Figure 1. Assets Held by Selected Financial Institutions, 2018:Q2

Trillions of $

Source: Federal Reserve, Financial Stability Report, November 2018, Table 3

The Congressional Research Service (CRS) has created a series providing an introduction to various financial services issues in the 116th Congress. Click on any of the titles below to access an In Focus, a two-page briefing product on issues of active and ongoing interest to Congress.

The CRS authors are also available to answer questions from congressional clients, research policy issues, prepare confidential memoranda, and provide in-person briefings. Their contact information may be found in each In Focus.

As shown in Figure 1, financial activity can generally be divided into three broad categories—banking, securities markets, and insurance. The financial regulatory structure is more fragmented, involving multiple, overlapping regulators at the federal and state levels. Further, because institutions, markets, and products can be subject to various regulations, an activity may fall under the purview of multiple regulators.

|

Figure 1. Assets Held by Selected Financial Institutions, 2018:Q2 Trillions of $ |

|

|

Source: Federal Reserve, Financial Stability Report, November 2018, Table 3 |

See CRS In Focus IF11065, Introduction to Financial Services: The Regulatory Framework, by Marc Labonte.

Traditionally, banking involves accepting deposits from customers and making loans to businesses and households. Holding $19 trillion in assets, banks and credit unions play a central role in the financial system by connecting borrowers to savers and allocating capital across the economy. As a result, banking is vital to the health and growth of the U.S. economy. Yet banking is an inherently risky activity involving extending credit and taking on liabilities, and banking panics and failures can create devastating losses. Banking regulation is divided among multiple federal regulators, including the Federal Reserve, the nation's central bank.

See CRS In Focus IF10035, Introduction to Financial Services: Banking, by Raj Gnanarajah and David W. Perkins; and CRS In Focus IF10054, Introduction to Financial Services: The Federal Reserve, by Marc Labonte.

Insurance involves collecting premiums from and making payouts to policyholders triggered by a predetermined event. Holding $10.1 trillion in assets, the insurance industry is often separated into two parts: life and health insurance, which also includes annuity products, and property and casualty insurance, which includes most other lines of insurance, such as homeowner's insurance, automobile insurance, and various commercial lines of insurance purchased by businesses. Insurance is primarily regulated at the state level.

See CRS In Focus IF10043, Introduction to Financial Services: Insurance, by Baird Webel.

Capital markets involve issuing contracts that pledge to make payments from the issuer to the holder, and trading those contracts on markets. Contracts take the form of debt (bonds) that involve a borrower and creditor relationship, and equity (stocks) that involve an ownership relationship. Securities firms hold $26.5 trillion in assets. Federal securities laws overseen by the Securities and Exchange Commission are broadly aimed at protecting investors; maintaining fair, orderly, and efficient markets; and facilitating capital formation.

See CRS In Focus IF10032, Introduction to Financial Services: The Securities and Exchange Commission (SEC), by Gary Shorter; and CRS In Focus IF11062, Introduction to Financial Services: Capital Markets, by Eva Su.

A derivative is a type of security that derives its value from some underlying asset at a designated point in time. For example, the derivative may be tied to a physical commodity (such as cattle, wheat, or oil), a stock index, or an interest rate. Derivatives come in several different forms, including futures, options, and swaps. Derivatives are primarily regulated by the Commodity Futures Trading Commission.

See CRS In Focus IF10117, Introduction to Financial Services: Derivatives, by Rena S. Miller.

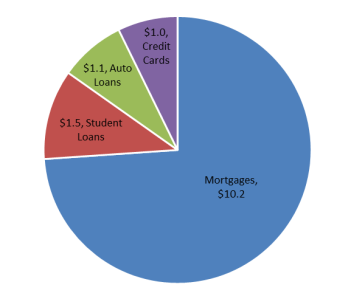

As Figure 2 illustrates, trillions of dollars of credit is extended to households from banks and nonbank financial institutions. The Consumer Financial Protection Bureau (CFPB) was established by the Dodd-Frank Act (P.L. 111-203) to implement and enforce federal consumer financial protection law while ensuring consumers can access credit. The CFPB also aims to ensure consumer financial markets are fair, transparent, and competitive.

|

Figure 2. Selected Household Credit, 2018:Q2 Trillions of $ |

|

|

Source: Federal Reserve, Financial Stability Report, November 2018, Table 2 |

See CRS In Focus IF10031, Introduction to Financial Services: The Bureau of Consumer Financial Protection (CFPB), by Cheryl R. Cooper and David H. Carpenter.

A mortgage is a loan that uses real estate as collateral. The U.S. residential mortgage market constitutes the largest share of household credit, with approximately $10 trillion in debt outstanding. The mortgage market has two major components—the primary market in which mortgages are originated and the secondary market in which existing mortgages are bought and sold. Certain government-sponsored enterprises play a crucial role in the mortgage market and are regulated by the Federal Housing Finance Agency.

See CRS In Focus IF10126, Introduction to Financial Services: The Housing Finance System, by Katie Jones and N. Eric Weiss.

Systemic risk is a risk posed by financial firms, market structure, or activities that could lead to a breakdown in financial stability, such as the 2007 to 2009 financial crisis. The Financial Stability Oversight Council, chaired by the Treasury Secretary, was created by the Dodd-Frank Act to identify and respond to risks to financial stability.

See CRS In Focus IF10700, Introduction to Financial Services: Systemic Risk, by Marc Labonte.

Anti-money laundering regulation refers to efforts to prevent criminal exploitation of financial systems to conceal the location, ownership, source, nature, or control of illicit proceeds. According to the United Nations, some $300 billion in illicit transnational crime proceeds (excluding tax evasion) likely flowed through the U.S. financial system in 2010.

See CRS In Focus IF11064, Introduction to Financial Services: Anti-Money Laundering Regulation, by Rena S. Miller and Liana W. Rosen.

Accounting is considered the language of finance. A common set of principles and rules help establish accounting standards. Accountants who audit financial statements (auditors) also adhere to a common set of audit principles and rules to independently examine financial statements. Accounting and auditing standards in the United States are promulgated and regulated by various federal, state, and self-regulatory organizations (SROs). Congress has allowed financial accounting and auditing practitioners to remain largely self-regulated, while retaining oversight responsibility.

See CRS In Focus IF10701, Introduction to Financial Services: Accounting and Auditing Regulatory Structure, U.S. and International, by Raj Gnanarajah.