Tax reform debates, including the debate surrounding the 2017 tax revision (P.L. 115-97), often consider the option of broadening the tax base in exchange for a reduction in statutory tax rates. One means of base-broadening is reducing or eliminating "tax expenditures," or revenue losses attributable to special provisions in the tax code. Policymakers also evaluate tax expenditures from a federal budgeting perspective, as tax expenditures may be viewed as "spending through the tax code." Though P.L. 115-97 makes major changes to the U.S. federal tax system, in aggregate, the change in the value of tax expenditures resulting from P.L. 115-97 appears modest.

The Sum of Tax Expenditures: Modest Changes Following P.L. 115-97

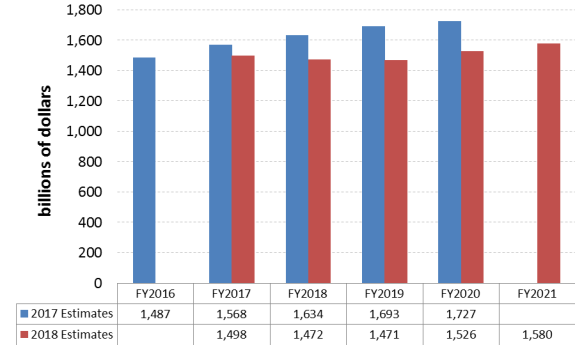

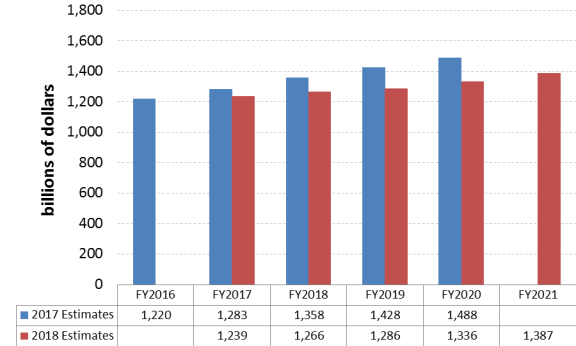

One way to examine how P.L. 115-97 might have changed the aggregate value of tax expenditures is to compare the sum of the Joint Committee on Taxation's (JCT's) tax expenditure estimates prepared in 2017, and the sum of JCT's 2018 tax expenditure estimates (see Figure 1). JCT's 2017 tax expenditure estimates, prepared before P.L. 115-97 was enacted, include FY2016 through FY2020. JCT's 2018 tax expenditure estimates, prepared after P.L. 115-97 was enacted, include FY2017 through FY2021.

Before looking at the years after P.L. 115-97 becomes effective (generally FY2018 and beyond), it is instructive to examine how JCT's tax expenditure estimates changed for FY2017 between 2017 and 2018. As illustrated in Figure 1, between 2017 and 2018, the sum of JCT's tax expenditure estimates for FY2017 fell. This decline suggests that factors other than P.L. 115-97, which is not generally effective until 2018, might explain changes in the estimated tax expenditure budget.

Figure 1 compares tax expenditure estimates prepared in 2017 for FY2018, FY2019, and FY2020, to tax expenditure estimates prepared in 2018 for those same fiscal years. This comparison provides some indication of the scope of the reduction in the value of tax expenditures, or base broadening, occurring in P.L. 115-97. On average, over the three years compared, the aggregate value of tax expenditures was about $195 billion lower per year, for estimates prepared after P.L. 115-97 was enacted. However, since the sum of the tax expenditure estimates for FY2017 also fell between 2017 and 2018, this suggests that not all of the decline was due to changes made in P.L. 115-97.

Tax expenditure estimates prepared in 2018 cover FY2017 through FY2021. Thus, these estimates include one year before P.L. 115-97 took effect (FY2017), a year for which most of P.L. 115-97 would be effective (FY2018), and three years with the revised tax code more fully effective (FY2019, FY2020, and FY2021). Comparing the sum of tax expenditure estimates prepared in 2018 for FY2017 to tax expenditure estimates prepared in 2018 for FY2018 through FY2021 suggests that, in aggregate, the value of tax expenditures fell very little as a result of P.L. 115-97. In FY2020 and FY2021, tax expenditures are estimated to be higher than they were estimated to be for FY2017.

|

Figure 1. Sum of Tax Expenditures

2017 estimates for FY2016–FY2020; 2018 estimates for FY2017–FY2021

|

|

|

Source: CRS analysis of Joint Committee on Taxation (JCT) 2017 (JCX-3-17) and 2018 (JCX-34-18) tax expenditure estimates.

Notes: The JCT estimates the revenue loss associated with each provision separately. When multiple provisions are considered together, there may be interaction effects. One 2008 analysis found that accounting for interaction effects increases the value of individual income tax expenditures.

|

The Sum of Individual and Corporate Tax Expenditures

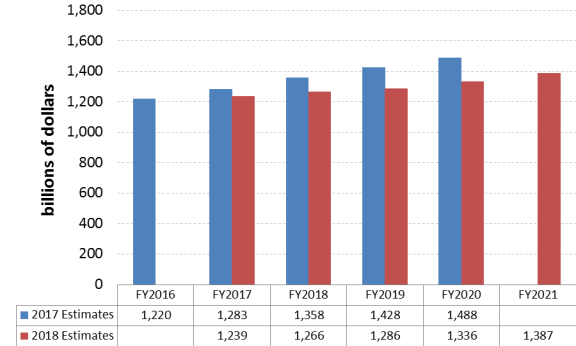

Figure 2 and Figure 3 look at the aggregate value of JCT's 2017 and 2018 tax expenditure estimates, separating individual tax expenditures from corporate tax expenditures. Examining the 2018 estimates, the sum of individual income tax expenditures is projected to rise each year, suggesting no evidence of base-broadening on the individual side in aggregate following P.L. 115-97. Comparing the 2017 and 2018 estimates for FY2018 through FY2020, individual income tax expenditure estimates appear lower in the 2018 estimates (which would incorporate the changes from P.L. 115-97). It is not clear, however, how much of that decline (if any) is the result of changes enacted in P.L. 115-97, or if tax expenditure estimates prepared in 2018 were less than those prepared in 2017 for other reasons.

|

Figure 2. Sum of Individual Tax Expenditures

2017 estimates for FY2016–FY2020; 2018 estimates for FY2017–FY2021

|

|

|

Source: See Figure 1.

Notes: See Figure 1.

|

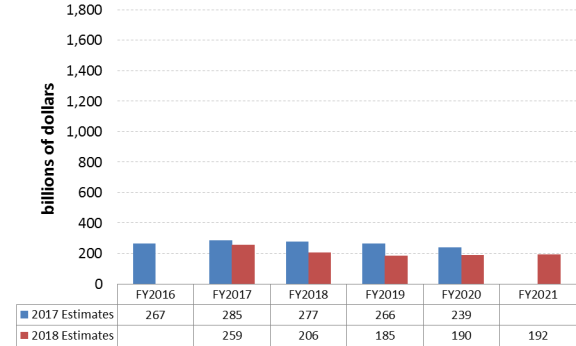

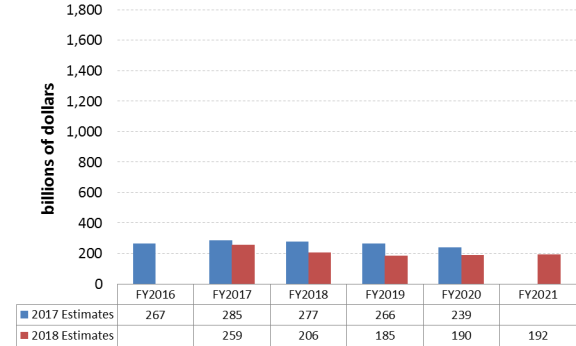

The value of corporate tax expenditures does appear to fall, in aggregate, following P.L. 115-97. Looking only at 2018 estimates, there is a decline in the sum of corporate tax expenditures after FY2017. Corporate tax expenditure estimates prepared in 2018 for FY2018 through FY2020 are also lower than those prepared in 2017 for those same years. The decline in the value of corporate tax expenditures may be driven by the reduced corporate rate and changes in the international tax system.

|

Figure 3. Sum of Corporate Tax Expenditures

2017 estimates for FY2016–FY2020; 2018 estimates for FY2017–FY2021

|

|

|

Source: See Figure 1.

Notes: See Figure 1.

|

More Tax Expenditure Provisions Added than Eliminated in P.L. 115-97

The change in the number, or count, of tax expenditure provisions in P.L. 115-97 was also modest. In recent years there have been roughly 200 tax expenditure provisions included in JCT's tax expenditure pamphlet. According to the JCT, P.L. 115-97 repealed nine tax expenditure provisions and added 17 new tax expenditure provisions to the code, resulting in a net increase of tax expenditures provisions in the income tax system.

Separately, the JCT identifies 55 tax expenditure provisions that were modified in P.L. 115-97. In some cases, the modifications reduced the cost of the tax expenditure (examples include itemized deductions for individuals, such as the mortgage interest deduction and the deduction for state and local taxes). In other cases, the provision was modified in a way that increased its cost (the child tax credit, for example).