Background

The Federal Milk Marketing Order (FMMO) system was established in the 1930s to aid farmers facing low milk prices. As transportation and refrigeration developed in the late 1800s and early 1900s, milk dealers (called "handlers" in the FMMO system) became the main agents moving producers' milk into larger consumption areas. No standard pricing systems existed at this time. Instead, milk dealers controlled the price producers received. Given the high perishability of milk, local dealers were perceived as having asymmetric market power over producers that resulted in unfair buying practices. Producer cooperatives formed in attempts to develop different pricing methods to enhance producer incomes. In the midst of the Great Depression of the 1930s, the federal government established marketing orders that set minimum prices that producers receive for their milk. Thus, FMMOs were intended to level the playing field by returning some market power to milk producers.1

Milk's Unique Market Conditions

Federal milk marketing policy is based on the premise that milk producers offer a commodity that is subject to certain unique market conditions:

- Fluid milk is highly perishable—it must be kept cool or refrigerated almost immediately after production. This creates logistical hurdles throughout the marketing chain.

- Milk production has no distinct planting and harvest season as compared to field crops—that is, milk production occurs continuously on a daily basis. Most farms have limited on-farm milk storage capacity, and new milk production must move to markets on a regular basis whether prices are high or low. This puts milk producers in a weak bargaining position vis-à-vis milk buyers.

- Milk production and demand exhibit seasonality patterns that further complicate the marketing process: Milk production tends to increase in the spring and early summer when pastures are lush and the weather is mild, but it tends to decline in the late summer, fall, and winter months. In contrast, milk demand tends to peak in the fall and winter months during the school year and decline in the spring and summer.

- Fluid milk has a more inelastic demand than most other dairy products—that is, fresh milk consumption is not very sensitive to price changes. However, lower prices do affect the economic viability of the dairy farm.

- Milk that is produced in excess of fluid needs is processed into manufactured products with a longer shelf-life, such as butter, cheese, powdered milk, yogurt, and ice cream.

- The dairy industry is a high fixed-cost industry: A dairy farm has substantial investments in infrastructure, equipment, and dairy cattle. For example, it takes nearly two years from the time a calf is born until it is mature enough to join the milking herd and start to generate revenue. During that time it must be housed, fed, and cared for (including veterinary services).

These factors place milk producers in a difficult market position that has the potential to lead to instability in the supply and price of milk. Wide fluctuations in the price of milk have been considered an undesirable characteristic of the milk market. Persistent price volatility can cause fluctuations in supply and prices that lead to market instability that can drive producers out of the market. It can also potentially compromise the market's ability to provide consumers a dependable supply of quality milk.

FMMOs are designed to stabilize market conditions. FMMOs require milk handlers to pay milk producers uniform prices for milk and adhere to other specified rules. They are designed to assure milk producers of fair treatment in the marketplace while assuring consumers of a consistent and adequate supply of dairy products.

FMMO Authority

FMMOs are permanently authorized and are therefore not subject to periodic reauthorization. The FMMO system has its origins in the 1930s with the Agricultural Adjustment Act of 1933 (48 Stat. 31), which authorized marketing agreements and licensing for processors. The 1935 amendments (49 Stat. 750) to the 1933 act expanded and made explicit the authority of the U.S. Department of Agriculture (USDA) to establish minimum prices for milk. Current FMMOs, however, are based on the Agricultural Marketing Agreement Act of 1937 (1937 act; 50 Stat. 246), as amended, which reenacted and amended the 1933 legislation.2

The most recent major national revision to FMMOs occurred as part of the 1996 farm bill—the Federal Agriculture Improvement and Reform Act (FAIR Act; P.L. 104-127)—which included a provision (Section 143) requiring that USDA "consolidate and reform" the FMMO system. The law mandated that USDA reduce the number of milk marketing orders from 31 to no fewer than 10 and no more than 14 by April 4, 1999.3 USDA published a proposed rule on January 30, 1998, to solicit public comment on proposals for consolidation of the order system, including changes to classified pricing; replacement of the benchmark Basic Formula Price; and changes in order provisions, terminology, and classification of milk by end use.4 The final rule was published on December 17, 1999, and went into effect on January 1, 2000.5

Individual FMMOs are established and amended through a formal public hearing process that allows interested parties to present evidence regarding marketing and economic conditions in support of, or in opposition to, instituting or amending an order. This process is described in Appendix B. FMMOs are overseen as part of the Dairy Program, administered by the USDA's Agricultural Marketing Service (AMS).6

Objectives of FMMOs

According to testimony USDA provided to the House Committee on Agriculture in 1979, the objectives of FMMOs are as follows:7

- to promote orderly marketing conditions in fluid milk markets,

- to improve the income situation of dairy farmers,

- to supervise the terms of trade in milk markets in such a manner as to achieve more equality of bargaining between producers and milk processors, and

- to assure consumers of adequate supplies of good quality milk at reasonable prices.

An additional benefit from FMMOs is that marketing order administrators collect comprehensive statistics on milk and milk markets. USDA and other dairy economists use these statistics to evaluate the effectiveness and equity of milk marketing orders.

USDA achieves the objectives of FMMOs through classified pricing, pooling, and minimum producer prices. Minimum prices are formula-based and determined, in part, by the values of milk components (i.e., butterfat, protein, and other solids) that rise and fall with changing market conditions.

Federal and State Orders

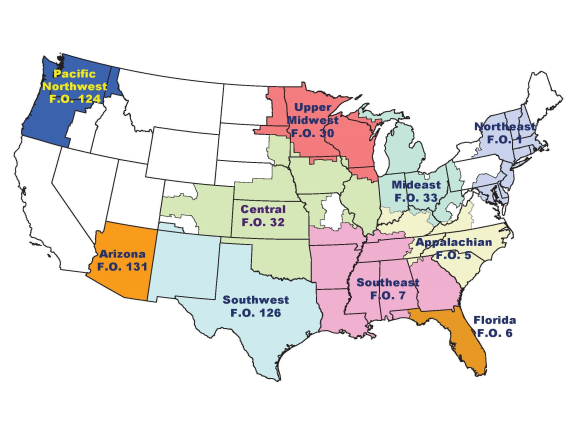

There are both federal and state milk marketing orders. The FMMO system regulates milk marketing across state lines but within explicitly defined and geographically aligned multistate regions. Following the revisions enacted in 1996 and implemented in 2000, 10 FMMOs currently operate (Figure 1), down from a peak of 83 in 1962.8

Some states have their own separate state-regulated milk marketing orders, with California being the largest of these. In some of the states, such as Pennsylvania and New York, price regulation of milk is covered in part by a federal order and partly by a state order. In others states (such as California, Montana, and Maine), price regulation of milk is covered by only state orders. In parts of some states, milk has no price regulation. State orders usually regulate milk prices that producers receive for fluid milk. Some states also regulate wholesale and/or retail milk prices. In states regulated by both federal and state orders, states may also consider marketing conditions unique to the state and set marketing requirements or pricing premiums beyond those required by a federal order.9

|

|

Source: AMS. Map is available at https://www.ams.usda.gov/sites/default/files/media/Federal%20Milk%20Marketing%20Orders%20Map.pdf. Note: F.O. = Federal Order. Blank areas of the map are regulated by state orders or are unregulated. Alaska and Hawaii are not in federal orders. |

Handlers and Usage

FMMOs regulate milk processors, known as handlers. Handlers purchase milk from dairy producers and/or producer cooperatives for fluid-milk bottling plants or dairy-product manufacturing plants. There are three types of handlers:10

- 1. Distributing plants that receive, process, and distribute fluid milk.

- 2. Supply plants that manufacture dairy products, play a role in balancing milk surplus in a marketing area, and supply milk to fluid plants if needed.

- 3. Dairy cooperatives that process fluid milk or manufacture dairy products. Unlike other handlers, cooperatives may pay their producer members in whatever manner the cooperative determines. They are not required to pay the FMMO minimum prices, but milk from cooperatives is classified and pooled like milk from other handlers.11

Handlers qualify for either full or partial regulation. If a plant has sales into a marketing area and meets certain criteria, such as volume thresholds, or the plant is not operated by a government agency or university, its milk sales are fully or partially regulated.12 Typically, a plant is fully regulated in the marketing area where it distributes most of its milk. A partially regulated plant has sales into a marketing area but does not meet certain criteria. For example, a producer-handler that produces milk, processes it, and markets it may be exempt from obligations to the marketing order pool.

Grades and Production

Perhaps the most critical aspect of federal orders is their regulation of the price paid to milk producers by handlers of Grade A milk, which accounts for 99% of total U.S. milk production in the United States.13 In 2015, 61% of U.S. milk production was pooled and marketed under FMMOs.14 Most of the remaining Grade A milk is regulated by state marketing orders, the largest being the California state order, which regulates about 19% of U.S. milk.15 About 1% of U.S. milk production is Grade B, which can be used only for certain manufactured dairy products.16 Grade B farm milk prices are not regulated by FMMOs.

Regulatory Scope

Milk handlers (excluding cooperatives) are required to pay no less than the minimum prices established by USDA using the classified pricing system (see "Current Dairy Pricing") for Grade A milk purchased from milk producers within the FMMO. Milk handlers, however, are free to purchase milk from any producer and to sell their processed milk at any price in any market. Handlers report receipts and end use of milk and maintain adequate records for the USDA market administrator to audit and verify the accuracy of the reported uses (see "USDA Administration").17 Each handler operating in the FMMO is treated similarly so that none gain advantage based on a cheaper milk supply.

The FMMO system does not regulate milk producers or restrict milk production. FMMOs do not guarantee milk producers a market for their milk, set a fixed price, or set a maximum price. A federal order also does not establish sanitary or quality standards.

For milk handlers, the FMMO does not regulate from whom to buy milk, to whom to sell milk, how much milk to buy or sell, or at what price to sell milk.

Current Dairy Pricing

Milk marketing orders require FMMO-regulated milk handlers to pay milk producers minimum prices for Grade A fluid milk. Orders primarily use two milk pricing mechanisms—classified end-use pricing and milk pooling—to determine the minimum price of the milk that handlers pay to producers. In turn, all milk producers within an order receive the same "uniform" price—also called the "blend" price—which represents a weighted share of all end uses of milk.18

Under the classified pricing system, the minimum price milk handlers must pay for milk components is calculated by formula based on end use. Handlers pay milk producers based on the pounds of milk marketed. The current system of pricing, with several additional adjustments, was implemented in January 2000 following the 1996 farm bill FMMO reform.

Class Prices

USDA classifies milk into four classes based on the end use of the milk:

- 1. Class I: fluid milk used for whole, lowfat, and skim milk, flavored milk, eggnog, and buttermilk;

- 2. Class II: milk used for soft products such as cottage cheese, yogurt, cream, and ice cream;

- 3. Class III: milk used for hard cheeses and cream cheese; and

- 4. Class IV: milk used for butter and dry products, primarily nonfat dry milk.

Class I fluid milk usually receives the highest minimum price under the federal order system. This helps to encourage the movement of milk from milk-surplus areas into milk-deficit areas and ensure sufficient supply of fluid milk to meet peak demand. Some dairy analysts believe that fluid milk would still typically carry a premium in the absence of marketing orders, reflecting transportation and other costs.19

By pricing surplus milk (i.e., milk in excess of fluid needs) at a lower price than fluid milk, classified pricing prevents such supplies from depressing the price of milk to dairy farmers to the point where the supply may become endangered. The minimum prices aim to protect milk producers from price reductions that might occur during episodes of milk surplus. This price protection can help stabilize milk producers despite weekly or daily variability in production.

Computing Class Prices

USDA determines a minimum price for each milk class based on the values of milk components such as butterfat, protein, nonfat solids, and other solids. These values rise and fall with changing market conditions.20 Formulas for these component values incorporate wholesale prices of manufactured dairy products, yield factors of milk components, and make allowances, or processing costs. Each class price is the sum of its skim milk and butterfat components. Skim milk prices are reported on a per hundredweight basis (cwt, or 100 pounds) and butterfat on a per pound basis. All classes of milk are priced on a standardized cwt basis that assumes that the milk consists of 96.5% skim milk and 3.5% butterfat.

See Appendix A for the formulas USDA uses to compute milk components and class prices.

Class I and Class II

Class I and II milk prices are computed differently than Class III and IV prices. Certain component prices used to compute Class I and II milk prices are announced by AMS in advance of a specific pricing month. AMS announces Class III and IV skim milk pricing factors and a butterfat pricing factor that are used to compute the base Class I price.21 AMS computes the base Class I price using the "higher of" the advanced Class III or IV skim milk pricing factor, also known as the Class I mover, and the advanced butterfat price. The advanced pricing factors are computed using the same wholesale prices used to compute Class III and Class IV prices (see below) using a two-week wholesale product weighted average.

A Class I differential is then added to the advanced Class I skim and advanced butterfat pricing factors to determine the actual Class I price in each FMMO.22 The intention of the Class I differential is to provide a premium to move milk into the high consumption areas of an order. Historically, a major component of the Class I differential for each FMMO has been the cost of transporting fluid milk from a surplus to a deficit region, or the distance differential. Class I differentials may vary between orders and within an order. For example, in the Upper Midwest order, the highest Class I differential is $1.80 per cwt in the marketing area near Chicago, and the lowest Class I differential is $1.60 per cwt in northwestern Minnesota and northeastern North Dakota. Nationally, the southern marketing area in the Florida order has the largest Class I differential at $6.00 per cwt.

Class II milk is priced using the announced advanced Class IV skim milk pricing factor. To this is added an additional $0.70 per cwt to encourage milk movement into Class II production. The Class II price is computed using the full month butterfat price.

The advanced prices and advanced pricing factors are announced no later than the 23rd of the month prior to the specific month (see "Milk Pricing Timeline").

Class III and Class IV

Class III and Class IV milk prices are determined by market wholesale prices of four dairy products: (1) Grade AA butter, (2) 40-pound blocks and 500-pound barrels of cheddar cheese, (3) nonfat dry milk, and (4) dry whey. USDA surveys dairy product wholesalers each week to determine the volume sold and the average price received for these manufactured dairy products.23 AMS reports monthly prices from the weighted average of either four or five weeks of surveyed sales. AMS publishes a schedule of release dates that states which weeks of wholesale prices are included in each month's weighted average.24

Using these wholesale prices, AMS computes component prices by deducting a fixed "make allowance" from the wholesale product prices and applying a fixed yield factor to the wholesale price. The make allowance is a national estimate of the cost of manufacturing specific products. The yield factor is an estimate of how much product is produced from a certain quantity of component. The make allowances and yield factors apply to all FMMOs.

At the end of the month, AMS announces the Class III and Class IV prices computed from the component values. All FMMOs use the same Class III and Class IV prices in computing prices paid by handlers to milk producers.

Milk Pricing Timeline

Determining the monthly price that producers receive for their milk is a multistep process spread over three months. It includes the months before and after the month being priced. For illustration, a brief description of the payment timeline for the price month of August 2017 follows:

- In July, AMS announced advanced prices and pricing factors for Class I and II milk. The announcement was on July 19. The announcement included the base Class I price. A Class I differential that varies by location is added to the base Class I price. The announcement also included the Class II skim milk price. Advanced prices and pricing factors are to be released no later than the 23rd of the month before the specific price month.

- AMS announced Class II, Class III, and Class IV prices and component prices on August 30. This announcement is to be released no later than the fifth of the month following the price month.

- Each FMMO pooled its milk receipts and end-use data for August to compute the uniform price, the minimum price that each handler must pay milk producers.

- Next, each USDA FMMO milk market administrator releases the uniform price for the order. The release dates for the uniform price are set in regulation and vary by FMMO but are generally "on or before" the 11th, 13th, or 14th of the following month. For August 2017, uniform prices were released in September.

- FMMO regulations require handlers to pay milk producers a partial payment during the specific price month and a final payment after uniform prices are computed. For August 2017 milk deliveries, milk producers received partial payments in about the third week of August and the final payment about three to four weeks later in September.

Milk Pooling

The second key feature of milk pricing in the FMMOs is the "pooling" of milk. Milk handlers are obligated to report milk receipts and milk end use by class to the FMMO market administrator. The total value of pooled milk receipts, as computed through classified price formulas, is the marketing order's producer-settlement fund. Each month some handlers will pay into the producer-settlement fund, and others will withdraw from the fund (see "Producer-Settlement Fund"). Each market administrator announces the uniform price for the month. Handlers pay milk producers and dairy cooperatives at least a uniform price based on a weighted average of the class prices. However, the computed uniform price paid to milk producers differs across the 10 FMMOs.25

Skim Milk and Butterfat Pricing

Four of the marketing orders—Arizona, Appalachian, Florida, and Southeast—pay milk producers based on the skim and butterfat value of milk. In these orders, the values of skim milk and butterfat are computed through the classified formulas. Milk producers are paid based on the pounds of skim milk and butterfat delivered to the marketing pool. For example, in the Southeast Order in August 2017:

- The uniform skim milk price was $9.83 per cwt, and the uniform butterfat price was $3.0111 per pound;

- The uniform price was ($9.83 x 0.965) + ($3.0111 x 3.5) = $20.02 per cwt.26

Component Pricing

The other six orders pay producers based on the value of the components as determined through classified pricing. Under the component system, milk producers are paid a uniform price equal to the Class III price plus a producer price differential (PPD). The PPD is an amount roughly equivalent to the sum of the value of all pooled milk for all classes minus the value of cheese components—protein, other solids, and butterfat. This amount is divided by the volume of pooled milk, resulting in a per cwt PPD. The PPD is added to the Class III price to compute the uniform price. For example, in the Central Order in August 2017:

- The Class III price was $16.57 per cwt as reported by AMS. The PPD was calculated at $0.56 cwt;

- The uniform price was $16.57 + $0.56 = $17.13 per cwt.27

Pool Adjustments

Adjustments may factor into the uniform price that producers receive from handlers. One is a somatic cell count (SCC) adjustment, which indicates the likelihood of harmful bacteria in milk. Four orders include adjustments for the SCC in the uniform price.28 Another is the producer location adjustment to the Class I differential, which is set for the principal pricing points in FMMOs. Handlers in the FMMO adjust the Class I differential based on their location in relationship to the principal pricing point. FMMOs may also make transportation adjustments to the pool for milk that may be shipped between supply and distribution plants when Class I milk is needed.

Producer-Settlement Fund

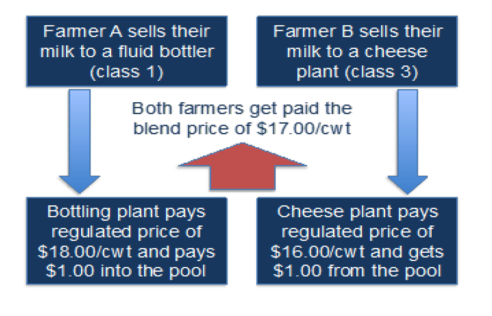

When milk handlers account for milk in the marketing pool and producer-settlement fund, some will pay money into the fund and others will withdraw money. Generally, handlers of Class I milk will pay into the producer-settlement fund, and handlers of lower class milk will withdraw funds when they pay producers the uniform price. Figure 2 provides a simple example of how this works, with two milk producers supplying milk for fluid and cheese use and the handlers paying at the uniform price level. The handlers pay the uniform—or in the example, blend price—of $17.00 per cwt to each producer, the average of Class I at $18.00 per cwt and Class III at $16.00 per cwt. The Class I handler pays $1.00 in the fund and the Class III handler receives $1.00 from the fund, equalizing the blend price for both handlers.

|

|

Source: American Dairy Products Institute, Milk Pricing 101, Intelligence, vol. 5, no. 6 (2017). |

Administration and Amendment of FMMOs

USDA Administration

The 1937 act gives USDA several authorities to achieve the objectives of the FMMO program. The Dairy Program of AMS administers the FMMOs. A USDA milk market administrator leads each FMMO.29 The federal costs associated with administering a federal order are partly covered by an assessment levied on handlers. Assessment rates are no more than $0.05 per cwt for the sum of various milk receipts specified in the Code of Federal Regulations.30

USDA milk market administrators' responsibilities include

- operating a laboratory to test milk to verify milk components, including butterfat, protein, and other solids. An accurate assessment of milk components is crucial to the eventual minimum price determinations for each class of milk end use.

- establishing market-wide values that must be paid to producers or their cooperatives (i.e., uniform prices) based on an assessment of milk end uses within the FMMO;

- auditing milk handler records to ensure compliance with order language; and

- assembling and publishing dairy market information.

Establishment and/or Amendment Process for FMMOs

Although USDA is responsible for developing the rules to regulate each FMMO, the dairy industry plays a major role in this process. Any changes to an FMMO's rules must be approved by milk producers in a referendum or though bloc voting of dairy farmer cooperatives. In addition, Congress can address issues related to the FMMO system through legislation.

AMS establishes and amends individual FMMOs through a formal public hearing process that allows interested parties to present evidence regarding marketing and economic conditions. Dairy producers, or their cooperative associations, usually initiate or amend an order by petitioning the Secretary of Agriculture to regulate the pricing of milk in their region. At least two-thirds of the affected producers must approve the proposed order through a referendum. Once established, an order is a legally binding instrument regulating all handlers or processors who dispose of fluid milk products within the specified marketing area.

When existing milk marketing orders are amended, a similar procedure is followed as if USDA has proposed a new marketing order: (1) USDA conducts a preliminary investigation; (2) USDA holds a public hearing to allow producers, handlers, and consumers to testify; (3) USDA issues a recommended decision; (4) USDA issues a final decision; (5) producers vote in referendum to approve or reject the amendment; and (6) USDA issues a final order. (See Appendix B on the amendment process.)

Current FMMO Issues

Some dairy stakeholders have raised concern about how AMS prices milk under federal orders and about the ability of fluid milk processors to manage risk. These include dairy forward pricing and Class I advanced pricing. Also, in 2015 California producers started the process for joining the FMMO system and will likely hold a referendum at some point in the future. A positive vote by these producers would increase the volume of milk production under federal orders. In addition, organic dairy producers have raised concerns about how FMMO pooling applies to organic milk handlers and producers.

Dairy Forward Contracts

In 1999, Congress authorized the dairy forward contract pilot program to provide dairy producers with a risk management tool used by other agricultural commodity producers.31 The program allowed producers who were not members of cooperatives to forward contract with proprietary handlers in exemption of FMMO minimum price requirements. (Dairy cooperatives had already been forward contracting and are not required to pay federal order minimum prices to their members.) Milk used for Class II, Class III, and Class IV purposes could be included in the program. Forward contracting on milk used for Class I (fluid milk) was prohibited.

After the pilot program expired in December 2004, Congress established the Dairy Forward Pricing Program (DFPP) in Section 1502 of the 2008 farm bill (P.L. 110-246). The DFPP included most of the language of the pilot program. Alternatively, producers and cooperatives were free to continue to price milk under FMMO minimum payment provisions. The DFPP was authorized through September 30, 2012.

After the 2008 farm bill provision expired in 2012, Congress extended the DFPP through September 30, 2013.32 Congress then reauthorized the DFPP in Section 1424 of the 2014 farm bill (P.L. 113-79), extending the forward contract program through September 30, 2018, with contracts signed by September 2018 to expire by September 30, 2021.

In a 2002 report mandated by Congress, USDA concluded that the pilot program was effective in reducing price volatility—the goal of forward contracting. It did not return a higher average payment price for milk.33 The study found that about 4% of eligible producers participated in the forward contracting pilot, pricing 5.3% of eligible milk under forward contracts. Twenty-two milk handlers offered producers forward contracts, and during the study period, an average of 25 plants received forward contracted milk monthly, ranging from 11 plants in the first month of the study to a high of 35 plants from August 2001 to November 2001.

Participation in the DFPP continued to be low. In 2011, AMS Deputy Administrator Dana Coale stated in written testimony to the House Agriculture Committee, "Participation in the program has been minimal, approximately 300 producers of a possible 10,000 to 15,000. Low participation rates may be attributed to perceived unfavorable price relationships and a limited number of processors offering forward contracts."34 This would indicate that 2% to 3% of producers who are not members of cooperatives use forward contracts.

In testimony before the House Committee on Agriculture in March 2017, the International Dairy Foods Association (IDFA) stated that Congress should make the DFPP permanent in the next farm bill. Making the DFPP permanent would eliminate the uncertainty that forward contract users face as the program's termination approaches at the end of a farm bill. In addition, IDFA said Congress should expand the program to include Class I milk to provide fluid processors with the same risk management tool available to dairy product manufacturers.35 At the same hearing, the National Milk Producers Federation (NMPF) stated that it supported the extension of DFPP but was noncommittal on extending it to Class I milk because of uncertainty on how this change would impact the price computations of milk.36 Those who oppose forward contracting for Class I milk might argue that it could undermine FMMO minimum pricing since Class I handlers effectively would not be required to pay the Class I price for milk.

Advanced Class I Pricing

Some Class I milk processors engage in cross-hedging using the Class III and Class IV Chicago Mercantile Exchange (CME) futures contracts to try to reduce the risk of price swings that may occur in fluid milk.37 Some analysts believe that FMMO advanced Class I pricing and the Class I formula of the "higher of" the Class III or Class IV skim milk pricing factors compromise the ability of processors to manage price risk in fluid milk (see "Class I and Class II"). The analysts believe that the advanced pricing factors contribute to large basis (cash price minus futures price) risk in using Class III or Class IV futures to hedge against risks for Class I milk.38 The view is that the utility of a cross-hedge is compromised because the Class I price is set about two weeks in advance of the CME settlement of the Class III and Class IV contracts. During this two-week gap, there could be significant shifts in the cheese or butter/powder markets that alter Class III and Class IV settlement prices. This would undermine the effectiveness of this risk management technique. Also, the Class I mover or "higher of" Class III or Class IV provision results in a risk that Class I prices will not align well with either the Class III or Class IV futures contracts.

To address this situation, NMPF and IDFA have proposed that Congress change the way USDA calculates the Class I advanced price. Instead of using the higher of the Class III or Class IV advanced pricing factors, the proposal calls for using the average of the advanced Class III and Class IV pricing factors, plus an additional $0.74 per cwt. According to analysis by the American Farm Bureau Federation, this change in the formula would have significantly reduced the basis risk (cash price minus futures price) on the CME contracts to about $0.02 per cwt, compared with an average of $0.47 per cwt on Class III and an average of $0.90 per cwt on Class IV during the 2001-2017 period.39

Supporters of this proposed change argue that it would create opportunity for fluid milk processors and large food companies seeking to hedge their costs of milk to more effectively manage price risk. Those that oppose the proposal may be concerned that this change would come through a legislative process instead of through the FMMO hearing process wherein producers and processors could express concerns about the proposal. Producers could also be concerned about effect the proposed formula change could have on the Class I milk price.

California Milk Marketing Order

In February 2015, dairy producers in California petitioned USDA to hold a hearing to promulgate a federal milk marketing order for their state.40 The petitioners believe that the way the California Department of Food and Agriculture (CDFA) currently administers the state order is causing disorderly marketing within California and that the FMMO system would provide more income to California milk producers.

In the 1996 farm bill, Congress authorized a California FMMO if state producers petitioned and approved such an order.41 The provision also allows California to maintain the state order milk quota. The 2014 farm bill amended the provision on California orders in the 1996 farm bill to require regular rulemaking rather than the expedited process that was used for consolidation of federal orders in the 1996 farm bill.42

The California state order and FMMOs differ in several ways. If California joins the federal order system, USDA will likely need to address these differences. As examples, California has five classes of milk, computes classified milk pricing differently than FMMO pricing, and has a milk quota system for Class I milk.43

The petitioning California dairy producers have stated that the California order fails to establish minimum prices in the California market that reflect national values. Specifically, California's Class 4b (equivalent to the FMMO Class III for cheese) formula undervalues whey in such a way that from August 2012 until February 2015, the minimum producer price was $1.96 per cwt lower than the FMMO Class III price.44 The petitioners assert that this difference in pricing benefits cheese processors in California at the expense of milk producers. The dairy producers argue that the California classified pricing has cost dairy farmers $1.5 billion from 2010 through 2014.45

The California milk producers stipulate in their petition that if California enters the FMMO system, the state quota system should be preserved. The quota system provides an additional payment from the state pool to quota holders. California originally established the milk quota in 1969 to pay producers of higher-valued fluid milk to join the state pooling system. Analysts estimate that the milk quota was valued at about $1.2 billion in 2015.46

USDA held public hearings on the California order from September 22 to November 8, 2015.47 USDA published a proposed rule, or "recommended decision," in the Federal Register on February 14, 2017, and included a 90-day comment period for the California FMMO.48

The "recommended decision" would allow California to maintain its quota system separate from the FMMO. Payments for the quota milk would be paid through authorized FMMO deductions, but CDFA would manage the quota. The California Order would adopt the four classes of milk of the FMMO system along with the FMMO make allowances and yield factors.

USDA is in the process of evaluating public comments, after which it is to release a final decision. Should this be a milk marketing order, California milk producers will vote on it.49 Milk producers affected by a California FMMO may vote on USDA's final decision, while qualified cooperatives may bloc vote for their members. If two-thirds of milk producers or producers that represent two-thirds of milk production vote positively, the California FMMO would be adopted.

Organic Milk

Handlers of certified organic milk who operate in FMMO marketing areas are obligated to participate in the FMMO pool for fluid products (Class I). According to the Organic Trade Association (OTA), most organic milk is purchased on long-term forward contracts, and about 65% of organic milk is processed into Class I products. Organic milk handlers pay prices well above the FMMO Class I price for fluid milk and for milk going into manufactured organic dairy products. AMS treats certified organic and conventional milk the same for minimum pricing and pooling under the FMMO system. However, conventional milk cannot be sold as organic milk, and OTA argues that the FMMO system disfavors organic milk handlers and producers.

In September 2015, OTA requested a USDA hearing to consider amending how FMMOs treat certified organic milk.50 Organic milk is pooled in the FMMOs, and organic fluid milk handlers are obligated to pay the FMMO Class I price into the producer-settlement fund. In addition, the FMMO system is supposed to balance fluid supplies with manufacturing milk supplies when necessary. However, an organic fluid bottler would not be able to rely on conventional milk handlers in the FMMO to supply organic milk, because milk handlers cannot substitute conventional milk for organic milk. According to FMMO statistics, organic milk accounted for 5.5% of total fluid milk products across all orders in 2016.51

OTA proposed that organic milk handlers receive a producer-settlement fund credit. The proposal was based on 7 C.F.R. 1000.76(b), referred to as the "Wichita Option," which governs milk payments by partially regulated distributing plants—plants that occasionally market fluid milk in the order.52 Under this section, if partially regulated handlers demonstrate that they pay producers more than the FMMO uniform price, they may be exempt from paying into the producer-settlement fund.

Under the OTA proposal, if organic milk handlers pay producers a price for all milk—regardless of class usage—above the FMMO Class I price, plus a $2.90 per cwt threshold, they would be eligible for a producer-settlement fund credit. This proposed threshold is the premium for organic milk over conventional milk as calculated by the Central Milk Producers Cooperative, a large marketing agency that supplies milk to various markets. For example, if the FMMO Class I price were $22.00 per cwt and organic handlers paid $26.60 per cwt, the credit would be calculated as ($26.60 - ($22.00 + $2.90)) = $1.70 per cwt credit. If all handlers of Class I milk were obligated to pay $2.00 per cwt into the producer-settlement fund for a certain month, the organic milk handler would be obligated to pay in only $0.30 per cwt ($2.00 - $1.70). If the credit were higher than the monthly Class I handler obligation, organic handlers would not withdraw the difference from the pool.53

NMPF and 10 milk cooperatives opposed the OTA proposal in comments submitted to USDA.54 They argue that it would essentially exempt organic milk from FMMO revenue sharing and that it does not ensure that organic milk producers would receive the money, or a share of the money, that handlers kept by not paying into the producer-settlement fund. Also, opponents believed the proposal could harm conventionally produced milk in the balancing function between fluid and manufactured products. For example, if supplies of organic milk were larger than demand for fluid organic milk, the excess organic milk would likely end up being used as Class I fluid milk, resulting in conventional milk typically used as Class I being pushed into manufacturing classes, lowering uniform prices for all producers.

OTA withdrew its request for a hearing on January 12, 2017.55 OTA noted that the public record provided no explanation for why no hearing had been scheduled during the 16 months that had lapsed since OTA had requested a hearing. In the withdrawal letter, OTA noted that it could resubmit the proposal in the future.

Appendix A. USDA Classified Milk Formulas

Below are the FMMO price formulas for each of the four classes of milk. Each class price is the sum of its skim milk and butterfat components derived from wholesale prices for Grade AA butter, 40-pound blocks and 500-pound barrels of cheddar cheese, nonfat dry milk (NDM), and dry whey that USDA reports each month. The component prices (protein, butterfat, other solids, nonfat solids) are derived from the wholesale products and then used to compute skim milk and butterfat values. All classes of milk are priced on a standardized hundredweight basis (cwt, 100 pounds) that assumes that they are 96.5% skim milk and 3.5% butterfat. Skim milk prices are reported on a per cwt basis and butterfat on a per pound basis. The class formulas are adjusted to reflect the different weight reporting basis—0.965 for cwt and 3.5 for pounds.

Class I = (Class I skim milk price x 0.965) + (Class I butterfat price x 3.5)

- Class I Skim Milk Price = Higher of advanced Class III or IV skim milk pricing factors + applicable Class I differential.

- Class I Butterfat Price = Advanced butterfat pricing factor + (applicable Class I differential divided by 100).

The advanced pricing factors are computed using price formulas for skim and butterfat from the Class III and Class IV formulas below, except they are based on a two-week weighted average. The advanced factors are announced by the 23rd of the month prior to the specific pricing month.

Class II = (Class II skim milk price x 0.965) + (Class II butterfat price x 3.5)

- Class II Skim Milk Price = Advanced Class IV skim milk pricing factor + $0.70.

- Class II Butterfat Price = Butterfat price + $0.007.

- Class II Nonfat Solids Price = Class II skim milk price divided by 9.

The advanced class IV skim milk pricing factor is also announced by the 23rd of the month, but the butterfat price for Class II milk is based on the actual monthly butterfat price and not an advanced price. A premium of $0.70 (for cwt) and $0.007 (for pounds) is added to the skim and butterfat price, respectively, to attract milk to Class II use.

Class III = (Class III skim milk price x 0.965) + (Butterfat price x 3.5)

- Class III Skim Milk Price = (Protein price x 3.1) + (Other solids price x 5.9).

- Protein Price = ((Cheese price - $0.2003) x 1.383) + ((((Cheese price - $0.2003) x 1.572) - Butterfat price x 0.9) x 1.17).

- Other Solids Price = (Dry whey price - $0.1991) times 1.03.

- Butterfat Price = (Butter price - $0.1715) times 1.211.

The formulas include a four- or five-week weighted average of wholesale prices for cheese, dry whey, and butter with a make allowance deduction of $0.2003 for cheese and $0.1991 for dry whey. The yield factors are 1.383 and 1.572 for cheese and 1.03 for dry whey. The butterfat price is the same for Class IV.

Class IV = (Class IV skim milk price x 0.965) + (Butterfat price x 3.5)

- Class IV Skim Milk Price = Nonfat solids price x 9.

- Nonfat solids price = (Nonfat dry milk price - $0.1678) x 0.99.

- Butterfat price = (Butter price - $0.1715) times 1.211.

The Class IV price formulas include a four- or five-week weighted average of NDM and butter wholesale prices with a make allowance deduction of $0.1678 for NDM and $0.1715 for butter. The yield factors are 0.99 for NDM, 1.211 for butter, and 9 for the pounds of nonfat solids in 100 pounds of milk.

Appendix B. The Amendment Process for Federal Orders

Amending an existing milk marketing order follows procedures similar to what would be followed to create a new marketing order. The process can be summarized in the following six steps:56

1. Prehearing procedures including preliminary investigation by USDA. Although any producer or handler can petition USDA for a change in the federal order system, such a request usually emanates from dairy producers or their cooperative associations. USDA then investigates their proposals and determines whether a hearing is necessary. The amendment process requires that a formal notice of a hearing be published in the Federal Register, giving the time and place of the hearing and the proposals to be considered.

2. Public hearing. The principal participants at the hearing are representatives of producers, handlers, and consumers, who appear as witnesses and present evidence on how a proposed change in an order would affect their interests. The hearing is presided over by a USDA administrative law judge, who handles procedural questions and decides on the order of witnesses. Except for official documents, the public hearing record is the sole source of information for appraising the issues. At the close of a hearing, the judge presiding over the case sets a time period within which witnesses may file written briefs.

3. Recommended decision issued by USDA. After the hearing, the record is turned over to the AMS Dairy Program for study and preparation of a recommendation on the issues. The preparation time varies depending on the complexity of the issues. A proposed decision is made public by the Administrator of AMS. Interested persons appraise the potential effects of the proposed amended order and file written comments on the amended order.

4. Final decision issued by USDA. The Dairy Program is required to reexamine the findings and conclusions in light of the exceptions received and then provide a draft final decision to the Secretary of Agriculture for review, approval, and publication. The provisions of the order contained in the decision are USDA's final proposed regulations and are the provisions presented to producers for their approval.

5. Producer approval. Before USDA can issue an amended order, the affected producers and cooperatives must approve it by referendum. Approval is contingent on a favorable vote either by two-thirds of the eligible producers or by producers who supply two-thirds of the milk sold in the marketing area.

A dairy cooperative may bloc vote its membership on all questions involving new or amended orders. When this occurs, all producers within the cooperative are considered to have voted as the cooperative voted.

6. Final order. In the event of a favorable vote, USDA will publish the final order in the Federal Register. An important feature of the approval process is that producers are required to vote on the order as amended, not just the amendment to the order. This requirement is not explicit in the statute. Instead, it represents a long-standing USDA approach in carrying out the federal milk marketing order program. Although the amendment process usually allows for conflicting views to be resolved in advance of the final vote, some producers may conceivably have to choose between an order with which they are dissatisfied and no order at all.