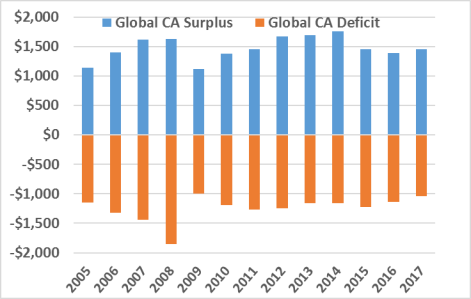

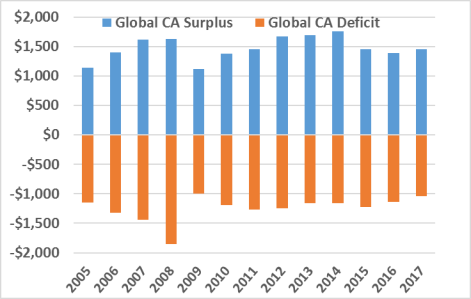

Figure 1. Global Current Account (CA) Surpluses and Deficits

($ in billions)

Source: International Monetary Fund; CRS calculations.

On July 17, 2019, the International Monetary Fund (IMF) published its annual report on global trade that identifies countries with "excessive" current account balances—both surpluses and deficits—and exchange rates that are "misaligned." The current account is a broad measure of a country's global economic engagement and is comprised of trade in goods, services, and official flows. By definition, surpluses or deficits in one country are offset by deficits or surpluses in other countries such that the global current account balance nets to zero (including statistical discrepancy), as indicated in Figure 1. The IMF report indicates that 35% to 45% of countries had balances that were "excessive," and that balances of about 3.0% of world gross domestic product (GDP)—both surpluses and deficits—remained relatively constant in 2018. Advanced economies, particularly the United States and the United Kingdom, account for the largest share of negative balances, or deficits, while China's positive current account and exchange rate were deemed to be in line with fundamentals. Other trade specialists argue that extensive cross-border capital flows have reduced the usefulness of the current account as a monitoring device and that policy prescriptions based on current account balances—and trade balances as the largest component of the current account—may be counterproductive.

|

Figure 1. Global Current Account (CA) Surpluses and Deficits ($ in billions) |

|

|

Source: International Monetary Fund; CRS calculations. |

The Trump Administration has used the U.S. trade balance and trade practices of U.S. trading partners as barometers for evaluating the success or failure of the global trading system, U.S. trade policy, and bilateral trade relations with various countries. The Trump Administration also characterizes the trade deficit as harming the performance and national security of the U.S. economy. Citing many of these concerns, President Trump imposed tariffs under three U.S. laws that allow the Administration to adopt trade restrictions based on certain criteria: (1) Section 201 (19 U.S.C. §2251), (2) Section 232 (19 U.S.C. §1862), and (3) Section 301 (19 U.S.C. §2411). The World Trade Organization (WTO) reported in June 2019 that since May 2018, tariff actions and retaliation by several countries represented a "dramatic spike" in import-restrictive measures that created "turbulence" in international trade and the world economy.

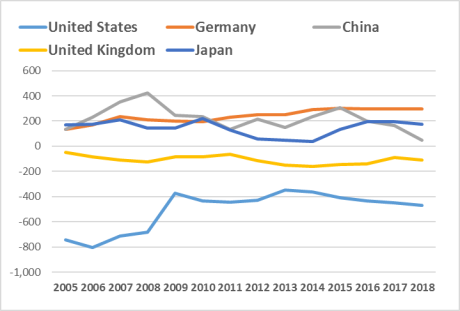

Since the mid-1970s, the United States has experienced current account deficits; in 2018, the United States had a current account deficit of $491 billion, $50 billion more than in 2017, as indicated in Figure 2. Among major economies, the United Kingdom is also experiencing current account deficits, while Germany, Japan, and China had surpluses. Relative to the size of the U.S. economy (measured by U.S. GDP), the current account deficit is equivalent to less than 3% of U.S. GDP.

|

Figure 2. Current Account Balances of Major Economies ($ in billions) |

|

|

Source: International Monetary Fund. |

The IMF monitors current account balances to signal countries that may face long-term debt sustainability issues. It also argues that imbalances may be "symptoms of distortions" and that sustained excess imbalances could "risk aggravating trade tensions," may lower the rate of global economic growth, and can be disruptive for emerging economies. Current account deficits and surpluses, however, may be useful at different times in response to country-specific shocks and to facilitate a globally efficient allocation of capital. While it encourages countries to take corrective measures, the IMF argues that using tariffs to target bilateral trade balances is "unlikely to affect aggregate balances and is costly in terms of domestic growth and employment, with negative global spillovers."

The IMF estimates "excessive" current account balances by comparing the actual current account position with a theoretical average level, identified as "normal." This theoretical normal positon represents values the IMF estimates by replacing current economic policies with "desired" economic policies that it determines are consistent with certain economic "fundamentals and desirable medium-term policies." The IMF also prepares a subjective evaluation using country-specific information. A current account balance that is excessive or a currency that is misaligned does not mean the IMF determines that a country is purposely manipulating its trade balance or its exchange rate. The IMF estimated that the gap in 2018 between the actual and estimated current account balance for the United States was negative 1.2% of GDP and the dollar was overvalued by about 10%.

Economic theory generally concludes that the U.S. trade deficit is largely the product of a low national savings rate, attributed in part to U.S. macroeconomic policy, or the combination of fiscal policy—notably large and persistent federal government budget deficits—and monetary policy. This combination of policies determines the overall national saving-investment balance, which determines the inward and outward flows of funds that affect the exchange value of the dollar and the U.S. trade balance. Individuals, businesses, and governments contribute to national saving rates. Given the macro origins of the overall trade balance, the IMF (chapter 4) argues that changes in the overall balance can affect bilateral trade balances, but conversely a change in a bilateral balance has little or no impact on the overall trade balance and likely is offset by changes in other bilateral balances. For example, tariff actions by the United States and China have reduced the U.S. trade deficit with China, but have not reduced the overall U.S. trade deficit due to trade diversion effects (exporters shifting trade from China to countries not subject to additional U.S. tariff measures).

For some trade specialists, the widely accepted characterization of the current account as a product of a domestic saving-investment relationship fails to distinguish between a country's domestic saving-investment balance, its ability to finance its trade deficit, and the role of cross-border capital flows. These flows suggest that imbalances in financing, not in the current account, can lead to macroeconomic instability similar to the 2008-2009 financial crisis.

For U.S. policymakers, global trade imbalances may raise at least two fundamental issues: