The American Family Act (AFA; S. 690/H.R. 1560) would significantly expand the child tax credit for low- and moderate-income taxpayers, especially those with young children. It also would eliminate the expanded child tax credit for higher-income families in effect from 2018 to 2025 as a result of P.L. 115-97. This Insight describes some of the major changes that would be made to the child tax credit by this legislation.

Under current law, eligible taxpayers can subtract up to $2,000 per qualifying child from their federal income tax liability. (See CRS Report R41873, The Child Tax Credit: Current Law.) A qualifying child is generally the taxpayer's dependent child who is under 17 years of age. The maximum amount of credit a family can receive is equal to the number of qualifying children in a family multiplied by $2,000.

If a family's tax liability is less than the value of their child tax credit, they may be eligible for a refundable child credit calculated using the earned income formula. Under this formula, a family is eligible for a refund equal to 15% of their earnings in excess of $2,500, up to the maximum amount of the refundable portion of the credit. The maximum amount of the refundable portion of the credit is $1,400 per qualifying child. The refundable portion of the child tax credit is often referred to as the additional child tax credit, or ACTC.

The credit phases out for single parents with income over $200,000 and married couples with income over $400,000. The taxpayer must provide the social security number (SSN) of their child to claim the credit. Generally, these parameters are in effect from 2018 through end of 2025 as a result of P.L. 115-97 (often referred to as the Tax Cuts and Jobs Act, or TCJA). After 2025, many of the parameters are scheduled to revert to pre-TCJA levels. (See CRS Report R45124, The Child Tax Credit: Legislative History.)

As with other refundable tax credits for individuals, taxpayers claim this credit annually, when they file their federal income tax return.

The AFA proposes several changes to the child tax credit, which are summarized in Table 1. Most notably, it would substantially expand the amount of the credit, eliminate the phase-in of the credit for lower-income taxpayers, and make the credit a monthly (as opposed to annual) benefit. Of note, the House and Senate bills differ on the maximum age of an eligible child. Under the House bill a child of up to 17 years old would be eligible for the credit whereas the Senate version retains the 16-year-old limit.

|

Current Law |

|||

|

Parameter |

American Family Act |

(2018-2025) |

(2026-) |

|

Maximum Credit Amount |

$3,600 per child under 6 years old $3,000 per child aged 6-16 years old (H.R. 1560 would extend the eligibility age for this credit to include 17 year olds, i.e., 6-17 years old). (annually adjusted for inflation) |

$2,000 per child aged 0-16 years old |

$1,000 per child aged 0-16 years old |

|

Maximum Refundable Credit Amount |

$3,600 per child under 6 years old $3,000 per child aged 6-16 years old (6-17 years old under H.R. 1560) (annually adjusted for inflation) |

$1,400 per child (annually adjusted for inflation) |

$1,000 per child |

|

Refundability Formula |

No formula; full credit amount is refundable. |

15% of earnings above $2,500 not to exceed the maximum refundable credit amount. |

15% of earnings above $3,000 not to exceed the maximum refundable credit amount. |

|

Phaseout Threshold |

$180,000 married filing jointly $130,000 head of household & single filers $90,000 married filing separately |

$400,000 married filing jointly $200,000 head of household & single filers $200,000 married filing separately |

$110,000 married filing jointly $75,000 head of household and single filers $55,000 married filing separately |

|

Phaseout Rate |

Credit is reduced by "applicable amount" for every $1,000 (or fraction thereof) above the phaseout threshold. Applicable amount: (total credit) / ($20 x number of qualifying children) (=$150 if all children are 6 years or older / $180 if all children are under 6 years) (annually adjusted for inflation) |

Credit is reduced by $50 for every $1,000 (or fraction thereof) above the phaseout threshold. |

Credit is reduced by $50 for every $1,000 (or fraction thereof) above the phaseout threshold. |

|

Child ID Requirements |

SSN |

SSN or ITIN |

|

|

Credit Paid by IRS |

Monthlya |

Annually |

Annually |

Source: Internal Revenue Code (IRC) Section 24 and the American Family Act of 2019 (S. 690, H.R. 1560).

Notes: Unless specifically noted, amounts are not annually adjusted for inflation.

a. The legislation directs the Treasury Secretary to make the credit advanceable on a monthly basis, or "as the Secretary determines to be administratively feasible."

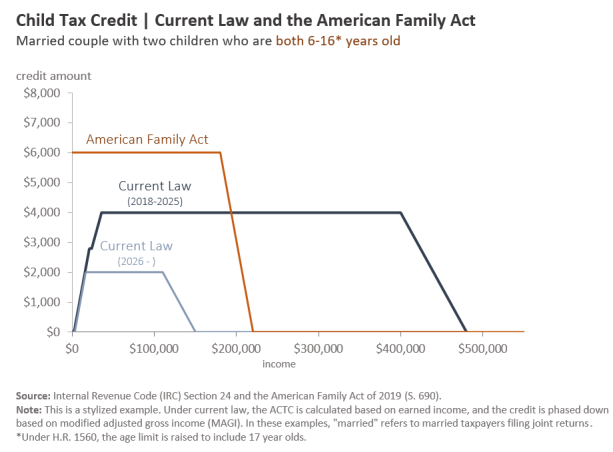

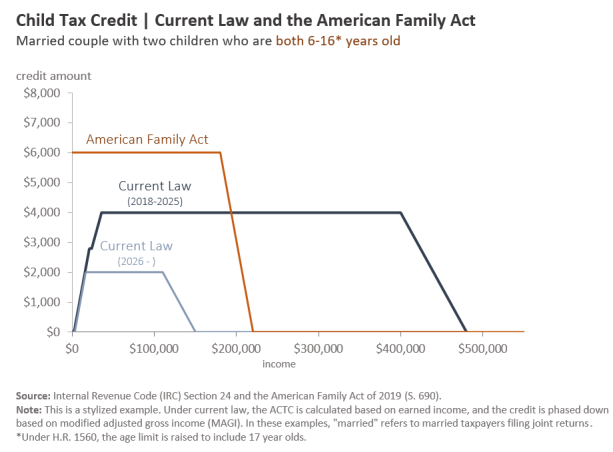

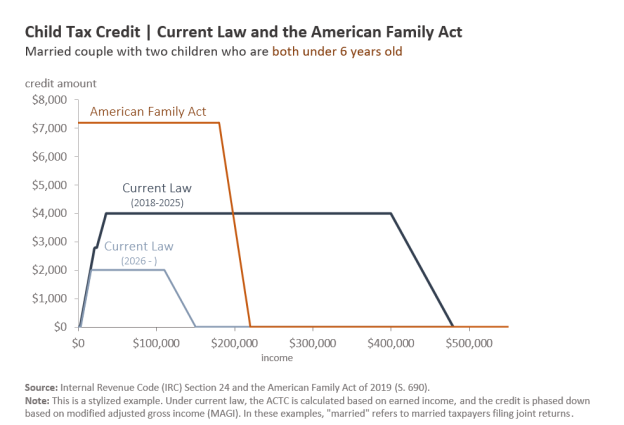

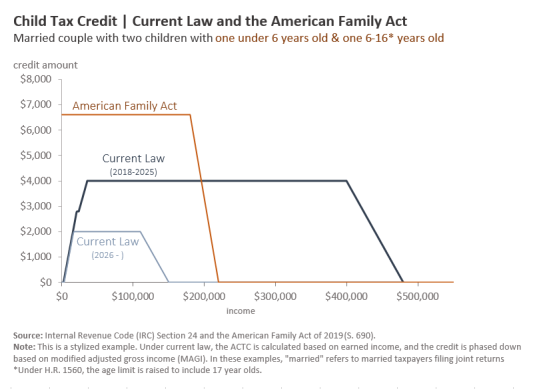

Below are graphs of child tax credit schedules for a married couple with two children, under current law and under the American Family Act proposal. Both the expansion of the credit under the P.L. 115-97 ("current law 2018-2025") and after the temporary expansion expires ("current law 2026-") are displayed for reference. These schedules are calculated assuming the taxpayer claims the standard deduction.

|

Under current law, a married couple with two children is eligible for up to $4,000 of child tax credit, irrespective of whether those children are under or over six years old. The credit phases in at a rate of 15 cents for every dollar of earned income over $2,500. The credit reaches its maximum amount of $4,000 when the taxpayer has earned income of $36,000 ($2,800 is received as the ACTC; $1,200 reduces income tax liability). When income exceeds $400,000, the credit begins to phase out until it equals $0 at $480,000 of income. In contrast, under the AFA proposal, if those two children are six years or older, the same family will receive a $6,000 credit. The credit amount does not phase in. When income exceeds $180,000, the credit begins to phase out until it equals $0 at $220,000 of income.

|

The next example looks at a married couple with two children both under six years old. Again, under current law, a married couple with two children is eligible for up to $4,000 of child tax credit, with the credit reaching its maximum amount when the taxpayer has earned income of $36,000 and equaling zero when the taxpayer has $480,000 of income. In contrast, under the AFA proposal, if both children are under six years old, the same family will receive a $7,200 credit. The credit amount does not phase in. When income exceeds $180,000, the credit begins to phase out until it equals $0 at $220,000 of income.

|

The final example looks at a family with two children, one under six and one over 6. Once again, under current law, a married couple with two children is eligible for a child tax credit of up to $4,000, with other credit parameters unchanged. In contrast, under the AFA proposal, the same family would receive a $6,600 credit. The credit amount does not phase in. When income exceeds $180,000, the credit begins to phase out until it equals $0 at $220,000 of income.