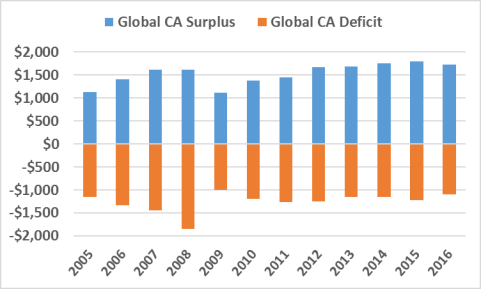

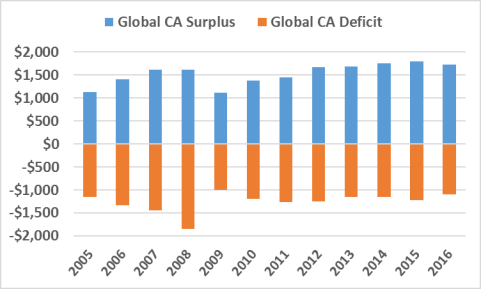

Figure 1. Global Current Account Surpluses and Deficits

($ in billions)

Source: International Monetary Fund.

In July 2018, the International Monetary Fund (IMF) released its latest report on global trade imbalances that identifies countries with "excessive" current account balances and exchange rates that are "misaligned." The current account is a broad measure of a country's global economic engagement and is comprised of trade in goods, services, and official flows. The report indicates that 40% to 50% of countries had imbalances that were "excessive," and that imbalances of about 3.25% of world GDP—both surpluses and deficits—remained constant in 2017, as indicated in Figure 1. In other words, some countries are saving too much and others are borrowing too much (globally, the combined saving and borrowing nets to zero, including statistical discrepancy). Individuals, businesses, and governments contribute to the saving rate. Advanced economies account for a rising share of the deficit: the United States has the single largest deficit. Other trade specialists argue that extensive cross-border capital flows have reduced the usefulness of the current account as a monitoring device and that policy prescriptions based on current account imbalances—and trade imbalances as the largest component of the current account—may be counterproductive.

|

Figure 1. Global Current Account Surpluses and Deficits ($ in billions) |

|

|

Source: International Monetary Fund. |

The IMF report potentially supports the Trump Administration's criticism of the global trading system. The Administration has used the U.S. trade deficit and trade practices of U.S. trading partners as barometers for evaluating the success or failure of the global trading system, U.S. trade policy, and bilateral trade relations with various countries. It also characterizes the trade deficit as harming the performance and national security of the U.S. economy. Citing many of these concerns, the President imposed tariffs under three U.S. laws that allow the Administration to impose trade restrictions based on certain criteria: (1) Section 201 (19 U.S.C. §2251), (2) Section 232 (19 U.S.C. §1862), and (3) Section 301 (19 U.S.C. §2411).

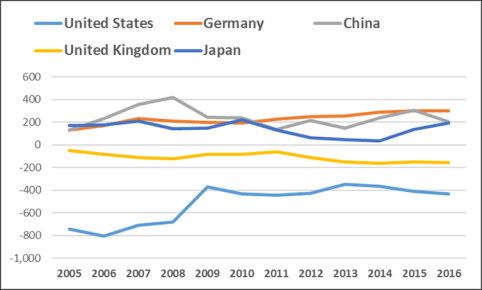

The United States has experienced current account deficits since the mid-1970s. In 2017, the United States had a current account deficit of about $450 billion, as indicated in Figure 2. The United Kingdom also experienced current account deficits, while Germany, Japan, and China had surpluses. Relative to the size of the U.S. economy (measured by U.S. gross domestic product [GDP]), the current account deficit is equivalent to less than 3% of U.S. GDP.

|

Figure 2. Current Account Balances of Major Economies ($ in billions) |

|

|

Source: International Monetary Fund. |

Current account balances are monitored to signal countries that may face long-term debt sustainability issues and, therefore, may require near-term adjustments to macroeconomic policies. The IMF argues that imbalances can be beneficial for countries with aging populations that accrue surpluses to draw down as workers retire. Also, the IMF argues that current account deficits and surpluses may be useful at different times for country-specific shocks and to facilitate a globally efficient allocation of capital. It also states that imbalances may be "symptoms of distortions" and that sustained excess imbalances "risk aggravating trade tensions," may lower the rate of global economic growth, and can be disruptive for emerging economies. The IMF encourages countries to take corrective measures, but argues that protectionist trade policies negatively affect domestic and global growth and have a limited impact on external balances.

The IMF estimates "excessive" current account balances by comparing the actual current account position with a theoretical average level, identified as "normal." This normal positon represents values that are consistent with certain economic "fundamentals and desirable medium-term policies," the IMF derives by replacing current economic policies with "desired" economic policies. A current account balance that is excessive or a currency that is misaligned does not mean the IMF determined that a country had purposely manipulated its trade balance or its exchange rate. The IMF also estimates a weighted average of exchange rates, or the real effective exchange rate (REER), that is consistent with the IMF's estimates of the normal current account position. Finally, the IMF prepares a subjective evaluation using country-specific information. The IMF estimates the gap between the actual and estimated current account balance for the United States was negative 1.6% of GDP and the dollar was overvalued by 8% to 16%.

Most economists conclude the U.S. trade deficit is largely the product of a low national savings rate, attributed in part to U.S. macroeconomic policy, or the combination of fiscal policy—notably large and persistent budget deficits—and monetary policy. This combination of policies determines the overall saving-investment balance in the economy, which then determines the inward and outward flows of funds that affect the international exchange value of the dollar and the U.S. trade balance. Although quite esoteric, some trade specialists argue that the widely accepted characterization of the current account as a product of a domestic saving-investment relationship ignores the size and extent of cross-border capital flows. These flows distinguish differences between the role of national saving from the actual financing of a trade deficit and suggesting imbalances in financing, not in the current account, can lead to macroeconomic instability similar to the 2008-2009 financial crisis. A country's ability to finance its trade deficit can be distinct from its domestic saving-investment balance, as is apparent from the U.S. experience.

Despite a low overall national savings rate, the United States has financed its trade deficit through various methods as foreigners have acquired U.S. government, business, and household assets. This process is facilitated by the perceived strengths of the U.S. economy and the role of the dollar as the preeminent global reserve currency. This broad international usage of the dollar, however, challenges the prospect that the dollar is misaligned, despite the persistent U.S. current account deficits, and the role of the current account as a trade or public policy monitoring indicator. It also implies that the ability of the United States to finance its current account deficit is distinct from its domestic saving-investment imbalance and likely will depend on foreign investors' evaluation of the relative security and stability of the United States as an investment location and of the relative attractiveness of dollar-denominated assets.