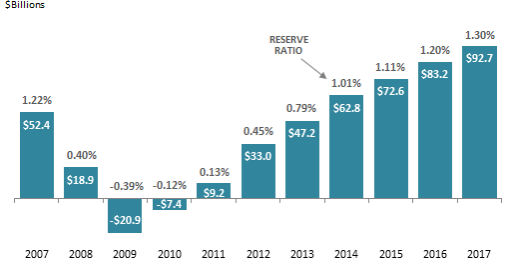

Figure 1. Deposit Insurance Fund Balance and Reserve Ratio

In $Billions

Source: FDIC's Quarterly Banking Profiles.

Note: All reported figures are as of year-end.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (P.L. 111-203; Dodd-Frank Act) changed the minimum deposit insurance reserve ratio to 1.35% from 1.15% and required the Federal Deposit Insurance Corporation (FDIC) to meet the increased reserve ratio by 2020. The Dodd-Frank Act also required the FDIC to offset the effects of the higher reserve ratio of 1.35% on banks with assets of less than $10 billion. The FDIC Board of Directors approved a final rule in March 2016 to meet this requirement by 2018. The approved plan changes how the assessments are apportioned between large and small banks.

Deposit insurance guarantees the repayment of deposits at a bank up to the insured limit ($250,000). It is intended to prevent bank runs and reduce the risk of systemic failure in the banking system. Member banks pay deposit insurance premiums (called assessments) to the FDIC, which maintains the Deposit Insurance Fund (DIF) to meet its obligations of insuring deposits and resolving failed banks. Since the start of federal deposit insurance in 1934, all depositors have been made whole up to their insured limit after a bank failure. The deposit insurance is backed by the full faith and credit of the United States.

Although the DIF was funded to its statutory limit before the 2007-2009 financial crisis, it was rapidly depleted by bank failures during the crisis. As shown in Figure 1, the DIF balance was at its lowest at the end of 2009 with a negative balance of $20.9 billion under accrual accounting. To replenish the DIF, the FDIC not only increased the assessment rate (discussed below) but also required banks in December 2009 to prepay the next three years of estimated insurance assessments, a total of $46 billion. The DIF balance has since recovered to $92.7 billion. Assessments fully financed the DIF; taxpayer support was not necessary during the financial crisis. Based on cash basis accounting, the FDIC had sufficient cash-flow to meet its operating needs.

The deposit insurance reserve ratio reflects the amount of funds held by the DIF as a percentage of insured deposits. Prior to the Dodd-Frank Act, the reserve ratio had a statutory minimum of 1.15% and a ceiling of 1.5% of domestic deposits. The Dodd-Frank Act changed the reserve ratio and how it is computed. Specifically, the Dodd-Frank Act increased the minimum reserve ratio to 1.35% and removed the upper limit. The law also required the FDIC to amend the assessment base to be the average consolidated total assets less average tangible equity, rather than total domestic deposits. The change in the assessment base is intended to allow the FDIC to determine assessment rates that better correlate with the risk profile of a bank.

The amount of assessments paid by each bank is determined by multiplying its assessments rate by its assessment base. The range of assessment rates are determined based on the risk category assigned to each bank based on the type of liabilities, size, and activities of the institution, with riskier banks paying a higher assessment rate. According to the FDIC, the change in the assessment model reflects the Dodd-Frank goal of having the assessments better reflect the risks posed by a bank. This goal is accomplished by requiring institutions that pose higher risks to pay higher assessments based on their specific risk profile rather than based on deposits.

In December 2010, the FDIC Board of Directors approved a long-term minimum target of 2.0% for the reserve ratio. The FDIC believes that a 2.0% reserve ratio improves the chance that the FDIC could maintain a stable insurance assessment rate and sustain a positive DIF balance even during a serious economic downturn. In December 2017 the Board of Directors of the FDIC concurred with the previously established minimum target of 2.0% for the reserve ratio.

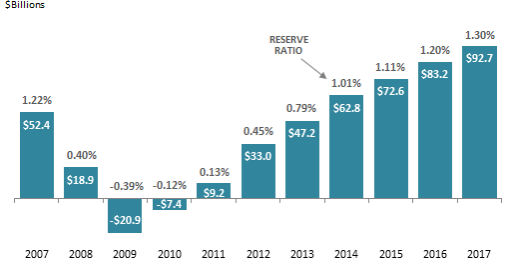

|

Figure 1. Deposit Insurance Fund Balance and Reserve Ratio In $Billions |

|

|

Source: FDIC's Quarterly Banking Profiles. Note: All reported figures are as of year-end. |

The Dodd-Frank Act required the FDIC to increase the minimum deposit insurance reserve ratio to 1.35% from 1.15%. The Dodd-Frank Act also required the FDIC to have the cost of the transition to the higher ratio be borne by large banks with assets of $10 billion or more once the 1.15% level was reached. The reserve ratio reached 1.15% as of the second quarter of 2016, and it was at 1.30% as of December 31, 2017. As a consequence of meeting the 1.15% level, the base assessment rate was reduced for all banks. However, the FDIC has begun assessing banks with consolidated assets of more than $10 billion a surcharge assessment of 4.5 basis points (0.045%) to ensure they bear more of the cost to meet the 1.35% reserve ratio by 2018. The surcharge assessment would apply to the assessment base above $10 billion, not to the first $10 billion.

Once the 1.35% level is reached, the FDIC expects it will reduce future assessments for small banks by providing offsets. The offsets are intended to compensate small banks for their contribution to increasing the DIF reserve ratio from 1.15% to 1.35%.

In the event the reserve ratio does not reach 1.35% by December 31, 2018, the FDIC would impose a shortfall assessment in 2019 on large banks with $10 billion or more. The FDIC's rationale for the accelerated target date of December 2018, rather than December 2020 as required by the Dodd-Frank Act, is to build the DIF in a timely manner to withstand future economic shocks and to reduce the likelihood of imposing assessments during another downturn. For perspective, there were 5,670 FDIC-insured banks as of December 2017, of which 123 banks had assets greater than $10 billion and 5,547 had assets less than $10 billion.