U.S. Participation in the MDBs

The United States is a member of five multilateral development banks (MDBs): the World Bank, African Development Bank (AfDB), Asian Development Bank (AsDB), European Bank for Reconstruction and Development (EBRD), and Inter-American Development Bank (IDB). It also belongs to two similar organizations, the International Fund for Agricultural Development (IFAD) and the North American Development Bank (NADBank). The World Bank also administers trust funds, focused on particular global issues such as food security and the environment.

The MDBs and Their Programs

The MDBs have similar programs, though they all differ somewhat in their institutional structure and emphasis. Each has a president and executive board that manages or supervises all of its programs and operations. Except for the EBRD, which makes only market-based loans, all the MDBs make both market-based loans to middle-income developing countries and concessional loans to the poorest countries. Their loans are made to governments or to organizations having government repayment guarantees. In each MDB, the same staff prepares both the market-based and the concessional loans, using the same standards and procedures for both.1 The main differences between them are the repayment terms and the countries which qualify for them.2

The MDBs also have specialized facilities which have their own operating staff and management but report to the bank's president and executive board. The World Bank's International Finance Corporation (IFC) and the IDB's Inter-American Investment Corporation (IIC) make loans to or equity investments in private-sector firms in developing countries (on commercial terms) without government repayment guarantees. The AsDB makes similar loans from its market-rate loan account. The World Bank's Multilateral Investment Guarantee Agency (MIGA) underwrites private investments in developing countries (on commercial terms) to protect against noneconomic risk. At the IDB, the Multilateral Investment Fund (MIF) helps Latin American countries institute policy reforms aimed at stimulating domestic and international investment. It also funds worker retraining and programs for small and micro-enterprises. The MIF originated as part of President Bush's 1990 Enterprise for the Americas Initiative (EAI).

The NADBank was created by the North American Free Trade Agreement (NAFTA) to fund environmental infrastructure projects in the U.S.-Mexico border region. The International Fund for Agricultural Development (IFAD), created in 1977, focuses on reducing poverty and hunger in poor countries through agricultural development.

Finally, the World Bank also serves as the trustee for several targeted multilateral development funds, for which the Administration has requested and Congress has appropriated funds. These multilateral funds include the Clean Technology Fund (CTF), the Strategic Climate Fund (SCF), the Global Environment Facility (GEF), and the Global Agriculture and Food Security Program (GAFSP).

Funding MDB Assistance Programs

The MDBs' concessional aid programs are funded with money donated by their wealthier member country governments. Periodically, as the stock of uncommitted MDB funds begins to run low, the major donors negotiate a new funding plan that specifies their new contribution shares.

Loans from the MDBs' market-rate loan facilities are funded with money borrowed in world capital markets. The IFC and IIC fund their loans and equity investments partly with money contributed by their members and partly with funds borrowed from commercial capital markets. The MDBs' borrowings are backed by the subscriptions of their member countries. They provide a small part of their capital subscriptions (3% to 5% of the total for most MDBs) in the form of paid-in capital. The rest they subscribe as callable capital. Callable capital is a contingent liability, payable only if an MDB becomes bankrupt and lacks sufficient funds to repay its own creditors. It cannot be called to provide the banks with additional loan funds.

Countries' voting shares are determined mainly by the size of their contributions. The United States is the largest stockholder in most MDBs, and has maintained this position to preserve veto power in some institutions over major policy decisions.

U.S. Appropriations for MDBs

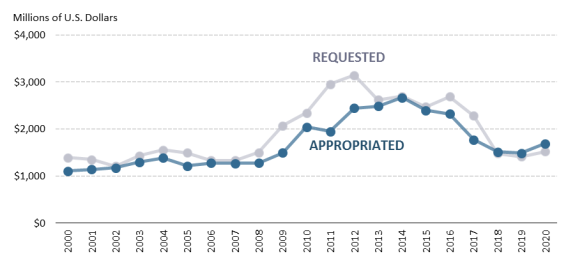

Figure 1, Figure 2, and Tables 1-5 show the amounts the Administration has requested and Congress has appropriated annually since FY2000 to the multilateral development banks. Note that the figures and tables do not include callable capital. Since the early 1980s, Congress has authorized but not appropriated callable capital.

As Figure 1 illustrates, appropriations to the MDBs increased dramatically starting in 2009, from $1.28 billion in 2008 to a peak of $2.67 billion in FY2014. The uptick was driven largely by capital increases for the non-concessional lending facilities at the MDBs in response to the global financial crisis, as well as the proliferation of trust funds administered by the World Bank focused on specific policy issues. As these commitments have been met, particularly in funding the capital increases at the MDBs, overall funding levels started declining. Appropriations declined through FY2019 to $1.49 billion. Appropriations to the MDBs rose in FY2020 to $1.69 billion. U.S. contributions to a capital increase for the World Bank's non-concessional lending facility, as well as U.S. contributions to IFAD and the GEF, appropriated by Congress but not requested by the Administration, primarily drove the increase.

|

Figure 1. Multilateral Development Banks: Budget Requests and Appropriated Funds, FY2000-FY2020 |

|

|

Source: See Tables 1-5. Note: Nominal U.S. dollars. |

|

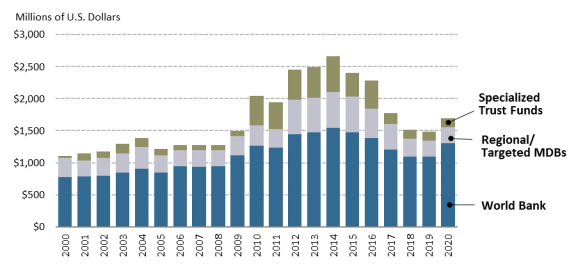

Figure 2. Multilateral Development Banks: Appropriated Funds by Category, FY2000-FY2020 |

|

|

Source: See Tables 1-5. Note: Nominal U.S. dollars. |

Table 1. Multilateral Development Banks: Budget Requests and Appropriated Funds, FY2000-FY2004

(in millions of dollars)

|

FY2000 |

FY2001 |

FY2002 |

FY2003 |

FY2004 |

||||||

|

Request |

Approp. |

Request |

Approp. |

Request |

Approp. |

Request |

Approp. |

Request |

Approp. |

|

|

World Bank Group |

||||||||||

|

Int'l Bank for Reconstruction & Development (IBRD) |

||||||||||

|

Int'l Development Association (IDA) |

803.4 |

771.3 |

835.6 |

773.3 |

803.4 |

792.4 |

874.3 |

844.5 |

976.8 |

907.8 |

|

Int'l Finance Corporation (IFC) |

||||||||||

|

Multilateral Investment Guarantee Agency (MIGA) |

10.0 |

4.0 |

16.0 |

10.0 |

10.0 |

5.0 |

3.6 |

1.6 |

4.0 |

1.1 |

|

Regional/Targeted Development Banks |

||||||||||

|

African Development Bank (AfDB) |

5.1 |

4.1 |

6.1 |

6.1 |

5.1 |

5.1 |

5.1 |

5.1 |

5.1 |

5.1 |

|

African Development Fund (AfDF) |

127.0 |

127.0 |

100.0 |

99.8 |

100.0 |

100.0 |

118.1 |

107.4 |

118.1 |

112.0 |

|

Asian Development Bank (AsDB) |

13.7 |

13.7 |

||||||||

|

Asian Development Fund (AsDF) |

177.0 |

77.0 |

125.0 |

71.8 |

103.0 |

98.0 |

147.4 |

97.2 |

151.9 |

143.6 |

|

Inter-American Development Bank (IDB) |

25.6 |

25.6 |

||||||||

|

Fund for Special Operations (FSO)a |

||||||||||

|

Inter-American Investment Corp (IIC)a |

25.0 |

16.0 |

34.0 |

24.9 |

25.0 |

18.0 |

30.4 |

18.2 |

30.9 |

|

|

Multilateral Investment Fund (MIF)a |

28.5 |

25.9 |

10.0 |

|

29.6 |

24.4 |

32.6 |

24.9 |

||

|

European Bank for Reconstruction and Development (EBRD) |

35.8 |

35.8 |

35.8 |

35.7 |

35.8 |

35.8 |

35.8 |

35.6 |

35.4 |

35.2 |

|

International Fund for Agricultural Development (IFAD) |

5.0 |

20.0 |

20.0 |

15.0 |

14.9 |

15.0 |

14.9 |

|||

|

North American Development Bank (NADB) |

||||||||||

|

Specialized Fundsb |

||||||||||

|

Global Environmental Facility (GEF) |

143.3 |

35.8 |

175.6 |

107.8 |

107.5 |

100.5 |

177.8 |

146.9 |

185.0 |

138.4 |

|

Clean Technology Fund |

||||||||||

|

Strategic Climate Fund |

||||||||||

|

Green Climate Fund |

||||||||||

|

Global Agriculture and Food Security Program (GAFSP) |

||||||||||

|

TOTAL MDB APPROPRIATION |

1,394.4 |

1,110.3 |

1,353.9 |

1,144.4 |

1,209.8 |

1,174.8 |

1,437.1 |

1,295.8 |

1,554.9 |

1,383.0 |

Table 2. Multilateral Development Banks: Budget Requests and Appropriated Funds, FY2005-FY2009

(in millions of dollars)

|

FY2005 |

FY2006 |

FY2007 |

FY2008 |

FY2009 |

||||||

|

Request |

Approp. |

Request |

Approp. |

Request |

Approp. |

Request |

Approp. |

Request |

Approp. |

|

|

World Bank Group |

||||||||||

|

Int'l Bank for Reconstruction & Development (IBRD) |

||||||||||

|

Int'l Development Association (IDA) |

1,061.3 |

843.2 |

950.0 |

940.5 |

950.0 |

940.5 |

1,060.0 |

942.3 |

1,277.0 |

1,115.0 |

|

Int'l Finance Corporation (IFC) |

||||||||||

|

Multilateral Investment Guarantee Agency (MIGA) |

1.7 |

1.3 |

1.1 |

|||||||

|

Regional/Targeted Development Banks |

||||||||||

|

African Development Bank (AfDB) |

5.1 |

4.1 |

5.6 |

3.6 |

5.0 |

3.6 |

2.0 |

2.0 |

0.8 |

|

|

African Development Fund (AfDF) |

118.0 |

105.2 |

135.7 |

134.3 |

135.7 |

134.3 |

140.6 |

134.6 |

156.1 |

150.0 |

|

Asian Development Bank (AsDB) |

23.8 |

|||||||||

|

Asian Development Fund (AsDF) |

112.2 |

99.2 |

115.3 |

99.0 |

115.3 |

99.0 |

133.9 |

74.5 |

115.3 |

105.0 |

|

Inter-American Development Bank (IDB) |

||||||||||

|

Fund for Special Operations (FSO)a |

||||||||||

|

Inter-American Investment Corp (IIC)a |

1.7 |

1.7 |

7.3 |

|||||||

|

Multilateral Investment Fund (MIF)a |

25.0 |

10.9 |

1.7 |

1.7 |

25.0 |

1.7 |

29.2 |

24.8 |

25.0 |

25.0 |

|

European Bank for Reconstruction and Development (EBRD) |

35.4 |

35.2 |

1.0 |

1.0 |

0.01 |

0.01 |

||||

|

International Fund for Agricultural Development (IFAD) |

15.0 |

14.9 |

15.0 |

14.9 |

18.0 |

14.8 |

18.1 |

17.9 |

18.0 |

18.0 |

|

North American Development Bank (NADB) |

||||||||||

|

Specialized Fundsb |

||||||||||

|

Global Environmental Facility (GEF) |

120.7 |

106.6 |

107.5 |

79.2 |

56.3 |

79.2 |

106.8 |

81.1 |

80.0 |

80.0 |

|

Clean Technology Fund |

400.0 |

|||||||||

|

Strategic Climate Fund |

||||||||||

|

Green Climate Fund |

||||||||||

|

Global Agriculture and Food Security Program (GAFSP) |

||||||||||

|

TOTAL MDB APPROPRIATION |

1,492.7 |

1,219.2 |

1,335.2 |

1,277.2 |

1,329.0 |

1,273.2 |

1,499.0 |

1,277.3 |

2,071.3 |

1,493.8 |

Table 3. Multilateral Development Banks: Budget Requests and Appropriated Funds, FY2010-FY2014

(in millions of dollars)

|

FY2010 |

FY2011 |

FY2012 |

FY2013 |

FY2014 |

||||||

|

Request |

Approp. |

Request |

Approp. |

Request |

Approp. |

Request |

Approp. |

Request |

Approp. |

|

|

World Bank Group |

||||||||||

|

Int'l Bank for Reconstruction & Development (IBRD) |

117.4 |

117.4 |

187.0 |

181.0 |

187.0 |

187.0 |

||||

|

Int'l Development Association (IDA) |

1,320.0 |

1,262.5 |

1,285.0 |

1,232.5 |

1,358.5 |

1,325.0 |

1,358.5 |

1,291.4 |

1,358.5 |

1,355.0 |

|

Int'l Finance Corporation (IFC) |

||||||||||

|

Multilateral Investment Guarantee Agency (MIGA) |

||||||||||

|

Regional/Targeted Development Banks |

||||||||||

|

African Development Bank (AfDB) |

32.4 |

32.4 |

32.4 |

30.8 |

32.4 |

32.4 |

||||

|

African Development Fund (AfDF) |

159.9 |

155.0 |

155.9 |

109.8 |

195.0 |

172.5 |

195.0 |

163.8 |

195.0 |

176.3 |

|

Asian Development Bank (AsDB) |

106.6 |

106.4 |

106.6 |

106.6 |

106.8 |

101.2 |

106.6 |

106.6 |

||

|

Asian Development Fund (AsDF) |

115.3 |

105.0 |

115.3 |

0.0 |

115.3 |

100.0 |

115.3 |

94.9 |

115.3 |

109.9 |

|

Inter-American Development Bank (IDB) |

102.0 |

75.0 |

102.0 |

107.3 |

102.0 |

102.0 |

||||

|

Fund for Special Operations (FSO)a |

||||||||||

|

Inter-American Investment Corp (IIC)a |

4.7 |

4.7 |

21.0 |

21.0 |

20.4 |

4.7 |

||||

|

Multilateral Investment Fund (MIF)a |

25.0 |

25.0 |

25.0 |

25.0 |

25.0 |

25.0 |

13.7 |

6.3 |

6.3 |

|

|

European Bank for Reconstruction and Development (EBRD) |

||||||||||

|

International Fund for Agricultural Development (IFAD) |

30.0 |

30.0 |

30.0 |

29.5 |

30.0 |

30.0 |

30.0 |

28.5 |

30.0 |

30.0 |

|

North American Development Bank (NADB) |

||||||||||

|

Specialized Fundsb |

||||||||||

|

Global Environmental Facility (GEF) |

86.5 |

86.5 |

175.0 |

89.8 |

143.8 |

89.8 |

129.4 |

124.8 |

143.8 |

143.8 |

|

Clean Technology Fund |

500.0 |

300.0 |

400.0 |

184.6 |

400.0 |

184.6 |

185.0 |

175.3 |

215.7 |

209.6 |

|

Strategic Climate Fund |

100.0 |

75.0 |

235.0 |

49.9 |

190.0 |

49.9 |

50.0 |

47.4 |

68.0 |

74.9 |

|

Green Climate Fund |

|

|||||||||

|

Global Agriculture and Food Security Program (GAFSP) |

408.4 |

99.8 |

308.0 |

135.0 |

134.0 |

128.2 |

135.0 |

133.0 |

||

|

TOTAL MDB APPROPRIATION |

2,341.4 |

2,043.7 |

2,957.2 |

1,948.3 |

3,144.4 |

2,447.9 |

2,625.4 |

2,488.3 |

2,695.6 |

2,666.8 |

Table 4. Multilateral Development Banks: Budget Requests and Appropriated Funds, FY2015-FY2019

(in millions of dollars)

|

FY2015 |

FY2016 |

FY2017 |

FY2018 |

FY2019 |

||||||

|

Request |

Approp. |

Request |

Approp. |

Request |

Approp. |

Request |

Approp. |

Request |

Approp. |

|

|

World Bank Group |

||||||||||

|

Int'l Bank for Reconstruction & Development (IBRD) |

192.9 |

187.0 |

192.9 |

187.0 |

6.0 |

5.9 |

|

|||

|

Int'l Development Association (IDA) |

1,290.6 |

1,287.8 |

1,290.6 |

1,197.1 |

1,384.1 |

1,197.1 |

1,097.0 |

1,097.0 |

1,097.0 |

1,097.0 |

|

Int'l Finance Corporation (IFC) |

|

|||||||||

|

Multilateral Investment Guarantee Agency (MIGA) |

|

|||||||||

|

Regional/Targeted Development Banks |

||||||||||

|

African Development Bank (AfDB) |

34.1 |

32.4 |

34.1 |

34.1 |

32.4 |

32.4 |

32.4 |

32.4 |

32.4 |

|

|

African Development Fund (AfDF) |

195.0 |

175.7 |

227.5 |

175.7 |

214.3 |

214.3 |

171.3 |

171.3 |

171.3 |

171.3 |

|

Asian Development Bank (AsDB) |

112.2 |

106.6 |

5.6 |

5.6 |

|

|||||

|

Asian Development Fund (AsDF) |

115.3 |

105.0 |

166.1 |

105.0 |

99.2 |

99.2 |

47.4 |

47.4 |

47.4 |

47.4 |

|

Inter-American Development Bank (IDB) |

102.0 |

102.0 |

102.0 |

102.0 |

21.9 |

21.9 |

|

|||

|

Fund for Special Operations (FSO) |

|

|||||||||

|

Inter-American Investment Corp (IIC) |

|

|||||||||

|

Multilateral Investment Fund (MIF) |

3.4 |

|

||||||||

|

European Bank for Reconstruction and Development (EBRD) |

|

|||||||||

|

International Fund for Agricultural Development (IFAD) |

30.0 |

30. |

31.9 |

31.9 |

30.0 |

30.0 |

30.0 |

30.0 |

30.0 |

|

|

North American Development Bank (NADB) |

45.0 |

10.0 |

45.0 |

|||||||

|

Specialized Funds |

||||||||||

|

Global Environmental Facility (GEF) |

136.6 |

136.6 |

168.3 |

168.3 |

146.6 |

146.6 |

102.4 |

139.6 |

68.3 |

139.6 |

|

Clean Technology Fund |

201.3 |

184.6 |

170.7 |

170.7 |

||||||

|

Strategic Climate Fund |

63.2 |

49.9 |

59.6 |

49.9 |

|

|||||

|

Green Climate Fund |

150.0 |

250.0 |

|

|||||||

|

Global Agriculture and Food Security Program (GAFSP) |

43.0 |

43.0 |

23.0 |

23.0 |

|

|||||

|

Central America & Caribbean Catastrophe Risk Insurance Program |

12.5 |

|

||||||||

|

Global Infrastructure Facility (GIF) |

20.0 |

|

||||||||

|

TOTAL MDB APPROPRIATION |

2,473.2 |

2,400.9 |

2,687.3 |

2,280.2 |

2,285.0 |

1,770.6 |

1,480.5 |

1,517.7 |

1,416.4 |

1,485.3 |

Table 5. Multilateral Development Banks: Budget Requests and Appropriated Funds, FY2020

(in millions of dollars)

|

FY2020 |

||

|

Request |

Approp. |

|

|

World Bank Group |

||

|

Int'l Bank for Reconstruction & Development (IBRD) |

206.5 |

206.5 |

|

Int'l Development Association (IDA) |

1,097.0 |

1,097.0 |

|

Int'l Finance Corporation (IFC) |

|

|

|

Multilateral Investment Guarantee Agency (MIGA) |

|

|

|

Regional/Targeted Development Banks |

||

|

African Development Bank (AfDB) |

|

|

|

African Development Fund (AfDF) |

171.3 |

171.3 |

|

Asian Development Bank (AsDB) |

|

|

|

Asian Development Fund (AsDF) |

47.4 |

47.4 |

|

Inter-American Development Bank (IDB) |

|

|

|

Fund for Special Operations (FSO) |

|

|

|

Inter-American Investment Corp (IIC) |

|

|

|

Multilateral Investment Fund (MIF) |

|

|

|

European Bank for Reconstruction and Development (EBRD) |

|

|

|

International Fund for Agricultural Development (IFAD) |

|

30.0 |

|

North American Development Bank (NADB) |

|

|

|

Specialized Funds |

||

|

Global Environmental Facility (GEF) |

|

139.5 |

|

Clean Technology Fund |

||

|

Strategic Climate Fund |

||

|

Green Climate Fund |

||

|

Global Agriculture and Food Security Program (GAFSP) |

||

|

TOTAL MDB APPROPRIATION |

1,522.2 |

1,691.8 |

Sources: Derived from annual appropriation legislation and Treasury Department budget presentation documents.

Notes: Data include rescissions. Data do not include "callable capital," or funds that the United States has committed to provide to the MDBs if they need it. Since the early 1980s, callable capital has been authorized, but not appropriated. To date, there has never been a call on callable capital. Table does not include requests or appropriations for multilateral debt relief initiatives. Totals may not add due to rounding. Data are nominal U.S. dollars.

a. Part of the Inter-American Development Bank (IDB) Group.

b. The World Bank serves as the trustee for these multilateral development funds.