An analysis of the Senate Finance Committee-approved tax reform bill by the Joint Committee on Taxation (JCT) indicates that the legislation would result in some taxpayers paying more in taxes, some paying less in taxes, and some seeing little or no change in their tax liability. JCT's analysis, dated November 27, 2017, was conducted before the Senate passed H.R. 1 with an amendment on December 2, 2017. While the analysis was provided to the Washington Post and others, it has not been posted on JCT's website.

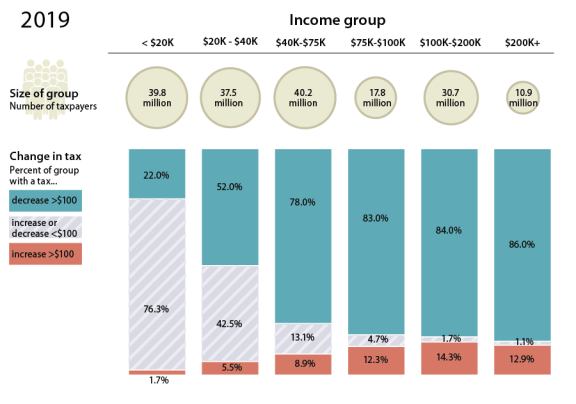

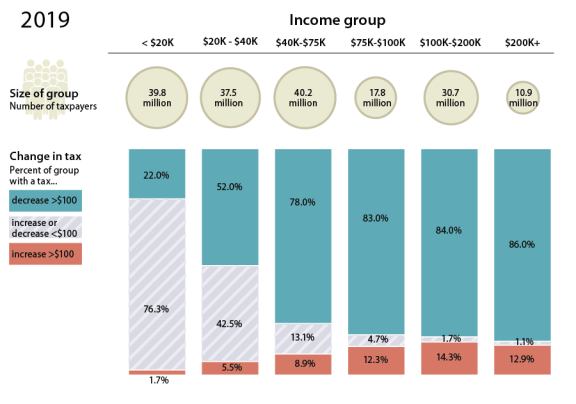

As illustrated in Figure 1, JCT estimates that in 2019,

- the majority of the lowest-income taxpayers would see little or no change in their tax liability (i.e., an increase or decrease of less than $100);

- as income increases, a greater proportion of taxpayers would see a tax cut (i.e., a tax decrease of more than $100); and

- as income increases, an increasing, though relatively small, proportion of taxpayers would see their taxes increase by more than $100.

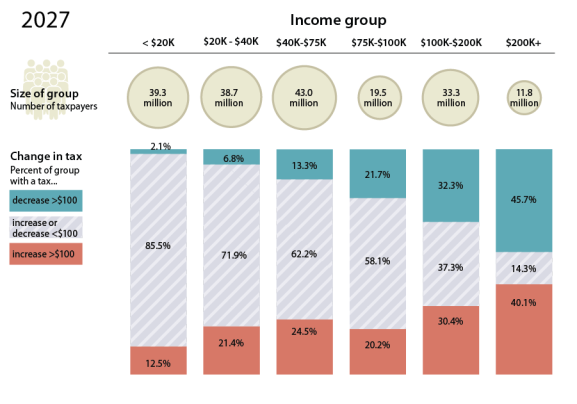

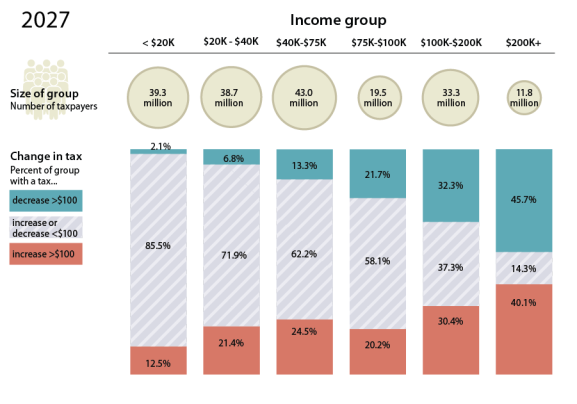

Over time, according to the JCT, the share of taxpayers receiving a tax cut would fall, and the share paying more in taxes would increase, as would the share seeing little or no change, as illustrated in Figure 2. This is primarily the result of the expiration of the individual income tax changes at the end of 2025 in the Senate committee bill.

|

Figure 1. Proportion of Taxpayers Receiving a Tax Cut or a Tax Increase

Greater Than $100 in 2019 Under Senate Finance Committee-Reported Version of H.R. 1

|

|

|

Source: Joint Committee on Taxation D-17-54.

Notes: Analysis was conducted prior to passage of H.R. 1 in the Senate on December 2, 2017. Income is defined as adjusted gross income (AGI) plus certain excluded income items.

|

|

Figure 2. Proportion of Taxpayers Receiving a Tax Cut or a Tax Increase

Greater Than $100 in 2027 Under Senate Finance Committee-Reported Version of H.R. 1

|

|

|

Source: Joint Committee on Taxation D-17-54.

Notes: Analysis was conducted prior to passage of H.R. 1 in the Senate on December 2, 2017. Income is defined as adjusted gross income (AGI) plus certain excluded income items.

|

There are several limitations with these estimates. First, this analysis was based on the Senate committee bill prior to its passage on December 2, 2017. Insofar as the legislation changes, these estimates may also change. For example, recent press reports indicate that the top bracket for individuals may be reduced from 39.6% to 37% in the conference bill. All else being equal, this would increase the share of higher-income taxpayers receiving a tax cut. Second, these estimates do not provide information about the size of tax increases or decreases faced by taxpayers at different income levels. Taxpayers who receive a cut of $500, for example, are grouped together with taxpayers who receive a tax cut of $10,000. Third, these estimates do not provide information about the underlying factors that result in taxpayers receiving a cut or an increase.

Other analyses—like one done by the New York Times using TaxBrain—illustrate the broad constellation of factors that can result in taxpayers receiving a cut or an increase, including (but not limited to) where they live, the number of children they have, whether they incurred significant medical expenses, and whether they own a home. (TaxBrain is an open-source tax model sponsored by the American Enterprise Institute.)

However, these estimates do suggest that unless significant changes are made to the Senate bill, the majority of taxpayers would initially see a tax cut of over $100, many taxpayers would see little or no change in their tax bill (generally lower-income taxpayers), and others would see a tax increase. These estimates also suggest that, barring major changes to the Senate bill, once the individual income tax provisions expire, the majority of taxpayers would see little or no change or would face a tax increase.