Overview of the Medicare Program

Medicare, administered by the Centers for Medicare and Medicaid Services (CMS), is the nation's federal insurance program that pays for covered health services for most persons aged 65 years and older and for most permanently disabled individuals under the age of 65.1 As a health insurance program, Medicare reimburses health care providers and suppliers, such as hospitals, physicians, and medical equipment companies, for the services and products they provide to Medicare beneficiaries. Medicare is prohibited by law from interfering in the practice of medicine or controlling the manner in which medical services are provided. It also is required to pay for covered services provided to eligible persons so long as specific criteria are met. As such, the growth in per person Medicare expenditures largely reflects the medical practices, use of technology, and underlying costs in the broader health care system. Spending under the program (except for a portion of administrative costs) is considered mandatory spending and is not subject to the appropriations process. Thus, there generally are no limits on annual Medicare spending.

Since its enactment in 1965, the Medicare program has undergone considerable change. Because of its rapid growth, both in terms of aggregate dollars and as a share of the federal budget, the Medicare program has been a major focus of deficit reduction legislation passed by Congress.2 With a few exceptions, reductions in program spending have been achieved largely through freezes or reductions in payments to providers, primarily hospitals and physicians, and by making changes to beneficiary premiums and other cost-sharing requirements. For example, the Patient Protection and Affordable Care Act (ACA; P.L. 111-148, as amended) made numerous changes to the Medicare program that modify provider reimbursements, provide incentives to improve the quality and efficiency of care, and enhance certain Medicare benefits.3

Four Parts of Medicare

Medicare consists of four distinct parts, A through D:

- Part A covers inpatient hospital services, skilled nursing care, hospice care, and some home health services. Most persons aged 65 and older are automatically entitled to premium-free Part A because they or their spouse paid Medicare payroll taxes for at least 40 quarters (10 years) on earnings covered by either the Social Security or the Railroad Retirement systems.

- Part B covers a broad range of medical services, including physician services, laboratory services, durable medical equipment, and outpatient hospital services. Enrollment in Part B is optional; however, most beneficiaries with Part A also enroll in Part B.

- Part C (Medicare Advantage, or MA) is a private plan option for beneficiaries that covers all Parts A and B services, except hospice. Individuals choosing to enroll in Part C must be eligible for Part A and also must enroll in Part B. About one-third of Medicare beneficiaries are enrolled in MA.4

- Part D covers outpatient prescription drug benefits. This portion of the program is optional. About 76% of Medicare beneficiaries are enrolled in Medicare Part D or have coverage through an employer retiree plan subsidized by Medicare.5

Beneficiary Costs

In addition to paying premiums for Medicare Parts B and D,6 beneficiaries must pay other out-of-pocket costs, such as deductibles and coinsurance, for services provided under all parts of the Medicare program. There is no limit on beneficiary out-of-pocket spending, and most beneficiaries have some form of supplemental insurance through private Medigap plans, employer-sponsored retiree plans, or Medicaid to help cover a portion of their Medicare premiums and/or deductibles and coinsurance.

Provider and Plan Payments

Under traditional Medicare, Parts A and B, the government generally pays providers directly for services on a fee-for-service basis using different prospective payment systems, or fee schedules.7 Under Parts C and D, Medicare pays private insurers a monthly capitated per person amount to provide coverage to enrollees. The capitated payments are adjusted to reflect differences in the relative cost of sicker beneficiaries with different risk factors including age, disability, or end-stage renal disease.

Medicare Trust Funds and Sources of Revenue

The Medicare program has two separate trust funds—the Hospital Insurance (HI) Trust Fund for Part A and the Supplementary Medical Insurance (SMI) Trust Fund for Parts B and D.8 (For beneficiaries enrolled in MA [Part C], payments are made on their behalf in appropriate portions from the HI and SMI Trust Funds.) Both the HI and SMI Trust Funds are maintained by the Department of the Treasury and overseen by a Medicare Board of Trustees that reports annually to Congress concerning the funds' financial status.9 Financial projections are made using economic assumptions based on current law, including estimates of consumer price index (CPI), workforce size, wage increases, and life expectancy.

The Medicare trust funds are financial accounts in the U.S. Treasury into which all income to the program is credited and from which all benefits and associated administrative costs of the program are paid. The trust funds are solely accounting mechanisms—there is no actual transfer of money into and out of the funds. As long as a trust fund has a balance, the Department of the Treasury is authorized to make payments for it from the U.S. Treasury.

Hospital Insurance Trust Fund

The Part A portion of Medicare is financed through the HI Trust Fund.

Sources of HI Revenue

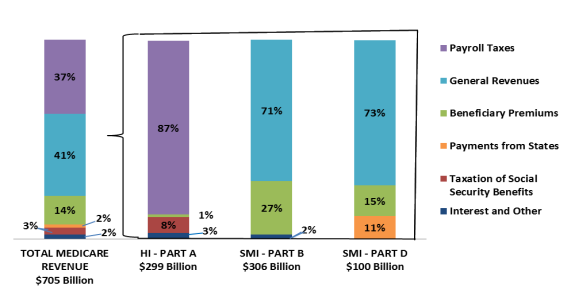

The HI Trust Fund is funded primarily by a dedicated payroll tax of 2.9% of earnings, shared equally between employers and workers. (See Figure 1.) Unlike Social Security, there is no upper limit on wages subject to Medicare payroll taxes. Beginning in 2013, the ACA has imposed an additional tax of 0.9% on high-income workers with wages over $200,000 for single tax filers and over $250,000 for joint filers.10 Other sources of income to the HI Trust Fund include premiums paid by voluntary enrollees who are not entitled to premium-free Medicare Part A, a portion of the federal income taxes paid on Social Security benefits, and interest on federal securities held by the trust fund.

HI Trust Fund Mechanics

HI operates on a pay-as-you-go basis; the taxes paid by current workers and their employers are used to pay Part A benefits for today's Medicare beneficiaries. When the government receives Medicare revenues (payroll taxes), income is credited by the Treasury to the HI Trust Fund in the form of special-issue interest-bearing government securities.11 (Interest on these securities also is credited to the trust fund.) The tax income exchanged for these securities then goes into the general fund of the Treasury and is indistinguishable from other cash in the general fund; this cash may be used for any government spending purpose. When payments for Medicare Part A services are made, the payments are paid out of the general treasury and a corresponding amount of securities is deleted from (written off) the HI Trust Fund.

|

|

Source: Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, The 2018 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, June 5, 2018, Table II.B1. Notes: Totals may not add to 100% due to rounding. HI = Hospital Insurance; SMI = Supplementary Medical Insurance. In 2017, Part B premiums represented over 25% of Part B income due, in part, to a $3.00 per month Part B premium surcharge imposed by the Bipartisan Budget Act of 2015 (P.L. 114-74). |

In years in which the trust fund spends less than the income it receives, the trust fund securities exchanged for any income in excess of spending show up as assets on the financial accounting balance sheets and are available to the system to meet future obligations. The trust fund surpluses are not reserved for future Medicare benefits but are simply bookkeeping entries that indicate how much Medicare has lent to the Treasury (or alternatively, what is owed to Medicare by the Treasury). From a unified budget perspective, these assets represent future budget obligations and are treated as liabilities. If the HI Trust Fund is not able to pay all current expenses out of current income and accumulated trust fund assets, it is considered to be insolvent.12

Supplementary Medical Insurance Trust Fund

The SMI Trust Fund consists of two accounts: Part B and Part D.

Sources of SMI Revenue

Unlike the HI portion of Medicare, the SMI program was not intended to be supported through dedicated sources of income. Instead, it relies primarily on general tax revenues and beneficiary premiums as revenue sources.13

The Part B portion of SMI is funded mainly through beneficiary premiums (set at 25% of estimated program costs for the aged)14 and general revenues (most of the remaining amount, approximately 75%). In 2018, the standard monthly Part B premium is $134.00.15 However, certain low-income enrollees receive assistance with their premiums from Medicaid (joint federal-state funding), and, since 2007, high-income enrollees pay higher premiums. Beginning in 2011, additional revenues from an annual fee imposed on certain manufacturers and importers of branded prescription drugs also are credited to the SMI Trust Fund.16

Part D is financed through a combination of beneficiary premiums (set at 25.5% of the estimated cost of the standard benefit), general revenues, and state transfer payments (to cover a portion of the costs of beneficiaries enrolled in both Medicare and Medicaid—the dual-eligibles). Actual Part D premiums may vary depending on which plan the enrollee selects. Low-income enrollees may receive premium assistance through the Part D low-income subsidy (all federal funding), and, starting in 2011, higher income enrollees pay higher premiums.

SMI Trust Fund Mechanics

The level of SMI funding is automatically updated each year to cover expenditures in the upcoming year. If actual costs exceed those estimated when the funding was set, the amount of financing in the next year (i.e., general revenues and beneficiary premiums) may be adjusted to recover the shortfall. Similarly, if actual costs are less than expected in a given year, income levels needed for the next year may be adjusted downward. Because of these automatic adjustments, the SMI Trust Fund is always kept in balance and cannot become insolvent.

Medicare Spending in 201717

In calendar year (CY) 2017, Medicare provided benefits to about 58.4 million people (49.5 million people aged 65 and older and 8.9 million disabled people under the age of 65) at an estimated total cost of $710 billion.18 Most of that amount, about $702 billion (99%), was spent on program benefits, with the remaining amount used for program administration. (See Table 1.)

|

HI |

SMI |

Total |

||

|

Part A |

Part B |

Part D |

||

|

Expenditures (billions) |

||||

|

Benefits |

$293.3 |

$308.6 |

$100.1 |

$702.1 |

|

Hospital |

144.6 |

53.3 |

— |

197.9 |

|

Skilled Nursing |

28.3 |

— |

— |

28.3 |

|

Home Health Care |

6.9 |

11.5 |

— |

18.4 |

|

Physician Services |

— |

69.1 |

— |

69.1 |

|

Private Plans (Part C) |

94.5 |

115.1 |

— |

209.7 |

|

Prescription Drugs |

— |

— |

100.1 |

100.1 |

|

Other |

19.1 |

59.6 |

— |

78.8 |

|

Administrative Expenses |

3.2 |

5.0 |

−0.1 |

$8.1 |

|

Total Expenditures |

$296.5 |

$313.7 |

$100.0 |

$710.2 |

|

Enrollment (millions) |

||||

|

Aged |

49.2 |

45.3 |

37.3 |

49.5 |

|

Disabled |

8.9 |

8.1 |

7.1 |

8.9 |

|

Total Enrollment |

58.0 |

53.4 |

44.5 |

58.4 |

|

Average expenditures per enrollee |

$5,055 |

$5,780 |

$2,252 |

$13,087 |

Source: 2018 Report of the Medicare Trustees, Table II.B1.

Notes: Totals do not necessarily equal the sums of rounded components.

2017 HI Operations

At the beginning of CY2017, the HI Trust Fund had an asset balance of about $199 billion. During 2017, Part A expenditures were about $297 billion. Approximately $262 billion of that amount was funded by payroll taxes and $38 billion by interest income and other sources. (See "Sources of HI Revenue.") Because revenue income exceeded expenditures, about $3 billion in surplus accumulated in the HI Trust Fund. At the end of 2017, the HI Trust Fund had an asset balance of approximately $202 billion. This means that if or when HI spending exceeds income in future years, the trust fund will be able to spend a total of $202 billion in addition to what it receives in income.19

2017 SMI Operations

In CY2017, total spending for Part B was close to $314 billion, with general revenues financing approximately $217 billion of that amount and premiums covering most of the remainder. Total spending for Part D reached about $100 billion in 2017, with more than $73 billion of that amount paid for by general revenues. In addition, approximately $11 billion was covered by state transfer payments, and $16 billion was covered by beneficiary premiums. It should be noted that although beneficiary premiums are set at a rate to cover 25.5% of the costs of standard Part D benefits, the program pays for the premiums of about one-third of enrollees because these enrollees qualify for low-income assistance. As a result, Part D premiums represented about 15% of Part D revenues in 2017. (See Figure 1.)

Estimated Date of HI Trust Fund Insolvency

From 2008 to 2015, Part A expenditures exceeded HI income each year, and the assets credited to the trust fund were drawn down to make up the deficit. In 2016 and 2017, the HI Trust Fund ran a small surplus;20 however, the Medicare trustees project a return to deficits in 2018 and in the following years until the HI Trust Fund becomes depleted (insolvent) in 2026. At that time, there would no longer be sufficient funds to fully cover Part A expenditures; although HI would continue to receive tax income, the funds would cover only 91% of Part A expenses. The trustees suggest that, under these circumstances, beneficiary access to Part A services "could rapidly be curtailed."21

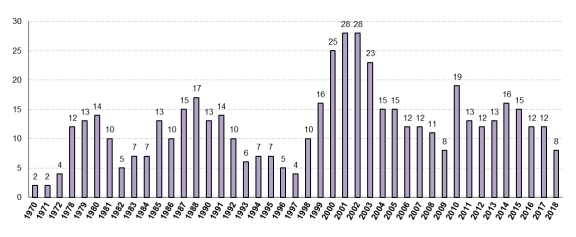

Almost from its inception, the HI Trust Fund has faced a projected shortfall and eventual insolvency (see Figure 2), with insolvency dates ranging from 2 years to 28 years from the year of the projection. However, to date, the HI Trust Fund has never become insolvent. There are no provisions in the Social Security Act that govern what would happen if that were to occur; for example, there is no authority in law for the program to use general revenues to fund Part A services in the event of such a shortfall. Unless action is taken prior to the expected date of insolvency to increase HI revenues or decrease expenditures, Congress may face a decision regarding the provision of additional funding to make up for these deficits and to allow for full and on-time payments to Part A providers.

Because income (general revenue and premiums) to the SMI Trust Fund is updated automatically each year to ensure that the program has enough money to continue operating, the SMI Trust Fund is kept in balance and is always solvent. However, the Medicare trustees continue to express concerns about the rapid growth in SMI (Parts B and D) costs.

Projected Medicare Spending Growth

Although the 2018 Medicare Trustees Report notes a recent slowing in the growth of U.S. national health expenditures,22 the trustees still project that U.S. health care expenditures, including Medicare spending, will grow faster than gross domestic product (GDP) in most future years. For Medicare, the projected growth in the prices of health services plus anticipated increases in utilization rates and in the complexity of services provided are expected to contribute to rising costs of Medicare relative to GDP. The aging of the baby boom population is also expected to contribute to significant increases in benefit expenditures.23

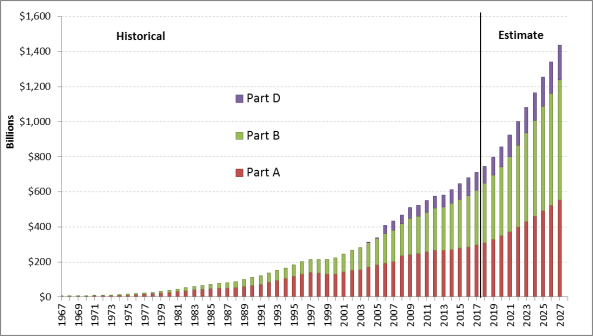

Over the next 10 years, the Medicare trustees estimate that total Medicare expenditures will increase from $710 billion in 2017 to close to $1.44 trillion in 2027. Of the $1.44 trillion, about $555 billion is expected to be spent on Part A services, $685 billion on Part B services, and $195 billion on Part D services. (See Figure 3.)

|

|

Source: 2018 Report of the Medicare Trustees, Expanded and Supplementary Tables (historical data); and Report Tables III.B4; III.C4; and III.D3 (projected data). |

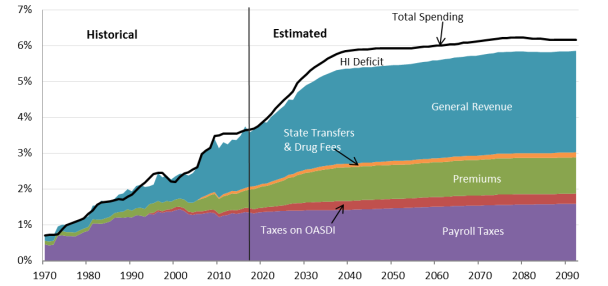

Growth in Medicare Expenditures Relative to GDP

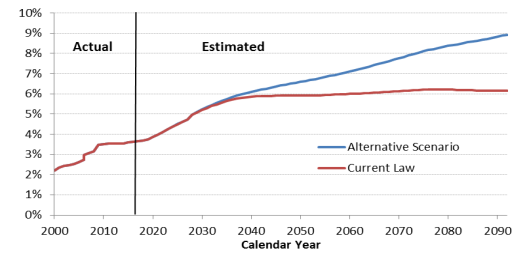

A comparison of Medicare expenditures (for Medicare Parts A through D, combined) to GDP provides a measure of the amount of financial resources that will be necessary to pay for Medicare services relative to the output of the U.S. economy. Under current law, the trustees expect total Medicare expenditures to increase from 3.7% of GDP in 2018 to about 5.9% of GDP by 2042, mainly due to the rapid growth in the number of beneficiaries, and then to about 6.2% of GDP in 2092, with growth in health care cost per beneficiary becoming the more significant factor in those years. (See Figure 4.)

Over the next 75 years, general revenues and beneficiary premiums are expected to play an increasing role in financing the program. For example, the level of general revenues needed to fund SMI is expected to increase from 1.6% of GDP in 2018 to an estimated 2.8% in 2092 under current law.24 Similarly, income from beneficiary premiums is expected to increase from 0.6% of GDP in 2018 to 1.0% in 2092. In 2017, about 15.4% of total federal income taxes collected that year were used to fund the general revenue portion of SMI. It is expected that the portion of personal and corporate income taxes needed to fund SMI will increase to about 22% in 2030 and to about 26% in 2092. This amount is in addition to the payroll taxes used to fund the Part A (HI) portion of the program.

|

Figure 4. Medicare Cost and Non-interest Income, |

|

|

Source: Summary of the 2018 Annual Reports of the Social Security and Medicare Boards of Trustees, Chart C, at http://www.ssa.gov/oact/TRSUM/index.html. |

Unfunded and General Revenue Obligations

The trustees report provides estimates of the present value of the HI deficit—the unfunded obligation—over both a 75-year horizon and an "infinite" horizon. (See Table 2.) This unfunded obligation represents the dollar amount by which expenditures would need to be reduced or revenue increased to maintain the financial soundness of the program over a period of time. The trustees estimate that the current value of funding needed to cover the expected difference between income to the HI Trust Fund and expenditures over the next 75 years is $4.5 trillion. The trustees note that this financial imbalance could be addressed by immediately increasing payroll taxes to 3.72% (from the current 2.9%), or by immediately decreasing expenditures by 17%, or by some combination of the two. From a budgetary standpoint, the accumulated assets in the trust fund are considered liabilities, as the redemption of the assets represents a formal budget commitment. Therefore, the starting balance of $0.2 trillion in the HI Trust Fund needs to be added to the unfunded obligation of $4.5 trillion for a present value of $4.7 trillion shortfall in dedicated revenues.

The trustees report also provides estimates of the present value of future SMI spending. Although SMI is funded automatically and does not face a shortfall, the general revenue portion represents obligated federal spending. The present value of expected general revenues needed to pay for Medicare Parts B and D over the next 75 years is $33.0 trillion. Adding the HI unfunded obligation estimate and the present value of future SMI spending for the 75-year period yields a total of $37.7 trillion.25 In other words, it would take about $37.7 trillion in current dollars to cover the cost of Medicare not funded through dedicated sources over the next 75 years.

|

Present Value of HI Deficit |

Present Value of SMI General Revenues |

Total |

||||

|

Part A |

Part B |

Part D |

||||

|

Unfunded obligations through 2092 |

$4.7 trilliona |

General revenue contributions through 2092 |

$25.1 trillion |

$7.9 trillion |

$37.7 trillion |

|

|

Unfunded obligations through infinite horizon |

-$2.0 trilliona |

General revenue contributions through infinite horizon |

$46.4 trillion |

$19.3 trillion |

$63.7 trillion |

|

Source: 2018 Report of the Medicare Trustees, Tables V.F2, V.G1, V.G3, V.G5.

a. Budgetary and trust fund accounting rules differ in the treatment of trust fund assets. From a budgetary standpoint, the accumulated assets in the trust fund are considered liabilities, as the redemption of the assets represents a formal budget commitment. The starting balance of $0.2 trillion in the HI Trust Fund is thus included in this figure. Under trust fund accounting methods, which exclude the asset balance, the unfunded HI obligation for the 75-year projection period would be $4.5 trillion and -$2.2 trillion for the infinite projection period.

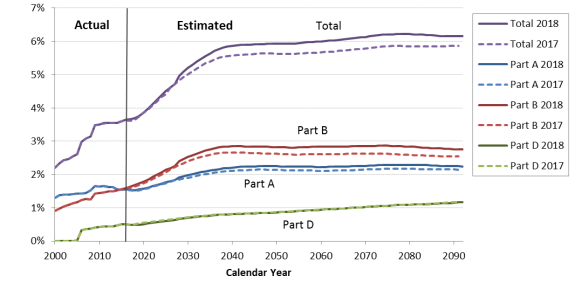

Comparison to Prior-Year Estimates

Over both the short and long terms, projections of total Medicare spending in the 2018 trustees report are higher than those in the 2017 report. (See Figure 5.)

Both the short-term and the long-term financial outlooks for the HI Trust Fund have somewhat deteriorated compared to estimates in last year's report. The estimated depletion date of the HI Trust Fund is 2026, three years earlier than projected in the 2017 report. Over the next 75 years, the estimated HI actuarial deficit (the amount that would need to be added to the payroll tax to maintain HI solvency for this period) increased by 0.18%—from 0.64% of taxable payroll in the 2017 report to 0.82% of taxable payroll in the 2018 report. This increase is due to expected changes in both HI income and costs. The increase in projected HI costs is primarily due to higher-than-expected Part A expenditures in 2017 (which increases the projection base), recent legislation that increased hospital spending, and higher Medicare Advantage payments. The projected decrease in income is due to expected reductions in payroll taxes as a result of lower than expected wages in 2017 and lower projected GDP, and to expected reductions in income from the taxation of Social Security benefits as a result of recent tax legislation.

Part B projected short- and long-term costs are also higher in the 2018 report due to higher Medicare Advantage spending and recent legislation that ended caps for certain therapy services and eliminated the Independent Payment Advisory Board.26 In the short term, projected Part D costs are slightly lower than estimates in last year's report due to an expected increase in manufacturer rebates provided to Part D plans, and a decline in spending for hepatitis C and diabetes drugs. However, due to an assumption of a slightly higher growth rate in Part D, long-range projections of Part D spending remain similar to the trustees' 2017 projections.

|

Figure 5. Comparison of 2017 and 2018 Medicare Expenditure Projections (expenditures as a percentage of GDP) |

|

|

Sources: 2017 and 2018 Medicare Trustees Reports, Supplementary Tables. |

Alternative Projections

Throughout the 2018 report, the Medicare trustees caution that actual costs may be higher than their intermediate projections. For example, because the trustees are required to base their estimates on current law, their assumptions assume that physician payments will be updated according to levels set forth in the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA; P.L. 114-10),27 and that the full ACA-required Medicare plan and provider payment reductions will be maintained.

Because of concerns about the accuracy of these projections, the Medicare trustees asked the CMS Office of the Actuary to prepare an alternative projection based on the assumptions that annual physician payment updates will transition beginning in 2028 from current law to 2.2% by 2042, that the 5% bonuses for physicians in the advanced alternative payment models (APM) and the $500 million in additional payments to physicians in the merit-based incentive system (MIPS) will continue after 2025, and that ACA provider payment adjustments will be phased down beginning in 2028.28 Under this alternative scenario, long-term Medicare costs are projected to reach about 8.9% of GDP in 2092, instead of 6.2% under the trustees' current-law projections. Additionally, under the alternative scenario, the HI actuarial deficit would be 1.71% of taxable payroll (compared with 0.82% under the current-law projection), which could be addressed by immediately increasing payroll taxes to 4.61% or by immediately decreasing expenditures by 30% (compared with 3.72% and 17%, respectively, under current law). Because the differences in assumptions between current law and the alternative scenario do not begin until 2028, the alternative scenario projects the same 2026 date of HI insolvency.