Overview

The military retirement system is a government-funded benefit system that has been viewed historically as a significant incentive in retaining a career military force. The system includes a defined benefit (i.e., pension) element for all retirees and a defined contribution element for certain eligible retirees. The defined benefit includes a monthly annuity for qualified active and reserve retirees paid out of the Military Retirement Fund. The defined contribution benefit includes government-matching payments into an individual retirement Thrift Savings Plan (TSP) account. The amount of the retirement annuity depends on time served and basic pay at retirement. It is adjusted annually by a Cost-of-Living Adjustment (COLA) to help protect the annuity from the adverse consequences of inflation. Military retirees are also entitled to nonmonetary benefits, which include exchange and commissary privileges, medical care through TRICARE, and access to Morale, Welfare and Recreation facilities and programs.

The non-disability military retirement system has evolved since the late 1800s to meet four main goals.

- To keep the military forces of the United States young and vigorous and ensure promotion opportunities for younger members.

- To enable the armed forces to remain competitive with private-sector employers and the federal Civil Service.

- To provide a reserve pool of experienced military manpower that can be called upon in time of war or national emergency to augment active forces.

- To provide economic security for former members of the armed forces during their old age.

Among active duty personnel, eligibility for a monthly pension is generally based on a service requirement of at least 20 years of (active) service. For reserve component personnel, the system is based on points, and reservists do not generally begin to receive retired pay until the age of 60. Both the active duty and reserve component retirement systems vest at 20 years of qualifying service.1 However, some members who are retired with a physical disability may receive a pension with fewer years of service. Disability retirement offers a choice between two retirement compensation options: one based on years of service (longevity) or one on the severity of the disability.

In FY2018, approximately $54.7 billion was paid to approximately 2 million military retirees, and an additional $3.9 billion was paid to 317,088 survivors.2 As shown in Table 1, the number of military retirees and the cost of their retirement benefits have increased over the past decade.

|

Fiscal Year |

Retired Pay Recipients and Total Program Cost |

Regular Retirees from an Active Duty Military Career |

Disability Retirees |

Reserve Retirees |

Survivor Benefit Recipients |

|

2018 |

2,318,431 $58.69 billion |

1,465,692 $46.41 billion |

123,251 $1.68 billion |

412,400 $6.66 billion |

317,088 $3.94 billion |

|

2017 |

2,315,806 $57.4 billion |

1,469,751 $45.51 billion |

118,029 $1.59 billion |

408,595 $6.40 billion |

319,431 $3.95 billion |

|

2016 |

2,312,880 $57.01 billion |

1,472,140 $45.22 billion |

116,141 $1.56 billion |

401,580 $6.23 billion |

323,019 $3.98 billion |

|

2015 |

2,308,073 |

1,474,116 |

112,260 |

395,808 |

325,889 |

|

2014 |

2,297,889 |

1,473,315/ |

107,751 |

389,750 |

327,073 |

|

2013 |

2,284,233 |

1,470,803 |

103,160 $1.43 billion |

383,490 |

326,780 |

|

2012 |

2,272,295 |

1,472,087 |

95,910 |

376,052 |

328,246 |

|

2011 |

2,260,112 |

1,471,219 |

94,886 |

366,823 |

327,184 |

|

2010 |

2,211,580 |

1,467,936 |

92,704 |

356,602 |

299,478 |

|

2009 |

2,196,397 |

1,468,377 |

91,460 |

344,393 |

297,558 |

|

2008 |

2,170,803 |

1,466,705 |

85,502 |

328,664 |

296,580 |

|

2007 |

2,146,961 |

1,461,724 |

85,306 |

312,647 |

293,193 |

Sources Department of Defense, Statistical Report on the Military Retirement System; Fiscal Year Ended September 30, 2018, Office of the Actuary, May 2019, p, 23. Statistical documents available by fiscal year for FY2005-FY2018, available at http://actuary.defense.gov/.

Notes: Total Program Cost is total DOD obligations for that Fiscal Year. Survivors include the spouse, children, and others with insurable interests that are entitled to survivor benefits from the DOD Military Retirement Fund.

Congress grapples with constituent concerns as well as budgetary constraints in considering military retirement issues. In the past, some have viewed military retirement as a place where substantial savings could be made, arguing that the military retirement compensation is overly generous relative to pension systems in the civilian sector. In particular, they note that active duty military personnel become eligible for retirement at a relatively young age. In FY2018, the average active duty non-disability3 enlisted retiree was 43 years old and had 23 years of service at retirement; the average officer was 47 years old and had about 24 years of service at retirement.4

Others argue that the military retirement system is fair given the unique demands of military service. In addition, some have argued that past modifications to the system intended to save money have had a deleterious effect on military recruiting and retention, particularly in times of strong economic performance.

While congressionally mandated changes to the military retirement system have been infrequent, any potential changes are closely monitored by current servicemembers, retirees, survivors, and the veterans' service organizations that support them.

Retirement System Eligibility and Pay Calculations

There are currently three separate but related retirement systems within the DOD: one for active duty members, one for reservists, and one for those who become medically disabled and are unable to complete a 20-year military career due to their disability. Each of these systems has distinct eligibility requirements and formulas for calculating the retirement annuity.

Retirement pay calculations are based on the date when the servicemember first entered active duty and their pay base at the time of retirement.5 The defined benefit portion of the active and reserve component retirement systems cliff-vests after 20 years of service. This means servicemembers who leave the service prior to completing 20 years of eligible service typically will not receive any non-disability retirement benefit.6 This contrasts with eligibility for disabled members, who are vested on their disability retirement date regardless of years of service.

Active Component Retirement7

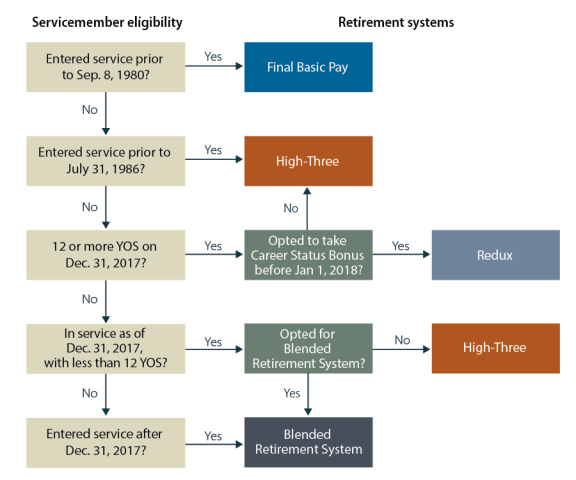

For active duty military personnel, there are four methods of calculating retired pay based on longevity: the Final Basic Pay System, "High Three," Redux, and the Blended Retirement System (BRS) (see Table 4 for a comparison of the benefits under each method). The applicable retirement calculation is based on the date when the servicemember first entered active duty, their pay base at the time of retirement, their years of service, and whether they chose the Redux system or the BRS (if eligible). Figure 1 shows how eligibility for retirement calculations is determined.

|

Figure 1. Active Duty, Non-Disability (Longevity) Retirement Eligibility Flowchart |

|

|

Source: CRS, derived from Title 10, United States Code. Note: YOS = Years of Service. |

Final Basic Pay (prior to September 8, 1980)

For persons who entered military service before September 8, 1980, the pay base is the final monthly basic pay received by the servicemember at the time of retirement multiplied by 2.5% for each year of service.8 The minimum amount of retired pay to which a member is entitled under this formula is therefore 50% of the retired pay computation base (20 years of service times 2.5%). For example, a servicemember who retires at 25 years receives 62.5% of the computation base (25 years of service times 2.5%).9

The Final Basic Pay cohort that entered the military before September 8, 1980, had 30 years of service in 2010. It was expected that all members of this group would be retired by 2016.10

High Three

Those who entered service on or after September 8, 1980, and before January 1, 2018, are eligible to elect the High Three system. For this system the computation base is the average of the highest 3 years (36 months) of basic pay rather than the final basic pay. Otherwise, calculations are the same as under the Final Basic Pay method.

Redux

The Redux military retirement system was initiated with the Military Retirement Reform Act of 1986 (P.L. 99-348). The Redux formula reduced the amount of retired pay for which military servicemembers who entered the armed forces on or after August 1, 1986, were eligible. This system was broadly unpopular, and by 1997 Congress began to take note of potential recruiting and retention problems associated with the change.11 In 1998, the Clinton Administration announced that it supported Redux repeal.12 The National Defense Authorization Act for Fiscal Year 2000 (P.L. 106-65 §§641 and 642) repealed compulsory Redux. It allowed post-August 1, 1986, entrants to retire under the High Three system or opt for Redux plus an immediate $30,000 cash payment. The FY2016 NDAA, enacted on November 25, 2015, terminated the Redux option.

Those who entered the service during the time when Redux was an option were required to select one of the following two options for calculating their retired pay within 180 days of reaching 15 years of service.

Option 1: Pre-Redux

Eligible servicemembers can opt to have their retired pay computed in accordance with the pre-Redux formula, described above as High Three.

Option 2: Redux

Eligible servicemembers can opt to have their retired pay computed in accordance with the Redux formula and receive an immediate $30,000 cash bonus called a Career Status Bonus.13 Those who select the Career Status Bonus (CSB) must remain on active duty until they complete 20 years of service or forfeit a portion of the bonus.

|

The Redux Formula Redux is different from the High Three formula in two major ways.

|

Blended Retirement System (BRS)

In the FY2016 NDAA, based on recommendations from the Military Compensation and Retirement Modernization Commission (MCRMC), Congress adopted a new retirement system, shifting from a purely defined benefit system to a blended defined benefit plus defined contribution system. Servicemembers with 12 or fewer years of service as of December 31, 2017, were afforded an opportunity to choose the BRS. The BRS is mandatory for individuals who entered the service on or after January 1, 2018. For these servicemembers, the computation base for the defined benefit will be the average of the highest three years (36 months) of basic pay, as in the High Three System; however, the multiplier is reduced to 2.0 from 2.5. This means that the pay base is the high three average at the time of retirement multiplied by 2.0% for each year of service. Therefore a servicemember retiring at 20 years would receive 40% of his or her pay base under the new formula and a 30-year retiree would receive 60% of his or her pay base.

The Lump Sum Payment

The Blended Retirement System also allows regular retirees (those with non-disability retirements) to receive a portion of their retired pay as a discounted lump sum. An individual entitled to retired pay may, no later than 90 days before the date of retirement, elect to receive

A lump sum payment of the discounted present value at the time of the election of an amount of the covered retired pay15 that the eligible person is otherwise entitled to receive for the period beginning on the date of retirement and the date the eligible person attains the eligible person's retirement age.16

For those who elect to receive a lump sum payment, after reaching the full retirement age for social security (usually 67), they will again receive 100% of their regular monthly annuity, which will be adjusted for annual cost of living increases.17 A reservist may elect the discounted lump sum to be calculated from the date the member first became eligible for retired pay (typically 60 years old) until social security retirement age. The law also allows retirees to take their lump sum payment as a single payment or up to four annual installments. The lump sum is discounted to the present value based on the annual rate published by DOD in June of each year and which goes into effect on January 1 of the following year.18 Lump sum payments are considered earned income and are taxed accordingly.

Members under the BRS with a disability retirement do not have the option of receiving a portion of retired pay as a discounted lump sum. Reserve component members may elect the discounted lump sum option from the date the member first becomes eligible for retired pay (typically 60 years old) until the social security full retirement age (typically 67). Based on an external study, the DOD Board of Actuaries assumes that approximately 5.2% of officers and 22.8% of enlisted members under the BRS will elect the lump sum option.19

|

Calculating the Lump Sum Payment An eligible retiree can elect one of two options for calculating the lump sum.

|

BRS Defined Contributions

Congress's decision to include a defined contribution element in the BRS was driven by the finding that under the legacy retirement systems, 83% of enlisted and 51% of officers did not complete the 20 years of service and thus received no retirement compensation for their service.20 This was at odds with retirement benefits in the private sector where firms increasingly offer a variety of defined contribution packages and are required by law to vest employees within a much shorter time period.21

Under the BRS, individuals entering service after January 1, 2018, are automatically enrolled in the Thrift Savings Plan (TSP) at an individual contribution level of 3% from his or her monthly basic pay or inactive duty pay beginning the first pay period after the member's 60th day of service. At that time, the services will also begin automatic monthly contributions of 1% of basic pay to the servicemember's TSP account. In addition, DOD will match servicemembers' contributions up to 4% of the servicemember's basic pay starting at two years and one day after the member first enters service and ending at 26 years of service.22 The servicemember is required to make individual total contributions of 5% in order to receive government matching of 4% (see Table 2 for government matching percentages). The servicemember is fully vested after two complete years of service and able to take ownership of the 1% contributions as well as any subsequent matching contributions. Any earnings on government contributions are immediately vested when they accrue. Servicemembers are immediately fully vested in any personal TSP contributions.

|

Individual Contribution Rate of Basic Pay or Inactive Duty Pay |

Government Automatic Contribution Rate of Basic Pay or |

Government Matching Contribution Rate of Basic Pay or |

Total Rate of TSP Monthly Contribution of Basic Pay or |

|

0% |

1% |

0% |

1% |

|

1% |

1% |

1% |

3% |

|

2% |

1% |

2% |

5% |

|

3% |

1% |

3% |

7% |

|

4% |

1% |

3.5% |

8.5% |

|

5% |

1% |

4% |

10% |

Source: Department of Defense, Guidance for Implementation of the Blended Retirement System for the Uniformed Services, Memorandum from the Deputy Secretary of Defense, January 27, 2017.

The services will also automatically enroll new servicemembers in the TSP program for individual contributions at a default amount of their basic pay unless the servicemember opts out. If the servicemember declines to make individual contributions, he or she will automatically be reenrolled every year at the default amount of 3% individual contribution. This requires the individual to make an active decision every year to not contribute to the TSP.

Continuation Pay

To provide a mid-career retention incentive under the BRS, Congress authorized continuation pay for members who are between 8 to 12 years of service, in return for a three-year service obligation.23 The pay may be distributed in a lump sum, or in a series of not more than four payments.24 The law allows an active duty (regular component) member or reserve component member who is performing Active Guard or Reserve duty25 to receive a minimum amount of continuation pay equal to 2.5 times their monthly basic pay. For reserve component members not on active duty, the minimum continuation pay is equal to at least 0.5 times the monthly basic pay of an active component member of similar rank and longevity.

The law also authorizes an additional amount of continuation pay, at the discretion of the Secretary concerned (see Table 3).26 For active component members that would be the amount of monthly basic pay multiplied by no more than 13.27 This flexibility awarded to military department Secretaries on the amount of additional continuation pay is intended to aid force-shaping by allowing the Secretaries to offer higher continuation payments to those in occupational specialties that are undermanned.

|

Component and Status |

Minimum Continuation Pay |

Additional Discretionary Continuation Pay |

|

Active Component |

2.5 times monthly base pay |

Up to 13 times monthly base pay |

|

Reserve Component on Active Duty as defined in 10 U.S.C. §101(d)(6) |

2.5 times monthly base pay |

Up to 6 times monthly base pay |

|

Reserve Component not on Active Duty as defined in 10 U.S.C. §101(d)(6) |

0.5 times monthly base pay |

Up to 6 times monthly base pay |

Source: 37 U.S.C. §356.

Note: Monthly base pay for reservists is calculated as the monthly base pay of an active component member of similar rank and longevity.

Under the blended system, reserve component members within the window of eligibility would receive the minimum continuation pay as discussed above (2.5 or 0.5 times the monthly basic pay of an active component member), plus an additional amount at the discretion of the Service Secretary that would be the amount of monthly basic pay multiplied by no more than six.

|

Final Basic Pay |

High Three |

Redux |

Blended Retirement System |

|

|

Applies to |

Servicemembers entering before September 8, 1980 |

Servicemembers entering from Sept. 8, 1980, through July 31, 1986, and persons entering after July 31, 1986, but opting not to accept the 15-year CSB |

Servicemembers entering after July 31, 1986, and accepting 15-year Career Status Bonus with additional 5-year service obligation |

Servicemembers entering on or after January 1, 2018, and those with 12 or fewer YOS on December 31, 2017, who choose to opt in. |

|

Basis of Computation |

Final rate of monthly basic pay |

Average monthly basic pay for the highest 36 months of basic pay |

Average monthly basic pay for the highest 36 months of basic pay |

Average monthly basic pay for the highest 36 months of basic pay |

|

Defined Benefit Multiplier |

2.5% per YOS |

2.5% per YOS |

2.5% per YOS, less 1% for each year of service less than 30 (restored at age 62) |

2.0% per YOS |

|

Defined Contribution |

Individual contributions to TSP, no matching |

Individual contributions to TSP, no matching |

Individual contributions to TSP, no matching |

1.0% minimum contribution into TSP from Service with up to 4.0% matching contributions |

|

Lump Sum Option |

Monthly annuity only |

Monthly annuity only |

Monthly annuity only |

Option for partial lump sum payment at retirement with full monthly annuity restored at eligibility age for full social security payments |

|

Additional Continuation Benefit |

None |

None |

$30,000 CSB payable at the 15-year anniversary with 5-year obligation to remain on active duty |

Minimum incentive pay between 8 to12 YOS w/3-year service obligation |

Sources: Adapted by CRS from Military Compensation Background Papers, Department of Defense, Seventh Edition, November 2011, and FY2016 NDAA.

Notes: YOS = Years of Service; CSB = Career Status Bonus.

Reserve Component Retirement28

There are many similarities between the active and reserve retirement systems. First, reserve component (RC) members must also complete 20 qualifying years of service to become eligible for a defined retirement benefit.29 Second, the reserve retirement system also accrues at the rate of 2.5% per equivalent year of qualifying service (explained below) at retirement eligibility for those who entered service prior to January 1, 2018, and 2.0% for those who enter on or after January 1, 2018. The primary difference between the reserve and the active system is the points system used to calculate qualifying years and equivalent years of service, as well as the age at which the retirement annuity begins. Also, Redux is not an option for reservists.

For retirement purposes, a qualifying year of service is a year in which a member of the RC earns at least 50 retirement points. Points are awarded for a variety of reserve activities

- one point for each day of active service, which includes annual training;30

- fifteen points a year for membership in the Ready Reserve;

- one point for each inactive duty training (IDT) period;31

- one point for each period of funeral honors duty; and

- one point for every three satisfactorily completed credit hours of certain military correspondence courses.

With multiple opportunities to earn points, a participating member of the selected reserve normally can accrue the requisite 50 points per year and thus earn a qualifying year for retirement. The maximum number of points per year, exclusive of active duty, has varied over time but is currently capped at 130 points.32 When active duty points are added to this total, the reservist cannot earn more than 365 points a year. The number of points is critical in determining both the number of years of qualifying service and the number of equivalent years of service for retired pay calculation purposes.

A reservist may retire after completing 20 years of qualifying service; there is no minimum age. However, the reservist will usually not become eligible for retired pay until age 60, at which time he or she also becomes eligible for military medical care.33 Upon retirement, the individual is normally transferred to the Retired Reserve and is entitled to a number of military benefits to include commissary and exchange privileges; access to Morale, Welfare and Recreation programs and facilities; and limited space available travel on military aircraft. Reservists in the Retired Reserve, but not yet retired pay eligible, are referred to as gray area retirees. Time spent in the Retired Reserve counts for longevity purposes and ultimately results in higher retired pay. For example, a lieutenant colonel who transitions to the Retired Reserve at age 45 will have his or her retired pay at age 60 calculated on the basic pay of a lieutenant colonel with an additional 15 years of longevity.

The date the reservist became a member of the armed forces determines whether their retired pay is calculated based on the Final Basic Pay, High Three, or Blended Retirement System. Those entering before September 8, 1980, will retire under the Final Basic Pay system while those entering after September 8, 1980 but before January 1, 2018, will retire under the High Three system. Those who first perform Reserve Component service (with no prior regular or reserve service) on or after January 1, 2018, will retire under the Blended Retirement System. Those reservists with prior service who have accumulated less than 12 equivalent years of service (< 4,320 points) may elect the BRS.

Calculation of Reserve Retired Pay

The actual calculation parallels the active duty system but requires adjustment to reflect the part-time nature of reserve duty. For example, consider a reserve component lieutenant colonel with 5,000 points who joined the military in January 1980 and transferred to the Retired Reserve in 2000 after completing 20 qualifying years of service. In 2015, after reaching 60 years of age, and becoming eligible to receive retired pay, the process for calculating her retired pay would be

Step 1: Divide the total points by 360 to convert the points to equivalent years of service (5,000 / 360 = 13.89).

Step 2: Multiply the equivalent years of service by the 2.5% multiplier (13.89 times 0.025 = 0.3472). Using the Final Basic Pay option, the 2015 pay base for a lieutenant colonel with 35 years of service (20 years of qualifying service plus 15 years in the Retired Reserve) is $8,762.40 per month.34

Step 3: Multiply the pay base by the retired pay multiplier ($8,762.40 times 0.3472) to produce a monthly retirement annuity of $3,042 per month.

Disability Retirement35

Servicemembers who, due to a disqualifying medical condition, are no longer able to perform their military duties, may qualify for disability retirement, commonly referred to as a Chapter 61 retirement. Eligibility is based on having a permanent and stable disability rated at 30% or more under the standard schedule of rating disabilities in use by the Department of Veterans Affairs at the time of determination.36 Some disability retirees are retired before becoming eligible for longevity retirement, while others have completed 20 or more years of service.

|

Formulas for Calculating Disability Retired Pay A servicemember retired for disability may select one of two available options for calculating their monthly retired pay.37

|

The maximum retired pay calculation under the disability formula cannot exceed 75% of basic pay.38 Disability retirees are not authorized to receive a lump sum payment under the Blended Retirement System.

Retired pay computed under the disability formula is subject to federal income tax, unless one or more of the following conditions applies: (1) the member's disability is the result of a combat-related injury, or (2) the individual was eligible to receive disability retirement payments prior to September 25, 1975, or (3) the individual was in the Armed Services prior to September 25, 1975, and later became eligible for disability retired pay.39 Retired pay under the longevity formula (for those entering after September 24, 1975) is taxable only to the extent that it exceeds what the individual would receive for a combat related injury under the disability formula.

Extraordinary Heroism Pay

Retired enlisted members of military services with less than 30 years of service may be eligible for a 10% increase in retired pay when credited with extraordinary heroism in the line of duty as determined by the Secretary of his or her service.40 This increase is subject to a maximum of 75% of the member's retired or retainer pay base. In 2002, Congress extended this benefit to enlisted members of the reserve component who are eligible for reserve retired pay.41

Military Retired Pay, Social Security, and Federal Income Tax

Military retirees receive full Social Security benefits in addition to their military retired pay. Current military personnel do not contribute a portion of their salary as part of the military retirement pay accrual. However, they have paid taxes into the Social Security trust fund since January 1, 1957 and are entitled to full Social Security benefits based on their military service. Military retired pay and Social Security are not offset against each other.

Military retired pay is not subject to withholding for Social Security tax. However, all non-disability retired pay is subject to withholding of federal income tax. A portion of the Social Security benefit may also be subject to federal income tax for individuals who have other income.

Retired Pay and the Cost-of-Living Adjustment (COLA)

Military retired pay is adjusted for inflation by statute (10 U.S.C. §1401a). The Military Retirement Reform Act of 1986, in conjunction with changes contained in the FY2000 National Defense Authorization Act (P.L. 106-65), provides for COLAs as indicated below. Congress has not modified the COLA formula since 1995.42 However, policymakers regularly discuss COLA modifications, typically with the aim of reducing costs and, hence, the payments to retirees. COLAs for 2007 to 2018 are shown in Table 5.

|

COLA Date |

Pre-Aug. 1986 COLA |

Post-Aug. 1986 COLA |

COLA Date |

Pre-Aug. 1986 COLA |

Post-Aug. 1986 COLA |

|

Dec. 1, 2007 |

2.3% |

2.3% w/o CSB |

Dec. 1, 2013 |

1.5% |

1.5% w/o CSB |

|

Dec. 1, 2008 |

5.8% |

5.8% w/o CSB |

Dec. 1, 2014 |

1.7% |

1.7% w/o CSB |

|

Dec. 1, 2009 |

0.0% |

0.0% w/o CSB |

Dec. 1, 2015 |

0.0% |

0.0% w/o CSB |

|

Dec. 1, 2010 |

0.0% |

0.0% w/o CSB |

Dec. 1, 2016 |

0.3% |

0.3% w/o CSB |

|

Dec. 1, 2011 |

3.6% |

3.6% w/o CSB |

Dec. 1, 2017 |

2.0% |

2.0% w/o CSB |

|

Dec. 1, 2012 |

1.7% |

1.7% w/o CSB |

Dec. 1, 2018 |

2.8% |

2.8% w/o CSB 1.8% w/ CSB |

Source: Office of the Under Secretary of Defense (Comptroller), DOD 7000.14-R Financial Management Regulation, Vol. 7B, Chapter 8, May 2019, Table 8-1, pp. 8-25 thru 8-26.

Notes: CSB = Career Status Bonus. The COLA increase for most retired pay is effective on December 1 of the year it is announced and reflected in the next scheduled payment. For example, the COLA effective December 1, 2017, will apply to payments through calendar year 2018.

COLAs for Pre-August 1, 1986, Entrants

For military personnel who first entered military service before August 1, 1986, each December a COLA equal to the percentage increase in the Consumer Price Index between the third quarters of successive years will be applied to military retired pay for the annuities paid beginning each January 1.43 This number is rounded to the nearest one-tenth of 1%.44 The COLA is applied to the monthly benefit amount and the final payment is rounded down to the nearest $1.00.45

COLAs for Personnel Who Entered Service On or After August 1, 1986

For those personnel who first entered military service on or after August 1, 1986, their COLAs will be calculated in accordance with either of two methods, as noted below.

Non-Redux Recipients

Those personnel who opted to have their retired pay computed in accordance with the pre-Redux (High Three) formula will have their COLAs computed as described above for pre-August 1, 1986, entrants.

Redux/$30,000 Cash Bonus Recipients

Those personnel who opt to have their retired pay computed in accordance with the Redux formula, have their COLAs computed using a different formula. Annual COLAs are held one percentage point below the actual inflation rate. So for example, the December 2017 COLA increase was 2.0% and Redux retirees saw a COLA increase of 1.0%. When a retiree reaches the age of 62, there is a one-time recomputation of his or her annuity to make up for the lost purchasing power caused by holding of annual COLA adjustments to the inflation rate minus one percentage point.46 This recomputation of COLA, in combination with the recomputation of the retired pay multiplier (discussed earlier), is a one-time increase in the member's monthly retired pay to parity with that of a similarly retired member who did not take the Redux option. After the recomputation at age 62, however, future COLA increases continue to be computed annually on the basis of the inflation rate minus one percentage point.

Concerns about the Future of Military Retirement

Some advocacy groups and servicemembers have expressed concerns about the implementation of the Blended Retirement System, in particular in relation to the reduced multiplier for the defined benefit (monthly annuity) and the lump sum payment option. These include the potential impacts of the BRS on recruitment and retention, as well as on the financial well-being of military personnel.

For example, there is some uncertainty as to whether the reduced multiplier for the defined benefit remains a strong enough retention incentive for mid-career personnel. A recent study for the Marine Corps that modeled potential retention outcomes found relatively small effects on force profiles, with officer retention being somewhat more sensitive than enlisted retention.47 The study also noted that retention may vary by occupational specialty—supporting the notion that flexibility may be needed for the services to vary the continuation pay, to offer other retention bonuses, or to lengthen minimum service requirements for high-demand fields.

In terms of financial well-being, the study found that, in general, those who retire after a 20-year career and contribute to the TSP throughout their career, will have lower take-home pay from retirement to age 60 than those in the legacy retirement system, but will be better off after the age of 60 when eligible to start drawing from the TSP without penalty.48 The total lifetime benefit was estimated to be slightly higher under the legacy retirement system than under the BRS.49 Since the average military retiree upon retirement is in his or her 40s, many choose to pursue a second civilian career and may also accrue retirement savings and benefits from his or her new employer. Estimates of retirement savings are sensitive to the amount a member contributes to the TSP and the return on investment for TSP accounts. One of the ways that Congress addressed these concerns was to require financial literacy training for servicemembers in the FY2016 NDAA with the authorization for the new retirement system.50

Military Retirement Budgeting and Costs

Military retirement costs, which include all payments to current retirees and survivors, have been rising modestly each year, due to a predictable, slow rise in the number of retirees and survivors coupled with cost-of-living increases. All DOD budgets through FY1984 reflected the costs of retired pay actually being paid out to personnel who had already retired. That is, Congress appropriated the amount of money required to pay current retirees each year as part of each annual defense appropriations bill.

Since FY1985, the accrual accounting concept has been used to budget for the costs of military retired pay. The unfunded liability resulting from the change in accounting practices is discussed in the next section. Under the accrual accounting system, the DOD budget for each fiscal year includes a contribution to a Military Retirement Fund (MRF)51 sufficient to finance future retirement payouts to current uniformed personnel when they retire, not the amount of retired pay actually paid to current retirees. These annual accrual contributions accumulate in the MRF, along with interest earned on them.52 Therefore, changes to military end-strength, increases or decreases in basic pay tables, or changes to retirement pay formulas, in any given year will result in same-year DOD budget obligations for military retired pay. Once military personnel retire, payments to them are made from the accumulated amounts in the MRF, not from the annual DOD budget.

The amount that DOD must contribute to the MRF each year to cover future retirement costs is determined by an independent, presidentially appointed, Department of Defense Retirement Board of Actuaries that decides how much is needed to cover future retirement costs as a percentage of military basic pay. Estimated future retirement costs are modeled based on the past rates at which active duty military personnel stayed in the service until retirement and on assumptions regarding the overall U.S. economy, including interest rates, inflation rates, and military pay levels. The model helps determine the level percentage of basic pay for each active servicemember that must be contributed from the DOD budget every year to cover future retirement costs—approximately 30 cents on every dollar of basic pay for full-time members.53 This is called the normal cost percentage (NCP) and DOD's NCP is shown in Table 6.

|

Benefit Formula |

Full-time (active component) |

Part-time (reserve component) |

||

|

FY2017 |

FY2018 |

FY2017 |

FY2018 |

|

|

Final Pay |

35.4% |

38.3% |

24.8% |

27.3% |

|

High-3 |

32.3% |

35.0% |

23.5% |

25.8% |

|

CSB/Redux |

31.7% |

34.3% |

NA |

NA |

|

BRS |

23.7% |

25.6% |

18.3% |

23.5% |

Source: DOD Office of the Actuary Valuation of the Military Retirement System reports.

Note: Because the multiplier for those retiring under the Blended Retirement System is reduced from 2.5 to 2.0, the NCP for those retiring under the new system is lower than the NCPs under legacy systems. Estimates of the magnitude of cost savings vary under the new system; however, all estimates suggest increased annual savings for DOD as the BRS is implemented

The Military Retirement Fund also receives intergovernmental transfers from the General Fund of the Treasury to fund the initial unfunded liability of the military retirement system. This is the total future cost of military retired pay that will result from military service performed prior to the implementation of accrual accounting in FY1985.

|

Sources of Military Retirement Fund (MRF) Income The MRF receives income from three sources 1) normal cost payments (NCPs) from the Services and U.S. Treasury; (2) U.S. Treasury payments to amortize the unfunded liability and for the normal cost of concurrent receipt benefits; and (3) investment (interest) income.54 |

Unfunded Liability

Current debates over both federal civilian and military retirement have included some discussion of unfunded liability, which consists of future retired pay costs incurred before the creation of the Military Retirement Fund in FY1985. The initial unfunded liability as of September 30, 1984 was $528.7 billion.55 The unfunded liability at the end of FY2017 was $767.9 billion.56 These obligations are being liquidated by the payment to the fund each year of an amount from the General Fund of the Treasury and are currently expected to be fully amortized by FY2025.57

Congressional action to change basic pay, retired pay, or associated benefits (e.g., concurrent retirement disability pay58, or survivor benefit program) may affect the unfunded liability. For example, the implementation of the Blended Retirement System reduced the unfunded liability by $800 million, while the FY2017 NDAA provision authorizing an extension of the Special Survivor Indemnity Allowance (SSIA) for certain survivors of military members raised the unfunded liability by $200 million.59 Section 621 of the NDAA for FY2018 (P.L. 115-91) extended the SSIA as a permanent benefit with annual COLA increases. The DOD Actuary estimates that this change will raise NCPs by approximately 0.1 percentage point and lead to an actuarial loss of approximately $8 billion to the Military Retirement Fund.60

Appendix. Retirement Reform Recommendations in Prior Reviews

Every four years, the President is required by law to direct a comprehensive review of the military compensation system and to forward the review, along with his recommendations, to Congress.61 This review is known as the Quadrennial Review of Military Compensation (QRMC). The Military Compensation and Retirement Modernization Commission (MCRMC) served as the 12th QRMC.62 The sections below summarize the recommendations of these commissions.

In the 10th Quadrennial Review of Military Compensation (QRMC), one of the directed areas of assessment was "the implications of changing expectations of present and potential members of the uniformed services relating to retirement."63 To accomplish this, the QRMC suggested a major revision of both the active and reserve retirement systems. Selected options were:

- 1. A defined benefit plan similar to the current High Three system that would vest personnel at 10 years of service, with benefits to begin either at age 60 (for personnel who have served less than 20 years of service) or age 57 (for those that served more than 20 years of service). Retirees could opt to receive the retirement annuity immediately upon retirement but the annuity would be reduced by 5% for each year under age 57.

- 2. Combined with the above defined benefit plan would be a defined contribution plan that would require the services to contribute up to 5% of annual base pay into a retirement account for each servicemember. The contribution would start at 2% for those with two years of service and increase incrementally until it reached 5% for those with five or more years of service. This plan would also vest at 10 years of service but withdrawals could not begin until age 60.

- 3. A system of gate pays would be established at specified career points to retain selected personnel in specified skill areas.

- 4. Separation pay would be used to encourage personnel in over-manned skills to separate prior to vesting at the 10-year point or becoming eligible for an immediate annuity at 20 years.

DOD submitted the 11th QRMC final report in 2012. While this QRMC did not have the same focus on the entire retirement system as the previous QRMC, DOD recommended more closely aligning active and reserve retirement systems with the goal of eventually transitioning to a total force single-system approach for both the active and reserve components. The report recommended the following modification to the reserve retirement system:64

Reserve component members who have attained 20 qualifying years for retirement benefits could begin receiving retired pay on the 30th anniversary of their service start date or at age 60, whichever comes first. Reserve members would receive one retirement point for each day of service, and the points needed for a qualifying year would be reduced from the current 50-point requirement to 35.

Military Compensation and Retirement Modernization Commission (MCRMC)

The National Defense Authorization Act (NDAA) for FY2013 (P.L. 112-239) established a Military Compensation and Retirement Modernization Commission (MCRMC) to provide the President and Congress with specific recommendations to modernize pay and benefits for the armed services. In terms of retirement, the commission was mandated to provide recommendations to "Modernize and achieve fiscal sustainability for the compensation and retirement systems for the Armed Forces and the other Uniformed Services for the 21st century."65 Notably, Section 674 of P.L. 112-239 mandated that the commission comply with conditions that would grandfather existing servicemembers and retirees into the existing retirement system, stating:

(i) For members of the uniformed services as of such date, who became members before the enactment of such an Act, the monthly amount of their retired pay may not be less than they would have received under the current military compensation and retirement system, nor may the date at which they are eligible to receive their military retired pay be adjusted to the financial detriment of the member.

(ii) For members of the uniformed services retired as of such date, the eligibility for and receipt of their retired pay may not be adjusted pursuant to any change made by the enactment of such an Act.

The commission delivered its final report and recommendations to Congress on January 29, 2015. Congress adopted many of the MCRMC's recommendations in the FY2016 NDAA. Several of the most prominent changes include, reduction of the retired pay multiplier, government matching contributions, and the lump sum option.

The MCRMC did not make any recommendations changing the 20-year eligibility for retirement; however, it recommended that the Secretary of Defense be given authority to modify the years-of-service requirement to shape the force profile as long as it does not impose involuntary changes on existing servicemembers. DOD expressed opposition to this proposal and Congress did not adopt a provision based on this MCRMC recommendation. The 20-year eligibility remains in current law.