Introduction

The State Children's Health Insurance Program (CHIP) is a federal-state program that provides health coverage to certain uninsured, low-income children and pregnant women in families that have annual income above Medicaid eligibility levels but do not have health insurance. CHIP is jointly financed by the federal government and the states and is administered by the states. Participation in CHIP is voluntary, and all states, the District of Columbia, and the territories participate.1 The federal government sets basic requirements for CHIP, but states have the flexibility to design their own version of CHIP within the federal government's basic framework. As a result, there is significant variation across CHIP programs.

States may design their CHIP programs in one of three ways: a CHIP Medicaid expansion, a separate CHIP program, or a combination approach in which the state operates a CHIP Medicaid expansion and one or more separate CHIP programs concurrently. CHIP benefit coverage and cost-sharing rules depend on program design. CHIP Medicaid expansions must follow the federal Medicaid rules for benefits and cost sharing. For separate CHIP programs, the benefits are permitted to look more like private health insurance, and states may impose cost sharing, such as premiums or enrollment fees, with a maximum allowable amount that is tied to annual family income.

Federal appropriations for CHIP are provided in statute. In recent years, the appropriations had been provided a couple years at a time. For instance, the Patient Protection and Affordable Care Act (ACA; P.L. 111-148, as amended) provided appropriations for FY2014 and FY2015, and the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA; P.L. 114-10) added appropriations for FY2016 and FY2017. However, the continuing resolution enacted on January 22, 2018 (P.L. 115-120), and the Bipartisan Budget Act of 2018 (BBA 2018, P.L. 115-123) together provided 10 years of CHIP funding. Currently, CHIP is funded through FY2027.

This report provides an overview of CHIP financing, beginning with an explanation of the federal matching rate. It describes various aspects of federal CHIP funding, such as the federal appropriation, state allotments, the Child Enrollment Contingency Fund, redistribution funds, and outreach and enrollment grants. The report ends with a section about the recent legislative activity that has resulted in federal funding for CHIP being provided through FY2027.

Federal Matching Rate

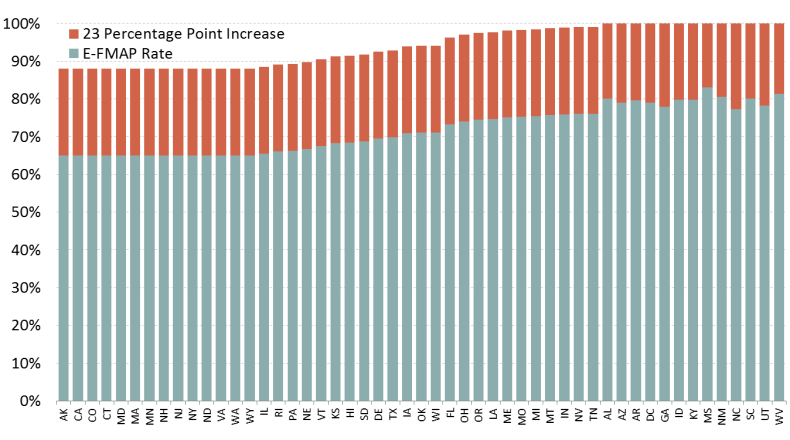

The federal government's share of CHIP expenditures (including both services and administration) is determined by the enhanced federal medical assistance percentage (E-FMAP) rate. The E-FMAP rate is based on the FMAP rate, which is the federal matching rate for the Medicaid program. The FMAP formula compares each state's average per capita income with average U.S. per capita income. The formula provides higher reimbursement to states with lower incomes (with a statutory maximum of 83%) and lower reimbursement to states with higher incomes (with a statutory minimum of 50%).2

The E-FMAP rate is calculated by reducing the state share under the regular FMAP rate by 30%.3 Statutorily, the E-FMAP (or federal matching rate) can range from 65% to 85%.4 For some CHIP expenditures, the federal matching rate is different from the E-FMAP rate. For instance, the matching rate for translation and interpretation services is the higher of 75% or states' E-FMAP rate plus 5 percentage points. Also, the Children's Health Insurance Program Reauthorization Act (CHIPRA; P.L. 111-3) included a provision that reduced the matching rate to the regular FMAP rate for children with family incomes exceeding 300% of the federal poverty level (FPL) with an exception for certain states.5

The ACA included a provision to increase the E-FMAP rate by 23 percentage points (not to exceed 100%) for most CHIP expenditures from FY2016 through FY2019. The continuing resolution enacted on January 22, 2018 (P.L. 115-120), extended the increase to the E-FMAP rate by one year (i.e., through FY2020), but the increase for FY2020 is to be 11.5 percentage points rather than 23 percentage points.

The increase to the E-FMAP does not apply to certain expenditures, such as translation services, CHIP children above 300% of FPL (with an exception for certain states), expenditures for administration of citizenship documentation requirements, expenditures for administration of payment error rate measurement, and Medicaid coverage of certain breast or cervical cancer patients.

The 23 percentage point increase changed the statutory range of the E-FMAP rate to between 88% and 100%. In FY2018, 13 states have E-FMAP rates of 100%. Figure 1 shows the state distribution of E-FMAP rates for FY2018, with the 23 percentage point increase. Because the federal share of CHIP is significantly higher with this increase, states are spending through the federal CHIP funding allocated to them (i.e., state CHIP allotments) faster with the increased E-FMAP rate.

Federal CHIP Funding

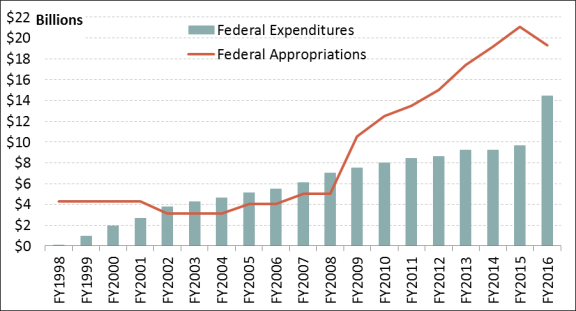

Federal CHIP funding is mandatory spending (i.e., funding controlled outside of the annual appropriations process through authorizing laws), and this funding is an entitlement to states that adhere to the federal CHIP rules. The funding for this program is provided through a mandatory appropriation set in statute. Figure 2 shows the federal appropriation amounts and federal expenditures for CHIP from FY1998 through FY2016.

|

Figure 2. CHIP Federal Expenditures and Federal Appropriations (FY1998 through FY2016) |

|

|

Sources: §2104 of the Social Security Act, §108 of the Children's Health Insurance Program Reauthorization Act (CHIPRA, P.L. 111-3) as amended by §10203(d)(2)(F) of the Patient Protection and Affordable Care Act (ACA; P.L. 111-148, as amended), and §301(b)(3) of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA; P.L. 114-10); and Medicaid Financial Management Reports. Note: Federal CHIP expenditures increased significantly from FY2015 to FY2016 due to the Patient Protection and Affordable Care Act (ACA; P.L. 111-148, as amended) provision that increased the E-FMAP rate (or federal matching rate) by 23 percentage points for most CHIP expenditures from FY2016 through FY2019. |

The federal appropriation amount is the maximum amount of federal funding for CHIP. Most of the federal CHIP expenditures are from state CHIP allotments, which are the federal funds allocated to each state to finance its CHIP program. In addition to allotments, states could receive shortfall funding, such as Child Enrollment Contingency Fund payments, redistribution funds, or Medicaid funds. Some CHIP funding is used to finance some Medicaid expenses. In addition, states can receive outreach and enrollment grants.

Federal Appropriation

The federal appropriation for CHIP is provided in Section 2104(a) of the Social Security Act. This amount is the overall annual ceiling on federal CHIP spending to the states, the District of Columbia, and the territories. CHIPRA increased the annual appropriation amounts substantially beginning in FY2009 and provided funding through FY2013. The ACA provided funding for an additional two years (i.e., through FY2015), and MACRA added appropriations for FY2016 and FY2017 at $19.3 billion and $20.4 billion,6 respectively.7

FY2018 began on October 1, 2017, without federal CHIP funding having been appropriated for the fiscal year. The continuing resolution enacted on December 22, 2017 (P.L. 115-96), provided $2.85 billion in appropriations for CHIP for the first six months of FY2018 (i.e., October 1, 2017, through March 31, 2018).

The full-year FY2018 appropriation for CHIP was not provided until January 22, 2018, when P.L. 115-120 provided CHIP appropriations for FY2018 through FY2023. The annual appropriation amounts for FY2018 through FY2023 increase annually from $21.5 billion in FY2018 to $25.9 billion in FY2023.8

Then, February 9, 2018, BBA 2018 provided appropriations for FY2024 through FY2027. The funding amounts for FY2024 through FY2026 are not specified; instead, such sums as necessary to fund allotments to states are provided. However, the funding for FY2027 is the combination of two semiannual appropriations of $7.65 billion plus a one-time appropriation of such sums as necessary to fund the allotments to states after taking into account the semiannual appropriations.

If the federal appropriations were not large enough to cover state allotments in any given year, the state allotments would be reduced proportionally. However, Figure 2 shows the federal appropriation has been more than sufficient to fund federal CHIP expenditures since FY2009.9 In fact, from FY2011 through FY2018, multiple appropriations laws have rescinded a total of $46.4 billion in funding from CHIP (see text box entitled "CHIP Changes in Mandatory Programs" for more detail about these rescissions).

|

CHIP Changes in Mandatory Programs Changes in mandatory programs (CHIMPs) are provisions in appropriations acts that reduce or constrain mandatory spending. From FY2011 through FY2018, multiple appropriations laws have rescinded a total of $46.4 billion in funding from CHIP through CHIMPs. As shown in Table 1, most of these rescissions have come from the performance bonus payment fund. The Children's Health Insurance Program Reauthorization Act (CHIPRA; P.L. 111-3) established performance bonus payments for states that increase their Medicaid (not CHIP) enrollment among low-income children above a defined baseline. States were eligible for performance bonus payments from FY2009 through FY2013. The fund balance for the performance bonus payments increased significantly every year because the transfers into the fund were substantially higher than the actual performance bonus payments to states. From FY2011 through FY2018, a total of $30.0 billion was rescinded from the performance bonus payment fund. Funds also have been rescinded from unobligated national allotments, which are federal appropriations funds not allocated for state allotments. In FY2015 through FY2018, a total of $14.6 billion was rescinded from unobligated national allotments. In FY2016, funds were rescinded from the Child Enrollment Contingency Fund in the amount of $1.7 billion. The Child Enrollment Contingency Fund is one potential CHIP shortfall funding source available to states (see the "Child Enrollment Contingency Fund" section). On Tuesday, May 8, 2018, the Trump Administration submitted to Congress a proposal for 38 rescissions of budget authority, totaling $15.4 billion. In their transmission, the Office of Management and Budget stated that these rescissions were transmitted pursuant to Section 1012 of the Congressional Budget and Impoundment Control Act of 1974 (2 U.S.C. 683). The proposal includes $7.0 billion in CHIP rescissions from two provisions. The first provision would rescind $5.1 billion from FY2017 federal CHIP funding, and the second provision would rescind $1.9 billion from the Child Enrollment Contingency Fund.10 The Congressional Budget Office (CBO) provided an assessment of the proposed CHIP rescissions, and CBO estimates the rescissions would not affect CHIP expenditures or the number of individuals with insurance coverage.11

Sources: Defense and Full-Year Appropriations, 2011 (P.L. 112-10); Consolidated Appropriations Act, 2012 (P.L. 112-74); Consolidated and Further Continuing Appropriations Act, 2013 (P.L. 113-6); Consolidated Appropriations Act, 2014 (P.L. 113-76); Continuing Appropriations Resolution, 2015 (P.L. 113-164); Consolidated and Further Continuing Appropriations Act, 2015 (P.L. 113-235); Continuing Appropriations Act, 2016 (P.L. 114-53); Consolidated Appropriations Act, 2016 (P.L. 114-113); Continuing Appropriations and Military Construction, Veterans Affairs, and Related Agencies Appropriations Act, 2017, and Zika Response and Preparedness Act (P.L. 114-223); Further Continuing and Security Assistance Appropriations Act, 2017 (P.L. 114-254); Consolidated Appropriations Act, 2017 (P.L. 115-31); Consolidated Appropriations Act, 2018 (P.L. 115-141). Note: Totals may not add due to rounding. |

State Allotments

State allotments are the federal funds allocated to each state and territory for the federal share of its CHIP expenditures. CHIPRA established a new allocation of federal CHIP funds among the states based largely on states' actual use of and projected need for CHIP funds.12 There are two formulas for determining state allotments: an even-year formula and an odd-year formula.13

In even years, such as FY2018, state CHIP allotments are each state's allotment for the prior year plus any Child Enrollment Contingency Fund (described below) payments from the previous year adjusted for growth in per capita National Health Expenditures and child population in the state.

In odd years, state CHIP allotments are each state's spending for the prior year (including federal CHIP payments from the state CHIP allotment, payments from the Child Enrollment Contingency Fund, and redistribution funds) adjusted using the same growth factor as the even-year formula (i.e., per capita National Health Expenditures growth and child population growth in the state).

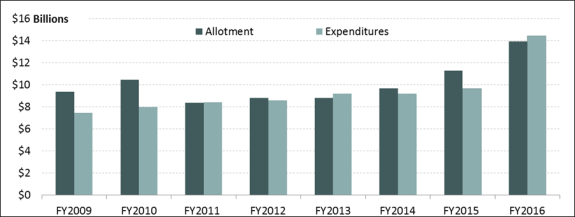

Since the odd-year formula is based on states' actual use of CHIP funds, it is called the re-basing year because a state's CHIP allotment can either increase or decrease depending on that state's CHIP expenditures in the previous year. Figure 3 shows how the re-basing for FY2011 significantly decreased the aggregate amount for state allotments from FY2010 to FY2011.

|

Figure 3. CHIP Allotments and Federal Expenditures (FY2009 through FY2016) |

|

|

Sources: Various Federal Register notices; Medicaid and CHIP Payment and Access Commission (MACPAC), "Federal CHIP Allotments, FYs 2015-2017," MACStats Exhibit 33, posted online May 10, 2017; and the Medicaid Financial Management Reports. Note: Federal CHIP expenditures increased significantly from FY2015 to FY2016 due to the Patient Protection and Affordable Care Act (ACA; P.L. 111-148, as amended) provision that increased the E-FMAP rate (or federal matching rate) by 23 percentage points for most CHIP expenditures from FY2016 through FY2019. The FY2016 allotments were calculated under a special rule that took into account the 23 percentage point increase in the E-FMAP that begins in that year. |

State CHIP allotment funds are available to states for two years, which explains why federal expenditures are higher than the state allotments in some years. The federal CHIP expenditures can include federal funding from states' allotments for the specified year and the prior year in addition to shortfall funding.

The allotment is available to states to cover the federal share of both CHIP benefit and administrative expenditures.14 However, no more than 10% of the federal CHIP funds that a state draws down from its CHIP allotment can be spent on nonbenefit expenditures, including expenditures for administration, translation services, and outreach efforts.

Shortfall Funding

If a state's CHIP allotment for the current year, in addition to any allotment funds carried over from the prior year, is insufficient to cover the state's projected CHIP expenditures for the current year, a few different shortfall funding sources are available. These sources include the Child Enrollment Contingency Fund, redistribution funds, and Medicaid funds.

Child Enrollment Contingency Fund

CHIPRA established the Child Enrollment Contingency Fund and made its funds available to states for FY2009 through FY2013. The ACA extended the availability of the Child Enrollment Contingency Fund and of payments from the fund through FY2015, and MACRA extended the fund and payments through FY2017. Together, P.L. 115-120 and BBA 2018 extend the funding mechanism for the Child Enrollment Contingency Fund through FY2027.15

A state is eligible for Child Enrollment Contingency Fund payments if it has both a funding shortfall16 and CHIP enrollment (for children) that exceeds a target level.17 As a result, not all states with funding shortfalls are eligible for Child Enrollment Contingency Fund payments.

The Child Enrollment Contingency Fund was funded with an initial deposit equal to 20% of the appropriated amount for FY2009 (i.e., $2.1 billion). In addition, for FY2010 through FY2027, such sums as are necessary for making Child Enrollment Contingency Fund payments to eligible states are to be deposited into the fund, but these transfers cannot exceed 20% of the federal appropriation for the fiscal year.

The Child Enrollment Contingency Fund payment formula is based on a state's growth in CHIP enrollment and per capita spending, which means a state may receive a payment from the fund that does not equal its actual shortfall. Iowa, Michigan, and Tennessee are the only states that have received Child Enrollment Contingency Fund payments over the period of FY2009 (when the funds were first available) through FY2017.18

Redistribution Funds

After two years, any unused state CHIP allotment funds are redistributed to shortfall states.19 For redistribution funds, a shortfall state is defined as a state that will not have enough money to meet projected costs in the current year after counting (1) the current year's state allotment, (2) unspent funds from the prior year's state allotment, and (3) available Child Enrollment Contingency Fund payments. If redistributed funds are insufficient to meet the needs of all shortfall states, each shortfall state receives a proportionate share of the available funds based on the shortfall in each state. From FY2009 through FY2017, Michigan and all five territories (American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, Puerto Rico, and the U.S. Virgin Islands) received redistribution funds.20

During the time when CHIP did not have a full-year appropriation at the beginning of FY2018, some special rules for redistribution funds were added to ensure that no state exhausted its federal CHIP funding. The continuing resolutions enacted on December 8, 2017 (P.L. 115-90), and December 22, 2017 (P.L. 115-96), both included special rules for redistribution funds. The special rule in the December 8, 2017, continuing resolution prioritized the allocation of redistribution funds to emergency shortfall states, which were states estimated to exhaust federal CHIP funding before January 1, 2018. The special rule in the December 22, 2017, continuing resolution extended the definition of emergency shortfall states through March 2018.

Medicaid Funds

States that design their CHIP program as a CHIP Medicaid expansion or a combination program and face a shortfall after receiving Child Enrollment Contingency Fund payments and redistribution funds may receive federal Medicaid matching funds to fund the shortfall in the CHIP Medicaid expansion portion of their CHIP program. When Medicaid funds are used to fund CHIP, the state receives the lower regular FMAP rate (i.e., the federal Medicaid matching rate) rather than the higher E-FMAP rate provided for other CHIP expenditures. However, although federal CHIP funding is capped, federal Medicaid funding is open-ended, which means there is no upper limit or cap on the amount of federal Medicaid funds a state may receive.

Federal CHIP Funds Finance Some Medicaid Expenditures

In some situations, such as the qualifying state option and the stairstep children, federal CHIP funding is used to finance Medicaid expenditures.

Qualifying State Option

Certain states had significantly expanded Medicaid eligibility for children prior to the enactment of CHIP in 1997, and these states are allowed to use their CHIP allotment funds to fund the difference between the Medicaid and CHIP matching rates (i.e., FMAP and E-FMAP rates, respectively) to finance the cost for children in Medicaid above 133% of FPL. This provision is referred to as the qualifying state option. FY2015 was the last year for which the qualifying state option was authorized until MACRA extended the qualifying state option through FY2017. Together, P.L. 115-120 and BBA 2018 extend the qualifying state option through FY2027.

The following 11 states meet the definition of a qualifying state: Connecticut, Hawaii, Maryland, Minnesota, New Hampshire, New Mexico, Rhode Island, Tennessee, Vermont, Washington, and Wisconsin. Although 11 states are eligible for this option, only 6 states (Connecticut, Minnesota, New Hampshire, Vermont, Washington, and Wisconsin) had CHIP expenditures under the qualifying state option in FY2016.21

Stairstep Children

The ACA required states to transition CHIP children aged 6 through 18 in families with annual income less than 133% of FPL to Medicaid, beginning January 1, 2014.22 Coverage for such children continues to be financed with states' CHIP annual allotment funding at the E-FMAP rate as long as their income eligibility is greater than the state's March 31, 1997, Medicaid income standard for children.23 However, the E-FMAP rate is not available for children between the ages of 6 and 18 who have access to private health insurance.

Outreach and Enrollment Grants

CHIPRA established outreach and enrollment grants aimed at reducing the number of children eligible for but not enrolled in Medicaid and CHIP and improving retention so that eligible children stay covered for as long as they are eligible for the programs.

CHIPRA provided $100 million to fund the outreach and enrollment grants for FY2009 through FY2013. The ACA extended the outreach and enrollment grants through FY2015 and provided an additional $40 million in funding. MACRA extended the outreach and enrollment grants through FY2017 and authorized another $40 million in funding. Most recently, P.L. 115-120 provides $120 million for CHIP outreach and enrollment grants for the period of FY2018 through FY2023 and BBA 2018 provides $48 million for CHIP outreach and enrollment grants for the period of FY2024 through FY2027.

Recent Legislative Activity

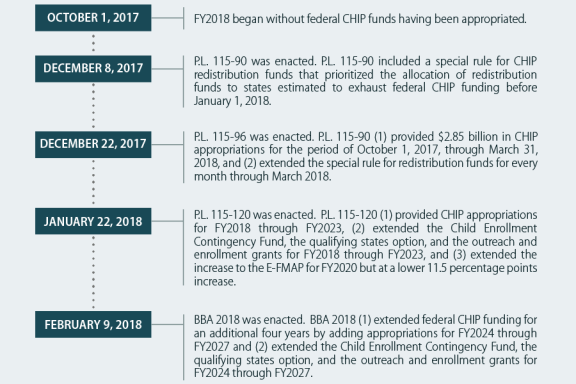

FY2018 began on October 1, 2017, without federal CHIP funding having been appropriated for the fiscal year. The full-year FY2018 appropriation for CHIP was not provided until January 22, 2018, when CHIP was provided appropriations for FY2018 through FY2023. Figure 4 shows a timeline of the legislative activity for CHIP funding from October 1, 2017, through February 9, 2018, when CHIP was provided appropriations for FY2024 through FY2027.

|

Figure 4. Timeline of Legislative Activity (October 1, 2017, through February 9, 2018) |

|

|

Sources: The continuing resolution enacted on December 8, 2017 (P.L. 115-90), the continuing resolution enacted on December 22, 2017 (P.L. 115-96), the continuing resolution enacted on February 9, 2018 (P.L. 115-120), and the Bipartisan Budget Act of 2018 (P.L. 115-123). Notes: BBA 2018 = Bipartisan Budget Act of 2018 (P.L. 115-123); CHIP = State Children's Health Insurance Program; E-FMAP = enhanced federal medical assistance percentage. |

At the beginning of FY2018, states funded the federal share of their CHIP programs with unspent funds from their FY2017 allotments; when states exhausted that funding, redistribution funds were available (i.e., unspent allotments from FY2016 and prior years redistributed to shortfall states). Since the redistribution funds were insufficient to fully fund all states for FY2018, each state received a proportionate share of the available funds based on the shortfall in that state. In December 2017, some states were expected to exhaust funding from these sources, and short-term funding for CHIP was provided through the continuing resolutions enacted on December 8, 2017 (P.L. 115-90), and December 22, 2017 (P.L. 115-96).

On December 8, 2017, a law (P.L. 115-90) was enacted to extend continuing appropriations for federal agencies and programs, and this law included language amending the CHIP statute to add a special rule for redistribution funds available through CHIP for the first quarter of FY2018. The special rule prioritized the allocation of redistribution funds to emergency shortfall states, which were states estimated to exhaust federal CHIP funding before January 1, 2018.

On December 22, 2017, a law (P.L. 115-96) was enacted to extend continuing appropriations for most federal agencies and programs (among other things) through January 19, 2018. Section 3201 of P.L. 115-96 (1) provided $2.85 billion in appropriations for CHIP for the period of October 1, 2017, through March 31, 2018, and (2) extended the special rule for redistribution funds that was added by P.L. 115-90 for every month through March 2018. The short-term funding provided in P.L. 115-96 was available through March 31, 2018.

The full-year CHIP appropriation for FY2018 was included in the continuing resolution enacted on January 22, 2018 (P.L. 115-120). This law also provides CHIP appropriations for FY2019 through FY2023, and it extends the Child Enrollment Contingency Fund, the qualifying states option, and the outreach and enrollment grants for FY2018 through FY2023. In addition, P.L. 115-120 extends the increase to the E-FMAP rate by one year (i.e., through FY2020), but the increase is to be 11.5 percentage points rather than 23 percentage points (i.e., the increase for FY2016 through FY2019).

BBA 2018 further extends CHIP funding for FY2024 through FY2027, and it also extends the Child Enrollment Contingency Fund, the qualifying states option, and the outreach and enrollment grants for FY2024 through FY2027.