Medicare Part B pays ambulance suppliers and providers for services and mileage under the Ambulance Fee Schedule (AFS). Congress established, through the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (P.L. 108-173), three temporary payment adjustments for ground ambulance transports. These temporary adjustments, among other AFS adjustments, are determined by the zip code where the patient is picked up; every zip code in the United States is eligible for at least one of the three temporary payment adjustments. Since enactment, Congress has modified and extended these adjustments. The current extension expires after December 31, 2017. The House Ways and Means Committee has proposed an agreement for a new five-year extension.

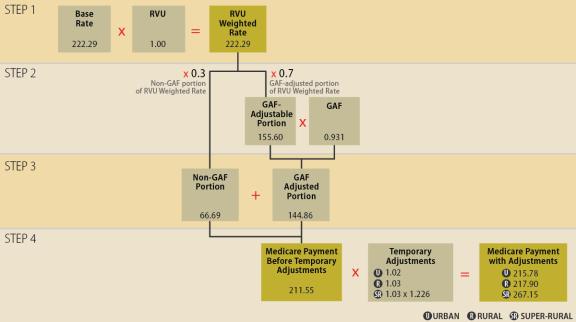

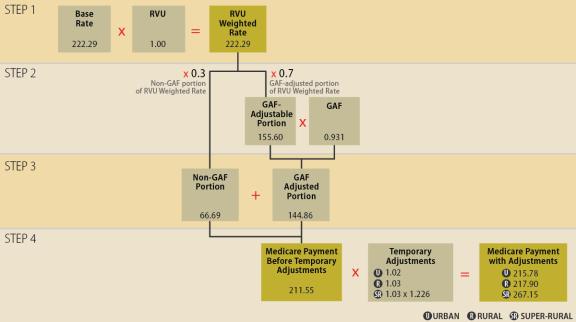

The AFS payment has two components, the service component and the mileage component. The service component payment covers the cost of personnel, equipment, and supplies and reflects the relative intensity of services provided to the patient at each of seven levels of service (referred to as the relative value unit, or RVU) and an adjustment to account for regional differences in costs (referred to as a geographic adjustment factor, or GAF). The mileage component payment covers transport costs and is the product of a single per-mile rate and the number of miles traveled with the patient onboard. The Medicare payment base rates for both the service and mileage components are updated annually by an inflation factor.

The first two temporary payment adjustments increase the Medicare service and mileage payments by 2% for ambulance transports in an urban zip code and 3% in a rural zip code. The third payment adjustment is a 22.6% increase that applies only to the service component payment of transports that originate in qualified rural areas (called super-rural areas)—areas that represent the least densely populated of all rural areas. Ambulance transports that receive the super-rural adjustment also receive the rural adjustment.

If the temporary adjustments expire, the Medicare AFS payment for the service and mileage components beginning January 1, 2018, will be the CY2017 Medicare payment amount before temporary adjustments multiplied by the annual inflation factor.

Figure 1 illustrates the service component of the AFS formula and the effect of the temporary payment adjustments on the most basic level of service, a Basic Life Support (BLS) nonemergency ambulance transport.

|

Figure 1. Example: Medicare AFS Service Component Payment and Temporary Adjustments

|

|

|

Source: CRS analysis of Medicare Ambulance Fee Schedule Public Use File CY2017.

Notes: Only the effect on the service component, not the mileage component, is reflected in the example since the super-rural adjustment applies only to the service component of the Medicare AFS payment. In this example, the CY2017 base rate is multiplied by an RVU of 1.00 for the most basic level of service, a Basic Life Support nonemergency ambulance transport. The selected CY2017 GAF of 0.931 for this example applies to North Carolina. For ambulance services in super-rural areas, both the super-rural and rural adjustments apply. AFS = Ambulance Fee Schedule; RVU = Relative Value Unit; GAF = Geographic Adjustment Factor.

|

A transport is eligible for the temporary payment adjustments if the patient point-of-pick-up is an urban, rural, or super-rural zip code. Table 1 illustrates the number of urban, rural, and super-rural zip codes nationally and by state (including the District of Columbia and U.S. territories) in 2017.

Table 1. Number of Urban, Rural, and Super Rural Zip Codes Under Medicare Ambulance Fee Schedule

|

National/State/DC/U.S. Territory

|

Urbana

|

Ruralb

|

Super-Ruralc

|

Total

|

|

National

|

23,425

|

11,683

|

7,829

|

42,937

|

|

AK

|

32

|

25

|

219

|

276

|

|

AL

|

481

|

215

|

158

|

854

|

|

AR

|

207

|

272

|

246

|

725

|

|

AS (American Samoa)

|

0

|

1

|

0

|

1

|

|

AZ

|

329

|

28

|

212

|

569

|

|

CA

|

2,174

|

324

|

226

|

2,724

|

|

CO

|

354

|

33

|

290

|

677

|

|

CT

|

395

|

50

|

0

|

445

|

|

DC

|

304

|

0

|

0

|

304

|

|

DE

|

82

|

17

|

0

|

99

|

|

FL

|

1,350

|

124

|

42

|

1,516

|

|

FM (Federated States of Micronesia)

|

0

|

4

|

0

|

4

|

|

GA

|

605

|

310

|

117

|

1,032

|

|

GU (Guam)

|

0

|

21

|

0

|

21

|

|

HI

|

77

|

66

|

0

|

143

|

|

IA

|

292

|

383

|

405

|

1,080

|

|

ID

|

98

|

33

|

204

|

335

|

|

IL

|

913

|

591

|

125

|

1,629

|

|

IN

|

534

|

453

|

13

|

1,000

|

|

KS

|

208

|

163

|

404

|

775

|

|

KY

|

309

|

699

|

22

|

1,030

|

|

LA

|

470

|

196

|

73

|

739

|

|

MA

|

681

|

70

|

0

|

751

|

|

MD

|

541

|

89

|

0

|

630

|

|

ME

|

134

|

200

|

171

|

505

|

|

MH (Marshall Islands)

|

0

|

2

|

0

|

2

|

|

MI

|

624

|

435

|

126

|

1,185

|

|

MN

|

412

|

245

|

386

|

1,043

|

|

MO

|

473

|

346

|

380

|

1,199

|

|

MP (Northern Mariana Islands)

|

0

|

3

|

0

|

3

|

|

MS

|

144

|

280

|

117

|

541

|

|

MT

|

55

|

11

|

345

|

411

|

|

NC

|

603

|

484

|

15

|

1,102

|

|

ND

|

61

|

24

|

334

|

419

|

|

NE

|

145

|

65

|

422

|

632

|

|

NH

|

100

|

175

|

17

|

292

|

|

NJ

|

732

|

16

|

0

|

748

|

|

NM

|

110

|

13

|

316

|

439

|

|

NV

|

164

|

21

|

72

|

257

|

|

NY

|

1,465

|

722

|

59

|

2,246

|

|

OH

|

829

|

658

|

0

|

1,487

|

|

OK

|

253

|

278

|

260

|

791

|

|

OR

|

232

|

75

|

193

|

500

|

|

PA

|

1,433

|

780

|

31

|

2,244

|

|

PR (Puerto Rico)

|

167

|

10

|

0

|

177

|

|

PW (Palau)

|

0

|

2

|

0

|

2

|

|

RI

|

90

|

1

|

0

|

91

|

|

SC

|

341

|

191

|

12

|

544

|

|

SD

|

47

|

32

|

339

|

418

|

|

TN

|

447

|

354

|

13

|

814

|

|

TX

|

1,661

|

454

|

612

|

2,727

|

|

UT

|

170

|

8

|

182

|

360

|

|

VA

|

797

|

417

|

63

|

1,277

|

|

VI (U.S. Virgin Islands)

|

0

|

16

|

0

|

16

|

|

VT

|

33

|

264

|

12

|

309

|

|

WA

|

448

|

121

|

175

|

744

|

|

WI

|

373

|

407

|

139

|

919

|

|

WV

|

421

|

404

|

111

|

936

|

|

WY

|

25

|

2

|

171

|

198

|

Source: CRS summary of Centers for Medicare & Medicaid Services' "CY2016 End of Year Zip Code File - Updated 11/17/2016."

a. Urban = an area within a Metropolitan Statistical Area (MSA) as defined by the Office of Management and Budget or a similar area as recognized by regulation. See 42 U.S.C. 1395ww(d)(2)(D).

b. Rural = an area located outside an urban area. See 42 U.S.C. 1395ww(d)(2)(D).

c. Super-rural = an area that ranks in the lowest 25% of all rural areas, by population density. See 42 U.S.C. 1395m(l)(12)(B).