Source: FDIC.

On February 9, 2019, BB&T and SunTrust—the 16th- and 17th-largest U.S. banks by asset size, respectively—announced they intend to merge, which would create the 8th-largest U.S. bank. This proposed merger illustrates a transformative 35-year trend of banking industry consolidation. Banks are becoming fewer, and industry assets are increasingly concentrated in large banks. Observers have warned that this trend could leave certain markets traditionally served by small banks underserved or unserved. In addition, large, complex banks—or "too big to fail" (TBTF) banks—potentially create market distortions and threaten systemic stability.

This Insight examines industry consolidation in general and the proposed BB&T-SunTrust merger specifically. For a detailed examination of related policy issues, see CRS Report R45518, Banking Policy Issues in the 116th Congress.

The number of institutions insured by the Federal Deposit Insurance Corporation (FDIC) fell from a peak of 18,083 in 1986 to 5,406 in 2018. Banks with less than $1 billion in assets fell from 17,514 to 4,631, and the share of industry assets held by them fell from 37% to 7%. Meanwhile, the number of banks with more than $10 billion in assets rose from 38 to 137, and the share of assets held by those banks increased from 28% to 84%.

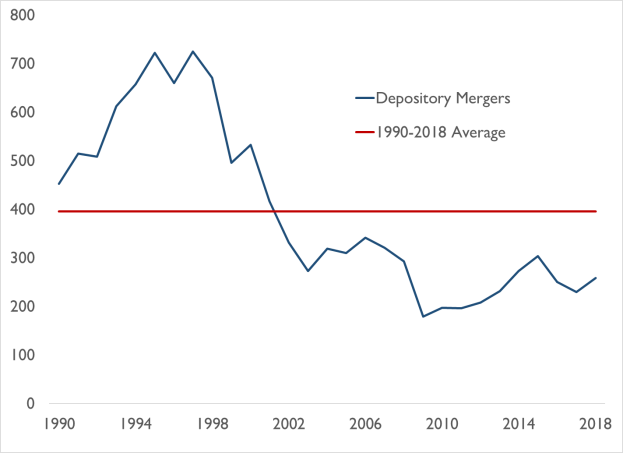

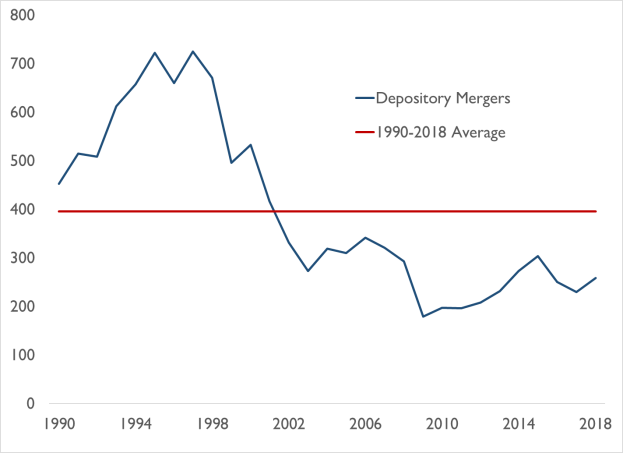

The decline occurred mainly through three methods: mergers, failures, and lack of new banks. Bank mergers, which averaged almost 396 per year from 1990 to 2018, are the largest factor in this decline, although mergers have slowed since the 2007-2009 financial crisis (see Figure 1).

|

|

Source: FDIC. |

Bank failures played a large role in this decline during and after financial crises (over 1,000 depositories failed following the savings and loans crisis, and over 500 failed following the 2007-2009 crisis). Failures have declined as economic conditions have improved, but the number of new banks has been extraordinarily small in recent years. On average, 152 new banks formed annually between 1990 and 2007; in 2018, 8 new banks formed. Certain analysts attribute the lack of new banks to slow economic growth and low interest rates. Critics of new bank regulations argue that regulatory burden inhibits new bank formation.

Banking operations in general may be subject to increasing economies of scale—meaning banks become more profitable as they get bigger—perhaps due to the growing role of information technology. If this is the case, banks could be merging to become more profitable through greater efficiency.

Some observers argue that banks experience economies of scale specifically in regulation compliance, meaning compliance costs may increase more slowly than revenues as bank size increases. Based on this argument, critics of new regulations assert regulatory burden is driving smaller banks to merge into larger institutions. However, the role regulatory burden plays in bank consolidation is a matter of debate, in part because empirically measuring economies of scale in compliance is difficult.

Mergers also could occur for reasons other than scale. For example, a bank that is struggling financially may look to merge with a stronger bank to stay in business. Alternatively, a larger bank may buy a small bank that has been outperforming its peers to add the successful portfolio to its own.

Other regulatory factors also could be driving consolidation. Through much of the 20th century, federal and state laws restricted banks' ability to open new branches and operate across state lines. States substantially relaxed these restrictions in the late 1980s, and the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 did so at the federal level. As a result, it became easier for banks to consolidate and spread operations to other markets.

BB&T has nearly $226 billion in total assets ($219 billion at its main depository) and 1,884 U.S. depository branch offices across 15 mostly southeastern states and the District of Columbia (DC). SunTrust has nearly $216 billion in total assets ($210 billion at its main depository) and 1,254 U.S. branches across 10 mostly southeastern states and DC.

The two organizations have characteristics that observers identify with "regional" banks—an unofficial bank classification. Both have a large amount of assets, mostly attributable to a single depository subsidiary, but are not nearly as large as the very largest U.S. banks. Both also have a relatively high concentration in loan making and deposit taking and a less-than-national geographic footprint.

Regional bank advocates argue these characteristics make such banks similar to "community" banks and dissimilar to risky, complex TBTF banks. Thus, they argue, certain regulations aimed at TBTF banks should be applied based on criteria that regional banks would not meet. Opponents of this position, citing the size of the banks' exposures and the amount of available resources for compliance, assert it is appropriate to subject the banks to stringent regulation. Given that, if the merger is approved, the new entity can reasonably be expected to have about $442 billion in total assets and continue to operate primarily as a lender and deposit taker, the merger may stir this ongoing debate.

Both banks are individually approaching the $250 billion asset threshold at which banks become subject to stricter advanced approaches capital requirements. Some research suggests that banks approaching such thresholds are motivated to merge, because they would prefer entering a more stringent regulatory regime with cost savings from a big jump in economies of scale to incrementally crossing the line. Arguably, this "in-for-a-penny-in-for-a-pound" strategy could be a factor in the proposed BB&T-SunTrust merger.

The $250 billion asset threshold will—once regulators implement Section 401 of P.L. 115-174—also be the criterion that automatically subjects banks to enhanced prudential regulation (EPR). BB&T and SunTrust currently are subject to EPR based on the original $50 billion threshold that Section 401 raises to $250 billion. Thus, depending on the timing of the implementation and the merger, the two banks may not technically cross into a new EPR regime. However, the in-for-a-penny-in-for-a-pound logic still may hold, because without a merger, even post-Section 401 implementation, each bank would be incrementally approaching a threshold that would trigger more stringent regulation.