Introduction

USAspending.gov, available to the public at http://www.usaspending.gov, is a government source for data on federal grants, contracts, loans, and other financial assistance. The website enables searching of federal awards from FY2008 to the present by state, congressional district (CD), county, and zip code. Grant awards include money the federal government commits for projects in states, local jurisdictions, regions, territories, and tribal reservations, as well as payments for eligible needs to help individuals and families. Contract awards refer to bids and agreements the federal government makes for specific goods and services.

USAspending.gov also provides tools for examining the broader picture of federal spending obligations by categories, such as budget function, agency, and object class. Budget function refers to the major purpose that the spending serves, such as Social Security, Medicare, and national defense. Object class refers to the type of item or service purchased by the federal government, such as grants, contracts, and personnel compensation and benefits.

For Congress, the ability to more accurately track these federal awards is necessary to better inform oversight of federal spending. In recent years, Congress has passed laws to create and improve systems used by government departments and agencies to report and input data on federal awards for contracts, grants, and other financial assistance.

- P.L. 109-282, the Federal Funding Accountability and Transparency Act of 2006 (FFATA), called for the creation of a database that became USAspending.gov. The publicly available database replaced data collection and annual reports issued for more than 30 years in the Census Bureau's Federal Aid to States (FAS) report and Consolidated Federal Funds Report (CFFR).1

- P.L. 111-5, the American Recovery and Reinvestment Act of 2009 (ARRA), required federal agencies awarding stimulus funding and state and local recipients of such funding to report spending back to the ARRA Recovery Board; this reporting also became a part of USAspending.gov.

- P.L. 113-101, the Digital Accountability and Transparency Act of 2014 (DATA Act), transferred responsibility for USAspending.gov from the Office of Management and Budget (OMB) to the Department of the Treasury and required that expenditures data be added to the federal agency obligations data already included in the USAspending.gov database. The DATA Act also required Treasury and OMB to develop government-wide data standardization to facilitate consolidating, automating, and simplifying reports on grant awards and contracts and to improve USAspending.gov underreporting and inconsistencies.

However, finding accurate and complete data on federal funds received by states and congressional districts continues to be challenging due to ongoing data quality problems identified by the Government Accountability Office (GAO) in June 2014.2 A GAO report released in November 2017 assessed the quality of data reported by agencies in May 2017 under new DATA Act standards. GAO identified issues and challenges with the completeness and accuracy of the data submitted, use of data elements, and disclosure of data limitations on what was, at the time, a beta version of the new USAspending.gov website.3 The beta version has since become the official site as of March 2018 and the previous version is no longer available. According to a note on the site, data quality and display improvements will be continually made on a rolling basis. Users of USAspending.gov should be aware that although search results may be useful for informing consideration of certain questions, these results may also be incomplete or contain inaccuracies.

USAspending.gov Background

Origins

FFATA required OMB to create a public database of all federal funds awarded to the final recipient level. The DATA Act followed eight years later and required the Department of the Treasury and OMB to develop government-wide data standardization to consolidate, automate, and simplify reports on grant awards and contracts to improve underreporting and inconsistencies as identified by GAO.4 These requirements in the DATA Act were intended to expand on the transparency efforts originally mandated by FFATA, specifically by

- disclosing direct agency expenditures and linking federal contract, loan, and grant spending information to federal agency programs;

- establishing government-wide data standards for financial data and providing consistent, reliable, and searchable data that are displayed accurately;

- simplifying reporting, streamlining reporting requirements, and reducing compliance costs, while improving transparency; and

- improving the quality of data submitted to USAspending.gov by holding agencies accountable.5

In addition, no later than four years after enactment (by spring 2018), Treasury and OMB must ensure that all information published on USAspending.gov conforms to government-wide data standards. OMB is also required to issue guidance so that all agencies can follow government-wide data standards when reporting on grantee and contractor awards.

Types and Timing of Data

The data in USAspending.gov are submitted by federal agencies and represent awards, including grants, contracts, loans, and other financial assistance (e.g., Medicare benefits, food stamps, unemployment benefits). USAspending.gov does not include data on actual spending by recipients. Federal agencies are required to submit reports on awards transactions within 30 days after transactions are implemented. There may be a longer lag-time with data from the Department of Defense, generally 90 days.

Site Features

USAspending.gov enables congressional staff and the public to search back to FY2008 for prime and subaward data by state, congressional district, and other jurisdictions. The site includes the following features:

- Advanced Award Search of prime and subaward data back to FY2008 allows filtering by award type, awarding agency, recipient, country, state, zip, county, CD, and other criteria. To identify where money is being spent, search on Place of Performance versus Recipient Location. Search results include awards that are active during the selected fiscal year, regardless of when the award initially started. Details on an individual award, including transaction history and subawards, may be viewed by clicking on the Award ID. The results list displayed can be downloaded at either the award or transaction level, along with additional details about each award, into a spreadsheet. The advanced search is currently being developed and improved on a rolling basis, so new features may have become available since the publication of this report.

- Spending Explorer enables "big picture" browsing of federal spending obligations and offers interactive data visualization by budget function, agency, and object class. With this tool, users can see the budget function breakdown by categories, such as Social Security, Medicare, and national defense; obligated amounts by agency; and obligations by object class categories, such as grants, contracts, and personnel compensation and benefits.

- Profiles Tab includes the following subtabs:

- Agencies features data on each agency's total budgetary resources, a dollar amount that has been obligated (or committed to be spent) against those budgetary resources, the breakdown of these obligations by object class, and the federal accounts through which the obligations are administered.

- Federal Accounts features a list of more than 2,000 federal accounts through which users can track spending obligations. Data in this section are presented visually through graphs and other infographics.

- States provides tables, interactive maps, and graphs showing a breakdown of a total awarded amount to each state back to FY2008. Breakdowns include totals by award type, county, and CD. Profiles also include top five rankings in various categories, such as awarding agencies and recipients.

- Recipients contains profiles of entities that have received federal awards in the form of contracts, grants, loans, or other financial assistance back to FY2008. Profiles include data on award trends over time and top five rankings in various categories.

- Download Center allows bulk exporting of large, pregenerated award data sets by agency, award type, and fiscal year through the Award Data Archive. The Custom Award Data page also allows downloading of large sets but provides additional filtering options.

Issues with Tracking Awards

In addition to the data quality problems in USAspending.gov mentioned earlier,6 the following issues should be taken into consideration.

Recipient Location Versus Place of Performance

As recipients of federal grant funding, state and local governments may provide services directly to beneficiaries. Alternatively, a state may act as a pass-through, redisbursing federal grant funding to localities using a formula or a competitive process7 through subgrants or subcontracts. Both federal grant and procurement awards thus may have a where awarded vs. where spent component that is not fully identified in grant or procurement records.

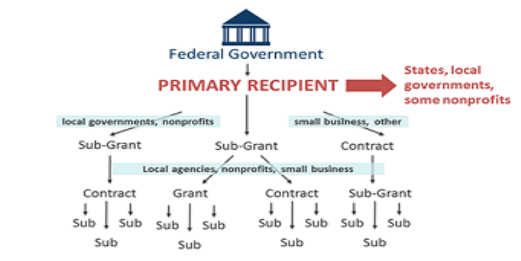

For example, most federal grant funding is awarded to states, which then subaward or subcontract to eligible recipients elsewhere in the state (see Figure 1). So, a project's place of performance (where the award is spent) may therefore differ from the initial recipient location (where the funding is awarded).

|

Figure 1. Examples of Federal Spending Streams Recipients at Multiple Levels |

|

|

Source: Jerry Brito, George Washington University, 2009; and the Congressional Research Service, 2016. |

In addition, a funding award may pass through multiple different jurisdictions (in different CDs) before reaching the final place of performance. For example,

- Federal grants may go first to the state (the state capital, in one CD), then be distributed to a city or county government (in one or more additional CDs), which then may pass the funds to an organization that spends the money in other CDs. A CD in which a state capital is located may appear to receive more federal funds than other CDs in the state, but searching USAspending.gov data by place of performance rather than recipient location would identify data by the project location.

- Procurement awards may be given to a corporation headquartered in one state (and one CD), but the company may spend the money manufacturing the purchased product at one or more of its manufacturing facilities in one or more additional states (and CDs).

Congressional District Data

The USAspending.gov advanced award search enables filtering by state and congressional district. When searching for CD data, note the following:

- For CD data, search USAspending.gov by place of performance rather than recipient location to identify awards by project location (see "Recipient Location Versus Place of Performance," above).

- Use caution when comparing CD data over time. During decennial redistricting, CD borders and numbers may change, but past data are not revised to account for redistricting. For example, comparing data from the 115th or 114th Congress with earlier data must take into account new district borders created by the 2010 decennial redistricting. Other geographic search options, such as by zip code or county, could be used to track funds within a CD, although borders may not exactly align.

- CDs that include state capitals will appear to receive more federal funds because states are prime recipients of federal block and formula grants. State Administering Agencies (SAAs) then pass through or subaward federal funding for projects throughout the state.

Other Data Sources

Federal Procurement Data System

The General Services Administration (GSA) maintains the Federal Procurement Data System–Next Generation (FPDS–NG) at https://www.fpds.gov/fpdsng_cms/index.php/en/, which contains statistical information on federal contracts. The FPDS–NG

- serves as the source of USAspending.gov contracts data;

- makes available Federal Procurement Reports from FY2000 forward on its website;

- includes data on contracts of more than $25,000 and summary data of procurements less than $25,000; and

- provides selected search capabilities by state (including aggregate county statistics), contractor name, and product or service category.

For more refined searching, such as by CD, the FPDS Help Desk can guide congressional staff and the public through filtering for data needed (called ad hoc reports).

Federal Audit Clearinghouse

States, local governments, and nonprofits (including universities) spending $750,000 or more8 in federal grants during a fiscal year are required to submit an audit detailing expenditures. Data from the audits are posted on the Census Bureau's Federal Audit Clearinghouse, at https://harvester.census.gov/facweb/Default.aspx. No printed documents are produced.

- Because the audit data are for the fiscal year of the filing agency or organization (which may differ from the federal fiscal year), they are not comparable with data from any other federal source.

- Searches may be conducted by organization or institution, Catalog of Federal Domestic Assistance (CFDA) program number, and geographic location (by city or state but not by congressional district). See search options at https://harvester.census.gov/facweb/.

U.S. Budget: Aid to State and Local Governments

The Analytical Perspectives volume of the President's budget covers various topics, including "Aid to State and Local Governments" (Chapter 14 in the FY2019 report).9 Federal grants-in-aid to state and local governments, U.S. territories, and American Indian tribal governments are intended to support government operations or the provision of services to the public. Grants are most often awarded as direct cash assistance, but federal grants-in-aid also can include payments for grants-in-kind—nonmonetary aid such as commodities purchased for the National School Lunch Program. Federal revenues shared with state and local governments also are considered grants-in-aid.10

The FY2019 budget proposes $749 billion in outlays for aid to state and local governments, an increase of 3% from FY2018.11 Individual program tables with state-by-state obligation data for grants-in-aid programs to state and local governments may be found on the OMB website. Tables 14-3 through 14-39 show state-by-state obligations for 35 federal grants-in-aid programs.12

Federal grants generally fall into one of two broad categories—categorical grants or block grants, depending on the requirements of the grant program. In addition, grants may be characterized by how the funding is awarded, such as by formula, by project, or by matching state and local funds. As recipients of federal grant funding, state and local governments may provide services directly to beneficiaries or states may act as a pass-through, disbursing grant funding to localities using a formula or a competitive process.13 As discussed above, this pass-through, or subawarding, at the state level makes tracking federally originated funds to the final recipient a challenge.

Pew Charitable Trust and National Priorities Project

The following projects analyze government-issued data on federal spending in states. CRS cannot validate either the research methodologies used or the conclusions drawn by the organizations. These sources are included here because they are frequently cited in policy papers and the media.

- Pew Charitable Trusts Fiscal Federalism Initiative, Federal Spending in the States: 2005 to 2014, March 3, 2016

http://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2016/03/federal-spending-in-the-states-2005-to-2014.

Sources of data include USAspending.gov, the Bureau of Economic Analysis, the Office of Personnel Management, and the Department of Defense; see Appendix Methodology at http://www.pewtrusts.org/~/media/Assets/2014/12/Federal_Spending_in_the_States_methodology_web_final.pdf.

For nearly three decades, through FY2010, the Census Bureau produced the Consolidated Federal Funds Report (CFFR), an annual look at the geographic distribution of federal spending (see discussion below). When the CFFR was discontinued, the Pew Charitable Trust Fiscal Federalism Initiative provided analysis to fill the gap. Data are divided into the five major categories used by the CFFR: (1) retirement benefits, (2) nonretirement benefits, (3) grants, (4) contracts, and (5) salaries and wages for federal employees.

- National Priorities Project, State Smart: Federal Funds in 50 States

https://www.nationalpriorities.org/smart/constructor/#

Sources of data include USAspending.gov, the Census Bureau, the Bureau of Economic Analysis, and the Bureau of Labor Statistics. For notes on methodology, see https://www.nationalpriorities.org/smart/resources/notes-and-sources/.

Through this project's interactive website, users can follow a representation of the flow of federal dollars to each state and the District of Columbia through spending on government personnel, contracts, aid to individuals (such as food stamps and Medicare), and public assistance programs. It also provides information on how much individuals and businesses in each state pay in federal taxes. Available data can be used to inform consideration of questions, such as

- What percentage of a state's budget comes from the federal government?

- How much, on average, do residents in a state receive in federal benefits, and how does that compare with other states?

- How much do individuals and businesses in a state pay in federal taxes?

Federal Aid to States and the Consolidated Federal Funds Report

These Census Bureau reports, published from FY1983 to FY2010 and available at https://www.census.gov/govs/pubs/title.html, were the federal government's primary documents summarizing the geographic distribution of federal monies to states and counties, whether grants, contracts, or appropriations. The FY2010 Federal Aid to States (FAS) and Consolidated Federal Funds Report (CFFR) were the last reports issued due to the termination of the Census Bureau's Federal Financial Statistics program. Federal obligations data continue to be posted on USAspending.gov, now the official source collecting federal awards data.

- FAS covered federal government expenditures to state and local governments and presented figures to the state level by program area and agency.

- CFFR included payments to state and local governments as well as to nongovernmental recipients. Dollar amounts reported represented either actual expenditures or obligations (see CFFR introduction and source notes for each table or graph).

- CFFR provided data to the state and county level for grants, salaries and wages, procurement contracts, direct payments for individuals, other direct payments, direct loans, guaranteed or insured loans, and insurance.

- Although CFFR indicated congressional districts (one or more) for each county, it did not give separate data by CD.

Selected Agency Grant Awards Databases and Information

USAspending.gov collects brief data on all federal grants and contracts awarded. However, some agencies, in particular those awarding research grants, also continue to post information on their own websites.

Department of Agriculture (USDA)

- Current Research Information System

https://cris.nifa.usda.gov/

Ongoing agricultural, food science, human nutrition, and forestry research, education and extension activities, with a focus on the National Institute of Food and Agriculture (NIFA) grant programs. Projects are conducted or sponsored by USDA research agencies, state agricultural experiment stations, land-grant universities, other cooperating state institutions, and participants in NIFA-administered grant programs, including Small Business Innovation Research and the Agriculture and Food Research Initiative.

Department of Education (ED)

- Institute of Education Sciences, Funded Research Grants and Contracts

http://ies.ed.gov/funding/grantsearch/index.asp

Department of Health and Human Services (HHS)

- Tracking Accountability in Government Grants System (TAGGS)

http://taggs.hhs.gov/AdvancedSearch.cfm

Database of awards from HHS and its subsidiaries. - National Institutes of Health (NIH) Research Portfolio Online Reporting Tools RePORTER

http://projectreporter.nih.gov/reporter.cfm

Includes projects funded by the NIH, Administration for Children and Families, Agency for Health Care Research and Quality, Centers for Disease Control and Prevention, Food and Drug Administration, and the U.S. Department of Veterans Affairs.

Department of Homeland Security (DHS)

- Federal Emergency Management Agency (FEMA), Public Assistance Grant Awards Activity

2013-2016: https://www.fema.gov/media-library/assets/documents/30731

2017-2019: https://www.fema.gov/media-library/assets/documents/128200

Daily activity of Public Assistance Grant Awards, including FEMA region, state, disaster declaration number, event description, mission assigned agency, assistance requested, obligated federal dollars, and date of obligation.

Department of Justice (DOJ)

- Office of Justice Programs (OJP), OJP Grant Award Data

http://ojp.gov/funding/Explore/OJPAwardData.htm

Department of Labor (DOL)

- Employment and Training Administration (ETA), Grants Awarded

http://www.doleta.gov/grants/grants_awarded.cfm

Environmental Protection Agency (EPA)

- Integrated Grants Management System (IGMS)

https://www3.epa.gov/enviro/facts/multisystem.html#

IGMS awards, administers, and monitors EPA grants regularly awarded to federal, state, or local government agencies, universities, and other institutions that support EPA's environmental programs.

Institute of Museum and Library Services (IMLS)

- IMLS Awarded Grants

http://www.imls.gov/recipients/grantsearch.aspx

National Endowment for the Arts (NEA)

- Grant Search

https://apps.nea.gov/grantsearch/

NEA grants awarded since 1998.

National Endowment for the Humanities (NEH)

- Funded Projects

https://securegrants.neh.gov/publicquery/main.aspx

National Library of Medicine (NLM)

- Health Services Research Projects in Progress (HSRProj)

http://wwwcf.nlm.nih.gov/hsr_project/home_proj.cfm

Database of ongoing health services research and public health projects, whether government, corporate, or private.

National Science Foundation (NSF)

- NSF Awards

http://www.nsf.gov/awardsearch/

Includes data from 1989 to the present. - Research.gov is a partnership of federal research-oriented grant-making agencies led by the NSF

http://www.research.gov/research-portal/appmanager/base/desktop?_nfpb=true&_eventName=viewQuickSearchFormEvent_so_rsr&wtlink=RSR_Search_homepage.

Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR)

- SBIR and STTR Awards

https://www.sbir.gov/sbirsearch/award/all

The SBIR/STTR program's mission is to stimulate technology innovation by strengthening the role of innovative small business in federal research and development. Currently, 11 federal agencies participate in the program: the Departments of Agriculture, Commerce (National Institute of Standards and Technology and the National Oceanic and Atmospheric Administration), Defense, Education, Energy, Health and Human Services, Homeland Security, and Transportation, and the Environmental Protection Agency, National Aeronautics and Space Administration, and National Science Foundation.

Transportation Research Board (TRB)

- Research in Progress

http://rip.trb.org/

View projects by subject, individuals, or organizations.

Further Reading

Data Foundation and Deloitte, "DATA Act 2022: Changing Technology, Changing Culture," report, May 2017, at http://www.datafoundation.org/data-act-2022/.

U.S. Senate, Permanent Subcommittee on Investigations, Committee on Homeland Security and Governmental Affairs, "Federal Agency Compliance with the DATA Act," report, July 2018, at https://www.hsgac.senate.gov/subcommittees/investigations/media/new-psi-report-details-failure-of-federal-agencies-to-submit-accurate-data-on-how-they-spend-taxpayer-dollars.

Urban Institute, "Follow the Money: How to Track Federal Funding to Local Governments," research report, February 26, 2018, at https://www.urban.org/research/publication/follow-money-how-track-federal-funding-local-governments.