Introduction

Banks differ from each other across numerous aspects of their business models, including balance sheet size, breadth of products and services offered, funding sources, and risk appetite, among others.1 Policymakers and experts generally agree that bank regulation should be tailored to account for these differences between institutions.2 As result, regulations are generally applied to banks based on meeting or not meeting some criteria. These criteria are established on an ad hoc basis, and are often (but not always) based on whether the bank is above or below a certain asset size threshold, such as $1 billion, $10 billion, or $50 billion in total assets. To what degree the application of regulation should vary and how those variations should be designed and implemented are debated issues. These issues have been prominent in recent years at least in part because legislative and regulatory responses to the financial crisis—such as the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank; P.L. 111-203) and the international agreement known as Basel III Accord3—have amended or introduced a number of regulations that include tailoring criteria.

Bank regulation aims to achieve certain potential benefits (e.g., better-managed risks, increased consumer protection, greater systemic stability) that justify potential costs of the regulation (e.g., reduced credit availability for certain consumers and businesses, slower economic growth over some period of time).4 The size of the realized benefits and costs of a regulation for any individual bank or group of banks are likely to depend in part on certain characteristics of that bank or group, such as willingness to take on risk, systemic importance, and ability to absorb compliance costs. Thus, appropriately fitting regulation to banks of different types is an important component of designing effective and efficient regulation. For illustrative purposes, consider the following simplified example. A regulation aimed at reducing systemic risk may produce greater benefit when applied to a very large, complex, globally active and interconnected institution than when applied to a single-branch institution making residential and farm loans in a rural community. In addition, the large institution may have more resources to comply with the regulation.

Achieving appropriate tailoring for thousands of diverse banks is more difficult than laid out in the stylized example above. Determining which banks should be regulated similarly to each other, differently from others, and how regulation should differ between groups varies from regulation to regulation. For example, the Dodd-Frank mandates enhanced prudential regulation for bank holding companies (BHCs) with more than $50 billion in assets and assigns primary consumer compliance supervision of banks with more than $10 billion to the Consumer Financial Protection Bureau (CFPB).5 U.S. regulators have created classifications—largely in adherence to Basel III—designating some large BHCs as advanced approaches banks and globally systemically important banks, subjecting them to stricter capital and liquidity requirements.6 Classifications are also in place for small banks. For example, certain banks with less than $1 billion are subject to less frequent examinations, and BHCs below that threshold are exempt from certain requirements involving mergers and capital ratios.7 In addition, a popular, but unofficial, terminology—which includes terms such as community bank and Wall Street—is used during debate related to bank regulation.

An exhaustive examination of all classifications and thresholds and dimensions across which these various types of banks differ is beyond the scope of this report. Instead, this report examines selected classifications of banks, briefly discusses selected legislation that would amend the existing tailoring system, and analyzes three selected characteristics (size, business activities, and reliance on capital funding) across which banking organizations may measurably differ.

Classifications of Banks

A potential source of confusion in the debate over tailored regulation is the diversity of both popular terminology describing banks and official statutory and regulatory classifications. Many people conceptually understand ways in which banks differ, and terms that are not specifically or universally defined have developed to describe those popularly understood concepts.8 Meanwhile, policymakers and regulators must develop specific classification criteria for the practical application of regulations. In addition, some observers assert the criteria used in the current regulatory classifications could be improved. This section examines three types of bank classifications:

- 1. Unofficial classifications described by popular but often subjective terminology,

- 2. Official classifications of banks officially defined in statute or regulation, and

- 3. Proposed classifications based on alternative criteria from those used in current statute or regulation.

Unofficial Classifications

Many terms are used to classify banks according to qualitative descriptions of the business models they employ. The utility of these terms is that they refer to widely held, intuitive understanding of the differences between bank types and appropriate levels of regulation for them. An examination of these terms can illustrate which characteristics observers believe should be considered when calibrating regulations. However, these terms can be problematic because they can be interpreted differently and reaching consensus on exactly which banks fall into each category is difficult.

"Main Street"

The terms community bank or Main Street bank typically refer to a bank that uses a simple deposit-taking and loan-making business model to meet the credit needs of a certain community. Although these banks may typically be small in terms of asset size, conceptually that does not necessarily have to be a determining factor. Nevertheless, community banks are often identified as such based on their small asset size. Complicating the identification of community banks using only size as a criterion is that no consensus exists over what the specific size threshold should be.9 In addition, many have observed that most small banks are generally different from large banks in a variety of ways besides asset size. For example, the Federal Deposit Insurance Corporation, for research purposes, identifies community banks by assessing certain metrics related to asset size, balance sheet characteristics, and geographic footprint.10 Under this definition, six banks with more than $10 billion in assets and one with almost $41 billion in assets were classified as community banks.11

Community banks are likely to be more concentrated in core commercial bank businesses of making loans and taking deposits and less involved in other activities such as securities trading or holding derivatives. Community banks also tend to operate within a smaller geographic area. These banks are generally more likely to practice relationship lending wherein loan officers and other bank employees have a longer-standing and perhaps more personal relationship with borrowers.12 Due in part to these characteristics, proponents of community banks assert that these banks are particularly important credit sources to local communities and otherwise underserved groups, as big banks may be unwilling to meet the credit needs of a small market of which they have little knowledge. Finally, relative to large banks, small banks are likely to have fewer employees, fewer resources to dedicate to regulatory compliance, and are less likely to individually pose a systemic risk to the broader financial system.13 For more information on the regulation of small banks, see CRS Report R43999, An Analysis of the Regulatory Burden on Small Banks, by Sean M. Hoskins and Marc Labonte.

"Wall Street"

Wall Street bank is a term for a very large, very complex bank that is involved in many business lines outside of what is viewed as the traditional commercial bank activities of making loans and taking deposits. Such a bank could have hundreds of billions or trillions of dollars' worth of assets and its corporate structure could involve hundreds or thousands of separate subsidiaries under a parent bank holding company (BHC). Although at least one of these subsidiaries must be a chartered bank, many others could be nonbanks, such as broker-dealers, asset managers, and insurance brokers or agents. Wall Street banks may be internationally active and have a global presence.14 The term Wall Street bank comes from the prominent role many of these institutions play in underwriting and trading securities, activities that commonly take place on Wall Street in New York City. However, an institution of the aforementioned size and complexity may not necessarily be headquartered or even active on the actual Wall Street.

Too Big To Fail (TBTF) bank is another term that refers to large, complex institutions, and refers to banks that meet a specific criterion that is not directly observable (or at least not directly observable until the government takes actions to save it from default).15 A bank is said to be TBTF when policymakers judge that its failure would cause such serious disruptions to the financial system that the resulting economic and social outcomes would be unacceptable. To avoid these outcomes, the government would be compelled to save the institution from failure, perhaps by directly giving it funding. Characteristics that could make an institution so important to the functioning of the financial system include its size, interconnectedness, complexity, or central role in a certain market or sector. The belief among market participants that the government will protect a certain bank or groups of banks could lead to moral hazard, wherein market participants do not adequately assess or monitor risk because they feel protected from potential losses. Moral hazard can result in excessive risk taking by the bank, lax risk monitoring by shareholders and creditors, and unfair funding advantages. In addition, government "bailouts" expose taxpayers to potential losses. Whether the policy reforms enacted by Dodd-Frank and Basel III effectively addressed these problems is a matter of debate. For more information on the TBTF issues, see CRS Report R42150, Systemically Important or "Too Big to Fail" Financial Institutions, by Marc Labonte.

Somewhere In Between

The terms regional bank and mid-size bank generally refer to banks that do not fit neatly into a "very large, complex, and systemically important" or "small and simple" dichotomy. The set of banks to which the terms are referring can vary widely. Often, the terms describe a bank that has a simple business model that focuses on taking deposits and making loans, but has a large amount of assets and services a certain region of the country.16 Other times, the terms mean a bank that is significantly larger and more complex than the thousands of community banks but nevertheless its failure would not pose a risk to systemic stability.17 In either case, the goal is often to describe banks that are in some way different than banks servicing small communities, but that are not of a scale such that the material distress at a single bank would destabilize the entire financial system.

Selected Official Classifications and Exemption Thresholds

Banking is one of the most heavily regulated industries in the United States, due to its key role in the economy, its inherent risks, and the potential taxpayer exposures it creates. Thus, all banks are subject to numerous requirements, regardless of size. For example, banks are generally subject to applicable federal and state laws related to banking, lending, and other financial activities, consumer protection, and money laundering. Banks generally face many prudential (or "safety and soundness") regulations, including requirements to maintain a certain minimum capital level and prohibitions on proprietary trading and affiliations with certain investment funds and companies. All banks must be FDIC insured and are subject to regulatory supervision, which includes examinations and reporting requirements. Banks that do not comply with all applicable laws and regulations are subject to enforcement actions, such as being compelled to take prompt corrective actions at the direction of a banking regulator.18

However, regulators and other policymakers have long recognized that appropriately regulating banks require that banks with differing characteristics face different regulatory regimes.19 As a result, they have created classifications and thresholds that subject each bank to certain regulations, exempt it from others, or otherwise alter its regulatory treatment. Many of these classifications use size-based asset thresholds that, once exceeded, subject a bank to additional regulation.20 The strengths and weaknesses of this approach are described in the "Banks by Asset Size" section. However, size considerations are only a component of other classification criteria.

This report does not include an exhaustive and detailed examination of every regulatory classification and exemption threshold. Instead, it examines a selection of prominent classifications facing banks that are often the subject of proposed changes.

$1 Billion Threshold

Small banks individually may pose relatively little risk to the financial system and possess fewer resources on an absolute basis to comply with regulation. As shown in Table 1, of the 4,539 banking organizations, 3,922 (over 86%) reporting positive assets to the Federal Reserve held less than $1 billion in assets as of June 30, 2017.21 These relatively small institutions are exempted from certain regulations. For example, banks below this threshold that achieve certain bank exam scores are subject to less frequent examinations.22 In addition, the quarterly reporting forms small banks are required to file with federal bank regulators are simpler and less detailed than those filed by larger banks.23 In accordance with the Federal Reserve's Small-Bank Holding Company Policy Statement, BHCs with less than $1 billion in assets are permitted to take on more debt in order to complete a merger and are not required to meet the same capital requirements at the holding company level (provided they meet certain other requirements concerning nonbank activities, off balance sheet exposures, and debt and equities outstanding).24 In addition, under the Community Reinvestment Act (P.L. 95-128)—which subjects banks to an evaluation on how well they meet community credit needs—compliance examination is simpler for banks below a threshold set slightly over $1 billion.25

Even among banks below this threshold, there is a substantive amount of variation between bank characteristics. For example, the median asset size for banking organizations in this group is $22 million in assets, making banking organizations near the $1 billion threshold about 45 times the size of the average banking organization in the group. However, policymakers and observers generally are not proposing that banks with less than $1 billion be subject to additional regulation or that this threshold be lowered. Thus, the data analysis that follows in this report focuses on the 617 banking organizations that are above the $1 billion threshold.

$10 Billion Threshold

For banks that exceed $1 billion in assets, the next major regulatory threshold is at $10 billion.26 As of June 30, 2017, 502 bank organizations (about 11%) held between $1 billion and $10 billion in assets, and 115 (2.5%) held more than $10 billion in assets. Policymakers have determined it is appropriate to subject banks exceeding this size to additional regulation, due to the amount of harm the failure of these banks could potentially cause to the economy and the resources available to the banks to dedicate to compliance. For example, the Consumer Financial Protection Bureau is the primary federal agency for consumer compliance supervision at banks with more than $10 billion in assets.27 In addition, banks of this size must complete a Dodd-Frank mandated, company-run stress test—an examination of whether the bank could remain adequately capitalized under hypothetical, stressed economic conditions—once a year.28 Furthermore, the interchange fees these banks receive when customers use debit cards to make purchases are capped by the Federal Reserve pursuant to Section 1075 of the Dodd-Frank Act.29

$50 Billion Threshold

For banks that exceed $10 billion in assets, the next major regulatory threshold is at $50 billion. As of June 30, 2017, 73 bank organizations (1.5% of the total) held between $10 billion and $50 billion and 42 organizations (less than 1%) held more than $50 billion. Section 165 of the Dodd-Frank Act directs the Federal Reserve to establish more stringent regulation for BHCs with more than $50 billion in assets, based on the rationale that banks of this size could destabilize the U.S. financial system if one were to fail or become distressed.30 Thus, BHCs of this size are subject to this enhanced prudential regulation.31 For example, in addition to company-run stress test requirements mentioned in the previous section, BHCs exceeding the $50 billion threshold must submit data about its balance sheet and income to the Federal Reserve to be used in a separate Federal Reserve-run stress test. Each of these banks must also submit a resolution plan, or "living will," to regulators detailing how the bank could be resolved through bankruptcy without spreading distress throughout the financial system. In addition, these banks are required to hold enough highly liquid assets to meet their cash flow needs during stress events, as determined by the banks' internal models. Finally, these banks also must meet a liquidity coverage ratio requirement and, upon implementation expected in 2019, a net stable funding ratio—designed to increase the likelihood that each bank can meet its obligations given its asset liquidity and funding sources.32

"Advanced Approaches Banks"

In 2004, the Basel Committee on Banking Supervision (BCBS)—an international standards setting body of bank regulators—created a framework known as the Basel II Accords.33 Part of this framework called for using the internal risk measurement systems at internationally active banks to determine the amount of capital each of these banks must hold to protect against risks and set minimum standards for those systems.34 In 2007, U.S. bank regulators implemented enhanced regulation related to these advanced approaches when calculating capital requirements, including setting the criteria for which banks the regulation would cover.35

Although certain allowances for banks to opt in or out have changed over time, the basic criteria has generally remained the same; banks with $250 billion in total assets or $10 billion in total foreign exposures are considered "advanced approaches banks." As of the end of 2016, 15 U.S. BHCs—including 8 globally systemically important banks (G-SIBs) discussed in the following section—were subject to these regulations.36 These banks were determined to be large and complex enough that they should have the sophistication necessary to estimate their risks more thoroughly than by using the relatively simple calculations required of other banks. As noted in the original rulemaking, the advanced approaches framework is "intended to produce risk-based capital requirements that are more risk-sensitive than the existing risk-based capital rules [and] seeks to build on improvements to risk assessment approaches that a number of large banks have adopted."37

Many of the additional requirements that advance approaches banks in the United States face involve regulatory ratio requirements—minimum ratios of balance sheet items that ensure banks are unlikely to fail—implemented by U.S. bank regulators following the recent financial crisis that generally adhere to BCBS's revised Basel III framework. One such requirement is that when calculating the ratios related to minimum capital requirements, advanced approaches banks must include certain off balance sheet exposures (to account for more complicated risks) in addition to the on balance sheet assets that all banks must include. Another is that these banks are subject to countercyclical capital buffers—a requirement to increase capital holdings that regulators can deploy to rein in risk-taking in the event regulators determine risks have become excessive. These banks also must meet more stringent liquidity coverage ratio and net stable funding ratio requirements.

"Globally Systemically Important Banks"

Basel III created a designation for certain banks that (if one were to fail or become distressed) could inflict destabilizing losses and contagion effects throughout the global financial system, calling such institutions globally systemically important banks (G-SIBs).38 In the United States, the Federal Reserve designates banks as G-SIBs based on a scoring system using two methods (called method 1 and method 2) to measure an institution's systemic importance—the likelihood that distress at or failure of the institution could destabilize the global financial system.39 A detailed examination of how the scores are calculated and what qualifies a bank as a G-SIB is beyond the scope of this report, but what is pertinent is that the size of the institution constitutes only one of 12 indicators measured under method 1 and one of nine indicators in method 2.40 Meanwhile, both scoring methods include indicators of interconnectedness, complexity, and cross-jurisdictional activity. Method 1 also measures substitutability—how easily its client servicing or infrastructure support could be picked up by another institution—and method 2 measures an institution's use of certain funding markets. Thus, the scores measure a number of aspects of a bank's business model besides its size. As a result, the eight G-SIBs are not the eight largest U.S. banks. As of the end of 2016, eight U.S. banks were designated as G-SIBs (the six largest, and the 9th and 13th largest).

The eight G-SIBs are subject to the most stringent regulations and supervisory expectations of any group of banks. A notable requirement is that they must hold additional capital—known as the G-SIB surcharge—to avoid facing certain limitations on shareholder payouts and bonus payments.41 In addition, these banks must hold a certain percentage of capital and debt that meets certain quality requirements designed to ensure that the banks have adequate total loss absorbing capacity (TLAC), thus improving their ability to survive losses and the likelihood they could be resolved in an orderly fashion in the event of failure.42

|

Classification |

Number of BHCs |

|

$0 - $1 billion |

3,922 |

|

$1 billion - $10 billion |

502 |

|

$10 billion - $50 billion |

73 |

|

Over $50 billion (but not Advanced Approaches or Globally Systemically Important Banks) |

27 |

|

Advanced Approaches Banks (but not Globally Systemically Important Banks) |

7 |

|

Globally Systemically Important Banks |

8 |

|

Total |

4,539 |

Source: Congressional Research Service (CRS) calculations using Federal Reserve Y-9C and Y-9SP data, accessed on July 24, 2017.

Note: These counts include savings and loan holding companies that are not subject to the same regulations facing bank holding companies, including certain regulations covered in this report.

Selected Proposals for Additional Tailoring

In general, all the classifications reviewed above except for the G-SIB designations are either solely based on total assets or (in the case of the advanced approaches designation) largely based on total assets. Some tailoring proposals call for calibrating the existing approach by raising or lowering specific thresholds. Other proposals assert this system (whatever the level of individual thresholds) is too heavily focused on one aspect of a bank (size) that does not directly reveal much about other characteristics, such as complexity, interconnectedness, and risk posed. Thus, these classifications alone arguably cannot effectively differentiate the application of regulations across disparate banks. Other classifications that use alternative methods to tailor regulation have been put forward including methods that examine a bank's activities, measure its capital levels, or are based on greater regulator discretion. This section examines these potential alternative criteria.

Activities-Based Criteria

A single line item on a bank balance sheet—total assets—does not provide information about the types of assets the bank owns or how it funds itself to accumulate those assets. Many banks are heavily concentrated in the business of making loans, using deposits for funding, and holding most of those loans on the balance sheet. Subjecting such an institution to costly regulation aimed at containing risks presented by complex activities, such as engaging in wholesale funding markets, securities market making, and hedging with derivatives, would arguably be unduly burdensome.43 Likewise, an institution that does engage significantly in such activities could be (and possibly strategically choose to remain) below a threshold at which such regulations come into effect. Again, the distinctions are conceptually simple, but hard in practice. The activities and markets a bank could engage in are myriad; where should policymakers draw the line?

Examples of activities-based criteria could be those that place limitations on securities and derivatives trading in which the bank engages.44 Trading assets and liabilities are generally financial instruments that a bank underwrites and deals in, has positions in for the purpose of selling in the near term, or has a position in to accommodate a customer.45 Trading assets and liabilities could potentially experience relatively large price fluctuations due to market volatility, and thus expose a bank to additional risks. Derivatives are instruments with values based on some underlying asset or reference, such as interest rates, exchange rates, equity prices, or commodities prices, and sudden, unexpected changes in the rate or value of the underlying references could expose derivatives holders to large losses and increased cash obligations to counterparties.46 In this way, although derivatives can be used to hedge risks, they can also expose an individual bank to additional risks. In addition, because counterparties in a derivative are often other financial institutions, derivatives could increase a bank's interconnectivity with the rest of the financial system. Because these activities are complex and potentially expose individual banks and the financial system to additional risks, they have been proposed as tailoring-based criteria.47

Thomas Hoenig, the vice chairman of the Federal Deposit Insurance Corporation, has made one such proposal. He argues a new classification of banks—"Traditional Banking Organizations" (TBOs)—should be established that would make qualifying banks eligible for certain regulatory relief.48 In the original April 2015 proposal, he suggested "defining eligibility for regulatory relief around the following criteria:

- banks that hold, effectively, zero trading assets or liabilities;

- banks that hold no derivative positions other than interest rate swaps and foreign exchange derivatives; and

- banks whose total notional value of all their derivatives exposures—including cleared and non-cleared derivatives—is less than $3 billion [later proposed at $8 billion]."49

This classification is intended to identify banks that limit themselves to minimal activity in certain markets that are perceived to be outside of a traditional commercial banking model, and exempt those from certain regulations, including certain Basel III and Dodd-Frank requirements.50 Advocates of this approach contend the criteria used in the classification accurately separate banks into two groups that use business models with substantially different risk profiles.

However, opponents of measures to separate traditional banking from other activities often argue that, while the activities identified in these criteria pose risks, it is not clear whether they pose greater risks to bank solvency and financial stability than do traditional banking activities, such as mortgage lending. Furthermore, taking on additional risks in different markets might diversify a bank's risk profile, making it less likely to fail.51 If this assessment is accurate, the TBO criteria would arguably be inappropriate measures of bank riskiness and thus not necessarily an appropriate basis for regulatory tailoring.

In the 115th Congress, S. 2155, H.R. 10 and H.R. 2121 would put certain activities-based criteria into statue, and in the 114th Congress, H.R. 4647 also addressed these criteria. These bills are covered in the "Selected Legislation" section.

Capital-Based Criteria

A bank secures funding by either issuing liabilities or raising capital. A bank's liabilities are largely the value of deposits and borrowings the bank owes savers and creditors. Capital is raised through various methods, including issuing equity to shareholders and instruments that can be converted into equity. Importantly, capital—unlike liabilities—does not require repayment of a specified amount of money, and so its value can fluctuate. Thus, capital gives banks the ability to absorb losses without failing.52 Because a primary goal of prudential regulation is to ensure that banks (whatever their size or activity) are unlikely to fail, and because how a bank chooses to fund itself is an important aspect of its business model, some policymakers have proposed tailoring criteria based on a bank's capital levels.

Banks are currently required to satisfy several minimum capital requirements, generally expressed as ratios between items on bank balance sheets.53 Capital ratios fall into one of two main types—a leverage ratio or a risk-weighted ratio. A leverage ratio treats all assets the same, requiring banks to hold the same amount of capital against the asset regardless of how risky each asset is. A risk-weighted ratio assigns a risk weight—a number based on the riskiness of the asset that the asset value is multiplied by—because some assets are more likely to lose value than others. Riskier assets receive a higher risk weight, which requires banks to hold more capital—to better enable them to absorb potential losses—to meet the ratio requirement.54 Tailoring regulations using capital-based criteria would entail identifying at least one of these ratios or constructing another to serve as the benchmark and establishing some level above the minimum at which a bank would be deemed well-capitalized enough to qualify for exemptions for some regulations.

An example of such a classification is the election option for strongly capitalized banks proposed in the Financial CHOICE Act of 2017 (FCA; H.R. 10), which would exempt banks that maintain a minimum capital ratio from a variety of prudential regulations. Currently, most banks must maintain at least 4% leverage ratio, and many choose to hold more.55 Under the FCA, if a bank had a 10% leverage ratio, it could elect to be exempt from requirements, including other capital ratios, certain liquidity requirements, and stress-test requirements.56 The FCA is covered in more detail in the "Selected Legislation" section.

Proponents of the measure argue that it is unnecessary to subject banks with high leverage ratios to other complex and burdensome regulation because holding that amount of capital makes them safe from failure.57 However, opponents assert that a single ratio is not a complete measure of bank riskiness and using one to exempt banks from certain requirements unwisely weakens necessary prudential regulation. For example, they argue that without risk weighting, banks would have an incentive to hold riskier assets because the same amount of capital must be held against both risky and safe assets.58

Regulator Tailoring with Required Analysis

Policymakers have long debated choosing between establishing rules-based and principles-based regulations. The classification systems discussed above are generally rules-based; if an objective, numerical (sometimes called bright line) threshold is crossed, then a bank becomes subject to or exempt from certain regulations. Such an approach has the advantage of minimizing ambiguity, uncertainty, and opacity in the application of regulations.59 Banks, investors, and regulators all clearly understand what regulation each bank will be subject to and why and can plan accordingly.

However, rules-based approaches may be problematic because rule makers may be unable to anticipate all relevant circumstances when promulgating the rule. Those circumstances would then not be considered during application of the rule.60 For example, take a hypothetical $51 billion bank that uses a very safe and simple business model and a $49 billion bank that uses a risky and complex one. Arguably, the first bank should be subject to less burdensome regulation and the second more rigorous. However, suppose a bright line regulatory threshold has been set at $50 billion, and a regulator does not have the authority to make a determination on which regulations to apply. In this scenario, the bank with the slightly higher assets may be subject to additional regulations whereas the slightly smaller one is not. Furthermore, such thresholds can lead to "cliff effects," wherein banks choose to remain below a certain threshold to avoid additional regulation even though growing larger would not necessarily increase their risk profile.61

Alternatively, Congress could grant regulators additional authority to tailor the application of regulation. An example of such authority is granted in the Dodd-Frank Act in the application of enhanced prudential regulation, permitting the Federal Reserve to "differentiate among companies on an individual basis or by category, taking into consideration their capital structure, riskiness, complexity, financial activities (including the financial activities of their subsidiaries), size, and any other risk related factors" and to "establish a threshold above [$50 billion]."62 In addition, regulators can exercise discretion in supervising different institutions. For example, the Federal Reserve has placed 12 BHCs and one insurance company in a special supervisory program administered by its Large Institution Supervision Coordinating Committee.63

Because of the potential weaknesses of the rules-based approach, some policymakers and industry participants have advocated for exempting more bank organizations from regulations in conjunction with allowing regulators to designate additional ones, provided the regulators perform certain analyses to justify such designations.64 They argue giving technical experts wider authority to determine whether certain regulations should apply to banks would lead to more effective and efficient regulation than bright line criteria.65 Opponents of this type of rule assert the advantages of the bright line approach—certainty and transparency—are preferable to a discretionary approach, which may entail uncertainty over regulatory treatment and opacity in how regulators make determinations.66

Legislation that would allow regulators to apply or exempt institutions from regulation based on certain analyses includes the Systemic Risk Designation Improvement Act (H.R. 3312/S. 1893) and the TAILOR Act (H.R. 1116/S. 366), which are covered in more detail in the "Selected Legislation" section.

Bank Characteristics

The various classifications and exemptions involved in bank regulation are intended to appropriately tailor regulation based on each bank's characteristics and risks. To examine to what degree existing and proposed classifications accomplish this, it is helpful to understand the differences between banks that do or do not meet the classification criteria. If examined at the depository subsidiary level, IDIs are relatively homogenous across many characteristics because the commercial banking activities are performed at these subsidiaries, whereas other activities are performed at nonbank subsidiaries. Because the objective of this report is to examine how banking organizations differ, it examines bank holding companies at the consolidated top-parent company level.67 The following section analyzes differences in the size, business activities, and capital levels of U.S. bank organizations and makes comparisons between organizations that meet certain criteria and those that do not meet those criteria. The metrics include total assets, certain balance sheet items that illustrate how involved an organization is in certain activities, and two capital ratios. For more information about the metrics, see Appendix A.

Banks by Asset Size

As discussed in the previous section most of the existing official regulation classifications are sized based, and this approach has both advantages and disadvantages. One advantage includes a lack of ambiguity over which banks are subject to what sets of regulations. One disadvantage is that a wide array of bank characteristics are not considered when determining what regulation the bank is subject. The efficacy of asset-based criteria depends in part on how closely correlated size is to other bank characteristics. This section examines bank organizations and their differences in activities and capital across asset sizes and compares the characteristics of banks that fall into different classification thresholds.68

Characteristics Across Different Asset Sizes

Examining bank organizations by asset size reveals some clear differentiation at the very largest institutions, but as the organizations get smaller, changes become more incremental—as shown in Table 2—and identifying cutoff points becomes more qualitative and subjective. The four largest bank organizations—JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup—are of a very large scale, all holding assets of more than $1.8 trillion. Citigroup, the fourth largest, is more than twice as large as the fifth largest, Goldman Sachs. Another dramatic drop off occurs between the sixth and seventh largest bank, as Morgan Stanley's $841 billion in assets is almost double U.S. Bancorp's $464 billion.

Table 2. Size and Selected Activities of the 20 Largest Banking Organizations

(as of June 30, 2017; dollar amounts in billions)

|

Institution Name |

Total Assets ($billions) |

Loans as % of Assets |

Deposits as % of Liabilities |

Trading Assets as % of Assets |

Trading Liabilities as % of Liabilities |

|

JPMorgan Chase & Co. |

$2,563 |

36.2% |

62.5% |

15.9% |

5.8% |

|

Bank of America Corporation |

$2,256 |

42.6% |

63.7% |

12.0% |

5.6% |

|

Wells Fargo & Company |

$1,931 |

50.6% |

75.7% |

5.0% |

1.6% |

|

Citigroup Inc. |

$1,864 |

35.5% |

58.8% |

13.9% |

8.4% |

|

Goldman Sachs Group, Inc. |

$907 |

11.0% |

15.3% |

34.4% |

14.7% |

|

Morgan Stanley |

$841 |

15.8% |

19.0% |

31.5% |

14.9% |

|

U.S. Bancorp |

$464 |

60.4% |

83.7% |

0.7% |

0.5% |

|

PNC Financial Services Group, Inc. |

$372 |

59.1% |

79.5% |

1.3% |

0.8% |

|

Bank of New York Mellon Corporation |

$355 |

17.3% |

75.0% |

1.6% |

1.3% |

|

Capital One Financial Corporation |

$351 |

69.9% |

79.5% |

0.2% |

0.1% |

|

TD Group U.S. Holdings LLC |

$349 |

42.3% |

79.1% |

4.4% |

2.9% |

|

HSBC North America Holdings Inc. |

$308 |

22.4% |

40.7% |

11.4% |

4.4% |

|

State Street Corporation |

$238 |

10.2% |

83.9% |

1.9% |

2.7% |

|

BB&T Corporation |

$221 |

65.6% |

82.2% |

0.8% |

0.2% |

|

Charles Schwab Corporation |

$221 |

15.3% |

79.9% |

2.6% |

0.0% |

|

Credit Suisse Holdings (USA), Inc. |

$215 |

10.2% |

0.0% |

21.2% |

6.2% |

|

Suntrust Banks, Inc. |

$207 |

71.0% |

87.4% |

2.8% |

0.5% |

|

DB Usa Corporation |

$191 |

6.4% |

13.5% |

12.4% |

8.6% |

|

Barclays US LLC |

$179 |

19.6% |

13.1% |

16.1% |

9.1% |

|

American Express Company |

$167 |

70.2% |

41.3% |

0.0% |

0.0% |

|

Average for $1 billion+ BHCs |

$32 |

68.5% |

87.0% |

0.5% |

0.2% |

Source: CRS calculations using Federal Reserve Y-9C data, accessed on July 24, 2017.

These large institutions differ from other norms among bank organizations with over $1 billion in assets as well. For the group as a whole, the unweighted average of deposits as a share of a bank organization's liabilities is 87%, and loans at the average institution account about 69% of assets. However, among the largest four organizations deposits range between 59% and 78% of liabilities and loans between 35% and 51% of assets, indicating that these institutions are less concentrated in deposit-taking and lending. In addition, although less than 1% of the average bank's assets are trading assets and less than 1% of its liabilities are trading liabilities, the top four's trading assets account for between 5% and 16% of total assets and trading liabilities between 2% and 8% of total liabilities. The fifth and sixth largest banks are even more focused in investment bank activities as opposed to commercial bank deposit-taking and lending. Deposits make up 15% and 19% of Goldman Sachs and Morgan Stanley liabilities, respectively, and loans 11% and 16% of assets. Meanwhile, trading assets account for 34% and 31% of their total assets, respectively, and trading liabilities were 15% of total liabilities for both firms.

As mentioned above, identifying natural cutoffs points at lower asset sizes becomes more subjective. Because these differences between assets become more incremental, there is no clear differentiation between the business models of groups of banks. The seventh ($464 billion), eighth ($372 billion), 10th ($351 billion), and 14th ($220 billion) all are near industry averages in deposits as a percentage of liabilities, loans as a percentage of assets, and trading assets as a percentage of assets, but many of the organizations near these sizes are not. The largest bank to exceed the average of funding with deposits and making loans is the 17th largest organization with $207 billion in assets. The largest to exceed both these metrics and have less than average trading assets is the 23rd largest organization with $152 billion in assets. Just as large organizations have significant variations in business models, smaller organizations also may deviate from the industry norms across these metrics with notably large deviations at particular organizations holding $125 billion, $59 billion, $48 billion, $43 billion, and $30 billion in assets.

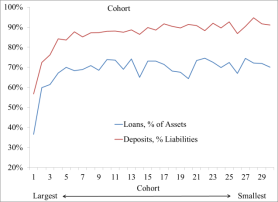

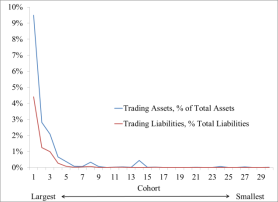

Despite the presence of outliers, certain correlations between size and other characteristics can be observed when bank organizations are placed into peer group cohorts. For example, if the largest 600 banking organizations are grouped into cohorts of 20 based on size (so the 20 largest bank organizations are grouped together in the first cohort, the 21st to 40th largest grouped in the second, etc.), the averages of each cohort show revealing trends. As illustrated in Figure 1 and Figure 2, the cohort of the largest organizations on average have well below industry averages of concentrations in loans and deposits and above industry averages of trading assets and liabilities. The next largest cohort averages move closer to the rest of the industry, but it is not until the fourth cohort (made up of banks with between $26 billion and $19 billion in assets), that the averages near those of the rest of the industry.

Differences Between Banks: Existing Size-Based Classifications

Because most existing bank regulatory tailoring is based on size, trends described above would be expected to be broadly similar to the differences found between bank organizations in the different regulatory buckets. Nevertheless, it can be helpful to review and examine the characteristics of banks that fall within certain thresholds. As Table 3 illustrates, generally institutions that are larger and fall into stricter regulatory classifications are more likely to be less reliant on deposits and loans and more heavily involved in trading activities. In addition, although there is no clear pattern seen in a main risk-weighted capital ratio, the simple leverage ratio does generally fall as institutions get larger. However, reviewing averages of a group of bank organizations may obscure outliers within any group.

|

Threshold Group |

Number |

Total Assets ($bns) |

Loans/ Assets |

Deposits/ Liabilities |

Trading Assets/ Assets |

Trading Liabilities/ Total Liabilities |

Derivatives ($bns) |

Tier 1 Leverage Ratio |

Tier 1 Capital Ratio |

|

$1-$10 billion |

502 |

2.8 |

70.4% |

89.5% |

0.1% |

0.0% |

0.2 |

10.6% |

14.0% |

|

$10-$50 billion |

73 |

21.2 |

67.2% |

82.6% |

0.9% |

0.4% |

71.8 |

9.9% |

13.4% |

|

$50+ billion (not Advanced Approaches or GSIB) |

27 |

136.7 |

53.2% |

66.0% |

4.2% |

1.8% |

144.8 |

9.6% |

15.2% |

|

Advanced Approaches (not GSIB) |

7 |

305.1 |

50.1% |

70.6% |

2.7% |

1.4% |

817.6 |

9.4% |

13.9% |

|

GSIBs |

8 |

1,369.4 |

27.4% |

56.7% |

14.5% |

6.9% |

28,566.5 |

8.5% |

15.1% |

Source: CRS calculations using Federal Reserve Y-9C data, accessed on July 24, 2017.

Notes: Six savings and loans holding companies (SLHC) that did not have to report capital ratios are not included in the capital ratio averages. They are grandfathered SLHCs not subject to the revised regulatory capital rules. Derivatives are given in gross notional position and thus may exceed total assets at individual banks.

Size Trends

Although an examination of banking trends over time is beyond the scope of this report, it is notable that in recent decades the banking industry has consolidated significantly. In general, the number of small institutions and the share of industry assets those institutions held have steadily declined, whereas the number of large banks and their share of industry assets have grown.69 For example, as of June 30, 2017, there were nine insured depository institutions with more than $250 billion in assets that together accounted for more than 50% of industry assets, up from two institutions over $250 billion that accounted for 9% of industry assets from 20 years earlier. Over that same period, the number of institutions with less than $1 billion fell from 10,630 to 5,035, and their share of industry assets fell from 22% to 7%.70

Observers disagree over the degree to which different causes have driven this industry consolidation.71 Critics of recent regulatory changes argue that the regulatory burden on small banks is too onerous, driving smaller banks to merge to create or join larger institutions. However, other observers cite different longer-term factors. Through much of the 20th century, federal and state laws restricted banks' ability to open new branches and banking across state lines was restricted; branching and banking across state lines was not substantially deregulated at the federal level until the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 (P.L. 103-328).72 When these restrictions were relaxed, it became easier for small banks to consolidate or mid-size and large banks to spread operations to other markets. In addition, there may be economies of scale (i.e., cost advantages due to size or volume of output) in banking, which would also drive industry consolidation.

Another issue to be considered regarding banks exceeding fixed thresholds over time is the effect of natural growth in the nominal value of assets due to inflation, the growth of the economy, and the growth of the financial industry. Some thresholds are indexed to change over time. For example, the Community Reinvestment Act (P.L. 95-128) threshold to be classified as a "small institution" and exempt from certain reporting requirements is indexed to inflation.73 However, many thresholds are not indexed, and as a result, fixed thresholds are continually declining over time in terms of real asset value or institution size relative to the economy or the financial industry. If Congress decided thresholds should be raised to match inflation year-to-year, it could index to some measure such as price levels, nominal GDP, or industry assets.

Banks by Activities

Some observers are critical of asset size thresholds because they do not necessarily reflect the activities in which a bank is engaged, which may be an important component of what regulation should be applied to particular institutions. Critics assert this approach inappropriately subjects banks that engage in a simple deposit-taking and loan-making business model to regulations designed to address the risks created by banks engaging in arguably more complex activities that create greater interconnections between institutions, such as securities and derivatives trading. This section examines how involved banking organizations are in these activities and compares banking organizations that would and would not be classified as TBOs under current proposals.

Industry Activities Statistics

FDIC Vice Chairman Thomas Hoenig proposes three activities-based criteria to qualify for regulatory relief as a traditional banking organization, and parent holding companies that did not meet the criteria would be required to create separate intermediate holding companies within the organization at which these activities would be performed.74 Those criteria are (1) no trading assets and liabilities, (2) no derivative positions other than interest rate and exchange rate derivatives, and (3) limited interest rate and exchange rate derivatives positions. According to Vice Chairman Hoenig's estimate, about 90% of all commercial bank depository institutions would qualify.75 This section of the report examines approximately how many banking organizations over $1 billion would qualify based on these criteria.76

Trading Activity

Of the 617 banking organizations with at least $1 billion in assets that report data to the Federal Reserve, 454 (74%) have no trading assets or liabilities. An examination of banks with no trading activity and those with trading activity reveals notable differences. As illustrated in Table 4, banks with trading activities on average are larger than those without any, less concentrated in loans and deposits, have more derivatives exposure, and have lower capital ratios than banks without these activities.

|

Number |

Total Assets ($bns)a |

Loans/ Assets |

Deposits/ Liabilities |

Trading Assets/ Assets |

Trading Liabilities/Total Liabilities |

Derivatives ($bns)a |

Tier 1 Leverage Ratio |

Tier 1 Capital Ratio |

|

|

Any Trading |

163 |

110.3 |

62.9% |

80.8% |

2.1% |

0.9% |

1,508.0 |

9.9% |

13.6% |

|

No Trading |

454 |

3.9 |

70.5% |

89.2% |

0.0% |

0.0% |

0.3 |

10.6% |

14.1% |

Source: CRS calculations using Federal Reserve Y-9C data, accessed on July 24, 2017.

Notes: Six SLHC that did not have to report capital ratios are not included in the capital ratio averages. They are grandfathered SLHCs not subject to the revised regulatory capital rules. Derivatives are given in gross notional position and thus may exceed total assets at individual banks.

a. All six BHCs with over $800 billion in total assets have trading activity. Since the table presents mean values, this small group of very large BHCs has a large influence of the values of the variables measured in dollars. If those six BHCs are removed, average total assets and derivatives decrease to $48.5 billion and $125.3 billion, respectively. The relationship that banks in this category tend to have substantially more assets and derivatives than their counterparts still holds.

Derivatives

Of the 617 organizations with more than $1 billion, 464 (75%) have some derivative positions. However, only 59 have positions in derivatives unrelated to interest rates or exchange rates, such as equities or commodities derivatives. As shown in Table 5, the data suggests that banking organizations with no derivative positions tend to be small institutions (average of $2.2 billion in assets), heavily focused on making loans (68% of assets) and taking deposits (91% of liabilities), and holding relatively high level of capital (11% leverage ratio).

|

Number |

Total Assets ($bns)a |

Loans/Assets |

Deposits/Liabilities |

Trading Assets/Assets |

Trading Liabilities/ Total Liabilities |

Derivatives ($bns)a |

Tier 1 Leverage Ratio |

Tier 1 Capital Ratio |

|

|

No Derivatives |

153 |

2.2 |

68.1% |

90.7% |

0.1% |

0.0% |

0.0 |

11.1% |

15.8% |

|

Interest Rate and FX only |

405 |

7.9 |

71.1% |

87.9% |

0.1% |

0.0% |

1.2 |

10.3% |

13.3% |

|

Varied Derivatives |

59 |

274.4 |

51.3% |

71.2% |

4.8% |

2.2% |

4,159.5 |

9.5% |

14.4% |

Source: CRS calculations using Federal Reserve Y-9C data, accessed on July 24, 2017.

Notes: Six SLHC that did not have to report capital ratios are not included in the capital ratio averages. They are grandfathered SLHCs not subject to the revised regulatory capital rules. Derivatives are given in gross notional position and thus may exceed total assets at individual banks.

a. All six BHCs with over $800 billion in total assets are "varied derivatives" holders. Since the table presents mean values, this small group of very large BHCs has a large influence of the values of the variables measured in dollars. If those six BHCs are removed average total assets and derivatives decrease to $109.9 billion and $363.9 billion, respectively. The relationship that banks in this category tend to have substantially more assets and derivatives than their counterparts still holds.

Banking organizations that hold only interest rate and exchange rate derivative positions are larger ($7.9 billion in assets) than those that have none, but are still relatively concentrated in loans (71%) and deposits (88%). In both groups, the average banking organization engages in almost no trading activity. The two groups notably differ in their average leverage ratios, as interest or exchange rate derivative holding organizations are more leveraged with an average leverage ratio of 10.3%. Meanwhile, organizations that have derivative positions in equities and commodities banks are on average very large ($274.4 billion) and more engaged in activities such as trading (5% of assets) and less engaged in lending (51% of assets) and deposits (71% of liabilities) relative the other two groups. These banking organizations on average hold a similar amount of capital as the interest and exchange rate derivatives holders. Notably, the average derivate position at banks with only interest rate and foreign exchange derivatives is a small fraction of the average position at banks with more extensive derivatives activity.

Differences Between Banks: Approximate TBO Criteria

In May 2017, FDIC's Vice Chairman Hoenig amended the proposed criteria to qualify as a TBO. These criteria do not necessarily refer to line items in the data referenced in this report. However, the data does allow an approximation to be made of which banks may qualify under the criteria using metrics that are available. Because grouping banks with a modified, simplified criteria and comparing their characteristics in aggregate is still illustrative of differences across types of banks, this section compares banks that meet and do not meet the following criteria: (1) no trading assets or liabilities, (2) no equities or commodities derivatives positions, (3) less than $8 billion of total interest rate or exchange rate derivatives positions, and (4) at least a 10% assets minus liabilities-to-equity ratio (an approximation of a 10% leverage ratio). For more detail on how the criteria used in this report differ from the vice chairman's proposal, see Appendix B.

Of the 617 banking organizations with at least $1 billion in assets that reported data to the Federal Reserve as of June 30, 2017, 256 (41%) met this modified TBO criteria and 361 did not. A number of the differences between the two types of banks are expected given the differences between the individual activities-based groups discussed in the previous section. However, combining criteria and adding a capital-based component does alter the results in interesting ways. As shown in Table 6, TBOs are on average substantially smaller in terms of assets ($3.8 billion) than non-TBOs ($52 billion). In addition, the TBO's regulatory capital ratios are higher than non-TBO. Given that the criteria include a leverage ratio, it is not surprising that the average leverage ratios differ. Nevertheless, the difference in the risk-based ratio is notable.

|

Number |

Total Assets ($bns)a |

Loans/ Assets |

Deposits/ Liabilities |

Trading Assets/ Assets |

Trading Liabilities/ Total Liabilities |

Derivatives ($bns)a |

Tier 1 Leverage Ratio |

Tier 1 Capital Ratio |

|

|

TBO |

256 |

3.8 |

69.8% |

89.0% |

0.0% |

0.0% |

0.2 |

11.9 |

15.7 |

|

Non-TBO |

361 |

52.0 |

67.5% |

85.6% |

0.9% |

0.4% |

681.1 |

9.4 |

12.8 |

Source: CRS calculations using Federal Reserve Y-9C data, accessed on July 24, 2017.

Notes: Six SLHC that did not have to report capital ratios are not included in the capital ratio averages. They are grandfathered SLHCs not subject to the revised regulatory capital rules. Derivatives are given in gross notional position and thus may exceed total assets at individual banks.

a. All six BHCs with over $800 billion in total assets are Non-TBOs. Since the table presents mean values, this small group of very large BHCs has a large influence of the values of the variables measured in dollars. If those six BHCs are removed, average total assets and derivatives decrease to $23.7 billion and $55.6 billion, respectively. The relationship that banks in this category tend to have substantially more assets and derivatives than their counterparts still holds.

Although the loans and deposits are a larger part of the TBO's business than non-TBOs, the difference is relatively small compared with the differences between banks differentiated by only activity-based criteria without a capital-based criteria examined in the previous section and illustrated in Table 4 and Table 5. This is partly because 184 of the 361 banking organizations in the non-TBO category met all the activities-based criteria, but failed to meet the capital-based criteria. Thus, more than half these banks are "traditional" in the sense that they do not have trading activity and limited derivatives, and so many may have similar characteristics to banks in the TBO category.

Banks by Capital Levels

Whatever a bank's size or activities, the amount of capital it holds is an indicator of its ability to absorb losses. For this reason, some observers have asserted that capital levels should play a prominent role in how that bank is regulated. Proponents of this approach generally favor setting a capital ratio threshold, with banks holding greater capital being provided with regulatory relief. This section examines capital levels across the banking industry and compares banks above a 10% leverage ratio threshold, the level at which several proposals have put forward as the threshold at which banks could qualify for regulatory relief.

Industry Capital Level Statistics

Banks are required to meet various capital ratios that differ based on which balance sheet items are counted as capital in the calculation, which items are included in the measure of exposure, and whether those exposure items are risk weighted. Examining the various technical aspects of these measures is beyond the scope of this report.77 This section groups banking organizations using a single measure of capital—the Tier 1 leverage ratio.78 This is an un-risk-weighted measure of capital that all banks must report. The Tier 1 capital ratio defines capital in the same way but is a risk-weighted measure. It is presented in the tables in this section to make a comparison between banking organizations' risk-weighted capital indicators.

Certain correlations appear when banking organizations are compared across leverage ratios. As shown, less-capitalized banks generally are less concentrated in loans and increasingly involved in trading activities. In addition, they generally become less concentrated in deposits, although the most capitalized banks (more than 12%) are less concentrated in deposits than similar cohorts (11-12% and 10-11%), and also have an exceptionally high risk-weighted ratio.

|

Tier 1 Leverage Ratio |

Number |

Total Assets ($bns) |

Loans/ Assets |

Deposits/Liabilities |

Trading Assets/ Assets |

Trading Liabilities/ Total Liabilities |

Derivatives ($bns) |

Tier 1 Capital Ratio |

|

>12% |

95 |

6.8 |

70.1% |

86.3% |

0.1% |

0.0% |

1.2 |

20.3 |

|

11-12% |

61 |

5.5 |

71.7% |

89.8% |

0.0% |

0.0% |

0.3 |

14.8 |

|

10-11% |

124 |

15.6 |

71.6% |

90.4% |

0.1% |

0.1% |

5.6 |

13.4 |

|

9-10% |

156 |

48.5 |

68.3% |

86.9% |

0.7% |

0.3% |

728.4 |

12.9 |

|

8-9% |

113 |

63.5 |

68.5% |

87.5% |

0.7% |

0.3% |

1,080.1 |

11.6 |

|

7-8% |

47 |

14.1 |

65.4% |

84.7% |

1.3% |

0.5% |

129.1 |

11.9 |

|

<7% |

15 |

81.1 |

45.7% |

73.0% |

4.0% |

1.9% |

242.4 |

11.7 |

Source: CRS calculations using Federal Reserve Y-9C data, accessed on July 24, 2017.

Notes: Six SLHC that did not have to report capital ratios are not included in the capital ratio averages. They are grandfathered SLHCs not subject to the revised regulatory capital rules. Derivatives are given in gross notional position and thus may exceed total assets at individual banks.

The relationship between an organization's leverage, size, and derivative position is not as clear cut, as average asset size rises and falls at different points along the progression. However, in regard to size (and setting aside a small fluctuation among the very highest capital ratios and a deviation from trend among those with a leverage ratio less than 8%), there is a general trend that banking organizations with higher leverage ratios tend to have fewer assets and smaller derivative positions.

Differences Between Banks: 10% Tier 1 Leverage Ratio Threshold

This report uses available data to group banking organizations based on a capital criterion—reported Tier 1 capital leverage ratio greater than 10%—which is similar to but not exactly the same as un-risk-weighted leverage ratio criteria that have been proposed elsewhere. For more detail on how the report criterion differs from other prominent simple leverage ratios proposals, see Appendix B. This section examines average characteristics of banking organizations above and below that threshold.

Given the relationships between variables observed in the previous section, certain observations related to banks falling on either side of a 10% threshold are unsurprising. Banks that are over the threshold hold on average $10.4 billion in assets compared with the average of $50.1 billion in assets for banks under the threshold, as shown in Table 8. Further comparisons of these two groups illustrate that the relatively highly capitalized group tends to hold on average a higher concentration of loans and deposits, lower concentrations of trading assets and liabilities, smaller derivative positions, and higher risk-weighted capital ratios.

Table 8. BHCs Over $1 Billion: Averages Above, Near, Below a 10% Leverage Ratios

(as of June 30, 2017)

|

Tier 1 Leverage Ratio |

Number |

Total Assets ($bns)a |

Loans/ Assets |

Deposits/Liabilities |

Trading Assets/ Assets |

Trading Liabilities/Total Liabilities |

Derivatives ($bns)a |

Tier 1 Capital Ratio |

|

>10% |

280 |

10.4 |

71.1% |

88.9% |

0.1% |

0.0% |

3.0 |

16.0 |

|

<10% |

331 |

50.1 |

66.8% |

86.2% |

0.9% |

0.4% |

727.3 |

12.3 |

Source: CRS calculations using Federal Reserve Y-9C data, accessed on July 24, 2017.

Notes: Six SLHC that did not have to report capital ratios are not included in the capital ratio averages. They are grandfathered SLHCs not subject to the revised regulatory capital rules. Derivatives are given in gross notional position and thus may exceed total assets at individual banks.

a. All six BHCs with over $800 billion in total assets are under 10%. Since the table presents mean values, this small group of very large BHCs has a large influence of the values of the variables measured in dollars. If those six BHCs are removed, average total assets and derivatives decrease to $19.1 billion and $44.9 billion, respectively. The relationship that banks in this category tend to have substantially more assets and derivatives than their counterparts still holds.

Selected Legislation

Multiple legislative alternatives for greater tailoring of bank regulations are available to Congress. A number of tailoring bills have been introduced and seen action in the current Congress and recent Congresses. This section briefly examines such legislation. The bills covered here do not represent an exhaustive list of all proposed legislation, but rather a selected list of illustrative examples that generally have seen committee or floor action or are frequent subject of debate.

New or Changed Asset-Size Thresholds

Some bills would raise existing asset thresholds at which banks would be subjected to more stringent regulation, thus providing regulatory relief to banks above the current threshold but below the proposed one.

The Consumer Financial Protection Bureau Examination and Reporting Threshold Act of 2017 (H.R. 3072 and S. 1499) would increase the size at which the Consumer Financial Protection Bureau (CFPB) becomes a bank's primary consumer compliance supervisor from $10 billion to $50 billion.

- The Small Bank Holding Company Relief Act (H.R. 1948) and the Community Bank Relief Act (S. 1284) would raise the threshold at which the Federal Reserve's Small-Bank Holding Company Policy Statement applies, exempting more BHCs from certain debt restrictions and from capital requirements provisions in Section 171 of the Dodd-Frank Act. H.R. 1948 would raise the threshold from $1 billion to $10 billion, and S. 1284 would raise it to $5 billion.

Other bills would create new exemptions from certain regulations that banks would qualify for based on being below an asset threshold. For example,

- The Community Lending Enhancement and Regulatory Relief Act (S. 1002) includes provisions that would establish new exemptions from certain regulations based on asset-size thresholds. The bill would exempt banks with less than $10 billion in assets from the Volcker Rule (a ban on proprietary trading and certain affiliations with investment funds) and certain lending escrow requirements, and would add a relaxed compliance option for mortgages subject to Ability-to-Repay standards. In addition, banks with less than $1 billion in assets would be exempt from certain management assessments of internal controls requirements.

Activities-Based Proposals

Several bills would allow banks to qualify for exemption from certain regulations or change their treatment under a regulation based on their nonparticipation or limited participation in certain activities.

- The Economic Growth, Regulatory Relief, and Consumer Protection Act (S. 2155) would exempt banks that have (1) less than $10 billion in assets and (2) trading assets and liabilities less than 5% of total assets from the Volcker Rule.

- The Traditional Banking Regulatory Relief Act of 2015 (H.R. 4647 in the 114th Congress) would have created a definition of a traditional banking organization that closely resembled the TBO criteria proposed by FDIC Vice Chairman Thomas Hoenig discussed in an earlier section. A bank that met the classification could have elected to meet a simple leverage ratio of 10% as the sole measure of capital adequacy, and therefore would have exempted these banks from meeting risk-weighted capital ratio requirements.

Other bills would classify banks based on their active involvement in certain activities, and provide certain regulatory relief based on the particular needs of banks engaged in that activity.

- The Pension, Endowment, and Mutual Fund Access to Banking Act (H.R. 2121) directs bank regulators to define "custodial bank" based on certain activities-based criteria, including "the percentage of total revenues generated by custodial businesses and the level of assets under custody." Banks meeting the definition would not have to count deposits at a central bank, subject to certain limitations, as an exposure for the purposes of meeting applicable supplementary leverage ratios.

Capital-Based Proposals

Certain bills would allow banks to qualify for certain regulatory relief based on them holding a requisite level of capital.

- The Financial CHOICE Act of 2017 (FCA; H.R. 10) would allow a banking organization to choose to be subject to a higher, 10% leverage ratio, and in exchange would be exempt from risk-weighted capital ratios; liquidity requirements; stress-test requirements; certain merger, acquisition, and consolidation restrictions; limitations on dividends; and other regulations.79 Some of the regulations from which a bank could receive relief apply to all banks, such as the risk-weighted capital ratios set by Basel III. Other regulations from which a bank could receive relief would apply only to larger banks, such as the Dodd-Frank Act's enhanced prudential regulations for banks with $50 billion or more in assets.

Regulator Designations and Tailoring

Some bills would direct or grant authority to bank regulatory agencies to subject banks to or exempt banks from particular regulations. In general, these bills also include provisions that regulators perform and disclose certain analyses justifying their decisions and sometimes raise existing thresholds.

- The Systemic Risk Designation Improvement Act (H.R. 3312 and S. 1893) would amend the provisions of the Dodd-Frank Act that subject banks with more than $50 billion in assets to enhance prudential regulation. Instead of using this asset-size threshold, the bills would subject banks that had been designated as globally systemically important banks to the enhanced regulation and allow the Federal Reserve to make a determination—provided certain factors were considered and subject to approval by the Financial Stability Oversight Council—to extend the enhanced regulation to certain additional banks.

- The Taking Account of Institutions with Low Operation Risk Act of 2017 (H.R. 1116 and S. 366) would require federal bank regulators to consider the risk profile and business models of individual institutions when implementing new regulations and tailor those regulations to limit the regulatory burden. The regulators would be required to perform certain analyses related to this tailoring as part of the rulemaking process.

Conclusion

Many policymakers and other observers generally agree that bank regulations should be tailored to appropriately apply regulations across banks of different business models and risk profiles, and thus increase the benefits and decreases the costs of regulation. In addition, they generally further agree over broad characteristics of banks that would warrant greater or lesser regulatory stringency (e.g., small and traditional banks serving the credit needs of a community should be subject to less regulation than large and complex banks operating on a national or global scale). However, determining how tailoring should be achieved is a contentious issue. Policymakers and observers disagree over whether simple "bright line" rules based on certain criteria achieve appropriate tailoring. In part, this stems from disagreement over the degree to which asset size, business activities, and capital levels are appropriate indicators. Data presented in this report suggests that these characteristics are correlated to each other, as asset size, trading activity, and likelihood of holding significant derivative positions all tend to rise and fall together, whereas capital levels move inversely to those characteristics. However, these correlations are not perfect as any given bank may not reflect these tendencies. Because there are thousands of banks that can vary in their business models and risk profiles in countless ways, identifying the best possible method for achieving bank regulatory tailoring is likely to continue to be a debated issue.

Appendix A. Variable and Grouping Descriptions

|

Variable |

Description |

FR Y-9C Mnemonics |

|

Number |

The count of the number of institutions in each category. |

|

|

Total Assets |

The total assets including but not limited to cash, loans and leases, securities, trading assets, premises, and other real estate owned. |

BHCK2170 (for BHCs filing Y-9C) and BHSP2170 (for BHCs filing Y-9SP) |

|

Loans/Assets |

Total loans and leases divided by Total Assets |

BHCK2122 / BHCK2170 |

|

Deposits/Liabilities |

Sum of all deposits divided by Total Liabilities |

(BHDM6631+BHDM6636 + BHFN6631+BHFN6636) / BHCK2948 |

|

Trading Assets/Assets |

Assets and other financial instruments held for trading divided by Total Assets |

BHCK3545 / BHCK2170 |

|

Trading Liabilities/Total Liabilities |

Liabilities from the BHC's trading activities divided by Total Liabilities |

BHCK3548 / BHCK2948 |

|

Derivatives |

Sum of gross notional amount of all derivatives contracts |

BHCKA126+ BHCKA127 + BHCK8723 + BHCK8724 + BHCK8725 + BHCK8726 + BHCK8727 + BHCK8728 |

|

Tier 1 Leverage Ratio |

Reported tier 1 leverage ratio |

BHCA7204 |

|

Tier 1 Capital Ratio |

Reported tier 1 risk-based capital ratio |

BHCA7206 |

Source: CRS calculations using Federal Reserve Y-9C data, accessed on July 24, 2017, at https://www.chicagofed.org/applications/bhc/bhc-home.

|

Name |

Description |

|

Any Trading |

Trading Assets > 0 OR Trading Liabilities > 0 |

|

No Trading |

Trading Assets = 0 AND Trading Liabilities = 0 |

|

Active Trading |

Trading Assets/Assets > 1% AND Trading Liabilities/Liabilities > 1% |

|

Limited Trading |

(0% > Trading Assets/Assets > 1%) AND (0% > Trading Liabilities/Liabilities > 1%) |

|

No Derivatives |

Sum of gross notional amounts all derivative contracts = 0 |

|

Interest Rate and FX only |

Sum of gross notional amounts interest rate and foreign exchange rate derivatives contracts > 0 AND Sum of gross notional amounts equities and commodities derivatives contracts = 0 |

|

Varied Derivatives |

Sum of gross notional amounts interest rate and foreign exchange rate derivatives contracts > 0 AND Sum of gross notional amounts equities and commodities derivatives contracts > 0 |

|

TBO |

Trading Assets = 0 AND Trading Liabilities = 0 AND Sum of gross notional amounts equities and commodities derivatives contracts = 0 AND 0 ≤ Sum of gross notional amounts of interest rate and foreign exchange rate derivatives contracts < $8 billion AND (Total Assets – Total Liabilities) / Total Assets ≥ 0.1 |

|

Non-TBO |

Trading Assets > 0 OR Trading Liabilities > 0 OR Sum of gross notional amounts equities and commodities derivatives contracts > 0 OR Sum of gross notional amounts of interest rate and foreign exchange rate derivatives contracts > $8 billion OR (Total Assets – Total Liabilities) / Total Assets < 0.1 |

Source: CRS definitions used for this report.

Appendix B. Traditional Banking Organization Criteria and Leverage Ratios Compared

The grouping of banks as Traditional Banking Organizations, or TBOs, in this report and the grouping that would occur under FDIC Vice Chairman Hoenig's proposal are not necessarily a 1-to-1 match. As with all groupings in this report, the data comes from that reported as of June 30, 2017, but bank's balance sheets continually change overtime. In addition, data considerations necessitate altering the criteria for the purposes of this report.

The criteria in FDIC Vice Chairman Hoenig's May 2017 proposal to classify banks as a TBO are as follows:

- 1. The bank holds no trading assets or liabilities (other than permissible derivatives);

- 2. The bank holds no derivative positions other than interest rate and foreign exchange derivatives;