Introduction

The employer shared responsibility provisions (ESRP) of the Patient Protection and Affordable Care Act (ACA; P.L. 111-148, as amended) generally incentivize large employers to offer adequate and affordable health insurance coverage to their full-time employees and their full-time employees' dependents. If an applicable large employer fails to offer health insurance or offers substandard coverage to its employees, that employer may be subject to a penalty.

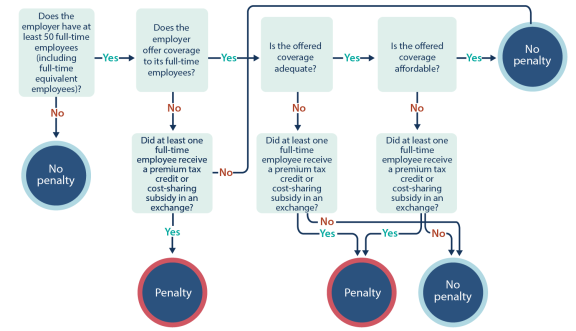

As shown in Figure 1, all common-law employers, including government entities (such as federal, state, local, or Indian tribal government entities), are responsible for annually determining whether they are considered an applicable large employer (ALE). An ALE is generally an employer that has at least 50 full-time employees (including full-time equivalent employees, which are a representation of non-full-time employees as full-time employees).

If an employer qualifies as an ALE in a given year, then it will be subject to the ESRP in the subsequent year. An employer subject to the ESRP is incentivized to offer adequate, affordable health insurance coverage to their full-time employees (and their full-time employees' dependents). If an employer does not offer such coverage, the employer risks being subject to a penalty if at least one full-time employee receives a premium tax credit or cost-sharing subsidy through a health insurance exchange (exchange).1

If an employer does not qualify as an ALE, then it will not be subject to the ESRP, nor will it be at risk of a penalty for failing to offer health insurance coverage to its full-time employees.

This report begins with an overview of how employers determine whether they are considered an ALE before outlining the ESRP. It then discusses the two types of ESRP penalties and introduces administrative aspects of the ESRP. This report also includes two appendixes that contain definitions of terms as used in the report and a summary of how various worker classifications are considered for ALE determinations and under the ESRP (Appendix A and Appendix B).

Employers Subject to the Employer Shared Responsibility Provisions

All common-law employers, including government entities (such as federal, state, local, or Indian tribal government entities) and nonprofit organizations that are exempt from federal income taxes, can be subject to the ESRP.

For an employer to be subject to the ESRP, the employer must be considered an ALE, which is an employer that has an average of at least 50 full-time employees (including full-time equivalent employees) on business days during the preceding calendar year.2 If an employer does not qualify as an ALE, then it will not be subject to the ESRP, nor will it be at risk of a penalty for failing to offer appropriate health insurance coverage to its full-time employees.

Applicable Large Employer Determination

To determine whether an employer is considered an ALE, an employer calculates its workforce size by averaging the combination of all full-time employees and full-time equivalent employees for each month of the previous calendar year.3 Generally, if this average is at least 50, the employer is considered an ALE and is subject to the ESRP.

ALE determinations are made on an annual basis. Once qualified, an employer is subject to the ESRP for the subsequent calendar year. For example, if an employer employed at least 50 full-time employees in 2018, it would be considered an ALE subject to the ESRP in 2019.4

In instances where multiple businesses have a certain level of shared ownership, these businesses must be aggregated into a controlled group before determining whether the group collectively is considered an ALE.5 This aggregation occurs even if the businesses are separate legal entities. If the controlled group is collectively determined to be an ALE (i.e., an aggregated ALE group), each subcomponent of that controlled group is considered an ALE, regardless of the total number of employees at that entity, and is subject to the ESRP.

Although both full-time employees and full-time equivalent employees are used to determine whether an employer is considered an ALE, ALEs are responsible for providing health care coverage only to full-time employees. In addition, when applicable, ALEs do not include full-time equivalent employees when calculating an ESRP penalty. These topics are discussed further in the sections on "Employer Shared Responsibility Provisions" and "Penalty Determination," below.

Full-Time Employees (Monthly Measurement Method)

An employee is generally considered full-time for each month that the individual works an average of at least 30 hours per week or 130 total hours in that month.6 If an employee is found to be a full-time employee for a specific month, that employee is counted as a full-time employee for each business day in that month. This method is referred to as the monthly measurement method.7

Part-Time Employees

Hours worked by part-time employees (i.e., not full-time employees) are converted into full-time equivalent employees and included in the determination of whether an employer is an ALE. To do so, all hours worked by part-time employees during a month are added up and divided by 120 to get the number of full-time equivalent workers in that month.8

|

Example: Full-Time Equivalent Calculation A firm has 35 full-time employees (each averaging 30 or more hours per week or 130 hours per month). In addition, the firm has 20 part-time employees who each work 24 hours per week (96 hours per month). Because of the hours worked, these part-time employees would be treated as equivalent to 16 full-time employees for the month based on the following calculation: 20 part-time employees x 96 hours = 1,920 total hours worked by part-time employees 1,920 ÷ 120 = 16 full-time employees The 16 full-time employees added to the 35 full-time employees will result in the firm being considered an applicable large employer based on the number of part-time hours worked: 16 full-time employees + 35 full-time employees = 51 full-time employees Because 51 > 50, the employer is considered to be a large employer under the employer penalty provisions in the Patient Protection and Affordable Care Act (ACA; P.L. 111-148, as amended). |

Seasonal Workers

Seasonal workers are individuals who perform any labor "on a seasonal basis where, ordinarily, the employment pertains to or is of the kind exclusively performed at certain seasons or periods of the year and which, from its nature, may not be continuous or carried on throughout the year."9

All hours worked by seasonal workers are summed and converted to full-time employees (including full-time equivalent employees) and included in the determination of whether an employer is an ALE unless two conditions are met. If (1) an employer would be considered a large employer for fewer than 120 days in a calendar year and (2) seasonal workers are what push the employer's full-time employee calculation to exceed 50 full-time employees for those days, the employer may effectively exclude the hours worked by seasonal workers and therefore would not be considered an ALE.10

The definition of seasonal workers is different from the definition of seasonal employees, which is used to determine which employees are considered full-time employees under ESRP. The differences in definitions are summarized in Table 5.

Other Types of Workers

As shown in Table 1, there are various types of workers other than full-time employees, part-time employees, and seasonal workers whose hours are counted using special rules for ALE determination (and, where applicable, under the ESRP). These rules tend to address discrepancies due to some individuals not being compensated on an hourly basis or having other characteristics that differentiate them from full-time employees, part-time employees, and seasonal workers. Definitions of these other types of workers and explanations of their associated rules are summarized in Appendix B.

Table 1. Hours of Service Counted Using Special Rules

(for purposes of applicable large employer determinations and the employer shared responsibility provisions)

|

Worker Classifications |

|

|

Volunteers |

Student Workers |

|

Employees with Difficult-to-Track Hours |

Religious Order Members with Vows of Poverty |

|

Employees with Layover or On-Call Hours |

Employees of Franchises |

|

Adjunct Faculty |

Independent Contractors |

|

Employees Covered by TRICARE or Veterans Affairs (VA) Coverage |

Temporary Staffing Firm Workers |

Source: CRS analysis of 26 U.S.C. §4980H; 79 Federal Register 8550; 29 C.F.R. §500.20(s)(1), as referenced by 26 U.S.C. §4980(H)(c)(2)(B)(ii); and 29 C.F.R. §54.4980H-1(38).

Notes: For category definitions and special rule explanations, please reference Appendix B of this report.

Employer Shared Responsibility Provisions

Once an employer is determined to be an ALE, the employer must either satisfy the ESRP by offering affordable and adequate health insurance coverage to its full-time employees (and their dependents) or risk being subject to a penalty payment if at least one full-time employee receives a premium tax credit through an exchange.11

For purposes of the ESRP, ALEs must identify which of their employees are considered full-time employees and need to be offered health insurance in order to not risk being subject to a penalty. To do this, employers may use the same full-time-employee conclusions from the ALE determination, may redetermine which employees are considered full-time using a different measurement method (see the "Look-Back Measurement Method," below), or, in certain instances, may use a combination of both methods.

When an ALE is part of an aggregated ALE group, each subcomponent (ALE member) is responsible for identifying which employees are considered full-time under the ESRP, deciding whether to offer health insurance coverage to its full-time employees, and if applicable, paying any specific ESRP penalty amount.12

If full-time employees were not offered appropriate health insurance by their employer (as defined in "Health Insurance Coverage Requirements for Employer Plans") and did not receive a premium tax credit through an exchange, the employer would not be subject to a penalty.13

ALEs are not at risk of a penalty for failing to offer health insurance coverage to non-full-time employees, such as part-time employees.

Health Insurance Coverage Requirements for Employer Plans

If an ALE decides to offer health insurance to its full-time employees (and their dependents), to satisfy the ESRP and not risk a penalty, this health insurance must be considered adequate and affordable.14

A plan is considered adequate when the health plan has an actuarial value of at least 60%.15 Actuarial value is a summary measure of a plan's generosity, expressed as the percentage of total medical expenses that are estimated to be paid by the issuer for a standard population's set of allowed charges. In other words, it reflects the relative share of cost sharing that may be imposed. The actuarial value calculation for determining minimum value includes the employer contributions to health savings accounts and health reimbursement accounts that are part of a high-deductible health plan.

A plan is considered affordable when an individual's required contribution toward the plan premium for self-only coverage does not exceed 9.56% of the employee's W-2 wages in 2018, and 9.86% of the employee's W-2 wages in 2019.16 (This percentage is annually adjusted.) The definition of affordable—for both an individual employee and a family—is based solely on the cost of individual-only coverage and does not take into consideration the often significantly higher cost of a family plan.17

Optional Full-Time Employee Redetermination

For purposes of identifying which employees are considered full-time under the ESRP and therefore would need to be offered health insurance coverage to prevent the risk of a penalty, an ALE may redetermine its total number of full-time employees using a different methodology (see the "Look-Back Measurement Method," below) instead of the monthly measurement method, which is the methodology used to determine whether an employer is considered an ALE.18 As a result, employers may have different full-time employee counts for purposes of determining (1) whether an employer is considered an ALE and (2) which employees need to be offered health insurance coverage to prevent an ESRP penalty (Table 2).

|

Determination |

Monthly Measurement |

Look-Back Measurement |

|

Whether an Employer Is an Applicable Large Employer |

Allowed |

Not Allowed |

|

Whether an Employee Is Considered Full-Time Under Employer Shared Responsibility Provisions |

Allowed |

Allowed |

Source: CRS analysis of 26 C.F.R. §54.4980H-3(d)(1)(v), 26 C.F.R. §54.4980H-3(d)(3)(v), and 26 U.S.C. §54.4980H-3(e).

Combining Methodologies

Employers may use a combination of the two methodologies in their redetermination. Specifically, employers may divide their employees into categories (as identified in Table 3) and may use either full-time employee measurement method (monthly or look-back) for each of these categories.19 However, employers may not use the look-back measurement method for variable-hour and seasonal employees if they use the monthly measurement method for employees with predictable schedules.20 Since employers initially use reasonable expectations to decide whether a new employee is considered a variable hour, seasonal, or full-time employee, the aforementioned structure would provide employers with the ability to move employees between measurement methods based entirely on the employer's expectations, which the Treasury Department and the Internal Revenue Service (IRS) deem as "an excessive level of subjectivity."21

Table 3. Employee Categories with Full-Time Employee Measurement Flexibilities

(employers may choose either monthly or look-back measurement method under the employer shared responsibility provisions)

|

Employee Categories |

|

|

Collectively Bargained Employees |

New Variable-Hour Employees |

|

Non-collectively Bargained Employees |

New Seasonal Employees |

|

Each Group of Collectively Bargained Employees Covered by a Separate Collective Bargaining Agreement |

Employees Whose Primary Places of Employment Are in Different States |

|

Salaried Employees |

New Part-Time Employees |

|

Hourly Employees |

|

Source: CRS analysis of 26 C.F.R. §54.4980H-3(d)(1)(v); 26 C.F.R. §54.4980H-3(d)(3)(v); 26 U.S.C. §54.4980H-3(e); and Internal Revenue Service (IRS), Internal Revenue Bulletin: 2014-9, Notice 2014-9, February 24, 2014, at http://www.irs.gov/irb/2014-9_IRB/ar05.html.

Notes: Monthly measurement method: Employers determine whether an employee is considered a full-time employee based off the total hours worked per week or averaged over a month. Look-back measurement method: Employers determine whether an employee is considered a full-time employee over the course of three stages: (1) the measurement period, (2) the administrative period, and (3) the stability period. Employers may not use the look-back measurement method for variable-hour and seasonal employees if they use the monthly measurement method for employees with predictable schedules.

Look-Back Measurement Method

Under the look-back measurement method, ALEs determine whether or not an employee is considered a full-time employee under the ESRP over the course of three stages:22

- 1. Measurement Period. The measurement period is the amount of time employers may measure, on average, whether employees are full-time employees.

- 2. Administrative Period. The administrative period is the amount of time an employer may take to identify and enroll full-time employees into health insurance coverage.

- 3. Stability Period. The stability period is the amount of time an employer may be subject to a penalty for not offering health insurance coverage to employees found to be full time during the measurement period.

Employers may determine the duration of these periods, which can vary between three groupings of workers (ongoing employees, new full-time employees, and new variable-hour and seasonal employees), within the limits outlined in Table 4.23 Within each of these groupings, employers also may apply different period lengths to each of the subcategories of workers identified in Table 3. Period length does not need to be consistent across all of these subcategories of workers but must be consistent within each subcategory.

|

Measurement Period |

Administrative Period |

Stability Period |

|

|

Ongoing Employees |

Retrospective 3 to 12 month perioda |

Up to 90 days (may neither reduce nor lengthen the measurement or stability period—can overlap prior stability period) |

At least 6 months but cannot be shorter in duration than measurement period |

|

New Full-Time Employees |

Not applicable |

Up to 3 months to enroll after start date |

Not applicable |

|

New Variable-Hour and Seasonal Employees |

First 3 to 12 months after start dateb |

Up to 90 days (measurement period and administrative period cannot exceed 13 months)c |

3 to 12 months but cannot be longer than measurement period |

Source: CRS interpretation of IRS, Internal Revenue Bulletin: 2014-9, Notice 2014-9, February 24, 2014, at http://www.irs.gov/irb/2014-9_IRB/ar05.html.

Notes: Measurement period is defined as the amount of time employers may measure (on average) whether employees are full time. Administrative period is defined as the amount of time employers can identify and enroll full-time employees in health insurance coverage. Stability period is the period in which an employer may be subject to an ESRP penalty for not providing health insurance coverage to employees found to be full-time employees during the measurement period. Full time is defined as having worked, on average, at least 30 hours per week or having 130 hours of service in the month.

a. For ongoing employees, this is referred to as the standard measurement period.

b. For new employees, this is referred to as the initial measurement period.

c. The initial measurement and administrative periods cannot last beyond the final day of the first calendar month beginning on or after the first anniversary of the employee's hiring (approximately 13 months).

Seasonal Employee Recalculation

As compared to ALE determinations, employers treat seasonal employees' work hours differently when identifying whether an employee is considered full time under the ESRP. This difference stems from distinctions in terminology in ESRP regulations, which use different definitions for seasonal workers and seasonal employees.

Seasonal workers are used to calculate whether an employer is an ALE. Although these workers are defined in regulations as labor performing at certain seasons or periods of the year, they effectively affect the ALE determination only when they are employed for more than 120 days (approximately four months).24

Seasonal employees are defined in regulations as employees hired into a position of six months or less. This term is used to determine whether an individual is considered a full-time employee under the ESRP (i.e., must be offered health insurance coverage to avoid a penalty and would be included in any applicable penalty calculation).25 In practice, regulations allow employers to use the "Look-Back Measurement Method" to calculate the full-time status of seasonal employees based on a 12-month measurement period. Because these individuals, by definition, usually work fewer than six months per year in a position, firms using the look-back measurement method may effectively exclude seasonal workers from being considered full-time workers under the ESRP (even if they were considered full-time employees for the ALE determination).

|

Term |

Definition |

Application |

Source |

|

Seasonal Worker |

Labor performed on a seasonal basis where, ordinarily, the employment pertains to or is of the kind exclusively performed at certain seasons or periods of the year and which, from its nature, may not be continuous or carried on throughout the year. |

Applicable Large Employer Determination |

29 C.F.R. §500.20(s)(1), as referenced by 26 U.S.C. §4980H(c)(2)(B)(ii) |

|

Seasonal Employee |

An employee who is hired into a position for which the customary annual employment is six months or less. |

Employer Shared Responsibility Provisions and Potential Penalty Calculation |

26 C.F.R. §54.4980H-1(38) |

Source: CRS analysis of 26 U.S.C. §4980H, 29 C.F.R. §500.20(s)(1), and 29 C.F.R. §54.4980H-1(38).

Notes: Seasonal workers are excluded from ALE determinations if (1) an employer would be considered a large employer for fewer than 120 days in a calendar year (approximately four months), and (2) seasonal workers are what push the employer's full-time employee calculation above 50 full-time employees for those days.

Applicable Large Employer Reporting

ALEs with full-time employees are required to report various types of information to the IRS and to their employees after the conclusion of every calendar year.26

ALEs are responsible for annually reporting two forms to the IRS: Form 1094-C, Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns, and Form 1095-C, Employer-Provided Health Insurance Offer and Coverage. These forms contain summary information about the health care coverage that the employer offered, if at all, to each employee considered full time for at least one month in the previous year.27

Specifically, each ALE is responsible for submitting at least one Form 1094-C to the IRS. This form is used to report the employer's general information, whether the ALE is an aggregated ALE (and if so, any applicable ALE subcomponents), the total number of full-time employees in each month of the previous year, whether the employer offered minimum essential coverage to its full-time employees, and the total number of all employees (i.e., full-time and non-full-time employees) in each month of the previous year.28

In addition, each ALE must submit to the IRS one Form 1095-C for each employee who was considered full time for any month of the previous calendar year.29 Form 1095-C is used to report employee personal information; employer general information; if and to whom (e.g., employee only or employee and dependents) the employer offered coverage in each month of the previous year; the employee's share of the monthly cost for the lowest-cost, self-only minimum essential coverage offered to the employee; and, if applicable, the months the employee and potential dependents were covered by an employer's self-insurance coverage.30

Generally, employers must submit these forms to the IRS by February 28 of the subsequent year if paper filed or by March 31 of the subsequent year if electronically filed.31 Employers that have to file more than 250 Form 1094-C or Form 1095-C documents often must file electronically, as consistent with other tax information reporting.32 If an ALE fails to file a correct calendar year 2018 form in 2019, it may be subject to a $270 per-return penalty, with a maximum penalty amount of $3.2755 million.33

ALEs also must provide their full-time employees with a written statement that contains the name and contact information of the ALE and the same information provided to the IRS.34 ALEs may elect to meet this requirement by providing each employee with a copy of his or her specific Form 1095-C that the ALE submitted to the IRS.

Each full-time employee must receive this information by January 31 of the subsequent year.35 If an ALE fails to provide a correct calendar year 2018 statement to a full-time employee in 2019, the ALE may be subject to a $270 per-statement penalty, with a maximum penalty amount of $3.2755 million.36

If an employer intentionally disregards the reporting requirements, the per-return penalty and maximum penalty amounts may be increased. Conversely, penalty amounts may be waived if an ALE fails to report due to reasonable cause.37

Penalty Determination and Notification

ALEs are potentially subject to an ESRP assessment payment if at least one full-time employee receives a premium tax credit through an exchange.38 An individual may be eligible for a premium tax credit if the individual's employer does not offer health insurance coverage or offers insurance that is either inadequate or unaffordable.39 Therefore, if an ALE offered adequate and affordable coverage to every full-time employee (and his or her dependents), the ALE would not be subject to an ESRP penalty.40

ESRP penalties apply to all applicable common-law employers, including government entities (such as federal, state, local, or Indian tribal government entities) and nonprofit organizations, even if the employers are exempt from federal income taxes.

Penalty Determination

- An ALE is assessed a penalty for each month that the ALE was in violation of the ESRP. If an ALE is subject to an ESRP penalty, the penalty amount is determined based on one of two formulas; the applicable formula depends on the number of full-time employees that received a health insurance coverage offer, if at all.

- Both penalties are indexed by a premium adjustment percentage each calendar year.41

Penalty for Applicable Large Employers Offering Health Insurance Coverage to at Least 95% of Full-Time Employees

If, for 2018, an ALE was subject to an ESRP penalty and offered health insurance to more than 95% of its full-time employees (and their dependents), the monthly penalty amount is the lesser of the following:42

- the number of full-time employees who received a premium credit multiplied by one-twelfth of $3,480 for any applicable month, or

- the total number of the firm's full-time employees minus 30, multiplied by one-twelfth of $2,320 for any applicable month.43

Penalty for Applicable Large Employers Offering Health Insurance Coverage to Less Than 95% of Full-Time Employees

If, for 2018, an ALE was subject to an ESRP penalty and offered health insurance coverage to less than 95% of its full-time employees (and their dependents), the monthly penalty assessed to an ALE is equal to the number of its full-time employees minus 30 multiplied by one-twelfth of $2,320 for any applicable month.44

Applicable Large Employer Notification

ALEs that are at risk of a potential ESRP penalty will receive two notifications: (1) by an exchange, when an employee is deemed eligible for advanced payments of the premium tax credit and enrolled in a qualified health plan through an exchange, and, (2) by the IRS, after the conclusion of the tax year.

Employer Notice from an Exchange

Exchanges must notify an employer within a "reasonable timeframe" that an employee was deemed eligible for advance payments of the premium tax credit and enrolled in a qualified health plan through the exchange.45 All exchanges, state-based and federally facilitated, are required to provide this notification.

Employers may appeal the exchange notification, though this notification does not determine or indicate a potential ESRP liability.46

Employer Notice from the IRS

Given the construction of the ESRP penalty, an employer will not be contacted by the IRS until after the employer's and all employees' tax returns have been filed. As part of its determination of whether an employer has an ESRP liability, the IRS notifies an ALE if one or more employees were allowed or received a premium tax credit through an exchange for one or more months during a year.47 Any IRS notification also will contain a proposed responsibility penalty amount and a corresponding explanation table.48

Employers generally must respond to the IRS within 30 days of receiving the IRS notification either agreeing with or appealing the computation.49 After correspondence between the IRS and the ALE has concluded, the IRS will provide a notice to the employer reflecting the final penalty amount and will provide payment options.50

Employer Shared Responsibility Provision Implementation

As enacted, the ESRP were supposed to take effect in 2014.51 However, the IRS provided transition relief in 2014 and did not enforce the ESRP or any associated penalties for that year. The IRS enforced a limited rollout of the provisions in 2015, generally applying the ESRP to employers with at least 100 full-time employees (including full-time equivalent employees). In 2016, the IRS further expanded enforcement to include nearly every business as required by law, except for certain specific circumstances.52 The ESRP were enforced on all ALEs beginning in 2017.

Although 2015 was the first year in which the provisions were enforced, ALEs did not receive a notification from federally facilitated exchanges during that year because the federally facilitated exchanges' employer notification program was not phased in until 2016.53 With respect to the IRS notification, ALEs began receiving a notification about potential penalties for tax year 2015 in November 2017. By January 2, 2018, the IRS had notified only 3,820 of 33,080 ALEs identified as being potentially subject to a penalty for tax year 2015.54

In 2017, an audit by the Treasury's Inspector General for Tax Administration found that the delay in IRS notifications resulted from some of the IRS's ESRP compliance processes either not working as intended or being delayed, not initiated, or canceled. The audit also found that as of March 21, 2018, the IRS still was unable to process paper information returns promptly and accurately.55

Appendix A. Definitions as Used Under the Employer Shared Responsibility Provisions

|

Term |

Definition |

Source |

|

Adequate |

A health insurance plan in which the health plan pays for at least 60%, on average, of covered health care expenses. |

26 U.S.C. §36B(c)(2)(C)(ii), as referenced by 26 C.F.R. §54.4980H-1(a)(28) |

|

Administrative Period |

Under the look-back measurement method, the term administrative period means an optional period, selected by an applicable large employer (ALE) member, of no longer than 90 days beginning immediately following the end of a measurement period and ending immediately before the start of the associated stability period. The administrative period also includes the period between a new employee's start date and the beginning of the initial measurement period, if the initial measurement period does not begin on the employee's start date. |

26 C.F.R. §54.4980H-1(a)(1) |

|

Affordable |

A health insurance plan in which an individual's required contribution toward the plan premium for self-only coverage does not exceed 9.56% of the employee's W-2 wages in 2018, and 9.86% of the employee's W-2 wages in 2019. This percentage is annually adjusted. |

26 C.F.R. §54.4980H-4(b)(1) |

|

Aggregated Applicable Large Employer Group |

A group of related entities (controlled group) that collectively has been determined to be an ALE. |

26 U.S.C. §4980H(c)(2)(C)(i) |

|

Applicable Large Employer |

An employer that employed an average of at least 50 full-time employees (including full-time equivalent employees) on business days during the preceding calendar year. |

26 U.S.C. §4980H(c)(2)(A) |

|

Applicable Large Employer Member |

An employer that is part of an aggregated ALE group. |

26 C.F.R. §54.4980H-1(a)(5) |

|

Controlled Group |

A grouping of entities that are treated as one unit because they are entirely or substantially owned by one individual or entity. |

26 U.S.C. §414(b), (c), (m), and (o) |

|

Dependent |

An employee's child who is younger than 26 years of age. Spouses are not considered dependents. |

26 C.F.R. §54.4980H-1(a)(12) |

|

Employee |

As defined under Internal Revenue Service (IRS) common-law rules, an employee is any individual who performs services for an employer that has the right to tell the individual what to do and how, when, and where to do the job. |

26 C.F.R. §31.3401(c)-1(a), as referenced by 26 C.F.R. §54.4980H-1(15) |

|

Employer |

As defined under IRS common-law rules, an employer is any person for whom an individual performs or performed any service, of whatever nature, as the employee of such person. The employer has the right to control and direct the individual who performs the services, including the means by which the result is accomplished. Under the ESRP, this definition includes government entities (such as federal, state, local, or Indian tribal government entities) and nonprofit organizations that are exempt from federal income taxes. |

26 C.F.R. §31.3121(d)-1(c), as referenced by 26 C.F.R. §54.4980H-1(16) |

|

Employer Shared Responsibility Provisions |

Generally require that employers with at least 50 full-time employees either offer health insurance coverage to their full-time employees (and full-time employees' dependents) or potentially make an assessment payment to the IRS. |

26 U.S.C. §4980H |

|

Employer Shared Responsibility Penalty |

A penalty an ALE must pay for failing to offer adequate and affordable health insurance coverage to its full-time employees and having at least one full-time employee receive a premium tax credit or cost-sharing reduction through a health insurance exchange. |

26 U.S.C. §4980H(a)(b) |

|

Full-Time Employee |

An employee who works, on average, at least 30 hours per week or 130 total hours in a month. |

26 U.S.C. §4980H(c)(4) |

|

Full-Time Equivalent Employees |

A representation of non-full-time employees as full-time employees for purposes of determining whether an employer is considered an ALE. Full-time equivalents are calculated by adding the total number of hours worked by part-time employees during a month and dividing by 120. |

26 C.F.R. §54.4980H-1(a)(22) |

|

Look-Back Measurement Method |

Employers determine whether an employee is considered a full-time employee over the course of three stages: (1) the measurement period, (2) the administrative period, and (3) the stability period. May be used only to determine which employees are considered full-time under the ESRP. |

26 C.F.R. §54.4980H-3(d) |

|

Measurement Period |

Under the look-back measurement method, the amount of time employers may measure (on average) whether employees are full time. |

26 C.F.R. §54.4980H-1(a)(25) |

|

Monthly Measurement Method |

A method by which employers determine whether an employee is considered a full-time employee for each month based off of the total hours worked per week or averaged over a month. |

26 C.F.R. §54.4980H-3(c) |

|

Part-Time Employee |

An employee who works, on average, less than 30 hours per week or 130 total hours in a month. |

26 C.F.R. §54.4980H-1(a)(32) |

|

Reasonable Cause |

With respect to waiving ESRP penalties, an ALE can show reasonable cause by demonstrating that either significant mitigating factors or a failure beyond the filer's control prevented adherence to a reporting requirement. |

26 C.F.R. §301.6724-1, as referenced by 26 C.F.R. §1.6055-1(h)(1) |

|

Reasonable Expectation |

With respect to determining whether a new employee is considered full time or part time, these are expectations that are considered reasonable based upon the facts and circumstances at an employee's start date. |

26 C.F.R. §54.4980H-3(d)(2)(ii) |

|

Reasonable Method |

With respect to determining the total hours worked for certain worker classifications, these are methods that are considered reasonable based on the relevant facts and circumstances. |

79 Federal Register 8551 |

|

Seasonal Employee |

An employee who is hired into a position for which the customary annual employment is six months or less. This term is used to determine whether an employee is considered full time under the ESRP. |

26 C.F.R. §54.4980H-1(a)(38) |

|

Seasonal Worker |

Labor performed on a seasonal basis where, ordinarily, the employment pertains to or is of the kind exclusively performed at certain seasons or periods of the year and which, from its nature, may not be continuous or carried on throughout the year. This term is used to determine an employer's ALE status. |

29 C.F.R. §500.20(s)(1), as referenced by 26 U.S.C. §4980H(c)(2)(B)(ii) |

|

Stability Period |

Under the look-back measurement method, the amount of time an employer may be subject to an ESRP penalty for not providing health insurance coverage to employees found to be full time during a measurement period. |

26 C.F.R. §54.4980H-1(a)(45) |

Source: Congressional Research Service analysis of sources referenced in the table.

Appendix B. Employer Shared Responsibility Provisions Treatment of Different Types of Worker Classifications

|

Worker Classification |

Definition |

Applicable Large Employer Determination |

Employer Shared Responsibility Provisionsa |

|

Full-Time Employee |

An employee who works, on average, at least 30 hours per week or 130 total hours in a month. |

Employers count the number of full-time employees. |

Employers count the number of full-time employees. |

|

Part-Time Employee |

An employee who works, on average, less than 30 hours per week or 130 total hours in a month. |

Employers combine and count the number of full-time equivalent employees. |

Excluded. |

|

Seasonal Workers |

Labor performed on a seasonal basis where, ordinarily, the employment pertains to or is of the kind exclusively performed at certain seasons or periods of the year and which, from its nature, may not be continuous or carried on throughout the year. |

Employers count the number of full-time employees and/or combine and count the number of full-time equivalent employees.b |

Not Applicable.c |

|

Seasonal Employees |

An employee who is hired into a position for which the customary annual employment is six months or less. |

Not Applicable.c |

Employers count the number of full-time employees. |

|

Volunteers |

Individuals who do not receive and are not entitled to receive compensation for any performed work, including volunteers of government entities and 501(c) organizations who receive no more than nominal compensation (e.g., volunteer firefighters). |

Excluded. |

Excluded. |

|

Student Workers |

Workers who also are enrolled as students at an educational institution. |

Employers (including educational organizations) count the number of paid student full-time employees and/or combine and count the number of paid student full-time equivalent employees.d Unpaid interns, unpaid externs, and students in positions subsidized through the Federal Work-Study program (or equivalent) are excluded. |

Employers (including educational organizations) count the number of paid student full-time employees.d Unpaid interns, unpaid externs, and students in positions subsidized through the Federal Work-Study program (or equivalent) are excluded. |

|

Religious Order Members with Vows of Poverty |

Members of a religious order who are subject to a vow of poverty and perform tasks usually required of an active member of the order. |

Excluded. |

Excluded. |

|

Employees Covered by TRICARE or Veterans Affairs Coverage |

Individuals receiving care under the TRICARE program or individuals enrolled in and receiving coverage through Department of Veterans Affairs health care programs under 38 U.S.C. Chapters 17 and 18. |

Excluded. |

Employers count the number of full-time employees. |

|

Employees with Hours that Are Difficult to Identify or Track |

Employees whose hours of service are particularly challenging to identify or track or whose hours of service present special difficulties within the context of the final regulations' general rules (e.g., commissioned sales). |

Employers use a "reasonable method" to determine total hours worked before counting the number of full-time employees and/or combining and counting the number of full-time equivalent employees.e |

Employers use a "reasonable method" to determine total hours worked before counting the number of full-time employees. |

|

Adjunct Faculty |

Employees who traditionally are compensated based on the number of courses or credit hours assigned but who also perform work outside of the classroom (e.g., class preparation, grading exams). |

Employers use a "reasonable method" to determine total hours worked before counting the number of full-time employees and/or combining and counting the number of full-time equivalent employees.e |

Employers use a "reasonable method" to determine total hours worked before counting the number of full-time employees. |

|

Employees with Layover Hours or On-Call Hours |

Employees who may be directed by the employer to remain overnight between flights (layover hours) or remain available to work (on call). |

Employers use a "reasonable method" to determine total hours worked before counting the number of full-time employees and/or combining and counting the number of full-time equivalent employees.e |

Employers use a "reasonable method" to determine total hours worked before counting the number of full-time employees. |

|

Controlled Group Employees |

Employees of employers that have a certain level of common or related ownership (e.g., franchises). |

The ownership group (controlled group) aggregates and counts the number of full-time employees and/or the number of full-time equivalent employees from every applicable large employer member. |

Each applicable large employer member counts the number of its own full-time employees. |

|

Temporary Staffing Firm Employees |

Workers who are employed by an agency but are contracted out to work at another location on a temporary basis. |

Employing agencies count the number of full-time employees and/or combine and count the number of full-time equivalent employees. |

Employing agencies count the number of full-time employees. |

|

Independent Contractors |

Workers who control what will be done and how it will be done but whose payer dictates the desired result of the work. |

Excluded from employer determination. |

Excluded from employer determination. |

Source: Congressional Research Service analysis of 26 U.S.C. §4980H; 79 Federal Register 8550-8558, 8579; 29 C.F.R. §500.20(s)(1), as referenced by 26 U.S.C. §4980(H)(c)(2)(B)(ii); and 29 C.F.R. §54.4980H-1(38).

Notes: Full-time equivalents are calculated by adding the total number of hours worked by part-time employees during a month and dividing by 120. Controlled Group: A grouping of entities that are treated as one unit because they are entirely or substantially owned by one individual or entity. Applicable Large Employer Member: An employer that is part of a controlled group that collectively has been determined to be an applicable large employer.

a. Employer shared responsibility provisions apply only to applicable large employers and refer to full-time employee determinations for purposes of health insurance coverage provision and any applicable penalty amounts.

b. Seasonal workers are excluded from this determination if the employer's workforce exceeds 50 full-time employees for at most 120 days and the employees that cause this excess are seasonal workers.

c. Due to a difference in terminologies used in regulations (i.e. seasonal employee rather than seasonal worker), employers must treat seasonal employees' work hours differently when identifying whether an employee is considered full-time for purposes of receiving health insurance coverage and/or determining the penalty amount than when determining whether an employer is considered an applicable large employer.

d. Includes student employees who are entitled to payment in a capacity other than through the federal work study program (or equivalent).

e. A method is considered reasonable based on the relevant facts and circumstances.