Introduction

Section 1341 of the Patient Protection and Affordable Care Act (ACA; P.L. 111-148, as amended) establishes a transitional reinsurance program that is designed to provide payment to non-grandfathered, non-group market health plans (also known as individual market health plans) that enrolled high-risk enrollees for 2014 through 2016.1 Under the program, the Secretary of the Department of Health and Human Services (HHS) collected reinsurance contributions from health insurers and from third-party administrators on behalf of group health plans. The Secretary then used those contributions to make reinsurance payments to health insurers who enrolled high-cost enrollees (statutes required the HHS Secretary to determine how high-risk enrollees are identified, and the Secretary in turn defined high-risk enrollees as high-cost enrollees) in their non-group market plans both inside and outside of the exchanges (also known as marketplaces, where individuals can shop for and purchase private health insurance coverage).2

This report provides an overview of the ACA's transitional reinsurance program. The transitional reinsurance program's aim is to protect against the potential incentive to increase premiums by offsetting the expenditures associated with high-risk individuals. The first section of the report provides background information on reinsurance and the ACA risk mitigation programs. The second section describes the components of the transitional reinsurance program, as well as implementation of the program. The third section discusses questions, including those raised by a 2016 Government Accountability Office (GAO) report, regarding the scope of HHS's authority to administer the transitional reinsurance program. Finally, the report includes a table in the Appendix that summarizes key aspects of the transitional reinsurance program.

Background

Insurance Risk and Reinsurance

The concept underlying insurance is risk (i.e., the likelihood and magnitude of financial loss). In any type of insurance arrangement, all parties seek to manage their risk, subject to certain objectives (e.g., coverage and/or profit goals). In health insurance, consumers (patients as insurance beneficiaries) and insurers (as providers or sellers of insurance) approach the management of insurance risk differently. From the consumer's point of view, a person (or family) buys health insurance to protect against financial losses resulting from the unpredictable use of potentially high-cost medical care. The insurer employs a variety of methods to manage the risk it takes on when providing health coverage to consumers to assure that the insurer operates a viable business (e.g., balancing premiums against the collective risk of the covered population). The insurer uses these methods when pooling risk so that premiums collected from all enrollees generally are sufficient to fund claims (plus administrative expenses and profits).3

Sometimes, however, even with the variety of methods an insurer may employ to manage risk, the risk taken on by the insurer may not be sufficient to protect against the chosen risk management strategies. For example, a single health insurance company may be unable to cover a catastrophic loss (i.e., individuals who experience illnesses that result in huge expenditures). To limit their risk exposure, insurers often transfer some of their liability or risk to another insurer, a reinsurance company.4 That is, just as an insurer pools the risk of its covered consumers, a portion of that risk gets further spread to other insurance companies, known as reinsurers.

Reinsurance, thus, is an extension of insurance and further acts as a risk-transfer and risk-spreading mechanism. Insurers often purchase reinsurance for four reasons: (1) to limit liability on specific risks; (2) to stabilize loss experience; (3) to protect against catastrophes; and (4) to increase capacity by taking on more risk (i.e., more covered individuals).5 The availability of reinsurance allows insurers to reduce their risk exposure and can affect the availability and affordability of health insurance coverage. That is, the availability of reinsurance may be one of many factors an insurer considers in assessing potential exposure to loss in a certain market. This may affect whether or not to enter a market, what types of products to offer, and how premiums are set.

Reinsurance also may be structured in different ways depending on the insurers' needs and can range from simple to complex. Generally, however, reinsurance contracts either may be a broad agreement covering some portion of the business or may cover a specific risk.6

Occasionally, the government may act as the reinsurer in certain markets to provide a stabilizing influence. Governmental involvement in insurance and reinsurance is not a new concept, and the government covers risks in many markets (outside of health insurance). One example of the federal government acting as a reinsurer is through the Terrorism Risk Insurance Act of 2002 (TRIA; P.L. 107-297). Prior to the September 11, 2001, terrorist attacks, insurance covering terrorism losses was normally included in general insurance policies without additional cost to the policyholders. Following the attacks, both primary insurers and reinsurers pulled back from offering terrorism coverage. TRIA created a temporary, three-year terrorism insurance program to calm the insurance markets through a government reinsurance backstop sharing in terrorism losses.7

The ACA provides another example in which the federal government acts as the reinsurer in an insurance market.

The ACA and Risk Mitigation

The ACA includes provisions that restructure the private health insurance market by implementing several market reforms, including some that impose requirements on health insurance plans.8 As part of a larger set of private health insurance market reforms, the ACA requires private health insurers to provide coverage to individuals regardless of health status, medical history, and preexisting conditions.9 Under the ACA, insurers can adjust premiums based solely on certain ACA-specified factors (i.e., individual or family enrollment, geographic rating area, tobacco use, and age).10 Further, some individuals may be eligible for financial assistance (i.e., premium tax credits and cost-sharing subsidies) through the health insurance exchanges (also known as the marketplaces).11 In addition, the ACA requires that most individuals maintain health insurance coverage or pay a penalty for noncompliance (i.e., the individual mandate).12

As previously mentioned, the insurer often employs a variety of methods to manage the risk it takes on when providing health coverage to consumers. For instance, insurers often use projected enrollment, projected claims costs, and other policy-specific features (e.g., consumer cost sharing, provider networks) for a pool of individuals to set health insurance rates. Yet, prior to ACA implementation, little information was known regarding many of these factors in the newly created markets.

Accordingly, the new ACA market reforms and the expanded pool of individuals seeking to purchase health insurance coverage contribute to the uncertainty that insurers face in the early years of ACA implementation. Much of the uncertainty centers on the types of individuals who may or may not seek coverage. For example, to what extent would healthy individuals decide to seek coverage in addition to unhealthy individuals? Also, did the expanded pool extend to individuals who were previously uninsured and/or may have delayed receiving health care services? Furthermore, what was the demand for health care services for this expanded pool of individuals?

To mitigate the financial risk that insurers face and to stabilize the price of health insurance in the non-group and small-group markets, the ACA establishes three risk mitigation programs: the transitional reinsurance program, the permanent risk adjustment program, and the temporary risk corridors program. Table 1 summarizes the goals, objectives, and potential sources of uncertainty or risk that each of the ACA's three risk mitigation programs aims to moderate. Table 1 does not include information on program implementation.13

|

Risk Mitigation Program |

Goal |

Objective |

Potential Uncertainty or Risk |

Time Frame |

Applicability |

|

Transitional Reinsurance Program |

Offset a plan's risk associated with high-cost enrollees. |

Provide funding to plans that incur high costs for individual enrollees. |

Uncertainty regarding health care usage and demand by the previously uninsured, as well as any pent-up demand due to the lack of health insurance. |

Temporary; 2014-2016 |

Health insurers and third-party administrators on behalf of group health plans pay in; only non-group market plans (inside and outside of the exchanges) are eligible for payment.a |

|

Permanent Risk Adjustment Program |

Protect against adverse selection.b |

Transfer funds from relatively low-risk plans to relatively high-risk plans. |

Risk of adverse selection. That is, individuals who expect or plan for high use of health services tend to seek out coverage and enroll in more generous plans, whereas individuals who do not expect to use many or any health services may not obtain coverage and, if they do, they tend to enroll in less generous plans. The asymmetric information results in insurers not able to accurately assess risk. |

Permanent; beginning plan year 2014 |

All non-grandfathered, non-group, and small-group market plans (inside and outside the exchanges) are subject to the risk adjustment program.c |

|

Temporary Risk Corridors Program |

Protect against inaccurate rate setting. |

Limit the insurer's gains and losses. |

Uncertainty regarding individuals who may or may not seek coverage and their subsequent demand for health services. Would healthy individuals seek coverage as well as unhealthy individuals? |

Temporary; 2014-2016 |

All qualified health plans (QHPs) in the non-group and small-group market (inside and outside the exchanges) are subject to the risk corridors program.d |

Source: Congressional Research Service (CRS) analysis of the Patient Protection and Affordable Care Act (ACA; P.L. 111-148, as amended) and its implementing regulations.

a. The non-group (also known as the individual) market is where an individual can purchase health coverage from an insurer. Health insurance can be provided to groups of people who are drawn together by an employer or other organization. When insurance is provided to a group, it is referred to as group coverage or group insurance. The group health insurance market is divided into two segments, small group and large group. Prior to the ACA, most states defined small as businesses having 50 or fewer employees. Under the ACA, the definition of small was set to expand to businesses having 100 or fewer employees beginning in 2016. However, President Obama signed into law the Protecting Affordable Coverage for Employees Act (PACE Act; P.L. 114-60) to rescind the ACA's expanded definition of small subject to the rules of the small-group market in the state.

b. Adverse selection occurs when individuals who expect or plan for high use of health services tend to enroll in more generous (and consequently more expensive) health plans.

c. A grandfathered health plan refers to an existing plan in which at least one individual has been enrolled since enactment of the ACA on March 23, 2010. A plan can maintain its grandfathered status as long as it meets certain requirements. Grandfathered health plans are exempt from the majority of ACA market reforms.

d. Qualified health plans (QHPs) are plans that are certified to be offered in the health insurance exchanges. Each exchange is responsible for certifying the plans it offers. QHPs can be offered both inside the health insurance exchanges and outside the exchanges on the private health insurance market.

The remainder of this report addresses the transitional reinsurance program.

The Transitional Reinsurance Program

Overview

Section 1341 of the ACA establishes the transitional reinsurance program.14 The transitional reinsurance program is a temporary program (plan years 2014-2016) that provides payment to non-group market health plans that enroll high-cost (specified in statutes as high-risk) enrollees both inside and outside the exchanges.15 Prior to ACA implementation, little information was available regarding health care usage and demand for the previously uninsured, as well as any pent-up demand due to the lack of health insurance coverage. Accordingly, to limit their risk exposure in offering plans on the non-group market, insurers would likely raise premiums to the extent possible to protect themselves against the potentially high cost associated with delayed care. However, some of the new ACA market reforms limit the degree to which insurers may vary premiums. For example, individuals who were previously uninsured may apply for coverage on a guaranteed-issue basis; insurers must accept these applicants and can only vary premiums based on the factors noted above.16 The transitional reinsurance program is designed to mitigate the financial risk associated with individuals who had delayed needed health care while they were uninsured.

The ACA requires that a transitional reinsurance program be established in each state for 2014 through 2016.17 The ACA establishes the transitional reinsurance program to be redistributive in nature in which the HHS Secretary collects reinsurance contributions from health insurers and from third-party administrators on behalf of group health plans;18 the HHS Secretary then uses those contributions to make reinsurance payments only to health insurers offering plans in the non-group market both inside and outside of the exchanges.19 Under the program, only non-group market health plans with high-cost enrollees are eligible for reinsurance payments; the program covers a portion of the claims costs for these enrollees based on payment parameters (see "Payment Parameters" section of this report) set by the HHS Secretary.20 Overall, the transitional reinsurance program transfers a portion of the funds collected from most non-group and group health insurers to non-group market plans with high-cost enrollees.

Aggregate Collection Amounts

The statutes specify that the aggregate collection for all states for the transitional reinsurance program is to be $10 billion for plan year 2014, $6 billion for plan year 2015, and $4 billion for plan year 2016.21 The statutes also specify that an additional collection be deposited into the general fund of the U.S. Treasury.22 The aggregate collection for the U.S. Treasury is to equal $2 billion for plan year 2014, $2 billion for plan year 2015, and $1 billion for plan year 2016.23 In addition, the statutes allow for the collection of additional amounts for program administration.24 The statutes do not specify the aggregate administration amounts; rather, the HHS Secretary provided estimates of these amounts in regulations.25 The estimated amounts for program administration equal $20.3 million for plan year 2014, $25.4 million for plan year 2015, and $32.0 million for plan year 2016. Table 2 includes the amounts to be collected for reinsurance payments and the U.S. Treasury, as specified in statutes; the amounts for program administration, as estimated by the Secretary, for 2014-2016; and a combined total.

|

Year |

Total Collection for Reinsurance Paymentsa |

Total Collection for U.S. Treasurya |

Total Collection for Program Administration |

Total |

|

2014 |

$10 billion |

$2 billion |

$20.3 millionb |

$12.02 billion |

|

2015 |

$6 billion |

$2 billion |

$25.4 millionc |

$8.03 billion |

|

2016 |

$4 billion |

$1 billion |

$32.0 milliond |

$5.03 billion |

Source: CRS analysis of statute and regulations.

a. Amounts are statutorily defined in §1341 of the Patient Protection and Affordable Care Act (ACA; P.L. 111-148, as amended).

b. Department of Health and Human Services (HHS), "Patient Protection and Affordable Care Act; HHS Notice of Benefit and Payment Parameters for 2014, Final Rule," 78 Federal Register 15410-15541, March 11, 2013.

c. HHS, "Patient Protection and Affordable Care Act; HHS Notice of Benefit and Payment Parameters for 2015, Final Rule," 79 Federal Register 13744-13843, March 11, 2014.

d. HHS, "Patient Protection and Affordable Care Act; HHS Notice of Benefit and Payment Parameters for 2016, Final Rule," 80 Federal Register 10750-10877, February 27, 2015.

National Per Capita Reinsurance Contribution

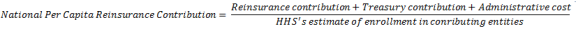

Although the statutes specify certain aggregate amounts to be collected (for reinsurance payments and U.S. Treasury) and allow collection for administration of the transitional reinsurance program, the statutes require the HHS Secretary to establish a methodology for determining how much each contributing entity (i.e., non-group health plan or group health plan) must contribute.26 The Secretary established a methodology whereby contributing entities pay a per person amount based on their enrollment.27 The per person contribution (i.e., the per capita national contribution) was calculated as the sum of (1) the aggregate contribution for the reinsurance program, (2) the additional contribution to the U.S. Treasury, and (3) the cost of administration divided by the estimated number of enrollees in plans required to make reinsurance contributions (see Figure 1).28

Accordingly, the national per capita reinsurance contribution was $63 for plan year 2014, $44 for plan year 2015, and $27 for plan year 2016.

Insurers could have paid national per capita reinsurance contribution amounts to the Centers for Medicare & Medicaid Services (CMS) in a single payment by mid-January of the following year or in two payments, the first payment due by mid-January of the following year and the second payment due by mid-November of the following year. For example, for plan year 2014, an insurer could have made a full payment of $63 per capita, due by January 1, 2015, or an insurer could have made the first payment of $52.50 per capita by January 15, 2015, and a second payment of $10.50 per capita by November 15, 2015.29

Payment Parameters

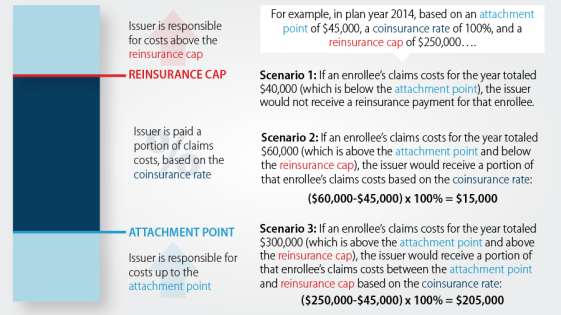

In addition to the national per capita reinsurance contribution, the statutes require the HHS Secretary to determine how high-risk enrollees are identified.30 Accordingly, HHS determined that reinsurance payments would be made to plans with high-cost enrollees.31 If an enrollee's total claims exceed a specified level (referred to as the attachment point), the insurer would be paid a proportion of claims costs (referred to as the coinsurance rate) beyond the attachment point until total claims costs reached a cap (referred to as the reinsurance cap).

The attachment point, coinsurance rate, and reinsurance cap together are the payment parameters that the Secretary proposes and publishes in the annual payment notice.32 Table 3 includes payment parameters (both proposed and final) for plan years 2014, 2015, and 2016.

|

Year |

Attachment Point |

Coinsurance Rate |

Reinsurance Cap |

|

2014 |

Currently $45,000a Previously $60,000b |

Currently 100.0%a Previously 80.0%b |

$250,000b |

|

2015 |

Currently $45,000c Previously $70,000a |

Currently 55.1%d Previously 50.0%a |

$250,000a |

|

2016 |

Currently $90,000c |

Currently 52.9%e Previously 50.0%c |

$250,000c |

Source: CRS analysis of regulations published by HHS.

a. HHS, "Patient Protection and Affordable Care Act; HHS Notice of Benefit and Payment Parameters for 2015 Final Rule," 79 Federal Register 13744-13843, March 11, 2014.

b. HHS, "Patient Protection and Affordable Care Act; HHS Notice of Benefit and Payment Parameters for 2014 Final Rule," 78 Federal Register 15410-15541, March 11, 2013.

c. HHS, "Patient Protections and Affordable Care Act; HHS Notice of Benefit and Payment Parameters for 2016 Final Rule," 80 Federal Register 10750-10877, February 27, 2015.

d. Centers for Medicare & Medicaid Services (CMS), "Transitional Reinsurance Program: Pro Rata Adjustment to the National Coinsurance Rate for the 2015 Benefit Year," June 17, 2016.

e. CMS, "Summary Report on Transitional Reinsurance Payments and Permanent Risk Adjustment Transfers for the 2016 Benefit Year," June 30, 2017.

An illustrative example of reinsurance payment eligibility and calculation, given the 2014 plan year's attachment point, coinsurance rate, and reinsurance cap, can be seen in Figure 2.

Program Implementation

The following sections describe implementation of the transitional reinsurance program in terms of its impact on health insurance premiums as well as information on amounts collected and remitted in plan years 2014-2016.

As mentioned, the goal of the transitional reinsurance program is to offset a plan's risk associated with high-cost enrollees. The availability of reinsurance allows insurers to reduce their risk exposure and may impact whether or not to enter a market, what types of products to offer, and what premiums to set. Accordingly, in determining premiums, an insurer would take into account the availability of reinsurance funds. According to analysis from the American Academy of Actuaries, the availability of reinsurance funds "reduces the risk to insurers, allowing them to offer premiums lower than they otherwise would be."33 The following sections include a brief discussion of the reinsurance program's impact on premiums in plan years 2014-2016. For each year, the insurers were aware of the amounts potentially available for reinsurance payments and used that information in developing premiums for the plan year.

The statutes specify amounts to be collected for the transitional reinsurance program and for the U.S. Treasury, and they allow for the collection of amounts toward program administration (see Table 2). However, collection amounts fell short of the target for the 2014-2016 plan years, as outlined below. The following sections describe amounts collected by CMS, amounts requested by insurers, and amounts remitted to insurers in the 2014-2016 plan years.

2014

For plan year 2014, $10 billion was to be available for reinsurance payments (see Table 2) as well the associated payment parameters (see Table 3) for the plan year.34 According to analysis from the American Academy of Actuaries, the availability of the reinsurance program funds, and the associated payment parameters, reduced health insurance premium rates in plan year 2014 by 10%-14%.35

For plan year 2014, the first or full reinsurance contribution was due to CMS by January 15, 2015, and the second reinsurance contribution was due by November 15, 2015. Eligible insurers also were required to submit reinsurance data by April 30, 2015.36 CMS remitted reinsurance payments to insurers between July 2015 and September 2015.

CMS collected approximately $9.7 billion in reinsurance contributions, which was below the target amount of $12.0 billion for plan year 2014 ($10.0 billion for reinsurance payments and $2.0 billion for U.S. Treasury, see Table 2).37 Nationwide, 437 insurers requested reinsurance-eligible claims of approximately $7.9 billion.38 And, given the coinsurance rate of 100% for plan year 2014 (see Table 3), CMS remitted approximately $7.9 billion for reinsurance payments to insurers.39 Moreover, approximately 18% of the reinsurance contributions for plan year 2014 (approximately $1.7 billion of the $9.7 billion) was reserved for reinsurance payments for the 2015 plan year.40 No amount was deposited to the U.S. Treasury.

2015

For plan year 2015, $6 billion was to be available for reinsurance payments (see Table 2) as well the associated payment parameters (see Table 3) for the plan year.41 According to analysis from the American Academy of Actuaries, the availability of the reinsurance program payments, and the associated payment parameters, reduced health insurance premium rates in plan year 2015 by 6%-11%.42

For plan year 2015, the first or full reinsurance contribution was due to CMS by January 15, 2016, and the second reinsurance contribution was due by November 15, 2016. Eligible insurers also were required to submit final reinsurance data by May 2, 2016.43 CMS remitted early reinsurance payments to insurers between March 2016 and April 2016 and remitted the remaining reinsurance payments once November 2016 contributions were collected.44

CMS collected approximately $6.5 billion in reinsurance contributions, which was below the target amount of $8.0 billion for plan year 2015 ($6.0 billion for reinsurance payments and $2.0 billion for U.S. Treasury, see Table 2).45 Nationwide, 497 insurers requested reinsurance-eligible claims of approximately $14.3 billion. And, given the coinsurance rate of 55.1% for plan year 2015 (see Table 3), CMS remitted approximately $7.8 billion for reinsurance payments to insurers.46 In March and April 2016, CMS remitted approximately $7.0 billion (of the $7.8 billion) in early reinsurance payments for the 2015 plan year to insurers.47 CMS made the remaining payment of approximately $0.8 billion after the November 15, 2016, contributions were collected.48

Of the approximately $6.5 billion collected for plan year 2015, CMS indicated that $500 million would be allocated on a pro rata basis of 1% for program administration and 99% to the U.S. Treasury.49 Accordingly, approximately $5 million and $495 million were allocated for program administration and to the U.S Treasury, respectively.50

2016

For plan year 2016, $4 billion was to be available for reinsurance payments (see Table 2) as well the associated payment parameters (see Table 3) for the plan year.51 According to analysis from the American Academy of Actuaries, the availability of the reinsurance program payments, and the associated payment parameters, reduced health insurance premium rates in plan year 2016 by 4%-6%.52

For plan year 2016, the first or full payment was due by January 15, 2017, and the second payment is due on November 15, 2017. Eligible insurers also were required to submit final reinsurance data by May 1, 2017.53 CMS anticipates remitting early reinsurance payments to insurers in August 2017 and expects to remit the remaining reinsurance payments once November 2017 contributions are collected.54

CMS anticipates collecting approximately $4.0 billion in reinsurance contributions, which is below the target amount of $5.0 billion for plan year 2016 ($4.0 billion for reinsurance payments and $1.0 billion for U.S. Treasury, see Table 2).55 Nationwide, 445 insurers requested reinsurance-eligible claims of approximately $7.5 billion. And, given the coinsurance rate of 52.9% for plan year 2016 (see Table 3), CMS expects to remit a total of approximately $4.0 billion for reinsurance payments to insurers.56 In August 2017, CMS expects to remit approximately $3.3 billion (of the $4.0 billion) in early reinsurance payments for the 2016 plan year to insurers.57 This early payment represents a portion of the full reinsurance payment that insurers will receive for the 2016 plan year. CMS will make a second reinsurance payment once the November 15, 2017, contributions have been collected.58 No amount is anticipated to be deposited to the U.S. Treasury.59

Scope of HHS's Authority to Administer and Fund the Transitional Reinsurance Program60

Although states are directed to establish their own transitional reinsurance programs, currently no state is doing so.61 The HHS Secretary is implementing the transitional reinsurance program for all states, citing the authority under Section 1321(c)(1) of the ACA.62 Under this authority, the Secretary may "take such actions as are necessary" to ensure that the requirements of the transitional reinsurance program are met.63 In those states where the federal government is implementing the transitional reinsurance program, HHS (through CMS) acts as the reinsurance entity for purposes of Section 1341 of the ACA, collecting contributions from covered insurers and third-party administrators (i.e., contributing entities),64 as well as making payments from those contributions to eligible insurers under the program.65

CMS currently allocates all collections in a given year to reinsurance payments for insurers until the statutory collection targets for those purposes have been met.66 Once the statutory collection targets for a year are satisfied, any further collections in that year would be allocated to program administration expenses and to the U.S. Treasury. Prior to adopting this allocation formula, CMS had issued a final rule with a different allocation method, which has since been amended. In its 2015 Payment Notice issued on March 11, 2014, the first collection was allocated solely toward reinsurance payments and program administration expenses, whereas the second collection was allocated only to the U.S. Treasury.67

Subsequently, in a March 21, 2014, proposed rule, CMS sought comment on its "legal authority to implement a prioritization of reinsurance contributions to reinsurance payments over payments to the U.S. Treasury."68 One commenter described Section 1341 of the ACA as "impos[ing] few requirements on the expenditure of reinsurance contributions, stating that the statute does not specify that payments must be made to insurers and to the U.S. Treasury simultaneously, or that the U.S. Treasury must receive its full funding before reinsurance pool payments are made."69 CMS noted its agreement with this argument, stating that Section 1341 "provides [the agency] with the discretion ... to determine the priority, method, and timing for the allocation of reinsurance contributions collected."70 Consistent with this conclusion, a final rule issued on May 27, 2014, revised the allocation formula. Under the current system, no funds collected from insurers are deposited in the Treasury until sufficient amounts have been received to fund the reinsurance program.71

The permissibility of CMS's final rule has been called into question by some observers. On September 29, 2016, GAO issued a legal opinion stating that the current method of allocating contributions from insurers is not authorized by Section 1341.72 In its opinion, GAO focused on the language of Section 1341, noting that when Congress has enacted statutory language that speaks directly to an issue, such statutory language, viewed in the context of the overall statutory scheme, must control.73 In particular, Section 1341 states that each insurer's contribution into the transitional reinsurance program "shall be designed so that each issuer's contribution amount for any calendar year ... reflects its proportionate share of an additional $2,000,000,000 for 2014, an additional $2,000,000,000 for 2015, and an additional $1,000,000,000 for 2016."74

GAO noted that this provision uses the mandatory term "shall" when directing HHS to collect amounts from insurers for the U.S. Treasury.75 The use of this term led GAO to the conclusion that the plain language of Section 1341 "requires[s] HHS to collect amounts for the Treasury and do so without qualification."76 In reaching this conclusion, GAO rejected CMS's argument that the use of the term "reflects" indicated that CMS retained a degree of flexibility in determining how to assess an insurer's U.S. Treasury contribution.77 In GAO's view, the plain language and structure of the statutory provision counseled against a permissive reading of the statute's allocation requirements.78

Further, GAO concluded that the statute "explicitly prohibits" such amounts collected for the U.S. Treasury from being used for reinsurance payments to insurers.79 Where overall collections were insufficient to meet the statutory targets, GAO stated that the proper course of action was to apportion the receipts between reinsurance payments and the U.S. Treasury on a pro rata basis instead of prioritizing one over the other.80 In support of this pro rata allocation of collections, GAO cited federal court decisions that held that, in cases where programs of federal spending were underfunded, the agency should "preserve the allocation formula" provided in the statute rather than exercise "total discretion in the allocation of the funds."81

Following the issuance of GAO's opinion, CMS indicated that it disagreed with GAO's conclusions and would continue to prioritize collections toward reinsurance payments.82 Past opinions by the Office of Legal Counsel (OLC) in the Department of Justice have taken the position that GAO legal opinions are not binding upon the executive branch, "[a]lthough the opinions and legal interpretations of the GAO and the Comptroller General often provide helpful guidance on appropriations matters and related issues.... "83

Other commentators have argued that the Supreme Court's recent decision in King v. Burwell counsels interpreting the ACA "[i]f at all possible ... in a way that is consistent" with "improving health insurance markets, not to destroy them."84 In King, a majority of the court rejected a literal application of the statutory provision governing health insurance premium subsidies in part because such a reading would have resulted in significantly higher premiums and lower enrollment.85 Arguably, CMS's prioritization of reinsurance contributions for reinsurance payments over U.S. Treasury contributions provides greater assistance to insurers by ensuring that more funding is available to make reinsurance payments to those insurers that enroll high-cost individuals. If the market consequences of not allowing such prioritization of reinsurance contributions would be similarly as significant, it could be argued that King suggests it might be permissible to depart from "the most natural reading of the statute."86

On the other hand, if allocating contributions to the U.S. Treasury would not result in the same degree of harm to the insurance market, it might be argued that the Court's opinion in King would not have any applicability to the interpretation of Section 1341 of the ACA. Moreover, the King Court's interpretation of the ACA provision was not simply based upon the potential policy consequences of a literal reading of the provision; rather, the Court's interpretation of the ACA provision was guided in part by the "broader structure" of ACA.87 Relying upon "the fundamental canon of statutory construction that the words of a statute must be read in their context and with a view to their place in the overall statutory scheme,"88 the King Court determined that support existed to interpret the ACA provision in a manner different than a plain reading of the text might initially suggest. It is not clear that a reviewing court would necessarily believe that the King ruling supports construing Section 1341 in a manner contrary to the reading suggested by its plain text, unless evidence could be found elsewhere in the ACA that favored a different interpretation. To date, it does not appear that any suits have been filed challenging CMS's prioritization of reinsurance contributions for reinsurance payments over U.S. Treasury contributions.

Appendix. Transitional Reinsurance Program Summary Table

Table A-1. Selected Summary Information for the Affordable Care Act's Transitional Reinsurance Program

|

Contribution Parameters |

Payment Parametersa |

||||||||

|

Year |

Total Collection for Reinsurance Paymentsb |

Total Collection for U.S. Treasuryb |

National Per Capita Reinsurance Contributionc |

Deadlines |

Attachment Pointd |

Coinsurance Ratee |

Reinsurance Capf |

Amounts Collected/ Anticipated |

Amounts Remitted |

|

2014 |

$10B |

$2B |

$63g |

Full payment by 01/15/15 or first payment of $52.50 by 01/15/15 and second payment of $10.50 by 11/15/15h |

Currently $45,000h Previously $60,000g |

Currently 100.0%h Previously 80.0%g |

$250,000g |

Total ≈ $9.7Bi ≈$8.7B collected as of Mar. 2015 ≈$1.0B more collected by |

≈$7.9B remitted for reinsurance paymentsj ≈$1.7B reserved for reinsurance payments for the 2015 plan yeark No amount deposited to the U.S. Treasury |

|

2015 |

$6B |

$2B |

$44h |

Full payment by 01/15/16 or first payment of $33.00 by 01/15/16 and second payment of $11.00 by 11/15/16h |

Currently $45,000l Previously $70,000h |

Currently 55.1%m Previously 50.0%h |

$250,000h |

Total ≈ $6.5Bk ≈$5.5B collected as of Feb. 2016 ≈$1.0B more collected by |

≈$7.8B remitted for reinsurance paymentsn ≈$495M deposited to U.S. Treasury o |

|

2016 |

$4B |

$1B |

$27l |

Full payment by 01/15/17 or first payment of $21.60 by 01/15/17 and second payment of $5.40 by 11/15/17h |

Currently $90,000l |

Currently 52.9%p Previously 50.0%l |

$250,000l |

Total ≈ $4.0Bq ≈$3.3B collected as of Apr. 2016 ≈$0.7B more anticipated by |

≈$4.0B anticipated for reinsurance paymentsr ≈$3.3B anticipated for initial partial payments to insurers in Aug. 2017s No amount anticipated to be deposited to the U.S. Treasuryt |

Source: Congressional Research Service (CRS) analysis of statutes, regulations, and guidance related to the Patient Protection and Affordable Care Act's (ACA's; P.L. 111-148, as amended) transitional reinsurance program as of August 9, 2017.

Notes:

a. The statutes require the Secretary of the Department of Health and Human Services (HHS) to determine how high-risk enrollees are identified. Accordingly, HHS determined that reinsurance payments would be made to plans with high-cost enrollees using the following payment parameters: attachment point, coinsurance rate, and reinsurance cap. The Secretary proposes and publishes the payment parameters in the annual payment notices. The payment parameters are subject to change.

b. Amounts are statutorily defined in ACA §1341.

c. The statutes specify certain aggregate amounts to be collected and allow the collection of amounts for program administration; the statutes require the HHS Secretary to establish a methodology for determining how much each contributing entity must contribute. The national per capita reinsurance contribution was calculated as the sum of the aggregate contribution for the reinsurance program, the additional contribution to the U.S. Treasury, and the cost of administration divided by the estimated number of enrollees in plans required to make reinsurance contributions.

d. The threshold dollar amount for claims costs incurred by a health insurer for an enrolled individual's covered benefits in a plan year, after which threshold the claims costs for such benefits are eligible for reinsurance payments. 45 C.F.R. §153.20.

e. The rate at which the applicable reinsurance entity will reimburse the health insurer for claims costs incurred for an enrolled individual's covered benefits in a plan year after the attachment point and before the reinsurance cap. 45 C.F.R. §153.20.

f. The threshold dollar amount for claims costs incurred by a health insurer for an enrolled individual's covered benefits, after which threshold the claims costs for such benefits are no longer eligible for reinsurance payments. 45 C.F.R. §153.20.

g. HHS, "Patient Protection and Affordable Care Act; HHS Notice of Benefit and Payment Parameters for 2014 Final Rule," 78 Federal Register 15410-15541, March 11, 2013.

h. HHS, "Patient Protection and Affordable Care Act; HHS Notice of Benefit and Payment Parameters for 2015 Final Rule," 79 Federal Register 13744-13843, March 11, 2014.

i. Centers for Medicare & Medicaid Services (CMS), "Summary Report on Transitional Reinsurance Payments and Permanent Risk Adjustment Transfers for the 2014 Benefit Year," September 17, 2015.

j. CMS, "Summary Report on Transitional Reinsurance Payments and Permanent Risk Adjustment Transfers for the 2014 Benefit Year," September 17, 2015. CRS confirmed with CMS that plan year 2014 payments have all been remitted to the insurers.

k. CMS, "The Transitional Reinsurance Program's Contribution Collections for the 2015 Benefit Year," February 12, 2016.

l. HHS, "Patient Protections and Affordable Care Act; HHS Notice of Benefit and Payment Parameters for 2016 Final Rule," 80 Federal Register 10750-10877, February 27, 2015.

m. CMS, "Transitional Reinsurance Program: Pro Rata Adjustment to the National Coinsurance Rate for the 2015 Benefit Year," June 17, 2016.

n. CMS, "Summary Report on Transitional Reinsurance Payment and Permanent Risk Adjustment Transfers for the 2015 Benefit Year," June 30, 2016. $6.5B (from 2015 collections) + $1.7B (from 2014 rollover) – $0.5B (for program administration and U.S. Treasury payment) ≈ $7.8B. Numbers may not sum precisely due to rounding.

o. CMS, "The Transitional Reinsurance Program's Contribution Collections for the 2015 Benefit Year," February 12, 2016. $0.5B (for program administration and U.S. Treasury payment) × 99% (pro rata amount to U.S. Treasury) ≈ $495M. The pro rata amount is based on regulations from HHS, "Patient Protection and Affordable Care Act; Exchange and Insurance Market Standards for 2015 and Beyond Final Rule," 79 Federal Register 30240-30353, May 27, 2014. Given that payment parameters are subject to change, the pro rata amount may be subject to change.

p. CMS, "Summary Report on Transitional Reinsurance Payments and Permanent Risk Adjustment Transfers for the 2016 Benefit Year," June 30, 2017.

q. In discussions between CRS and CMS, CMS confirmed that they expect $4.0 billion in reinsurance contributions for plan year 2016.

r. In discussions between CRS and CMS, CMS confirmed that approximately $4.0 billion is anticipated to be remitted to insurers for plan year 2016.

s. CMS, "Summary Report on Transitional Reinsurance Payments and Permanent Risk Adjustment Transfers for the 2016 Benefit Year," June 30, 2017. In discussions between CRS and CMS, CMS confirmed that early payments will be remitted in August 2017.