Source: Congressional Research Service (CRS), based on 2016 data from the Internal Revenue Service, Statistics of Income.

The Earned Income Tax Credit (EITC) is a refundable tax credit available to eligible workers. Because the credit is refundable, a worker need not owe federal income taxes to benefit from it. The EITC is the nation's largest cash anti-poverty program, with a tax year 2016 (returns filed in 2017) total of $66.7 billion claimed on 27.4 million tax returns. Most of the claimed EITC dollars—$64.7 billion, or 97% of total EITC dollars—were for taxpayers with children compared to $2.1 billion in claimed EITC for taxpayers with no qualifying children.

To claim an EITC, tax filers must (1) file a federal tax return, (2) have earned income, (3) meet the residency requirement, (4) have investment income below a certain threshold, (5) not have had a disallowed credit due to fraud or reckless disregard of the rules when previously claiming an EITC, and (6) provide a Social Security number for themselves and their spouses. In addition to these rules, a taxpayer without a qualifying child must also be between the ages of 25 and 64. A childless worker cannot claim an EITC if he or she can also be claimed for EITC purposes as a dependent on another person's tax return (e.g., a college student).

The EITC is a function of a taxpayer's earnings as well as the credit's phase-in or phase-out rate (which rate applies depends on the taxpayer's earnings). The amount of the EITC phases in as earnings increase, with earnings multiplied by the phase-in credit rate. The credit hits a maximum amount, plateaus (meaning the credit amount stays the same even as income rises), and is then phased-out as earnings exceeds certain thresholds. This phase-in, plateau at the maximum, and phase-out is often visually represented as a "trapezoid."

EITC credit amounts are lower for childless workers than for those with children. For 2019, the maximum EITC for a childless worker is $529 (Table 1). This compares with $3,526 for a tax filer with one child and $6,557 for a tax filer with three or more children. The maximum income levels below which taxpayers are eligible for an EITC is also lower for childless workers—in 2019, EITCs is fully phased out (the EITC amount is $0) once income reaches $15,570 for a single childless worker and $21,370 for married childless workers. For a single filer with one child, the EITC is fully phased out once income reaches $41,094. The income at which the EITC is fully phased out is higher for taxpayers filing joint returns or taxpayers with more children. For married taxpayers with three or more children, the EITC is fully phased out once income reaches $55,952.

The phase-in amounts for the childless EITC are lower than the phase-in amounts for workers with children. Along the phase-in range, for a childless worker each additional $100 in earnings results in a $7.65 EITC. For a worker with one child, an additional $100 in earnings results in a $34.00 EITC. The phase-in is higher for taxpayers with more children.

|

0 |

1 |

2 |

3 or more |

|

|

Phase-in Credit Rate |

7.65% |

34.00% |

40.00% |

45.00% |

|

Maximum EITC |

$529 |

$3,526 |

$5,828 |

$6,557 |

|

Phase-Out Rate |

7.65% |

15.98% |

21.06% |

21.06% |

|

Income at Which the EITC Begins to Phase Out |

||||

|

Single |

$8,650 |

$19,030 |

$19,030 |

$19,030 |

|

Married Filing Jointly |

$14,450 |

$24,820 |

$24,820 |

$24,820 |

|

Income at Which the EITC is Phased-Out |

||||

|

Single |

$15,570 |

$41,094 |

$46,703 |

$50,162 |

|

Married Filing Jointly |

$21,370 |

$46,884 |

$52,493 |

$55,952 |

Source: Congressional Research Service (CRS), based on Internal Revenue Code (IRC) Section 32, and the U.S. Department of the Treasury, Internal Revenue Service, Revenue Procedure 2018-57.

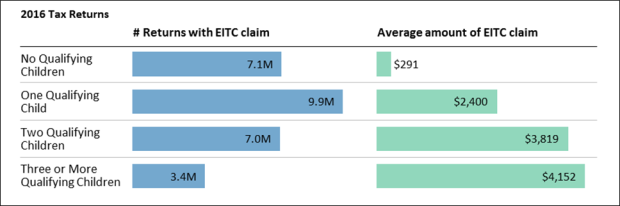

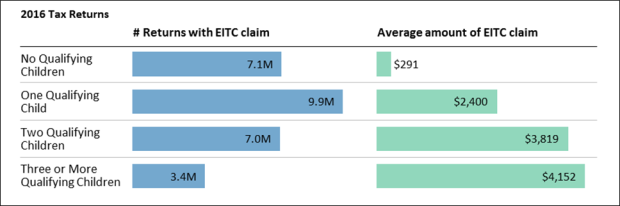

Though childless workers account for 3% of total EITC dollars, they account for 26% of all returns claiming the EITC for 2016. The average EITC for childless workers was $291 (Figure 1). In contrast, the average EITC was $2,400 for taxpayers with one qualifying child and $4,152 for taxpayers with three or more qualifying children.

|

|

Source: Congressional Research Service (CRS), based on 2016 data from the Internal Revenue Service, Statistics of Income. |

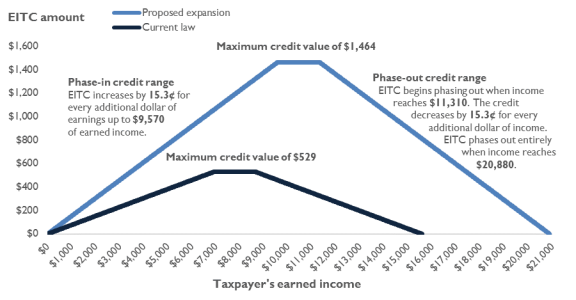

The Economic Mobility Act of 2019 (H.R. 3300), ordered to be reported to the full House by the House Ways and Means Committee on June 20, 2019, would expand the EITC for childless workers for two years, 2019 and 2020. It would double the phase-in credit percentage to 15.3%, increase the maximum EITC in 2019 to $1,464, and increase the maximum income at which the credit for these workers phases out (see Figure 2). The bill would also make eligible for the childless EITC individuals aged 19 to 24 (except for full-time college students) and those aged 65.

|

Figure 2. EITC for a Single, Childless Worker Under H.R. 3300 and Under Current Law, 2019 |

|

|

Source: Congressional Research Service (CRS). |

Research has found that the EITC both increases participation in the labor force and reduces poverty, but its impacts are generally restricted to families with children. An expanded EITC for childless individuals might similarly encourage work and reduce poverty for childless adults. A recent demonstration of an expanded childless EITC did show such impacts—specifically, reducing severe poverty and increasing work among women and very disadvantaged men. This expansion would increase the costs of the EITC. It also would no longer primarily target reducing poverty among children, who are a population group of traditional federal concern and who have the highest poverty rate when compared with nonelderly and elderly adults.