Introduction

A pension is a voluntary benefit offered by employers to assist employees in providing for their financial security in retirement. Department of Labor (DOL) data in 2014 indicated that 64% of full-time workers in the United States participated in a retirement plan sponsored by their employer.1 The two types of pension plans are defined contribution (DC) plans, in which participants have individual accounts that are the basis of income in retirement; and defined benefit (DB) plans, in which participants receive regular monthly benefit payments in retirement (which some refer to as a "traditional" type of pension).2 Pension plans are also classified by whether they are sponsored by one employer (single employer plans) or by more than one employer (multiemployer and multiple employer plans). Multiemployer pension plans are sponsored by employers in the same industry and maintained as part of a collective bargaining agreement. Multiple employer plans are sponsored by more than one employer but are not maintained as part of a collective bargaining agreement. Multiple employer pension plans are not common.3

Nearly all private-sector pension plans are governed by the Employee Retirement Income Security Act of 1974 (ERISA; P.L. 93-406), which is enforced by the Department of the Treasury, the DOL, and the Pension Benefit Guaranty Corporation (PBGC).4 Because of differences in the structure of the plans, single and multiemployer DB pension plans have different rules under some sections of ERISA. Examples include the existence of separate funding rules for each type of plan and pension insurance program.

Multiemployer DB plans are of current concern to Congress for several reasons:

- some plans have insufficient plan assets and may be unable to pay 100% of the benefits promised to plan participants;

- a few very large multiemployer DB pension plans are in such poor financial condition that they are expected to become insolvent within 10 years or 20 years;

- because the liabilities of these large pension plans are so great, PBGC would likely be unable to continue to guarantee participants' benefits if one or two of these plans became insolvent;

- legislation enacted in December 20145 provides options to stave off insolvency for some multiemployer DB pension plans; and

- some stakeholders have proposed new, alternative pension plan structures that they feel would avoid many of the problems inherent in the current multiemployer pension plan system.

Possible solutions to plan underfunding could involve some combination of increased contributions from the employers that sponsor pension plans, cuts in future benefits to plan participants who are currently working, cuts in current benefits to retired participants, or financial assistance from the U.S. government.

Background on Pensions

To protect the interests of pension plan participants and beneficiaries, Congress enacted ERISA (P.L. 93-406). ERISA is codified in the U.S. Code in Title 26 (Internal Revenue Code, or IRC) and Title 29 (Labor Code) and sets standards that pension plans must follow with regard to plan participation (who must be covered); minimum vesting requirements (how long a person must work for an employer to be covered); plan funding (how much must be set aside to pay for future benefits); and fiduciary duties, which require that a pension plan be operated in the sole interests of plan participants by plan sponsors, administrators, and others who oversee the plan. ERISA established PBGC, which is an independent federal agency that insures DB pension plans covered by ERISA. ERISA covers only private-sector pension plans and exempts pension plans established by the federal, state, and local governments and by churches.

Pension plans may be classified in a variety of ways, such as whether they receive tax preferences, whether they are sponsored by one or more than one employer, and whether the benefits are payable as a lifetime annuity at retirement or accrue in accounts for each of the participants.

Tax-Qualified Pension Plans

Sponsors of pension plans may choose for their plans to be tax qualified. Tax-qualified plans receive certain tax advantages. For example, employer contributions to qualified DB plans are tax-deductible expenses for employers in the year contributions are made. Qualified plans also meet IRC requirements with respect to vesting schedules (which determine when participants have a legal right to their benefits) and funding requirements (which determine the amounts plan sponsors must contribute to the plans they sponsor). In general, qualified DB pension plans must prefund future benefits.6 Nonqualified pension plans are not required by the IRC to be prefunded. Because one of the requirements to be a tax-qualified plan is to cover a broad range of employees in a company, nonqualified pension plans are designed for top-level executives and other highly compensated employees.

Single Employer, Multiple Employer, and Multiemployer Pension Plans

Pension plans are also classified by whether they are sponsored by one employer (single employer pension plans) or by more than one employer (multiple and multiemployer pension plans). Most pension plans are sponsored by one employer. DOL data indicate that 99.6% of all pension plans (covering 89% of all pension plan participants) are single employer pension plans.7

Single Employer Pension Plans

Single employer pension plans are sponsored by one employer and cover eligible workers employed by the plan sponsor. When an employee stops working for the employer sponsoring the plan, the worker stops accruing benefits under that plan. The sponsor may decide to cease offering its employees benefits under the plan, in which case the plan may be frozen or terminated. If a DB pension plan is frozen, participants no longer accrue benefits but employers maintain responsibility for the frozen plan (for example, employers may have to make additional contributions to make up for funding shortfalls that may result from decreases in the value of plan assets). Alternatively, employers may decide to terminate their pension plans. Employers that terminate their DB pension plans must guarantee participants' future benefits by purchasing annuities (a guaranteed monthly payment) from an insurance company for each participant's accrued benefit. If underfunded DB pension plans are terminated pursuant to company bankruptcy, PBGC becomes the trustee of the plans and pays participants their promised benefits, up to a statutory maximum benefit.8

Multiple Employer Pension Plans

Multiple employer pension plans are sponsored by more than one employer and are not maintained under collective bargaining agreements. They are treated as single employer pension plans for the purposes of funding rules.

Multiemployer Pension Plans

Multiemployer pension plans are sponsored by more than one employer and are maintained under collective bargaining agreements. Participants continue to accrue benefits while working for any employer that participates in the plan. Multiemployer pension plans pool risk so that the withdrawal of a few employers from the plan does not place the plan in financial jeopardy. However, in recent years, an increasing number of employers have left multiemployer pension plans (either voluntarily or through employer bankruptcy). As a result of declines in the value of plan assets (such as occurred during the 2008 financial market decline), some participants who worked for employers that withdrew from the plan may have unfunded vested benefits in the plan.

DB and DC Plans

Pension plans are either DB or DC. Over the past 30 years, employers have been offering fewer DB plans and more DC pensions. DOL data indicate that 64.2% of all pension plan participants were in DB plans in 1981, and that percentage declined to 28.5% in 2014.9

DB Pension Plans

Participants in DB pension plans receive monthly payments in retirement. In multiemployer DB pension plans, the payment is typically calculated as the length of service with employers that contribute to the plan multiplied by a dollar amount.10 The payments are paid by the plan for the lifetime of the worker after he or she retires. Plan participants who are married may receive a joint-and-survivor annuity, which is an annuity payable for the lifetime of the participant or the participant's spouse, whichever is longer.

DB pension plans are generally funded entirely by employer contributions. DOL data in 2011 (the most recent year available) indicated that among private-sector workers who participated in DB plans, 4% were required to make an employee contribution to the plans.11 Among public-sector workers who participated in DB plans in 2017, 79% were required to make a contribution to their DB pension plans.12

DC Pension Plans

Workers in DC pension plans contribute a percentage of their wages to an individually established account. Employers may also contribute a match to the DC plan, which is an additional contribution equal to some or all of the worker's contribution. The account accrues investment returns and is then used as a basis for income in retirement. DC plans do not provide guarantees of lifetime income, unless participants purchase an annuity. Examples of DC plans are 401(k), 403(b), and 4057(b) plans and the Thrift Savings Plan (TSP).13

Data on Pension Plans and Participants

Table 1 provides information on the number of single and multiemployer DC and DB pension plans in 2014 (the most recent year for which data are available) and the number of active and retired participants by plan type. In 2014, there were 1,403 multiemployer DB pension plans that covered 10.1 million participants, of which 39.5% were active participants, meaning that 60.5% were retired (thus receiving benefits). DB pension plans that have high percentages of active workers are better able to rely on future contributions from plan sponsors to make up for plan underfunding. This is because, on a per participant basis, employers' contributions toward the underfunding will be lower in plans with higher percentages of active workers.

|

Single Employer Pension Plans |

Multiemployer Pension Plans |

|||||||||||

|

Defined Contribution |

Defined Benefit |

Defined Contribution |

Defined Benefit |

|||||||||

|

Number of Plans |

|

|

|

|

||||||||

|

Number of Active Participants (millions) |

|

|

|

|

||||||||

|

Number of Retired Participants (millions) |

|

|

|

|

||||||||

|

Total Participants (millions) |

|

|

|

|

||||||||

|

Active as a Percentage of Total Participants |

|

|

|

|

||||||||

|

Plan Assets (billions) |

|

|

|

|

||||||||

Source: Department of Labor (DOL), Employee Benefits Security Administration, Private Pension Plan Bulletin Abstract of 2014 Form 5500 Annual Reports, Tables A2, A5, and B1, https://www.dol.gov/sites/default/files/ebsa/researchers/statistics/retirement-bulletins/private-pension-plan-bulletins-abstract-2014.pdf.

Notes: Multiple employer pension plans are categorized as single employer pension plans on Form 5500. Active participants include any workers currently in employment covered by a plan and who are earning or retaining credited service under a plan. This category includes any nonvested former employees who have not yet incurred a break in service. Active participants also include individuals who are eligible to elect to have the employer make payments to a 401(k) plan.

a. Unlike defined benefit plans, which pay benefits from a common pool of funds, defined contribution plans consist of individual accounts. The category Active as a Percentage of Total Participants is not meaningful for defined contribution plans.

Funding Levels in Multiemployer DB Pension Plans

The funding levels of multiemployer DB pension plans are varied: some plans are well funded and have adequate funds from which to pay all of their promised benefits, and a few plans are poorly funded and may become insolvent within 10 to 20 years. An insolvent multiemployer DB pension plan has depleted all of its assets and is unable to pay all of its current benefit obligations. Insolvent DB pension plans are eligible to receive financial assistance from PBGC. The Pension Protection Act of 2006 (PPA; P.L. 109-280) requires a plan that has a funding shortfall below specified levels to notify DOL of the plan's funding status and establish a plan to improve funding levels over time.

Background on Multiemployer DB Plan Funding

DB pension benefits are accrued by eligible employees while working. The benefit is paid, typically as a monthly annuity, during the worker's retirement. The benefits in DB plans subject to ERISA are required to be prefunded, which means that in the current year the plan sponsor sets aside adequate funds, taking into account expected future investment returns, for pension benefits earned in that year.14 Plan sponsors may also be required to make additional contributions for investment losses that occurred in previous years and increases in the present value of future plan obligations. Plan participants receive their monthly benefit in retirement from these funds that have been set aside.

The required contributions for employers in multiemployer DB pension plans are fixed for several years as established in collective bargaining agreements. Various situations have led to many pension plans having a smaller amount of funds than the amount of benefits that have been promised by the plan. These situations include declines in the values of plan assets (such as occurred during the stock market decline in 2008) and increases in the current value of future benefits (such as occurred when interest rates declined as a result of the Federal Reserve's efforts to strengthen the economy). Appendix A provides background for understanding pension plan funding issues.

Funding Standard Accounts and Funding Deficiencies

Multiemployer DB plans maintain funding standard accounts, which facilitate the administration of funding requirements. Charges (debits) to the account reduce the account balance and include the cost of benefits earned by participants during the year and investment losses.15 Credits increase the funding standard account and include employer contributions to the plan and investment gains.16

When the total credits to a multiemployer DB pension plan exceed the total charges, the plan has a "credit balance" and no contributions are required until future charges eliminate the credit balance. When the total charges exceed the total credits, a funding deficiency results and additional contributions to the plan may be required. According to PBGC, 90 plans (out of 1,471 plans) reported funding deficiencies in 2010.17

Table 2 provides the distribution of funding ratios in 2014 (the most recent year for which data are available) among (1) multiemployer DB pension plans and (2) the participants in these plans.18 The funding ratio was less than 50% for 539 plans, which was 37.9% of all multiemployer DB plans. These plans had 2.5 million participants, which was 55% of all multiemployer DB plan participants in 2014.

|

Funding Ratio |

Plans |

Participants |

||||||||

|

Number |

Percentage |

Number |

Percentage |

|||||||

|

Receiving Financial Assistancea |

|

|

|

|

||||||

|

Bookedb |

|

|

|

|

||||||

|

Less than 50% |

|

|

|

|

||||||

|

50% to 59% |

|

|

|

|

||||||

|

60% to 79% |

|

|

|

|

||||||

|

80% to 99% |

|

|

|

|

||||||

|

100% or more |

|

|

|

|

||||||

|

Total |

|

|

|

|

||||||

Source: Pension Benefit Guaranty Corporation (PBGC), Table M-13, 2015 Pension Insurance Data Tables, https://www.pbgc.gov/sites/default/files/2015-pension-data-tables.pdf.

Notes: Totals of percentages might not sum to 100% due to rounding.

a. Plans receiving financial assistance are insolvent and are receiving financial assistance from PBGC to pay promised benefits.

b. Booked plans are plans that are expected to become insolvent and whose liabilities have been included in PBGC's financial position and liabilities; however, these plans are not yet insolvent and may never require financial assistance.

Withdrawal Liability

When a company wishes to exit a multiemployer DB plan, the company is responsible for its withdrawal liability, defined as its share of unfunded vested benefits (benefits to which participants have a contractual right but which the plan has insufficient assets to pay).19 In instances in which an employer withdraws from a multiemployer DB pension plan because of the employer's bankruptcy, it may not be possible to recover the employer's withdrawal liability. As a result, there may be plan participants with vested benefits who worked for an employer that no longer participates in the plan. These participants are sometimes called orphan participants because they do not have an employer that will make additional contributions to the plan for their unfunded benefits. The existence of orphan plan participants can result in a worsening funding situation for the multiemployer plan, because DB plan assets are comingled in a trust and are not assigned to a particular employer's contributions or participant's benefit. Thus, benefit payments for all participants draw down general plan assets.

Reporting of Plan Funded Status

PPA requires that the actuary of a multiemployer DB pension plan annually certify the plan's status in one of three categories based on, among other factors, the funded status of the plan.20 A plan can be in critical status, endangered status, or neither category. A plan in critical or endangered status must take measures to improve its financial conditions. The PPA provisions that created the zone certifications were scheduled to sunset on December 31, 2014, but were made permanent by MPRA. In addition, MPRA added critical and declining as a fourth funded status category.

Critical (Red Zone) Status

A plan is in critical status if any of the following conditions apply: (1) the plan's funding ratio is less than 65% and the value of the plan's assets and contributions will be less than the value of benefits in the next six years; (2) in the current year, the plan is not expected to receive 100% of the contributions required by the plan sponsor, or the plan is not expected to receive 100% of the required contributions for any of the next three years (four years if the plan's funding ratio is 65% or less); (3) the plan is expected to be insolvent within five years (within seven years if the plan's funding ratio is 65% or less); or (4) the cost of the current year's benefits and the interest on unfunded liabilities are greater than the contributions for the current year, the present value of benefits for inactive participants is greater than the present value of benefits for active participants, and there is expected to be a funding deficiency within five years.

Plans in critical status must adopt a rehabilitation plan. The rehabilitation plan is a range of options (such as increased employer contributions and reductions in future benefits accruals) that, when adopted, will allow the plan to emerge from critical status during a 10-year rehabilitation period. If a plan cannot emerge from critical status by the end of the rehabilitation period using reasonable measures, it must either install measures to emerge from critical status at a later time (after the end of the rehabilitation period) or forestall insolvency. Plans in critical status may not increase benefits during the rehabilitation period.

Plans in critical status must provide notice to plan participants, beneficiaries, the collective bargaining parties, PBGC, and DOL.21

Critical and Declining Status

A plan is in critical and declining status if (1) it is in critical status and (2) the plan actuary projects the plan will become insolvent within the current year or within either the next 14 years or the next 19 years, as specified in law. Plans in critical and declining status must provide notice to plan participants, beneficiaries, the collective bargaining parties, PBGC, and DOL.22

Endangered (Yellow Zone) Status

A plan is in endangered status if (1) the plan's funding ratio is less than 80% funded or (2) the plan has a funding deficiency in the current year or is projected to have one in the next six years. A subcategory of endangered status is seriously endangered. A plan is seriously endangered if it meets both of these criteria.

Plans in endangered status must adopt a funding improvement plan, which is a range of options (such as increased contributions and reductions in future benefit accruals) that, when adopted, will reduce the plan's underfunding23 by 33% during a 10-year funding improvement period. Plans in seriously endangered status must adopt a funding improvement plan that will reduce underfunding by 20% during a 15-year funding improvement period. Plans in endangered or seriously endangered status cannot increase benefits during the funding improvement period.

Plans in endangered status must provide notice to plan participants, beneficiaries, the collective bargaining parties, PBGC, and DOL.24

Green Status

Plans that are in neither critical nor endangered status are considered to be in green status. These plans most likely will be able to pay all of the participants' benefits without changes to employers' contributions or participants' benefits.

Table 3 provides the number of multiemployer DB plan certifications within each funded status category for the 1,266 plans that reported their plan in 2014 (the most recent for which complete information is available).

|

Status |

Number of Plans |

|

Neither Critical nor Endangered (Green Zone) |

779 (61.5%) |

|

Endangered (Yellow Zone) |

159 (12.6%) |

|

Seriously Endangered |

5 (0.4%) |

|

Critical (Red Zone) |

323 (25.5%) |

Source: PBGC Databook, Table M-18, https://www.pbgc.gov/sites/default/files/2015-pbgc-data-tables-multiemployer-supplement.pdf.

Notes: Plans began reporting critical and declining status in 2015 and so this status does not appear in this table. Fifty plans reported to DOL their status as critical and declining in 2015. See http://www.dol.gov/ebsa/criticalstatusnotices.html.

The IRS does not indicate why the number of certifications received is less than total number of multiemployer DB pension plans. PBGC had previously indicated that the total number of plan certifications is less than the total number of multiemployer defined benefit pension plans because some plans are terminated but continue to pay benefits (wasting trusts) and are required to file annual Form 5500 reports but are not required to file zone certifications. See Pension Benefit Guaranty Corporation (PBGC), Multiemployer Pension Plans: Report to Congress Required by the Pension Protection Act of 2006, January 22, 2013, p. 40, http://www.pbgc.gov/documents/pbgc-report-multiemployer-pension-plans.pdf.

PBGC Multiemployer Insurance Program

PBGC is a federal government agency created by ERISA in 1974 to protect the benefits of participants in private-sector DB pension plans. PBGC operates two insurance programs: a single employer insurance program and a multiemployer insurance program. The two programs function quite differently. In the single employer program, PBGC becomes the trustee of terminated, underfunded DB pension plans and pays benefits up to a statutory maximum amount. In the case of multiemployer plans, PBGC does not insure against termination. Rather, when a multiemployer DB pension plan becomes insolvent and is unable to pay participants their promised benefits, PBGC provides financial assistance in the form of loans (which are not expected to be repaid) made to multiemployer DB plans. As a condition for the loans, plans must reduce participants' benefits to a statutory maximum benefit.

PBGC's multiemployer insurance program receives revenues from two sources: (1) premium revenue paid by the sponsors of multiemployer pension plans and (2) interest income from holdings of the U.S. Treasury debt. Premium revenue is placed in a revolving fund that, by law, is invested in the U.S. Treasury debt.

At the end of FY2017, PBGC reported a deficit of $65.1 billion in the multiemployer insurance program.25 If a sufficient number of multiemployer pension plans exhaust their plan assets and become unable to pay promised benefits, it is likely that PBGC would also exhaust its assets. PBGC indicated that there is more than a 50% chance of PBGC insolvency by the end of 2025, a more than 90% chance of insolvency by the end of 2028, and a 99% chance of insolvency by 2036.26

|

Financial Assistance Paid |

$141 million |

|

Number of Plans Receiving Financial Assistance |

72 |

|

Premium Income |

$291 million |

|

Investment Loss |

-$53 million |

|

Total Assets |

$2.3 billion |

|

Present Value of Future Financial Assistance |

$67.3 billion |

|

Net Position (Total Assets Minus Present Value of Future Financial Assistance) |

-$65.1 billion |

Source: PBGC FY2017 Annual Report, Financial Summary—Multiemployer Program, p. 32, https://www.pbgc.gov/sites/default/files/pbgc-annual-report-2017.pdf.

Note: The present value of future financial assistance consists of the value of benefits to be paid to participants in insolvent plans, terminated but not yet insolvent, and ongoing plans that are projected to exhaust plan assets within 10 years.

In its FY2016 Projections Report released on June 17, 2015,27 PBGC indicated that the multiemployer insurance program will face significant financial challenges over the next 10 years to 20 years: the multiemployer program is more likely than not to become insolvent by the end of 2025 and faces a 99% likelihood of insolvency by 2035.28

The value of assets in the multiemployer program at the end of FY2017 was $2.3 billion, and PBGC estimated the present value of the next 10 years of insurance premiums to be $2.8 billion. These two sources of funds roughly total $5.0 billion and represent the amount of resources available to PBGC from which to provide future financial assistance over the next 10 years. PBGC estimated the present value of future financial assistance to multiemployer plans from FY2017 to FY2026 to range from $7.2 billion (assuming no future benefit suspensions or plan partitions under MPRA) to $7.4 billion (assuming future benefit suspensions and plan partitions under MPRA).29 This deficit of $2.4 billion is the amount by which PBGC will be unable to provide sufficient financial assistance for plans to pay the PBGC guaranteed maximum benefit ($12,870 per year per participant) over this period. The projections report noted that plans likely will require significant amounts of financial assistance even after FY2026 because the present value of PBGC's financial position in 2026 was estimated to be a deficit ranging from $57.8 billion (assuming future benefit suspensions and plan partitions under MPRA) to $58.6 billion (assuming no future benefit suspensions or plan partitions under MPRA).30

In an August 2016 report, the Congressional Budget Office (CBO) provided several estimates of the PBGC multiemployer program's financial condition.31 CBO's cash-based estimates account for spending and revenue in the years when they are expected to occur. CBO estimates that from 2017 to 2026, PBGC will be obligated to pay $9 billion in claims but will only have sufficient resources to pay $6 billion. From 2027 to 2036, claims to PBGC are estimated to be $35 billion but PBGC will only have sufficient resources to pay $5 billion. CBO also provided fair-value estimates, which are the present value of all expected future claims for financial assistance, net of premiums received.32 CBO's fair-value estimate of PBGC's future obligations was $101 billion.

Current and Future Financial Assistance to Multiemployer Pension Plans

PBGC provides financial assistance to insolvent multiemployer pension plans. In addition to providing details about the number of plans receiving financial assistance, PBGC estimates the number of plans that might need financial assistance in the future. Potential future financial assistance is categorized as either (1) probable or (2) reasonably possible, depending on whether the PBGC expects to provide the assistance (1) within 10 years or (2) between 10 years and 20 years.

Plans Currently Receiving Financial Assistance

Seventy-two multiemployer plans received financial assistance in FY2017 that totaled $141 million. The net liability associated with these plans was $2.7 billion.33

Probable Exposure to Future Financial Assistance

Plans are classified as "probable" if the plan is (1) terminated and underfunded but not yet receiving financial assistance or (2) ongoing but expected to be insolvent within 10 years. In FY2017,

- 68 multiemployer plans had been terminated but had not yet started receiving financial assistance. The net liability associated with these plans was $2.0 billion.

- 47 plans were ongoing but expected to be insolvent within 10 years. The net liability associated with these plans was $62.7 billion.

The dollar amount of probable exposure to future financial assistance increased from $58.9 billion in FY2016 to $64.7 billion in FY2017. Two plans likely account for a large amount of this liability. In its FY2013 annual report, PBGC indicated that approximately $26 billion of the probable future financial assistance is a result of the potential insolvency of two large plans.34 One plan, classified by PBGC in the "transportation, communications, and utilities" industry, had a net liability to PBGC of $20 billion as of the end of FY2013.35 A second plan, classified by PBGC in the "agriculture, mining, and construction" industry, had a net liability of $6 billion to PBGC at the end of FY2013.36

Reasonably Possible Exposure to Future Financial Assistance

Plans are classified as "reasonably possible exposure to future financial assistance" if the plan is ongoing but is projected to be insolvent in 10 years to 20 years. In its FY2017 annual report, PBGC estimated its reasonably possible exposure to be $14 billion. This figure was a decrease from the $19.5 billion reported in FY2016.

PBGC Guarantees

PBGC guarantees benefits in pension plans up to a statutory maximum level. When an insolvent multiemployer DB pension plan becomes insolvent, the plan must reduce participants' benefit to the PBGC maximum amount before the plan receives the assistance. The statutory maximum benefit in multiemployer plans that receive financial assistance from PBGC is the product of a participant's years of service multiplied by the sum of (1) 100% of the first $11 of the monthly benefit accrual rate and (2) 75% of the next $33 of the accrual rate. For a participant with 30 years of service, the statutory monthly maximum annual maximum benefit is $1,073 or an annual maximum benefit of $12,870 per year.37

PBGC Premium and Investment Income in FY2017

PBGC reported $291 million in premium income from multiemployer plans in FY2017.38 PBGC also reported a loss of $53 million in investment income from holdings of the U.S. Treasury debt. Premiums are placed in a revolving fund, which, by law, must be invested in Treasury securities.

PBGC Premium Levels

The PBGC multiemployer insurance program is funded by a per participant premium paid by each pension plan. In 2018, the sponsors of multiemployer DB pension plans pay an annual premium of $28 for each participant in the plan. The premium is indexed to increases in the average national wage.

Inadequacy of PBGC Premiums

Unlike the single employer insurance program, PBGC does not become trustee of insolvent multiemployer pension plans. For this reason, the only sources of funding for the financial assistance to insolvent multiemployer pension plans are (1) the collection of premiums that multiemployer plan sponsors pay to PBGC and (2) interest income from the investment of past premium income in the U.S. Treasury bonds. If the amount of financial assistance were to exceed the amount of premium revenue, then the revolving fund containing the investments in U.S. Treasuries could become depleted.

As mentioned above, PBGC estimated its probable exposure to future financial assistance to be $64.7 billion39 over the next 10 years and its reasonably possible exposure to future financial assistance to be $14 billion. The premium income in PBGC's multiemployer program was $291 million in FY2017. PBGC has indicated that the multiemployer insurance program is likely to become insolvent in 10 years to 15 years, even before any new financial obligations are added.40

Premium levels likely are inadequate to provide continued financial assistance to insolvent multiemployer plans and could exhaust PBGC's ability to guarantee participants' benefits. PBGC has indicated that once resources are exhausted in its multiemployer program, insolvent plans would be required to reduce benefits to levels that could be sustained through premium collections only. PBGC premiums are set by law. Members of Congress and some stakeholders, such as plan sponsors, might be reluctant to raise premiums to the levels necessary to fund promised benefits if the probable exposure scenario developed.

Multiemployer DB Pension Plan Policy Issues

Some Members of Congress have expressed a desire to address the challenges faced by the sponsors of multiemployer DB pension plans and by PBGC's multiemployer insurance program.41 Policymakers have been giving increased attention to issues concerning multiemployer DB pension plans and PBGC's multiemployer insurance program.42 One reason for the increased attention was that some of the funding rules for multiemployer DB pension plans were scheduled to sunset on December 31, 2014.

In the Multiemployer Pension Reform Act of 2014, enacted as Division O in the Consolidated and Further Continuing Appropriations Act, 2015 (MPRA; P.L. 113-235) Congress, among other provisions, (1) made permanent certain funding rules that were scheduled to sunset and (2) allowed some plans to stave off insolvency by reducing benefits for some participants. Some Members of Congress have expressed interest in additional proposals that would create new multiemployer pension plan structures that the creators of the proposals say would eliminate some of the problems currently faced by some multiemployer DB pension plans.43

Likely Insolvency of a Few Large Multiemployer Pension Plans and PBGC Insurance Program

Although many multiemployer DB pension plans are underfunded, most can expect their funding position to improve with modest changes to the plan, such as increased employer contributions.44 However, a few large multiemployer plans are in very poor financial condition and are likely to become insolvent.

Insolvent DB multiemployer pension plans are eligible for financial assistance from PBGC. PBGC has sufficient assets from which to provide financial assistance to currently insolvent plans and to smaller multiemployer plans that may become insolvent in the future. However, if one or more large multiemployer plans become insolvent, PBGC would likely have insufficient resources from which to pay 100% of the benefits owed to plan participants.

PBGC has indicated that once it has exhausted the assets in the multiemployer insurance program revolving funds, it would be able to pay total benefits equal to total premium income. This would likely mean that participants' benefits would be cut to levels below the current maximum benefit.45 In this scenario, if Congress wished to pay 100% of the participants' benefits, then premiums would have to rise to levels that many plan sponsors, plan participants, and policymakers would find unreasonable. PBGC estimated that premium levels would need to increase in the range of 59% to 85% to ensure solvency over the next 10 years and in the range of 363% to 552% to ensure solvency over the next 20 years.46

Multiemployer Pension Reform Act of 2014

In December 2014, Congress enacted MPRA, which (1) increased the premiums that multiemployer DB pension plans pay to PBGC, (2) modified certain multiemployer DB pension funding rules, (3) facilitated mergers and partitions of multiemployer DB pension plans, and (4) allowed certain multiemployer DB pension plans to reduce benefits to stave off insolvency.

Many of the bill's provisions were in a 2013 proposal put forward by the National Coordinating Committee for Multiemployer Plans (NCCMP), which is an organization that represents a number of multiemployer pension plans.47 NCCMP created a Retirement Security Review Commission (the commission) to gather input from a coalition of employers and labor groups for multiemployer DB pension reform proposals. In February 2013, the commission issued a report to advance a proposal that it indicated would reform and strengthen the multiemployer pension system.48 The commission proposed the following: (1) reforms to existing funding rules for multiemployer pension plans; (2) solutions to address deeply troubled multiemployer DB pension plans (plans that are expected to become insolvent in the next 10 years); and (3) new plan designs to encourage the creation of new multiemployer plans.49 MPRA contained provisions that reformed some existing funding rules and addressed the problems of deeply troubled plans. MPRA did not contain any provisions related to new plan designs.

Details of the provisions of MPRA are in Appendix B.

Applications for Benefit Reductions

As of March 8, 2018, the Department of the Treasury has received 22 applications from multiemployer DB pension plans to reduce benefits under MPRA. The Treasury has approved four applications and denied five applications.50 Nine applications have been withdrawn and four are in review.

The Central States, Southeast And Southwest Areas Pension Plan (Central States) was the first plan to submit an application to the U.S. Treasury.51 The application received a considerable amount of attention because the plan has more than 400,000 participants and was proposing to reduce benefits to approximately two-thirds of plan participants. It is the largest multiemployer DB pension in critical and declining status. As noted above, because of the size of its benefit obligations, and absent any federal financial assistance, the insolvency of Central States would likely lead to the insolvency of PBGC.

On May 6, 2016, the U.S. Treasury denied Central States' application.52 It cited three instances in which the application failed to meet the criteria in MPRA for the approval of benefit suspensions: (1) the actuarial projections in the application failed to show that the proposed benefit reductions would avoid insolvency, (2) the proposed benefit reductions were not distributed equitably, and (3) the participant notices were not written so as to be understood by the average plan participant. Central States indicated that it would not resubmit its application to reduce benefits.53

The Joint Select Committee on Solvency of Multiemployer Pension Plans

The Bipartisan Budget Act of 2018 (P.L. 115-123), enacted February 9, 2018, created the Joint Select Committee on Solvency of Multiemployer Pension Plans to address the impending insolvencies of several large multiemployer defined benefit (DB) pension plans and PBGC.54 The committee consists of 16 Members of Congress, including four House and Senate leaders from each party.55

Hearings

The joint committee must hold five or more public meetings and three or more public hearings, which may include field hearings. Each cochair (Senators Orrin Hatch and Sherrod Brown) will be able to select an equal number of witnesses for each hearing.

Report and Legislative Language

The committee must provide to Congress no later than November 30, 2018, a report and proposed legislative language to improve the solvency of multiemployer DB plans and the PBGC. The report and proposed legislative language must be approved by (1) a majority of committee members appointed by the Speaker of the House and Majority Leader of the Senate and (2) a majority of committee members appointed by the Minority Leader of the House and Minority Leader of the Senate.

Consideration of Joint Committee Bill

The provisions that establish the joint committee contain provisions that provide for the consideration of the joint committee's bill by the Senate Committee on Finance and the Senate Committee on Health, Education, Labor, and Pensions (HELP). The bill also provides for consideration of the joint committee's bill by the full Senate.

There are no provisions that require consideration of the bill by any committees in the House or by the full House.

Appendix A. Defined Benefit Plan Funding

This appendix provides background on basic concepts related to the funding of DB pension plans.

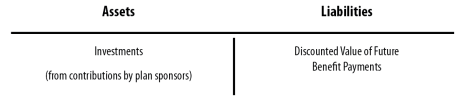

DB Plan Balance Sheet

Figure A-1 depicts a typical DB pension plan's balance sheet. It consists of plan assets, which are the value of the investments made with accrued employer (and employee, if any) contributions to the plan, and plan liabilities, which are the value of participants' benefits earned under the terms of the plan. Plan assets are invested in equities (such as publicly traded stock), debt (such as the U.S. Treasury and corporate bonds), private equity, hedge funds, and real estate.

|

Figure A-1. Typical Balance Sheet of a Defined Benefit Pension Plan |

|

|

Source: Congressional Research Service (CRS). |

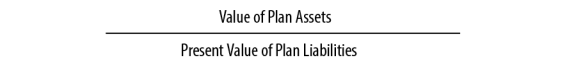

DB Plan Funding Ratio

The funding ratio measures the adequacy of a DB pension plan's ability to pay for promised benefits. The funding ratio is calculated as

A funding ratio of 100% indicates that the DB plan has set aside enough funds, if the invested funds grow at the expected rate of return or better, to pay all of the plan's benefit obligations. Funding ratios that are less than 100% indicate that the DB plan will not be able to meet all of its future benefit obligations. Because benefit obligations are paid out over a period of 20 years to 30 years, participants in an underfunded plan will likely receive their promised benefits in the near term. However, if the underfunding persists without additional contributions, plan participants might not receive 100% of their promised benefits in the future.

In response to strong investment returns in the 1990s, many multiemployer DB pension plans increased benefits to participants. Many of these plans then became underfunded during the early 2000s as financial markets weakened. Their financial position worsened as a result of (1) stricter funding rules put in place in the Pension Protection Act of 2006 (P.L. 109-280), (2) the decline in equity markets in 2008, (3) low interest rates as a result of weak economic conditions, and (4) the bankruptcy of some of the firms participating in the plans.

The Value of Plan Assets

Pension plans report the value of plan assets using two methods: market values (the value at which each asset can be sold on a particular date) or smoothed values (the average of the past, and sometimes expected future, market values of each asset). The smoothing of asset values prevents large swings in asset values and creates a more predictable funding environment for plan sponsors. One of the drawbacks of smoothing is that smoothed asset values may be substantially different from market values. Some advocates of reporting market values note that smoothed values are often higher than market values (particularly during periods of market declines), which could overstate the financial health of some pension plans. Some advocates of smoothing argue that market values are useful only if a plan needs to know its liquidated value (e.g., if the plan had to pay all of its benefit obligations at one point in time), which is unlikely to be the case as most pension plans are likely to be ongoing concerns.

Plan Liabilities

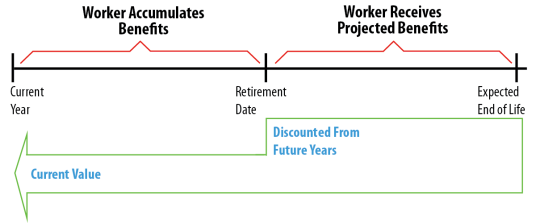

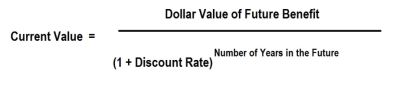

A pension plan's benefits are a plan liability spread out over many years in the future. These future benefits are calculated and reported as current dollar values (also called present value). Figure A-2 shows the process by which future benefits are discounted. Using a formula, benefits that are expected to be paid in a particular year in the future are calculated so they can be expressed as a current value. The process is called discounting, and it is the reverse of the process of compounding, which projects how much a dollar amount will be worth at a point in the future.

|

|

Source: CRS. |

The formula by which future values are calculated as current values is in Figure A-3.

|

|

Source: CRS. |

For example, assuming a discount rate of 10%, $121 in two years' time is worth $121(1.1)2=$100 today. The present value of a dollar amount is inversely related to both the discount rate and the number of years in the future. As the discount rate or number of years in the future increases, present value decreases; as the discount rate or number of years decreases, present value increases. In the above example, if the discount rate is 15%, then $121 in two years' time is worth $121(1.15)2=$91.49 today, and $121 in three years' time is worth $121(1.1)3=$79.56.

Discount Rate Used to Value Future Benefits

In the context of DB pension plans, plan actuaries calculate the present value of future benefit obligations by estimating (1) the dollar amount of the benefits accrued by plan participants and (2) the years in the future in which the benefits are expected to be paid. The Internal Revenue Code does not require multiemployer pension plans to use a specific discount rate to value their future benefit obligation. The assumptions a plan uses must be reasonable and offer the best estimate of the plan's expected experience.56 In practice, multiemployer plans generally discount plan liabilities using the expected rate of return on the plan's assets. However, multiemployer plans are required to value plan liabilities using rates of returns to bonds, as well. On Schedule MB of Form 5500, multiemployer plans report the present value of future benefits discounted by the expected return on plan assets (listed as the Accrued Liability Under Unit Credit Cost Method) and by long-term bond yields (listed as the Current Liability under the "RPA '94" Information).57 The RPA '94 discount rate is generally lower than a plan's expected return on assets.

Pension policy experts have several viewpoints on the appropriate discount rate that pension plans should use to value plan liabilities.58 Broadly speaking, some actuaries recommend that pension plans discount future benefits using the expected rate of return on plan investments (the current practice for multiemployer DB pension plans). Some financial economists, by contrast, recommend that plans discount the liabilities using a discount rate that reflects the likelihood that the benefit obligation will be paid.

The rationale for the actuaries' approach is as follows: because funds are to be set aside to pay an obligation in the future, the amount that has to be set aside should consider the rate of the return on the investment. For example, given an expected return of 10%, a $100 obligation payable in one year would be valued at $90.91 in today's dollars ($100 ÷ 1.1 = $90.91), and $90.91 could be set aside today to pay the $100 future obligation.

The rationale for the approach favored by financial economists is that pension obligations should be discounted based on the likelihood that they will be received by plan participants. Because participants are very likely to receive most of their pension benefits (for example, because of vesting provisions in ERISA and PBGC guaranties), their pension benefits should be discounted using a discount rate close to the risk-free rate. Financial economists say that the actuaries' approach may make an inappropriate connection between the value of liabilities and the rate of return on assets. For example, the value of the obligation can be increased or decreased by changing the assumption on the rate of return, which suggests that a pension plan could eliminate some of its underfunding by investing the plan's assets in riskier investments.59

The approach suggested by some actuaries results in discount rates that are generally higher than the rates that result by using the approach suggested by some financial economists. One effect of this divergence of opinion is that the value of pension plan benefit obligations is higher (and funding ratios are lower) using the approach favored by some financial economists. For example, in March 2012, a Credit Suisse study estimated the underfunding of multiemployer DB pension plans at $101 billion under the actuaries' approach and $428 billion under the financial economists' approach.60

Appendix B. Summary of the Provisions in the Multiemployer Pension Reform Act

The National Coordinating Committee for Multiemployer Plans (NCCMP) is an organization that represents a number of multiemployer pension plans. In 2013, it created a Retirement Security Review Commission (the commission) to gather input from a coalition of employers and labor groups for multiemployer DB pension reform proposals. Many of the commission proposals were included in the Multiemployer Pension Reform Act of 2014, enacted as Division O in the Consolidated and Further Continuing Appropriations Act, 2015 (MPRA; P.L. 113-235).

MPRA increased the premiums that the sponsors of multiemployer DB pension plans pay to PBGC. The premium increased from $12 per participant to $26 per participant. In addition, beginning in 2016, the premium is increased annually for changes in the average national wage.61

Sections 101 to 111 of MPRA made the following changes to the funding rules for multiemployer DB plans:

- Eliminates the sunset of provisions related to the zone certification status;

- Permits plans to enter critical status if they anticipate being in that status in the next five years. Under prior law, multiemployer plans were required to make changes to the plan structure when they entered critical status. However, plans could not make changes if they anticipated entering that status (they had to wait until they entered that status);

- Allows plans that emerge from critical status not to reenter critical status for at least one year following their emergence. Under prior law, because different criteria existed in the funding status tests for plans emerging from critical status, some plans emerged from and then immediately reentered critical status;

- Authorizes plans that meet the criteria for endangered status but have funding improvement plans that do not require additional contributions or benefit changes not to be certified as in endangered status. Some plans that entered endangered status did not have to make any changes to contributions or benefit levels to emerge from that status. Under prior law, these plans continued to be classified as being in endangered status;

- Permits plan actuaries for plans in endangered status, when developing funding improvement plans, to use the funding status as of the date of certification of the status rather than having to calculate the plan's funding status as of the beginning of the funding improvement plan. Under prior law, plan actuaries had to calculate the funding status at date of certification of endangered status and make a projection of the funding status at the beginning of the funding improvement period;

- Allows plans in endangered status to adopt some of the rules that previously had been available only to plans in critical status, including contribution decreases and the waiver of excise taxes. Some plans that were in endangered status actively sought to be placed in critical status because a number of the restrictions placed on plans in endangered status were more onerous than those placed on plans in critical status;

- Enables funding improvement plans and rehabilitation plans to specify the course of action if the collective bargaining agreement expires and the parties cannot agree on a schedule. Prior law provided no guidance as to the course of action a plan must take if a collective bargaining agreement expired when a plan was in endangered or critical status;

- Allows rules for plans in critical status to take priority over rules for plans in reorganization when both occur simultaneously. The Multiemployer Pension Plan Amendments Act of 1980 (P.L. 96-364) required plans in weak financial condition to undergo reorganization and established rules for plans in reorganization to improve funding. There potentially were conflicts between some of the rules for plans that were both in reorganization and in endangered or critical status;

- Permits contribution increases as part of a funding improvement plan or a rehabilitation plan to be disregarded in determining withdrawal liability. Plans that are in critical or endangered status could inadvertently make changes that could have increased plans' withdrawal liability; and

- Provides preretirement survivor annuities to plan participants who die after the date of plan insolvency or termination. Plan participants in multiemployer plans that are insolvent or that have been terminated were ineligible for preretirement survivor annuities. This provision is in contrast to participants in single employer plans, who remain eligible for survivor annuities after plan termination.

Assistance for Deeply Troubled Plans

Some multiemployer DB pension plans are in very poor financial condition and are likely to become insolvent. If one or two of the largest plans become insolvent, PBGC would likely have insufficient resources from which to guarantee participants' benefits. If PBGC is unable to pay participants' guaranteed benefits, it is unclear whether PBGC would receive financial assistance from the federal government. PBGC was established to be self-financing, and ERISA states that the "United States is not liable for any obligation or liability incurred by the corporation."62 Some Members of Congress have expressed a reluctance to consider providing financial assistance to PBGC.63

Deeply troubled multiemployer DB plans have limited options to avoid insolvency. Increased contributions and cuts to adjustable benefits to active plan participants are likely to be insufficient to return these plans to solvency. Participants' benefits in insolvent plans would be reduced to the PBGC guaranteed levels, or possibly lower, if PBGC has insufficient resources from which to pay 100% of the benefits guaranteed to participants.

Facilitate Mergers and Partitions

Sections 121 and 122 of MPRA provide PBGC with greater authority to facilitate mergers and partitions of multiemployer pension plans.

In a plan merger, the assets and liabilities of one plan are transferred to another plan. MPRA allows PBGC to promote and facilitate mergers between multiemployer plans, provided the merger is in the interests of the participants of at least one of the plans and is not reasonably expected to be adverse to the overall interests of the participants in any of the plans. Actions by PBGC to facilitate mergers include providing training and technical assistance, mediation, and communication with stakeholders. PBGC also may provide financial assistance to the merged plan if, among other provisions, (1) one of the plans in the merger is in critical and declining status, (2) financial assistance will reduce PBGC's expected long-term loss, and (3) financial assistance is necessary for the merged plan to remain solvent.

In a partition, PBGC gives approval to divide a plan that meets specified criteria into two plans.64 The goal of the partition is to restore the original plan to financial health. Some key features of the plan partition process include the following:

- The original plan must be in critical and declining status and must have taken all reasonable measures to avoid insolvency, including reducing participants' benefits to 110% of PBGC maximum guarantee benefit level;

- PBGC must expect that a partition of the plan would reduce PBGC's long-term loss with respect to the plan and that the partition would not impair PBGC's ability to provide financial assistance to other plans;

- Some or all orphan participants and their liabilities from the original plan are transferred to a newly created plan (also called a successor plan);

- The successor plan is administered by the original plan;

- No assets from the original plan are transferred to the successor plan. The successor plan receives financial assistance from PBGC to pay benefits to the participants in that plan; and

- Participants' benefits in the successor plan are reduced to PBGC maximum benefit levels; the original plan provides participants the difference between (1) the reduced benefit in the original plan and (2) the PBGC maximum benefit provided in the successor plan.

Benefit Reductions

Section 201 of MPRA allows certain multiemployer DB plans to reduce benefits for participants. The following are features of the provisions for benefit reductions:

- Only plans that are in critical and declining status may cut benefits.

- The Treasury Secretary, in consultation with the PBGC and the Labor Secretary, may reject a plan's application to reduce benefits if the plan sponsor's determination of the need for benefit reductions is "clearly erroneous."

- Participants in most plans are able to reject the reduction of benefits, if a majority of all participants and beneficiaries vote to do so. However, plans deemed to be systematically important are able to reduce participants' benefits without a vote. A systemically important plan is one in which PBGC would pay $1 billion or more in benefit payments if the benefit reductions were not implemented. There are likely only a handful of plans that are systematically important.

- Individuals cannot have their benefits cut below 110% of the PBGC maximum guarantee. Because the maximum guarantee in 2015 is $12,870 per year, a participant whose benefit is suspended would have to receive a benefit of at least $14,157.

- Disabled individuals and retirees aged 80 or older may not have their benefits reduced. Individuals between the ages of 75 and 80 may not receive the maximum benefit reduction.

- Benefit reductions must be distributed equitably. MPRA lists a number of factors that a plan sponsor may consider in making determinations. These factors include the age and life expectancy of participants; the length of time an individual has been receiving benefits from the plan; and the years to retirement for participants who are currently working.

- Benefit reductions in certain plans are to be ordered, first, among participants who worked for an employer that withdrew and failed to pay, in full, the required payments to exit the plan (known as withdrawal liability); and second, among other participants except those who worked for an employer that (1) withdrew from the plan, (2) fully paid its withdrawal liability, and (3) established a separate plan to provide benefits in an amount equal to benefits reduced as a result of the financial condition of the original plan. For example, this third exclusion applies to participants who worked for United Parcel Service and are in a trucking industry multiemployer plan.

Reducing retirees' benefits was a contentious issue.65 For example, some feared that retirees could be asked to shoulder a burden that otherwise could be fixed by increased employer contributions. Another concern was that retirees, particularly the most vulnerable, might not have adequate representation in discussions of changes to deeply troubled multiemployer DB pensions.66 MPRA addressed some of these issues. For example, individuals who are disabled or who are aged 80 and older may not have their benefits reduced and, except for several systematically important multiemployer plans, plan participants must vote on whether to reject any proposed benefit suspensions.

Recommendations Not Included in MPRA

The following 4 of the 13 recommendations from the Retirement Security Commission for changes to the funding rules for multiemployer DB pensions were not in MPRA. These changes would have

- provided for automatic triggers for funding relief when dramatic declines occur in financial markets. Under current law, Congress must authorize changes in funding rules, which can result in a delay between the onset of financial difficulties for pension plans and the implementation of funding relief;

- allowed plans to pay certain additional benefits (a 13th check) that would not have been considered a part of a participant's accrued benefit. Plans that experience favorable investment returns sometimes provide participants an additional benefit. If the 13th check is offered on a regular basis, then the benefit is considered a regular benefit, which cannot be reduced or eliminated;

- eliminated the potential exposure to an Internal Revenue Service (IRS) excise tax for plans that were granted amortization extensions under PPA. Prior to PPA, in exchange for a schedule of funding improvements, the IRS allowed some plans to extend the length of time to make up for investment losses. As a result of the 2008 market downturn, many plans failed to meet the requirements for the schedule of funding improvements and potentially are subject to an IRS excise tax. PPA provided for amortization extensions that made the pre-PPA extensions unnecessary; and

- permitted plan participants to convert DC accounts into annuities payable from their DB pension plans, which would have allowed participants who have DC accounts to receive lifetime income from their DC plans.