Introduction

Growing demands on the transportation system and constraints on public resources have led to calls for more private-sector involvement in the provision of transportation infrastructure through what are known as "public-private partnerships" or "P3s." As defined by the U.S. Department of Transportation (DOT), "public-private partnerships (P3s) are contractual agreements between a public agency and a private-sector entity that allow for greater private-sector participation in the delivery and financing of transportation projects."1 Typically, the "public" in public-private partnerships refers to a state government, local government, or transit agency. The federal government exerts influence over the prevalence and structure of P3s through its transportation programs, funding, and regulatory oversight, but is usually not a party to a P3 agreement.

This report discusses the benefits and limitations of P3s that involve long-term private financing, the experience with these types of P3s in the United States, and current federal policy. The report outlines a number of issues and policy options that Congress might consider: project evaluation and transparency, asset recycling, incentive grants, infrastructure banks, tax credits for equity and debt, Interstate highway tolling, and changes to an existing federal loan program.

Types of P3s

With the traditional method of providing transportation infrastructure, known as "design-bid-build," the public sector is in charge of building, financing, operating, and maintaining a facility, although construction and other activities are typically contracted out to the private sector. By contrast, a public-private partnership may involve private-sector participation in any or all phases of development and operation of a new facility or the operation and maintenance of an existing facility. The many different forms P3s can take are characterized by the extent of the private sector's participation: design-build; design-build-finance; design-build-operate-maintain; design-build-finance-operate-maintain (DBFOM); and long-term lease agreements.

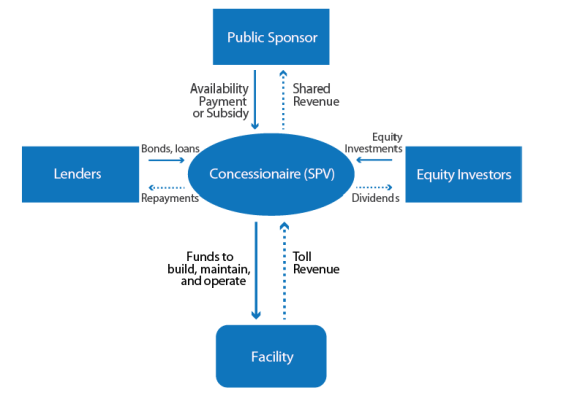

It is these last two types of P3s, DBFOM and long-term lease agreements, which generate the most interest and discussion. These P3s are also known as concession agreements, as they involve the ongoing participation of a private partner, termed the concessionaire, in managing the facility as a business.

- DBFOM P3s involve the private sector in most facets of constructing, operating, and maintaining a new facility, including long-term financing. The private-sector partner is repaid by facility users, through fares or tolls, or by payments from state or local government over the life of the contract. Known as "availability payments," these payments from the government are contingent on the "availability" of the facility consistent with agreed performance standards, such as snow removal times, but do not depend on facility demand. Figure 1 depicts the relationships between the public and private partners in a toll road DBFOM P3, such as the $2 billion Capital Beltway (I-495) High Occupancy Toll (HOT) Lanes project that opened for traffic in Northern Virginia in 2012. The parties are Capital Beltway Express, LLC (a joint venture of Fluor, a construction and engineering company, and Transurban, an Australian firm specialized in managing toll roads) and the Virginia Department of Transportation.

- Long-term lease agreements involve the operation and maintenance of an existing facility by a private concessionaire for a specified amount of time. The private partner pays the public sector a concession fee and agrees to operate and maintain the facility to prescribed standards. In return, the private company typically collects tolls or other user fees to pay lenders and debt holders and to generate a return on equity investment. Many cargo terminals in U.S. ports are operated by for-profit firms under contracts with the public port agencies that own the underlying land. A prominent example of this type of P3 is the 75-year lease concession of the Indiana Toll Road that was awarded in 2006 to the Indiana Toll Road Concession Company (ITRCC), a partnership between Cintra, a Spanish developer of transportation infrastructure, and Macquarie Infrastructure Group, then a subsidiary of an Australian investment bank, for a single lump-sum payment of $3.8 billion. Ownership of the lease was transferred to IFM Investors after the bankruptcy of ITRCC in 2014.

|

Figure 1. Relationships Between Partners in a DBFOM Toll Road P3 Project |

|

|

Source: Federal Highway Administration, Risk Assessment for Public-Private Partnerships: A Primer, December 2012, p. 2-3, https://www.fhwa.dot.gov/ipd/pdfs/p3/p3_risk_assessment_primer_122612.pdf. Note: SPV = special-purpose vehicle, a legal entity created solely to serve a specific function, in this case to conduct a single transportation project. |

P3 Implementation

Implementing the procurement of infrastructure projects through P3s typically requires the public sector to establish a legal and policy framework through a state enabling statute. These laws provide the authority for state and local government agencies to establish P3s and typically include provisions that limit the types of P3 arrangements allowed, how projects are to be selected and approved, how proposals are reviewed, the involvement of the public, and requirements for the release of information.2 According to DOT, 35 states, the District of Columbia, and Puerto Rico currently have general P3 enabling legislation.3

The implementation of a P3 typically entails complex and costly legal, financial, and technical issues that require public oversight over the course of a long-term contract. This may require extensive staff time and hiring of outside experts. An important aspect is the evaluation of projects. This may involve traffic and revenue studies, risk assessment, studies of project costs and financial feasibility, and value-for-money analysis that compares the proposed P3 with delivery of the project by the public sector.4

To date, the number of transportation P3s in the United States is relatively small, as is the amount of long-term private financing provided. According to one source, from 1993 through September 2017 there were 32 transportation P3s involving long-term financing, with total project costs totaling $45 billion. This includes the 99-year lease of the Chicago Skyway; the I-595 managed lanes project in Florida; the Purple Line light rail transit project in Maryland; and the first large airport P3, the $5 billion renovation of Terminal B at LaGuardia Airport in New York, agreed to in June 2016. Other possible airport P3s include Los Angeles, San Diego, and Denver.5

Although the pace of P3 deals has accelerated over time, P3s remain a very small percentage of investment in transportation. The Congressional Budget Office estimated that the value of contracts involving privately financed roads over 20 years through 2012 was less than 1% of government highway spending.6 Others have noted that P3s currently account for about 2% of public infrastructure outlays.7 P3s and private investment in surface transportation are relatively larger in many other countries, including Portugal, Spain, Australia, and the United Kingdom.8

There are a number of possible reasons for the limited use of P3s in the United States. Among them are the following:

- Municipal bonds, long-term debt instruments that receive preferential income tax treatment, allow state and local governments to borrow at lower cost than private investors. P3s are more widely used in many other countries, where there is no similar tax preference for state or local government borrowing.9

- P3s are a source of financing, not a source of funding. They require some type of revenue stream, such as a toll, fare, or tax, to service debt and provide a return on private equity, and such measures can be unpopular.10

- While the federal government can encourage the development of P3s, decisions are taken at the state and local level. Many states have very limited experience with P3s. Fifteen states do not have enabling statutes.

Benefits of P3s

There are three main potential benefits of P3s. First, P3s are a way to attract private capital to invest in transportation infrastructure. This can be particularly important when public-sector budgets are heavily constrained. P3s, therefore, can spur the building of transportation facilities earlier than would be the case if left to the public sector alone. The opportunity to invest in equity or taxable debt may lure pension funds and foreign investors, which generally are not subject to U.S. federal income tax and thus do not benefit from the tax exclusion of interest on municipal bonds.

Second, P3s may be able to build and operate transportation facilities more efficiently than the public sector through better management and innovation in construction, maintenance, and operation. Private companies may be more able to examine the full life-cycle cost of investments, whereas public agency decisions are often tied to short-term budget cycles.

Third, through P3s the public sector can transfer to the private-sector partner many of the risks of building, maintaining, and operating transportation infrastructure (Table 1). One major risk is that a facility will cost more to operate and maintain than budgeted, particularly if initial construction is poor. Another is that a facility to be financed by tolls will have less demand than estimated, and will fail to generate the expected revenue. Transferring these and other risks to the private sector may not save money, as the private partner requires compensation for assuming them, but the risk transfer may provide greater certainty for the public sector.

Limitations of P3s

Concerns with P3s include the types of projects involved, the risks retained by the public sector, and transportation planning. Private-sector investors are drawn to projects that have the greatest potential financial returns, adjusted for risk. P3s that are reliant on tolls or other user fees, therefore, are unlikely to address transportation issues in rural areas or on lightly traveled routes. However, P3s in these areas may be viable if based on state and local government availability payments.

Although some risks are typically transferred to the private sector in a P3, the public sector may retain significant risk. In some P3s, the public sector retains revenue risk, thus putting itself on the line to repay creditors if the project fails to generate anticipated revenue. Poorly written contracts, weak private-sector partners, and external events may force the public sector to renegotiate the P3 contract or to assume project ownership. And many transportation P3s involve federal loans through the Transportation Infrastructure Finance and Innovation Act (TIFIA) program, exposing federal taxpayers to losses if project revenue is insufficient to service the loans.

Table 1. Possible Allocation of Risks Between Public and Private Partners in Transportation Projects

|

Risk Type |

Design-Bid-Build (Traditional) |

Design-Build |

Design-Build-Finance-Operate-Maintain |

|

Change in Scope |

Public |

Public |

Public |

|

NEPA Approvals |

Public |

Public |

Public |

|

Permits |

Public |

Shared |

Private |

|

Right of Way |

Public |

Public |

Shared |

|

Utilities |

Public |

Shared |

Shared |

|

Design |

Public |

Private |

Private |

|

Geological Conditions |

Public |

Public |

Private |

|

Hazardous Materials |

Public |

Public |

Shared |

|

Construction |

Private |

Private |

Private |

|

Quality Assurance/Quality Control |

Public |

Shared |

Private |

|

Security |

Public |

Public |

Shared |

|

Final Acceptance |

Public |

Private |

Private |

|

Operations and Maintenance |

Public |

Public |

Private |

|

Financing |

Public |

Public |

Private |

|

Demand/revenue risk |

Public |

Public |

Private |

|

Force Majeure |

Public |

Shared |

Shared |

Source: Adapted by CRS from Federal Highway Administration, Risk Valuation and Allocation for Public-Private Partnerships (P3s), 2013, https://www.fhwa.dot.gov/ipd/pdfs/p3/factsheet_02_riskvalutationandallocation.pdf.

Note: NEPA = National Environmental Policy Act.

P3s may have longer-term effects on the transportation system insofar as they influence decisions about what to build and where. Unsolicited project proposals may not reflect the priorities of the state, region, or locality as incorporated into short- and long-range transportation plans. Noncompete clauses in P3 contracts may restrict public improvements near a privately operated facility or require the payment of compensation. Such restrictions may impede the ability of public agencies to increase capacity and to devise coordinated congestion management policies. The exceedingly long terms of some concession agreements, 99 years in some cases, tie the hands of planners and policymakers years into the future, when conditions may be very different.

Most transportation P3s to date have involved highways or marine cargo terminals. Only a few have involved public transportation, intercity passenger rail, or airports. User fees (fares) collected by public transportation agencies make up less than one-third, on average, of the funding used to provide transit service, and rail projects are similarly challenged. Private-sector entities are unlikely to initiate projects in such situations, and the public sector has sought to finance only a few transit projects through availability payments. Airport P3s have been inhibited by a number of factors including restrictions on the use of lease proceeds for airport purposes, cheaper financing for public airport operators through tax-exempt bonds, and regulatory conditions such as the necessity for 65% of air carriers serving an airport to approve a lease or sale.11

Federal Role in P3s

Transportation Infrastructure Finance and Innovation Act (TIFIA) Program

The main way in which the federal government has encouraged P3s and private financing in surface transportation is through the TIFIA program, which provides long-term, low-interest loans and other types of credit to project sponsors.12 Loans can be provided up to a maximum of 49% of project costs. Projects eligible for TIFIA assistance include highways and bridges, public transportation, intercity passenger bus and rail, intermodal connectors, and intermodal freight facilities.13

Several features of TIFIA financing make it attractive to project sponsors, including private-sector partners. Federal credit assistance provides funds at the same fixed interest rate at which the U.S. Treasury borrows, a lower rate than would be available to any private borrower. Loans are available for up to 35 years from the date of substantial completion, repayments can be deferred for up to 5 years after substantial completion, and amortization can be flexible. TIFIA financing is also available with a senior or subordinate lien, but is typically used as subordinate debt, meaning it is in line to be repaid after the project's operational expenses and senior debt obligations. However, the TIFIA statute includes a provision requiring that in the event of a project bankruptcy, the federal government will be made equal with senior debt holders. This is referred to as the "springing lien," and has led some to ask whether TIFIA financing is truly subordinate. The springing lien issue notwithstanding, TIFIA financing is generally thought to reduce project risk, thereby helping the partners in a P3 to secure private financing at rates lower than would otherwise be possible.

There are a number of eligibility criteria for TIFIA assistance. One is creditworthiness: to be eligible, a project's senior debt obligations and the borrower's ability to repay the federal credit instrument must receive investment-grade ratings from at least one nationally recognized credit rating agency. Generally, a project must cost $50 million or more to be eligible for assistance, but the threshold is $15 million for intelligent transportation system projects and $10 million for transit-oriented development projects, rural projects, and local projects. One further eligibility requirement is that loans must be repaid with a dedicated revenue stream. Limiting the federal share of project costs, encouraging private finance, and insisting on creditworthiness standards are ways in which the program attempts to rely on market discipline to limit the federal government's exposure to losses.

One attraction of TIFIA from the federal point of view is that a relatively small amount of budget authority can be leveraged into a large amount of loan capacity. Because the government expects its loans to be repaid, an appropriation need only cover administrative costs and the subsidy cost of credit assistance. According to the Federal Credit Reform Act of 1990 (2 U.S.C. §661(a)), the subsidy cost is "the estimated long-term cost to the government of a direct loan or a loan guarantee, calculated on a net present value basis, excluding administrative costs." A typical rule of thumb is that the average subsidy cost of a TIFIA loan is 10%, meaning that $1 million of budget authority can provide $10 million of loan capacity.

The Fixing America's Surface Transportation (FAST) Act (P.L. 114-94) reduced the direct authorization of funding for TIFIA to an average of $285 million per year from FY2016 through FY2020 from $1 billion per year in FY2014 and FY2015. Seen in isolation, this reduces DOT's capacity to issue loans by approximately $7.25 billion in FY2016, assuming a 10% subsidy cost and excluding administrative costs. However, the FAST Act also allows states to use funds from two federal highway grant programs to pay for the subsidy and administrative costs of credit assistance. This has the potential to increase TIFIA financing much above the $275 million direct authorization, but at the discretion of state departments of transportation.

Private Activity Bonds and Tax Issues

Private activity bonds (PABs), a type of municipal bond issued for transportation and secured by revenue generated by the project financed with the bonds, have been an important financing mechanism for P3s. Congress has approved limited use of tax-exempt PABs for selected transportation projects, as outlined in Section 142 of the Internal Revenue Code. These include airports, docks and wharves, mass commuting facilities, high-speed intercity rail facilities, and qualified highway or surface freight transfer facilities. The Secretary of Transportation must approve the use of PABs for qualified highway or surface freight transfer facilities, and the aggregate amount allocated must not exceed $15 billion. As of January 23, 2017, $10.9 billion of the $15 billion had been allocated.14 Examples of P3s partially financed with PABs are the Capital Beltway (I-495) High Occupancy Toll (HOT) Lanes project in Northern Virginia and the Gold Line transit rail project in Denver.

Other aspects of federal tax law also affect P3s, such as depreciation. Businesses are allowed to claim a deduction from their reported income for the depreciating value of their physical assets. The rate at which the private partners in a P3 may depreciate their assets for tax purposes can have a significant effect on the rate of return of a project. Under current law, for example, roads and bridges are generally depreciated over 15 years using the Modified Accelerated Cost Recovery System's (MACRS's) Alternative Depreciation System (ADS), if utilizing tax-exempt bond financing. If this period is less than the expected life of the asset, the short depreciation period represents a form of government subsidy to the project. Different depreciation schedules may apply for other types of transportation assets and in other situations.15 Reducing the depreciation period (or allowing the entire investment to be subtracted from income in the first year, known as "expensing") effectively reduces the marginal tax rate on income from the investment, which increases the after-tax rate of return to the investors.

State Infrastructure Banks

Another source of financing for P3 projects is state infrastructure banks (SIBs). Most of these were created in response to a program originally established by Congress in 1995 (P.L. 104-59). According to the Federal Highway Administration, 32 states and Puerto Rico have established a federally authorized SIB. Several states, among them California, Florida, Georgia, Kansas, Ohio, and Virginia, have SIBs that are unconnected to the federal program.16 Local governments have also begun to embrace the idea. For example, the City of Chicago has established a nonprofit organization, the Chicago Infrastructure Trust, as a way to attract private investment for public works projects, and Dauphin County, PA, has established an infrastructure bank to loan funds to the 40 municipalities within its borders and to private project sponsors. Funds for the loans are derived from a state tax on liquid fuels.17

Federal law allows a state to use some of its share of federal surface transportation funds to capitalize a SIB. The FAST Act also provides authority for a TIFIA loan to a state infrastructure bank (SIB) to capitalize a "rural project fund" within the bank. There are some requirements in federal law for SIBs connected with the federal program (23 U.S.C. §610), but for the most part their structure and administration are determined at the state level. Most SIBs are housed within a state department of transportation, but at least one (Missouri) was set up as a nonprofit corporation, and another (South Carolina) is a separate state entity.

Most SIBs function as revolving loan funds, in which money is directly loaned to project sponsors and its repayment with interest provides funds to make more loans.18 Some SIBs, such as those in Florida and South Carolina, have the authority to use their initial capital as security for issuing bonds to raise further money as a source of loans, with loan repayments then used to service the bonds.19 SIBs also typically offer project sponsors other types of credit assistance such as letters of credit, lines of credit, and loan guarantees.

In general, state infrastructure banks have not been significant participants in financing transportation projects. Moreover, most of their credit assistance is provided to local governments rather than private participants in P3s.20 According to one survey, between 1995 and 2012 federal and nonfederal SIBs entered into about 1,100 agreements worth a total of $9 billion, an average of about $8 million per agreement. About 70% of the projects helped by SIBs were highway projects, with aviation, water, transit, rail, and other types of projects accounting for the remaining activity. However, SIB activity has varied widely from state to state. Eight states—Pennsylvania, Ohio, California, Texas, Florida, Kansas, Missouri, and Arizona—account for three-quarters of SIB loans, and five states—South Carolina, Florida, Arizona, Texas, and California—account for three-quarters of the agreement value.21

Several factors may explain the generally low level of activity of state infrastructure banks and the dominance of public projects.22 Capitalization of the banks has typically lagged because the federal funds that could be used have already been committed to traditional projects. Moreover, there are relatively few small, local projects that have the ability to generate sufficient revenue to repay a loan. Tolling, for example, is often infeasible (due to low traffic volumes) or unpopular. Moreover, P3s rarely work for smaller projects because of the costs of procurement and oversight. Because projects funded by a federally authorized SIB must comply with federal regulations on matters such as environmental review and prevailing wages, project sponsors may decide it is cheaper and quicker to use funding from another source. Other concerns include how a SIB may affect a state's debt limit and credit rating and objections to creating an independent entity that can engage in off-budget financing.23

Build America Bureau

DOT has also been mandated to support P3s by compiling and making available best practices in the use of P3s, developing model contracts, and providing technical assistance. The FAST Act authorized the creation of a new bureau within DOT to consolidate federal transportation financing programs and support for P3s. To fulfill this mandate, DOT established the Build America Bureau in July 2016.

The Build America Bureau is responsible for administering TIFIA, the Railroad Rehabilitation and Improvement Financing (RRIF) program, the state infrastructure bank program, the allocation of PABs, and the Nationally Significant Freight and Highway Projects Program (23 U.S.C. §117). It is also responsible for providing help to project sponsors with other DOT grant programs; establishing and disseminating best practices and providing technical assistance with innovative financing and P3s; ensuring transparency of P3 agreements; developing procurement benchmarks; and working with project sponsors to navigate environmental reviews and permitting to reduce uncertainty and delays.

Policy Issues and Options

P3 agreements are typically negotiated between a private company and a state or local government, the owners of most transportation infrastructure; the federal government is not directly involved. However, the federal government can pursue policies to encourage P3s or not, and it can implement regulations on the way in which P3s are formed, particularly when federal funding, financing, and tax incentives are involved in the project. Limiting the formation of P3s would predominantly entail restricting federal benefits to such projects. Two broad policy options for expanding use of P3s would be to actively encourage P3s with program incentives, but with regulatory controls to protect the public interest, or to aggressively encourage the use of P3s through program incentives and deregulation.

Protecting the Public Interest

P3s offer a number of potential benefits for states and localities, but they also present a number of trade-offs and potential problems. Skeptics emphasize that P3s sometimes involve little private money or are subsidized by the public sector, that risk transfer from the public to the private sector can be illusory, and that P3 contracts may constrain government decisions about the transportation system.24 Proponents of this view tend to be cautious about the benefits of P3s and favor regulations designed to protect the public interest. Two aspects of protecting the public interest are the evaluation of P3 projects and the transparency of the negotiations and agreement between the public and private sectors.

Evaluation

Concerns about undervaluing public assets and windfall private profits are common with P3 deals. An often cited example is the 75-year lease of parking meters in Chicago that the city's inspector general argued was undervalued by 46%.25 For this reason, the Government Accountability Office and others have proposed requiring rigorous up-front analysis of the costs and benefits of a P3.26 One such approach is a value-for-money analysis that compares a traditional public-sector procurement with a P3 on the basis of projected risk-adjusted life-cycle costs. This may inform decisions about "which procurement approach to use, which risks to allocate to the private sector, and which private sector bid to accept."27

Such analyses are not without their own problems because they rest on a host of estimates and assumptions, including project costs, the valuation of risks, and future interest rates. Nevertheless, Congress could require the use of value-for-money analysis or a similar analysis tool for proposed P3 projects using federal funding or financing. This was one recommendation of the House Transportation and Infrastructure Committee's Special Panel on Public-Private Partnerships (T&I Special Panel), which met in 2014.28

Transparency

Disclosure of information to the public, especially at an appropriate time in the decisionmaking process, is another issue in the development of P3 agreements and throughout the contract period. The T&I Special Panel noted that "when federal funds are proposed to be included in a P3 agreement, the federal government should ensure that the project sponsor develops the agreement through a transparent process, the parties are held accountable, and there is an accurate accounting of the total federal investment."29 The information disclosed in highway P3s might include the proposed contract, current and future toll rates, the use of toll revenue for other investments, noncompete clauses, and administrative costs incurred by the public sector. In terms of the federal investment, the T&I Special Panel recommended that federal agencies should provide detailed information including tax benefits deriving from tax-preferred financing and asset depreciation allowances. A tradeoff to consider, however, is that the private sector may be less willing to enter into partnerships without confidentiality of certain aspects of a project, such as innovations and cost structures.30

Asset Recycling

The federal government could offer financial incentives for state and local governments to enter into long-term lease concessions of public assets and to "recycle" the proceeds from these deals into other infrastructure investments.31 Assets with the potential for leasing are those with user-fee revenue streams, such as toll roads and airports. New investments in infrastructure could involve facilities with or without such revenue streams, such as rural roads and transit systems. In Australia, the national government paid an incentive grant of 15% of the value of the asset to state and territorial governments to enter into such agreements. For example, the State of Victoria leased the Port of Melbourne for 50 years for nearly $10 billion, with those funds to be spent on removing highway-rail grade crossings and other regional infrastructure projects.32

This asset recycling program was active from 2014 until 2016. Criticisms of the Australian program included that the public sector loses control of income-producing assets for a one-time infusion of funds; that the incentive payment may lead to poor decisions by state and local government to privatize assets; and that the incentive funding favors states and localities that have large assets to privatize.33

Incentive Grants

Federal grants also could be made available to encourage the development of P3 projects for new projects. One option would be to set up a program of $2 billion per year to provide grants of up to 20% of costs for projects that would require life-cycle costing of capital, operations, and maintenance. These grants would be available to both government and P3 projects, but the expectation would be that a significant number of projects would be implemented with a P3.34 Canada has implemented a similar program with incentives provided by the P3 Canada Fund.35

Infrastructure Banks

A national infrastructure bank could be designed to promote development of P3s. The central idea of a national infrastructure bank, or "I-bank," would be to provide low-cost, long-term loans on flexible terms, much like the TIFIA program.36 However, an I-bank might have more independence than TIFIA, which is controlled by DOT, and as a separate organization might be able to build up a specialized staff, including expertise on the creation and oversight of P3s. Funding could come from an appropriation to pay for administrative costs and the subsidy cost of credit assistance, although in some formulations an I-bank would raise its own capital through bond issuance.

Many different formulations of an I-bank have been proposed over the past few years. Three I-bank proposals introduced in the 115th Congress are the National Infrastructure Development Bank Act of 2017 (H.R. 547) by Representative DeLauro, the Partnership to Build America Act of 2017 (H.R. 1669) by Representative Delaney, and the Building and Renewing Infrastructure for Development and Growth in Employment (BRIDGE) Act (S. 1168) by Senator Warner.

A related idea is the formation of a federal financing fund, most likely in the Department of the Treasury, which could administer all federal credit programs. This would improve consistency and use of best practices across infrastructure sectors, and would avoid the conflict of interest within federal agencies of promoting projects and providing credit.37

An alternative to creating a national infrastructure bank could be enhancing state infrastructure banks that already exist in many states. Although they tend to provide credit assistance to small projects that do not involve a P3, an expansion of their role may make them more supportive of projects involving a private partner. One of the biggest stumbling blocks to federally authorized SIBs has been capitalization. This is because federal grant funds that could be used to capitalize a SIB have typically been committed elsewhere. A FAST Act provision provides authority for a TIFIA loan to a SIB, but to date none have been made. Other ideas that have been proposed but not enacted include dedicating federal funds to SIBs (H.R. 7, 112th Congress) and authorizing SIBs to issue a type of tax credit bond (H.R. 2534; S. 1250, 113th Congress).

Equity Investment Tax Credits

To encourage the development of P3s, the federal government could provide a tax credit for equity investment in infrastructure projects. A recent tax credit proposal is the Move America Act of 2017 (S. 1229; H.R. 3912), introduced by Senators Hoeven and Wyden and Representative Jackie Walorski.38 The act would provide a 5% tax credit on investment in a qualified fund or project for 10 years. Qualified funds would include state infrastructure banks and water pollution and drinking water revolving loan funds. An investment in a fund or a project eligible for the tax credit could take the form of equity, a loan, or a loan guarantee. A criticism of equity investment tax credits is that they could be a windfall for equity investors and would not produce any new infrastructure investment. However, others argue that a well-designed tax credit for investors "should generate incremental tax-oriented equity augmenting (not displacing) the level of financial equity justified by project cash flows."39

Private Activity Bonds

Private activity bonds (PABs) provide P3 projects access to municipal bond market rates available to government project sponsors. Under current law, the use of tax-exempt, qualified PABs for transportation projects is limited to a fixed $15 billion for the life of the program. About $11 billion of the $15 billion has been allocated. Several proposals have sought to raise the cap. For example, the Obama Administration's FY2017 budget proposal included a provision to increase this amount to $19 billion. Another proposal is to standardize the tax rules for different types of projects and to uncap the volume.40 A more limited proposal, part of the Move America Act of 2017, is for the establishment of a new type of PAB known as Move America Bonds. These bonds would have some features to encourage P3s.

Changes to TIFIA Program

Another option for Congress is to increase direct funding for or otherwise adjust the TIFIA program. The FAST Act cut direct funding to the TIFIA program, while allowing states to trade formula grant funding for a larger loan. At the moment states do not have to make that trade because the TIFIA program is not in danger of running out of budget authority. In October 2017, unobligated budget authority in the TIFIA program amounted to about $1.5 billion. If the TIFIA program does exhaust its direct funding in the future, an unanswered question is whether states will voluntarily choose to use grant funding to pay the subsidy and administrative costs of a loan. Streamlining the application process to speed up approvals is another possible option for improving the use of TIFIA financing in P3 projects.41

P3s and Interstate Highway Tolls

User fees such as vehicle tolls provide a revenue stream to retire bonds issued to finance a project and to provide a return on investment. Many parts of the Interstate Highway System, those in urban areas and some in rural areas, have traffic levels that would make it financially viable to have toll-supported P3s.42 The need for reconstructing Interstates is likely to accelerate in the years ahead, as many reach their approximately 50-year design life. Many of these projects are likely to be very expensive "mega-projects," running into the hundreds of millions of dollars. Although imposing tolls on "free" roads is likely to be unpopular, Congress could allow states to impose tolls on an Interstate after its reconstruction as a way to facilitate P3 involvement in financing such projects.