Introduction

The U.S. farm sector is vast and varied. It encompasses production activities related to traditional field crops (such as corn, soybeans, wheat, and cotton) and livestock and poultry products (including meat, dairy, and eggs), as well as fruits, tree nuts, and vegetables. In addition, U.S. agricultural output includes greenhouse and nursery products, forest products, custom work, machine hire, and other farm-related activities. The intensity and economic importance of each of these activities, as well as their underlying market structure and production processes, vary regionally based on the agro-climatic setting, market conditions, and other factors. As a result, farm income and rural economic conditions may vary substantially across the United States.

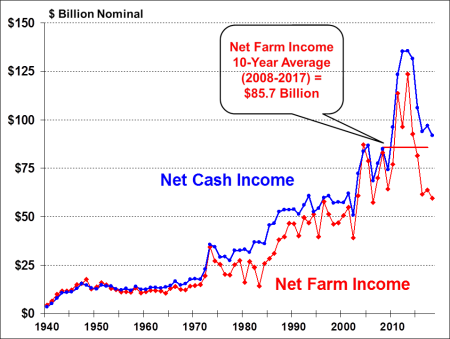

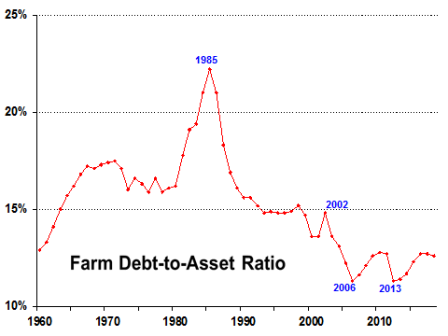

Annual U.S. net farm income is the single most watched indicator of farm sector well-being, as it captures and reflects the entirety of economic activity across the range of production processes, input expenses, and marketing conditions that have prevailed during a specific time period. When national net farm income is reported together with a measure of the national farm debt-to-asset ratio, the two summary statistics provide a quick and widely referenced indicator of the economic well-being of the national farm economy.

|

Measuring Farm Profitability Two different indicators measure farm profitability: net cash income and net farm income. Net cash income compares cash receipts to cash expenses. As such, it is a cash flow measure representing the funds that are available to farm operators to meet family living expenses and make debt payments. For example, crops that are produced and harvested but kept in on-farm storage are not counted in net cash income. Farm output must be sold before it is counted as part of the household's cash flow. Net farm income is a more comprehensive measure of farm profitability. It measures value of production indicating the farm operator's share of the net value added to the national economy within a calendar year independent of whether it is received in cash or noncash form. As a result, net farm income includes the value of home consumption, changes in inventories, capital replacement, and implicit rent and expenses related to the farm operator's dwelling that are not reflected in cash transactions. Thus, once a crop is grown and harvested, it is included in the farm's net income calculation, even if it remains in on-farm storage. Key Concepts

National versus State-Level Farm Household Data This report focuses singularly on aggregate national net farm income projections for 2018 as reported by the U.S. Department of Agriculture's (USDA) Economic Research Service (ERS).1 Aggregate data often hide or understate the tremendous diversity and regional variation that occurs across America's agricultural landscape. For insights into the differences in American agriculture, visit the ERS websites on "Farm Structure and Organization" and "Farm Household Well-being."2 |

USDA's 2018 Farm Income Forecast

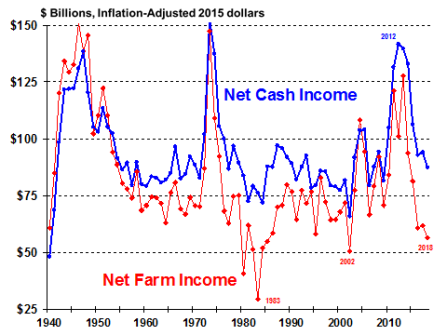

According to ERS, U.S. net farm income is forecast at $59.5 billion in 2018, down nearly 7% from last year (Table 1).3 The forecast decline in 2018 net farm income represents continued agriculture-sector economic weakness since 2013's record high of $123.8 billion. Abundant domestic and international supplies of grains and oilseeds suggest a fourth straight year of relatively weak commodity prices in 2018. The net farm income forecast for 2018 is substantially below the 10-year average of $85.7 billion (Figure 1). In inflation-adjusted dollars, the 2018 forecast is the lowest since 2002 (Figure 2). Net cash income is also projected lower in 2018 at $91.9 billion (-5.2%). Since the record highs of 2013, net farm income and net cash income have fallen by 52% and 32%, respectively (Figure 1).

Selected Highlights

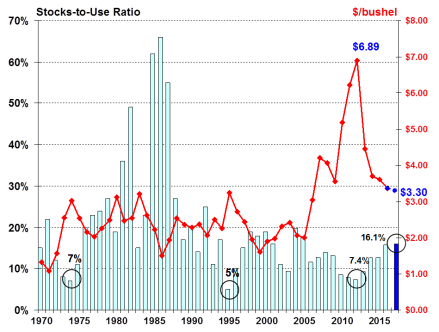

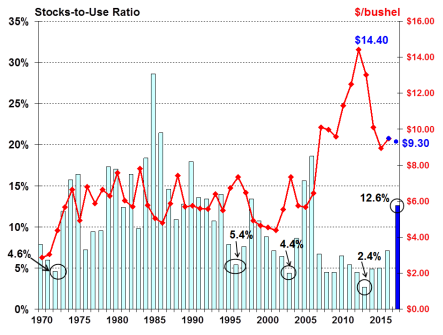

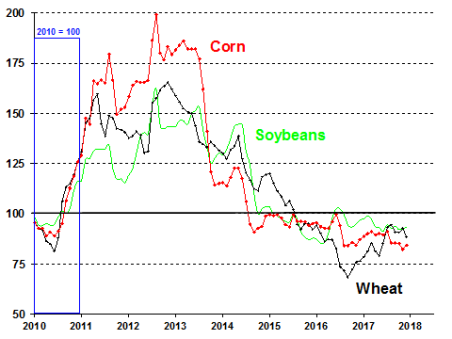

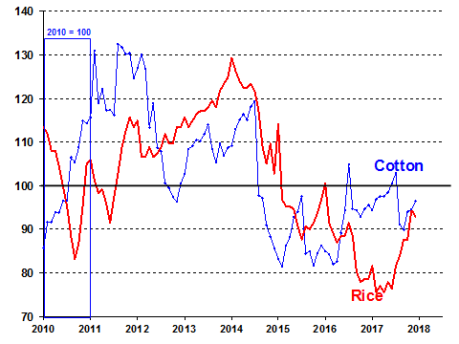

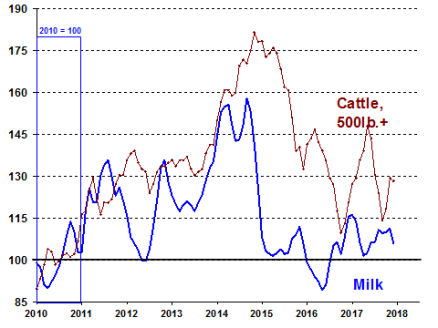

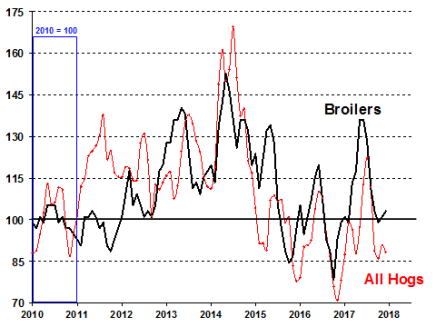

- Net cash income and net farm income are both forecast lower in 2018 relative to 2017, thus continuing a general downward trend in farm income since 2013—primarily the result of a significant decline in most farm commodity prices since the 2013-2014 period (Figure 29 to Figure 32).

- Farm prices for most feedstuffs (feed grains, hay, and wheat), oilseeds (Figure 11), and animal products (beef, pork, broilers, eggs, and milk; Figure 13) have declined substantially since 2013-2014 as U.S. and global grain and oilseed stocks and animal herds have rebuilt (Table 4).

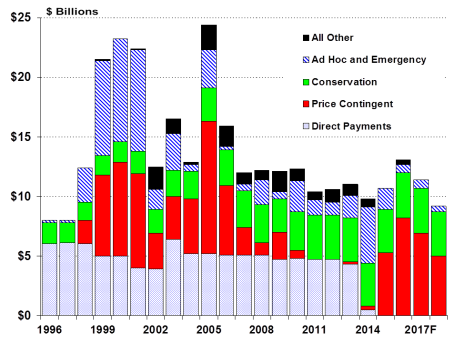

- Government payments in 2018 are projected down (-18.6%) from 2017 at $9.3 billion (Figure 14). Under the Agricultural Risk Coverage (ARC) program, several years of low farm prices have reduced the historical revenue guarantee and resulting payments, while payments under the Price Loss Coverage (PLC) program are projected lower due to slightly stronger rice and wheat farm prices, which would result in lower payments under that program.

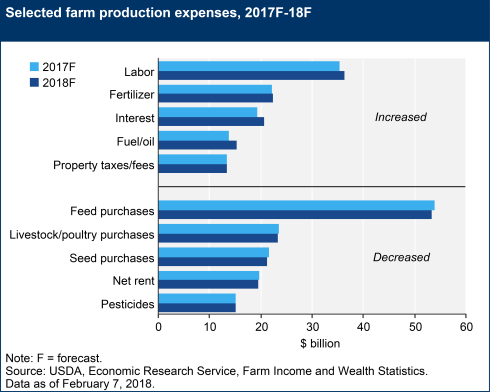

- Total production expenses for 2018 (Figure 15), at $359.2 billion, are projected up from 2017 (+1.0%), driven largely by fuel, electricity, labor, and interest costs.

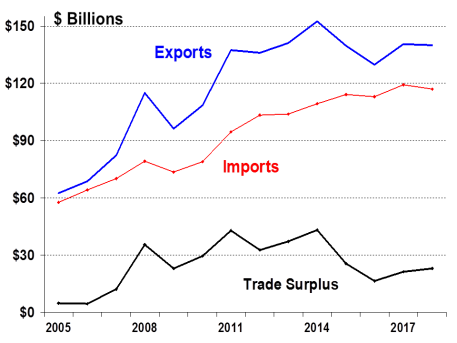

- Global demand for U.S. agricultural exports (Figure 19) is expected to repeat 2017's relatively strong value of $140 billion in 2018—still below the record of $152.3 billion set in 2014.4

- Farm asset values and debt levels are projected to be up slightly in 2018—asset values at $3,087 billion (+1.6%) and farm debt at $389 billion (+1.0%)—leaving the projected debt-to-asset ratio nearly unchanged at 12.6%, down slightly from 12.7% in 2017 (Figure 25).

|

|

Source: ERS, "2018 Farm Income Forecast," February 7, 2018. All values are nominal—that is, not adjusted for inflation. Values for 2018 are forecasts. |

|

Figure 2. Annual U.S. Farm Sector Inflation-Adjusted Income, 1940-2018 |

|

|

Source: ERS, "2018 Farm Income Forecast," February 7, 2018. All values are adjusted for inflation using the chain-type gross domestic product deflator, where 2015 = 100, Office of Management and Budget, Historical Tables, Table 10.1, https://www.whitehouse.gov/omb/budget/Historicals; 2018 is forecast. |

U.S. Agriculture: Wrap Up of 2017

Normal weather conditions prevailed in most U.S. growing regions, with the notable exception of Montana and the Dakotas, where severe drought impacted the small-grain crops. The north-central drought expanded in late summer into Idaho, Oregon, Washington, and parts of southern Iowa. As a result of the north-central drought, yield and output for spring-grown barley and wheat crops were significantly lower in the affected states. Overall, 2017 U.S. wheat production was down nearly 25% from 2016. This production shortfall, coupled with strong export demand for U.S. wheat, pushed the U.S. wheat farm price to $4.60 per bushel during the 2017-2018 crop year—an 18% increase over the previous year's $3.89 but still well below the $7.77 achieved in 2012. Reduced rainfall appears to have also lowered sorghum, oat, and forage-crop output in affected regions. However, the effect on the corn and soybean crops was minimal.

In January 2018, USDA reported 2017 fall winter wheat plantings at 32.7 million acres—the lowest level since 1909.5 The low winter wheat planted acres reflects poor profitability when compared with soybeans. U.S. soybean plantings have been steadily expanding out of the traditional Corn Belt—the fertile agricultural zone stretching from Ohio westward through Indiana, Illinois, Iowa, southern Minnesota, and northern Missouri to the eastern half of Nebraska and Kansas—and into the Central and Northern Plains. Many market analysts predict that U.S. soybean plantings in 2018 may exceed corn plantings for the first time in history.

Corn and soybeans are the two largest U.S. commercial crops in terms of both value and quantity. These crops provide important inputs for the domestic livestock, poultry, and biofuels sectors. In addition, the United States is traditionally one of the world's leading exporters of corn, soybeans, and soybean products—vegetable oil and meal. As a result, the outlook for these two crops is critical to both farm sector profitability and regional economic activity across large swaths of the United States as well as in international markets. For the past several years, U.S. corn and soybean crops have experienced remarkable growth in both productivity and output, thus helping to build stockpiles at the end of the marketing year (Figure 3 and Figure 4) and pressure prices lower in U.S. and international markets heading into 2018.

Planted acres for both feed grains6 (102.8 million acres) and wheat (46.0 million acres) were down in 2017 (-5.2% and -8.2%, respectively) from a year earlier. However, soybean-planted acres were estimated at a record 90.1 million (+8.0%), nearly matching corn planted acres at 90.2 million. The record soybean plantings coupled with the strong yield (49.1 bushels/acres) produced a record U.S. soybean harvest of 4.4 billion bushels in 2017. The record harvest is expected to pressure soybean farm prices lower to a projected $9.30 per bushel (-1.8%) for the 2017/18 marketing year.7 For corn, a record national average yield of 176.6 bushels/acre helped to produce the second largest U.S. corn harvest on record. The large corn supplies are expected to build ending stocks as a share of usage to 16.1% at the end of the 2017-2018 marketing year (August 30, 2018), thus pushing the expected market-year price down (-1.8%) to $3.30/bushel (bu.). The corn and soybean price forecasts for 2018 are the lowest since 2006 for both crops.

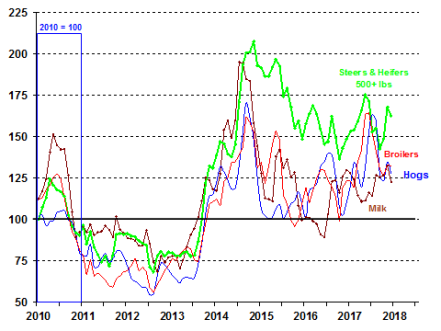

Livestock and poultry prices remained resilient during 2017 despite strong growth in meat output as strong demand growth and cheap feed grains helped maintain positive profit margins (Figure 7).

Early Crop Outlook for 2018

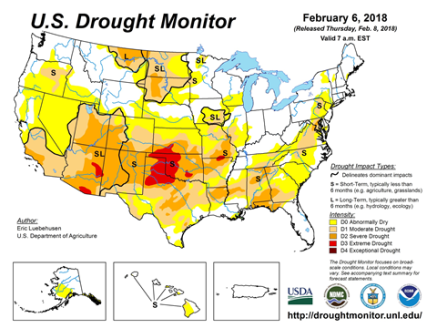

Heading into the 2018 spring planting period, USDA weather reports in early February indicate increasingly dry conditions across the southern tier of the United States and the northern plains. Such dry conditions are generating considerable concerns for producers with no or little access to irrigation (Figure 5).8 Much of U.S. cattle production occurs in the southern plains states, where the driest conditions currently persist. Dry pasture and range conditions tend to limit feeding choices and raise costs for ranchers in affected areas. Weather and growing conditions can change rapidly. Crop plantings for 2018 are expected to get into full swing by March in most southern states (weather and soil moisture permitting).

|

Figure 5. Drought Monitor Reveals Dry Conditions Across Much of United States |

|

|

Source: USDA, Office of the Chief Economist, Current U.S. Drought Monitor, February 6, 2018, http://droughtmonitor.unl.edu/data/jpg/current/current_usdm.jpg. |

Early Livestock Outlook for 2018

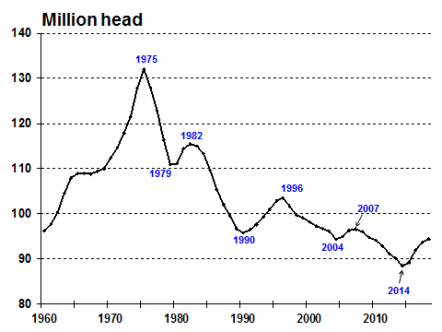

USDA's January Cattle report found that the U.S. cattle herd expansion, which has been growing since 2015, has slowed markedly but is still projected to grow through 2018.9 Similarly, U.S. hog and poultry flocks have been growing and are expected to continue to expand into 2018.10 Record profitability among cow-calf producers in 2014 coupled with then-improved forage conditions helped to set off the beef cow herd expansion (Figure 6).11 The continued cattle expansion through 2018—despite weakening profitability—is primarily the result of a substantial lag in the biological response to the strong market price signals of late 2014.

During the 2007-2014 period, high feed and forage prices plus widespread drought in the Southern Plains—the largest U.S. cattle production region—had resulted in an 8% contraction of the U.S. cattle inventory (Figure 6). Reduced beef supplies led to higher producer and consumer prices, which in turn triggered the slow rebuilding phase in the cattle cycle that started in 2014 (see the price-to-feed ratio for steers and heifers, Figure 7). The resulting continued expansion of beef supplies pressured market prices lower in 2016, but strong domestic and international demand across all meat categories—beef, pork, and poultry—helped support prices and profitability in 2017.

For 2018, increases in production of beef (+5.9%), pork (+5.1%), broilers (+2.3%), and eggs (+2.1%) are projected to expand relatively robustly. Fortunately for producers, USDA projects that combined domestic and export demand will continue to grow for red meat (+4.4%) and poultry (+2.2%), thus helping to support profit margins in 2018 (Table 4).

The changing conditions for the U.S. livestock sector may be tracked by the evolution of the ratios of livestock output prices to feed costs (Figure 7). A higher ratio suggests greater profitability for producers.12 The cattle-, hog-, and broiler-to-feed margins all moved upwards in the first half of 2017 before falling back in the last half of 2017.13 The hog and cattle sectors remain profitable. However, continued production growth of between 2% and 3% for red meat and poultry suggests that prices are vulnerable to weakness in demand.

Milk prices and the milk-to-feed ratio crept upwards in 2017, suggesting improving profitability. However, this result varies widely across the United States, with many small or marginally profitable producers facing continued financial difficulties. In addition, both U.S. and global milk production are projected to continue growing into 2018. As a result, milk prices could come under further pressure in 2018.

With respect to the federal milk margin protection program (MPP) instituted by the 2014 farm bill (Agricultural Act of 2014, P.L. 113-79), the formula-based milk-to-feed margin used to determine government payments is likely to remain above the $8.00 per hundredweight (cwt.) threshold needed to trigger payments (Figure 8).14 The MPP margin differs from the USDA-reported milk-to-feed ratio shown in Figure 7 but reflects the same market forces.

|

Figure 8. The MPP Margin Above $8/cwt. Heading into 2018 (National average farm price of milk less average feed costs per 100 lbs.) |

|

|

Source: NASS, Agricultural Prices, January 30, 2018; calculations by CRS. All values are nominal. Note: The margin equals the All Milk price minus a representative feed price based on the formula used by the MPP of the 2014 farm bill (P.L. 113-79). See CRS Report R43465, Dairy Provisions in the 2014 Farm Bill (P.L. 113-79). |

|

|

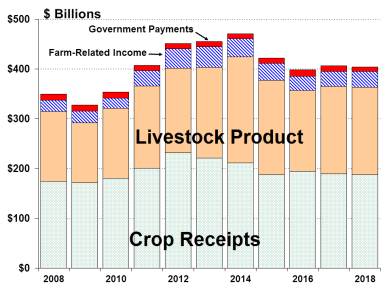

Source: ERS, "2018 Farm Income Forecast," February 7, 2018. All values are nominal. Values for 2018 are forecasts. Notes: Receipts from crop and livestock product sales, and government payments, are described in "Gross Cash Income Highlights". Farm-related income includes income from custom work, machine hire, agro-tourism, forest product sales, insurance indemnities, and cooperative patronage dividend fees. |

Gross Cash Income Highlights

Total farm sector gross cash income for 2018 is projected to be down (-0.5%) to $404.1 billion, driven by a decline (-0.5%) in the value of agricultural sector production (Figure 9), including small declines in crop (-0.8%) and livestock (-0.3%) output. An increase in projected farm-related income (+7%) is offset by sharply lower government payments (-18.6%) (Table 1).

Projected farm-sector revenue sources and revenue shares include crop revenues (47% of sector revenues), livestock receipts (43%), government payments (2%), and other farm-related income, including crop insurance indemnities, machine hire, and custom work (8%).

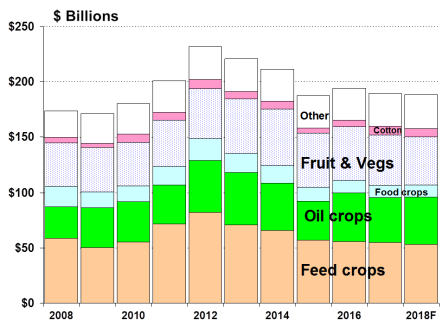

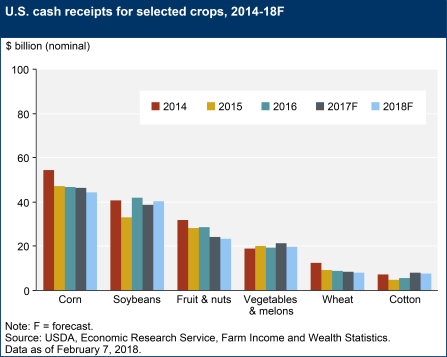

Crop Receipts

Total crop sales peaked in 2012 at $231.6 billion when a nationwide drought pushed commodity prices to record or near-record levels. In 2018, crop sales are projected at $188.2 billion, down slightly from 2017 (Figure 10). The crop sector includes 2018 projections (and percentage changes from 2017) for the following commodity groups:

- feed crops—corn, barley, oats, sorghum, and hay: $53.3 billion (-2.7%);

- oil crops—soybeans, peanuts, and other oilseeds: $42.9 billion (+4.4%);

- food grains—wheat and rice: $10.6 billion (-0.7%);

- fruits and nuts: $23.6 billion (-2.3%);

- vegetables and melons: $19.8 billion (-7.0%);

- cotton: $7.6 billion (-5.9%); and

- all other crops—including tobacco, sugar, greenhouse, and nursery crops: $29.0 billion (+2.3%).

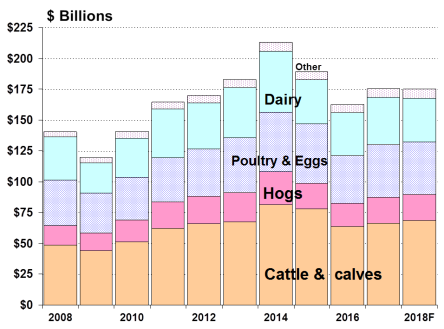

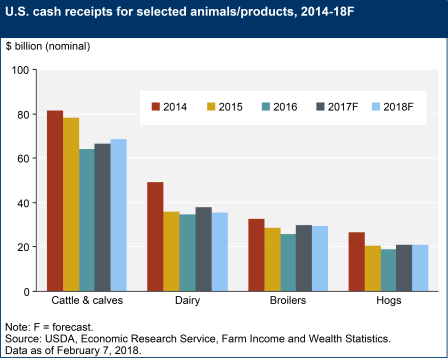

Livestock Receipts

The livestock sector includes cattle, hogs, sheep, poultry and eggs, dairy, and other minor activities. Cash receipts for the livestock sector grew steadily since 2009, peaking in 2014 at a record $212.8 billion. However, the sector turned downward in 2015 (-10.8%) and again in 2016 (-12.3%), driven largely by projected year-over-year price declines across major livestock categories (Table 4 and Figure 12). In 2017, livestock sector cash receipts recovered with year-to-year growth of 7.7% to $175.4 billion. In 2018, cash receipts for the livestock sector are projected down slightly at $174.9 billion (-0.3%). Highlights include 2018 projections (and percentage changes from 2017) for the following livestock groups:

- cattle and calf sales: $68.7 billion (+3.3%),

- hog sales: $21.0 billion (-0.4%),

- poultry and egg sales: $42.7 billion (-0.6%), and

- dairy sales, valued at $35.3 billion (-6.7%).

|

|

Source: ERS, "2018 Farm Income Forecast," February 7, 2018. All values are nominal. Values for 2018 are forecasts. |

|

|

Source: ERS, "2018 Farm Income Forecast," February 7, 2018. All values are nominal. Values for 2017 and 2018 are forecasts. |

|

Figure 12. U.S. Livestock Product Cash Receipts by Source, 2008-2018 |

|

|

Source: ERS, "2018 Farm Income Forecast," February 7, 2018. All values are nominal. Values for 2018 are forecasts. |

|

Figure 13. Cash Receipts for Selected Animal Products, 2014-2018 |

|

|

Source: ERS, "2018 Farm Income Forecast," February 7, 2018. All values are nominal. Values for 2017 and 2018 are forecasts. |

Government Payments

Government payments in 2018 are projected down at $9.3 billion (-18.6%) from 2017 due largely to projected lower payments of $5.0 billion in 2018 under the PLC and ARC revenue support programs for major field crops—down from $6.9 billion in 2017 (Figure 14).

ARC and PLC are new revenue support programs established by the 2014 farm bill (Agricultural Act of 2014; P.L. 113-79).15 The PLC program replaced the previous Counter-Cyclical Price (CCP) program but with a set of reference prices based on substantially higher support levels for most program crops. ARC relies on a five-year moving average price trigger in its payment calculation but also adopts the PLC reference price as the minimum guarantee in years when market prices fall below it. The ARC and PLC support levels are expected to trigger payments of $5 billion in 2018, as compared with $6.9 billion in 2017 and $8.2 billion in 2016.

Government payments of $9.3 billion would represent a relatively small share (2%) of projected gross cash income of $404.1 billion in 2018. In contrast, government payments are expected to represent 16% of the projected net farm income of $59.5 billion. However, the importance of government payments as a percent of net farm income varies nationally by crop and livestock sector and by region.

Payments under the price-contingent marketing loan benefit are forecast at $1 million in 2018, compared with $11.6 million in 2017 and $206 million in 2016, as program crop prices are expected to remain above most program loan rates through 2018 (Table 4). The 2014 farm bill eliminated farm fixed direct payments, whose decoupled payment rates were fixed in previous legislation.16 The MPP for dairy is expected to earn savings as producer premiums paid exceed federal MPP payments by $3 million in 2018.

Conservation programs include all conservation programs operated by USDA's Farm Service Agency and the Natural Resources Conservation Service that provide direct payments to producers. Estimated conservation payments of $3.7 billion are forecast for 2018, nearly unchanged from $3.8 billion in 2017.

Supplemental and ad-hoc disaster assistance payments are forecast at $504 million in 2018, a 28% decline from $699 million in 2017.17

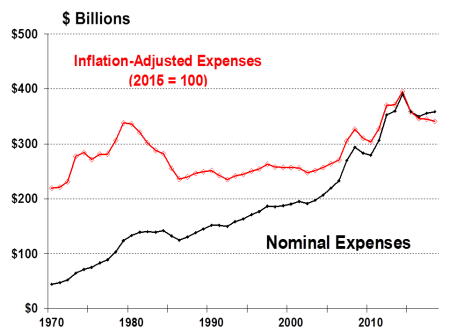

Production Expenses

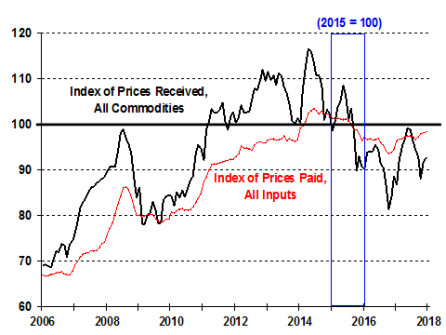

Total production expenses for 2018 for the U.S. agricultural sector are projected to be up (+1.0%) from 2017 in nominal dollars at $359.2 billion (Figure 15). A comparison of the indexes of prices paid versus prices received reveals that the prices received index generally declined from 2014 through 2016 before rebounding in 2017 (Figure 16). Farm input prices (as reflected by the prices paid index) showed a similar pattern but with a much smaller decline from their 2014 peak, thus suggesting that sector profit margins have been squeezed since 2014. The largest single production expense change projected for 2018 is non-real estate interest, which is projected to expand by 13.8%.

Production expenses will affect crop and livestock farms differently. The principal expenses for livestock farms are feed costs, purchases of feeder animals and poultry, and hired labor. Feed costs are projected to be down in 2018 (-1.3%). Replacement animal costs are also projected lower by 0.8% in 2018 (Figure 17). However, hired labor is projected up by 4.4%.

Projected changes to the principal crop expenses in 2018 are mixed: Fuel (+10.2%) and fertilizers (+1.1%) are projected up, while pesticides (-0.2%) and seed (-1.5%) are projected lower.

|

|

Source: ERS, "2018 Farm Income Forecast," February 7, 2018. Inflation-adjusted expenses are calculated using the chain-type GDP deflator, OMB, Historical Tables, Table 10.1. Amounts for 2018 are forecasts. |

|

Figure 17. Farm Production Expenses for Selected Items, 2017 and 2018 |

|

|

Source: ERS, "2018 Farm Income Forecast," February 7, 2018. All values are nominal. Values for 2017 and 2018 are forecasts. |

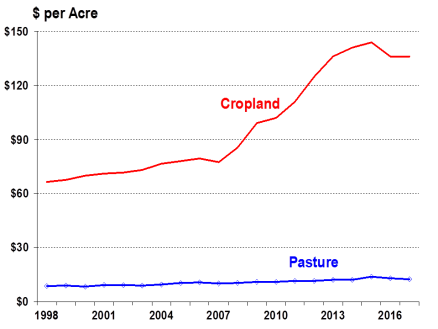

Cash Rental Rates

Renting or leasing land is a way for young or beginning farmers to enter agriculture without incurring debt associated with land purchases. It is also a means for existing farm operations to adjust production more quickly in response to changing market and production conditions while avoiding risks associated with land ownership. The share of rented farmland varies widely by region and production activity. However, for some farms it constitutes an important component of farm operating expenses. Since 2002, about 38% of agricultural land used in U.S. farming operations has been rented.18

Some farmland is rented from other farm operations—nationally about 8% of all land in farms in 2012 (the most recent year for which data are available)—and thus constitutes a source of income for some operator landlords. However, the majority of rented land in farms is rented from nonoperating landlords. Nationally in 2012, 30% of all land in farms was rented from someone other than a farm operator. Total net rent to nonoperator landlords is projected to be down slightly (-0.2%) at $16.3 billion in 2018.

Average cash rental rates for 2018 are not yet available. In 2017 rental rates—which were set the preceding fall of 2016 or in early spring of 2017—still reflected the high crop prices and large net returns of the preceding several years (especially the 2011-2014 period) and had yet to decline substantially (Figure 18). The national rental rate for crop land peaked at $144 per acre in 2015 and has been at $136 per acre for the past two years (2016-2017).19

|

Figure 18. U.S. Average Farm Land Cash Rental Rates Since 1998 |

|

|

Source: NASS, "Quick Stats," downloaded August 30, 2017. All values are nominal. |

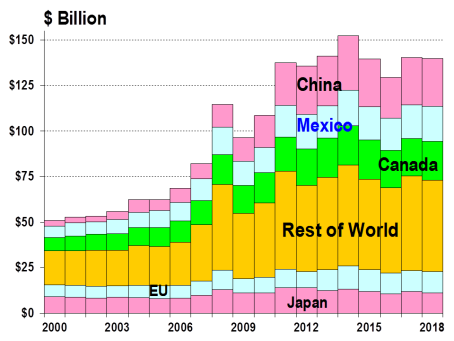

Agricultural Trade Outlook

U.S. agricultural exports have been a major contributor to farm income, especially since 2005. As a result, the downturn in those exports that followed 2014's peak of $152.3 billion both coincided with and deepened the downturn in farm income that started in FY2015. In general, since reaching $137.4 billion in FY2011, U.S. agricultural exports fluctuated and have been between $130 billion and $152 billion (Figure 19).

Key U.S. Agricultural Trade Highlights

- USDA projects U.S. agricultural exports at $140 billion in FY2018 (unchanged from 2017's total). This includes processed and unprocessed agricultural product exports.

- USDA also projects that U.S. agricultural imports will be lower at $117.0 billion (-2%), with a resulting agricultural trade surplus of $23.0 billion (+8%).

- The top three markets for U.S. agricultural exports are China, Canada, and Mexico, in that order. Together, these three countries are expected to account for $66.8 billion, or 48% of total U.S. agricultural exports in FY2018 (Figure 20).

|

Figure 19. U.S. Agricultural Trade Since 2005, Nominal Values |

|

|

Source: ERS, Outlook for U.S. Agricultural Trade, AES-102, November 30, 2017. Values for 2017 and 2018 are projections. |

- A substantial portion of the increase in U.S. agricultural exports since 2010 has also been due to higher-priced grain and feed shipments, record oilseed exports to China, and growing animal product exports to East Asia.

- The fourth- and fifth-largest U.S. export markets are the European Union and Japan, which are projected to account for a combined 16% of U.S. agricultural exports in FY2018 (Figure 20). However, these two markets have shown relatively limited growth in recent years when compared with the rest of the world.

- The "Rest of World" (ROW) component of U.S. agricultural trade—South and Central America, the Middle East, Africa, and Southeast Asia—has shown strong import growth in recent years. ROW is expected to account for 36% of U.S. agricultural exports in 2018.

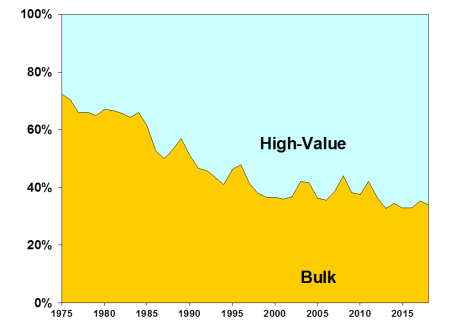

- Over the past four decades, U.S. agricultural exports have experienced fairly steady growth in shipments of high-value products (Figure 21). As grain and oilseed prices decline, so will the bulk value share of U.S. exports.

- Bulk commodity shipments (primarily wheat, rice, feed grains, soybeans, cotton, and unmanufactured tobacco) are forecast at a 34% share of total U.S. agricultural exports in 2018 at $47.5 billion, down 4% from 2017's $49.6 billion. This compares with an average share of over 60% during the 1970s and 1980s.

- In contrast, high-valued export products—including horticultural products, livestock, poultry, and dairy—are forecast at $92.5 billion (+2%), for a 66.1% share of U.S. agricultural exports in 2018.

|

Figure 21. U.S. Agricultural Trade: Bulk vs. High-Value Shares |

|

|

Source: ERS, Outlook for U.S. Agricultural Trade, AES-102, November 30, 2017. Percentages for FY2017 and FY2018 are projected. |

U.S. Farm and Manufactured Agricultural Product Export Shares

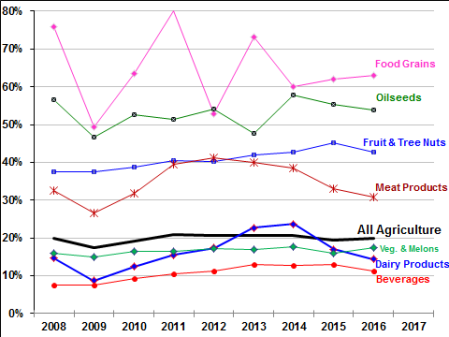

The share of agricultural production (based on value) sold outside the country indicates the level of U.S. agriculture's dependence on foreign markets, as well as the overall market for U.S. agricultural products.

|

The U.S. Export Share Measurement for Agriculture Because agricultural and food exports consist of farm commodities and their manufactured products, a substantial component of export value represents value-added from marketing and processing. This value-added must be accounted for in measuring the U.S. export share. With this in mind, ERS calculates the export value share for agriculture as follows.20 The numerator includes aggregated export values for all agricultural products—including bulk commodities and manufactured products. The denominator includes the total value of U.S. farm and manufactured agricultural production—estimated as the sum of farm cash receipts for crop and livestock production plus the value added by agricultural manufacturers. The value-added amount for agricultural processing is from the U.S. Census Bureau's Annual Survey of Manufacturers. |

As a share of total farm and manufactured agricultural production, U.S. exports are estimated to account for 19.8% of the overall market for agricultural products from 2008 through 2016—the most recent data year for this calculation (Figure 22). The export share of agricultural production varies significantly by product category.

- At the upper end of the range for export shares, the bulk food grain export share has varied between 50% and 80% since 2008, while the oilseed export share has ranged between 47% and 58%.

- Mid-spectrum range of export shares include the export share for fruit and tree nuts, which has ranged from 37% to 45%, while meat products have ranged from 27% to 41%.

- At the low end of the spectrum, the export share of vegetable and melon sales has ranged from 15% to 18%, the dairy products export share from 9% to 24%, and the agricultural-based beverage export share between 7% and 13%.

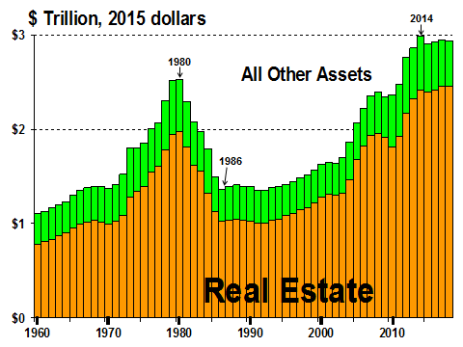

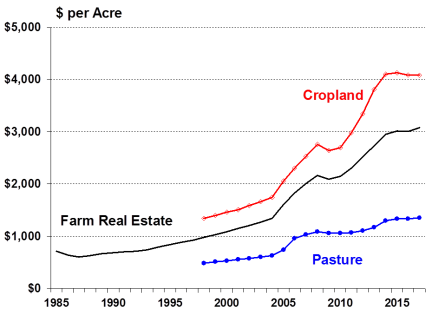

Farm Asset Values and Debt

The U.S. farm income and asset-value situation and outlook suggest a relatively stable financial position heading into 2018 for the agriculture sector as a whole—but with considerable uncertainty regarding the downward outlook for prices and market conditions for the sector and an increasing dependency on international markets to absorb domestic surpluses:

- Farm asset values—which reflect farm investors' and lenders' expectations about long-term profitability of farm sector investments—are projected to be up 1.6% in 2018 to a nominal $3,087 billion (Table 3). In inflation-adjusted terms (using 2015 dollars), farm asset values peaked in 2014 (Figure 23).

- Nominally higher farm asset values are expected in 2018 due to strength in real estate values (+2.1%) as well as a slight increase in non-real estate values (+0.6%). Real estate traditionally accounts for the bulk of the total value of farm sector assets—nearly an 81% share.

- Crop land values are closely linked to commodity prices. The leveling off of crop land values in 2017 reflects mixed forecasts for commodity prices (corn, soybeans, and cotton lower; wheat, rice, and livestock products higher) and the uncertainty associated with international commodity markets (Figure 24).

- Total farm debt is forecast to rise to $388.9 billion in 2018 (+1.0%) (Table 3).

- Farm equity (or net worth, defined as asset value minus debt) is projected to be up 1.6% at $2,698 billion in 2018 (Table 3).

- The farm debt-to-asset ratio is forecast to be down slightly in 2018 at 12.6%, a relatively low value by historical standards (Figure 25).

|

Measuring Farm Wealth: The Debt-to-Asset Ratio A useful measure of the farm sector's financial wherewithal is farm sector net worth as measured by farm assets minus farm debt. A summary statistic that captures this relationship is the debt-to-asset ratio. Farm assets include both physical and financial farm assets. Physical assets include land, buildings, farm equipment, on-farm inventories of crops and livestock, and other miscellaneous farm assets. Financial assets include cash, bank accounts, and investments such as stocks and bonds. Farm debt includes both business and consumer debt linked to real estate and non-real estate assets (e.g., financial assets, inventories of agricultural products, and the value of machinery and motor vehicles) of the farm sector. The debt-to-asset ratio compares the farm sector's outstanding debt related to farm operations relative to the value of the sector's aggregate assets. Change in the debt-to-asset ratio is a critical barometer of the farm sector's financial performance, with lower values indicating greater financial resiliency. A lower debt-to-asset ratio suggests that the sector is better able to withstand short-term increases in debt related to interest rate fluctuations or changes in the revenue stream related to lower output prices, higher input prices, or production shortfalls. The largest single component in a typical farmer's investment portfolio is farmland. As a result, real estate values affect the financial well-being of agricultural producers and serve as the principal source of collateral for farm loans. |

|

|

Source: NASS, Land Values 2017 Summary, August 2017. Notes: Farm real estate value measures the value of all land and buildings on farms. Cropland and pasture values are available only since 1998. All values are nominal. |

|

|

Source: ERS, "2018 Farm Income Forecast," February 7, 2018. Values for 2018 are forecasts. |

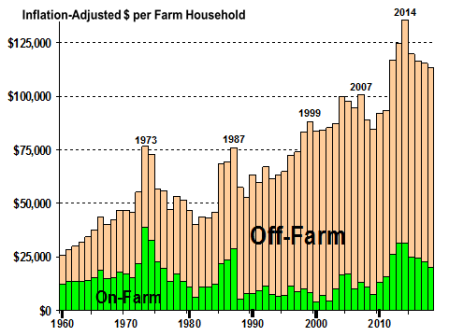

Average Farm Household Income

Farm household wealth is derived from a variety of sources.21 A farm can have both an on-farm and an off-farm component to its balance sheet of assets and debt. Thus, the well-being of farm operator households is not equivalent to the financial performance of the farm sector or of farm businesses because of the inclusion of other stakeholders in farming—including landlords and contractors—and because farm operator households often have nonfarm investments, jobs, and other links to the nonfarm economy.

On-Farm vs. Off-Farm Income Shares

Average farm household income (sum of on- and off-farm income) is projected at $119,252 in 2018 (Table 2), down slightly (-0.3%) from 2017 and below the record of $134,164 in 2014. About 18% ($21,230) of total farm household income is from farm production activities, and the remaining 82% ($98,122) is earned off the farm (including financial investments). The share of farm income derived from off-farm sources had increased steadily for decades but peaked at about 95% in 2000 (Figure 26).

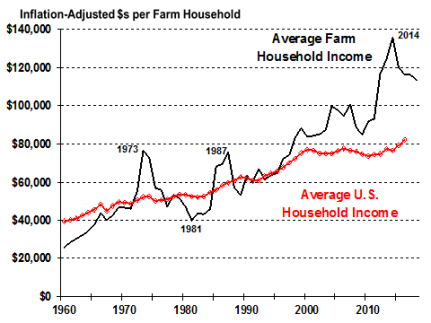

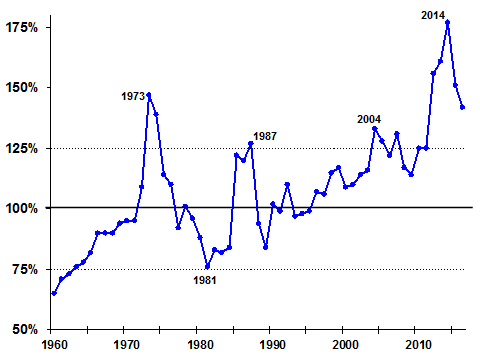

U.S. Total vs. Farm Household Average Income

- Since the late 1990s, farm household incomes have surged ahead of average U.S. household incomes (Figure 27 and Figure 28).

- In 2016 (the last year for which comparable data were available), the average farm household income of $117,918 was about 42% higher than the average U.S. household income of $83,143 (Table 2).

|

Figure 28. Ratio of Average U.S. Farm to National Household Income |

|

|

Source: ERS, "2018 Farm Income Forecast," February 7, 2018. The year 2016 is the last year with comparable data. |

USDA Monthly Farm Prices Received Charts

The following set of four charts (Figure 29 to Figure 32) presents USDA data on monthly farm prices received for several major farm commodities—corn, soybeans, wheat, upland cotton, rice, milk, cattle, hogs, and chickens. The data is presented in an indexed format where monthly price data for year 2010 = 100 to facilitate comparisons.

USDA Farm Income Data Tables

Three tables at the end of this report (Table 1 to Table 3) present aggregate farm income variables that summarize the financial situation of U.S. agriculture. In addition, Table 4 presents the annual average farm price received for several major commodities, including the USDA forecast for the 2016-2017 marketing year.

|

Item |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018a |

Change (%)a |

||||||||||||||||||

|

1. Cash receipts |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Cropsb |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Livestock |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

2. Government paymentsc |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Fixed direct paymentsd |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

CCP-PLC-ARCe |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Marketing loan benefitsf |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Conservation |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Ad hoc and emergencyg |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

All otherh |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

3. Farm-related incomei |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

4. Gross cash income (1+2+3) |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

5. Cash expensesj |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

6. NET CASH INCOME |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

7. Total gross revenuesk |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

8. Total production expensesl |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

9. NET FARM INCOME |

|

|

|

|

|

|

|

|

|

Source: ERS, Farm Income and Wealth Statistics; U.S. and State Farm Income and Wealth Statistics, updated as of February 7, 2018.

a. Data for 2018 are USDA forecasts. Change represents year-to-year projected change between 2017 and 2018.

b. Includes Commodity Credit Corporation loans under the farm commodity support program.

c. Government payments reflect payments made directly to all recipients in the farm sector, including landlords. The nonoperator landlords' share is offset by its inclusion in rental expenses paid to these landlords and thus is not reflected in net farm income or net cash income.

d. Direct payments include production flexibility payments of the 1996 Farm Act through 2001 and fixed direct payments under the 2002 Farm Act since 2002.

e. CCP = counter-cyclical payments. PLC = Price Loss Coverage. ARC = Agricultural Risk Coverage.

f. Includes loan deficiency payments, marketing loan gains, and commodity certificate exchange gains.

g. Includes payments made under the ACRE program, which was eliminated by the 2014 farm bill (P.L. 113-79).

h. Cotton ginning cost-share, biomass crop assistance program, milk income loss, tobacco transition, and other miscellaneous program payments.

i. Income from custom work, machine hire, agri-tourism, forest product sales, and other farm sources.

j. Excludes depreciation and perquisites to hired labor.

k. Gross cash income plus inventory adjustments, the value of home consumption, and the imputed rental value of operator dwellings.

l. Cash expenses plus depreciation and perquisites to hired labor.

|

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|||||||||

|

Average U.S. farm income by source |

|

|

|

|

|

|

|

|

||||||||

|

On-farm income |

|

|

|

|

|

|

|

|

||||||||

|

Off-farm income |

|

|

|

|

|

|

|

|

||||||||

|

Total farm income |

|

|

|

|

|

|

|

|

||||||||

|

Average U.S. household income |

|

|

|

|

|

|

NA |

NA |

||||||||

|

Farm household income as share of U.S. avg. household income (%) |

|

156% |

|

177% |

151% |

142% |

NA |

NA |

Source: ERS, Farm Household Income and Characteristics, principal farm operator household finances, data set updated as of February 7, 2018, http://www.ers.usda.gov/data-products/farm-household-income-and-characteristics.aspx.

Note: NA = not available. Data for 2017 and 2018 are USDA forecasts.

|

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|||||||||||||||||

|

Farm assets |

|

|

|

|

|

|

|

|

||||||||||||||||

|

Farm debt |

|

|

|

|

|

|

|

|

||||||||||||||||

|

Farm equity |

|

|

|

|

|

|

|

|

||||||||||||||||

|

Debt-to-asset ratio (%) |

|

|

|

|

|

|

|

|

Source: ERS, Farm Income and Wealth Statistics; U.S. and State Farm Income and Wealth Statistics, updated as of February 7, 2018, http://www.ers.usda.gov/data-products/farm-income-and-wealth-statistics.aspx.

Note: Data for 2017 and 2018 are USDA forecasts.

|

Commoditya |

Unit |

Year |

2012-2013 |

2013-2014 |

2014-2015 |

2015-2016 |

2016-2017 |

2017-2018b |

% Chgc from 2016-2017 |

2018-2019b |

% Chgd from 2017-2018 |

Loan Ratee |

Refer-ence Price |

|

Wheat |

$/bu |

Jun-May |

7.77 |

6.87 |

5.99 |

4.89 |

3.89 |

4.55-4.65 |

18.3% |

— |

— |

2.94 |

5.50 |

|

Corn |

$/bu |

Sep-Aug |

6.89 |

4.46 |

3.70 |

3.61 |

3.36 |

3.05-3.55 |

-1.8% |

— |

— |

1.95 |

3.70 |

|

Sorghum |

$/bu |

Sep-Aug |

6.33 |

4.28 |

4.03 |

3.31 |

2.79 |

2.90-3.40 |

12.9% |

— |

— |

1.95 |

3.95 |

|

Barley |

$/bu |

Jun-May |

6.43 |

6.06 |

5.30 |

5.52 |

4.96 |

4.15-4.75 |

-10.3% |

— |

— |

1.95 |

4.95 |

|

Oats |

$/bu |

Jun-May |

3.89 |

3.75 |

3.21 |

2.12 |

2.06 |

2.50-2.70 |

26.2% |

— |

— |

1.39 |

2.40 |

|

Rice |

$/cwt |

Aug-Jul |

15.10 |

16.30 |

13.40 |

12.10 |

10.40 |

12.10-12.90 |

20.2% |

— |

— |

6.50 |

14.00 |

|

Soybeans |

$/bu |

Sep-Aug |

14.40 |

13.00 |

10.10 |

8.95 |

9.47 |

8.90-9.70 |

-1.8% |

— |

— |

5.00 |

8.40 |

|

Soybean Oil |

¢/lb |

Oct-Sep |

47.13 |

38.23 |

31.60 |

29.86 |

32.48 |

31.0-34.0 |

0.1% |

— |

— |

— |

— |

|

Soybean Meal |

$/st |

Oct-Sep |

468.11 |

489.94 |

368.49 |

324.6 |

315 |

305-335 |

1.6% |

— |

— |

— |

— |

|

Cotton, Upland |

¢/lb |

Aug-Jul |

72.5 |

77.9 |

61.3 |

61.2 |

68 |

67-71 |

1.5% |

— |

— |

45-52 |

none |

|

Choice Steers |

$/cwt |

Jan-Dec |

122.86 |

125.89 |

154.56 |

148.12 |

120.86 |

121.52 |

0.5% |

116-123 |

-1.7% |

— |

— |

|

Barrows/Gilts |

$/cwt |

Jan-Dec |

60.88 |

64.05 |

76.03 |

50.23 |

46.16 |

50.48 |

9.4% |

47-49 |

-4.9% |

— |

— |

|

Broilers |

¢/lb |

Jan-Dec |

86.6 |

99.7 |

104.90 |

90.5 |

84.3 |

93.5 |

10.9% |

88-94 |

-2.7% |

— |

— |

|

Eggs |

¢/doz |

Jan-Dec |

117.4 |

124.7 |

142.3 |

181.8 |

85.7 |

100.9 |

17.7% |

114-121 |

16.5% |

— |

— |

|

Milk |

$/cwt |

Jan-Dec |

18.53 |

20.05 |

23.97 |

17.12 |

16.30 |

17.63 |

8.2% |

15.70-16.40 |

-9.0% |

— |

— |

Source: Various USDA agency sources as described in the notes below. bu = bushels, cwt = 100 pounds, lb = pound, st = short ton (2,000 pounds), doz = dozen.

a. Price for grains and oilseeds are from NASS, Agricultural Prices. Calendar year data are for the first year. For example, 2017-2018 = 2017.—= no value, and USDA's out-year 2017-2018 crop price forecasts will first appear in the May 2018 WASDE. Soybean and livestock product prices are from USDA, Agricultural Marketing Service: soybean oil—Decatur, IL, cash price, simple average crude; soybean meal—Decatur, IL, cash price, simple average 48% protein; choice steers—Nebraska, direct 1,100-1,300 lbs.; barrows/gilts—national base, live equivalent 51%-52% lean; broilers—wholesale, 12-city average; eggs—Grade A, New York, volume buyers; and milk—simple average of prices received by farmers for all milk.

b. Data for 2017-2018 are USDA forecasts. Data for 2018-2019 are USDA projections.

c. Percent change from 2016-2017, calculated using the difference from the midpoint of the range for 2017-2018 with the estimate for 2016-2017.

d. Percent change from 2017-2018, calculated using the difference from the midpoint of the range for 2018-2019 with the estimate for 2017-2018.

e. Loan rate and reference prices are for the 2017-2018 market year. See CRS Report R43076, The 2014 Farm Bill (P.L. 113-79): Summary and Side-by-Side.