Introduction

The child tax credit was created in 1997 by the Taxpayer Relief Act of 1997 (P.L. 105-34) to help ease the financial burden that families incur when they have children. Like other tax credits, the child tax credit reduces tax liability dollar for dollar of the value of the credit. Initially the child tax credit was a nonrefundable credit for most families. A nonrefundable tax credit can only reduce a taxpayer's income tax liability to zero, while a refundable tax credit can exceed a taxpayer's income tax liability, providing a cash payment primarily to low-income taxpayers who owe little or no income tax. Over the past 20 years, legislative changes have significantly changed the credit, transforming it from a generally nonrefundable credit available only to the middle and upper-middle class, to a refundable credit that more low-income families are eligible to claim.

This report provides an overview of the credit under current law and also provides some summary data on these benefits. For a complete legislative history of the credit, see CRS Report R45124, The Child Tax Credit: Legislative History, by [author name scrubbed].

Current Law

The child tax credit allows taxpayers to reduce their federal income tax liability (the income taxes owed before tax credits are applied) by up to $2,000 per qualifying child. If the value of the credit exceeds the amount of tax a family owes, the family may be eligible to receive a full or partial refund of the difference. The refundable portion of the credit is sometimes referred to as the additional child tax credit or ACTC. The total amount of their refund is calculated as 15% (the refundability rate) of earnings that exceed $2,500 (the refundability threshold), up to the maximum amount of the refundable portion of the credit ($1,400 per child).

The credit phases out for higher-income taxpayers. The child tax credit can offset a taxpayer's Alternative Minimum Tax (AMT) liability. Currently, the maximum credit per child, refundability threshold, and phaseout thresholds are not indexed for inflation. From 2018 to 2025, the maximum amount of the ACTC is indexed for inflation. Table 1 provides an overview of key provisions of the child tax credit under current law and how they will change, as scheduled under P.L. 115-97.

|

Parameter |

P.L. 115-97 |

Pre-2018/Post 2025 |

|

Maximum credit per child |

$2,000 |

$1,000 |

|

Maximum refundable portion of the credit per child (ACTC) |

$1,400 |

$1,000 |

|

Refundability Threshold |

$2,500 |

$3,000 |

|

Refundability Rate |

15% |

15% |

|

Phaseout Threshold |

$200,000 unmarried taxpayer |

$55,000 married separate return |

|

Phaseout Rate |

5% |

5% |

|

Offset AMT tax liability |

YES |

YES |

Source: Internal Revenue Code, 26 U.S.C. §24.

Note: The refundable portion of the child tax credit is often referred to as the additional child tax credit or ACTC.

Detailed Overview of Current Credit

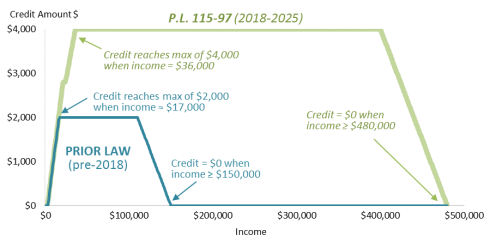

Each of the key parameters of the child tax credit as in effect from 2018-2025 is described in more detail below. The legislative changes made to the child tax credit by P.L. 115-97 have significantly expanded the child tax credit, especially for upper-income taxpayers, as illustrated in Figure 1.

|

Figure 1. The Child Tax Credit for a Married Couple with Two Children |

|

|

Source: Internal Revenue Code (IRC) Section 24. Notes: This is a stylized example. In actuality, the ACTC is calculated based on earned income and the credit is phased down based on modified adjusted gross income (MAGI). In addition, in these examples, "married" refers to married taxpayers filing joint returns. The "notch" in the graph when the credit amount equals $2,800 (the vertical axis) occurs when the maximum ACTC amount has been reached. |

Maximum Credit per Child

Eligible families can claim a child tax credit and reduce their federal income tax liability by up to $2,000 per qualifying child.1 The maximum credit a family can receive is equal to the number of qualifying children a taxpayer has, multiplied by $2,000. For example, a family with two qualifying children may be eligible for a $4,000 credit. Families may receive the child tax credit as a reduction in tax liability (the nonrefundable portion of the credit), a refundable credit (the amount of the credit in excess of tax liability), or a combination of both.2 The refundable portion of the credit—the ACTC—is discussed in the subsequent section.

The Nonrefundable $500 Credit for Non-Child Tax Credit DependentsAt the end of 2017, President Trump signed into law P.L. 115-97,3 which made numerous changes to the federal income tax for individuals and businesses.4 As discussed in this report, the law made numerous changes to the child tax credit. The law also created a new temporary credit for non-child tax-credit-eligible dependents. This credit is equal to $500 per non-child credit-eligible dependent. The amount is not annually adjusted for inflation. The phaseout parameters of the child credit (e.g., phaseout thresholds of $400,000 married filing jointly, $200,000 other taxpayers, 5% phaseout rate) apply to the family credit. As discussed below, while P.L. 115-97 imposes a new Social Security number (SSN) requirement for qualifying children being claimed under the child tax credit, the law does not statutorily impose a similar requirement on non-child credit-eligible dependents. This credit is generally available for dependents not eligible for the child tax credit. Non-child credit-eligible dependents excludes otherwise eligible dependents who are not U.S. citizens and are residents of Mexico or Canada. This provision is scheduled to be in effect from 2018 through the end of 2025. |

Beginning in 2026, the maximum amount of the credit is scheduled to revert to $1,000 per qualifying child.

Maximum Additional Child Tax Credit (ACTC) per Child, the Refundability Threshold and Refundability Rate

For taxpayers with little or no federal income tax liability, they will be eligible for little if any of the nonrefundable portion of the child tax credit. Instead, they may be eligible to receive the child tax credit as a refundable credit. The refundable portion of the child tax credit is often referred to as the additional child tax credit or ACTC. The amount of the refundable child tax credit is generally calculated using the "earned income formula"5 up to the maximum ACTC amount of $1,400 per qualifying child.

Under the earned income formula, a taxpayer may claim an ACTC equal to 15% of the family's earned income in excess of $2,500, up to the maximum ACTC amount (i.e., up to $1,400 multiplied by the number of qualifying children). The $2,500 amount is referred to as the refundability threshold; the 15% is referred to as the refundability rate. If a taxpayer's earnings are below the refundability threshold, they are ineligible for the ACTC. For every dollar of earnings above this amount, the value of the taxpayer's ACTC increases by 15 cents, up to the maximum amount of the credit ($1,400 per qualifying child). For purposes of calculating the ACTC, earned income is defined as wages, tips, and other compensation included in gross income. It also includes net self-employment income (self-employment income after deduction of one-half of Social Security payroll taxes paid by a self-employed individual).

Beginning in 2026, the refundability threshold is scheduled to increase to $3,000 and the maximum ACTC per child (the amount that exceeds income tax liability) is scheduled to decrease to $1,000 per child.

The Phaseout Threshold and Phaseout Rate

The child tax credit phases out for higher-income families. The $2,000-per-child value of the credit falls by a certain amount as a family's income rises. Specifically, for every $1,000 of modified adjusted gross income (MAGI)6 above a threshold amount, the credit falls by $50—or effectively by 5% of MAGI above the threshold. The threshold amount depends on a taxpayer's filing status, and equals $200,000 for single parents and married taxpayers filing separate returns, and $400,000 for married taxpayers filing joint returns. The actual income level at which the credit is entirely phased out (i.e., equals zero) depends on the number of qualifying children a taxpayer has. Generally, it takes $40,000 of MAGI above the phaseout threshold to completely phase out $2,000 of credit. For example, the credit will completely phase out for a married couple with two children if their MAGI exceeds $480,000 (see Figure 1).

Definition of a Qualifying Child

In order to claim the child tax credit, a taxpayer's child must be considered "a qualifying child" and meet several requirements which may differ from eligibility requirements for other child-related tax benefits:

- 1. The child must be under 17 years of age during the entire year for which the taxpayer claims the credit (for example, if the child was 16.5 years on December 31, 2017, the taxpayer could claim the credit on their 2017 federal income tax return).

- 2. The child must be eligible to be claimed as a dependent on the taxpayer's return.7

- 3. The child must be the taxpayer's son, daughter, grandson, granddaughter, stepson, stepdaughter, niece, nephew, or an eligible foster child of the taxpayer.

- 4. The child must live at the same principal residence as the taxpayer for more than half the year for which the taxpayer wishes to claim the credit.

- 5. The child cannot provide more than half of their own support during the tax year.

- 6. The child must be a U.S. citizen or national. If they are not a U.S. citizen or national, they must be a resident of the United States.

The age and citizenship requirements for a qualifying child for the child tax credit differ from the definition of qualifying child used for other tax benefits and can cause confusion among taxpayers. For example, a taxpayer's 18-year-old child may meet all the requirements for a qualifying child for the EITC, but will be too old to be eligible for the child tax credit.

ID Requirements to Claim the Child Tax Credit

The statute requires that taxpayers who intend to claim the child tax credit provide a valid taxpayer identification number (TIN) for each qualifying child on their federal income tax return. Under a temporary change in effect from 2018 through the end of 2025, the child's TIN must be a work-authorized Social Security number (SSN). The SSN must be issued before the due date of the tax return. Failure to provide the child's SSN may result in the taxpayer being denied the credit (both the nonrefundable and refundable portions of the credit).

Absent any legislative changes, beginning in 2026, a valid TIN for qualifying children will include individual taxpayer identification numbers (ITINs) and Social Security numbers (SSNs). ITINs are issued by the Internal Revenue Service (IRS) to noncitizens who do not have and are not eligible to receive SSNs. ITINs are supplied solely so that noncitizens are able to comply with federal tax law, and do not affect immigration status.

In addition, in order to claim the child tax credit in a given tax year, the taxpayer must also provide their own taxpayer identification number that must be issued before the due date of the tax return. This is a permanent ID requirement that is not scheduled to expire.

Disallowance of the Credit Due to Fraud or Reckless Disregard of the Rules

A tax filer is barred from claiming the child tax credit for a period of 10 years after the IRS makes a final determination to reduce or disallow a tax filer's child tax credit because that individual made a fraudulent child tax credit claim. A tax filer is barred from claiming the child tax credit for a period of two years after the IRS determines that the individual made a child tax credit claim "due to reckless and intentional disregard of [the] rules" of the child tax credit, but that disregard was not found to be due to fraud.8

Data on the Child Tax Credit

Estimates from the Internal Revenue Service (IRS) and Tax Policy Center highlight several key aspects of the child tax credit:

- The total dollar amount of the child tax credit has grown over time: Data from the IRS indicate that the total dollar amount of the child tax credit has increased significantly since enactment. These estimates do not include the impact of recent legislative changes made by P.L. 115-97, which, all else being equal, will expand the total cost of this tax benefit.

- In 2018, the majority of the tax benefit will go to taxpayers with income between $75,000 and $500,000: The Tax Policy Center (TPC) estimates that the majority of child tax credit dollars in 2018 will go to taxpayers with more than $75,000 of income, with nearly one-third of the benefit going to taxpayers with income between $100,000 and $200,000.9 In comparison, a relatively small share will go to very-low-income or very-high-income taxpayers.

- In 2018, over 90% of taxpayers with children and income between $30,000 and $500,000 will receive the child tax credit. The Tax Policy Center (TPC) estimates that across most income groups, the vast majority of taxpayers with children will receive the child tax credit in 2018. About half of the lowest-income taxpayers will receive the credit and no taxpayers with children and income over $1 million will receive the credit.

- In 2018, taxpayers with income between $100,000 and $200,000 will on average receive the largest credit. The Tax Policy Center (TPC) estimates that taxpayers with children and income between $100,000 and $200,000 will on average receive a credit of over $3,000 in 2018. Taxpayers with children with income under $20,000 will receive on average a credit of less than $1,000, while the wealthiest taxpayers with children will receive on average a credit of $10.

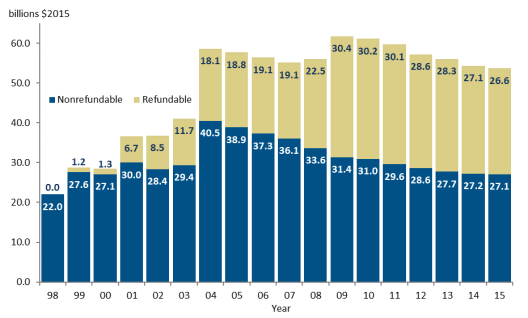

Total Child Tax Credit Dollars, 1998-2015

IRS estimates of the amount of total child tax credit dollars (inflation adjusted to 2015 dollars) received by taxpayers indicate that this tax benefit has more than doubled in size since enactment, from aggregate receipt of $22 billion in 1998 to approximately $54 billion in 2015, as illustrated in Figure 2.

|

|

Source: IRS Statistics of Income Table 3.3 Note: The Joint Committee on Taxation estimates that the temporary changes to the child tax credit will cost $573.4 billion between 2018 and 2026. (This estimate does not include the budgetary impact of the SSN requirement, which is estimated to save $29.8 billion over the same time period.) JCX-67-17. |

A significant component in the growth of the child tax credit has been the growth in the refundable portion of the credit, which now comprises approximately half of child tax credit dollars received by taxpayers. (For an overview of the legislative changes that have influenced the expansion of both the refundable and nonrefundable portions of the credit, see CRS Report R45124, The Child Tax Credit: Legislative History, by [author name scrubbed].) The most recent IRS data available are for the 2015 tax year (i.e., 2015 income tax returns filed in 2016), and hence do not include the impact of the legislative changes made to the credit by P.L. 115-97. As previously discussed, these legislative changes are currently scheduled to be in effect from 2018 through the end of 2025. The Joint Committee on Taxation has estimated that the modification to the child tax credit formula will cost an estimated $573.4 billion between 2018 and 2026, or on average $64 billion a year.10 (These estimates include the budgetary cost of the $500 nonrefundable credit for non-child tax-credit-eligible dependents.) JCT also estimates that the new SSN requirement will save $29.8 billion between 2018 and 2026, or on average $3 billion per year.

Total Child Tax Credit Dollars by Income Level

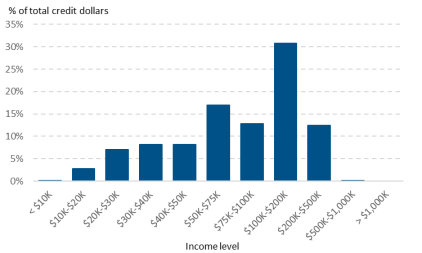

The Tax Policy Center (TPC) estimated the distribution of aggregate child tax credit by income level11 for 2018 under current law (i.e., including the changes made by P.L. 115-97). These estimates include the $500 credit for non-child tax-credit-eligible dependents. TPC estimates that nearly one-third of all child tax credit dollars (31%) will go to taxpayers with income between $100,000 and $200,000, as illustrated in Figure 3.

Slightly more than one-quarter of all child tax credit dollars (26.5%) will go to taxpayers with income under $50,000. Lower-income taxpayers will generally receive a credit of $1,400 or less per child, depending on their earnings. In contrast, higher-income taxpayers with sufficient income tax liability will receive a credit of $2,000 per child. For example, a single parent with two children and $15,000 of income will be eligible for a $1,875 credit (received entirely as the refundable child credit or ACTC), less than the maximum ACTC for two children of $2,800 (2x $1,400) and less than the maximum credit for two children of $4,000 (2 x $2,000). The highest-income taxpayers will not receive a credit due to the credit phaseout.

Share of Taxpayers with Children Receiving the Child Tax Credit

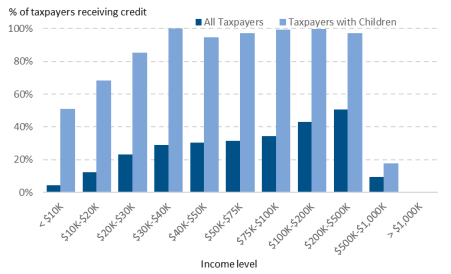

TPC estimated the share of all taxpayers and taxpayers with children that would receive the child tax credit in 2018. The estimates indicate that among taxpayers with children, almost all taxpayers will receive the child tax credit. More than 90% of taxpayers with children and income between $40,000 and $500,000 will receive the child tax credit. In contrast, about half (51%) of taxpayers with children and income under $10,000 will receive the child tax credit in 2018, and less than one-fifth (18%) of taxpayers with income between $500,000 and $1 million will receive the credit, as illustrated in Figure 4. Fewer low-income families with children will benefit from the child tax credit since taxpayers with income under $2,500 (the refundability threshold) will not be eligible for the refundable portion of the credit. In contrast, due to the phaseout of the credit at higher income levels, virtually no taxpayers with income over $1 million will be eligible to claim it.

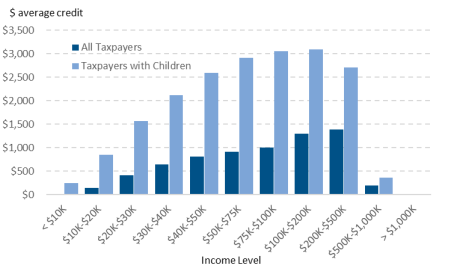

Average Child Tax Credit Amount

TPC estimated the average child tax credit amount by income level for all taxpayers and taxpayers with children in 2018. Their estimates indicate that taxpayers with children and income between $100,000 and $200,000 will receive the largest credit on average—an estimated $3,100. Taxpayers with income under $20,000 will receive on average a credit of less than $1,000, while the wealthiest taxpayers with children (income over $1 million) will on average receive a credit of $10. Lower-income taxpayers are eligible to receive a credit of up to $1,400 per child, although they may receive less depending on their earned income. In contrast, higher-income taxpayers, with sufficient income tax liability, will be eligible for up to a $2,000 credit per child. The highest-income taxpayers will be ineligible for the credit due to the phaseout.