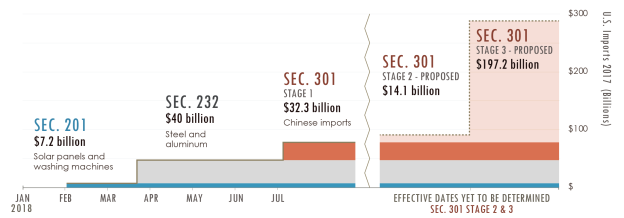

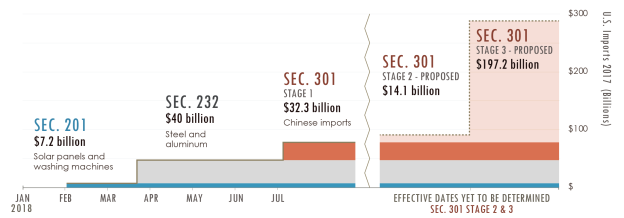

Source: CRS calculations with data from U.S. Census Bureau sourced through Global Trade Atlas.

Notes: Based on 2017 import values. Increased U.S. import tariffs may reduce demand for imports lowering annual import values.

Concerns over the U.S. trade deficit and trading partner trade practices have been a focus of the Trump Administration. Citing these concerns, the President has imposed tariffs under three U.S. laws that allow the Administration to impose trade restrictions based on certain criteria unilaterally: (1) Section 201 (Table 1) on U.S. imports of washing machines and solar products; (2) Section 232 () on U.S. imports of steel and aluminum, and potentially autos and uranium, and (3) Section 301 (Table 3) on U.S. imports from China. In 2017, U.S. imports of goods subject to the additional tariffs, which range from 10%-50%, totaled $80 billion (Table 4), a figure that would increase should additional proposed tariffs go into effect (Figure 1). While the tariffs may benefit some import-competing U.S. producers, they are also likely to increase costs for downstream users of imported products and some consumer prices. The Administration is likely using the tariffs in part to pressure affected countries into broader trade negotiations, such as the recently announced U.S.-EU trade liberalization talks, but it is unclear what specific outcomes the Administration is seeking.

|

|

Source: CRS calculations with data from U.S. Census Bureau sourced through Global Trade Atlas. Notes: Based on 2017 import values. Increased U.S. import tariffs may reduce demand for imports lowering annual import values. |

Congress delegated aspects of its constitutional authority to regulate foreign commerce to the President through these trade laws. These statutory authorities allow presidential action, based on agency investigations and other criteria, to impose import restrictions to address specific concerns (see text box). They have been used infrequently in the past two decades, in part due to the 1995 creation of the World Trade Organization (WTO) and its enforceable dispute settlement system. Prior to this Administration, U.S. import restrictions were last imposed under these trade laws in 1982 for Section 232, 2001 for Section 301, and 2002 for Section 201.

|

U.S. Laws Related To Trump Administration Trade Actions Section 201 of the Trade Act of 1974 – Allows the President to impose temporary duties and other trade measures if the U.S. International Trade Commission (ITC) determines a surge in imports is a substantial cause or threat of serious injury to a U.S. industry. Section 232 of Trade Expansion Act of 1962 – Allows the President to take action to adjust imports of products the Department of Commerce finds to be threatening to impair U.S. national security. Section 301 of Trade Act of 1974 – Allows the United States Trade Representative (USTR) to suspend trade agreement concessions or impose import restrictions if it determines a U.S. trading partner is violating trade agreement commitments or engaging in discriminatory or unreasonable practices that burden or restrict U.S. commerce. |

Increasing U.S. tariffs or imposing other import restrictions through these laws potentially opens the United States to complaints that it is violating its WTO and free trade agreement (FTA) commitments. Several U.S. trading partners, including Canada, China, Mexico, and the European Union have initiated dispute settlement proceedings and imposed retaliatory tariffs in response. The retaliatory tariffs in effect cover approximately $60 billion of U.S. annual exports, based on 2017 export data (Table 5).

Retaliation may be amplifying the potential negative effects of the U.S. tariff measures. Economically, retaliatory tariffs broaden the scope of U.S. industries potentially harmed, targeting those reliant on export markets and sensitive to price fluctuations, such as agricultural commodities. Some U.S. manufacturers have announced plans to shift production to other countries in order to avoid the tariffs on U.S. exports. Lost market access resulting from the retaliatory tariffs may compound concerns raised by many U.S. exporters that the United States increasingly faces higher tariffs than some competitors in foreign markets as other countries proceed with trade liberalization agreements eliminating tariffs, such as the recently signed EU-Japan FTA. Negative effects could grow if a tit-for-tat process of retaliation continues and the scale of trade affected increases. For example, in response to China's retaliation against U.S. Section 301 tariffs, USTR has proposed counter-retaliation tariffs covering an additional $200 billion of U.S. imports, doubling the current tariff coverage and potentially affecting approximately half of U.S. annual imports from China.

Additional actions by the Administration could result in considerably larger potential trade effects. On March 23, 2018, the Commerce Department initiated a new Section 232 investigation on U.S. auto and auto parts imports. Motor vehicles and parts accounted for $361 billion of U.S. imports in 2017. The EU, which accounts for more than $50 billion of U.S. motor vehicle and parts imports, has reportedly threatened comparable retaliatory measures. The globally integrated nature of the industry could complicate the impact of the tariffs. For example, affiliates of foreign motor vehicle firms operating in the United States exported more than $49 billion (nearly $70 billion including wholesale trade) in 2015. Although the auto investigation remains ongoing, the Administration has stated it will not impose tariffs while the recently announced U.S.-EU trade talks are ongoing. On July 18, the Administration began a fourth Section 232 investigation on U.S. uranium imports.

Many Members of Congress and U.S. businesses, interest groups, and trade partners, including major allies, have weighed in on the President's actions. While some U.S. stakeholders support the President's use of unilateral trade actions, many have raised concerns, including the Chairs of the Ways and Means and Senate Finance Committees, about potential negative impacts. In July 2017, Congress passed a nonbinding resolution directing appropriations bill conferees to include language giving Congress a role in Section 232 determinations, and several Members have introduced legislation that would constrain the President's authority (e.g., S. 3013 and S. 3266). As it debates the Administration's import restrictions, Congress may consider the following:

The tables below provide a timeline of key events related to each U.S. trade action, as well as the range of potential trade volumes affected by the U.S. tariffs and U.S. trading partners' retaliations. In addition to tariffs, the President has imposed quotas, or quantitative limits on U.S. imports of certain goods from specified countries, as well as tariff-rate quotas (TRQs), for which one tariff applies up to a specific quantity of imports and a higher tariff applies above that threshold.

|

Key Dates |

|

|

U.S. Import Restriction |

Solar Cells: 4-year TRQ with 30% above quota tariff, descending 5% annually. Solar Modules: 4-year 30% tariff, descending 5% annually. Large Residential Washers: 3-year TRQ, 20% in quota tariff descending 2% annually, 50% above quota tariff descending 5% annually. Large Residential Washer Parts: 3-year TRQ, 50% above quota tariff, descending 5% annually. |

|

Countries Affected |

Canada excluded from the duties on washers. Certain developing countries excluded if they account for less than 3% individually or 9% collectively of U.S. imports of solar cells or large residential washers, respectively. All other countries included. |

|

Current Status |

Effective February 7, 2018. |

Table 2. Section 232 Steel and Aluminum Investigations

|

Key Dates |

|

|

U.S. Import Restriction |

Aluminum: 10% tariffs on specified list of aluminum imports effective indefinitely. Steel: 25% tariffs on specified list of steel imports effective indefinitely. |

|

Countries Affected |

Aluminum: Australia and Argentina* permanently exempted. Steel: Australia, Argentina*, Brazil*, and South Korea* permanently exempted. All other countries included. (*) Quantitative import restrictions imposed in place of tariffs. |

|

Current Status |

Effective March 23, 2018. (Retaliation also in effect, see Table 5) |

Table 3. Section 301 China Trade Barriers Investigation

|

Key Dates |

|

|

U.S. Import Restriction |

Stage 1 – 25% import tariff on 818 U.S. imports (final, approx. $34 billion) Stage 2 – 25% import tariff on 228 U.S. imports (proposed, approx. $16 billion). Stage 3 – 10% import tariff on 6,031 U.S. imports (proposed, approx. $200 billion). |

|

Countries Affected |

China |

|

Current Status |

Stage 1 – Effective July 6, 2018. Stage 2 – Proposed, hearing 7/24 to determine final list. Stage 3 – Proposed, hearing 8/20 to determine final list. (Retaliation also in effect, see Table 5) |

Table 4. Proposed and Existing U.S. Import Restrictions

|

U.S. Trade Action |

U.S. Imports (millions, 2017) |

Additional Tariff |

Potential Tariff Revenue* (millions, 2017) |

Effective Date |

||

|

Section 201 |

Solar Cells/ Modules |

$5,196 |

TRQ (0%, 30%)/ 30% |

$1,559 |

February 7, 2018 |

|

|

Large Washers/ Washer Parts |

$1,927 |

TRQ (20%, 50%)/ TRQ (0%, 50%) |

$964 |

February 7, 2018 |

||

|

Total |

$7,123 |

$2,523 |

||||

|

Section 232 |

Aluminum |

$16,643 |

10% |

$1,664 |

March 23, 2018 |

|

|

Steel |

$23,369 |

25% |

$5,842 |

March 23, 2018 |

||

|

Total |

$40,012 |

$7,507 |

||||

|

Section 301 |

China - Stage 1 |

$32,262 |

25% |

$8,066 |

July 6, 2018 |

|

|

China - Stage 2 |

$14,116 |

25% |

$3,529 |

TBD |

||

|

China - Stage 3 |

$197,214 |

10% |

$19,721 |

TBD |

||

|

Total |

$243,592 |

$31,316 |

|

|||

|

Total in Effect |

$79,975 |

$18,095 |

|

|||

|

Total Formally Proposed |

$293,421 |

$41,345 |

|

|||

Source: Calculations by CRS based on trade data from U.S. Census Bureau and tariff data from Administration notifications.

Notes: (*) Potential tariff revenue estimated using 2017 import values. This does not account for potential fluctuations in demand resulting from the tariffs or other variables. It is useful for comparing the magnitude of the various tariff actions but should not be used to estimate actual tariff collection. TRQ tariff revenue estimated assuming all imports are subject to over quota tariff.

Table 5. Proposed and Existing Retaliatory Actions

|

Retaliatory Trade Action |

U.S. Exports (millions, 2017) |

Additional Tariff |

Potential Tariff Revenue* (millions, 2017) |

Effective Date |

||

|

Section 201 |

$1,377** |

TBD |

$474** |

2021 |

||

|

$654** |

TBD |

$220** |

2021 |

|||

|

Japan (Solar) |

$83** |

TBD |

$25** |

2021 |

||

|

Total |

$2,114 |

$719 |

|

|||

|

Section 232 |

$12,748 |

10-25% |

$1,920 |

July 1, 2018 |

||

|

European Union (EU) – Stage 1 |

$3,204 |

10-25% |

$781 |

June 25, 2018 |

||

|

EU – Stage 2 |

$4,239 |

10-50% |

$931 |

2021 |

||

|

$3,691 |

7-25% |

$730 |

Partial-June 5, Full-July 5, 2018 |

|||

|

$3,008** |

TBD |

$515** |

TBD |

|||

|

$2,969 |

15-25% |

$645 |

April 2, 2018 |

|||

|

$1,911** |

TBD |

$440** |

TBD |

|||

|

$1,788 |

5-40% |

$267 |

June 21, 2018 |

|||

|

$1,396 |

10-50% |

$240 |

June 21, 2018 |

|||

|

Total |

$33.834 |

$6,469 |

||||

|

Section 301 |

$33,834 |

25% |

$8,459 |

July 6, 2018 |

||

|

$14,345 |

25% |

$3,586 |

TBD |

|||

|

Total |

$48,179 |

$12,045 |

|

|||

|

Total in Effect |

$59,630 |

$13,042 |

|

|||

|

Total Formally Proposed |

$85,247 |

$19,233 |

|

|||

Source: CRS calculations based on import data of U.S. trade partner countries sourced from Global Trade Atlas and tariff details from WTO or government notifications.

Notes: (*) Potential tariff revenue estimated using 2017 import values. This does not account for potential fluctuations in demand resulting from the tariffs or other variables. It is useful for comparing the magnitude of the various tariff actions but should not be used to estimate actual tariff collection. (**) Retaliation announcements did not include a product list or specific tariff values. Retaliatory export and tariff value estimated based on retaliation commensurate with U.S. tariff actions.