Introduction

The Railroad Retirement Board (RRB),1 an independent federal agency, administers retirement, survivor, disability, unemployment, and sickness insurance for railroad workers and their families under the Railroad Retirement Act (RRA) and the Railroad Unemployment Insurance Act (RUIA).2 These acts cover workers who are employed by railroads engaged in interstate commerce and related subsidiaries, railroad associations, and railroad labor organizations. Lifelong railroad workers receive railroad retirement benefits instead of Social Security benefits; railroad workers with nonrailroad experience receive benefits either from railroad retirement or Social Security, depending on the length of their railroad service.

The number of railroad workers has been declining since the 1950s, although the rate of decline has been irregular and recent years have seen increases in railroad employment after reaching an all-time low of 215,000 workers in January 2010. Recently, railroad employment peaked in April 2015 to 253,000 workers, the highest level since November 1999, and then declined through FY2017, falling to 221,000 workers.3 The total number of beneficiaries under the RRA and RUIA decreased from 623,000 in FY2008 to 574,000 in FY2017, and total benefit payments increased from $10.1 billion to $12.6 billion during the same time.4 During FY2017, the RRB paid nearly $12.5 billion in retirement, disability, and survivor benefits to approximately 548,000 beneficiaries.5 Almost $105.4 million in unemployment and sickness benefits were paid to approximately 28,000 claimants.6

This report explains the programs under RRA and RUIA, including how each program is financed, the eligibility rules, and the types of benefits available to railroad workers and family members. It also discusses how railroad retirement relates to the Social Security system. For a quick overview of this topic, see CRS In Focus IF10481, Railroad Retirement Board: Retirement, Survivor, Disability, Unemployment, and Sickness Benefits.

Railroad Retirement, Survivor, and Disability Benefits

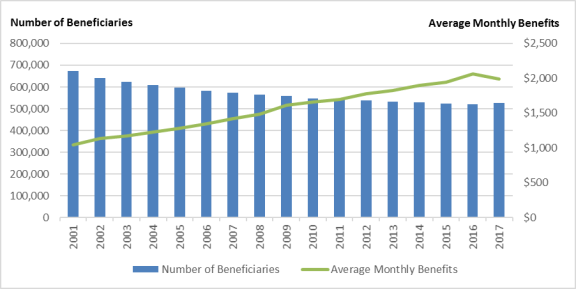

The RRA authorizes retirement, survivor, and disability benefits for railroad workers and their families.7 In December 2017, there were a total of 526,100 RRA beneficiaries, decreasing from 672,400 in 2001. This decline might partly result from the decline in railroad employment in the past five decades.8 The average monthly benefit for each beneficiary was about $1,986 in 2017, which increased from $1,043 in 2001, reflecting the growth in average wages and prices (see Figure 1).

Financing

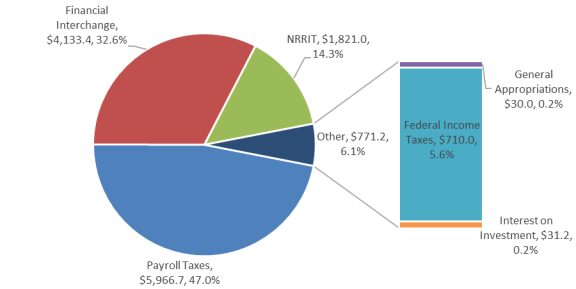

The railroad retirement, disability, and survivor program is mainly financed by payroll taxes, financial interchanges from Social Security, and transfers from the National Railroad Retirement Investment Trust (NRRIT) (see Figure 2), all of which accounted for 93.9% of the $12.7 billion gross funding of the RRA program during FY2017. The remaining 6.1% of the program was financed by federal income taxes levied on railroad retirement benefits,9 interest on investment and other revenue, and general appropriations to pay the costs of phasing out vested dual benefits.

|

Figure 2. Financial Sources for Railroad Retirement, Disability and Survivor Program, FY2017 (Dollar amounts are in millions) |

|

|

Source: Railroad Retirement Board, 2018 Annual Report, page 8, at https://www.rrb.gov/sites/default/files/2018-08/2018_Annual_Report.pdf. Notes: Gross funding was $12.7 billion in FY2017. Numbers may not add due to rounding. |

Payroll taxes, which provided 47.0% of gross RRA funding in FY2017, are the largest funding source for railroad retirement, survivor, and disability benefits.10 Railroad retirement payroll taxes are divided into two tiers—Tier I and Tier II taxes. The Tier I tax is the same as the Social Security payroll tax: railroad employers and employees each pay 6.2% on earnings up to $132,900 in 2019.11 The Tier II tax is set each year based on the railroad retirement system's asset balances, benefit payments, and administrative costs.12 In 2019, the Tier II tax is 13.1% for employers and 4.9% for employees on earnings up to $98,700. Tier II taxes are used to finance Tier II benefits, the portion of Tier I benefits in excess of Social Security retirement benefits (such as unreduced early retirement benefits for railroad employees with at least 30 years of railroad service), and supplemental annuities.13

Tier I payroll taxes are deposited in the Social Security Equivalent Benefit Account (SSEBA), which pays the Social Security level of benefits and administrative expenses allocable to those benefits. The SSEBA also receives or pays the financial interchange transfers between the railroad retirement and Social Security systems. The financial interchange with Social Security provided 32.6% of gross RRA funding in FY2017. The purpose of the financial interchange is to place the Social Security trust funds in the same position they would have been in, if railroad employment had been covered under Social Security since that program's inception.14

Tier II tax revenues that are not needed to pay current benefits or associated administrative costs are held in the National Railroad Retirement Investment Trust (NRRIT), which is invested in both government securities and private equities.15 NRRIT transfers provide another revenue source for railroad benefits, and they were 14.3% of gross RRA funding in FY2017. Prior to the Railroad Retirement and Survivors' Improvement Act of 2001 (P.L. 107-90), surplus railroad retirement assets could only be invested in U.S. government securities—just as the Social Security trust funds must be invested in securities issued or guaranteed by the U.S. government. The 2001 act established the NRRIT to manage and invest the assets in the Railroad Retirement Account in the same way that the assets of private-sector and most state and local government pension plans are invested. The remainder of the railroad retirement system's assets, such as assets in SSEBA, continues to be invested solely in U.S. government-issued or -granted securities.

The combined fair market value of Tier II taxes and NRRIT assets is designed to maintain four to six years' worth of RRB benefits and administrative expenses. To maintain this balance, the Railroad Retirement Tier II tax rates automatically adjust as needed. This tax adjustment does not require congressional action, according to Section 204 of the 2001 act.

Eligibility and Types of Benefits

To be insured for railroad benefits, a worker must generally have at least 10 years of covered railroad work or 5 years performed after 1995 and "insured status" under Social Security rules (generally 40 earnings credits)16 based on combined railroad retirement and Social Security-covered earnings. An insured railroad worker's family may be entitled to receive railroad retirement benefits. If a worker does not qualify for railroad retirement benefits, his or her railroad work counts toward Social Security benefits. Of the total $12.5 billion benefit payments during FY2017, 60.0% (or $7.5 billion) were paid in retirement annuities to retired workers, 8.0% (or $1.0 billion) in disability annuities, 14.4% (or $1.8 billion) in spouse annuities, and 16.8% (or $2.1 billion) in survivor annuities.17

Tier I Retirement Annuities

Tier I annuities are designed to be nearly equivalent to Social Security Old Age, Survivors, and Disability Insurance benefits. Tier I annuities are calculated using the Social Security benefit formula and are based on both railroad retirement and Social Security-covered employment.18 However, Tier I annuities are more generous than Social Security benefits in certain situation. For example, at the age of 60, railroad workers with at least 30 years of covered railroad work may receive unreduced retirement annuities.19 At the full retirement age (FRA), which is gradually increasing from 65 to 67 for Social Security and railroad retirement beneficiaries, insured workers with fewer than 30 years of service may receive full retirement annuities.20 Alternatively, workers with fewer than 30 years of service may, starting at the age of 62, receive annuities that have been reduced actuarially for the additional years the worker is expected to spend in retirement. Tier I benefit reductions for early retirement are similar to those in the Social Security system. As the FRA rises, so will the reduction for early retirement.21 If a railroad employee delays retirement past FRA, Tier I annuities are increased by a certain percentage for each month up until the age of 70, which is identical to the benefit increase provided by Delayed Retirement Credits under the Social Security system.22

In general, Social Security benefits are subtracted from Tier I annuities, because work covered by Social Security is counted toward Tier I annuities. Beneficiaries insured by both systems receive a single check from the RRB. Railroad retirement annuities may also be reduced for certain pensions earned through federal, state, and local government work that is not covered by Social Security.23 For early retirees who continue to work for a nonrailroad employer while receiving the retirement benefit during the year prior to FRA, Tier I benefits are reduced by $1 for every $2 earned above an exempt amount ($17,040 in 2018).24 After Tier I benefits are first paid, they increase annually with a cost-of-living adjustment (COLA) in the same manner as Social Security benefits.25

Retirement annuities are not payable to workers who continue to work in a covered railroad job or who return to railroad work after retirement.

Tier II Retirement Annuities

Tier II retirement annuities are paid in addition to Tier I annuities and any private pension and retirement saving plans offered by railroad employers. They are similar to private pensions and based solely on covered railroad service. Tier II annuities for current retirees are equal to seven-tenths of 1% of the employee's average monthly earnings in the 60 months of highest earnings, times the total number of years of railroad service.26 Tier II annuities are increased annually by 32.5% of the Social Security COLA.

Tier II annuities are not (in contrast to Tier I annuities) reduced if a worker receives Social Security benefits or a government pension that was not covered by Social Security. For railroad retirees and spouses who work for their last pre-retirement nonrailroad employer while receiving retirement benefits,27 Tier II annuities are reduced by $1 for every $2 earned, capped at 50% of the Tier II annuity. There is no cap to the earnings-related reduction in railroad Tier I or Social Security benefits. In addition, the earnings-related reduction applies to all Tier II beneficiaries regardless of age, whereas for railroad Tier I and Social Security benefits, the earnings-related reduction applies only until the beneficiary reaches FRA.

Other Retired Worker Benefits: Supplemental Annuities and Vested Dual Benefits

Tier II payroll taxes also finance a supplemental annuity program. Supplemental annuities are payable to employees first hired before October 1981, aged 60 with at least 30 years of covered railroad service or aged 65 and older with at least 25 years of covered railroad service, and a current connection with the railroad industry.28

In addition, general revenues finance a vested dual benefit for those who were insured for both railroad retirement and Social Security in 1974 when the two-tier railroad retirement benefit structure was established.29 Neither supplemental annuities nor vested dual benefits are adjusted for changes in the cost of living during retirement. Supplemental annuities are subject to the same earnings reductions as Tier II benefits; vested dual benefits are subject to the same earnings reductions as Tier I benefits.

Disability Annuities

Railroad workers may be eligible for disability annuities if they become disabled regardless of whether the disability is caused by railroad work. The RRB determines whether a worker is disabled based on the medical evidence provided during the application process. Railroad workers found to be totally and permanently disabled from all work may be eligible for Tier I benefits at any age if the worker has at least 10 years of railroad service.30 Totally disabled workers may also receive Tier II benefits at the age of 62 if they have 10 or more years of service. Occupational disability annuities are also payable to workers found to be permanently disabled from their regular railroad occupations, if the worker is at least 60 years old with 10 years of service (or any age with 20 years of service), and with a current connection to the railroad industry. A five-month waiting period after the onset of disability is required before any disability annuity can be payable.

Disability annuities are not payable if a worker is currently employed in a covered railroad job. Disability benefits are suspended if a beneficiary earns more than a certain amount after deducting certain disability-related work expenses.31 The Tier I portion of disability benefits may be reduced for the receipt of workers compensation or government disability benefits.

Spouse Annuities

In any month that a worker collects a railroad retirement or disability annuity, his or her spouse may also be eligible for a spousal annuity equal to or greater than the benefit he or she would have received if the worker's railroad work had been covered by Social Security. A spouse is eligible for a spousal annuity when he or she reaches the same minimum age required for the worker (i.e., either at the age of 60 or 62, depending on years of the worker's service). At any age, a spouse may be eligible for a spousal annuity if he or she cares for the worker's unmarried child under the age of 18 (or a child of any age that was disabled before the age of 22). An individual must have been married to the railroad worker for at least one year before he or she applies for the spousal annuities, with certain exceptions. A qualifying spouse receives 50% of the worker's Tier I benefit before any reductions (or, if higher, a Social Security benefit based on his or her own earnings). Spouses may also receive 45% of the worker's Tier II benefit before any reductions.

Divorced spouses of retired or disabled railroad workers may also be eligible for spousal annuities. A divorced spouse may receive 50% of the worker's Tier I benefit before reductions, but no Tier II benefits. To qualify, the former spouse must have been married to the worker for at least 10 years and must not currently be married (remarriages if any must have terminated); both the worker and former spouse must be at least 62 years old.32

For spouses, as for railroad workers, Social Security benefits are subtracted from Tier I annuities. The Tier I portion of a spouse annuity may also be reduced for receipt of any pension from government employment not covered by Social Security based on the spouse's own earnings.33 Spouses are subject to reductions based on the primary worker's earnings as well as on their own earnings. For example, for early retirement, spouses are subject to different benefit reductions from workers.34 Finally, spouse annuities are reduced by the amount of any railroad benefits earned based on their own work.

Survivor Annuities

After the worker's death, surviving spouses, former spouses, children, and other dependents may be eligible to receive survivor annuities, which are paid in addition to any private life insurance offered by railroad employers. To be insured for survivor annuities, the worker must have had a current connection with the railroad industry at the time of death. Railroad survivor annuities are generally higher than comparable Social Security benefits because railroad workers' families may be entitled to Tier II annuities as well as Tier I annuities (as noted above, Tier I annuities are equivalent to Social Security benefits). In cases where no monthly survivor annuities are paid, a lump-sum payment may be made to certain survivors.35

The widows and widowers of railroad workers may be eligible to receive survivor annuities. At FRA, a surviving spouse may be eligible for 100% of the worker's Tier I annuity (or his or her own Social Security or railroad retirement Tier I benefit, if higher). The widow(er) may also receive up to 100% of the worker's Tier II annuity. As early as the age of 60 (or age 50, if disabled), widows and widowers may receive reduced survivor annuities.36 A qualifying widow(er) must have been married to the deceased railroad worker for at least nine months, with certain exceptions.37 At any age, a widow(er) caring for a deceased worker's child under the age of 18 may receive a survivor annuity equal to 75% of the worker's Tier I annuity, as well as up to 100% of the worker's Tier II annuity. Widow(er)s who are the natural or adoptive parent of the deceased worker's child do not have to meet the length of marriage requirement.

Survivor annuities may also be payable to a surviving divorced spouse or remarried widow(er). To qualify for benefits, a surviving divorced spouse has to be married to the employee for at least 10 years and is unmarried or remarried after age 60 (age 50 for disabled surviving divorced spouse).38 A surviving divorced spouse who is unmarried can qualify for benefits at any age if caring for the employee's child who is under age 16 or disabled.39 Benefits are limited to the amounts Social Security would pay (Tier I only) and therefore are less than the amount of the survivor annuity otherwise payable.

Railroad workers' children may also receive survivor annuities. To qualify, a child must be unmarried and under the age of 18 (or 19 if still in high school). Disabled adult children may qualify if their disability began before the age of 22. Eligible children receive 75% of the worker's Tier I annuity and 15% of the worker's Tier II annuity.40 In addition, if a worker's parent was dependent on the worker for at least half of the parent's support, he or she may receive 82.5% of the worker's Tier I annuity and 35% of the worker's Tier II annuity after reaching age 60.

Survivor annuities are not payable to a current railroad employee, and survivor annuities are reduced by any railroad retirement benefit the survivor has earned through his or her own railroad work. Survivors receive the same reductions as retired workers for Social Security benefit receipt; they also have reductions from government pension receipts that are not covered by Social Security.41 A family maximum applies to survivor benefits, usually applicable when three or more survivors receive benefits on a worker's record (not counting divorced spouses).42

In summary, Table 1 provides data on railroad retirement, survivor, and disability annuities as of June 2018.

|

Type of Annuity |

Number of Benefitsa |

Percentage of Total Benefits |

Average Monthly Benefit ($) |

|

Age-Based |

189,262 |

29.5% |

$2,806.4 |

|

Disability -Under Full Retirement Age (FRA) |

25,795 |

4.0% |

$2,744.3 |

|

Disability -At or Above FRA |

47,012 |

7.3% |

$2,466.6 |

|

Supplemental |

120,409 |

18.8% |

$41.5 |

|

Spouse |

141,993 |

22.1% |

$1,047.0 |

|

Divorced Spouse |

5,126 |

0.8% |

$652.8 |

|

Aged Widow(er) |

85,297 |

13.3% |

$1,709.1 |

|

Disabled Widow(er) |

3,440 |

0.5% |

$1,360.1 |

|

Widowed Mother and Father |

592 |

0.1% |

$1,875.7 |

|

Remarried Widow(er) |

2,936 |

0.5% |

$1,108.5 |

|

Divorced Widow(er) |

9,690 |

1.5% |

$1,113.3 |

|

Children |

8,339 |

1.3% |

$1,109.2 |

|

Partition Paymentsb |

1,841 |

0.3% |

$316.9 |

|

Total Benefits |

641,732c |

100.0% |

$1,636.8d |

Source: Railroad Retirement Board, Bureau of the Actuary, Quarterly Benefit Statistics, April-June 2018, Table 1, https://rrb.gov/sites/default/files/2018-09/stat_qbs0618.pdf.

Notes: Numbers may not add due to rounding.

a. Total number of benefits paid includes multiple benefits paid to individual beneficiaries. Benefits were paid to 512,045 beneficiaries.

b. The court-ordered partitioned portion of the Tier II, vested dual and supplemental benefit payments can be made to spouses and divorced spouses when the railroad worker is deceased or not otherwise entitled to an annuity.

c. The total number of benefits does not include the number of dependent parents' annuities, which was 21 in current payment status.

Railroad Unemployment and Sickness Benefits

Railroad workers may qualify for daily unemployment and sickness benefits under the Railroad Unemployment Insurance Act (RUIA).43 These monetary benefits are paid in addition to any paid leave or private insurance an employee may have. For sickness benefits, a worker must be unable to work because of illness or injury. Sickness benefits are distinct from disability benefits because they are intended to cover a finite, temporary period of time. Workers may not earn any money while receiving unemployment or sickness benefits.

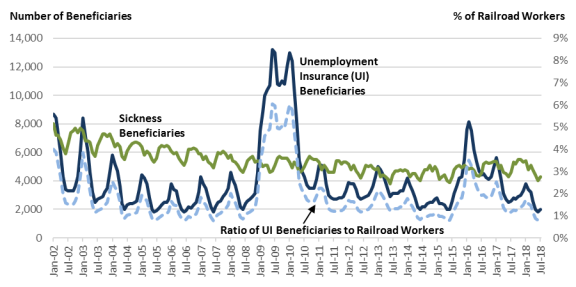

Figure 3 displays the monthly number of beneficiaries with unemployment and sickness benefits from January 2002 to July 2018, respectively. Although the number of sickness beneficiaries stayed relatively stable over time, the number of unemployment insurance beneficiaries increased significantly during and after the most recent economic recession from 2007 to 2009.

|

|

Source: Railroad Retirement Board, Bureau of the Actuary, Benefits and Beneficiaries, January 2002 to July 2018, Table 2. |

Financing

Railroad unemployment and sickness benefits are financed solely by railroad employers' payroll taxes, based on the taxable earnings of their employees. Employers' tax rates depend on the past rates of unemployment and employees' sickness claims. For calendar year 2018, the employer tax rate ranges from 2.2% to 12.0% on the first $1,560 of each employee's monthly earnings.

The payroll tax proceeds not needed immediately for unemployment and sickness insurance benefits or operating expenses are deposited in the Railroad Unemployment Insurance Account maintained by the Treasury. This account, together with similar unemployment insurance accounts for each state, forms a Federal Unemployment Insurance Trust Fund whose deposits are invested in U.S. government securities, and the Railroad Unemployment Insurance Account receives interest based on these deposits. During FY2017, payroll tax contributions from railroad employers totaled $126.4 million and interest income was about $4 million.

The RUIA provides for employers to pay a surcharge if the Railroad Unemployment Insurance Account falls below an indexed threshold amount.44 The surcharge is added to the employer's tax rate. However, the total tax rate plus the surcharge cannot exceed the maximum rate of 12.0%, unless the surcharge is 3.5%, in which case the maximum tax rate is increased to 12.5%. From 2004 through 2010, the surcharge was 1.5%. The surcharge in 2011 was 2.5% and 1.5% in 2012 with no surcharges in 2013 or 2014. The surcharge in 2018 was 1.5%, the same as the level in the past three years.

Eligibility and Benefits

Eligibility for railroad unemployment and sickness benefits is based on recent railroad service and earnings. The annual benefit year begins on July 1. Eligibility is based on work in the prior year, or the base year. To qualify in the benefit year beginning July 1, 2018, railroad workers must have base year earnings of $3,862.50 in calendar year 2017, counting no more than $1,545 per month.45 New railroad workers must also have at least five months of covered railroad work in the base year. To receive unemployment benefits, a worker must be ready, willing, and able to work.

The maximum daily unemployment and sickness benefit payable in the benefit year that began July 1, 2018, is $77, and the maximum benefit for a biweekly claim is $770. However, due to sequestration pursuant to the Budget Control Act of 2011 (P.L. 112-25, as amended), the maximum daily benefit of $77 is reduced by 6.2% to $72.23 and the maximum biweekly benefit is reduced by 6.2% to $722.26 through September 30, 2019.46 Railroad workers receive these benefits only to the extent that they are higher than other benefits they receive under the RRA, the Social Security Act, or certain other public programs, including workers compensation.

Unemployment and sickness beneficiaries may receive normal benefits for up to 26 weeks in a benefit year or until the benefits they receive equal their creditable earnings in the base year if sooner.47 Employees with at least 10 years of covered railroad service may qualify for extended benefits for 13 weeks after they have exhausted normal benefits. Table 2 displays the number and average weekly amount of RUIA benefits paid in June 2018.

Workers who apply for unemployment benefits are automatically enrolled in a free job placement service operated by railroad employers and the RRB.48

|

Type of Benefits |

Number of Normal Benefits |

Number of Extended Benefits |

Average Weekly Benefit |

|

Unemployment |

2,863 |

573 |

$334.25 |

|

Sickness |

6,388 |

1515 |

$335.50 |

Source: Railroad Retirement Board, Bureau of the Actuary, Quarterly Benefit Statistics, April-June 2018, Table 3, https://rrb.gov/sites/default/files/2018-09/stat_qbs0618.pdf.