Introduction

This report provides background information and potential oversight issues for Congress on the Coast Guard's programs for procuring 8 National Security Cutters (NSCs), 25 Offshore Patrol Cutters (OPCs), and 58 Fast Response Cutters (FRCs). The Coast Guard's proposed FY2019 budget requests a total of $705 million in acquisition funding for the NSC, OPC, and FRC programs.

The issue for Congress is whether to approve, reject, or modify the Coast Guard's funding requests and acquisition strategies for the NSC, OPC, and FRC programs. Congress's decisions on these three programs could substantially affect Coast Guard capabilities and funding requirements, and the U.S. shipbuilding industrial base.

The NSC, OPC, and FRC programs have been subjects of congressional oversight for several years, and were previously covered in an earlier CRS report that is now archived.1 CRS testified on the Coast Guard's cutter acquisition programs most recently on July 25, 2017.2 The Coast Guard's plans for modernizing its fleet of polar icebreakers are covered in a separate CRS report.3

Background

Older Ships to Be Replaced by NSCs, OPCs, and FRCs

The 91 planned NSCs, OPCs, and FRCs are intended to replace 90 older Coast Guard ships—12 high-endurance cutters (WHECs), 29 medium-endurance cutters (WMECs), and 49 110-foot patrol craft (WPBs).4 The Coast Guard's 12 Hamilton (WHEC-715) class high-endurance cutters entered service between 1967 and 1972.5 The Coast Guard's 29 medium-endurance cutters include 13 Famous (WMEC-901) class ships that entered service between 1983 and 1991,6 14 Reliance (WMEC-615) class ships that entered service between 1964 and 1969,7 and two one-of-a-kind cutters that originally entered service with the Navy in 1944 and 1971 and were later transferred to the Coast Guard.8 The Coast Guard's 49 110-foot Island (WPB-1301) class patrol boats entered service between 1986 and 1992.9

Many of these 90 ships are manpower-intensive and increasingly expensive to maintain, and have features that in some cases are not optimal for performing their assigned missions. Some of them have already been removed from Coast Guard service: eight of the Island-class patrol boats were removed from service in 2007 following an unsuccessful effort to modernize and lengthen them to 123 feet; the one-of-a-kind cutter that originally entered service with the Navy in 1944 was decommissioned in 2011; and the Hamilton-class cutters are being decommissioned as new NSCs enter service. A July 2012 Government Accountability Office (GAO) report discusses the generally poor physical condition and declining operational capacity of the Coast Guard's older high-endurance cutters, medium-endurance cutters, and 110-foot patrol craft.10

Missions of NSCs, OPCs, and FRCs

NSCs, OPCs, and FRCs, like the ships they are intended to replace, are to be multimission ships for routinely performing 7 of the Coast Guard's 11 statutory missions, including

- search and rescue (SAR);

- drug interdiction;

- migrant interdiction;

- ports, waterways, and coastal security (PWCS);

- protection of living marine resources;

- other/general law enforcement; and

- defense readiness operations.11

Smaller Coast Guard patrol craft and boats contribute to the performance of some of these seven missions close to shore. NSCs, OPCs, and FRCs perform them both close to shore and in the deepwater environment, which generally refers to waters more than 50 miles from shore.

NSC Program

National Security Cutters (Figure 1)—also known as Legend (WMSL-750)12 class cutters because they are being named for legendary Coast Guard personnel13—are the Coast Guard's largest and most capable general-purpose cutters.14 They are larger and technologically more advanced than Hamilton-class cutters, and are built by Huntington Ingalls Industries' Ingalls Shipbuilding of Pascagoula, MS (HII/Ingalls).

|

|

Source: U.S. Coast Guard photo accessed May 2, 2012, at http://www.flickr.com/photos/coast_guard/5617034780/sizes/l/in/set-72157629650794895/. |

The Coast Guard's acquisition program of record (POR)—the service's list, established in 2004, of planned procurement quantities for various new types of ships and aircraft—calls for procuring 8 NSCs as replacements for the service's 12 Hamilton-class high-endurance cutters. The Coast Guard's FY2017 five-year Capital Investment Plan (CIP) estimated the total acquisition cost of the eight ships at $5.559 billion, or an average of about $695 million per ship.

Although the Coast Guard's POR calls for procuring a total of 8 NSCs to replace the 12 Hamilton-class cutters, Congress through FY2018 has funded 11 NSCs, including two (the 10th and 11th) in FY2018. Six NSCs are now in service (the sixth was commissioned into service on April 1, 2017), and the seventh and eighth are scheduled for delivery in 2018 and 2019, respectively. The Coast Guard's proposed FY2019 budget requests $65 million in acquisition funding for the NSC program; this request does not include additional funding for a 12th NSC.

For additional information on the status and execution of the NSC program from a March 2016 GAO report, see Appendix C.

OPC Program

Offshore Patrol Cutters (Figure 2, Figure 3, and Figure 4)—also known as Heritage (WMSM-915)15 class cutters because they are being named for past cutters that played a significant role in the history of the Coast Guard and the Coast Guard's predecessor organizations16—are to be smaller, less expensive, and in some respects less capable than NSCs.17 Coast Guard officials describe the OPC program as the service's top acquisition priority. OPCs are being built by Eastern Shipbuilding Group of Panama City, FL.

The Coast Guard's POR calls for procuring 25 OPCs as replacements for the service's 29 medium-endurance cutters. The FY2017 CIP estimates the total acquisition cost of the 25 ships at $10.523 billion, or an average of about $421 million per ship. The first OPC was funded in FY2018 and is to be delivered in 2021. The Coast Guard's proposed FY2019 budget requests $400 million in acquisition funding for the OPC program for the construction of the second OPC (which is scheduled for delivery in 2022) and for procurement of long leadtime materials (LLTM) for the third OPC (which is scheduled for delivery in 2023).

|

Figure 2. Offshore Patrol Cutter Artist's rendering |

|

|

Source: "Offshore Patrol Cutter Notional Design Characteristics and Performance," accessed September 16, 2016, at https://www.uscg.mil/acquisition/opc/pdf/OPC%20Placemat%2036x24.pdf. |

|

Figure 3. Offshore Patrol Cutter Artist's rendering |

|

|

Source: "Offshore Patrol Cutter Notional Design Characteristics and Performance," accessed September 16, 2016, at https://www.uscg.mil/acquisition/opc/pdf/OPC%20Placemat%2036x24.pdf. |

|

Figure 4. Offshore Patrol Cutter Artist's rendering |

|

|

Source: Image received from Coast Guard liaison office, May 25, 2017. |

The Coast Guard's Request for Proposal (RFP) for the OPC program, released on September 25, 2012, established an affordability requirement for the program of an average unit price of $310 million per ship, or less, in then-year dollars (i.e., dollars that are not adjusted for inflation) for ships 4 through 9 in the program.18 This figure represents the shipbuilder's portion of the total cost of the ship; it does not include the cost of government-furnished equipment (GFE) on the ship,19 or other program costs—such as those for program management, system integration, and logistics—that contribute to the above-cited figure of $421 million per ship.20

At least eight shipyards expressed interest in the OPC program.21 On February 11, 2014, the Coast Guard announced that it had awarded Preliminary and Contract Design (P&CD) contracts to three of those eight firms—Bollinger Shipyards of Lockport, LA; Eastern Shipbuilding Group of Panama City, FL; and General Dynamics' Bath Iron Works (GD/BIW) of Bath, ME.22 On September 15, 2016, the Coast Guard announced that it had awarded the detail design and construction (DD&C) contract to Eastern Shipbuilding. The contract covers detail design and production of up to 9 OPCs and has a potential value of $2.38 billion if all options are exercised.23

Section 223 of the Howard Coble Coast Guard and Maritime Transportation Act of 2014 (S. 2444/P.L. 113-281 of December 18, 2014) states the following:

SEC. 223. MULTIYEAR PROCUREMENT AUTHORITY FOR OFFSHORE PATROL CUTTERS.

In fiscal year 2015 and each fiscal year thereafter, the Secretary of the department in which the Coast Guard is operating may enter into, in accordance with section 2306b of title 10, United States Code, multiyear contracts for the procurement of Offshore Patrol Cutters and associated equipment.

For additional information on the status and execution of the OPC program from a March 2016 GAO report, see Appendix C.

FRC Program

Fast Response Cutters (Figure 5)—also called Sentinel (WPC-1101)24 class patrol boats because they are being named for enlisted leaders, trailblazers, and heroes of the Coast Guard and its predecessor services of the U.S. Revenue Cutter Service, U.S. Lifesaving Service and U.S. Lighthouse Service.25—are considerably smaller and less expensive than OPCs, but are larger than the Coast Guard's older patrol boats.26 FRCs are built by Bollinger Shipyards of Lockport, LA.

|

Figure 5. Fast Response Cutter With an older Island-class patrol boat behind |

|

|

Source: U.S. Coast Guard photo accessed May 4, 2012, at http://www.flickr.com/photos/coast_guard/6871815460/sizes/l/in/set-72157629286167596/. |

The Coast Guard's POR calls for procuring 58 FRCs as replacements for the service's 49 Island-class patrol boats.27 The FY2017 CIP estimates the total acquisition cost of the 58 cutters at $3.764 billion, or an average of about $65 million per cutter. A total of 50 FRCs have been funded through FY2018. The 26th was commissioned into service on March 9, 2018. The Coast Guard's proposed FY2019 budget requests $240 million in acquisition funding for the procurement of four more FRCs.

For additional information on the status and execution of the FRC program from a March 2016 GAO report, see Appendix C.

Funding in FY2013-FY2019 Budget Submissions

Table 1 shows annual requested and programmed acquisition funding for the NSC, OPC, and FRC programs in the Coast Guard's FY2013-FY2019 budget submissions. Actual appropriated figures differ from these requested and projected amounts.

Table 1. NSC, OPC, and FRC Funding in FY2013-FY2019 Budget Submissions

Figures in millions of then-year dollars

|

Budget |

FY13 |

FY14 |

FY15 |

FY16 |

FY17 |

FY18 |

FY19 |

FY20 |

FY21 |

FY22 |

FY23 |

|

NSC program |

|||||||||||

|

FY13 |

683 |

0 |

0 |

0 |

0 |

||||||

|

FY14 |

616 |

710 |

38 |

0 |

45 |

||||||

|

FY15 |

638 |

75 |

130 |

30 |

47 |

||||||

|

FY16 |

91.4 |

132 |

95 |

30 |

15 |

||||||

|

FY17 |

127 |

95 |

65 |

65 |

21 |

||||||

|

FY18 |

54 |

65 |

65 |

21 |

6.6 |

||||||

|

FY19 |

65 |

n/a |

n/a |

n/a |

n/a |

||||||

|

OPC program |

|||||||||||

|

FY13 |

30 |

50 |

40 |

200 |

530 |

||||||

|

FY14 |

25 |

65 |

200 |

530 |

430 |

||||||

|

FY15 |

20 |

90 |

100 |

530 |

430 |

||||||

|

FY16 |

18.5 |

100 |

530 |

430 |

430 |

||||||

|

FY17 |

100 |

530 |

430 |

530 |

770 |

||||||

|

FY18 |

500 |

400 |

457 |

716 |

700 |

||||||

|

FY19 |

400 |

n/a |

n/a |

n/a |

n/a |

||||||

|

FRC program |

|||||||||||

|

FY13 |

139 |

360 |

360 |

360 |

360 |

||||||

|

FY14 |

75 |

110 |

110 |

110 |

110 |

||||||

|

FY15 |

110 |

340 |

220 |

220 |

315 |

||||||

|

FY16 |

340 |

325 |

240 |

240 |

325 |

||||||

|

FY17 |

240 |

240 |

325 |

325 |

18 |

||||||

|

FY18 |

240 |

335 |

335 |

26 |

18 |

||||||

|

FY19 |

240 |

n/a |

n/a |

n/a |

n/a |

||||||

|

Total |

|||||||||||

|

FY13 |

852 |

410 |

400 |

560 |

890 |

||||||

|

FY14 |

716 |

885 |

348 |

640 |

585 |

||||||

|

FY15 |

768 |

505 |

450 |

780 |

792 |

||||||

|

FY16 |

449.9 |

557 |

865 |

700 |

370 |

||||||

|

FY17 |

467 |

865 |

820 |

920 |

809 |

||||||

|

FY18 |

794 |

800 |

857 |

763 |

724.6 |

||||||

|

FY19 |

705 |

n/a |

n/a |

n/a |

n/a |

||||||

Source: Table prepared by CRS based on FY2013-FY2019 budget submissions.

Note: n/a means not available.

Issues for Congress

Whether to Fund a 12th NSC in FY2019

One issue for Congress is whether to fully or partially fund the acquisition of a 12th NSC in FY2019. Based on funding provided by Congress for the procurement of the 11th NSC in FY2018, fully funding the procurement of a 12th in FY2019 might require about $635 million.

Supporters of procuring a 12th NSC in FY2019 could argue that a total of 12 NSCs would provide one-for-one replacements for the 12 Hamilton-class cutters, that the Coast Guard's POR record includes only about 61% as many new cutters as the Coast Guard has calculated would be required to fully perform the Coast Guard's anticipated missions in coming years (see "Planned NSC, OPC, and FRC Procurement Quantities" below, as well as Appendix A); and that funding the 12th NSC in FY2019 would allow the Coast Guard and HII/Ingalls, in identifying an efficient production profile for the ship, to consider options for building the 10th, 11th, and 12th NSCs at intervals of less than 12 months.

Skeptics or opponents of procuring a 12th NSC in FY2019 could argue that that the Coast Guard's POR includes only 8 NSCs, that the Coast Guard's fleet mix analyses (see "Planned NSC, OPC, and FRC Procurement Quantities" below, as well as Appendix A) have not shown a potential need for more than 9 NSCs, and that in a situation of finite Coast Guard budgets, funding a 12th NSC in FY2018 might require reducing funding for other Coast Guard programs. They might also argue that deferring procurement of a 12th NSC to FY2020 would permit an efficient one-per-year production profile for the 10th, 11th, and 12th NSCs.

Number of FRCs to Fund in FY2019

Another issue for Congress is whether to fund the acquisition of four FRCs in FY2019, as requested, or some other number, such as six, which is the maximum number that has been acquired in some prior fiscal years. As shown in Table 1, the Coast Guard's FY2019 budget requests $240 million for the procurement of four FRCs. Based on prior-year appropriations for FRCs, procuring a total of six FRCs in FY2019 would require $340 million, or $100 million more than the requested amount.

Supporters of funding the acquisition of six FRCs in FY2019 could argue that it would increase production economies of scale and thus reduce the unit acquisition cost of the ships, and help the Coast Guard to close more quickly a gap in patrol boat capacity that is limiting the Coast Guard's ability to interdict illegal drugs and carry out other missions. Supporters of funding the acquisition of four FRCs in FY2019 could argue that that in a situation of finite Coast Guard budgets, funding two additional FRCs at an additional cost of $100 million might require reducing funding for other Coast Guard programs.

Annual or Multiyear Contracting for OPCs

Another issue for Congress is whether to acquire OPCs using annual contracting or multiyear contracting in the form of multiyear procurement (MYP) or block buy contracting. The Coast Guard currently plans to use a contract with options for procuring the first 9 OPCs. Although a contract with options may look like a form of multiyear contracting, it operates more like a series of annual contracts. Contracts with options do not achieve the reductions in acquisition costs that are possible with MYP and block buy contracting. Using MYP or block buy contracting involves accepting certain tradeoffs.28

As mentioned earlier, Section 223 of the Howard Coble Coast Guard and Maritime Transportation Act of 2014 (S. 2444/P.L. 113-281 of December 18, 2014) grants authority to use MYP in the OPC program. MYP typically cannot be used on the first several ships in a shipbuilding program because the law that regulates MYP (10 U.S.C. 2306b) requires a stable design for an acquisition program to qualify for MYP. In a shipbuilding program, a stable design is typically demonstrated by completing the construction of the first ship in the class, by which time the first several ships in the class typically have been funded and put under contract.

Block buy contracting, by comparison, can be used at the start of a shipbuilding program, beginning with the first ship. (Indeed, this was a principal reason why block buy contracting was in effect invented in FY1998, as the contracting method for procuring the Navy's first four Virginia-class attack submarines.) As with MYP, authority for using block buy contracting must be granted by Congress. Since Section 223 of P.L. 113-281 grants authority to use MYP but not block buy contracting, Congress would need to grant authority to the Coast Guard to use block buy contracting in the OPC program.

CRS estimates that if the Coast Guard were to use block buy contracting with economic order quantity (EOQ) purchases (i.e., up-front batch purchases) of components for acquiring the first several OPCs, and either MYP or block buy contracting with EOQ purchases for acquiring the remaining ships in the program, the savings on the total acquisition cost of the 25 OPCs (compared to costs under contracts with options) could amount to roughly $1 billion. CRS also estimates that acquiring the first nine ships in the OPC program under the current contract with options could forego roughly $350 million of the $1 billion in potential savings.

One potential option for the subcommittee would be to look into the possibility of having the Coast Guard either convert the current OPC contract at an early juncture into a block buy contract with EOQ authority, or, if conversion is not possible, replace the current contract at an early juncture with a block buy contract with EOQ authority.29 Replacing the current contract with a block buy contract might require recompeting the program, which would require effort on the Coast Guard's part and could create business risk for Eastern Shipbuilding Group, the shipbuilder that holds the current contract. On the other hand, the cost to the Coast Guard of recompeting the program would arguably be small relative to a potential additional savings of perhaps $300 million, and Eastern arguably would have a learning curve advantage in any new competition by virtue of its experience in building the first OPC.

OPC Procurement Rate

The current procurement profile for the OPC, which reaches a maximum projected rate of two ships per year, would deliver OPCs many years after the end of the originally planned service lives of the medium-endurance cutters that they are to replace. Coast Guard officials have testified that the service plans to extend the service lives of the medium-endurance cutters until they are replaced by OPCs. There will be maintenance and repair expenses associated with extending the service lives of medium-endurance cutters, and if the Coast Guard does not also make investments to increase the capabilities of these ships, the ships may have less capability in certain regards than OPCs.

One possible option for addressing this situation would be to increase the maximum annual OPC procurement rate from the currently planned two ships per year to three or four ships per year. Doing this could result in the 25th OPC being delivered about four years or six years sooner, respectively, than under the currently planned maximum rate. Increasing the OPC procurement rate to three or four ships per year would require a substantial increase to the Coast Guard's Procurement, Construction, and Improvements (PC&I) account,30 an issue discussed in Appendix B.

Increasing the maximum procurement rate for the OPC program could, depending on the exact approach taken, reduce OPC unit acquisition costs due to improved production economies of scale. Doubling the rate to four ships per year, for example, could reduce unit procurement costs by as much as 10%, which could result in hundreds of millions of dollars in additional savings in acquisition costs for the program. Increasing the maximum procurement rate could also create new opportunities for using competition in the OPC program. Notional alternative approaches for increasing the OPC procurement rate to three or four ships per year include but are not necessarily limited to the following:

- increasing the production rate to three or four ships per year at Eastern Shipbuilding—an option that would depend on Eastern Shipbuilding's production capacity;

- introducing a second shipyard to build Eastern's design for the OPC;

- introducing a second shipyard (such as one of the other two OPC program finalists) to build its own design for the OPC—an option that would result in two OPC classes; or

- building additional NSCs in the place of some of the OPCs—an option that might include descoping equipment on those NSCs where possible to reduce their acquisition cost and make their capabilities more like that of the OPC. Such an approach would be broadly similar to how the Navy is planning to use a descoped version of the San Antonio (LPD-17) class amphibious ship as the basis for its LPD-17 Flight II (LPD-30) class amphibious ships.31

Planned NSC, OPC, and FRC Procurement Quantities

Another issue for Congress concerns the Coast Guard's planned NSC, OPC, and FRC procurement quantities. The POR's planned force of 91 NSCs, OPCs, and FRCs is about equal in number to the Coast Guard's legacy force of 90 high-endurance cutters, medium-endurance cutters, and 110-foot patrol craft. NSCs, OPCs, and FRCs, moreover, are to be individually more capable than the older ships they are to replace. Even so, Coast Guard studies have concluded that the planned total of 91 NSCs, OPCs, and FRCs would provide 61% of the cutters that would be needed to fully perform the service's statutory missions in coming years, in part because Coast Guard mission demands are expected to be greater in coming years than they were in the past. For further discussion of this issue, about which CRS has testified and reported on since 2005,32 see Appendix A.

NSC Program: Initial Testing

Another potential oversight issue for Congress concerns the results of initial testing of the NSC. A January 2016 GAO report stated:

The U.S. Navy, the Coast Guard's independent test agent, completed initial testing for the National Security Cutter (NSC) in April 2014 and rated the NSC as operationally effective and suitable. Still, testing revealed 10 major deficiencies.... Initial testing is an event designed to verify performance of critical systems to ensure assets are capable of meeting mission requirements. The event tests critical operational issues and key performance parameters. The NSC fully met 12 of 19 key performance parameters. Tests of one key performance parameter, as well as other critical systems, were deferred to follow-on testing. The Coast Guard and the U.S. Navy disagree on the NSC's requirements for cutter boat operations. Without clear requirements the Navy and Coast Guard will not have a basis for determining actions to resolve any performance issues. Coast Guard officials acknowledged that clarifying these requirements would be beneficial.

The Coast Guard plans to begin follow-on testing in fall 2016. It must submit corrective action plans to the U.S. Navy to close any deficiencies. According to Coast Guard documentation, it may choose not to correct all deficiencies due to the cost of changes. Department of Homeland Security (DHS) acquisition guidance does not specify the timing of follow-on testing or the actions to be taken in response to the findings. Without a definite time frame DHS risks encountering the same problems as the NSC program experienced with future acquisitions and fielding assets without knowing the full capabilities.

During operations, the NSC has experienced performance issues that were not identified during initial testing, and the Coast Guard has planned design changes to some of the cutters' equipment.... However, the Coast Guard has not yet found the causes for problems affecting the NSC's propulsion systems. As a result of these and other equipment failures, the NSC has been operating in a degraded condition in some mission areas. DHS has no plans for additional acquisition review boards for the NSC, which would provide oversight going forward. Continued management-level oversight by DHS would help ensure that problems identified during testing and operations are addressed.33

Legislative Activity for FY2019

Summary of Appropriations Action on FY2019 Acquisition Funding Request

Table 2 summarizes appropriations action on the Coast Guard's request for FY2019 acquisition funding for the NSC, OPC, and FRC programs.

Table 2. Summary of Appropriations Action on FY2019 Acquisition Funding Request

Figures in millions of dollars, rounded to nearest tenth

|

Request |

Request |

HAC |

SAC |

Final |

|

NSC program |

65 |

|||

|

OPC program |

400 |

|||

|

FRC program |

240 |

|||

|

TOTAL |

705 |

Source: Table prepared by CRS based on Coast Guard's FY2019 budget submission, HAC committee report, and SAC chairman's mark and explanatory statement on FY2019 DHS Appropriations Act. HAC is House Appropriations Committee; SAC is Senate Appropriations Committee.

Legislative Activity for FY2018

Summary of Appropriations Action on FY2018 Acquisition Funding Request

Table 3 summarizes appropriations action on the Coast Guard's request for FY2018 acquisition funding for the NSC, OPC, and FRC programs.

Table 3. Summary of Appropriations Action on FY2018 Acquisition Funding Request

Figures in millions of dollars, rounded to nearest tenth

|

Request |

Request |

HAC |

SAC |

Final |

|

NSC program |

54 |

54 |

701 |

1,241 |

|

OPC program |

500 |

500 |

500 |

500 |

|

FRC program |

240 |

240 |

240 |

340 |

|

TOTAL |

794 |

794 |

1,441 |

2,080 |

Source: Table prepared by CRS based on Coast Guard's FY2018 budget submission, HAC committee report, and SAC chairman's mark and explanatory statement on FY2018 DHS Appropriations Act. HAC is House Appropriations Committee; SAC is Senate Appropriations Committee.

FY2018 DHS Appropriations Act (H.R. 3355/S. XXXX)

House

The House Appropriations Committee, in its report (H.Rept. 115-239 of July 21, 2017) on H.R. 3355, recommended the funding levels shown in Table 3. In addition, Section 531(8) of H.R. 3355 as reported would rescind $95 million in FY2017 funding for the Acquisition, Construction, and Improvements (AC&I) funding. H.Rept. 115-239 states the following: "The Committee recommends a rescission of $95,000,000 in title V of this bill from funds provided in fiscal year 2017 for long lead time material for a tenth National Security Cutter that was neither requested by the Coast Guard nor is a requirement." (Page 46)

Senate

On November 21, 2017, the Senate Appropriations Committee released a Chairman's recommended bill text (referred to here as S. XXXX) and explanatory statement for the FY2018 DHS appropriations act.34 The funding recommendations from the explanatory statement are shown in the SAC column of Table 3.

The paragraph in the bill text that makes appropriations for the Coast Guard's Acquisition, Construction, and Improvements (ACI) account states that within the total appropriated for the account, "$95,000,000 shall be immediately available and allotted to contract for long lead time materials for the eleventh National Security Cutter notwithstanding the availability of funds for production or post-production costs."

The chairman's explanatory statement states:

National Security Cutter.—The NSC program was originally established to replace the fleet of High Endurance Cutters, which are now 50-years-old. Since that time, the Coast Guard's responsibilities have changed, and threats to the homeland have multiplied. In 2016, the Coast Guard interdicted 6,346 illegal migrants, the highest amount in a decade and 201 metric tons of cocaine with a street value of nearly $6,000,000,000, which reflect new record highs for the service. In fiscal year 2017, four NSCs interdicted at least 56.3 metric tons of cocaine with a street value of $1,663,383,500. Of the total amount interdicted, USCGC STRATTON (WMSL–752) alone removed six metric tons of uncut cocaine with a street value in excess of $177,270,000, nearly 30 percent of her construction cost in a single deployment. Despite these successes, the interagency was unable to target more than 500 known smuggling events due to a lack of resources. The existing program of record for NSC's will provide only 61 percent as many new cutters as the Coast Guard has calculated would be required to fully perform its anticipated missions in the coming years. Additionally, concepts initiated by the Coast Guard that underpinned the assumption that 12 High Endurance Cutters could be replaced with fewer NSCs have proven ineffective. Until the FRCs and OPCs are fully operational, continued investment in the NSC line is prudent, low-risk, and the most expeditious means by which to provide state of the art ships. In recent months, Coast Guard leadership has communicated to the Committee that a tenth NSC would be a valuable asset to the Coast Guard as it performs its high-seas missions. Therefore, the Committee strongly supports the recapitalization of the Coast Guard's aging fleet and the continued production of the NSC. To this end, the Committee recommends $540,000,000 for the construction of a tenth NSC and $95,000,000 to be made immediately available to contract for LLTM for an eleventh NSC.

Offshore Patrol Cutter.—Initiating construction of the OPC is a significant milestone in the recapitalization of the Coast Guard fleet. These cutters will replace the fleet of Medium Endurance Cutters and further enhance the Department's layered security strategy. The recommendation includes $500,000,000 for the OPC, consistent with the budget request. These funds will provide for production of OPC1, LLTM for OPC2, program activities, test and evaluation, government furnished equipment, and training aids.

Fast Response Cutter.—The Committee recommends $240,000,000 to acquire FRC hulls 45 through 48, as requested. (Pages 58-59)

FY2018 DHS Appropriations Act (Division E of H.R. 3354)

House

H.R. 3354, which earlier was the FY2018 Department of the Interior, Environment, and Related Agencies Appropriations Bill, subsequently became a consolidated appropriations bill that includes, inter alia, the FY2018 DHS Appropriations Act (H.R. 3355—see previous section) as Division E. The text of H.R. 3354 as a consolidated appropriations act was posted by the House Rules Committee as Rules Committee Print 115-31.35

FY2018 DHS Appropriations Act (Division F of

H.R. 1625/P.L. 115-141)

Conference

The FY2018 DHS Appropriations Act was enacted as Division F of H.R. 1625/P.L. 115-141 of March 23, 2018, the Consolidated Appropriations Act, 2018. The funding recommendations from the explanatory statement are shown in the conference column of Table 3.

The paragraph in Division F of H.R. 1625/P.L. 115-141 that appropriates funds for the Coast Guard's Acquisition, Construction, and Improvements (AC&I) account states that of the amount provided for the account, "$95,000,000 shall be immediately available and allotted to contract for long lead time materials for the eleventh National Security Cutter notwithstanding the availability of funds for production or post-production costs."

The explanatory statement for Division F stated:

National Security Cutter. The total includes $1,241,000,000 for the NSC program. This amount includes $540,000,000 for the construction of a tenth NSC, $95,000,000 to be made immediately available to contract for LLTM for an eleventh NSC, and $540,000,000 for the construction of the eleventh NSC. Crewing concepts initiated by the Coast Guard that underpinned the assumption that 12 High Endurance Cutters could be replaced with 8 NSCs have proven unworkable.

Offshore Patrol Cutter. The recommendation includes $500,000,000 for the OPC, consistent with the budget request. These funds will provide for production of OPCl, LLTM for OPC2, program activities, test and evaluation, government furnished equipment, and training aids.

Fast Response Cutter. The Coast Guard program of record calls for 58 FRCs, of which 44 have been ordered and 26 have been delivered and are in service today. The recommendation provides $340,000,000 for six FRCs, four of which are for the current program of record and two of which are to initiate replacement of the 110-foot Island Class Cutters supporting U.S. Central Command in Southwest Asia. (Pages 46-47)

Coast Guard Authorization Act of 2017 (H.R. 2518/S. 1129)

House

H.R. 2518 was introduced in the House on May 24, 2017. Section 211 of H.R. 2518 as introduced states the following:

SEC. 211. Contracting for major acquisitions programs.

(a) In general.—Subchapter II of chapter 15 of title 14, United States Code, is amended by adding at the end the following:

"§ 580. Contracting for major acquisitions programs

"(a) In general.—The Commandant of the Coast Guard may enter into contracts for major acquisition programs.

"(b) Authorized methods.—Such contracts—

"(1) may be block buy contracts;

"(2) may be incrementally funded;

"(3) may include combined purchases, also known as economic order quantity purchases, of—

"(A) materials and components; and

"(B) long lead time materials; and

"(4) may be multiyear contracts that comply with section 2306b of title 10.

"(c) Subject to appropriations.—Any contract entered into under subsection (a) shall provide that any obligation of the United States to make a payment under the contract is subject to the availability of appropriations for that purpose.".

(b) Clerical amendment.—The analysis at the beginning of such chapter is amended by adding at the end of the items relating to such subchapterthe following:

"580. Contracting for major acquisitions programs.".

(c) Conforming amendments.—The following provisions are repealed:

(1) Section 223 of Public Law 113–281 (14 U.S.C. 577 note), and the item relating to that section in the table of contents in section 2 of such Act.

(2) Section 221(a) of Public Law 112–213 (14 U.S.C. 573 note).

(3) Section 207(a) of Public Law 114–120 (14 U.S.C. 87 note).

Section 212 of H.R. 2518 as introduced states the following:

SEC. 212. National Security Cutter.

(a) Standard Method for Tracking.—The Commandant of the Coast Guard may not certify an eighth National Security Cutter as Ready for Operations before the date on which the Commandant provides to the Committee on Transportation and Infrastructure of the House of Representatives and the Committee on Commerce, Science, and Transportation of the Senate—

(1) a notification of a new standard method for tracking operational employment of Coast Guard major cutters that does not include time during which such a cutter is away from its homeport for maintenance or repair; and

(2) a report analyzing cost and performance for different approaches to achieving varied levels of operational employment using the standard method required by paragraph (1) that, at a minimum—

(A) compares over a 30-year period the average annualized baseline cost and performances for a certified National Security Cutter that operated for 185 days away from homeport or an equivalent alternative measure of operational tempo—

(i) against the cost of a 15 percent increase in days away from homeport or an equivalent alternative measure of operational tempo for a National Security Cutter; and

(ii) against the cost of the acquisition and operation of an additional National Security Cutter; and

(B) examines the optimal level of operational employment of National Security Cutters to balance National Security Cutter cost and mission performance.

(b) Conforming amendments.—

(1) Section 221(b) of the Coast Guard and Maritime Transportation Act of 2012 (14 U.S.C. 573 note) is repealed.

(2) Section 204(c)(1) of the Coast Guard Authorization Act of 2015 (130 Stat. 35) is repealed.

Senate

S. 1129 was introduced in the Senate on May 18, 2017. Section 211 of S. 1129 as introduced states the following:

SEC. 211. Multiyear contracts.

The Secretary is authorized to enter into a multiyear contract for the procurement of a tenth, eleventh, and twelfth National Security Cutter and associated government-furnished equipment.

Appendix A. Planned NSC, OPC, and FRC Procurement Quantities

This appendix provides further discussion on the issue of the Coast Guard's planned NSC, OPC, and FRC procurement quantities.

Overview

The Coast Guard's program of record for NSCs, OPCs, and FRCs includes only about 61% as many cutters as the Coast Guard calculated in 2011 would be needed to fully perform its projected future missions. The Coast Guard's planned force levels for NSCs, OPCs, and FRCs have remained unchanged since 2004. In contrast, the Navy since 2004 has adjusted its ship force-level goals eight times in response to changing strategic and budgetary circumstances.36

Although the Coast Guard's strategic situation and resulting mission demands may not have changed as much as the Navy's have since 2004, the Coast Guard's budgetary circumstances may have changed since 2004. The 2004 program of record was heavily conditioned by Coast Guard expectations in 2004 about future funding levels in the PC&I account. Those expectations may now be different, as suggested by the willingness of Coast Guard officials in 2017 to begin regularly mentioning the need for an PC&I funding level of $2 billion per year (see Appendix B).

It can also be noted that continuing to, in effect, use the Coast Guard's 2004 expectations of future funding levels for the PC&I account as an implicit constraint on planned force levels for NSCs, OPCs, and FRCs can encourage an artificially narrow view of Congress's options regarding future Coast Guard force levels and associated funding levels, depriving Congress of agency in the exercise of its constitutional power to provide for the common defense and general welfare of the United States, and to set funding levels and determine the composition of federal spending.

2009 Coast Guard Fleet Mix Analysis

The Coast Guard estimated in 2009 that with the POR's planned force of 91 NSCs, OPCs, and FRCs, the service would have capability or capacity gaps37 in 6 of its 11 statutory missions—search and rescue (SAR); defense readiness; counterdrug operations; ports, waterways, and coastal security (PWCS); protection of living marine resources (LMR); and alien migrant interdiction operations (AMIO). The Coast Guard judges that some of these gaps would be "high risk" or "very high risk."

Public discussions of the POR frequently mention the substantial improvement that the POR force would represent over the legacy force. Only rarely, however, have these discussions explicitly acknowledged the extent to which the POR force would nevertheless be smaller in number than the force that would be required, by Coast Guard estimate, to fully perform the Coast Guard's statutory missions in coming years. Discussions that focus on the POR's improvement over the legacy force while omitting mention of the considerably larger number of cutters that would be required, by Coast Guard estimate, to fully perform the Coast Guard's statutory missions in coming years could encourage audiences to conclude, contrary to Coast Guard estimates, that the POR's planned force of 91 cutters would be capable of fully performing the Coast Guard's statutory missions in coming years.

In a study completed in December 2009 called the Fleet Mix Analysis (FMA) Phase 1, the Coast Guard calculated the size of the force that in its view would be needed to fully perform the service's statutory missions in coming years. The study refers to this larger force as the objective fleet mix. Table A-1 compares planned numbers of NSCs, OPCs, and FRCs in the POR to those in the objective fleet mix.

|

Ship type |

Program of Record (POR) |

Objective Fleet Mix From FMA Phase 1 |

Objective Fleet Mix compared to POR |

||

|

Number |

% |

||||

|

NSC |

8 |

9 |

+1 |

+13% |

|

|

OPC |

25 |

57 |

+32 |

+128% |

|

|

FRC |

58 |

91 |

+33 |

+57% |

|

|

Total |

91 |

157 |

+66 |

+73% |

|

Source: Fleet Mix Analysis Phase 1, Executive Summary, Table ES-8 on page ES-13.

As can be seen in Table A-1, the objective fleet mix includes 66 additional cutters, or about 73% more cutters than in the POR. Stated the other way around, the POR includes about 58% as many cutters as the 2009 FMA Phase I objective fleet mix.

As intermediate steps between the POR force and the objective fleet mix, FMA Phase 1 calculated three additional forces, called FMA-1, FMA-2, and FMA-3. (The objective fleet mix was then relabeled FMA-4.) Table A-2 compares the POR to FMAs 1 through 4.

|

Ship type |

Program of Record (POR) |

FMA-1 |

FMA-2 |

FMA-3 |

FMA-4 (Objective Fleet Mix) |

|

NSC |

8 |

9 |

9 |

9 |

9 |

|

OPC |

25 |

32 |

43 |

50 |

57 |

|

FRC |

58 |

63 |

75 |

80 |

91 |

|

Total |

91 |

104 |

127 |

139 |

157 |

Source: Fleet Mix Analysis Phase 1, Executive Summary, Table ES-8 on page ES-13.

FMA-1 was calculated to address the mission gaps that the Coast Guard judged to be "very high risk." FMA-2 was calculated to address both those gaps and additional gaps that the Coast Guard judged to be "high risk." FMA-3 was calculated to address all those gaps, plus gaps that the Coast Guard judged to be "medium risk." FMA-4—the objective fleet mix—was calculated to address all the foregoing gaps, plus the remaining gaps, which the Coast Guard judge to be "low risk" or "very low risk." Table A-3 shows the POR and FMAs 1 through 4 in terms of their mission performance gaps.

Table A-3. Force Mixes and Mission Performance Gaps

From Fleet Mix Analysis Phase 1 (2009)—an X mark indicates a mission performance gap

|

Missions with performance gaps |

Risk levels of these performance gaps |

Program of Record (POR) |

FMA-1 |

FMA-2 |

FMA-3 |

FMA-4 (Objective Fleet Mix) |

|

Search and Rescue (SAR) capability |

Very high |

X |

||||

|

Defense Readiness capacity |

Very high |

X |

||||

|

Counter Drug capacity |

Very high |

X |

||||

|

Ports, Waterways, and Coastal Security (PWCS) capacitya |

High |

X |

X |

|||

|

Living Marine Resources (LMR) capability and capacitya |

High |

X |

X |

[all gaps addressed] |

||

|

PWCS capacityb |

Medium |

X |

X |

X |

||

|

LMR capacityc |

Medium |

X |

X |

X |

||

|

Alien Migrant Interdiction Operations (AMIO) capacityd |

Low/very low |

X |

X |

X |

X |

|

|

PWCS capacitye |

Low/very low |

X |

X |

X |

X |

Source: Fleet Mix Analysis Phase 1, Executive Summary, page ES-11 through ES-13.

Notes: In the first column, The Coast Guard uses capability as a qualitative term, to refer to the kinds of missions that can be performed, and capacity as a quantitative term, to refer to how much (i.e., to what scale or volume) a mission can be performed.

a. This gap occurs in the Southeast operating area (Coast Guard Districts 7 and 8) and the Western operating area (Districts 11, 13, and 14).

c. This gap occurs in Alaska and in the Northeast operating area (Districts 1 and 5).

d. This gap occurs in the Southeast and Western operating areas.

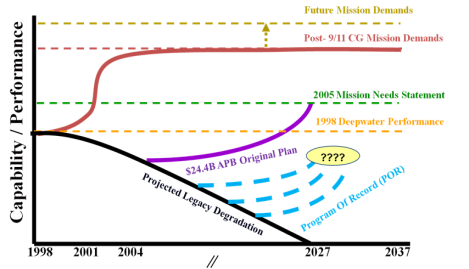

Figure A-1, taken from FMA Phase 1, depicts the overall mission capability/performance gap situation in graphic form. It appears to be conceptual rather than drawn to precise scale. The black line descending toward 0 by the year 2027 shows the declining capability and performance of the Coast Guard's legacy assets as they gradually age out of the force. The purple line branching up from the black line shows the added capability from ships and aircraft to be procured under the POR, including the 91 planned NSCs, OPCs, and FRCs. The level of capability to be provided when the POR force is fully in place is the green line, labeled "2005 Mission Needs Statement." As can be seen in the graph, this level of capability is substantially below a projection of Coast Guard mission demands made after the terrorist attacks of September 11, 2001 (the red line, labeled "Post-9/11 CG Mission Demands"), and even further below a Coast Guard projection of future mission demands (the top dashed line, labeled "Future Mission Demands"). The dashed blue lines show future capability levels that would result from reducing planned procurement quantities in the POR or executing the POR over a longer time period than originally planned.

FMA Phase 1 was a fiscally unconstrained study, meaning that the larger force mixes shown in Table A-2 were calculated primarily on the basis of their capability for performing missions, rather than their potential acquisition or life-cycle operation and support (O&S) costs.

Although the FMA Phase 1 was completed in December 2009, the figures shown in Table A-2 were generally not included in public discussions of the Coast Guard's future force structure needs until April 2011, when GAO presented them in testimony.38 GAO again presented them in a July 2011 report.39

The Coast Guard completed a follow-on study, called Fleet Mix Analysis (FMA) Phase 2, in May 2011. Among other things, FMA Phase 2 includes a revised and updated objective fleet mix called the refined objective mix. Table A-4 compares the POR to the objective fleet mix from FMA Phase 1 and the refined objective mix from FMA Phase 2.

Table A-4. POR Compared to Objective Mixes in FMA Phases 1 and 2

From Fleet Mix Analysis Phase 1 (2009) and Phase 2 (2011)

|

Ship type |

Program of Record (POR) |

Objective Fleet Mix from FMA Phase 1 |

Refined Objective Mix from FMA Phase 2 |

|

NSC |

8 |

9 |

9 |

|

OPC |

25 |

57 |

49 |

|

FRC |

58 |

91 |

91 |

|

Total |

91 |

157 |

149 |

Source: Fleet Mix Analysis Phase 1, Executive Summary, Table ES-8 on page ES-13, and Fleet Mix Analysis Phase 2, Table ES-2 on p. iv.

As can be seen in Table A-4, compared to the objective fleet mix from FMA Phase 1, the refined objective mix from FMA Phase 2 includes 49 OPCs rather than 57. The refined objective mix includes 58 additional cutters, or about 64% more cutters than in the POR. Stated the other way around, the POR includes about 61% as many cutters as the refined objective mix.

Compared to the POR, the larger force mixes shown in Table A-2 and Table A-4 would be more expensive to procure, operate, and support than the POR force. Using the average NSC, OPC, and FRC procurement cost figures presented earlier (see "Background"), procuring the 58 additional cutters in the Refined Objective Mix from FMA Phase 2 might cost an additional $10.7 billion, of which most (about $7.8 billion) would be for the 24 additional FRCs. (The actual cost would depend on numerous factors, such as annual procurement rates.) O&S costs for these 58 additional cutters over their life cycles (including crew costs and periodic ship maintenance costs) would require billions of additional dollars.40

The larger force mixes in the FMA Phase 1 and 2 studies, moreover, include not only increased numbers of cutters, but also increased numbers of Coast Guard aircraft. In the FMA Phase 1 study, for example, the objective fleet mix included 479 aircraft—93% more than the 248 aircraft in the POR mix. Stated the other way around, the POR includes about 52% as many aircraft as the objective fleet mix. A decision to procure larger numbers of cutters like those shown in Table A-2 and Table A-4 might thus also imply a decision to procure, operate, and support larger numbers of Coast Guard aircraft, which would require billions of additional dollars. The FMA Phase 1 study estimated the procurement cost of the objective fleet mix of 157 cutters and 479 aircraft at $61 billion to $67 billion in constant FY2009 dollars, or about 66% more than the procurement cost of $37 billion to $40 billion in constant FY2009 dollars estimated for the POR mix of 91 cutters and 248 aircraft. The study estimated the total ownership cost (i.e., procurement plus life-cycle O&S cost) of the objective fleet mix of cutters and aircraft at $201 billion to $208 billion in constant FY2009 dollars, or about 53% more than the total ownership cost of $132 billion to $136 billion in constant FY2009 dollars estimated for POR mix of cutters and aircraft.41

A December 7, 2015, press report states the following:

The Coast Guard's No. 2 officer said the small size and advanced age of its fleet is limiting the service's ability to carry out crucial missions in the Arctic and drug transit zones or to meet rising calls for presence in the volatile South China Sea.

"The lack of surface vessels every day just breaks my heart," VADM Charles Michel, the Coast Guard's vice commandant, said Dec. 7.

Addressing a forum on American Sea Power sponsored by the U.S. Naval Institute at the Newseum, Michel detailed the problems the Coast Guard faces in trying to carry out its missions of national security, law enforcement and maritime safety because of a lack of resources.

"That's why you hear me clamoring for recapitalization," he said.

Michel noted that China's coast guard has a lot more ships than the U.S. Coast Guard has, including many that are larger than the biggest U.S. cutter, the 1,800-ton [sic:4,800-ton] National Security Cutter. China is using those white-painted vessels rather than "gray-hull navy" ships to enforce its claims to vast areas of the South China Sea, including reefs and shoals claimed by other nations, he said.

That is a statement that the disputed areas are "so much our territory, we don't need the navy. That's an absolutely masterful use of the coast guard," he said.

The superior numbers of Chinese coast guard vessels and its plans to build more is something, "we have to consider when looking at what we can do in the South China Sea," Michel said.

Although they have received requests from the U.S. commanders in the region for U.S. Coast Guard cutters in the South China Sea, "the commandant had to say 'no'. There's not enough to go around," he said.42

Potential oversight questions for Congress include the following:

- Under the POR force mix, how large a performance gap, precisely, would there be in each of the missions shown in Table A-3? What impact would these performance gaps have on public safety, national security, and protection of living marine resources?

- How sensitive are these performance gaps to the way in which the Coast Guard translates its statutory missions into more precise statements of required mission performance?

- Given the performance gaps shown in Table A-3, should planned numbers of Coast Guard cutters and aircraft be increased, or should the Coast Guard's statutory missions be reduced, or both?

- How much larger would the performance gaps in Table A-3 be if planned numbers of Coast Guard cutters and aircraft are reduced below the POR figures?

- Has the executive branch made sufficiently clear to Congress the difference between the number of ships and aircraft in the POR force and the number that would be needed to fully perform the Coast Guard's statutory missions in coming years? Why has public discussion of the POR focused mostly on the capability improvement it would produce over the legacy force and rarely on the performance gaps it would have in the missions shown in Table A-3?

Appendix B. Funding Levels in PC&I Account

This appendix provides background information on funding levels in the Coast Guard's Procurement, Construction, and Improvements (PC&I) account.43

Overview

As shown in Table B-1, the FY2013 budget submission programmed an average of about $1.5 billion per year in the PC&I account. As also shown in the table, the FY2014-FY2016 budget submissions reduced that figure to between $1 billion and $1.2 billion per year.

Table B-1. Funding in PC&I Account in FY2013-FY2019 Budgets

Figures in millions of dollars, rounded to nearest tenth

|

Budget |

FY13 |

FY14 |

FY15 |

FY16 |

FY17 |

FY18 |

FY19 |

FY20 |

FY21 |

FY22 |

FY23 |

Avg. |

% change compared to avg. for FY13 budget |

|

FY13 |

1,217.3 |

1,429.5 |

1,619.9 |

1,643.8 |

1,722.0 |

1,526.5 |

— |

||||||

|

FY14 |

951.1 |

1,195.7 |

901.0 |

1,024.8 |

1,030.3 |

1,020.6 |

-33.1% |

||||||

|

FY15 |

1,084.2 |

1,103.0 |

1,128.9 |

1,180.4 |

1,228.7 |

1,145.0 |

-25.0% |

||||||

|

FY16 |

1,017.3 |

1,125.3 |

1,255.7 |

1,201.0 |

1,294.6 |

1,178.8 |

-22.8% |

||||||

|

FY17 |

1,136.8 |

1,259.6 |

1,339.9 |

1,560.5 |

1,840.8 |

1,427.5 |

-6.5% |

||||||

|

FY18 |

1,203.7 |

1,360.9 |

1,602.7 |

1,810.6 |

1,687.5 |

1,533.1 |

+0.4% |

||||||

|

FY19 |

1,886.8 |

n/a |

n/a |

n/a |

n/a |

n/a |

n/a |

Source: Table prepared by CRS based on Coast Guard FY2013-FY2019 budget submissions.

The Coast Guard has testified that funding the PC&I account at a level of about $1 billion to $1.2 billion per year would make it difficult to fund various Coast Guard acquisition projects, including a new polar icebreaker and improvements to Coast Guard shore installations. Coast Guard plans call for procuring OPCs at an eventual rate of two per year. If each OPC costs roughly $400 million, procuring two OPCs per year in an PC&I account of about $1 billion to $1.2 billion per year, as programmed under the FY2014-FY2016 budget submissions, would leave about $200 million to $400 million per year for all other PC&I-funded programs.

Since 2017, Coast Guard officials have been stating more regularly what they stated only infrequently in earlier years: that executing the Coast Guard's various acquisition programs fully and on a timely basis would require the PC&I account to be funded in coming years at a level of about $2 billion per year. Statements from Coast Guard officials on this issue in past years have sometimes put this figure as high as about $2.5 billion per year.

Using Past PC&I Funding Levels as a Guide for Future PC&I Funding Levels

In assessing future funding levels for executive branch agencies, a common practice is to assume or predict that the figure in coming years will likely be close to where it has been in previous years. While this method can be of analytical and planning value, for an agency like the Coast Guard, which goes through periods with less acquisition of major platforms and periods with more acquisition of major platforms, this approach might not always be the best approach, at least for the PC&I account.

More important, in relation to maintaining Congress's status as a co-equal branch of government, including the preservation and use of congressional powers and prerogatives, an analysis that assumes or predicts that future funding levels will resemble past funding levels can encourage an artificially narrow view of congressional options regarding future funding levels, depriving Congress of agency in the exercise of its constitutional power to set funding levels and determine the composition of federal spending.

Past Coast Guard Statements About Required PC&I Funding Level

At an October 4, 2011, hearing on the Coast Guard's major acquisition programs before the Coast Guard and Maritime Transportation subcommittee of the House Transportation and Infrastructure Committee, the following exchange occurred:

REPRESENATIVE FRANK LOBIONDO:

Can you give us your take on what percentage of value must be invested each year to maintain current levels of effort and to allow the Coast Guard to fully carry out its missions?

ADMIRAL ROBERT J. PAPP, COMMANDANT OF THE COAST GUARD:

I think I can, Mr. Chairman. Actually, in discussions and looking at our budget—and I'll give you rough numbers here, what we do now is we have to live within the constraints that we've been averaging about $1.4 billion in acquisition money each year.

If you look at our complete portfolio, the things that we'd like to do, when you look at the shore infrastructure that needs to be taken care of, when you look at renovating our smaller icebreakers and other ships and aircraft that we have, we've done some rough estimates that it would really take close to about $2.5 billion a year, if we were to do all the things that we would like to do to sustain our capital plant.

So I'm just like any other head of any other agency here, as that the end of the day, we're given a top line and we have to make choices and tradeoffs and basically, my tradeoffs boil down to sustaining frontline operations balancing that, we're trying to recapitalize the Coast Guard and there's where the break is and where we have to define our spending.44

An April 18, 2012, blog entry stated the following:

If the Coast Guard capital expenditure budget remains unchanged at less than $1.5 billion annually in the coming years, it will result in a service in possession of only 70 percent of the assets it possesses today, said Coast Guard Rear Adm. Mark Butt.

Butt, who spoke April 17 [2012] at [a] panel [discussion] during the Navy League Sea Air Space conference in National Harbor, Md., echoed Coast Guard Commandant Robert Papp in stating that the service really needs around $2.5 billion annually for procurement.45

At a May 9, 2012, hearing on the Coast Guard's proposed FY2013 budget before the Homeland Security subcommittee of the Senate Appropriations Committee, Admiral Papp testified, "I've gone on record saying that I think the Coast Guard needs closer to $2 billion dollars a year [in acquisition funding] to recapitalize—[to] do proper recapitalization."46

At a May 14, 2013, hearing on the Coast Guard's proposed FY2014 budget before the Homeland Security Subcommittee of the Senate Appropriations Committee, Admiral Papp stated the following regarding the difference between having about $1.0 billion per year rather than about $1.5 billion per year in the PC&I account:

Well, Madam Chairman, $500 million—a half a billion dollars—is real money for the Coast Guard. So, clearly, we had $1.5 billion in the [FY]13 budget. It doesn't get everything I would like, but it—it gave us a good start, and it sustained a number of projects that are very important to us.

When we go down to the $1 billion level this year, it gets my highest priorities in there, but we have to either terminate or reduce to minimum order quantities for all the other projects that we have going.

If we're going to stay with our program of record, things that have been documented that we need for our service, we're going to have to just stretch everything out to the right. And when we do that, you cannot order in economic order quantities. It defers the purchase. Ship builders, aircraft companies—they have to figure in their costs, and it inevitably raises the cost when you're ordering them in smaller quantities and pushing it off to the right.

Plus, it almost creates a death spiral for the Coast Guard because we are forced to sustain older assets—older ships and older aircraft—which ultimately cost us more money, so it eats into our operating funds, as well, as we try to sustain these older things.

So, we'll do the best we can within the budget. And the president and the secretary have addressed my highest priorities, and we'll just continue to go on the—on an annual basis seeing what we can wedge into the budget to keep the other projects going.47

At a March 12, 2014, hearing on the Coast Guard's proposed FY2015 budget before the Homeland Security subcommittee of the House Appropriations Committee, Admiral Papp stated the following:

Well, that's what we've been struggling with, as we deal with the five-year plan, the capital investment plan, is showing how we are able to do that. And it will be a challenge, particularly if it sticks at around $1 billion [per year]. As I've said publicly, and actually, I said we could probably—I've stated publicly before that we could probably construct comfortably at about 1.5 billion [dollars] a year. But if we were to take care of all the Coast Guard's projects that are out there, including shore infrastructure that that fleet that takes care of the Yemen [sic: inland] waters is approaching 50 years of age, as well, but I have no replacement plan in sight for them because we simply can't afford it. Plus, we need at some point to build a polar icebreaker. Darn tough to do all that stuff when you're pushing down closer to 1 billion [dollars per year], instead of 2 billion [dollars per year].

As I said, we could fit most of that in at about the 1.5 billion [dollars per year] level, but the projections don't call for that. So we are scrubbing the numbers as best we can.48

At a March 24, 2015, hearing on the Coast Guard's proposed FY2016 budget before the Homeland Security subcommittee of the House Appropriations Committee, Admiral Paul Zukunft, Admiral Papp's successor as Commandant of the Coast Guard, stated the following:

I look back to better years in our acquisition budget when we had a—an acquisition budget of—of $1.5 billion. That allows me to move these programs along at a much more rapid pace and, the quicker I can build these at full-rate production, the less cost it is in the long run as well. But there's an urgent need for me to be able to deliver these platforms in a timely and also in an affordable manner. But to at least have a reliable and a predictable acquisition budget would make our work in the Coast Guard much easier. But when we see variances of—of 30, 40% over a period of three or four years, and not knowing what the Budget Control Act may have in store for us going on, yes, we are treading water now but any further reductions, and now I am—I am beyond asking for help. We are taking on water.49

An April 13, 2017, press report states (emphasis added):

Coast Guard Commandant Adm. Paul Zukunft on Wednesday [April 12] said that for the Coast Guard to sustain its recapitalization plans and operations the service needs a $2 billion annual acquisition budget that grows modestly overtime to keep pace with inflation.

The Coast Guard needs a "predictable, reliable" acquisition budget "and within that we need 5 percent annual growth to our operations and maintenance (O&M) accounts," Zukunft told reporters at a Defense Writers Group breakfast. Inflation will clip 2 to 3 percent from that, but "at 5 percent or so it puts you on a moderate but positive glide slope so you can execute, so you can build the force," he said.50

In an interview published on June 1, 2017, Zukunft said (emphasis added):

We cannot be more relevant than we are now. But what we need is predictable funding. We have been in over 16 continuing resolutions since 2010. I need stable and repeatable funding. An acquisition budget with a floor of $2 billion. Our operating expenses as I said, they've been funded below the Budget Control Act floor for the past five years. I need 5 percent annualized growth over the next five years and beyond to start growing some of this capability back.

But more importantly, we [need] more predictable, more reliable funding so we can execute what we need to do to carry out the business of the world's best Coast Guard.51

Appendix C. Additional Information on Status and Execution of NSC, OPC, and FRC Programs from March 2016 GAO Report

This appendix presents additional information on the status and execution of the NSC, OPC, and FRC programs from a March 2016 GAO report reviewing DHS acquisition programs.52

NSC Program

Regarding the NSC program, the GAO report states the following:

Notably, officials from six [DHS acquisition] programs explained that their current KPPs [key performance parameters] are still poorly defined and may require revisions going forward. For example, USCG officials identified that the NSC's cutter boat requirements should have been written more clearly, and, in January 2016, we recommended the NSC program office clarify them.... 53

... DHS has not identified specific actions to improve the affordability of one of the programs that department leadership reviewed—USCG NSC—and this program continues to face a funding gap exceeding 10 percent. In this case, the USCG did not provide DHS leadership critical information necessary for addressing affordability issues.....54

... the USCG NSC program—one of the department's largest investments—continues to face a funding gap exceeding 10 percent even though it was reviewed in September 2014. We found that the funding certification memo that the USCG provided to the DHS ARB [Acquisition Review Board] did not include as much detail as the others we reviewed across DHS components. Specifically, the NSC funding certification, signed by the USCG CFO [Chief Financial Officer], consisted of only a high-level narrative discussion, stating that adjustments would be made, as necessary, to sustain and operate the NSC. Unlike the other funding certifications we reviewed, it did not include detailed tables that quantified cost estimates, funding streams, and the monetary value of proposed tradeoffs. We also found that DHS leadership did not document any tradeoffs to improve the program's affordability after the September 2014 ARB. While the DHS CFO's June 2014 memorandum identifies that the success of the ARB reviews is dependent on the quality of the information presented to the ARB, it does not specify what information the components should include in the memos. It does not specifically require detailed information, such as quantifying cost estimates, funding streams, and the monetary value of proposed tradeoffs. We have previously established that information should be communicated to management in a form that enables them to carry out their responsibilities. Without detailed information, the ARB will be unable to hold fully informed discussions about tradeoffs needed to improve program affordability.... 55

The [Coast Guard's C4ISR acquisition] program is continuing to work to replace the C4ISR [command and control, communications, computers, intelligence, surveillance, and reconnaissance] system on the NSC because it relies on contractor-proprietary software that is becoming obsolete and is costly to maintain. This transition has been delayed by more than 7 years largely due to funding shortfalls and, according to program officials, difficulties scheduling system installations when the NSCs are in port. Future funding shortfalls would likely delay the transition further, and it appears that the program's cost estimate exceeds its funding plan significantly from fiscal year 2016 to 2020. However, the gap may not be as great as it appears. The C4ISR funding plans DHS has presented to Congress do not identify all of the funding the USCG plans to allocate to C4ISR operations. GAO has reported on USCG affordability issues since 2011 (GAO-11-743). In April 2015, GAO recommended DHS account for all of the operations and maintenance funding the USCG is allocating to its major acquisition programs in an annual report to Congress. DHS concurred with this recommendation, but USCG officials told GAO they have made no progress in accounting for these funding allocations. This issue obscures the size of future funding gaps, and the actual amount allocated through fiscal year 2015 may be greater than $797 million.

Test Activities [for the C4ISR program]

The USCG initially planned to test the C4ISR system separately from its planes and vessels, including the NSC, but officials subsequently decided to test the C4ISR system in conjunction with the planes and vessels to save money and avoid duplication. However, the C4ISR system's KPPs were not specifically evaluated during the NSC's operational test because the necessary testing activities were not fully integrated into the NSC test plan. The USCG deferred a significant portion of the C4ISR testing on the NSC to later dates including the testing of cybersecurity capabilities and real-time tactical communications with the Navy. In June 2014, GAO recommended the USCG fully integrate C4ISR assessments into other assets' operational test plans or test the C4ISR program independently in order to assess the operational effectiveness and suitability of the C4ISR system. The USCG concurred with GAO's recommendation and stated that it planned to test the C4ISR system's KPPs during follow-on testing for the NSC. The NSC's follow-on operational test and evaluation was scheduled for fiscal year 2015, but slipped to the end of fiscal year 2016 when the USCG refined the NSC's testing schedule. In the meantime, the USCG is using the C4ISR system on deployed NSCs.... 56

Performance

The USCG has been operating the NSC since 2010, and it initiated production of the eighth NSC in 2015, but it has not yet demonstrated the NSC can fully meet 7 of its 19 key performance parameters (KPP). In September 2015, USCG officials indicated they were in the process of validating data that would demonstrate the NSC could meet the KPP that establishes the NSC's transit range requirement. The NSC's other unmet KPPs include those related to unmanned aircraft, cutter-boat deployment, and interoperability requirements.

Acquisition Strategy

The USCG awarded delivery and task orders to produce the first three NSCs to Integrated Coast Guard Systems—a joint venture between Northrop Grumman and Lockheed Martin—as part of the now-defunct acquisition effort designated Deepwater. In 2006, the USCG revised its Deepwater acquisition strategy, citing cost increases, and took over the role of lead systems integrator, acknowledging that it had relied too heavily on contractors. In 2010, the USCG awarded the production contract for the fourth NSC to Northrop Grumman. In 2011, Northrop Grumman spun off its shipbuilding sector as an independent company named Huntington Ingalls Industries (HII). HII is producing the sixth, seventh, and eighth NSCs for the USCG, and plans to deliver the eighth NSC in 2019.

Program Execution

From 2008 to 2014, the program's schedule for completing developmental testing slipped nearly 5 years, and its schedule for completing initial operational testing slipped nearly 3 years. In July 2011, GAO reported on a number of issues the USCG identified during developmental testing that the USCG needed to address before initiating operational testing, including performance and safety issues (GAO-11-743). The program's full operational capability date also slipped, from fiscal year 2016 to fiscal year 2020, although program officials anticipate it will occur sooner. USCG officials attributed the schedule slips to, among other things, funding shortfalls. The NSC has adhered to the revised schedule since January 2014, but going forward, the NSC is projected to face additional funding shortfalls. From fiscal year 2016 to fiscal year 2020, the NSC's costs are projected to exceed its funding by $401 million. However, the funding gap may not be as large as it appears. The NSC funding plan DHS has presented to Congress does not identify all of the funding the USCG plans to allocate to the NSC's operations. GAO has reported on USCG affordability issues since 2011. In April 2015, GAO recommended DHS account for all of the operations and maintenance funding the USCG is allocating to its major acquisition programs in an annual report to Congress. DHS concurred with this recommendation, but USCG officials told GAO they have made no progress in accounting for these funding allocations. This issue obscures the size of the future funding gaps, and the amount allocated through fiscal year 2015 may be greater than $5.7 billion.

From 2008 to 2014, the program's acquisition cost estimate increased from $4.7 billion to $5.7 billion. The USCG primarily attributed this increase to the lingering impacts of Hurricane Katrina, which struck the region where the NSCs are being built in 2005. USCG officials explained that the hurricane created labor shortages, which increased rates and decreased productivity. Alternatively, from 2008 to 2014, the program's life-cycle cost estimate decreased from $24.3 billion to $21.9 billion. USCG officials attributed this decrease to increasingly accurate cost estimates for personnel, materials, and maintenance. The program's approved cost thresholds remained stable from January 2014 to January 2016.

Test Activities

The NSC completed its initial operational testing in 2014, and the Department of Homeland Security's (DHS) Director of Operational Test and Evaluation (DOT&E) subsequently found the NSC operationally effective and suitable. However, testing identified several major deficiencies, and the USCG did not demonstrate the NSC could fully meet 7 of its 19 KPPs. For example, the USCG has not yet procured an unmanned aircraft system for the NSC, and has not yet demonstrated the NSC can meet the related KPP. Three of the NSC's unmet KPPs are related to cutter-boat deployment in rough seas. USCG officials indicated that challenges remain in determining a path forward to resolve these KPPs because the USCG and its operational test agent have different interpretations of the cutter boat requirements. In January 2016, GAO recommended the NSC program office clarify the KPPs for the cutter boats.

USCG officials have indicated that all deficiencies and unmet KPPs will be tested as part of follow-on operational test and evaluation (FOT&E), but it is unclear when the USCG will complete the NSC's FOT&E. The USCG has planned test activities through the end of fiscal year 2017 and USCG officials indicated that DOT&E will independently assess the FOT&E results. However, it is unclear when the USCG will actually demonstrate the NSC can meet its unmanned aircraft and intelligence requirements. In January 2016, GAO recommended DHS specify when the USCG must complete the NSC's FOT&E and any further actions the NSC program should take following FOT&E.

Other Issues

In May 2015, DHS reported the program office had 55 full time equivalents (FTE) but needed 62 FTEs. USCG officials have told GAO this has made it difficult to obligate funds in a timely manner. However, according to USCG officials, as of September 2015 the program office was in the process of hiring staff to fill several vacancies.

Program Office Comments [from the Coast Guard]

Cost estimates cited herein are threshold values taken from the approved NSC baseline. They do not reflect current estimates to complete based on updated data, which includes actual production contract award amounts for NSCs 7 and 8. The NSC program completed IOT&E [initial operational test and evaluation] in 2014 and continues to work with DHS to complete remaining testing and resolve pending discrepancies. Delaying IOT&E was a deliberate decision to ensure maximum benefits from the testing and resulted in the Navy evaluator's assessment that the NSC is "Operationally Effective and Suitable." Despite not fully completing all aspects of IOT&E, recent NSC operations have resulted in rarely seen magnitudes of law enforcement success. USCGC BERTHOLF recently seized nearly 29,000 pounds of cocaine, part of a remarkable 2015 interagency/partner nation effort which included more than 110 interdictions, the arrest of 700 suspected smugglers, and the seizure of 709,888 pounds of cocaine worth roughly $9.4 billion.

GAO Response