permission."56 The FCC dismissed the petition on November 6, 2015, citing its 2015 Open Internet Order, which stated that the FCC would not regulate any internet content.57 The 2017 Restore Internet Freedom Order reversed the 2015 Open Internet Order by reclassifying ISPs under Title I, but it also did not address the regulation of edge providers.58 Thus, pursuant to the 2015 Open Internet Order, the FCC has left oversight of edge providers to other agencies, principally the FTC and DOJ. The FTC deals with consumer privacy issues under its broad authority to prohibit unfair and deceptive trade practices, and the FTC and DOJ deal with unfair methods of competition that may violate antitrust laws.

The FTC has expanded its examination of consumer data privacy concerns from its initial edge provider focus to include vertical integration by ISPs. On March 26, 2019, the FTC issued orders to seven ISPs to obtain information on how they collect, retain, use, and disclose information about consumers and their devices.59 The order specifically addressed the need to better understand ISPs' privacy practices because their vertical integration allows them to provide advertising-supported content produced by related entities within the companies.

The FTC and DOJ opened antitrust investigations of possible anticompetitive behavior by "Big Tech" firms, reportedly including Google, Apple, Facebook, and Amazon. 60 On September 6, 2019, the attorneys general of eight states and the District of Columbia announced an investigation of Facebook and Google for possible antitrust violations.61 By October 22, 2019, the number of participating attorneys general had reportedly grown to 47.62

A key question in these antitrust investigations could be determining the market for edge providers. Generally, a market is established based on specific goods or services, and their substitutability with other goods and services.63 However, because some edge providers offer multiple goods and services that could be classified in multiple industries, it has become difficult to determine which market(s) these edge providers belong in. For example, should each product sold on Amazon (e.g., clothes, children's toys, books) be placed in a separate market? If so, should products that are sold by another company on Amazon's website be considered Amazon's products or the selling company's products? Are physical books sold on Amazon in the same market as its Kindle e-books or its Audible audiobooks? Competition analysis generally involves defining the market of a product, which can be particularly complex in the analysis of edge providers.

Determining the market share for edge providers that rely on digital advertising rather than selling tangible products may be even more complicated. In addition to the complexity of defining which market some of these edge providers fall in,64 it can be difficult to determine their "sales," as they generally do not obtain revenue from offering their content to users. These edge providers obtain revenue from selling advertisement spaces using users' data or from selling users' data directly. Should the market share for these edge providers be determined by the total advertising revenue obtained from each website or by the amount of user data collected? In the latter case, how should user data be "priced"? Should all edge providers that rely on digital advertising be compared to each other in one market, or should these edge providers be separated based on content?

Considerations for Congress

On June 3, 2019, the House Judiciary Committee announced that it would begin an investigation into competition in digital markets.65 It has held five hearings, which have raised questions and discussions including or related to the topics covered in this report. Among the major questions related to edge providers that Congress may wish to consider are the following:

- How does vertical integration among ISPs and edge providers affect competition? One of the difficulties in answering this question is the inability to evaluate how the market would have developed absent vertical integration. For example, vertical integration may lead to greater innovation in some cases, but to less innovation in others. It is also unclear how the effect of vertical integration on competition should be measured. As many users of edge providers' services do not pay for those services in a monetary sense, price effects, which are traditionally used to evaluate the extent of competition, may not be a sufficient measure.

- How could inequities in the amount of consumer data obtained by edge providers affect competition in the future? Consumer data may become increasingly important as machine learning and artificial intelligence technologies are further refined. It could be used to predict behavior among consumers or provide other competitive advantages for edge providers with large amounts of consumer data.

- Should competition among edge providers be regulated, and if so, to what extent? While the DOJ and FTC examine specific companies on a case-by-case basis for consumer protection or antitrust violations, the establishment of a regulatory framework could help prohibit anticompetitive practices. However, regulations may also disadvantage potential entrants while strengthening incumbents, and may impede innovation. Edge providers offer a wide variety of products and services, which could complicate the establishment of a single regulatory framework. However, other aspects of competition among edge providers, such as their relations with ISPs, are a matter relevant to all edge providers.