Introduction

Did P.L. 115-97 Modify

|

The federal government supports adoption in two primary ways: federal grants to state governments and tax benefits for individual taxpayers that help offset the costs of adopting a child.3 This report focuses on federal adoption tax benefits, which consist of an adoption tax credit and an income tax exclusion for employer-provided adoption assistance.

This report provides an in-depth overview of these tax benefits. It is structured to first provide a brief summary of adoption in the United States, including the number of adoptions and the average cost of adoption. The report then turns to a detailed description of the adoption tax credit and the exclusion for employer-provided adoption assistance, including a summary of administrative data on the adoption credit (similar data on the exclusion are unavailable). Next, the report summarizes the legislative history of these tax benefits. Finally, the report concludes with a discussion and analysis of potential policy options related to these benefits.

Brief Overview of Adoption in the United States

Adoption is a social and legal process in which an adult is formally made the parent of another individual (usually a child). The legal process in adoption generally requires that a court terminate the parental rights and responsibilities of birth parents (or earlier adoptive parents) and subsequently grant those rights and responsibilities instead to the adoptive parents.

For the purposes of understanding adoption tax benefits, adoption can be categorized in one of three ways:

- 1. Domestic public agency adoption: An adoption facilitated with the involvement of a state child welfare agency.4 (Note that most domestic public adoptions are special needs adoptions, discussed subsequently.)

- 2. Domestic private adoption: An adoption facilitated by a private agency, adoption facilitator, or attorney.5

- 3. Intercountry or foreign adoption: An adoption of a noncitizen or nonresident child by families who are citizens or legal residents of the United States.6

Number of Adoptions

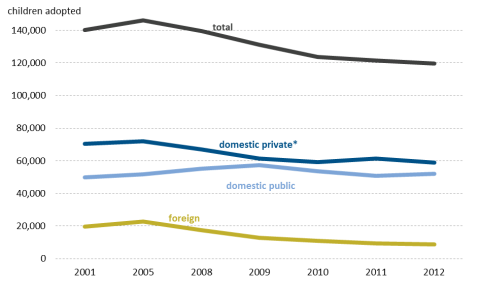

Data on adoption indicate that approximately 120,000 children were adopted in the United States in 2012. Of these adoptions, 44% where domestic public agency adoptions, 49% were domestic private adoptions (including stepchild adoptions), and 7% were international adoptions.7 These same data indicate that 49 per 100,000 adults became adoptive parents in 2012.8

Recent Trends in Number of Adoptions by Adoption Type

Overall, the total number of adoptions has fallen between 2001 and 2012 as illustrated in Figure 1, largely driven by a steep decline in foreign adoptions. The number of domestic public agency adoptions has been stable over the past decade, between approximately 50,000 and 57,000 children a year.9 The number of domestic private adoptions has fallen from about 70,000 per year in 2001 to 60,000 per year in 2012. (This figure includes stepchild adoptions, which do not qualify for adoption tax benefits. Notably, while data on the number of stepchild adoptions as a share of domestic private adoptions are unavailable, it is believed that they comprise a significant proportion of this type of adoption.)10 Finally, foreign adoptions have declined between 2001 and 2012 from approximately 20,000 per year to approximately 9,000 per year.

|

|

Source: HHS, Child Welfare Information Gateway, Trends in U.S. Adoptions: 2008-2012, https://www.childwelfare.gov/pubPDFs/adopted0812.pdf. Notes: * The number of domestic private adoptions includes domestic private adoptions (facilitated by private agencies, individuals, and attorneys), tribal adoptions, and stepparent adoptions. Stepparent adoptions do not qualify for adoption tax benefits. |

Costs of Adoption

Adoption costs vary widely, depending on the type of adoption and the particular circumstances of each adoption. However, the Department of Health and Human Services (HHS) has estimated cost ranges for different types of adoption as follows:

- Domestic public agency adoptions: $0 to $2,50011

- Domestic private adoptions: $15,000 to $45,00012

- Intercountry adoptions: $20,000 to $50,00013

Actual adoption costs may be higher depending on the particular circumstances of the adoption.

The Adoption Tax Credit

The adoption tax credit helps qualifying taxpayers offset some of the costs of adopting a child. Although the credit may be claimed for nearly all types of adoptions (excluding the adoption of a spouse's child), there are some special rules related to claiming the credit for intercountry adoptions and for adoption of children with special needs.

|

What Is the Difference Between a Credit and an Exclusion? A credit—like the adoption tax credit—reduces tax liability dollar for dollar of the value of the credit. So a taxpayer with a $5,000 tax liability and a $1,000 credit would have a net tax liability of $4,000. An exclusion—like the exclusion for employer-provided adoption assistance—reduces the amount of income subject to tax. So if the taxpayer earns $100,000, but $10,000 of it is excluded from income, for the purposes of taxation, their income is $90,000. The amount by which an exclusion reduces taxes owed is proportional to the taxpayer's top marginal tax rate. If they exclude $1,000 and are in the 10% bracket, the exclusion reduces tax liability by $100, while if the taxpayer is in the 35% bracket, their tax liability falls by $350. |

In 2018, taxpayers may be able to receive an adoption credit of up to $13,810 (this amount is annually adjusted for inflation). The credit is reduced for taxpayers with income14 over $207,140 and is phased out completely for taxpayers with more than $247,140 in income (these amounts are subject to annual inflation adjustment). The adoption credit is not refundable.15 However, the credit may be carried forward and claimed on future tax returns for up to five years after initially claimed. The eligibility rules and calculation of the credit are described in detail below.

Eligibility Requirements

Before calculating the credit the taxpayer can claim for a given year, the taxpayer must determine whether the child being adopted (or in the process of being adopted) is eligible, and the amount of qualifying expenses to which the credit can be applied.

Eligible Child

A taxpayer can only claim expenses related to the adoption of an eligible child.16 The term eligible child refers to children under age 18 and to older individuals who are physically or mentally incapable of taking care of themselves.17

Qualifying Expenses

Qualifying expenses must be directly related to the adoption of an eligible child. They include18

- reasonable and necessary adoption fees,

- court costs,

- attorney fees,

- travelling expenses while away from home (including amounts spent on meals and lodging), and

- other expenses directly related to and for the principal purposes of the legal adoption of an eligible child by the taxpayer (e.g., home study costs).19

Qualified adoption expenses do not include

- any expense for which a deduction or credit is allowed under any other provision of the tax code;

- funds for adoption expenses that are received under any federal, state, or local program;

- expenses incurred to carry out any surrogate parenting arrangement;

- expenses incurred in connection with adopting a spouse's child (i.e., a stepchild); or

- adoption expenses reimbursed under an employer program.

Taxpayers cannot claim a credit for expenses that violate federal or state law, are incurred in carrying out any surrogate parenting agreement, or are for the adoption of a child who is the child of the taxpayer's spouse, though they may be able to claim expenses for the adoption of a child of a domestic partner (see shaded textbox).20

Filing Requirements to Claim the Credit

To claim the adoption tax credit, a taxpayer must file IRS Form 8839 and include the name of the adopted child (if known), their age, and the child's taxpayer identification number (TIN). In most cases, the child's TIN is their Social Security number (SSN). However, in cases where the adopting parents do not have or cannot obtain the child's Social Security number, they may be able to use an adoption taxpayer identification number or ATIN.21 If the child's name, age, and TIN are not provided, the IRS may disallow the credit until additional information about the adopted child is provided by the taxpayer.

In addition, a married couple generally must file a joint tax return to claim the adoption tax credit.22 If two taxpayers who are registered domestic partners adopt a child together, they may split the qualified expenses and the resulting credit by mutual agreement, but the total amount of the credit that can be claimed for a given adopted child is still subject to the same limit ($13,810 in 2018).23

Timing of When Qualifying Expenses Can Be Claimed for Domestic vs. Foreign Adoptions

For domestic adoptions that are not yet finalized, taxpayers may claim qualifying expenses for the credit in the year following the year the expense is paid. This means that the taxpayer may claim the adoption tax credit for expenses paid even if a domestic adoption is never finalized.24 Expenses paid in the year an adoption is finalized can be claimed on that year's tax return. Expenses paid after an adoption is finalized can be claimed the year the payment is made.

In contrast, as illustrated in Table 1, some of these timing rules differ for adoptions of foreign children.25 Specifically, for adoptions of foreign children, any expenses paid before the adoption is finalized can only be claimed in the year the adoption is finalized. If a foreign adoption is never finalized, the taxpayer cannot apply any expenses connected to that adoption attempt toward the credit. As with domestic adoptions, expenses incurred after a foreign adoption is finalized can be claimed the year they are paid.

Table 1. When Expenses Can Be Used to Claim the Adoption Tax Credit for

Domestic and Foreign Adoptions

|

When Qualified Expenses |

When Taxpayer May Apply Expenses Toward the Credit |

|

|

Domestic Adoptions |

Foreign Adoptions |

|

|

Any year before the adoption is finalized |

The year after the year of payment (So expenses incurred in 2017 would be used to claim the credit on a 2018 tax year return.) |

Year adoption is finalized (So if the adoption was finalized in 2017, expenses incurred before 2017 could be used to claim the credit on a 2017 tax return.) If a foreign adoption is never finalized, the taxpayer cannot apply any expenses connected to that adoption attempt toward the credit. |

|

Year adoption is finalized |

Year adoption is finalized |

Year adoption is finalized |

|

Years after the year the adoption is finalized |

Year expenses are paid |

Year expenses are paid |

Source: IRC Section 23(a)(2) and IRC Section 23(e).

Calculating the Credit

In 2018, the maximum amount of the credit is $13,810 per child. The maximum adoption tax credit that can be claimed in a given year, per eligible child, is equal to the lesser of (1) qualifying adoption expenses that can be claimed in that year (see the discussion of timing in the preceding section) or (2) the maximum statutory amount of the credit per child. The maximum statutory amount is annually adjusted for inflation. If the child is a special needs child, the credit amount is always the maximum statutory amount per child, irrespective of the actual expenses incurred. (The definition of a "special needs" adoption is discussed subsequently.) The maximum aggregate amount of the adoption tax credit that the taxpayer can claim on their tax return equals the sum of the credit amounts for each eligible child.26

The maximum amount of the credit a taxpayer can claim in a given year may differ from the actual amount the taxpayer does claim in that year for two reasons:

- 1. Income Limitation: The maximum credit amount per adopted child (i.e., $13,810 in 2018) is reduced because the taxpayer's income is above the statutory income limitation (i.e., the maximum credit amount is phased down).

- 2. Nonrefundability/Carryforward: The taxpayer's tax liability is smaller than the amount of the credit the taxpayer can claim in a given year. Since the credit is nonrefundable, the amount of the credit actually claimed in a given year by definition cannot be greater than taxes owed. Hence, in cases where the calculated credit is greater than the taxpayer's tax liability, the actual credit he or she will be able to claim will be equal to their tax liability. For the purposes of the adoption tax credit, the value of the credit in excess of tax liability can be "carried forward" and claimed on future tax returns.

Theoretically, both limitations may apply to the same taxpayer. In practice, however, higher-income taxpayers will more likely be subject to the first limitation, while lower- and middle-income taxpayers are more likely to be subject to the second limitation. Notably, while nonrefundability of the credit limits the amount that can be claimed in a given year, a taxpayer may be able to recover the value of the credit on subsequent tax returns as a result of a five-year carryforward provision. Each of these limitations is discussed subsequently.

Income Limitation

The amount of the credit which can be claimed for each eligible child is reduced if a taxpayer's modified adjusted gross income (MAGI) is above a phaseout threshold.27 In 2018, this phaseout threshold equals $207,140. This threshold amount is adjusted annually for inflation. The credit amount phases down ratably (i.e., proportionally) if a taxpayer's income is between $207,140 and $247,140. Hence, if a taxpayer's income is $227,140—exactly the midpoint of the phaseout range—the amount of the tax credit is reduced by 50%. Similarly, if the taxpayer's income is $217,140—one-quarter of the phase out-range—the amount of the credit is reduced by 25%. Taxpayers with income $40,000 or more above the threshold—$247,140 in 2018—are ineligible for the credit. Notably, while the phaseout threshold is adjusted annually for inflation, the phaseout range of $40,000 is fixed and does not increase over time.

Nonrefundability/Carryforward

The adoption tax credit is a nonrefundable credit. Nonrefundable credits by definition cannot exceed taxes owed. Absent carryforward provisions for nonrefundable credits, credits in excess of tax liability are effectively forfeited by the taxpayer. In the case of the adoption tax credit, any excess of the credit above tax liability can be "carried forward" on subsequent tax returns for up to five years. In other words, depending on the amount of the tax credit the taxpayer is eligible for and his or her tax liability, a tax credit for an adoption first claimed on a 2018 tax return can be carried forward to a 2023 income tax return or until used, whichever comes first. While taxpayers benefit from being able to carry forward the unused credit, there are practical complexities to carrying a credit over several years. For example, taxpayers must keep track of when expenses are incurred and, if they carry forward a credit, how much they have claimed in previous years for a given adoption. The stylized example in Table A-1 in the appendix illustrates the potential complexity of claiming the adoption tax credit using the carryforward provision.

Rules for Special Needs Children

A taxpayer claiming the credit for the adoption of a special needs child is assumed to have incurred the maximum amount of qualifying expenses, regardless of the actual expenses incurred.

A special needs child for the purposes of the adoption tax credit (and exclusion) does not necessarily mean the child has a medical condition or a disability. Instead, for the purposes of these tax benefits, special needs adoptions are the adoptions of children whom the state child welfare agency considers difficult to place for adoption. (The definition of "special needs" for purposes of adoption tax benefits is largely the same as "special needs" for purposes of the federal adoption assistance program that is included in Title IV-E of the Social Security Act.)28

Most foster care adoptions (i.e., domestic public adoptions)—81.3%—are special needs adoptions, but few other adoptions are special needs adoptions.29 Specifically, a child is considered to have special needs if the child's state of residence determines that

- the child cannot or should not be returned to the birth parents' home;

- there is a specific factor or condition (e.g., age of child; child is member of sibling group seeking adoption together; child has medical, physical, or social-emotional disability; or child is member of a minority race/ethnicity)30 that leads to the reasonable conclusion that the child will not be adopted without assistance provided to the adoptive parents; and

- the child is a citizen or legal resident of the United States. (This last rule generally excludes any foreign adoptions from being considered special needs adoptions.)

Data on the Adoption Tax Credit

As shown in Table 2, 63,960 taxpayers—0.04% of all taxpayers—claimed the adoption tax credit in 2015. The average credit was $3,928, which was 29% of the maximum credit amount of $13,400 in 2015.

The largest share of adoption tax credit claimants—slightly less than one-third of adoption tax credit claimants—had adjusted gross income (AGI) between $100,000 and $200,000. Relatively few taxpayers with AGIs of more than $200,000 claimed the credit as a result of the credit phase out. (As previously discussed, in 2018 the credit amount phases down proportionally if a taxpayer's income is between $207,140 and $247,140.)

The greatest share of adoption tax credit dollars—approximately 60%—went to taxpayers with AGI between $100,000 and $200,000. In contrast, no taxpayers with adjusted gross income (AGI) under $30,000 claimed the credit. This likely reflects the nonrefundability of the credit, which results in taxpayers with little to no tax liability receiving little if any amount of the credit.

Table 2. Number of Taxpayers Claiming the Adoption Tax Credit and Total and Average Credit Amount, by AGI, 2015

|

Tax Returns with the Adoption Credit |

||||||

|

Adjusted Gross Income |

Share of All Tax Returns |

Number of Returns with Credit |

Share of Returns With Tax Credit |

Total Credit Dollars (millions $) |

Share of Credit Dollars |

Average Credit Amount per Return |

|

Under $30k |

43.8% |

0 |

0.0% |

$0.0 |

0.0% |

$0 |

|

$30k to under $50k |

17.6% |

17,133 |

26.8% |

$17.3 |

6.9% |

$1,010 |

|

$50k to under $75k |

13.3% |

15,093 |

23.6% |

$34.6 |

13.8% |

$2,295 |

|

$75k to under $100k |

8.5% |

10,007 |

15.6% |

$38.1 |

15.2% |

$3,805 |

|

$100k to under $200k |

12.3% |

20,327 |

31.8% |

$151.8 |

60.4% |

$7,469 |

|

$200k and over |

4.5% |

1,400 |

2.2% |

$9.4 |

3.7% |

$6,719 |

|

Total |

100% |

63,960 |

100% |

$251.2 |

100% |

$3,928 |

Source: Internal Revenue Service, Statistics of Income, Table 3.3.

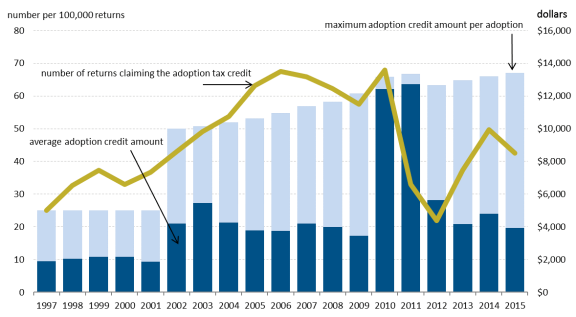

As illustrated in Figure 2, the number of taxpayers claiming the adoption tax credit each year generally increased between 1997 (when the credit was first in effect) and 2010, then decreased in 2011 and 2012, increased again in 2013 and 2014, and fell in 2015.

From 1997 to 2001, the average credit amount per taxpayer was roughly $2,000. This amount roughly doubled between 2002 and 2009 to about $4,000 and then grew significantly to over $11,000 between 2010 and 2011, subsequently falling again to an average of approximately $4,000 between 2012 and 2015.

The trends in adoption tax credit claims and the average credit amount per taxpayer illustrated in Figure 2 may have occurred for a variety of reasons. For example, these trends may be partly explained by legislative changes made to the credit. Some of the increase in claimants (and the average amount of the credit) between 2002 and 2009 in comparison to the period between 1997 and 2001 may be the result of legislative expansions of the credit. Under the Economic Growth and Tax Relief Reconciliation Act (EGTRRA; P.L. 107-16), the maximum amount of the credit was effectively doubled and the income level at which the credit phased out was also increased. The expanded phaseout range may have resulted in a larger average credit as well as more upper-income taxpayers being able to claim the credit.

Some trends—like the decline in the number of claims of the credit between 2006 and 2009—may also be explained by the decline in adoptions, especially of foreign children. Some data suggest that families that adopt foreign children are more likely to claim the adoption tax credit—and claim more dollars of the credit—than families that pursue other types of adoption, especially domestic public adoptions.31 Hence, the steep decline in foreign adoptions (see Figure 1), especially between 2006 and 2009, may have resulted in fewer taxpayers claiming the adoption tax credit in those years.

Some of the trends may also be a result of the "carryforward provision" of the credit. Up until 2010, the adoption tax credit was nonrefundable, but taxpayers could "carry forward" any unused credit for up to five years after initially claiming the credit. For example, if a taxpayer was eligible for a $12,000 adoption credit, but their tax liability was $2,000 every year, the taxpayer would claim $2,000 of the adoption credit initially and carry forward the remainder every year for five years. Indeed, as indicated in Figure 2, up until 2010, taxpayers claimed on average less than half of the maximum value of the credit. If these taxpayers were eligible for the maximum amount of the credit, they would need to carry forward the tax credit to future tax returns to claim the entire value of the credit. This may have resulted in the number of returns claiming the adoption steadily increasing until 2010: every year taxpayers who claimed the adoption tax credit would include first-time claimants as well as claims for previous years.

When the credit was made refundable in 2010, taxpayers could the claim entire amount of their 2010 credit and any carryover credit they had from previous years, virtually eliminating credits carried forward to 2011. This may explain the steep drop in the number of claimants in 2011, as compared to 2010, illustrated in Figure 2. Indeed, the number of taxpayers claiming the adoption credit appears to be more closely linked with the structure of the credit than the actual number of adoptions. For example, between 2000 and 2006, the number of taxpayers claiming the adoption tax credit steadily rose as illustrated in Figure 2, while the actual number of adoptions fell over the same time period, as illustrated in Figure 1. After the credit became nonrefundable again in 2012, the number of claimants of the credit began to increase, even though there is no evidence that the number of adoptions increased.

The Exclusion for Employer-Provided Adoption Assistance

Taxpayers whose employers offer qualifying adoption assistance programs as a fringe benefit may not have to pay income taxes on some or all of the value of this benefit.32 The maximum amount that can be excluded from the taxpayer's income is capped at a maximum amount per adoption which is the same maximum amount of the credit: $13,810 in 2018.

Since the exclusion reduces income subject to taxation, it reduces taxes in proportion to the taxpayer's tax bracket. For example, if a taxpayer receives $2,000 of excludible employer-provided adoption assistance and is in the 10% tax bracket, the exclusion results in $200 of avoided income taxes. If a taxpayer is in the 35% tax bracket, the same $2,000 exclusion is worth $700 in tax savings. (By contrast, the tax credit reduces tax liability dollar for dollar of the value of the credit. For example, if a taxpayer had $2,000 of qualifying adoption expenses and applied those expenses toward the adoption credit, he or she could receive a credit of $2,000, irrespective of the taxpayer's tax bracket.)

Taxpayers can claim the exclusion and the credit concurrently for the same adoption, but cannot claim both tax benefits for the same expenses. Hence, for one adoption, a taxpayer is eligible for up to $13,810 in tax-free employer-provided adoption assistance and a $13,810 adoption credit. (Taxpayers who claim both benefits for the same adoption must reduce the amount of qualified adoption expenses eligible for the credit by the amount of qualified adoption expenses excluded under an employer-provided adoption assistance plan.) Combined, the maximum value of these two tax benefits could equal up to $18,920 in reduced tax liability per adoption in 2018 depending on a taxpayer's expenses, income level, and availability of employer-sponsored adoption assistance program at their work.

In addition to having the same per-adoption maximum as the adoption tax credit, the exclusion for employer-provided adoption assistance is subject to the same income limitation (i.e., phaseout)33 and the same definitions of "qualified adoption expenses" and "eligible child." Similar rules that apply to special needs children for the credit also apply for the exclusion. In other words, if a taxpayer adopts a child with special needs and an employer has a qualified adoption assistance program, the taxpayer will be able to exclude up to $13,810 of income regardless of what the actual adoption expenses are and even if the taxpayer or the employer does not actually pay any qualified adoption expenses. The filing requirements for the exclusion are the same as for the credit. Finally, the same timing rules that apply to the adoption credit for domestic versus foreign adoption also apply to the exclusion. Thus, in order for the employer-provided adoption benefits to be excludable from income (and hence not taxable) for a foreign adoption, the amounts paid under the adoption assistance program must be paid either during or after the year the adoption becomes final (see Table 1).

Employer-provided adoption assistance programs are a separate employee benefit that must fulfill all of the following requirements to be excludable from an employee's income:

- 1. The employer must provide notice of the plan to eligible employees.

- 2. The plan must not discriminate in favor of highly compensated employees.34

- 3. Employees must provide reasonable substantiations of qualifying expenses.

As long as these requirements are met, employers generally have discretion over other aspects of these plans.

Administrative data from the IRS on the exclusion of employer-provided adoption assistance—comparable to the data on the adoption tax credit—are unavailable.

Legislative History of the Credit and Exclusion

Before the enactment of the adoption tax credit and exclusion for employer-provided adoption assistance in the mid-1990s, Congress enacted an itemized deduction for adoption expenses associated with the adoption of a special needs child as part of the Economic Recovery Tax Act of 1981 (P.L. 97-34).35 This deduction was repealed five years later by the Tax Reform Act of 1986 (P.L. 99-514).36 The Joint Committee on Taxation provided several reasons for the repeal of this tax benefit:

- Adoption assistance for special needs children was more appropriate through an expenditure program.

- The itemized deduction provided its greatest benefits to higher-income taxpayers who had less need for federal assistance for adoption.

- Agencies with expertise in adoption (i.e., not the IRS) should have budgetary control over adoption assistance.37

However, a decade later, Congress again enacted tax incentives designed to encourage adoptions. A summary of enacting legislation and major legislative changes is provided below. For brevity, laws that made technical corrections or minor changes are not discussed.38

The Small Business and Job Protection Act of 1996 (P.L. 104-188)

The Small Business and Job Protection Act of 1996 (P.L. 104-188) created an adoption tax credit and an exclusion for employer-provided adoption assistance that went into effect in 1997. Between 1997 and 2001, the adoption credit was available to special needs and non-special needs adoptions. As with the current credit, the amount of the credit equaled the amount of qualifying expenses up to a maximum credit amount. Under P.L. 104-188, the maximum amount of qualifying expenses that could be applied toward the credit was $5,000, or $6,000 for expenses associated with the adoption of a special needs child. The credit phased out proportionally for taxpayers with AGI between $75,000 and $115,000. (Neither the maximum amount of the credit nor the phaseout levels were annually adjusted for inflation under this law.) Qualifying adoption expenses, rules related to foreign adoptions, the five-year carryforward, the definition of a special needs adoption, and the definition of an eligible child were effectively the same as they are under current law. Notably, beginning in 2002, the credit would only be available for special needs adoptions. Effectively, the $5,000 credit available for adoptions that were not special needs adoptions was scheduled to expire at the end of 2001.

The law also enacted a temporary exclusion for employer-provided adoption assistance that went into effect beginning in 1997. The maximum amount of the exclusion, like the credit, was limited to $5,000, or $6,000 for special needs adoptions, and the amount that could be excluded phased out for taxpayers with AGI between $75,000 and $115,000. (Neither the maximum amount of the exclusion nor the phaseout levels were annually adjusted for inflation under this law.) As under current law, many terms and definitions of the exclusion were identical to those of the credit. The exclusion—for both non-special needs and special needs adoptions—was scheduled to expire at the end of 2001.

Advocates for these adoption tax incentives believed that these benefits would alleviate the financial barrier to adoption, and thus encourage more adoptions.39 In addition, it was reported at the time when the current tax benefits were enacted, at least eight House members had adopted one or more children and had personally experienced both the financial and bureaucratic burden of adopting.40

Congress seemed especially concerned with encouraging adoptions of children from the U.S. foster care system, children who for the purposes of adoption tax benefits are often categorized as "special needs." This may have been an important factor in creating a larger credit for special needs adoptions. As then-Representative Cardin stated:41

It is very costly in our system to adopt children. Many parents are not able to do that because of the costs. So the central part of this bill is to remove that financial burden, to reduce it significantly on the outset, to make it possible for more children to be adopted. Madam Speaker, I want to point out another feature of the bill, and that is special needs adoptions which are much more difficult children to place, that have disabilities, that are older, and it is more difficult to place these children in permanent adoption circumstances. This bill recognizes that and provides additional incentives for special needs adoption.

The Economic Growth and Tax Relief Reconciliation Act of 2001 (P.L. 107-16)

The Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA; P.L. 107-16) temporarily extended and expanded the adoption tax credit and the exclusion for employer-provided adoption assistance. Specifically, from 2002 through 2010, the law42

- extended the adoption credit for the adoption of children other than special needs children;

- increased the maximum credit and exclusion amount from $5,000 ($6,000 for a special needs child) to $10,000 per eligible child, including special needs children (this amount was adjusted annually for inflation);43

- provided that for the adoption of special needs children the credit and exclusion amount equal the maximum credit and exclusion amount ($10,000) regardless of actual expenses (this amount was adjusted annually for inflation occurring since 2002);44 and

- increased the income level at which the credit and exclusion phased out from $75,000 to $150,000 (these amounts were adjusted annually for inflation). Hence the credit phased out for taxpayers with income between $150,000 and $190,000.

According to the Joint Committee on Taxation, the credit and exclusion were extended because "Congress believed that the adoption credit and exclusion have been successful in reducing the after-tax cost of adoption to affected taxpayers."45 These benefits were increased because Congress noted that many taxpayers incurred expenses above the previous maximums of $5,000 and $6,000 for special needs adoptions. Ultimately, "Congress believed that increasing the size of both the adoption credit and exclusion and expanding the numbers of taxpayers who qualify for the tax benefits will encourage more adoptions and allow more families to afford adoption."46

The Patient Protection and Affordable Care Act (P.L. 111-148)

The Patient Protection and Affordable Care Act (ACA; P.L. 111-148) temporarily modified the adoption tax credit and exclusion for 2010 and 2011. Specifically, the law made the adoption tax credit refundable for these two years.47 The law also increased the maximum credit amount and exclusion amount from $10,000 to $13,170 in 2010 and subsequently adjusted for inflation in 2011.

Senator Nelson, speaking at a news conference concerning the modifications to the adoption tax credit included in the ACA, justified making the credit refundable as a way to encourage adoption among lower-income Americans who might not be able to afford adoption:48

... the adoption credit has been increased, and in addition to that, it's been made as a refundable tax credit so that lower-income people, adoption is getting more and more expensive. It's not like when I adopted, much more expensive. And this will mean that lower income people would have the opportunity for adoption, as well.

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (P.L. 111-312)

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (P.L. 111-312) extended the EGTRRA provisions for the credit and the exclusion through 2012, but allowed all the modifications made by the ACA to expire as scheduled at the end of 2011.

Hence the credit reverted to a $10,000 nonrefundable credit annually adjusted for inflation occurring since 2002. The maximum amount of the exclusion also reverted to $10,000 adjusted for inflation occurring since 2002.

The American Taxpayer Relief Act of 2012 (P.L. 112-240)

The American Taxpayer Relief Act of 2012 (ATRA; P.L. 112-240) made the EGTRRA modifications to the credit and exclusion permanent.

Policy Considerations

There are several ways economists evaluate tax benefits, including adoption tax benefits. Specifically, economists may assess whether adoption tax benefits encourage adoptions, the distribution of these benefits among taxpayers, and the complexity of administering the tax provision. These perspectives may be helpful to policymakers interested in analyzing or modifying adoption tax benefits and are discussed subsequently.

Do Adoption Tax Benefits Encourage Adoption?

Adoption is generally viewed as beneficial to all individuals involved in the process (adopted children, adopted parents, and birth parents) and society more broadly. Hence, many believe that adoption should be encouraged, including through federal policies like tax benefits. There is currently little evidence, however, that adoption tax benefits are an effective policy tool to increase adoptions.49 Although the amount of adoption tax benefits has increased over time (Figure 2), the actual number of children adopted has not (Figure 1). Current adoption tax benefits may simply be too small in comparison to the actual costs of adoption to encourage families to adopt, or a family's decision to adopt may not be heavily influenced by financial incentives, but instead may be influenced by more personal issues or beliefs. If adoption tax benefits do not lead to additional adoptions, they are considered economically inefficient by economists and are instead a windfall benefit to families that would have adopted even in the absence of these benefits.

Who Benefits from Adoption Tax Incentives?

Given that there is little evidence that adoption tax benefits encourage adoption, the fairness of these benefits may be of particular interest. As previously discussed, the vast majority of adoption tax benefits go to upper-income Americans,50 even though data suggest that a significant number of lower- and middle-income Americans adopt.51 In 2015, while half (50.4%) of adoption tax credit claimants had income under $75,000, these taxpayers received one-fifth of adoption credit dollars (20.7%), as illustrated in Table 2. The majority of adoption tax credit dollars (79.3%) went to taxpayers with income of $75,000 or more, with 60% of adoption tax credit dollars going to those with income between $100,000 and $200,000. While comparable data are not available for the exclusion of employer-provided adoption benefits, exclusions generally tend to provide the largest tax savings to those paying the highest marginal tax rates (i.e., upper-income taxpayers).

Under several economic definitions of "fairness," adoption tax benefits would be considered unfair (or inequitable). For example, the principle of vertical equity implies that taxpayers with greater income, and hence more economic resources, should pay more in tax. The principal of vertical equity underpins the progressive nature of the federal income tax code, where those with more income pay a greater share of that income in taxes through higher tax rates. Under the definition of vertical equity, adoption tax benefits which primarily benefit higher-income taxpayers would lessen the progressivity of the federal income tax and hence be inequitable.

Adoption tax benefits may also be considered inequitable under the definition of "horizontal equity." According to the principal of horizontal equity, similar taxpayers should pay a similar amount in taxes. Many economists consider taxpayers to be similar if they have similar levels of income.52 Hence, if two tax units earn $40,000 and both pay $8,000 in taxes, then the tax system is horizontally equitable. However, adoption tax benefits (like many tax preferences) can result in taxpayers with the same income paying different amounts in taxes, depending on their characteristics such as whether they own a home (the mortgage interest deduction), send a child to college (higher education tax benefits), or adopt (adoption tax benefits).

Challenges with Administering Adoption Tax Benefits

Recent evidence suggests that adoption tax benefits have been difficult for the IRS to administer to keep both erroneous benefit claims and taxpayer burden low. In 2012—when the IRS was processing mostly 2011 income tax returns and the adoption tax credit was refundable—they selected 69% of returns with adoption tax credit claims for audit. In most cases, these returns were selected because the IRS flagged the required adoption documentation as missing, invalid, or insufficient. However, after auditing these returns the IRS "disallowed $11 million—or one and one half percent—in adoption credit claims."53 One reason the IRS may have flagged such a large proportion of returns for audit—even when so few dollars of benefits were improperly claimed—was the IRS's lack of familiarity with adoption documentation. As the IRS Taxpayer Advocate (TAS) remarked,54

The documentation that certifies adoptions varies from state to state. A determination of whether a child is considered to have special needs is also a state-based decision. The result is a variety of documentation that may meet the requirements for the adoption credit. As we have seen with the Earned Income Tax Credit (EITC), when taxpayers are required to provide non-standardized documentation to establish eligibility, it often leads to problems for both taxpayer and the IRS.

The recent IRS challenges with administering the refundable adoption credit highlight fundamental challenges with having the IRS—which is focused on collecting revenue—administer a social policy like an adoption incentive.

Policy Options

Adoption tax benefits were originally enacted to encourage more adoptions, especially of American children in the foster care system. More recently Congress temporarily made the credit refundable for 2010 and 2011, expanding eligibility for the credit to lower- and middle-income taxpayers. Congress may in the future seek further modifications to the credit or exclusion for employer-provided adoption assistance to achieve certain policy goals. Some of these options are discussed below.

Replace the Current Tax Benefits with a Direct Spending Program

Given that there is little evidence that adoption tax benefits increase adoptions, Congress may be interested in eliminating these benefits and replacing them with direct spending on adoption, especially if it views a direct spending program as more effective at encouraging adoptions. Alternatively, Congress could eliminate adoption tax benefits and direct any additional revenue to deficit reduction.55

Make the Credit and Exclusion More Generous

Congress could modify the benefits in a variety of ways to make them larger. For example, they could increase the credit and exclusion percentage from 100% to 200% of qualifying expenses, doubling the amount of the credit and exclusion. Alternatively, Congress could increase (or eliminate) the current statutory cap on the value of the benefits ($13,810 in 2018), so that the tax benefits were closer to the actual adoption costs. While this would increase the value of adoption tax benefits for many taxpayers, it is still unclear if it would encourage more adoptions. While there is some evidence that the type of adoption is influenced by cost (i.e., families may pursue a domestic foster care adoption due to cost versus a more expensive international adoption), there is little evidence of any effect of adoption tax benefits on the decision to adopt. In addition, increasing the size of adoption tax benefits will increase the total cost of adoption tax benefits. Data from the IRS indicate that on 2015 tax returns, about $251 million worth of adoption tax credits were claimed. (Similar data for the exclusion are unavailable, although estimates from the Tax Policy Center suggest that the cost of the exclusion is small in comparison to the credit.)56

Make the Credit Refundable

Congress could choose to make the adoption tax credit refundable, so that taxpayers with little or no tax liability could claim the entire value of the credit in a given year. As previously discussed, under current law, the adoption tax credit is nonrefundable, meaning the value of the credit claimed in any year cannot exceed income taxes owed in that year. In effect, tax liability acts as a cap on the value of a nonrefundable tax credit. However, unlike other nonrefundable credits for individuals, the amount of the credit in excess of income taxes owed in a given year may be carried forward and claimed for up to five years after initially claimed. The adoption tax credit was temporarily refundable for two years—2010 and 2011—which may provide some insights into the benefits and costs of making this credit refundable.

Policymakers interested in expanding eligibility for the adoption tax credit to low- and middle-income taxpayers may consider making the adoption tax credit refundable. This would promote equity among taxpayers at different income levels who are able to adopt.

|

2011 (Refundable) |

||||

|

Adjusted Gross Income (AGI) |

Total |

Refundable Portion |

Non-refundable Portion |

2015 |

|

Under $30k |

24.6% |

24.6% |

0.0% |

0.0% |

|

$30k to under $50k |

11.6% |

10.9% |

0.8% |

6.9% |

|

$50k to under $75k |

21.3% |

17.8% |

3.5% |

13.8% |

|

$75k to under $100k |

8.7% |

4.7% |

4.0% |

15.2% |

|

$100k to under $200k |

33.1% |

10.2% |

22.9% |

60.4% |

|

$200k and over |

0.5% |

0.0% |

0.5% |

3.7% |

|

Total |

100.0% |

68.3% |

31.7% |

100.0% |

Source: Internal Revenue Service, Statistics of Income, Table 3.3.

Notes: The most recent year the adoption tax credit was refundable was 2011. Hence, in 2011 the taxpayer could receive the entire value of the credit, irrespective of tax liability. In 2015, the adoption tax credit was nonrefundable, meaning its value could not be greater than the taxpayer's income tax liability. Any amount of the credit in excess of tax liability in 2015 can be carried forward up to five years on future tax returns.

Making the credit refundable may also reduce taxpayers' compliance burden in claiming the credit and result in current claimants receiving the full value of the credit sooner, instead of carrying the credit forward for up to five years. As previously discussed and illustrated in Figure 2, when the adoption tax credit was nonrefundable, taxpayers on average claimed significantly less than the maximum amount of the credit. Given that adoption expenses tend to exceed the maximum credit amount, many of these taxpayers may have carried the adoption credit forward on subsequent tax returns. This would require diligent record keeping on the part of taxpayers until they had claimed the total credit amount or they had exhausted the five-year time limit of the carryforward, whichever came first. It would also mean that among those taxpayers who carried forward the credit, there could be a significant lag between when adoption expenses were incurred and when the credit for those expenses was actually claimed. For example, if a taxpayer incurred $10,000 in legal expenses in 2010 for a foreign adoption that was finalized in 2012, they could only begin claiming the credit on their 2012 income tax return, filed in early 2013. Depending on their tax liability, they could continue to carry forward the credit for those expenses until their 2017 tax return, a return filed generally in early 2018.

Finally, making the credit refundable could encourage the adoption of more children from the domestic foster care system, an often repeated goal of these tax benefits (see "Legislative History of the Credit and Exclusion"). Data indicate adoptions from foster care tend to account for a greater share of adoptions among low-income taxpayers—who would likely not be eligible for a nonrefundable credit—than higher-income taxpayers. One study found that "foster care adoptions accounted for about 10 percent of the adoptions completed by filers with incomes over $100,000, compared with more than 25 percent of the adoptions completed by filers with incomes below $50,000."57 The same study found that foster care adoption accounted for 29% of adoptions among taxpayers with income under $25,000, while overall foster care adoptions accounted for 18% of adoptions among all tax filers.

On the other hand, making the credit refundable could potentially increase compliance burdens on taxpayers claiming the credit as well as pose administrative challenges to the IRS. Insofar as policymakers remain concerned about the improper payments of refundable tax credits,58 they may seek ways to prevent taxpayers from either mistakenly or fraudulently claiming the adoption tax credit. Depending on the processes used to reduce improper payments, taxpayer burden could increase, as could administrative difficulties for the IRS. For example, when the adoption tax credit was temporarily refundable, the IRS required taxpayers claiming the credit to file a paper return (they could previously e-file), and include both IRS Form 8839 as well as specific adoption-related documentation, which varied based on whether the adoption was foreign or domestic, final or not final, and of a child with special needs or not.

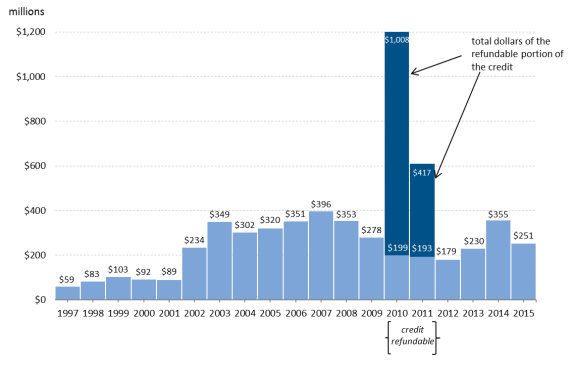

Finally, making the adoption tax credit refundable could increase the budgetary cost of the credit if no other modifications to the credit were made (like reducing the maximum credit amount). As illustrated in Figure 3, the total amount of the credit claimed in 2010 ($1.2 billion)—the first year the credit was refundable—and 2011 ($610 million) was nearly four times and two times, respectively, the average annual aggregate credit amount between 2002 and 2009 (approximately $325 million per year). Some of the increased cost in 2010 may have been a result of taxpayers with unused "carried forward" credit dollars claiming all of the remaining credit in 2010, as opposed to carrying it forward after 2010.59 Taken as a whole, the 2010 and 2011 data provide some indication as to the range of the cost of making the credit refundable with no alterations to the formula. Policymakers could also make the credit refundable and adjust the credit formula (and the phaseout income level) to reduce the budgetary cost of refundability.

|

Figure 3. Total Dollar Amount of Adoption Tax Credits Claimed, 1997-2015 |

|

|

Source: Internal Revenue Service, Statistics of Income, Individual Complete Report (Publication 1304), Table A and Table 3.3. |

Provide Parity Between Different Types of Adoptions for the Credit and Exclusion

As previously discussed, the legislative history indicates that Congress intended to provide the largest tax benefits to taxpayers adopting children from the U.S. foster care system. Insofar as this policy goal changes, Congress may modify adoption tax benefits to provide parity between different types of adoption. For example, if Congress was interested in encouraging more foreign adoptions, it could change the timing rules of foreign adoptions to be identical to domestic adoptions. Currently, taxpayers who adopt a child from abroad can only claim tax benefits once the adoption is finalized, unlike those who adopt domestically, who can claim benefits the year after expenses are incurred (see Table 1). In addition, Congress could modify the definition of "special needs adoption" to include children adopted through domestic private adoption or internationally, allowing more families to claim the maximum benefit regardless of actual expenses incurred.

Allow Adoptive Parents to Submit a Third-Party Affidavit to Verify an Adoption

As previously discussed, when the credit became refundable, the IRS required taxpayers to file a paper tax return with copies of adoption documentation. While this policy was intended to help the IRS verify adoption claims, the IRS, according to the Taxpayer Advocate, seemed unfamiliar with the enormous varieties of documentation, and flagged many returns erroneously for audit. One potential solution that Congress may consider is allowing taxpayers to use a standard third-party affidavit that allows the relevant adoption intermediary, be they a state or private agency, to attest to the adoption. This would also provide IRS examiners with one standardized document to verify, potentially reducing confusion among IRS examiners, and burden among taxpayers.

Convert the Exclusion for Employer-Provided Adoption Assistance into a Deduction

The exclusion for adoption assistance is only available to taxpayers whose employers provide adoption assistance benefits. One option to expand the availability of this benefit is to convert the exclusion into a deduction that could be claimed regardless of whether adoption assistance was provided as an employee benefit. For example, the exclusion could be converted to an "above-the-line" deduction available to all taxpayers regardless of whether they itemize their deductions or not. The same formula for the credit and income phaseouts could apply. While this policy change might expand the availability of this benefit, it would also likely increase the cost of the provision and complexity for taxpayers, who could now claim both a credit and deduction for their expenses. In addition, the value of the deduction in terms of tax savings—like the exclusion—depends on the taxpayer's tax bracket. A $5,000 deduction (or exclusion) can save a taxpayer up to $500 in the 10% tax bracket, but $1,750 if he or she is in the 35% bracket. In other words, deductions and exclusions tend to provide the greatest tax savings to the highest-income taxpayers.

Appendix A. Timing Rules and Carryforwards of the Adoption Credit

Below is an illustrative example of how a taxpayer who incurs $20,000 in adoption expenses would claim the adoption tax credit using the carryforward. For simplicity, this example is a domestic private adoption (i.e., not a special needs nor a foreign adoption). In addition it is assumed that the taxpayer's income is below the phaseout amount, so he or she can claim the maximum credit.

Table A-1. Calculating the Adoption Tax Credit for $20,000 of Adoption Expenses

Domestic Adoption Finalized in 2014

|

2012 |

2013 |

2014 |

2015 |

2016 |

|

|

Was the adoption finalized? |

No |

No |

Yes |

NA |

NA |

|

Maximum statutory credit amount |

$12,650 |

$12,970 |

$13,190 |

$13,400 |

$13,460 |

|

Maximum credit that can be claimed by the taxpayer based on credits claimed in prior years (statutory amount – credit already claimed for the adoption in previous years) |

Credit cannot be claimed this year |

$12,970 |

$10,190 ($13,190-$3,000) |

$7,400 ($13,400-$3,000 |

$3,460 ($13,460 |

|

Qualifying expenses incurred during the year |

$5,000 |

$15,000 |

$0 |

$0 |

$0 |

|

Expenses to claim the credit in a given year |

$ |

$0 |

|||

|

new expenses to claim the credit |

$0 |

$5,000 |

$15,000 |

$0 |

$0 |

|

expenses carried forward from previous years |

$0 |

$0 |

$2,000 |

$7,190 |

$3,190 |

|

total |

$0 |

$5,000 |

$17,000 |

$7,190 |

$3,190 |

|

Calculated amount of the credit (before tax liability) |

$0 |

$5,000 |

$10,190 |

$7,190 |

$3,190 |

|

Income Tax Liability |

$3,000 |

$3,000 |

$3,000 |

$4,000 |

$4,000 |

|

Amount of credit claimed |

$0 |

$3,000 |

$3,000 |

$4,000 |

$3,190 |

|

Amount of expenses that can be carried forward |

$0 |

$2,000 |

$7,190 |

$3,190 |

$0 |

In 2012, the taxpayer incurs $5,000 of expenses, but since the adoption is not finalized, the credit cannot be claimed on his or her 2012 income tax return. Instead, the taxpayer must wait to file a 2013 tax return to apply these expenses toward claiming the credit. (For domestic adoptions, if the adoption is not yet finalized, the expenses can be applied toward claiming the adoption tax credit the year after they are incurred.)

On a 2013 tax return, the taxpayer can apply expenses incurred in 2012 and claim up to a $5,000 tax credit for that year. However, in 2013 the taxpayer's income tax liability is $3,000, so the actual amount of the adoption tax credit the taxpayer can claim in 2013 is $3,000. The taxpayer can carry forward the difference of $2,000.

On the taxpayer's 2014 tax return, he or she can apply the $15,000 of expenses incurred in 2013 as well as the $2,000 in carried-forward expenses from the previous year, for a total of $17,000 of expenses. (The $15,000 of expenses incurred in 2014 can be claimed on the taxpayer's 2014 return because the adoption is finalized in 2014.) The maximum amount of the credit the taxpayer can claim in 2014 is $10,190 (the statutory maximum minus the $3,000 of credit already claimed). As a result of the $3,000 tax liability in 2014, the taxpayer will claim a $3,000 credit, and carry forward the difference of $7,190.

On a 2015 tax return, even though the taxpayer has incurred no additional expenses, he or she can apply the carried-forward expenses of $7,190 and continue to claim the credit. The maximum amount of the credit that can be claimed in 2015 is $7,400 (the statutory maximum minus the $6,000 of credit already claimed). However, in 2015 the taxpayer's income tax liability is $4,000, so the actual amount of the adoption tax credit the taxpayer can claim in 2015 is $4,000. The taxpayer can carry forward the difference of $3,190.

The taxpayer can apply the carried-forward expenses of $3,190 and continue to claim the credit on a tax return in 2016. The maximum amount of the credit that can be claimed in 2016 is $3,460 (the statutory maximum minus the $10,000 of credit already claimed). In 2016 the taxpayer's income tax liability is $4,000, so the actual amount of the adoption tax credit the taxpayer can claim in 2016 is $3,190. The taxpayer has no additional carryforward.