Introduction

Medicaid is a means-tested entitlement program that finances the delivery of primary and acute medical services as well as long-term services and supports.1 Medicaid is jointly funded by the federal government and the states. Participation in Medicaid is voluntary for states, though all states, the District of Columbia, and the territories choose to participate. Each state designs and administers its own version of Medicaid under broad federal rules. While states that choose to participate in Medicaid must comply with all federal mandated requirements, state variability is the rule rather than the exception in terms of eligibility levels, covered services, and how those services are reimbursed and delivered. The federal government pays a share of each state's Medicaid expenditures.2

This report describes the federal medical assistance percentage (FMAP) calculation used to reimburse states for most Medicaid expenditures, and it lists the statutory exceptions to the regular FMAP rate.

The Federal Medical Assistance Percentage

The federal government's share of most Medicaid service costs is determined by the FMAP rate, which varies by state and is determined by a formula set in statute. The FMAP rate is used to reimburse states for the federal share of most Medicaid expenditures, but exceptions to the regular FMAP rate have been made for certain states, situations, populations, providers, and services.3

The FMAP rate is also used in determining the phased-down state contribution ("clawback") for Medicare Part D, the federal share of certain child support enforcement collections, Temporary Assistance for Needy Families (TANF) contingency funds, a portion of the Child Care and Development Fund (CCDF), and foster care and adoption assistance under Title IV-E of the Social Security Act.

An enhanced FMAP (E-FMAP) rate is provided for both services and administration under the State Children's Health Insurance Program (CHIP), subject to the availability of funds from a state's federal allotment for CHIP. The E-FMAP rate is calculated by reducing the state share under the regular FMAP rate by 30%.4

How FMAP Rates Are Calculated

The FMAP formula compares each state's per capita income relative to U.S. per capita income. The formula provides higher reimbursement to states with lower incomes (with a statutory maximum of 83%) and lower reimbursement to states with higher incomes (with a statutory minimum of 50%). The formula5 for a given state is:

FMAPstate = 1 - ((Per capita incomestate)2/(Per capita incomeU.S.)2 * 0.45)

The use of the 0.45 factor in the formula is designed to ensure that a state with per capita income equal to the U.S. average receives an FMAP rate of 55% (i.e., state share of 45%). In addition, the formula's squaring of income provides higher FMAP rates to states with below-average incomes (and vice versa, subject to the 50% minimum).6

The Department of Health & Human Services (HHS) usually publishes FMAP rates for an upcoming fiscal year in the Federal Register during the preceding November. This time lag between announcement and implementation provides an opportunity for states to adjust to FMAP rate changes.

Data Used to Calculate State FMAP Rates

The per capita income amounts used to calculate FMAP rates for a given fiscal year are several years old by the time the FMAP rates take effect because, as specified in Section 1905(b) of the Social Security Act, the per capita income amounts used in the FMAP formula are equal to the average of the three most recent calendar years of data available from the Department of Commerce. In its FY2019 FMAP calculations, HHS used state per capita personal income data for 2014, 2015, and 2016 that became available from the Department of Commerce's Bureau of Economic Analysis (BEA) in September 2017. The use of a three-year average helps to moderate fluctuations in a state's FMAP rate over time.

BEA revises its most recent estimates of state per capita personal income on an annual basis to incorporate revised and newly available source data on population and income.7 It also undertakes a comprehensive data revision—reflecting methodological and other changes—every few years that may result in upward and downward revisions to each of the component parts of personal income. These components include the following:

- earnings (wages and salaries, employer contributions for employee pension and insurance funds, and proprietors' income);

- dividends, interest, and rent; and

- personal current transfer receipts (e.g., government social benefits such as Social Security, Medicare, Medicaid, state unemployment insurance).8

As a result of these annual and comprehensive revisions, it is often the case that the value of a state's per capita personal income for a given year will change over time. For example, the 2014 state per capita personal income data published by BEA in September 2013 (used in the calculation of FY2017 FMAP rates) differed from the 2014 state per capita personal income data published in September 2017 (used in the calculation of FY2019 FMAP rates).

It should be noted that the definition of personal income used by BEA is not the same as the definition used for personal income tax purposes. Among other differences, BEA's personal income excludes capital gains (or losses) and includes transfer receipts (e.g., government social benefits), while income for tax purposes includes capital gains (or losses) and excludes most of these transfers.

Factors That Affect FMAP Rates

Several factors affect states' FMAP rates. The first is the nature of the state economy and, to the extent possible, a state's ability to respond to economic changes (i.e., downturns or upturns). The impact on a particular state of a national economic downturn or upturn will be related to the structure of the state economy and its business sectors. For example, a national decline in automobile sales, while having an impact on all state economies, will have a larger impact in states that manufacture automobiles as production is reduced and workers are laid off.

Second, the FMAP formula relies on per capita personal income in relation to the U.S. average per capita personal income. The national economy is basically the sum of all state economies. As a result, the national response to an economic change is the sum of the state responses to economic change. If more states (or larger states) experience an economic decline, the national economy reflects this decline to some extent. However, the national decline will be lower than some states' declines because the total decline has been offset by states with small decreases or even increases (i.e., states with growing economies). The U.S. per capita personal income, because of this balancing of positive and negative, has only a small percentage change each year. Since the FMAP formula compares state changes in per capita personal income (which can have large changes each year) to the U.S. per capita personal income, this comparison can result in significant state FMAP rate changes.

In addition to annual revisions of per capita personal income data, comprehensive revisions undertaken every four to five years may also influence regular FMAP rates (e.g., because of changes in the definition of personal income). The impact on FMAP rates will depend on whether the changes are broad (affecting all states) or more selective (affecting only certain states or industries).

FY2019 Regular FMAP Rates

Regular FMAP rates for FY2019 (the federal fiscal year that begins on October 1, 2018) were calculated and published November 21, 2017, in the Federal Register.9 In the Appendix A to this report, Table A-1 shows regular FMAP rates for each of the 50 states and the District of Columbia for FY2014 through FY2019.

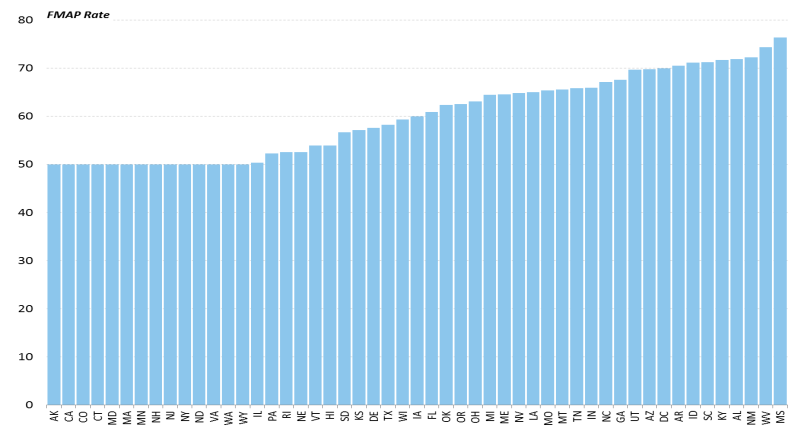

Figure 1 shows the state distribution of regular FMAP rates for FY2019. Fourteen states are to have the statutory minimum FMAP rate of 50.00%, and Mississippi is to have the highest FMAP rate of 76.39%.

|

Figure 1. State Distribution of Regular FMAP Rates FY2019 |

|

|

Sources: Department of Health and Human Services, "Federal Financial Participation in State Assistance Expenditures; Federal Matching Shares for Medicaid, the Children's Health Insurance Program, and Aid to Needy Aged, Blind, or Disabled Persons for October 1, 2018 Through September 30, 2019," 82 Federal Register 55383, November 21, 2017. Note: State-by-state FY2019 regular FMAP rates are listed in Table A-1. |

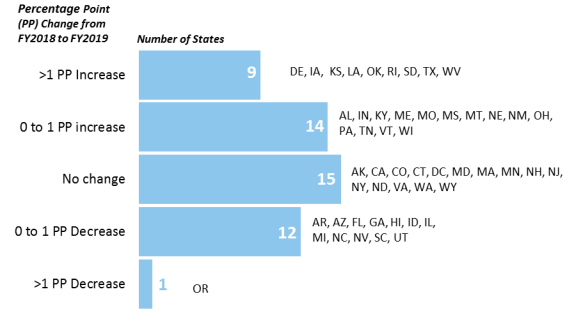

As shown in Figure 2, from FY2018 to FY2019, the regular FMAP rates for 36 states is to change, whereas the regular FMAP rates for the remaining 15 states (including the District of Columbia) is to remain the same.10

|

Figure 2. FMAP Rate Changes for States from FY2018 to FY2019 |

|

|

Source: Prepared by the Congressional Research Service (CRS) using FY2018 and FY2019 regular FMAP rates. Note: Specific FMAP rate changes for each state are listed in Table A-1. |

For most of the states experiencing an FMAP rate change from FY2018 to FY2019, the change is to be less than one percentage point. The regular FMAP rate for 14 states is to increase by as much as one percentage point, and the FMAP rate for 12 states is to decrease by as much as one percentage point.

For states that are to experience an FMAP rate change greater than one percentage point from FY2018 to FY2019, nine states are to experience an FMAP rate increase of greater than one percentage point. Oklahoma is to have the largest FMAP rate increase of 3.81 percentage points, with the FMAP rate increasing from 58.57% to 62.38% Oregon is the only state that is to experience an FMAP rate decrease of greater than one percentage point, with the FMAP rate decreasing 1.06 percentage points from 63.62% to 62.56%.

The District of Columbia's FY2019 FMAP rate was not calculated according to the regular FMAP formula because the FMAP rate for the District of Columbia has been set in statute at 70% since 1998 for the purposes of Title XIX and XXI of the Social Security Act. However, for other purposes, the percentage for the District of Columbia is 50%, unless otherwise specified by law.

FMAP Exceptions

Although FMAP rates are generally determined by the formula described above, exceptions to the regular FMAP rate have been made for certain states, situations, populations, providers, and services.

Table 1 lists current exceptions to the FMAP in Medicaid statute and regulations. Past FMAP exceptions are listed in Table B-1.

Some of these exceptions were included in the Social Security Amendments of 1965 (P.L. 89-97), which is the law that enacted the Medicaid program. Other exceptions have been added over the years. The Patient Protection and Affordable Care Act (ACA; P.L. 111-148, as amended) added a number of exceptions to the FMAP for "newly eligible" individuals, "expansion states," disaster-affected states, specified preventive services and immunizations, smoking cessation services for pregnant women, specified home and community-based services, health home services for certain people with chronic conditions, and home- and community-based attendant services and supports.11

|

Exception |

Description |

Citations |

|

|

Territories and Certain States |

|||

|

Territories |

As of July 1, 2011, FMAP rates for the territories (Puerto Rico, American Samoa, the Commonwealth of the Northern Mariana Islands, Guam, and the Virgin Islands) were increased from 50% to 55%. Unlike the 50 states and the District of Columbia, the territories are subject to federal spending caps.a The 55% also applies for purposes of computing the E-FMAP rate for CHIP. |

Most recently P.L. 111-148, as amended by P.L. 111-152; SSA §1905(b), 1108(f) and (g) |

|

|

District of Columbia |

As of FY1998, the District of Columbia's FMAP rate is set at 70% (without this exception, it would be at the statutory minimum of 50%). The 70% also applies for purposes of computing the E-FMAP rate for CHIP. |

P.L. 105-33; SSA §1905(b) |

|

|

Special Situations |

|||

|

Adjustment for disaster recovery |

Beginning in CY2011, a disaster-recovery FMAP adjustment is available for states in which (1) during one of the preceding seven years, the President declared a major disaster under the Stafford Act and every county in the state warranted at least public assistance under that act and (2) the regular FMAP rate declines by a specified amount. To trigger the adjustment, a state's regular FMAP rate must be at least three percentage points less than such state's last year's regular FMAP rate plus (if applicable) any hold harmless increase under P.L. 111-5; the adjustment is an FMAP rate increase equal to 50% of the difference between the two. To continue receiving the adjustment, the state's regular FMAP rate must be at least three percentage points less than last year's adjusted FMAP rate; the adjustment is an FMAP rate increase equal to 25% of the difference between the two. Louisiana is the only state that was eligible for the disaster-recovery adjusted FMAP from the fourth quarter of FY2011 (when the adjustment was first available) through FY2014. No state has met the requirements since FY2014. |

P.L. 111-148, as amended by P.L. 111-152, P.L. 112-96 P.L, and P.L. 112-141; SSA §1905(aa); 75 Federal Register 80501 (December 22, 2010) |

|

|

Adjustment for certain employer contributions |

As of FY2006, significantly disproportionate employer pension and insurance fund contributions will be excluded from the calculation of Medicaid FMAP rates. This will have the effect of reducing certain states' per capita personal income relative to the national average, which in turn could increase their Medicaid FMAP rates. Any identifiable employer contributions towards pensions or other employee insurance funds are considered to be significantly disproportionate if the increase in the amount of employer contributions accrued to residents of a state exceeds 25% of the total increase in personal income in that state for the year involved. To date, no state has qualified for this adjustment. |

P.L. 111-3 §614; 75 Federal Register 63482 (October 15, 2010) |

|

|

Certain Populations |

|||

|

"Newly eligible" individuals enrolled in new eligibility group through 133% FPL |

Since January 1, 2014, states have had the option to expand Medicaid coverage to non-elderly, nonpregnant adults at or below 133% FPL (i.e., the ACA Medicaid expansion). An increased federal matching rate is provided for services rendered to "newly eligible" individuals in this group. The "newly eligible" are defined as those who would not have been eligible for Medicaid in the state as of December 1, 2009 or were eligible under a waiver but not enrolled because of limits or caps on waiver enrollment. The federal matching rates for "newly eligible" individuals equal: CY2014-CY2016 = 100%; CY2017 = 95%; CY2018 = 94%; CY2019 = 93%; CY2020+ = 90%. |

P.L. 111-148, as amended by P.L. 111-152; SSA §1905(y) |

|

|

"Expansion state" individuals enrolled in new eligibility group through 133% FPL |

Prior to the ACA Medicaid expansion, some states provided health coverage for all low-income individuals using Medicaid waivers. As a result, these states have few or no individuals who qualify for the "newly eligible" federal matching rate. To address this issue, as of CY2014, an increased federal matching rate is available for individuals in "expansion states" who were eligible for Medicaid as of March 23, 2010 (P.L. 111-148's enactment date) in the new eligibility group for non-elderly, nonpregnant adults at or below 133% FPL. "Expansion states" are defined as those that, as of March 23, 2010, offered health benefits coverage meeting certain criteria statewide to parents and nonpregnant childless adults at least through 100% FPL. The formula used to calculate "expansion state" federal matching rates is [regular FMAP + (newly eligible federal matching rate – regular FMAP) * transition percentage equal to 50% in CY2014, 60% in CY2015, 70% in CY2016, 80% in CY2017, 90% in CY2018, and 100% in CY2019+]. Since the formula for the "expansion state" federal matching rate is based on the regular FMAP rate, the "expansion state" federal matching rates vary based on a states' regular FMAP rates until CY2019, at which point they are to equal the "newly eligible" federal matching rates: CY2014 = at least 75%; CY2015 = at least 80%; CY2016 = at least 85%; CY2017 = at least 86%; CY2018 = at least 90%; CY2019 = 93%; CY2020+ = 90%. |

P.L. 111-148, as amended by P.L. 111-152; SSA §1905(z)(2) |

|

|

Certain women with breast or cervical cancer |

For states that opt to cover certain women with breast or cervical cancer who do not qualify for Medicaid under a mandatory eligibility pathway and are otherwise uninsured, expenditures for these women are reimbursed using the E-FMAP rate that applies to CHIP. |

P.L. 106-354, as amended by P.L. 107-121; SSA §1905(b) |

|

|

Qualifying Individuals program |

States are required to pay Medicare Part B premiums for Medicare beneficiaries with income between 120% and 135% FPL and limited assets (referred to as "qualifying individuals"), up to a specified dollar allotment. They receive 100% federal reimbursement for these costs, which are financed at the federal level by a transfer of funds from Medicare to Medicaid. |

P.L. 105-33, permanently extended via P.L. 114-10 ; SSA §1933(d) |

|

|

Certain Providers |

|||

|

Indian Health Service facility |

States receive 100% federal reimbursement for Medicaid services provided through an Indian Health Service facility. |

P.L. 94-437; SSA §1905(b) |

|

|

Certain Services |

|||

|

Certain preventive services and immunizations |

As of CY2013, states that opt to cover—with no cost sharing—clinical preventive services recommended with a grade of A or B by the United States Preventive Services Task Force (USPSTF) and adult immunizations recommended by the Advisory Committee on Immunization Practices (ACIP) receive a one percentage point increase in their FMAP rate for those services. |

P.L. 111-148, as amended by P.L. 111-152; SSA §1905(b) |

|

|

Smoking cessation for pregnant women |

As of CY2013, states that opt to cover USPSTF preventive services and ACIP adult immunizations as noted above also receive a one percentage point increase in their FMAP rate for smoking cessation services that are mandatory for pregnant women. |

P.L. 111-148, as amended by P.L. 111-152; SSA §1905(b) |

|

|

Family planning |

States receive 90% federal reimbursement for family planning services and supplies. |

P.L. 92-603; SSA §1903(a)(5) |

|

|

Health homes |

As of CY2011, states have an option for providing "health home" and associated services to certain individuals with chronic conditions. They receive 90% federal reimbursement for these services for the first eight quarters that the health home option is in effect in the state. |

P.L. 111-148, as amended by P.L. 111-152; SSA §1945(c)(1) |

|

|

Community First Choice Option |

As of FY2011, states have an option for providing home and community-based attendant services and supports for certain individuals at or below 150% FPL, or a higher income level applicable to those who require an institutional level of care. They receive a six percentage point increase in their regular FMAP rate for these services. |

P.L. 111-148, as amended by P.L. 111-152; SSA §1915(k)(2) |

|

|

Administrative Activities |

|||

|

Training of Medical Personnel |

States receive 75% federal matching rate for costs attributable to compensation or training of skilled professional medical personnel, and staff directly supporting such personnel. |

P.L. 89-97; SSA §1903(a)(2)(A)&(B) |

|

|

Immigration Verification System |

States receive 100% federal reimbursement for the cost of implementation and operation of an immigration status verification system. |

P.L. 99-603; SSA §1903(a)(4) |

|

|

Fraud Control Unit |

States receive 75% federal matching rate for state expenditures related to the operation of a state Medicaid fraud control unit. |

P.L. 95-142; SSA §1903(a)(6) |

|

|

Preadmission Screening |

State expenditures attributable to preadmission screening and resident review for individuals with mental illness or mental retardation who are admitted to a nursing facility receive 75% federal matching rate. |

P.L. 100-203; SSA §1903(a)(2)(C) |

|

|

Survey and Certification |

States receive 75% federal matching rate for state expenditures related to survey and certification of nursing facilities. |

P.L. 100-203; SSA §1903(a)(2)(D) |

|

|

Managed Care Review Activities |

States receive 75% federal matching rate for state expenditures related to performance of medical and utilization review activities or external independent review of managed care activities. |

P.L. 97-35; SSA §1903(a)(3)(C) |

|

|

Claims and Eligibility Systems |

States receive 90% federal matching rate for the design, development, or installation of mechanized claims systems and 75% federal matching rate for operating mechanized claims systems. Both federal reimbursement percentages are subject to certain criteria set by the Secretary of HHS, which includes whether the activity is likely to provide more efficient, economical, and effective administration of claims processing. CMS published a final rule to permanently amend the definition of Mechanized Claims Processing and Information Retrieval systems to include systems used for eligibility determination, enrollment, and eligibility reporting activities thereby making the 90% federal matching rate available for the design, development and installation or enhancement of eligibility determination systems, and 75% federal matching rate for maintenance and operations available for such systems. |

P.L. 92-603; SSA §1903(a)(3)(A) and (B); 80 Federal Register 75819 (December 4, 2015) |

|

|

Translation or Interpretation Services |

Administrative expenditures for translation or interpretation services in connection with the "enrollment of, retention of, and use of services" under Medicaid receive 75% federal matching rate. For CHIP, the increased match is 75%, or the state's E-FMAP rate plus 5 percentage points, whichever is higher, and the CHIP increased match is subject to the 10% cap on administrative expenditures. The increased federal matching rate for translation or interpretation services is only available for eligible expenditures claimed as administrative and not expenditures claimed as medical assistance-related (which receive each state's regular FMAP rate). |

P.L. 111-3; SSA §1903(a)(2)(E); State Medicaid Director Letter, State Health Official 10-007, CHIPRA 18, July 1, 2010. |

|

|

General Administration |

Remaining state expenditures found necessary for proper and efficient administration of the state plan receive a 50% federal matching rate. |

P.L. 89-97; SSA §1903(a)(7) |

|

Source: CRS, based on sources noted in the table.

Notes: Unless noted, exceptions do not apply for purposes of computing the E-FMAP rate for CHIP. SSA = Social Security Act; FPL = federal poverty level; CHIPRA = Children's Health Insurance Program Reauthorization Act.

a. Section 20301 of the Bipartisan Budget Act of 2018 (BBA 2018; P.L. 115-123) increases the federal Medicaid funding for Puerto Rico and the U.S. Virgin Islands provided under SSA Section 1108(g)(5) for the period of January 1, 2018, through September 30, 2019. For all the additional federal Medicaid funding for Puerto Rico and U.S. Virgin Islands provided in BBA 2018, the matching rate is increased to 100% (i.e., fully federally funded).

Conclusion

The FMAP rate is used to reimburse states for the federal share of most Medicaid expenditures. In FY2019, 13 states are to have the statutory minimum FMAP rate of 50%, and Mississippi is to have the highest FMAP rate of 76.39%. From FY2018 to FY2019, the regular FMAP rates for 36 states is to change, while the regular FMAP rates for the remaining 15 states (including the District of Columbia) is to remain the same.

Exceptions to the regular FMAP rate have been made for certain states, situations, populations, providers, and services. The ACA added a number of exceptions to the FMAP for "newly eligible" individuals, "expansion states," disaster-affected states, specified preventive services and immunizations, smoking cessation services for pregnant women, specified home and community-based services, health home services for certain people with chronic conditions, and home and community-based attendant services and supports.

The federal share of Medicaid expenditures used to be about 57% in a typical year, which meant the state share was about 43%. However, with the exceptions to the FMAP added by the ACA (mainly the "newly eligible" matching rate), the federal share of Medicaid expenditures has increased. In FY2014, the federal share of Medicaid expenditures was 61% on average, and it is estimated to have increased to 63% for FY2015 and FY2016. The average federal share is expected to decrease to 61% by FY2020 as the "newly eligible" matching rate phases down to 90%.12

Appendix A. FMAP Rates for Medicaid, by State

Table A-1 shows regular FY2014-FY2019 FMAP rates calculated according to the formula described in the text of the report (see "How FMAP Rates Are Calculated"). In FY2019, FMAP rates range from 50% (14 states) to 76% (Mississippi). From FY2018 to FY2019, regular FMAP rates are to decrease for 13 states, increase for 23 states, and remain the same for 15 states (including the District of Columbia). Most of the states (14 states) for which the FMAP rates do not change have the statutory minimum FMAP rate of 50%, and the FMAP rate for the District of Columbia is statutorily set at 70%.

|

FY2014 |

FY2015 |

FY2016 |

FY2017 |

FY2018 |

FY2019 |

Change FY2018 to FY2019 |

|

|

Alabama |

68.12 |

68.99 |

69.87 |

70.16 |

71.44 |

71.88 |

0.44 |

|

Alaska |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

0.00 |

|

Arizona |

67.23 |

68.46 |

68.92 |

69.24 |

69.89 |

69.81 |

-0.08 |

|

Arkansas |

70.10 |

70.88 |

70.00 |

69.69 |

70.87 |

70.51 |

-0.36 |

|

California |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

0.00 |

|

Colorado |

50.00 |

51.01 |

50.72 |

50.02 |

50.00 |

50.00 |

0.00 |

|

Connecticut |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

0.00 |

|

Delaware |

55.31 |

53.63 |

54.83 |

54.20 |

56.43 |

57.55 |

1.12 |

|

District of Columbiaa |

70.00 |

70.00 |

70.00 |

70.00 |

70.00 |

70.00 |

0.00 |

|

Florida |

58.79 |

59.72 |

60.67 |

61.10 |

61.79 |

60.87 |

-0.92 |

|

Georgia |

65.93 |

66.94 |

67.55 |

67.89 |

68.50 |

67.62 |

-0.88 |

|

Hawaii |

51.85 |

52.23 |

53.98 |

54.93 |

54.78 |

53.92 |

-0.86 |

|

Idaho |

71.64 |

71.75 |

71.24 |

71.51 |

71.17 |

71.13 |

-0.04 |

|

Illinois |

50.00 |

50.76 |

50.89 |

51.30 |

50.74 |

50.31 |

-0.43 |

|

Indiana |

66.92 |

66.52 |

66.60 |

66.74 |

65.59 |

65.96 |

0.37 |

|

Iowa |

57.93 |

55.54 |

54.91 |

56.74 |

58.48 |

59.93 |

1.45 |

|

Kansas |

56.91 |

56.63 |

55.96 |

56.21 |

54.74 |

57.10 |

2.36 |

|

Kentucky |

69.83 |

69.94 |

70.32 |

70.46 |

71.17 |

71.67 |

0.50 |

|

Louisianab |

62.11 |

62.05 |

62.21 |

62.28 |

63.69 |

65.00 |

1.31 |

|

Maine |

61.55 |

61.88 |

62.67 |

64.38 |

64.34 |

64.52 |

0.18 |

|

Maryland |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

0.00 |

|

Massachusetts |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

0.00 |

|

Michigan |

66.32 |

65.54 |

65.60 |

65.15 |

64.78 |

64.45 |

-0.33 |

|

Minnesota |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

0.00 |

|

Mississippi |

73.05 |

73.58 |

74.17 |

74.63 |

75.65 |

76.39 |

0.74 |

|

Missouri |

62.03 |

63.45 |

63.28 |

63.21 |

64.61 |

65.40 |

0.79 |

|

Montana |

66.33 |

65.90 |

65.24 |

65.56 |

65.38 |

65.54 |

0.16 |

|

Nebraska |

54.74 |

53.27 |

51.16 |

51.85 |

52.55 |

52.58 |

0.03 |

|

Nevada |

63.10 |

64.36 |

64.93 |

64.67 |

65.75 |

64.87 |

-0.88 |

|

New Hampshire |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

0.00 |

|

New Jersey |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

0.00 |

|

New Mexico |

69.20 |

69.65 |

70.37 |

71.13 |

72.16 |

72.26 |

0.10 |

|

New York |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

0.00 |

|

North Carolina |

65.78 |

65.88 |

66.24 |

66.88 |

67.61 |

67.16 |

-0.45 |

|

North Dakota |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

0.00 |

|

Ohio |

63.02 |

62.64 |

62.47 |

62.32 |

62.78 |

63.09 |

0.31 |

|

Oklahoma |

64.02 |

62.30 |

60.99 |

59.94 |

58.57 |

62.38 |

3.81 |

|

Oregon |

63.14 |

64.06 |

64.38 |

64.47 |

63.62 |

62.56 |

-1.06 |

|

Pennsylvania |

53.52 |

51.82 |

52.01 |

51.78 |

51.82 |

52.25 |

0.43 |

|

Rhode Island |

50.11 |

50.00 |

50.42 |

51.02 |

51.45 |

52.57 |

1.12 |

|

South Carolina |

70.57 |

70.64 |

71.08 |

71.30 |

71.58 |

71.22 |

-0.36 |

|

South Dakota |

53.54 |

51.64 |

51.61 |

54.94 |

55.34 |

56.71 |

1.37 |

|

Tennessee |

65.29 |

64.99 |

65.05 |

64.96 |

65.82 |

65.87 |

0.05 |

|

Texas |

58.69 |

58.05 |

57.13 |

56.18 |

56.88 |

58.19 |

1.31 |

|

Utah |

70.34 |

70.56 |

70.24 |

69.90 |

70.26 |

69.71 |

-0.55 |

|

Vermont |

55.11 |

54.01 |

53.90 |

54.46 |

53.47 |

53.89 |

0.42 |

|

Virginia |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

0.00 |

|

Washington |

50.00 |

50.03 |

50.00 |

50.00 |

50.00 |

50.00 |

0.00 |

|

West Virginia |

71.09 |

71.35 |

71.42 |

71.80 |

73.24 |

74.34 |

1.10 |

|

Wisconsin |

59.06 |

58.27 |

58.23 |

58.51 |

58.77 |

59.37 |

0.60 |

|

Wyoming |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

50.00 |

0.00 |

|

Number with increase from previous year |

14 |

21 |

22 |

25 |

25 |

23 |

|

|

Number stayed the same from previous year |

14 |

12 |

12 |

13 |

13 |

14 |

|

|

Number with decrease from previous year |

22 |

17 |

16 |

12 |

12 |

13 |

|

Source: Department of Health and Human Services, Annual Federal Register Notices.

Notes: Reflects FMAP rates calculated using the regular FMAP formula, with exceptions noted below.

a. Section 4725(b) of the Balanced Budget Act of 1997 amended Section 1905(b) to provide that the FMAP rate for the District of Columbia shall be set at 70% for purposes of titles XIX and XXI and for capitation payments and DSH allotments under those titles. For other purposes, the percentage for the District of Columbia is 50%, unless otherwise specified by law.

b. Louisiana's FMAP rate was higher than the regular FMAP rate from the fourth quarter of FY2011 through FY2014 due to the disaster-recovery FMAP adjustment. In FY2011, Louisiana's FMAP rate was its regular FMAP rate of 63.61% for the first three quarters of the year, and the disaster-recovery adjusted FMAP rate that took effect for the fourth quarter of the year was 68.04%. The table reflects the disaster-recovery adjusted FMAP rates for FY2012 through FY2014, but the regular FMAP rates for those years would have been 61.09% for FY2012, 61.24% for FY2013, and 60.98% for FY2014.

Appendix B. Past FMAP Rate Exceptions

Although FMAP rates are generally determined by the statutory formula described above, Table 1 lists current exceptions that have been added to the Medicaid statute and regulations over the years, and Table B-1 lists past FMAP exceptions.

|

Exception |

Description |

Citations |

|

Territories and Certain States |

||

|

Alaska |

Alaska's FMAP rate was set in statute for FY1998-FY2000 at 59.80%; used an alternative formula for FY2001-FY2005 that reduced the state's per capita income by 5% (thereby increasing its FMAP rate); and was held at its FY2005 level for FY2006-FY2007. These provisions also applied for purposes of computing the E-FMAP rate for CHIP. |

P.L. 105-33 §4725(a); P.L. 106-554 Appendix F §706; P.L. 109-171 §6053(a) |

|

Special Situations |

||

|

State fiscal relief, FY2009-FY2011 |

FMAP rates were increased from the first quarter of FY2009 through the third quarter of FY2011, providing states with more than $100 billion (about $84 billion for the original provision and $16 billion for a six-month extension) in additional funds. All states received a hold harmless to prevent any decline in regular FMAP rates and an across-the-board increase of 6.2 percentage points until the last two quarters of the period, at which point the across-the-board percentage point increase phased down to 3.2 and then 1.2; qualifying states received an additional unemployment-related increase. Each territory could choose between an FMAP increase of 6.2 percentage points along with a 15% increase in its spending cap, or its regular FMAP rate along with a 30% increase in its cap; all chose the latter. States were required to meet certain requirements in order to receive the increase. |

P.L. 111-5 §5001, as amended by P.L. 111-226 §201 |

|

Adjustment for Hurricane Katrina |

In computing FMAP rates for any year after 2006 for a state that the Secretary of HHS determines has a significant number of Hurricane Katrina evacuees as of October 1, 2005, the Secretary must disregard such evacuees and their incomes. Although it was labeled as a "hold harmless for Katrina impact," the provision language required evacuees to be disregarded even if their inclusion would increase a state's FMAP rate. Due to lags in the availability of data used to calculate FMAP rates, FY2008 was the first year to which the provision applied. HHS proposed and finalized a methodology that prevented the lowering of any FY2008 FMAP rates and increased the FY2008 FMAP rate for one state (Texas). The methodology took advantage of a data timing issue that does not apply after FY2008. HHS had initially expressed concern that some states could see lower FMAP rates in later years as a result of the provision, but the final methodology indicated that there is no reliable way to track the number and income of evacuees on an ongoing basis and therefore no basis for adjusting FMAP rates after FY2008. The provision also applied for purposes of computing the enhanced FMAP rate for CHIP. |

P.L. 109-171; 72 Federal Register 3391 (January 25, 2007) and 44146 (August 7, 2007) |

|

State fiscal relief, FY2003-FY2004 |

FMAP rates for the last two quarters of FY2003 and the first three quarters of FY2004 were not allowed to decline (i.e., were held harmless) and were increased by an additional 2.95 percentage points, providing states with about $10 billion in additional funds (they also received $10 billion in direct grants). Although Medicaid disproportionate share hospital (DSH) payments are reimbursed using the FMAP rate, the increase did not apply to DSH. States had to meet certain requirements in order to receive an increase (e.g., they could not restrict eligibility after a specified date). |

P.L. 108-27 §401(a) |

|

Certain Populations |

||

|

Certain "expansion states" |

During CY2014 and CY2015, an FMAP rate increase of 2.2 percentage points was available for "expansion states" that (1) the Secretary of HHS determines did not receive any federal matching rate increase for "newly eligible" individuals and (2) had not been approved to divert Medicaid disproportionate share hospital funds to pay for the cost of health coverage under a waiver in effect as of July 2009. The FMAP rate increase applied to those who are not "newly eligible" individuals as described in relation to the new eligibility group for non-elderly, nonpregnant adults at or below 133% FPL. |

P.L. 111-148, as amended by P.L. 111-152; SSA §1905(z)(1) |

|

Certain Providers |

||

|

Primary care payment rates |

During CY2013 and CY2014, states were required to provide Medicaid payments at or above the Medicare rates for primary care services (defined as evaluation and management and certain administration of immunizations) furnished by a physician with a primary specialty designation of family, general internal, or pediatric medicine. States received 100% federal reimbursement for expenditures attributable to the amount by which Medicare exceeded their Medicaid payment rates in effect on July 1, 2009. |

P.L. 111-148, as amended by P.L. 111-152; SSA §1902(a)(13)(C); 77 Federal Register 66670. |

|

Certain Services |

||

|

State balancing incentive payments |

During FY2011-FY2015, state balancing incentive payments were available under certain conditions for states in which less than 50% of Medicaid expenditures for long-term services and supports (LTSS) were noninstitutional. Qualifying states with less than 25% noninstitutional LTSS had to plan to achieve a 25% target to receive a five percentage point increase in their FMAP rate for noninstitutional LTSS; those with less than 50% had to plan to achieve a 50% target to receive a two percentage point increase. Federal spending on these increased FMAP rates was limited to $3 billion during the period. |

P.L. 111-148, as amended by P.L. 111-152, §10202 |

Source: Congressional Research Service, based on sources noted in table.