Introduction

The Patient Protection and Affordable Care Act (ACA; P.L. 111-148, as amended) created a permanent risk adjustment program that aims to reduce some of the incentives insurers may have to avoid enrolling individuals who are at risk of high health care costs in the private health insurance market—specifically in the individual (non-group) and small-group markets.1 Section 1343 of the ACA established the risk adjustment program, which is designed to assess charges to health plans that have relatively healthier enrollees compared with other health plans in a given state. The program uses collected charges from plans with comparatively healthy enrollees to make payments to plans in the same state that have relatively sicker enrollees. The Centers for Medicare & Medicaid Services (CMS) administers the risk adjustment program as a budget-neutral program, so that payments made are equal to the charges collected in each state.2 Risk adjustment transfers are intended to account for differences in health risk among plans in each state while allowing for premium differences based on allowable rating factors.3

CMS assesses payments and charges on an annual basis, beginning in the 2014 benefit year. All non-grandfathered, individual market and small-group market health plans, both inside and outside of the exchanges, participate in this program.

Prior to the ACA, most state laws (and federal law under limited circumstances) allowed insurers to minimize their exposure to high-risk individuals by charging higher or lower premiums to potential enrollees based on factors such as age, gender, and health status.4 However, under current federal law, insurers in the individual and small-group markets are unable to set premiums based on gender or health status and are limited in how much they may vary premiums by age.5 Without being permitted to account for the risk from individuals who expect or plan for high use of health services on the basis of the aforementioned criteria, insurers still may attempt to avoid such individuals by using benefit designs, networks, formularies, and/or marketing techniques that are not likely to appeal to them (though insurers are limited by other ACA requirements, such as being required to offer coverage for the Essential Health Benefits).6

Under the ACA's permanent risk adjustment program, the Secretary of the Department of Health and Human Services (HHS) established criteria and methods to determine the actuarial risk of plans within a given state in order to make payments and assess charges.7 Enrollees in health plans differ in their degree of risk based on such factors as their health status, with sicker individuals considered high risk and expected to have greater health costs than healthier, or low-risk, individuals.8 Individuals who perceive themselves as high risk, as opposed to those who perceive themselves as low risk, are likely to have different behaviors related to health insurance. High-risk individuals, who perceive that they will need more health services, may be more motivated to seek out and enroll in plans with more comprehensive coverage and benefits than might low-risk individuals.9 Since individuals have more information about their own health status than does an insurer, they are able to consider this information when choosing a health plan; by contrast, an insurer is not able to take this information into account when establishing coverage, benefits, and premiums for the plan.10 The risk adjustment program is intended to reduce the likelihood that an insurer will aim to enroll only low-risk individuals and help ensure that price differences of plans reflect the plan design and benefits available rather than risk.

Risk adjustment is a risk mitigation strategy that has been incorporated into other insurance programs. It is a component of the Medicare program, as well as some state Medicaid programs. Other countries with regulated, private health insurance markets, such as the Netherlands, Switzerland, Germany, Australia, and South Africa, also have risk adjustment mechanisms.11 In addition, risk adjustment was part of the Commonwealth Care program in Massachusetts from 2009 through 2016.12 Although risk adjustment programs may have similar aims, program designs may vary. HHS used the Medicare risk adjustment program as the basis for the ACA risk adjustment program, although HHS made modifications especially to account for the different populations in the programs.13

The risk adjustment program is the only permanent program that was part of the three ACA risk mitigation programs, including the transitional reinsurance program and the temporary risk corridors program. This report provides responses to frequently asked questions related to the risk adjustment program. The first several questions pertain to background on insurance markets, why risk mitigation matters, and the role of risk adjustment in risk mitigation. The following questions relate to the mechanics of the risk program, including how enrollee risk scores are calculated and how risk adjustment payments and charges are determined. Responses to the concluding questions provide information on the experience of the risk adjustment program thus far and future changes to the program.

Background

Understanding the sources of private health insurance coverage and how such coverage is regulated at the federal level may be useful in providing context around the current federal law and the permanent risk adjustment program (see text box "Sources and Regulation of Private Health Insurance Coverage").

|

Sources and Regulation of Private Health Insurance Coverage The private market can be described as having three segments: individual (or non-group), small group, and large group. Most Americans with private health insurance coverage obtain such coverage as part of a group of people drawn together by an employer or other organization, such as a union. Groups generally are formed for some purpose other than obtaining insurance (e.g., employment). The applicability of federal rules to group coverage varies based on certain characteristics of the plan sponsor (e.g., employer), including the following:

Consumers may obtain health insurance—outside of a group—in the individual (or non-group) health insurance market. In this market, consumers purchase insurance directly from an insurer or through the individual health insurance exchange. Current law requires health insurance exchanges to be established in all states. The exchanges are marketplaces in which individuals and small businesses can shop for and purchase private health insurance coverage. Each state has two types of exchanges—an individual exchange and a Small Business Health Options Program (SHOP) exchange. An individual exchange is where individuals can purchase non-group insurance and apply for premium and cost-sharing subsidies. A SHOP exchange is where small businesses can purchase small-group insurance and apply for small business health insurance tax credits. These exchanges may be operated under the same or separate governing structures. A state can choose to establish its own state-based exchange. If a state opts not to, or if the Department of Health and Human Services (HHS) determines that the state is not in a position to administer its own exchange, then HHS will establish and administer the exchange in the state as a federally facilitated exchange. |

Why Does Risk Matter in Health Insurance?

The concept underlying insurance is risk (i.e., the likelihood and magnitude of experiencing a financial loss). In any type of insurance arrangement, all parties seek to manage their risk, subject to certain objectives (e.g., coverage and/or profit goals). In health insurance, consumers (or patients, as insurance enrollees) and insurers (as sellers of insurance) approach the management of health insurance risk differently. From the consumer's point of view, a person (or family) buys health insurance to protect against financial losses resulting from the unpredictable use of potentially high-cost medical care. The insurer employs a variety of methods to manage the risk it takes on when providing health coverage to consumers to assure that the insurer operates a viable business (e.g., balancing premiums against the collective risk of the covered population). The insurer uses these methods when pooling risk so that premiums collected from all enrollees generally are sufficient to fund claims (plus administrative expenses and profit).

Where insurers have discretion, they are likely to act in their own financial self-interest to limit their exposure to risk.14 Prior to the ACA, insurers in the individual and small-group markets could assess the risk of an individual or group applying for insurance coverage using characteristics such as health status, gender, and age with certain exceptions. Using such characteristics, insurers could charge higher premiums for higher-risk individuals, or they could deny coverage if an individual represented too much risk, so long as the denial of coverage was permitted under state law.15 Similarly, before the ACA, an individual with a preexisting condition may have had that condition excluded from coverage or coverage for a preexisting condition may have been delayed for a period of time (e.g., 6 to 36 months, or indefinitely) depending on state laws and other federal requirements.16 The converse was also true—insurers had been able to charge lower premiums to lower-risk individuals based on health status, gender and age, with some exceptions.

Why Is the Mitigation of Health Insurance Risk and Uncertainty Relevant Under Current Federal Law?

The ACA includes provisions that aim to restructure the private health insurance market by implementing several market reforms targeting the individual and small-group markets, including some that impose requirements on health insurance plans.17 As part of a larger set of private health insurance market reforms, the ACA requires private health insurers to provide coverage to individuals regardless of health status, medical history, and preexisting conditions.18 Prior to the ACA, insurers in the small-group market already were prohibited from denying coverage based on these factors. Under current federal law, insurers can adjust premiums based solely on certain factors (i.e., individual or family enrollment, geographic rating area19, tobacco use, and age).20

Additional market reforms aim to expand the pool of individuals seeking to purchase health insurance coverage. Under the ACA reforms, some individuals may be eligible for financial assistance (i.e., premium tax credits and cost-sharing subsidies) through the health insurance exchanges (also known as the marketplaces), which may make these individuals more likely to purchase health insurance.21 In addition, the ACA, as originally enacted, had required that most individuals maintain health insurance coverage or pay a penalty for noncompliance (i.e., the individual mandate), but the penalty associated with the individual mandate will be effectively eliminated beginning in 2019.22 The expanded pool created by the ACA reforms contributes to the uncertainty that insurers face. (Uncertainty was particularly high in the early years of ACA implementation.) Much of the uncertainty centers on the types of individuals who may or may not seek coverage in the expanded pool. For example, to what extent will healthy individuals decide to seek coverage in addition to unhealthy individuals? Also, will the expanded pool extend to individuals who previously were uninsured and/or may have delayed receiving health care services? Furthermore, what will be the demand for health care services for this expanded pool of individuals?

In addition to the risks and uncertainty described above, one phenomenon that exists in health insurance markets is that individuals who expect or plan for high use of health services are more likely to seek out coverage and enroll in plans with more benefits than individuals who do not expect to use many or any of the health services.23 Prior to the ACA, state law (and federal law, under limited circumstances) determined whether insurers could minimize their exposure to this risk by charging higher or lower premiums to potential enrollees based on factors such as gender, age and health status.24 However, under current federal law, insurers in the individual and small-group markets are unable to set premiums based on gender or health status, and insurers are limited in how much they can vary premiums by age. Notwithstanding this change, and although insurers are limited by other ACA requirements, insurers still could attempt to gain a competitive advantage by avoiding individuals who expect or plan for high use of health services (e.g., sicker, older individuals) by using benefit designs, networks, formularies, and/or marketing techniques that are not likely to appeal to these individuals.25

Financial assistance, such as premium tax credits and cost-sharing subsidies (and the individual mandate, though the penalty has been effectively eliminated), are intended to encourage enrollment for all individuals and to reduce the risk that only individuals who expect or plan to have high use of health services will purchase health insurance.26 However, some risk remains, and an insurer may experience losses if it enrolls a disproportionate share of enrollees with high health care claims costs during the year.27

What Health Insurance Risk Mitigation Programs Are Included Under Current Federal Law?

The ACA established three risk mitigation programs to mitigate the financial risk that insurers face and to stabilize the price of health insurance in the individual and small-group markets: (1) the transitional reinsurance program, (2) the temporary risk corridors program, and (3) the permanent risk adjustment program. These three programs—administered by CMS with participation by private insurers—are designed to make the health insurance market more stable and predictable. They also are designed to encourage insurers to participate and compete with one another on quality, level of service, and price rather than on the risk of enrollees who select a particular plan.28

Table 1 summarizes the goals and methods of each of the ACA's three risk mitigation programs and the potential sources of uncertainty or risk that each program aims to moderate to encourage insurers to participate in the market.

Table 1 does not include information on program implementation.

|

Risk Mitigation Program |

Goal |

Potential Uncertainty or Risk |

Method |

Time Frame |

Applicability |

|

Transitional Reinsurance Program |

Offset a plan's risk associated with high-cost enrollees. |

Uncertainty regarding health care usage and demand by the previously uninsured, as well as any pent-up demand due to the previous lack of health insurance. |

Provide funding to plans that incur high costs for individual enrollees. |

Temporary; 2014-2016. |

Health insurers and third-party administrators on behalf of group health plans pay in; only individual market plans (inside and outside the exchanges) are eligible for payment.a |

|

Temporary Risk Corridors Program |

Protect against inaccurate rate setting. |

Uncertainty regarding individuals who may or may not seek coverage and their subsequent demand for health services. Would healthy individuals seek coverage, as well as unhealthy individuals? |

Limit the insurer's gains and losses. |

Temporary; 2014-2016. |

All qualified health plans in the individual and small-group markets (on and off the exchanges) are subject to the risk corridors program.c |

|

Permanent Risk Adjustment Program |

Protect against adverse selection, which is individuals who expect or plan for high use of health services tending to enroll in more generous (and consequently more expensive) health plans, and risk selection, which is that although insurers are limited by some ACA requirements, they design benefits, networks, formularies, or use other methods to avoid individuals who expect or plan for high use of health services. |

Risk of adverse selection and risk selection. Insurers are unable to assess risk accurately because consumers have more information about their health than insurers (known as asymmetric information). |

Transfer funds from plans with relatively low-risk pools of enrollees to plans with relatively high-risk pools of enrollees. |

Permanent; beginning in benefit year 2014. |

All non-grandfathered, individual, and small-group market plans (inside and outside the exchanges) are subject to the risk adjustment program.b |

Source: Congressional Research Service (CRS) analysis of the Patient Protection and Affordable Care Act (ACA; P.L. 111-148, as amended) and its implementing regulations.

a. The individual market is where an individual or family can purchase health coverage from an insurer or through the individual health insurance exchange. Health insurance can be provided to groups of people who are drawn together by an employer or other organization, such as a union. When insurance is provided to a group, it is referred to as group coverage or group insurance. The group health insurance market is divided into two segments, small group and large group. In general, the small-group market includes groups with 50 or fewer employees and the large-group market includes groups with more than 50 employees. P.L. 114-60.

b. A grandfathered health plan refers to an existing plan in which at least one individual has been enrolled since enactment of the ACA on March 23, 2010. A plan can maintain its grandfathered status as long as it meets certain requirements. Grandfathered health plans are exempt from the majority of ACA market reforms.

c. Qualified health plans (QHPs) are plans that are certified to be offered in the health insurance exchanges. Each exchange is responsible for certifying the plans it offers. QHPs can be offered both inside the health insurance exchanges and outside the exchanges on the private health insurance market.

How Is the Risk Adjustment Program Supposed to Reduce an Insurer's Risk?

Individuals differ in their health insurance risk based on their health status, with sicker individuals considered as high risk and as expected to have greater health costs than healthier individuals (i.e., low-risk individuals). Without a risk adjustment mechanism, a plan that enrolls a larger proportion of sicker (i.e., high-risk) enrollees than other plans in the market would need to charge a more costly average premium (across all of its enrollees) to be financially viable, all else being equal. Under the risk adjustment program, an insurer can set premiums for plans with sicker-than-average (i.e., high-risk) enrollees lower than the expected cost of claims because the insurer will receive a risk adjustment transfer payment to make up some or all of the difference.29 Conversely, an insurer of a plan with healthier-than-average (i.e., low-risk) enrollees will set premiums higher than what is anticipated to be needed to cover enrollees' claims cost because part of that premium will be owed to other insurers in the form of risk adjustment charges.30 The risk adjustment program is intended to encourage insurers to set premiums that reflect differences in the plan design and the benefits available rather than the risk of enrollees who choose a particular plan.31

Mechanics of the Risk Adjustment Program

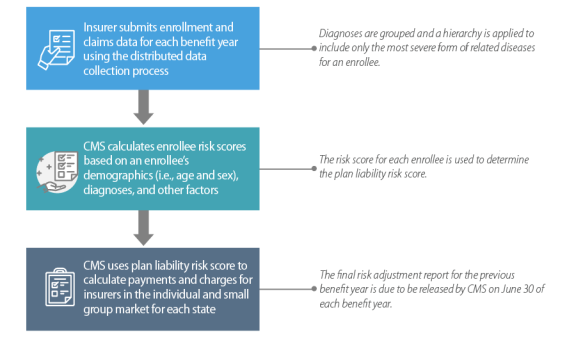

Figure 1 provides a summary of risk adjustment program operations for a given benefit year. The below steps provide an overview of the operational steps to determine plan transfer payments.

Step 1: Collect Data

- Insurers submit enrollment and claims data for their plans in a state and market using the CMS distributed data collection process.

Step 2: Determine Enrollee Risk Scores

- CMS uses the data to measure an insurer's risk for each plan. The initial calculation is to determine a risk score for individuals actually enrolled for a particular benefit year based on the enrollee's demographic information and diagnoses for that year using CMS's risk adjustment model.32 The risk score is a relative measure of how costly that enrollee is anticipated to be for the plan.33

Step 3: Calculate Plan Liability Risk Score

- CMS uses the risk scores for each enrollee in the plan to calculate the plan liability risk score—the insurer's risk—for the plan in a rating area.

Step 4: Determine Insurer Payment or Charge

- The plan liability risk score is used in the payment transfer formula, which compares the predicted costs of enrollees to the expected premiums that a plan may collect. This complex formula also includes various other factors that may impact predicted costs and expected premiums.34

- The differences between predicted costs and expected premiums (both relative to the state average for the market) for all of the plans within a state are compared to the state average premiums to translate these differences into payments and charges.35 Payments and/or charges are then aggregated across rating areas by plan and then by insurer in the individual or small group market in each state. All non-grandfathered, individual market, and small-group market health plans both inside and outside of the exchanges participate in this program.36

Step 5: Inform Insurers/States of Payments and Charges

- CMS releases a final report for the risk adjustment program with the transfers. The final risk adjustment report for the benefit year is due to be released on June 30 following the benefit year.

|

|

Source: CRS-developed flow chart of the permanent risk adjustment program based on information from CMS. Note: CMS denotes Centers for Medicare & Medicaid Services. |

How Are Data for the Risk Adjustment Program Collected?

Data for the risk adjustment program are collected using a distributed data approach.37 Insurers submit data for all eligible plans including enrollee information, medical claims, pharmacy claims, and supplemental diagnosis information from their proprietary systems to a server controlled by the insurer. The server runs software developed by CMS to verify the data submitted and execute the risk adjustment process. Once the risk adjustment process is completed, CMS and insurers receive plan-level, summarized data files and insurers receive additional detailed, individual-level data. CMS uses the data files to calculate risk adjustment payments and charges. Data are collected for each benefit year, with all data gathered for consideration in the risk adjustment program—including adjudicated claims—by April 30 of the following benefit year.38

How Are Enrollee Risk Scores Determined for the Risk Adjustment Program?

CMS uses the Truven MarketScan® Commercial Claims and Encounter Data to approximate (i.e., model) the relationship between diagnoses and health care expenditures and then develops coefficients used to calculate an enrollee's risk score—a relative measure of how costly the enrollee is anticipated to be for the plan—based on the enrollee data submitted by the insurer.39 There are three risk adjustment models—one for adults (aged 21+), one for children (aged 2-20) and one for infants (aged 0-2).40 Several factors are used to determine a risk score for an enrollee, including an enrollee's diagnosis information and demographics (i.e., age and sex), how many months the enrollee was covered, and whether an enrollee participated in a plan with cost-sharing subsidies (See "What Factors Are Used to Determine an Enrollee's Risk Score?" for more information). Coefficients are determined separately for each health plan metal level designation (See "Actuarial Value and Metal Level" text box in Section "What Factors Are Used to Determine an Enrollee's Risk Score?").

How Is Diagnosis Information Categorized to Calculate Enrollee Risk Scores?

CMS reviewed input from clinician consultants along with empirical analysis and background research they conducted to adapt the diagnoses used in the Medicare risk adjustment model for use in the ACA risk adjustment program.41 The diagnoses for the risk adjustment model were first grouped into diagnostic groups (DXGs) and then further aggregated into condition categories (CCs). CCs describe a set of largely similar diseases that are related clinically to one another and are similar with respect to cost (e.g., Diabetes with Acute Complications is a CC that includes DXGs for Type II Diabetes with Ketoacidosis or Coma as well as Type I Diabetes with Ketoacidosis or Coma).

Only the most severe manifestation among related diseases for an enrollee is included for risk adjustment. Hierarchies are imposed among similar CCs to determine hierarchical condition categories (HCCs), which identify the most severe manifestation among related diseases (see the text box "Risk Score Example" in section "What Factors Are Used to Determine an Enrollee's Risk Score?").

What Factors Are Used to Determine an Enrollee's Risk Score?

The main factors used to determine an enrollee's risk score are the demographic factor and the HCCs. The demographic factor is determined based on an enrollee's age category (21-24, 25-29, etc., up to the age of 60+ for adults; 2-4, 5-9, etc., up to the age of 20 for children) and sex (male and female).42 Diagnosis codes for an enrollee in the adult and child models are mapped to the appropriate CCs, and then the hierarchy is applied to groups of CCs to determine the HCCs.43 For an example of how diagnosis codes are categorized into CCs and HCCs, see the text box "Risk Score Example."44

|

Risk Score Example: Mapping Diagnosis Codes to Hierarchical Condition Categories A hypothetical enrollee is a 54-year-old male with the following diagnosis codes:

These diagnosis codes are then mapped to condition categories (CCs).

Once the CCs are determined, a hierarchy is applied to determine hierarchical condition categories (HCCS). There are three CCs related to diabetes, and the hierarchy is applied as follows:

The enrollee in this example has CCs 20 and 21, so the HCC for this enrollee will be 20: Diabetes with Chronic Complications. |

Two additional factors are used in the adult model only. A new factor was added to the adult model starting in the 2017 benefit year to capture costs for enrollees who are enrolled in a plan for only part of a year.45 The adult model also includes a severity interaction factor.46 There are eight HCCs that are considered to be indicators of severe illness (e.g., HCC 126: Respiratory Arrest). When these indicators of severe illness are present along with certain HCCs, the increased costs related to those interactions are included in the model.

A cost-sharing factor is included for any enrollees who participate in cost-sharing plans.47 Individuals enrolled in cost-sharing plans face lower cost-sharing requirements (e.g., lower deductibles). Therefore, enrollees in cost-sharing plans may use more health services than they would without the available cost-sharing subsidies.

|

Actuarial Value and Metal Level Most health plans sold in the individual and small group markets as established under the ACA are required to meet actuarial value (AV) standards, among other requirements. AV is a summary measure of a plan's generosity, expressed as the percentage of medical expenses estimated to be paid by the insurer for a standard population and set of allowed charges. In other words, the higher the percentage, the lower the cost sharing, on average, for the population. AV is not a measure of plan generosity for a specific enrolled individual or family, nor is it a measure of premiums or benefits packages. A health plan that is subject to the AV standards is given a precious metal designation: platinum (AV of 90%), gold (80%), silver (70%), or bronze (60%). |

What Is an Example of an Enrollee Risk Score Calculation?

CRS developed a sample risk score calculation for a fictitious enrollee (see text box entitled "Risk Score Example, Continued: Calculating an Enrollee's Risk Score"). This example builds on the previous example of determining the HCCs for a hypothetical enrollee (see the section "How Are Enrollee Risk Scores Determined for the Risk Adjustment Program?" and text box labeled "Risk Score Example"). The coefficients used by CRS in this example came from the HHS Notice of Benefit and Payment Parameters.48

|

Risk Score Example: Calculating an Enrollee's Risk Score Continuing from Text Box titled "Risk Score Example: Mapping Diagnosis Codes to Hierarchical Condition Categories," a hypothetical enrollee is a 54-year-old male with an HCC for Diabetes with Chronic Complications (20). He was enrolled in a plan with a silver-metal level that also is a cost-sharing plan (87% AV level) for six months during the 2017 benefit year (see Text Box "Actuarial Value and Metal Level" in section "What Factors Are Used to Determine an Enrollee's Risk Score?" for additional information). The following model factors will be used to calculate the enrollee's risk score:

The risk score for this enrollee is calculated as follows: (0.355 +0.929 +0.170)×1.12 = 1.628 |

How Are Payments and Charges Determined Under the Risk Adjustment Program?

The payment transfer formula is used in the risk adjustment program to determine the flow of money from low-risk plans to high-risk plans.49 CMS administers risk adjustment as a budget-neutral program within each state, so the sum of all charges for plans with lower-than-average risk equals the payments made to plans with higher-than-average risk in a state and market (i.e., individual and small group). A plan's risk adjustment payment or charge is determined by calculating the predicted costs considering the health status of the plan's actual enrollees relative to the statewide average and subtracting expected premium revenue based on allowable rating factors (i.e., individual or family enrollment, geographic rating area, tobacco use, and age) relative to the statewide average. Risk adjustment transfers are intended to account for differences in health risk among plans while allowing premium differences based on allowable rating factors.

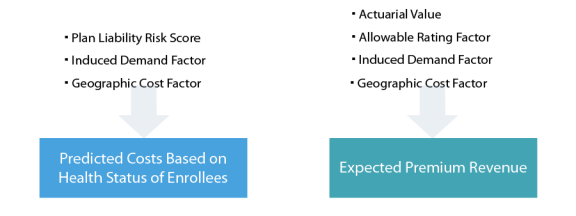

The difference between predicted costs and expected revenues is then multiplied by the average premium for the state and the market (i.e., individual or small group) to determine the plan charge (if expected revenue is greater than predicted costs) or payment (if predicted costs are greater than expected revenue).50 Figure 2 shows the different factors used when calculating the predicted costs and the expected premium revenue. Each factor is explained in greater detail below. The transfer formula is applied to each plan for each rating area within a state, so when a plan exists in multiple rating areas within a state, transfers are calculated in separate plan segments, one per rating area, and then are aggregated by plan and then plans are aggregated for each insurer within a state. CMS reports risk adjustment payments and charges for a given benefit year in a yearly report which according to regulation is released on June 30th of the following benefit year, and transfers are paid/charged on a rolling basis after that point.

How Are Predicted Costs Determined for a Plan?

Three factors are used in the risk adjustment transfer formula to determine a plan's predicted costs: (1) plan liability risk score (PLRS), (2) induced demand factor, and (3) geographic cost factor (GCF).51

Plan Liability Risk Score

The PLRS is calculated based on the risk scores for each enrollee (see "How Are Enrollee Risk Scores Determined for the Risk Adjustment Program?" for additional information). Risk scores are calculated for each enrollee regardless of the type of plan (e.g., HMO, PPO) that enrollee is in or whether the enrollee is in an individual or a family policy. The PLRS is calculated by multiplying the enrollee's risk score and the months enrolled, then summing this month-weighted risk score across all enrollees in a plan and rating area. Then, the result of that sum is divided by the sum of the months enrolled that are considered "billable" in the plan (i.e., months enrolled for all of the individuals in that plan, but only including the first three children for family policies).52

Induced Demand Factor

The induced demand factor measures how an enrollee's use of health services can be attributed to the more generous benefits provided by a plan. This factor varies by metal level and is intended to prevent insurers from receiving payments through risk adjustment due to differences in the plan design and benefits (see the text box "Actuarial Value and Metal Level" in section "What Factors Are Used to Determine an Enrollee's Risk Score?" for more information).

Geographic Cost Factor (GCF)

The GCF accounts for differences in input prices and medical care utilization that vary geographically within a state and may affect premiums. The GCF is determined by comparing the average silver plan premiums in a rating area to the state average silver plan premiums.

How Is Expected Premium Revenue Determined for a Plan?

Four factors are used in the risk adjustment transfer formula to determine the expected premium revenue: (1) actuarial value (AV) of the plan, (2) allowable rating factor (ARF) based on age, (3) induced demand factor, and (4) GCF.53

Actuarial Value

The plan's AV accounts for differences in the percentage of enrollee costs that the plan will cover if its enrollees represent a "typical" population (see Text Box "Actuarial Value and Metal Level" in section "What Factors Are Used to Determine an Enrollee's Risk Score?" for more information).54

Allowable Rating Factor

The ARF reflects the ages of enrollees in a plan and the impact on the premium the plan would collect based on the age rating rules.55 The rating for the most expensive group cannot be more than three times as high as the rating of the lowest group (e.g., an enrollee who is 21 years of age has an ARF of 1.00, and the maximum rating for an enrollee aged 64 and older is 3.00). A plan with a higher ARF can collect more premium revenue due to the age rating than a plan with a lower ARF. For example, an insurer has a Plan A with an ARF of 2.00 and a Plan B with an ARF of 1.60. The insurer would be able to collect 25% more Plan A premiums than Plan B premiums, given the differences in age rating.

Induced Demand Factor and Geographic Cost Factor

The induced demand factor and GCF are included on both sides of the transfer equation. See "Induced Demand Factor" for an explanation of the Induced Demand Factor and "Geographic Cost Factor" for an explanation of the GCF.

What Is an Example of How Risk Adjustment Payments and Charges May Be Distributed Across Insurers in a State and Market?

Under the risk adjustment program, an insurer can set premiums for plans with sicker-than-average (i.e., high-risk) enrollees lower than the expected cost of claims because the insurer will receive a risk adjustment transfer payment to make up some or all of the difference. Conversely, an insurer of a plan with healthier-than-average (i.e., low-risk) enrollees will set premiums higher than what is anticipated to be needed to cover enrollees' claims cost because part of that premium will be owed to other insurers in the form of risk adjustment charges. Since risk adjustment payments or charges impact an insurer's net premiums, CMS expects that insurers will try to anticipate transfer payments or charges and adjust their premiums accordingly.56 Premiums are often determined in the spring prior to open enrollment (e.g., for the 2019 benefit year, spring 2018) which begins on November 1 (e.g., for the 2019 benefit year, November 1, 2018). Data are collected for risk adjustment during the benefit year and are due on April 30 the following benefit year (e.g., for the 2019 benefit year, risk adjustment data collection will be due on April 30, 2020).

In the following hypothetical example which is drawn from the American Academy of Actuaries report Insights on the ACA Risk Adjustment Program, there are three insurers in a hypothetical state and market (i.e., individual or small group): Insurer A, Insurer B, and Insurer C.57

Insurer A's premium is 10% below the market average ($270, compared to a state market average of $300), and it attracted a healthier-than-average population (relative risk of negative 10%, as compared to the market). Therefore, Insurer A had a risk adjustment charge of $30 (10% of $300, the state market average premium). Although the $30 charge is 10% of the state average premium, it amounts to about 11% of Insurer A's collected premiums ($270). Given its relative risk, Insurer A would have expected the net premium after the risk adjustment charge to be $243 ($270 in premium charges, minus $27 in risk adjustment charge). However, since the risk adjustment charge of $30 was calculated using the market average premium ($300), as opposed to Insurer A's premium ($270), the net premium is actually $240 ($270 – $30) after the risk adjustment charge, so Insurer A is left with a shortfall of 1% of premium. In this example, Insurer B set premiums to match the market average, and also has the largest market share. Insurer's B's relative risk is the market average, so thus there is not a risk adjustment transfer. Insurer C has a premium of $330, and it attracted a sicker-than-average population (relative risk of positive 10%). Insurer C will receive a risk adjustment payment of $30, which is 10% of the $300 state average premium, but only 9% of its collected premiums, so Insurer C also is left with a shortfall of approximately 1% of premium.

Table 2. Hypothetical Example of Risk Adjustment Charges and Payments Distributed Across a State and Market

|

Insurer A |

Insurer B |

Insurer C |

Entire Market |

|

|

Market Share |

15% |

70% |

15% |

100% |

|

Actual Premium per Member per Month |

$270 |

$300 |

$330 |

$300 |

|

Relative Risk |

-10% |

0% |

10% |

0% |

|

Expected Net Premium per Member per Month |

$243 |

$300 |

$363 |

$301 |

|

Transfer Amount per Member per Month |

-$30 |

$0 |

$30 |

$0 |

|

Actual Net Premium per member per month |

$240 |

$300 |

$360 |

$300 |

|

Excess/(Shortfall) per member per month |

($3) |

$0 |

($3) |

($1) |

Source: Barb Klever et al., Insights on the ACA Risk Adjustment Program, American Academy of Actuaries, April 2016, p.12, at http://actuary.org/files/imce/Insights_on_the_ACA_Risk_Adjustment_Program.pdf.

As discussed in the American Academy of Actuaries report Insights on the ACA Risk Adjustment Program, the relative position of an insurer's premiums within the market will affect whether or not the premium amounts, after accounting for risk adjustment transfers, are adequate for the insurer. An insurer's premiums are designed to reflect the risk of the entire market and not just the risk of the insurer's enrollees. If premiums for an insurer do not correctly account for the difference between their enrollees' risk and the risk of the entire market, then premiums may be incorrect (i.e., too high or too low), which may result in unanticipated losses or gains. For example, similar to Insurer A in Table 2, if an insurer sets premiums lower than the average within the market because of incorrectly anticipating the risk in the total market and then has healthier-than-average enrollees, the insurer will be assessed a risk adjustment charge. It is possible that the insurer may not have enough premiums to cover the risk adjustment charge and could face solvency issues if there are not enough premiums to cover claims and administrative costs.

Small insurers and new insurers may find it more difficult to set premiums due to greater variability in their risk profiles. Also, new insurers may not have tools that help manage health care spending, such as provider discounts or utilization management programs, but may choose to set premiums competitively to attract enrollees.

How Is the Risk Adjustment Program Expected to Impact Premiums?

The risk adjustment program is intended to allow insurers that enroll a high-risk (e.g., sicker) population and those that enroll a low-risk (e.g., healthier) population in the same market to refrain from charging different premiums based on enrollee risk, ideally allowing price differences to reflect plan benefits, efficiency, and value.58 CMS expects that insurers will try to anticipate transfer payments or charges and adjust their premiums accordingly.59

Though the risk adjustment program protects insurers from a portion of financial losses related to having an enrollee population with higher-than-average risk (i.e., a sicker enrollee population) relative to other insurers, the program is not intended to ensure that premiums can cover the costs of average claims within a state.60 If the costs of enrollees in the state and the market are greater than expected, the statewide average premium likely will be too low.61 Though the risk adjustment program would still transfer funds between insurers, it does not add money into the system, so the premiums may not cover the cost of enrollees in the entire state or market. In addition, the risk adjustment program does not ensure more stable premiums from one year to the next.62 These forms of risk and uncertainty were supposed to be addressed by the other temporary risk mitigation programs included in the ACA: the transitional reinsurance program and the temporary risk corridors programs (see the section titled "What Health Insurance Risk Mitigation Programs Are Included Under Current Federal Law?" for additional information).63

How Do Insurers Determine Premiums?

Insurers develop rates for premiums based on a number of factors, including the population covered in the risk pool, projected medical costs, administrative costs insurers face, and laws and regulations.64 Insurers pool risk so that premiums from enrollees that do not get sick can help cover the costs of enrollees who do get sick, and premiums are set to reflect the health status of the risk pool as a whole at the state level, rather than just the plan's risk pool. Plan design (e.g., services in a plan, expected utilization of health services, cost sharing) and underlying health care costs (e.g., the price for health care services in a geographic area, fees negotiated with providers) also are considered when determining premiums. Most of the collected premiums go to paying medical claims. Premiums also must be able to cover an insurer's administrative costs (e.g., product development, sales, enrollment, claims processing) as well as profit or surplus (for not-for-profit insurers). Some laws, regulations, and policy changes affect premiums as well (e.g., fees, taxes, the presence of risk sharing programs). For example, in 2017, the American Academy of Actuaries cited several factors impacting premiums, including the end of the transitional reinsurance program, the repeal of the expansion of the small-group market, and the delay in the health insurer fee. In 2018, it cited legislative and regulatory uncertainty (e.g., funding cost-sharing subsidies, the enforcement of the individual mandate) as factors influencing premiums.65

The Risk Adjustment Program in Practice

The risk adjustment program began in 2014 and recently completed calculations for the 2017 benefit year (its fourth year).

When Will the Risk Adjustment Payments and Charges Be Published?

According to regulation, the risk adjustment report for a given benefit year will be published on June 30 of the following benefit year (e.g., the risk adjustment report for the 2016 benefit year was published on June 30, 2017).66 The final risk adjustment report and its appendixes can be found at on the Center for Consumer Information and Insurance Oversight website at https://www.cms.gov/CCIIO/Programs-and-Initiatives/Premium-Stabilization-Programs/index.html.67 Although CMS suspended collections and payments on July 7, 2018, based on a court decision related to the risk adjustment methodology, the agency issued a final rule on July 24, 2018, which reissued the risk adjustment methodology with additional explanation, which CMS stated would allow the agency to continue operating the program.68

What Has Been the Experience of the Risk Adjustment Program Thus Far?

Since the risk adjustment program is a relatively new program, there has not yet been a lot of analysis done on this program. However, both the American Academy of Actuaries and CMS found evidence suggesting that the risk adjustment program was functioning as intended in 2014. The American Academy of Actuaries reported that risk adjustment transfers reduced the medical loss ratios for insurers with high loss ratios and increased the loss ratios among insurers with low cost ratios, generally bringing the loss ratios closer together for insurers that received payments and those that experienced charges.69 The medical loss ratio for an insurer is the percentage of premium spent on health care claims and other expenses related to improving health care quality. By bringing the loss ratios for insurers closer together, the risk adjustment program is evening out an insurer's experience in a particular market. Premiums include factors other than risk associated with claims cost, such as administrative costs and profit. Thus, even if risk adjustment perfectly captured each insurer's risk (and compensated accordingly), the American Academy of Actuaries stresses that it would expect to see some variation in loss ratios.70 Also, CMS found that insurers with risk adjustment charges generally had relatively low plan liability risk scores and relatively low amounts of paid claims per enrollee; conversely, insurers that had a relatively high amount of paid claims per enrollee also had higher plan liability risk scores and were more likely to receive a risk adjustment payment.71

In their respective reports, both the American Academy of Actuaries and CMS analyzed the relative impact of risk adjustment according to the size of the insurer. Both organizations found that smaller insurers (i.e., those with less market share) had more variability in their risk adjustment payments and charges as a percentage of premium.72 The American Academy of Actuaries reported that smaller insurers were somewhat more likely than larger insurers to have a higher risk adjustment transfer relative to the percentage of premium.73 This correlation was attributed to the nature of the risk adjustment program, because insurers with a higher market share are by definition more likely close to the market average than insurers with smaller market share, which are more likely to have enrollees skewed toward either lower-than-average or higher-than-average risk.74 CMS also reported that the size of an insurer did not determine whether or not it received a risk adjustment payment or charge.75

In addition, both reports enumerated potential operational difficulties insurers may have experienced during the first year of the risk adjustment program. The American Academy of Actuaries suggested that because risk adjustment was a new program in 2014, some insurers may have experienced technical difficulties with the distributed data collection process and that these difficulties may have impacted small and new insurers more than larger, more established insurers, though not necessarily.76 CMS noted that some insurers had difficulty submitting data.77 Both organizations suggested that over time, data submission would become easier.78

Furthermore, both organizations suggested that pricing premiums to take into account risk adjustment transfers for the first year of the risk adjustment program may have been difficult and that pricing would be more accurate as time passed.79

What Changes Are Being Implemented in the Risk Adjustment Program?

While there have been several changes made to the risk adjustment program since it began, two more substantial changes to the risk adjustment program were finalized to be implemented for the next benefit year (2018). They are (1) adding prescription drugs in the risk adjustment model to help improve the accuracy of an enrollee's risk score and (2) creating a high-cost risk pool. Below is a brief description of the changes.

Inclusion of Prescription Drugs

Prescription drugs were added to the adult risk adjustment model starting in the 2018 benefit year.80 CMS created prescription drug categories (RXCs) to group drugs to be included in the risk adjustment model. Some RXCs are used to impute (i.e., ascribe) diagnoses, and some are used to indicate the severity of a diagnosis that is included through medical coding. CMS worked with clinician consultants and staff clinicians to determine RXCs both for ascribing diagnoses and for indicating a more severe case of the related diagnosis (making it likely that the enrollee will incur greater medical expenses than an enrollee who has the diagnosis but not a prescription drug). CMS included prescription drug classes where there is a low risk of unintended impacts on provider prescribing behavior. The agency intends to monitor prescription drug utilization for any unintended impacts and may make changes to the RXCs in the future if it finds evidence of such impacts.

The American Academy of Actuaries suggested including prescription drugs in the risk adjustment model in its report on risk adjustment.81 During the rulemaking process for the 2018 benefit year, the academy commented that including prescription drugs would improve the model's accuracy, enhance the prediction of costs for partial-year enrollees, and improve payments for conditions that are treated with high-cost drugs.82

High-Cost Risk Pool

Starting in the 2018 benefit year, CMS created a national-level, high-cost risk pool for the individual market and the small group market to remove any potential incentive for insurers to avoid extremely high-cost enrollees and to better capture the risk associated with these enrollees in risk adjustment payments and charges.83 While an enrollee who is considered high-risk is expected to have higher overall claims cost, other enrollees who are not high-risk may have (one time) expensive claims and thus be considered high-cost in a given year. For high-cost enrollees (whether high risk or not) an insurer will receive an adjustment to their transfer amounts equal to 60% of the costs above a defined threshold (the threshold for high-cost enrollee is defined as enrollees with total claims costs above $1 million in a benefit year). To maintain budget neutrality, CMS first will calculate the total amount of paid claims costs above the threshold to determine the amount to be transferred. Then, CMS will calculate an adjustment as a percentage of an insurer's total premiums in each market. Once determined, this amount will be added to or subtracted from an insurer's transfer amount calculated by excluding costs above the threshold the high-cost enrollees. CMS indicated that it expects this adjustment to be a very small percentage of premiums, estimating less than 0.5% of premiums for either market.

The American Academy of Actuaries noted in its risk adjustment report that risk adjustment typically does not compensate insurers adequately for very high-cost enrollees and that it may be appropriate for the risk adjustment program to incorporate a process for transfers for high-cost outliers.84 CMS also reported that most risk adjustment programs do not predict the existence of high-cost enrollees very precisely because the risk scores reflect the average costs for individuals in a specific age group, with a specific sex, and with specific diagnoses.85 Since most spending for insurance companies is related to high cost enrollees, insurers may still have an incentive to avoid very high cost enrollees.86 Additionally, other research also has found that risk adjustment programs do not adequately account for high-cost cases and, as a result, that insurers have an incentive to avoid these high-cost enrollees.87

The creation of a high-cost risk pool to provide payments to insurers for a portion of the costs of high-cost enrollees works similarly to how the ACA's transitional reinsurance program did.88 However, the attachment point (referred to as the threshold under the high-cost risk pool) is significantly higher (i.e., $1 million) than the attachment points that were used for the transitional reinsurance program (i.e., $90,000 in 2016). 89 See the text box labeled "High Cost Risk Pool Example" for an illustration of the difference.90