Introduction

The Patient Protection and Affordable Care Act (ACA; P.L. 111-148, as amended) requires health insurance exchanges (also known as marketplaces) to be established in every state. ACA exchanges are virtual marketplaces in which consumers and small businesses can shop for and purchase private health insurance coverage and, where applicable, be connected to public health insurance programs (e.g., Medicaid).1 Exchanges are intended to simplify the experience of obtaining health insurance. They are not intended to supplant the private market outside of the exchanges but rather to provide an additional source of private health insurance coverage options.

This report provides an overview of key aspects of the health insurance exchanges. The report includes summary information about the major functions of exchanges and how they are structured. It describes individual and small business eligibility and enrollment processes, provides enrollment estimates, explains the financial assistance available to certain consumers and small businesses, and discusses consumer enrollment assistance options. The report also reviews the role of exchanges in certifying participating plans and outlines the range of plans offered through exchanges. It briefly addresses funding for the exchanges. It provides a high-level description of these exchange-related topics while referencing other CRS reports with further information on specific topics, including on topics related to market stabilization policy considerations.

Types of Exchanges

Individual and SHOP Exchanges

The ACA required health insurance exchanges to be established in all states and the District of Columbia (DC). In general, the health insurance exchanges began operating in October 2013 to allow consumers to shop for health insurance plans that began as soon as January 1, 2014.

Most states have two types of exchanges—an individual exchange and a small business health options program (SHOP) exchange.2 In an individual exchange, eligible consumers can compare and purchase non-group insurance for themselves and their families and can apply for premium tax credits and cost-sharing reductions.3 In a SHOP exchange, small businesses can compare and purchase small-group insurance and can apply for small business health insurance tax credits; in addition, employees of small businesses can enroll in plans offered by their employers on a SHOP exchange.4 Besides facilitating consumers' and small businesses' purchase of coverage (by operating a web portal, making determinations of eligibility for coverage and any financial assistance, and offering different forms of enrollment assistance), the other major function of the exchanges is to certify, recertify, and otherwise monitor the plans that participate in those marketplaces. Individual and SHOP exchanges can be operated by either the state or the federal government, as described below.

State-Based and Federally Facilitated Exchanges

A state can choose to establish its own state-based exchange (SBE). If a state opts not to administer its own exchange, or if the Department of Health and Human Services (HHS) determines that the state is not in a position to do so, then HHS is required to establish and administer the exchange in the state as a federally facilitated exchange (FFE). States also may have a state-based exchange using a federal platform (SBE-FP), which means they have an SBE but use the federally facilitated information technology (IT) platform (i.e., HealthCare.gov).

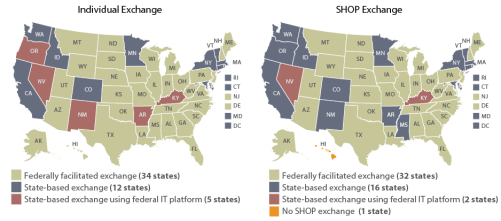

For the 2018 plan year, 34 states have FFEs, 12 states have SBEs, and 5 states have SBE-FPs.5 In addition, state involvement in the FFEs may vary. In many states with FFEs, the exchange is wholly operated and administered by HHS. But in some cases, states partner with HHS to perform some functions, such as plan management or consumer assistance.6

Like the individual exchanges, SHOP exchanges may be federally facilitated (FF-SHOP; 32 states), state-based (SB-SHOP; 16 states), or state-based using the federal IT platform (SB-FP-SHOP; 2 states).7 One state is exempted from operating a SHOP exchange.8 For the 2018 plan year, most states' individual and SHOP exchanges are administered in the same way (i.e., both state-based or both federally facilitated). However, a handful of states have different approaches for their individual and SHOP exchanges.

See Figure 1 and Table A-1 for the exchange types by state.

|

Figure 1. Individual and SHOP Exchange Types by State, Plan Year 2018 |

|

|

Sources: Congressional Research Service (CRS) illustration based on data from the following sources: Notes: SHOP = small business health options program; IT = information technology. Counts of "states" include the District of Columbia. In the individual exchanges, "plan year" is generally that calendar year, but group coverage plan years, including in the SHOP exchanges, may start at any time during a calendar year. See "Types of Exchanges" in this report for discussion of the different exchanges. See Table A-1 for the exchange types by state in table form and for additional details. |

Facilitating Purchase of Coverage

A primary function of the exchanges is to provide a way for consumers and small businesses to compare and purchase health plan options offered by insurers.9

Individual Exchanges

Eligibility and Enrollment Process

Consumers may purchase health insurance plans for themselves or their families in their state's individual exchange. Consumers may enroll as long as they (1) meet state residency requirements;10 (2) are not incarcerated, except individuals in custody pending the disposition of charges; and (3) are U.S. citizens, U.S. nationals, or "lawfully present" residents.11 Undocumented individuals are prohibited from purchasing coverage through the exchanges, even if they were to pay the entire premium without financial assistance.

Consumers can use their state's exchange website (Healthcare.gov or a state-run site) to compare and enroll in plans, and the exchange websites are required to display a calculator that estimates consumers' costs after any cost-sharing reductions or premium tax credits for which they are eligible (see "Premium Tax Credits and Cost-Sharing Reductions" in this report). Consumers may be linked to Medicaid or the State Children's Health Insurance Program (CHIP) enrollment pages if they are eligible.

In addition to using the exchange websites, consumers can enroll by phone, by mail, or in person—including through an agent, broker, or plan issuer—as available by state. Enrollment assistance is available for those who want it (see "Individual and SHOP Exchange Enrollment Assistance" in this report).

Once the exchange receives and verifies consumers' eligibility and enrollment information, it may continue to serve as a conduit through which consumers pay their premiums to their issuers. Alternatively, consumers may pay premiums directly to their issuers.

Enrollment Periods and Enrollment Estimates

Consumers may enroll in coverage through the exchanges only during specified enrollment periods.

Anyone eligible for exchange plan coverage may enroll during an annual open enrollment period (OEP).12 The OEP typically takes place in fall of the year preceding the plan year. The OEP for calendar year 2018 coverage was November 1, 2017, to December 15, 2017, for FFE and SBE-FP states (see Table 1 for enrollment periods). States with SBEs may observe different OEPs. For 2018 coverage, all 12 SBEs' OEPs lasted longer than the federal OEP.13 The OEP for plan year 2019 is currently set as November 1, 2018, to December 15, 2018, for FFE and SBE-FP states.

Consumers also may be allowed to enroll for coverage in an exchange if they qualify for a special enrollment period (SEP).14 Generally, consumers qualify for SEPs due to a change in personal circumstances—for example, a change in marital status or number of dependents—or loss of qualifying coverage.15 HHS also may choose to offer SEPs or extend an OEP for some or all consumers due to broadly applicable circumstances.16 In addition, consumers generally may enroll in Medicaid or CHIP whenever they qualify, regardless of their state's exchange OEP.

Annual individual exchange enrollment estimates to date are shown in Table 1. Given the exchange eligibility determination process as well as the OEPs and SEPs, data on exchange enrollment are released in stages. Pre-effectuated enrollment is the number of unique individuals who have been determined eligible to enroll in an exchange plan and have selected a plan. These individuals may or may not have submitted the first premium payment. In general, cumulative and final pre-effectuated enrollment estimates are released during and soon after an annual open enrollment period.

Subsequently, effectuated enrollment is the number of unique individuals who have been determined eligible to enroll in an exchange plan, have selected a plan, and have submitted the first premium payment for an exchange plan. Effectuated enrollment estimates generally are point-in-time and may change over the coverage year. For example, due to changes in life circumstances, an individual may disenroll (e.g., if later offered coverage through an employer) or enroll (e.g., given eligibility for an SEP) in an exchange plan.

|

PY2014 |

PY2015 |

PY2016 |

PY2017 |

PY2018 |

|

|

Healthcare.gov OEPa |

Oct. 1, 2013-Mar. 31, 2014 |

Nov. 15, 2014-Feb. 15, 2015 |

Nov. 1, 2015-Jan. 31, 2016 |

Nov. 1, 2016-Jan. 31, 2017 |

Nov. 1, 2017-Dec. 15, 2017 |

|

National Enrollment, |

8.0 million |

11.7 million |

12.7 million |

12.2 million |

11.8 million |

|

National Enrollment, Effectuated c |

6.3 million as of Dec. 2014 |

8.8 million as |

9.1 million as of Dec. 2016 d |

10.3 million as of Feb. 2017 e |

Not released as of this report |

Source: CRS analysis based on Department of Health and Human Services (HHS) annual reports of individual exchange enrollment in private health insurance plans. Some of these reports are available at HHS, Assistant Secretary for Planning and Evaluation (ASPE), "Historical Research," at https://aspe.hhs.gov/historical-research. Some are available at CMS, Center for Consumer Information and Insurance Oversight (CCIIO), "Data Resources," at https://www.cms.gov/CCIIO/ Resources/Data-Resources/index.html; others are available elsewhere on the CMS site. The 2018 pre-effectuated estimates are available at CMS, "Health Insurance Exchanges 2018 Open Enrollment Period Final Report," April 3, 2018, at https://www.cms.gov/Newsroom/MediaReleaseDatabase/Fact-sheets/2018-Fact-sheets-items/2018-04-03.html. Contact report author for all sources.

Notes: PY = plan year; OEP = open enrollment period; SEP = special enrollment period. FFE = federally facilitated exchange; SBE = state-based exchange; SBE-FP = state-based exchange using the federal information technology platform. See "State-Based and Federally Facilitated Exchanges" in this report for more information.

a. The Healthcare.gov OEP applies to FFE and SBE-FP states. The OEPs of SBEs may be longer in a given year. In some years, there also have been federal OEP extensions or SEPs for broadly applicable situations, such as in the 2018 OEP, due to natural disasters in 2017. See "Enrollment Periods" and footnote 16 in this report.

b. Pre-effectuated enrollment is the number of unique individuals who have been determined eligible to enroll in an exchange plan and have selected a plan but may or may not have submitted the first premium payment. Final pre-effectuated enrollment estimates are typically released following an OEP and include any broadly applicable OEP extensions or longer SBE OEPs. See "Enrollment Periods" in this report for more information.

c. Effectuated enrollment is the number of unique individuals who have been determined eligible to enroll in an exchange plan, have selected a plan, and have submitted the first premium payment for an exchange plan. HHS may release effectuated enrollment estimates for different points in time over a plan year. See "Enrollment Periods" in this report for more information.

d. CMS initially (in June 2016) reported 11.1 million effectuated enrollment as of March 2016. In June 2017, CMS updated this number to 10.8 million as of March 2016 and 9.1 million as of December 2016.

e. As of the date this report was published, these are the latest effectuated data released for 2017.

Premium Tax Credits and Cost-Sharing Reductions

Consumers purchasing coverage through the individual exchanges may be eligible to receive financial assistance. Eligibility for such assistance is based primarily on income and provided in the form of premium tax credits and cost-sharing reductions.17

The premium tax credit is generally available to consumers who do not have access to public coverage (e.g., Medicaid) or employment-based coverage that meets certain standards.18 The credit is designed to reduce an eligible individual's cost of purchasing health insurance coverage through the exchange. The amount of the premium tax credit is based on a statutory formula and varies from person to person. It is designed to provide larger credit amounts to individuals with lower incomes compared to those with higher incomes.

The premium credit is refundable, so individuals may claim the full credit amount when filing their taxes, even if they have little or no federal income tax liability. The credit also is advanceable, so instead of waiting until they file taxes, individuals may choose to receive the credit on a monthly basis to coincide with the payment of insurance premiums (technically, these advance payments go directly to issuers). Advance payments automatically reduce monthly premiums by the credit amount. Therefore, the direct cost of insurance to a consumer eligible for premium credits generally will be lower than the advertised cost for a given exchange plan.

In addition to premium tax credits, certain consumers also may be eligible to receive cost-sharing reductions that reduce out-of-pocket expenses.19 There are two forms of cost-sharing reductions, and individuals may receive both if they meet the applicable eligibility requirements.20

- The first form of cost-sharing assistance reduces the annual out-of-pocket limit applicable to an individual's exchange plan. Annual out-of-pocket limits apply to all plans in the exchanges and to other plans under the ACA. In 2018, the annual out-of-pocket limit is $7,350 for a self-only plan and $14,700 for coverage other than self-only (e.g., a family plan). In 2019, those limits will be $7,900 and $15,800, respectively.21 This form of cost-sharing assistance further lowers the spending cap for eligible consumers.

- The second form reduces cost-sharing requirements applicable to an individual's exchange plan. All exchange plans must meet certain requirements related to actuarial value, or the percentage of allowed health care expenses that issuers will cover. This form of cost-sharing assistance reduces the percentage of costs that the individual is responsible for, effectively raising the actuarial value of the plan.22

SHOP Exchanges

Eligibility and Enrollment Process

Certain small businesses are eligible to use the SHOP exchanges. For the purposes of SHOP exchange participation, states may define small employers (or small businesses) as employers that have 50 or fewer full-time employees or employers that have 100 or fewer full-time employees.23 A majority of states define small as having 50 or fewer employees, and only four states employ the 100-or-fewer-employee definition for their SHOP exchanges.24 As of 2017, all states have the option to allow large businesses to use SHOP exchanges, as well, but no states have taken that option.25

To participate in a SHOP exchange, a small business must offer coverage to all of its full-time employees, meaning those working 30 or more hours per week on average.26 The business may, but is not required to, offer coverage to part-time or other employees. Employees must meet the same citizenship and other eligibility requirements that apply in the individual exchanges.

For an employee to obtain coverage through a SHOP exchange, a SHOP-eligible employer must select one or more plan options on the SHOP exchange for its employees to choose from.27 Then, employees can visit the SHOP exchange website to compare their employer's plan options and to enroll. Employers and their employees also can work with a SHOP-registered broker or directly with a plan issuer instead of going through their SHOP exchange's web portal (or if their SHOP exchange does not offer a web portal with enrollment functionality, as discussed below).

Small employers that want to offer more than one plan option to their employees generally are able to do so. Via the employee choice method, also called horizontal choice, the employer can allow its employees to select any plan at a certain coverage and value tier (e.g., a certain metal level of actuarial value).28 As of 2017, there is also a vertical choice method, under which employers can allow their employees to select any plan "across all available actuarial value levels of coverage from a single issuer."29

Changes in SHOP Exchange Web Portal Functionality

Citing early difficulties in getting some SHOP exchange websites online, CMS issued guidance in March 2014 that exchanges still developing their SB-SHOP websites could use a direct enrollment approach for plan year 2014, meaning small businesses and their employees would work directly with agents, brokers, or issuers to compare and purchase coverage rather than enrolling online.30 In subsequent guidance, CMS extended that policy for plan years beginning in 2015-2019, still for SB-SHOPs only. As of April 2016, CMS indicated that SB-SHOPs would need to implement online portals in time for plan years beginning in 2019 and outlined different options for those states to consider, including transitioning to the federal IT platform (becoming an SB-FP-SHOP) or applying for an ACA Section 1332 waiver to obtain an exception to the requirement to have a SHOP exchange at all.31

Via the "2019 Notice of Benefit and Payment Parameters" (2019 Payment Notice) finalized in April 2018, HHS signaled a new policy direction, citing generally low employer participation in the SHOP exchanges and decreasing issuer participation.32 For plan years beginning in 2018, the direct enrollment approach is not just a transitional option for SB-SHOP states: it is the only option in FF-SHOP and SB-FP-SHOP states.33 Although small businesses using the SHOP exchange in those states still will be able to use the Healthcare.gov portal to browse plans and determine their eligibility for small business tax credits (discussed below), they will not be able to enroll in a plan through the SHOP web portal. States with SB-SHOPs also can choose to maintain or return to a direct enrollment approach or to maintain online enrollment, if they have it.

HHS also confirmed in the 2019 Payment Notice that because of these reductions in federal SHOP web portal functionality, going forward, state-based SHOP exchanges will not be able to use the federal IT platform. In other words, HHS is eliminating the SB-FP-SHOP option (discussed above in "Types of Exchanges"). The two states that currently use this option, Kentucky and Nevada, may continue to do so if desired, knowing that the Healthcare.gov functionality is to be diminished.

As of June 2018, three SB-SHOP states still use their initial direct enrollment approaches and five other SB-SHOPs are transitioning to this approach and/or are instructing small businesses to enroll directly with issuers off the exchange because no issuers are offering plans in their SHOP exchange in 2018.34 For FF-SHOP and SB-FP-SHOP exchange states, Healthcare.gov instructs users of the new direct enrollment approach.35

Enrollment Periods and Enrollment Estimates

Enrollment in a SHOP exchange is not limited to a specified OEP, except in certain circumstances.36 Specific circumstances aside, a SHOP exchange must allow employers to enroll any time during a year, and the employer's plan year must consist of the 12-month period beginning with the employer's effective date of coverage.

Unlike individual exchange enrollment data, SHOP exchange enrollment data are not released annually. However, CMS estimated that there were approximately 27,000 small employers and 233,000 employees using the SHOP exchanges across the country in January 2017.37 CMS previously estimated 10,700 active small employers and 85,000 employees in the SHOP exchanges as of May 2015.38

Small Business Health Care Tax Credit

Certain small businesses are eligible for small business health care tax credits.39 In general, these credits are available only to small businesses that purchase coverage through SHOP exchanges and subsidize their employees' premiums. The intent of the credit is to assist small employers with the cost of providing health insurance coverage to employees. The credits are available to eligible small businesses for two consecutive tax years (beginning with the first year the small employer purchases coverage through a SHOP exchange).

The maximum credit is 50% of an employer's contribution toward premiums for for-profit employers and 35% of employer contributions for nonprofit organizations. The full credit is available to employers that have 10 or fewer full-time equivalent (FTE) employees who have average taxable wages of $26,600 or less (in 2018).40 In general, the credit is phased out as the number of FTE employees increases from 10 to 25 and as average employee compensation increases to a maximum of two times the limit for the full credit.41

Employees who enroll in a SHOP plan do not receive this tax credit, nor are they eligible for the premium tax credit or cost-sharing reductions available to certain consumers who purchase coverage on the individual market (discussed in this report in "Premium Tax Credits and Cost-Sharing Reductions").

Individual and SHOP Exchange Enrollment Assistance

Statute and regulations require that exchanges—both individual and SHOP—carry out certain consumer-assistance functions.42 Exchanges (both federally facilitated and state-based) must establish Navigator programs and certified application counselor (CAC) programs.43 Under these programs, individuals are trained to conduct public outreach and education activities; help consumers make informed decisions about their insurance options; and help consumers access individual and SHOP exchange coverage and cost-sharing assistance or public program coverage (e.g., Medicaid or CHIP) if they qualify. Although consumer assistance personnel (including Navigators and CACs) can help consumers and small employers understand their options, the assistors may not advise them on which plan to select. Once consumers or small employers choose a plan, assisters may help them enroll in coverage. Neither Navigators nor CACs may be health issuers or take compensation from issuers or consumers for selling health policies.44

Pursuant to state law, exchanges also may allow insurance agents and brokers, including web-based brokers, to help consumers and small employers obtain coverage through exchanges.45 Brokers and agents are licensed by the states and generally are paid on a commission basis by insurance companies.

Besides facilitating in-person assistance, exchanges also must provide for the operation of a call center and maintain a website that meets certain informational requirements.46 Overall, exchanges' consumer outreach efforts and materials must meet certain standards regarding accessibility for individuals with disabilities or with limited English proficiency.47

Administering the Exchanges

In addition to carrying out their consumer-facing activities that facilitate the purchase of coverage, exchanges are responsible for several administrative functions, including certifying the plans that will participate in their marketplaces.48 SBEs, SBE-FPs, and state entities in some FFEs (where states have chosen to perform some plan-management functions) are each responsible for annually certifying or recertifying plans to be sold in their exchanges as qualified health plans (QHPs, see "Qualified Health Plans," below). In FFEs in which HHS oversees all plan-related functions, CMS does this for each state.

QHP certification involves a review of various factors, including the benefits a plan will cover, the network of providers it will include, its premium rates, its marketing practices, and its adherence to quality-of-care standards.49 The QHP certification process is to be completed each year in time for issuers to advertise their plans and rates during the exchanges' annual OEP.

Exchanges' other administrative activities include collecting enrollment and other data, reporting data to and otherwise interacting with the Departments of HHS and the Treasury, and working with state insurance departments and federal regulators to conduct ongoing oversight of plans.

Qualified Health Plans

In general, health insurance plans offered through exchanges must be QHPs.50A QHP is a plan that is offered by a state-licensed issuer that meets specified requirements, is certified by an exchange, and covers the essential health benefits (EHB) package.51 The EHB package requires plans to cover 10 broad categories of benefits and services, comply with limits on consumer cost sharing on the EHB, and meet certain generosity requirements.52

QHPs must comply with the same state and federal requirements that apply to health plans offered outside of exchanges.53 A QHP offered through an individual exchange must comply with state and federal requirements applicable to individual market plans; a QHP offered through a SHOP exchange must comply with state and federal requirements applicable to plans offered in the small-group market. For example, QHPs offered through individual and SHOP exchanges must cover specified preventive services without imposing cost sharing, just like plans offered in the individual and small-group markets outside of exchanges.

A QHP is the only type of comprehensive health plan an exchange may offer, but QHPs may be offered outside of exchanges, as well.

Types of QHPs and Other Plans Offered Through Exchanges

Most plans offered in the exchanges are QHPs, including child-only plans, catastrophic plans, consumer operated and oriented plans (CO-OPs), and multi-state plans (MSPs). Stand-alone dental plans are the only non-QHPs offered in the exchanges. Some plans that are available in the exchanges also are available off the exchanges.

The types of plans that may be available through exchanges are summarized in Table B-1.

Exchange Funding

The ACA provided an indefinite (i.e., unspecified) appropriation for HHS grants to states to support the planning and establishment of exchanges.54 For each fiscal year between FY2011 and FY2014, the HHS Secretary determined the total amount that was made available to each state for exchange grants. However, none of these exchange grants could be awarded after January 1, 2015, and exchanges were expected to be self-sustaining beginning in 2015.

Exchanges may generate funding to sustain their operations, including by assessing fees on participating health insurance plans.55 To raise funds for the exchanges it oversees, HHS assesses a monthly fee on each health insurance issuer that offers plans through an FFE or SBE-FP. The fee is a percentage of the value of the monthly premiums that the issuer collects on exchange plans in a given state, and HHS updates the percentage each year through rulemaking. (See Table 2.) Currently, these user fees are the primary source of funding for FFEs; they are estimated to account for 70% of all FFE funding in FY2018.56

Most SBEs also assess user fees on issuers participating in their exchanges, often 1%-3% of premiums or a monthly flat fee.57 States also can use other state funding to support their exchanges, and some have become FFEs or moved to the federal IT platform due to challenges and/or costs of maintaining their exchanges.58

User fees also have been assessed on issuers participating in SHOP exchanges. However, in the 2019 Payment Notice, HHS announced that the fees won't be assessed for issuers selling plans under the new model of reduced federal IT support (see "Changes in SHOP Exchange Web Portal Functionality" in this report).

Table 2. "User Fee" Assessed Monthly on Issuers Participating in Exchanges, by Year

(fee is the stated percentage of the value of monthly premiums collected by issuer on exchange plans)

|

PY 2014 |

PY 2015 |

PY 2016 |

PY 2017 |

PY 2018 |

PY 2019 |

|

|

FFE Issuers |

3.5% |

3.5% |

3.5% |

3.5% |

3.5% |

3.5% |

|

SBE-FP Issuers |

n/a |

n/a |

n/a |

1.5% |

2% |

3% |

Sources: CRS analysis of federal regulations:

HHS, "Patient Protection and Affordable Care Act; HHS Notice of Benefit and Payment Parameters for 2017 [2017 Payment Notice]," Final Rule, 81 Federal Register 12203, March 8, 2016. See pages 12293-12295.

HHS, "Patient Protection and Affordable Care Act; HHS Notice of Benefit and Payment Parameters for 2018; Amendments to Special Enrollment Periods and the Consumer Operated and Oriented Plan Program [2018 Payment Notice]," Final Rule, 81 Federal Register 94058, December 22, 2016. See pages 94138-94139.

HHS, "Patient Protection and Affordable Care Act; HHS Notice of Benefit and Payment Parameters for 2019 [2019 Payment Notice]," Final Rule, 83 Federal Register 16930, April 17, 2018. See pages 17006-17007.

Notes: PY = plan year. FFE = federally-facilitated exchange. SBE = state-based exchange. SBE-FP = state-based exchange using the federal information technology (IT) platform. See "Types of Exchanges" in this report for a description of exchange types.

n/a = Although some SBE-FPs existed prior to plan year 2017, HHS did not begin assessing a user fee on issuers in those states until then.

SBEs' assessment of user fees, if any, varies, as discussed in this section of the report.

Further Reading

For more information about certain issues addressed in or relevant to this report, see the following CRS reports:

- CRS Report R45146, Federal Requirements on Private Health Insurance Plans

- CRS Report R44425, Health Insurance Premium Tax Credits and Cost-Sharing Subsidies

- CRS Report R44438, The Individual Mandate for Health Insurance Coverage: In Brief

Appendix A. Exchange Types by State

|

State |

Individual Exchange |

SHOP Exchange |

Are the State's Individual and SHOP Exchanges the Same Type? |

|

Alabama |

FFE |

FF-SHOP |

Yes |

|

Alaska |

FFE |

FF-SHOP |

Yes |

|

Arizona |

FFE |

FF-SHOP |

Yes |

|

Arkansas |

SBE-FP |

SB-SHOPa |

No |

|

California |

SBE |

SB-SHOP |

Yes |

|

Colorado |

SBE |

SB-SHOPa |

Yes |

|

Connecticut |

SBE |

SB-SHOP |

Yes |

|

Delaware |

FFEb |

FF-SHOP |

Yes |

|

District of Columbia |

SBE |

SB-SHOP |

Yes |

|

Florida |

FFE |

FF-SHOP |

Yes |

|

Georgia |

FFE |

FF-SHOP |

Yes |

|

Hawaii |

FFE |

No SHOP exchangec |

No |

|

Idaho |

SBE |

SB-SHOPa |

Yes |

|

Illinois |

FFEb |

FF-SHOP |

Yes |

|

Indiana |

FFE |

FF-SHOP |

Yes |

|

Iowa |

FFEb |

FF-SHOP |

Yes |

|

Kansas |

FFE |

FF-SHOP |

Yes |

|

Kentucky |

SBE-FP |

SB-FP-SHOP |

Yes |

|

Louisiana |

FFE |

FF-SHOP |

Yes |

|

Maine |

FFE |

FF-SHOP |

Yes |

|

Maryland |

SBE |

SB-SHOP |

Yes |

|

Massachusetts |

SBE |

SB-SHOP |

Yes |

|

Michigan |

FFEb |

FF-SHOP |

Yes |

|

Minnesota |

SBE |

SB-SHOPa |

Yes |

|

Mississippi |

FFE |

SB-SHOP |

No |

|

Missouri |

FFE |

FF-SHOP |

Yes |

|

Montana |

FFE |

FF-SHOP |

Yes |

|

Nebraska |

FFE |

FF-SHOP |

Yes |

|

Nevada |

SBE-FPd |

SB-FP-SHOP |

Yes |

|

New Hampshire |

FFEb |

FF-SHOP |

Yes |

|

New Jersey |

FFE |

FF-SHOP |

Yes |

|

New Mexico |

SBE-FP |

SB-SHOP |

No |

|

New York |

SBE |

SB-SHOPa |

Yes |

|

North Carolina |

FFE |

FF-SHOP |

Yes |

|

North Dakota |

FFE |

FF-SHOP |

Yes |

|

Ohio |

FFE |

FF-SHOP |

Yes |

|

Oklahoma |

FFE |

FF-SHOP |

Yes |

|

Oregon |

SBE-FP |

SB-SHOPa |

No |

|

Pennsylvania |

FFE |

FF-SHOP |

Yes |

|

Rhode Island |

SBE |

SB-SHOP |

Yes |

|

South Carolina |

FFE |

FF-SHOP |

Yes |

|

South Dakota |

FFE |

FF-SHOP |

Yes |

|

Tennessee |

FFE |

FF-SHOP |

Yes |

|

Texas |

FFE |

FF-SHOP |

Yes |

|

Utah |

FFE |

FF-SHOPe |

Yes |

|

Vermont |

SBE |

SB-SHOPa |

Yes |

|

Virginia |

FFE |

FF-SHOP |

Yes |

|

Washington |

SBE |

SB-SHOPa |

Yes |

|

West Virginia |

FFEb |

FF-SHOP |

Yes |

|

Wisconsin |

FFE |

FF-SHOP |

Yes |

|

Wyoming |

FFE |

FF-SHOP |

Yes |

|

TOTAL: 51 |

FFE: 34 SBE: 12 SBE-FP: 5 |

FF-SHOP: 32 SB-SHOP: 16 SB-FP-SHOP: 2 No SHOP: 1 |

Yes: 46 No: 5 |

Sources: Congressional Research Service (CRS) illustration based on data from the following sources:

Individual exchange types: Centers for Medicare & Medicaid Services (CMS), "2018 Marketplace Open Enrollment Period Public Use Files: 2018 OEP State-Level Public Use File," April 18, 2018, at https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Marketplace-Products/Downloads/2018_OE_State.zip. SHOP exchange types: Kaiser Family Foundation, "State Health Insurance Marketplace Types, 2018," at https://www.kff.org/health-reform/state-indicator/state-health-insurance-marketplace-types/; verified at Healthcare.gov at https://www.healthcare.gov/small-businesses/employers/.

Notes:

SHOP = Small business health options program.

FFE and FF-SHOP = Federally facilitated individual exchange; federally facilitated SHOP exchange.

SBE and SB-SHOP = State-based individual exchange; state-based SHOP exchange.

SBE-FP and SB-FP-SHOP = State-based individual exchange using the federal information technology (IT) platform; state-based SHOP exchange using the federal IT platform.

Counts of "states" include the District of Columbia. In the individual exchanges, "plan year" is generally that calendar year, but group coverage plan years, including in the SHOP exchanges, may start at any time during a calendar year. See "Types of Exchanges" in this report for discussion of the different exchanges. See Figure 1in this report for the exchange types by state in map form.

a. In these SB-SHOP states, the SHOP web portal is using or transitioning to a direct enrollment approach: it does not offer online enrollment but instead instructs users to connect with agents or brokers offering plans through the state's SHOP exchange, or outside of it if there are no plans offered in the state's SHOP exchange. Idaho, Oregon, and Vermont have only or primarily used a direct enrollment approach. New York and Connecticut do not appear to have an online enrollment portal but do allow small businesses to compare plans online and either mail in an enrollment form or enroll with an agent or broker. The SHOP webpages of Arkansas, Minnesota, and Washington report that because no issuers have offered SHOP plans in 2018, they will transition current SHOP plan holders to direct relationships with agents or brokers to discuss renewal in off-exchange coverage. Contact report author for sources.

b. In many FFE states, the federal government performs all functions. But in these FFE states, the state partners with the federal government to perform some functions. CMS data do not identify these "partnership" variations, but the Kaiser Family Foundation tracks them at the site linked above.

c. Hawaii received an ACA Section 1332 waiver allowing it not to operate a SHOP exchange. See State of Hawaii, Department of Labor and Industrial Relations, "ACA Small-Business Health Options Program (SHOP)—Waiver Approved on 12/30/2016," at http://labor.hawaii.gov/aca-smallbiz/. For more information on Section 1332 waivers, see CRS Report R44760, State Innovation Waivers: Frequently Asked Questions.

d. However, Nevada appears to be transitioning from an SBE-FP to an SBE. See National Association for State Health Policy, "Nevada's Insurance Exchange Director Talks about Transitioning to a State-Based Marketplace and Saving Millions," April 24, 2018, at https://nashp.org/nevadas-insurance-exchange-director-heather-korbulic-talks-about-transitioning-to-a-state-based-marketplace/.

e. Effective 2018, Utah has transitioned from an SB-SHOP to an FF-SHOP. See Utah Governor's Office of Economic Development, Avenue H Health Insurance Exchange, "Small Businesses," at https://avenueh.com/businesses, accessed June 1, 2018.

Appendix B. Types of Plans Offered Through the Exchanges

|

Summary |

Can Use Premium Tax Credits or Cost-Sharing Reductions? |

Can Be Offered Outside Exchanges? |

||

|

Qualified Health Plan (QHP) |

A plan that is offered by a state-licensed issuer that meets specified requirements, is certified by an exchange, and covers the essential health benefits (EHB) package. |

Yes |

Yes |

|

|

QHP Variations |

||||

|

Child-Only Health Insurance Plan |

A plan in which only individuals under the age of 21 may enroll. If an issuer offers an all-ages QHP in an exchange, it also must offer a child-only plan at the same actuarial level. |

Yes |

Yes |

|

|

Catastrophic Plan |

A plan that provides the EHB and coverage for at least three primary care visits; however, it does not meet the minimum requirements related to coverage generosity (i.e., actuarial value). Offered in individual but not small business health options program (SHOP) exchanges. Consumer eligibility requirements apply.a |

No |

Yes |

|

|

Consumer Operated and Oriented Plan (CO-OP) |

A plan sold by a nonprofit, member-run health insurance company created via a Patient Protection and Affordable Care Act (ACA; P.L. 111-148, as amended) program.b |

Yes |

Yes |

|

|

Multi-state Plan (MSP) |

A plan sold in the exchanges under contract with the federal Office of Personnel Management (OPM).c |

Yes |

No |

|

|

Non-QHPs |

||||

|

Dental-Only Plan |

Coverage for dental care. May be offered either as a stand-alone plan or in conjunction with a QHP, as long as it covers pediatric dental benefits that meet relevant EHB requirements. |

Yes, in certain circumstances. |

Yes |

|

Sources: CRS analysis of statute and regulation. QHP definition: 42 U.S.C. §18021. Child-only and catastrophic plans: 42 U.S.C. §18022. CO-OPs: 42 U.S.C. §18021 and 42 U.S.C. §18042. MSPs: 42 U.S.C. §18021 and 42 U.S.C. §18054. Dental-only plans: 42 U.S.C. §18031(d)(2)(B)(ii), 45 C.F.R. §155.1065, and 45 C.F.R. §155.705. Premium tax credits and cost-sharing reductions: 26 U.S.C. §36B(c)(3)(A) and 42 U.S.C. §18071(f)(1).

Notes:

a. Catastrophic plans are available only to individuals under the age of 30 and individuals who obtain hardship or affordability exemptions from the ACA's individual mandate to maintain minimum essential coverage or pay a penalty. See CRS Report R44438, The Individual Mandate for Health Insurance Coverage: In Brief.

b. The HHS Secretary is required to use funds appropriated to the CO-OP program to finance start-up and solvency loans for eligible nonprofit organizations applying to become a CO-OP. The majority of products offered by a CO-OP must be QHPs sold in the non-group and small-group markets, including through exchanges.

c. The ACA directs OPM to contract with private issuers in each state to offer at least two QHPs under the MSP program. The term multi-state plan is meant to indicate that this program extends across the states, not that the plans themselves are necessarily interstate.