Introduction

The Supplemental Nutrition Assistance Program (SNAP) provided food assistance to a monthly average of 42.2 million persons in 20.9 million households in FY2017. Total benefit costs were $63.7 billion in FY2017.

SNAP participation and costs increased markedly from FY2007 to FY2013, mostly as a result of automatic and legislated responses to the recession.1 In FY2014, both participation and costs declined from peak FY2013 levels and have continued to decline. While much of the FY2007 to FY2013 increase in participation and costs was attributable to the poor economy, states during this period also increasingly adopted more expansive "categorical eligibility" rules—a set of policies that make a SNAP applicant eligible based on the applicant's involvement with other low-income assistance programs: benefits from the Temporary Assistance for Needy Families (TANF) block grant, Supplemental Security Income (SSI), and state-financed General Assistance (GA) programs. This report discusses categorical eligibility and some of the issues raised by it. It first describes the three different types of categorical eligibility: traditional categorical eligibility conveyed through receipt of need-based cash assistance, and the newer "narrow" and "broad-based" categorical eligibilities conveyed via TANF "noncash" benefits. It also provides recent information on current state practices with regard to categorical eligibility.

The Agriculture Act of 2014 (the "2014 Farm Bill," P.L. 113-79) made no changes to SNAP categorical eligibility rules. The House-passed version of the bill that became the 2014 Farm Bill would have eliminated "narrow" and "broad-based categorical eligibility," retaining only "traditional" categorical eligibility for recipients of cash assistance. However, the House-passed provision was not included in the conference agreement on the bill.

In the 115th Congress's work toward the next farm bill, the House Committee on Agriculture's bill, the Agriculture and Nutrition Act of 2018 (H.R. 2), voted out of committee on April 18, 2018, would make changes to limit but not eliminate broad-based categorical eligibility. (Described further in "Consideration of Related Proposals for the Next Farm Bill.")

Regular and Categorical Eligibility for SNAP

Federal law provides the basic eligibility rules for SNAP. There are two basic pathways to gain financial eligibility for SNAP: (1) having income and resources below specified levels set out in federal SNAP law; and (2) being "categorically," or automatically, eligible based on receiving benefits from other specified low-income assistance programs.

Eligibility through Meeting Federal Income and Resource Tests

Under the regular federal rules, SNAP provides eligibility to households based on low income and limited assets. Households must have net income (income after specified deductions) below 100% of the federal poverty guidelines. In addition, federal rules provide that households without an elderly or disabled2 member must have gross income (income before deductions) below 130% of the federal poverty guidelines (see Table A-1).

Additionally, the regular eligibility rules provide that a household must have liquid assets below a specified level. Under federal rules in FY2018, a household's liquid assets must also be below $2,250, and below $3,500 in the case of households with an elderly or disabled member. The value of the home is excluded from this "assets test," as are certain other forms of assets (e.g., retirement and educational savings).

Further, a portion of the value of a household's vehicles is not counted toward the asset limit (up to $4,650 of the fair market value of a household's vehicles). However, federal law gives states the option to further exclude the value of vehicles from being counted toward the asset limit. States may elect to use the exclusion applicable for TANF assistance in their SNAP program. Under TANF, many states fully exclude the value of one vehicle. This option is distinct from categorical eligibility.

Categorical Eligibility

Federal law also makes households in which all members are either eligible for or receive benefits from TANF, Supplemental Security Income (SSI), or state-financed GA programs categorically, or automatically, eligible for SNAP.3 These households, who have already gone through eligibility determination for those programs, bypass the income and resource tests discussed above and are deemed financially eligible.4 They then have their SNAP benefits determined.

Categorically eligible households have their SNAP benefits determined under the same rules as other households. A household's SNAP benefit amount is based on the maximum benefit (which varies by household size) and its net countable income after deductions for certain expenses. While the household may be categorically eligible, its net income may be too high to actually receive a SNAP benefit. The exception is that all eligible households consisting of one or two persons are eligible for at least the minimum monthly benefit, set at $15 in the 48 contiguous states and the District of Columbia for FY2018.

Early History

Special rules providing for expedited eligibility of cash assistance recipients date back to amendments to the Food Stamp program enacted in 1971.5 These rules were eliminated in the rewrite of food stamp law enacted in 1977, but they were reinstated in phases during the early 1980s through 1990.6 Categorical eligibility was seen as advancing the goals of simplifying administration, easing entry to the program for eligible households, emphasizing coordination among low-income assistance programs, and reducing the potential for errors in establishing eligibility for benefits.7 The Food Security Act of 1985 conveyed categorical eligibility to all households receiving cash aid from Aid to Families with Dependent Children (AFDC), SSI, or state-run GA programs. These programs had their own income and resource tests (often more stringent than food stamp tests), so subjecting a household to a separate set of income and resource tests for food stamps could be seen as redundant and inefficient.

The 1996 Welfare Law and TANF

The current form of categorical eligibility resulted from the 1996 welfare reform law (the Personal Responsibility and Work Opportunity Reconciliation Act of 1996, P.L. 104-193). That law ended AFDC, replacing it with TANF. AFDC was a traditional cash assistance program. Within some federal rules, states set AFDC eligibility and benefit amounts, but federal law established it as a cash welfare program. AFDC eligibility rules were generally more restrictive than those for food stamps, and most AFDC families also received a substantial food stamp benefit.

TANF, on the other hand, is a broad-purpose block grant that gives states broad flexibility to expend funds. The statutory purpose of TANF is to increase state flexibility to achieve four policy goals:8

- 1. provide assistance to needy families so that children can be cared for in their own homes or in the homes of their relatives;

- 2. end dependence by needy parents on government benefits through promoting work, job preparation, and marriage;

- 3. reduce the incidence of out-of-wedlock pregnancies; and

- 4. promote the formation and maintenance of two-parent families.

States may expend TANF funds and associated state funds (called Maintenance of Effort or MOE funds) in any manner "reasonably calculated"9 to achieve the TANF purpose, providing broad authority for the types of activities that may be funded. These activities include the traditional cash assistance programs—which convey traditional categorical eligibility.10 However, in FY2016 traditional cash welfare accounted for only 24% of all expenditures from the TANF block grant and MOE funds.

TANF funds a wide range of other benefits and services that seek to ameliorate the effects, or address the root causes, of child poverty. TANF benefits and services to achieve the first two goals of TANF (provide assistance, end dependence of needy parents on government benefits) must be for needy families with children. These benefits or services are need-tested, though states determine their own income thresholds. These benefits are often available to families at higher levels of income than is cash assistance, often a multiple of the federal poverty threshold, and without an asset test.

Moreover, TANF services directed at the third and fourth goals shown above can be for any person in a state; that is, TANF services to reduce out-of-wedlock pregnancies or promote two-parent families are not restricted to families with children. Federal rules also do not require that they be need-tested. Thus, these benefits and services are potentially available to a state's entire population.

What TANF Means for Categorical Eligibility

The 1996 welfare reform law did not substantively change SNAP law with respect to categorical eligibility. Rather, it simply replaced the reference to AFDC with one to TANF in the section of law that conveys categorical eligibility. As discussed above, TANF gives states much broader authority than they had under AFDC to offer different types of benefits and services. This expansion of authority under TANF had major implications for categorical eligibility, allowing states to convey categorical eligibility based on receipt of a wide range of human services rather than simply cash welfare.

U.S. Department of Agriculture (USDA) regulations issued in 2000 provide rules for which noncash or in-kind TANF or MOE-funded benefits or services can be used to convey SNAP categorical eligibility.11 The regulations require that states make categorically eligible for SNAP

- households in which all members receive or are authorized to receive12 cash assistance funded by TANF or MOE dollars; and

- households in which all members receive or are authorized to receive noncash aid funded at least 50% by TANF or MOE dollars.

The regulations imposed one restriction on states in conveying categorical eligibility: if the TANF- or MOE-funded benefit or service was aimed at achieving TANF goals three (reducing out-of-wedlock pregnancies) or four (promoting two-parent families), the state would have to choose a program with an income limit of no more than 200% of the federal poverty guideline for conveying categorical eligibility.

Additionally, subject to the 200% of poverty restriction discussed above, the regulations give states the option of making categorically eligible for SNAP

- households in which all members receive or are authorized to receive noncash assistance funded less than 50% by TANF or MOE dollars; and

- households in which at least one member receives or is authorized to receive noncash aid funded at least partially by TANF or MOE dollars, but the state agency determines the whole household benefits from such noncash aid.

Traditional, Narrow, and Broad-Based Categorical Eligibility

As discussed, in instances of categorical eligibility, SNAP applicants can be found eligible for SNAP based on their receipt of benefits from other specified means-tested programs.13 At minimum, households that receive Temporary Assistance for Needy Families (TANF) cash assistance, Supplemental Security Income (SSI), or state-funded general assistance cash benefits must be found categorically eligible for SNAP. However, the 1996 welfare reform law's creation of TANF as a broad-based block grant has allowed for a state option to include a long list of benefits/services that can convey SNAP eligibility. This section discusses state choices in this area as of February 2018.

Scope and Reach of Categorical Eligibility

The current status of SNAP categorical eligibility is the product of state choices. At minimum, a state must implement "traditional" categorical eligibility, but some states allow additional programs and benefits to convey categorical eligibility. The USDA has developed a typology of state practices on categorical eligibility, categorizing states into three groups:

- Traditional categorical eligibility only. In its traditional form, a household where all members receive need-tested cash aid from SSI, GA, or TANF is automatically made eligible for SNAP as well. These households have already met the income and (in general) resource test for cash aid. Note that states set income and asset eligibility rules for TANF and GA (see Table A-2 for maximum earnings possible for entry to TANF cash assistance in July 2016). SSI provides a federal income floor based on federal rules for the needy who are aged, blind, or disabled. However, states may supplement SSI with their own funds, leading to state variation in SSI eligibility as well. Based on the most current information available, only six states currently convey only traditional categorical eligibility.

- "Narrow" categorical eligibility. These states have expanded categorical eligibility beyond just traditional categorical eligibility, but in a way to limit the number of households made eligible for SNAP. These states convey categorical eligibility through receipt of cash and certain TANF noncash benefits, such as child care and counseling. Based on the most current information available, only five states have "narrow" categorical eligibility policies.

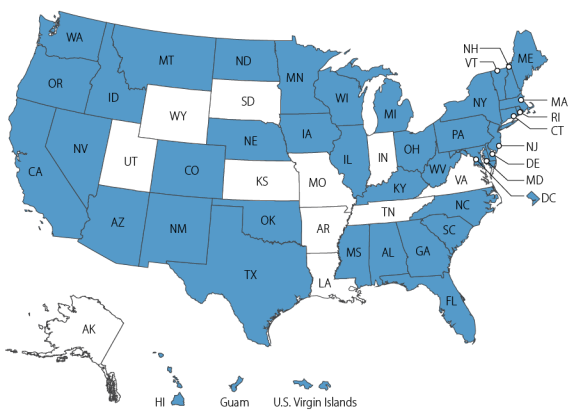

- "Broad-based" categorical eligibility. These states have expanded categorical eligibility in ways that make most, if not all, households with low incomes in a state categorically eligible for SNAP. States could make all low-income households in a state—including those without children—eligible for a TANF-funded service directed at either the reducing out-of-wedlock pregnancies or promoting two-parent families goals of TANF. If a state opted to do so, any low-income household (under 200% of poverty, per regulation) could either receive, or be authorized to receive, such a TANF-funded service. Based on the currently available information, 39 states, the District of Columbia, Guam, and the Virgin Islands have broad-based categorical eligibility policies.

USDA currently does not have reliable information on the number of states that have opted to use "narrow" categorical eligibility. However, they do track both the number of states and rules used for states that have opted to use broad-based categorical eligibility. Figure 1 displays a map showing the states that use broad-based categorical eligibility (shaded in blue).

"Broad-Based" Categorical Eligibility Practices

Broad-based categorical eligibility is a policy that makes most households with incomes below a certain threshold categorically eligible for SNAP. Typically, households are made categorically eligible through receiving or being authorized to receive a minimal TANF- or MOE-funded benefit or service, such as being given a brochure or being referred to a social services "800" telephone number (see Table 1). Recalling the USDA regulation, the brochure or telephone number must be funded with TANF or MOE dollars and thus must be directed at a TANF purpose.14 The Department of Agriculture reports that, as of February 2018, 42 jurisdictions operated broad-based categorical eligibility to make most or all households in their state with whom the state welfare office comes in contact SNAP eligible.

Table 1 shows the use of SNAP broad-based categorical eligibility by state as of February 2018. Of the 42 jurisdictions using broad-based categorical eligibility,

- 40 make all family types eligible (New Hampshire and New York limit broad-based categorical eligibility to certain household types);

- 37 currently have no asset test. Note, though, currently in 13 of these jurisdictions, households with an elderly and disabled member with incomes in excess of 200% of the federal poverty guidelines have to meet the regular SNAP asset tests of $3,500 for households of that type);

- 5 states (Idaho, Maine, Michigan, Nebraska, and Texas) apply an asset test for all households); and

- 31 have a gross income limit above 130% of the federal poverty guidelines.

According to USDA policy and guidance, there is a general way that a state would administer broad-based categorical eligibility for a SNAP applicant. The local SNAP office would collect basic income information on the applicant; if the applicant's income is below the limit specified, then the state office would administer, or determine whether a member of the household was authorized to receive, a relatively nominal TANF-funded benefit or service. Receipt of this TANF benefit or service then constitutes SNAP eligibility through broad-based categorical eligibility. (As discussed above, it is still possible to be categorically eligible but receive no benefit because net income is too high.)15

As an illustration, in the case of the District of Columbia, as shown in the table, if the applicant's gross income is below 200% of poverty, the applicant would then receive a particular brochure for a program that is TANF-funded and would then be eligible for SNAP through the broad-based categorical eligibility pathway.

Table 1. SNAP Broad-Based Categorical Eligibility by State

Information as of February 2018, excludes states without broad-based categorical eligibility

|

State |

Households Eligible |

Type of TANF Benefit or Servicea |

Asset Rules |

Gross Income Limit for Households Without an Elderly or Disabled Member (% of federal poverty guidelines)b |

|

Alabama |

All |

Brochure |

No limit. Households with an elderly or disabled member with incomes over 200% of poverty face a $3,500 asset limit. |

130% |

|

Arizona |

All |

Referral on application |

No limit |

185% |

|

California |

All |

Pamphlet |

No limit |

200% |

|

Colorado |

All |

Notice on application |

No limit. Households with an elderly or disabled member with incomes over 200% of poverty face a $3,500 asset limit. |

130% |

|

Connecticut |

All |

"Help for People in Need" brochure |

No limit |

185% |

|

Delaware |

All |

Application refers to a pregnancy prevention hotline |

No limit |

200% |

|

District of Columbia |

All |

Brochure |

No limit |

200% |

|

Florida |

All |

Notice |

No limit |

200% |

|

Georgia |

All |

TANF Community Outreach Services brochure |

No limit. Households with an elderly or disabled member with incomes over 200% of poverty face a $3,500 asset limit. |

130% |

|

Hawaii |

All |

Brochure |

No limit |

200% |

|

Idaho |

All |

Flyer about referral service |

$5,000 |

130% |

|

Illinois |

All |

Guide to services |

No limit. Households with an elderly or disabled member with incomes over 200% of poverty face a $3,500 asset limit. |

165% |

|

Iowa |

All |

Notice of eligibility |

No limit |

160% |

|

Kentucky |

All |

Resource guide |

No limit. Households with an elderly or disabled member with incomes over 200% of poverty face a $3,500 asset limit. |

130% |

|

Maine |

All |

Resource guide |

$5,000 |

185% |

|

Maryland |

All |

Referral to services on application |

No limit |

200% |

|

Massachusetts |

All |

Brochure |

No limit. Households with an elderly or disabled member with incomes over 200% of poverty face a $3,500 asset limit. |

200% |

|

Michigan |

All |

Notice on application |

$5,000. First vehicle is excluded; other vehicles with fair market value over $15,000 are counted. |

200% |

|

Minnesota |

All |

Domestic violence brochure |

No limit |

165% |

|

Mississippi |

All |

Language on notice |

No limit |

130% |

|

Montana |

All |

Brochure |

No limit |

200% |

|

Nebraska |

All |

Pamphlet |

$25,000 for liquid assets |

130% |

|

Nevada |

All |

Pregnancy prevention information on application |

No limit |

200% |

|

New Hampshire |

Households with at least one dependent child |

Brochure |

No limit |

185% |

|

New Jersey |

All |

Brochure |

No limit |

185% |

|

New Mexico |

All |

Brochure |

No limit |

165% |

|

New York |

Households with dependent care expenses; or Households with earned income |

Brochure mailed yearly |

No limit. Households with an elderly or disabled member with incomes over 200% of poverty face a $3,500 asset limit. |

200% (for households with dependent care expenses) 150% (for households with earned income and no dependent care expenses) |

|

North Carolina |

All |

Not specified |

No limit |

200% |

|

North Dakota |

All |

Statement on application/recertification forms and pamphlet |

No limit |

200% |

|

Ohio |

All |

Ohio Benefit Bank information on approval notice |

No limit. Households with an elderly or disabled member with incomes over 200% of poverty face a $3,500 asset limit. |

130% |

|

Oklahoma |

All |

Certification notice has 2-1-1 number for information and referral to community services |

No limit |

130% |

|

Oregon |

All |

Pamphlet |

No limit |

185% |

|

Pennsylvania |

All |

Pamphlet |

No limit. Households with an elderly or disabled member with incomes over 200% of poverty face a $3,500 asset limit. |

160% |

|

Rhode Island |

All |

Publication |

No limit. Households with an elderly or disabled member with incomes over 200% of poverty face a $3,500 asset limit. |

185% |

|

South Carolina |

All |

Pamphlet |

No limit. Households with an elderly or disabled member with incomes over 200% of poverty face a $3,500 asset limit. |

130% |

|

Texas |

All |

Information about various services provided on the application |

$5,000 (excludes one vehicle up to $15,000, includes excess vehicle value). |

165% |

|

Vermont |

All |

Bookmark with telephone number and website for services |

No limit |

185% |

|

Washington |

All |

Information and referral services provided on approval letter. |

No limit |

200% |

|

West Virginia |

All |

Information and referral services program brochure |

No limit |

130% |

|

Wisconsin |

All |

Job Net services language on approval and change notices |

No limit |

200% |

|

Guam |

All |

Brochure |

No limit |

165% |

|

Virgin Islands |

All |

Brochure |

No limit. Households with an elderly or disabled member with incomes over 200% of poverty face a $3,500 asset limit. |

175% |

Source: Prepared by the Congressional Research Service based on data from U.S. Department of Agriculture, Food and Nutrition Service (FNS).

a. Type of TANF benefit or service is information collected by the USDA, and this column utilizes USDA's terms. References to a notice or notice on application generally refers to an agency communication that an applicant may be eligible for TANF or related benefit.

b. Households with an elderly or disabled member do not have a gross income limit in SNAP.

Incomes and Assets of SNAP Households

Income

Because broad-based categorical eligibility conveys SNAP to households with gross incomes as high as 200% of poverty, there is concern that it could be unduly expanding the program. However, broad-based categorical eligibility has not resulted in large numbers of households receiving SNAP who have gross incomes, as measured using SNAP income counting rules, exceeding 130% of poverty.16 Table 2 shows that in FY2016, a monthly average of 4.2% of all households without an elderly or disabled member had incomes above 130% of poverty. (As mentioned above, households with an elderly or disabled member are not subject to the 130% of poverty gross income limit under regular federal eligibility rules.)

|

|

Households Without an Elderly or Disabled Member |

Households With an Elderly or Disabled Member |

All SNAP Households |

|

Below Poverty |

85.3% |

76.9% |

81.8% |

|

100% to 130% of poverty |

10.5 |

15.4 |

12.6 |

|

131% of poverty and higher |

4.2 |

7.7 |

5.7 |

|

Totals |

100.0 |

100.0 |

100.0 |

Source: Congressional Research Service (CRS) tabulations of the FY2016 SNAP Quality Control Data File.

Notes: Detail may not add to totals because of rounding. The information on the Quality Control Data File sometimes fails to categorize a household with a disabled member. Therefore, some households classified in this table as "without an elderly or disabled member" may in fact contain a disabled person.

Table 3 shows both the number and percentage of households without an elderly or disabled member that have incomes above 130% of poverty by state.17 Note that tabulations in Table 2 and Table 3 reflect states' SNAP households under states' broad-based categorical eligibility practices in place during FY2016. Some states' current practices are different from their practices in FY2016, so tabulations here do not necessarily reflect current state practices.

Table 3. Estimates of SNAP Households without an Elderly or Disabled Member with Gross Incomes Over 130% of Poverty by State, FY2016

|

State |

Number of SNAP Households Without an Elderly or Disabled Member and Gross Income of 131% of Poverty or Higher |

Percentage of All SNAP Households Without an Elderly or Disabled Member and with Gross Income of 131% of Poverty or Higher |

|

Alabama |

2,013 |

0.9% |

|

Alaska |

0 |

0.0 |

|

Arizona |

15,883 |

5.4 |

|

Arkansas |

155 |

0.1 |

|

California |

66,759 |

3.8 |

|

Colorado |

530 |

0.4 |

|

Connecticut |

10,981 |

8.9 |

|

Delaware |

3,526 |

8.6 |

|

District of Columbia |

2,390 |

5.6 |

|

Florida |

64,689 |

6.4 |

|

Georgia |

10,375 |

2.1 |

|

Hawaii |

2,606 |

5.5 |

|

Idaho |

71 |

0.2 |

|

Illinois |

6,143 |

1.0 |

|

Indiana |

0 |

0.0 |

|

Iowa |

8,586 |

8.0 |

|

Kansas |

0 |

0.0 |

|

Kentucky |

278 |

0.2 |

|

Louisiana |

0 |

0.0 |

|

Maine |

3,409 |

9.1 |

|

Maryland |

22,023 |

9.6 |

|

Massachusetts |

23,481 |

13.4 |

|

Michigan |

29,750 |

7.0 |

|

Minnesota |

10,963 |

8.8 |

|

Mississippi |

239 |

0.2 |

|

Missouri |

1,251 |

0.6 |

|

Montana |

2,091 |

6.9 |

|

Nebraska |

213 |

0.5 |

|

Nevada |

11,318 |

7.8 |

|

New Hampshire |

2,090 |

10.7 |

|

New Jersey |

12,076 |

5.3 |

|

New Mexico |

4,531 |

3.4 |

|

New York |

21,833 |

3.3 |

|

North Carolina |

27,907 |

5.9 |

|

North Dakota |

1,009 |

7.6 |

|

Ohio |

2,399 |

0.6 |

|

Oklahoma |

0 |

0.0 |

|

Oregon |

19,710 |

8.6 |

|

Pennsylvania |

33,931 |

7.5 |

|

Rhode Island |

4,492 |

9.7 |

|

South Carolina |

725 |

0.4 |

|

South Dakota |

179 |

0.7 |

|

Tennessee |

0 |

0.0 |

|

Texas |

41,121 |

4.2 |

|

Utah |

99 |

0.2 |

|

Vermont |

2,649 |

15.2 |

|

Virginia |

0 |

0.0 |

|

Washington |

25,846 |

8.4 |

|

West Virginia |

1,755 |

1.9 |

|

Wisconsin |

25,824 |

12.3 |

|

Wyoming |

0 |

0.0 |

|

Guam |

1,171 |

9.8 |

|

Virgin Islands |

852 |

9.0 |

|

Totals |

529,921 |

4.2 |

Source: Congressional Research Service (CRS) tabulation of the FY2015 SNAP Quality Control data file.

Notes: Some states that have gross income limits of 130% of poverty report a small number of households without an elderly or disabled member as having incomes above 130% of poverty. This is likely because of limitation on the Quality Control Data File in identifying disabled individuals. The information on the Quality Control Data File sometimes fails to categorize a household with a disabled member. Therefore, some households classified in this table as "without an elderly or disabled member" may in fact contain a disabled person.

Assets

As discussed above, broad-based categorical eligibility also eliminates the SNAP asset test in many states. Since states that do not administer an asset test generally do not collect data on the assets of SNAP households, it is not possible to determine the extent to which broad-based categorical eligibility has resulted in households with assets above the usual SNAP limit receiving benefits.

Consideration of Related Proposals for the Next Farm Bill

The enacted 2014 Farm Bill did not change categorical eligibility, although the House-passed version would have eliminated broad-based categorical eligibility.

As the 115th Congress begins work toward the next farm bill, the bill voted out of committee by the House Agriculture Committee, the Agriculture and Nutrition Act of 2018 (H.R. 2), would make changes to limit but not eliminate broad-based categorical eligibility. Debate during the committee's April 18, 2018, markup was substantially focused on the bill's SNAP provisions, including the changes to categorical eligibility. None of the committee's Democrats voted for the bill.

Section 4006 of H.R. 2, as ordered to be reported, would change broad-based categorical eligibility in a few ways. In states with broad-based options in place, some but not all households would be affected by this change. Under the proposal:

- To be categorically eligible, households would have to receive SSI, state general assistance, or "cash assistance or ongoing and substantial services" through a state program funded by TANF. While these terms would be subject to implementation, it is expected that a brochure may not meet this more specific TANF-funded benefit.

- There would be two gross income limits for broad-based categorical eligibility:

- 1. Households with an elderly or disabled member must be at or below 200% of the federal poverty line.

- 2. Households without an elderly or disabled member must be at or below 130% of the federal poverty line.

The Congressional Budget Office (CBO) estimates that the amendments to categorical eligibility would reduce SNAP spending by $5.035 billion dollars over 10 years (FY2019-FY2028).18

Appendix.

Table A-1. Counted (Net) and Basic (Gross) Monthly Income Eligibility Limits for SNAP, FY2018

Eligibility Limits in Effect October 1, 2017, to September 30, 2018

|

Household Size |

48 States, DC, and the Territories |

Alaska |

Hawaii |

|

Counted (net) monthly income eligibility limits (100% of poverty): |

|||

|

1 person |

$1,005 |

$1,255 |

$1,155 |

|

2 persons |

1,354 |

1,691 |

1,556 |

|

3 persons |

1,702 |

2,127 |

1,957 |

|

4 persons |

2,050 |

2,563 |

2,358 |

|

5 persons |

2,399 |

2,999 |

2,759 |

|

6 persons |

2,747 |

3,435 |

3,160 |

|

7 persons |

3,095 |

3,870 |

3,560 |

|

8 persons |

3,444 |

4,306 |

3,961 |

|

Each additional person |

349 |

436 |

401 |

|

Basic (gross) monthly income eligibility limits (130% of poverty): |

|||

|

1 person |

$1,307 |

$1,632 |

$1,502 |

|

2 persons |

1,760 |

2,199 |

2,023 |

|

3 persons |

2,213 |

2,765 |

2,544 |

|

4 persons |

2,665 |

3,332 |

3,065 |

|

5 persons |

3,118 |

3,898 |

3,586 |

|

6 persons |

3,571 |

4,465 |

4,107 |

|

7 persons |

4,024 |

5,031 |

4,628 |

|

8 persons |

4,477 |

5,598 |

5,150 |

|

Each additional person |

453 |

567 |

522 |

Source: U.S. Department of Agriculture, Food and Nutrition Service.

Table A-2. Maximum Monthly Earnings a Family of Three May Have and Still Meet Initial Eligibility for TANF Cash Assistance: July 2016

Family Composed of One Parent and Two Children

|

State |

Maximum Monthly Earnings |

Maximum Monthly Earnings as a Percentage of the 2016 Federal Poverty Guidelines |

|

Alabama |

$269 |

16.0% |

|

Alaska |

1,679 |

80.0 |

|

Arizona |

585 |

34.8 |

|

Arkansas |

279 |

16.6 |

|

California |

1,381 |

82.2 |

|

Colorado |

511 |

30.4 |

|

Connecticut |

908 |

54.0 |

|

Delaware |

428 |

25.5 |

|

DC |

601 |

35.8 |

|

Florida |

393 |

23.4 |

|

Georgia |

514 |

30.6 |

|

Hawaii |

1,740 |

90.0 |

|

Idaho |

972 |

57.9 |

|

Illinois |

840 |

50.0 |

|

Indiana |

378 |

22.5 |

|

Iowa |

1,061 |

63.2 |

|

Kansas |

519 |

30.9 |

|

Kentucky |

908 |

54.0 |

|

Louisiana |

360 |

21.4 |

|

Maine |

1,023 |

60.9 |

|

Maryland |

795 |

47.3 |

|

Massachusetts |

1,143 |

68.0 |

|

Michigan |

815 |

48.5 |

|

Minnesota |

1,327 |

79.0 |

|

Mississippi |

457 |

27.2 |

|

Missouri |

557 |

33.2 |

|

Montana |

817 |

48.6 |

|

Nebraska |

991 |

59.0 |

|

Nevada |

1,575 |

93.8 |

|

New Hampshire |

844 |

50.2 |

|

New Jersey |

636 |

37.9 |

|

New Mexico |

941 |

56.0 |

|

New York |

879 |

52.3 |

|

North Carolina |

681 |

40.5 |

|

North Dakota |

1,331 |

79.2 |

|

Ohio |

840 |

50.0 |

|

Oklahoma |

824 |

49.0 |

|

Oregon |

616 |

36.7 |

|

Pennsylvania |

677 |

40.3 |

|

Rhode Island |

1,277 |

76.0 |

|

South Carolina |

1,548 |

92.1 |

|

South Dakota |

857 |

51.0 |

|

Tennessee |

1,315 |

78.3 |

|

Texas |

402 |

23.9 |

|

Utah |

668 |

39.8 |

|

Vermont |

1,103 |

65.7 |

|

Virginia |

665 |

39.6 |

|

Washington |

1,040 |

61.9 |

|

West Virginia |

565 |

33.6 |

|

Wisconsin |

1,932 |

115.0 |

|

Wyoming |

1,256 |

74.8 |

Source: Congressional Research Service (CRS), based on data from the Urban Institute's Welfare Rules Database.