What Is the Budget Resolution and How Is It Enforced?

The Congressional Budget Act of 1974 (hereinafter referred to as the Budget Act) provides for the annual adoption of a budget resolution.1 The budget resolution reflects an agreement between the House and Senate on a budgetary framework designed to establish parameters within which Congress will consider subsequent budgetary legislation.

The budget resolution does not become law; therefore no money is spent or collected as a result of its adoption. Instead, it is meant to assist Congress in considering an overall budget plan. Once agreed to by both chambers, the budget resolution creates parameters that may be enforced in two primary ways: (1) by points of order, and (2) by using the budget reconciliation process.

Enforcement Through Points of Order

Once the budget resolution has been agreed to by both chambers, certain levels contained in it are enforceable through points of order. This means that if legislation is being considered on the House or Senate floor that would violate certain levels contained in the budget resolution, a Member may raise a point of order against the consideration of that legislation. Points of order can be raised against bills, resolutions, amendments, or conference reports. If such a point of order is raised against legislation for violating levels in the budget resolution, the presiding officer makes a ruling on the point of order based on estimates provided by the relevant Budget Committee.2

Points of order are not self-enforcing, meaning that if no Member raises a point of order, a chamber may consider and pass legislation that would violate levels established in the budget resolution. In addition, either chamber may waive the point of order. The process for waiving points of order, and the number of Members required to waive points of order, varies by chamber. Generally, such points of order can be waived in the House by a simple majority of Members3 and in the Senate by three-fifths of all Senators.4

The Budget Act requires that the budget resolution include the following budgetary levels for the upcoming fiscal year and at least four out years: total spending, total revenues, the surplus/deficit, new spending for each major functional category, the public debt, and (in the Senate only) Social Security spending and revenue levels. The Budget Act also requires that the aggregate amounts of spending recommended in the budget resolution be allocated among committees.5 The Budget Act provides that the House and Senate Appropriations Committees receive an allocation for only the upcoming fiscal year (referred to as the budget year), but the remaining House and Senate committees receive allocations for the entire period covered by the budget resolution. The Budget Act requires that the House and Senate Appropriations Committees subdivide their allocations by subcommittee and report these sub-allocations to their respective chambers.

While the Budget Act requires that the budget resolutions include the levels described above, it does not require that all of these levels be enforceable by points of order. (Some levels in the budget resolution are, therefore, included only for informational purposes.)

Budgetary levels that are enforceable include spending and revenue aggregates and committee spending allocations. The Budget Act prohibits the consideration of (1) any measure that would cause spending to exceed levels in the budget resolution,6 or (2) any measure that would cause total revenue levels to fall below the levels in the budget resolution.7

Likewise, the Budget Act prohibits the consideration of legislation that would violate the committee spending allocations.8 Similarly, once the Appropriations Committees report their sub-allocations to their respective chambers, the Budget Act bars the consideration of any spending measures that would cause those sub-allocations to be violated.

Enforcement Through the Budget Reconciliation Process

While points of order can be effective in enforcing the budgetary goals outlined in the budget resolution, they can be raised against legislation only when it is pending on the House or Senate floor. This can be effective for legislation such as appropriations measures, which typically provide funding for one year and are therefore considered on the House and Senate floor annually. Points of order cannot, however, limit direct spending or revenue levels resulting from current law.

Often, for the budgetary levels in the budget resolution to be achieved, Congress must pass legislation to alter the levels of revenue and/or direct spending resulting from current law. In this situation, Congress seeks to reconcile the levels resulting from existing law with the budgetary levels expressed in the budget resolution. To assist in this process, the budget reconciliation process allows the expedited consideration of such legislation.

If Congress intends to use the reconciliation process, reconciliation directives (also referred to as reconciliation instructions) must be included in the annual budget resolution. These directives instruct individual committees to develop and report legislation that would change laws within their respective jurisdictions related to direct spending, revenue, or the debt limit. Once a specified committee develops legislation, the reconciliation directive may direct it to report the legislation for consideration in its chamber or submit it to the Budget Committee to be included in an omnibus reconciliation measure. Such reconciliation legislation is then eligible to be considered under special expedited procedures in both the House and Senate.9

What Complications Arise When the House and Senate Do Not Reach Agreement on a Budget Resolution?

The budget resolution reflects an agreement between the House and Senate on a budgetary plan for the upcoming fiscal year. When the House and Senate do not reach final agreement on this plan, the budget process for the upcoming fiscal year may become complicated. Without an agreement on budgetary parameters, it may be more difficult for Congress to reach agreement on subsequent budgetary legislation, both within each chamber and between the chambers.

If Congress agreed upon a budget resolution for the prior fiscal year, that resolution remains in effect and may provide some operative parameters, since a resolution includes multi-year enforceable levels.10 The usefulness of such levels may be limited, however, due to altered economic conditions and technical factors, not to mention any changes in congressional budgetary goals.

Furthermore, since a committee allocation to the Appropriations Committee is made for only the upcoming fiscal year, the House and Senate cannot rely on a prior year's budget resolution. This means that there is no allocation of spending made to the Appropriations Committees and no formal basis for them to make the required spending sub-allocations.11 Without such enforceable budgetary levels, the development and consideration of individual appropriations measures may encounter difficulties.

Further, the Budget Act sought to require adoption of a budget resolution before Congress could consider budgetary legislation for the upcoming year. Under Section 303(a) of the Budget Act, the House and Senate generally may not consider spending, revenue, or debt limit legislation for a fiscal year until the budget resolution for that fiscal year has been adopted. The Budget Act provides for exceptions, however, and in addition allows the point of order to be waived in both chambers by a simple majority.

Without agreement on a budget resolution, Congress also may not use the budget reconciliation process. This means that any budgetary changes to revenue or mandatory spending may not be considered under the special expedited procedures provided by the budget reconciliation process.

What Can Be Used for Budget Enforcement in the Absence of a Budget Resolution?

In the absence of a budget resolution, other budget enforcement mechanisms are available to Congress comprising two general categories. First, there are types of budget enforcement that are entirely separate from the budget resolution, such as chamber rules and statutory spending caps. These mechanisms remain in effect in the absence of a budget resolution and place restrictions on certain types of budgetary legislation. Such enforcement is briefly described below in the section titled "What Types of Budgetary Enforcement Exist Outside of the Budget Resolution?"

Second, in the absence of agreement on a budget resolution, Congress may employ alternative legislative tools to serve as a substitute for a budget resolution. When Congress has been late in reaching final agreement on a budget resolution, or has not reached agreement at all, it has relied on such substitutes. These substitutes are typically referred to as "deeming resolutions," because they are deemed to serve in place of an agreement between the two chambers on an annual budget resolution for the purposes of establishing enforceable budget levels for the upcoming fiscal year (or multiple fiscal years). Employing a deeming resolution, however, does not preclude Congress from subsequently agreeing to a budget resolution.

While referred to as deeming resolutions, such mechanisms are not formally defined and have no specifically prescribed content. Instead, they simply denote the House and Senate, often separately, engaging legislative procedures to deal with enforcement issues on an ad hoc basis. As described below, the mechanisms vary in form and function, but they always (1) include or reference certain budgetary levels (e.g., aggregate spending limits and committee spending allocations) and (2) contain language stipulating that such levels are to be enforceable by points of order as if they had been included in a budget resolution.12

In Which Years Did Congress Rely on Deeming Resolutions in the Absence of Agreement on a Budget Resolution?

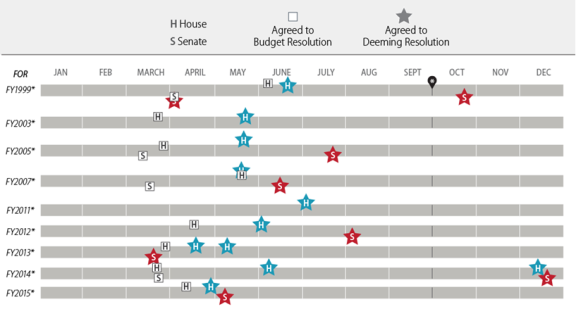

As shown in Table 1, since the creation of the budget resolution, dates of adoption have varied, and there have been nine years in which Congress did not come to agreement on a budget resolution. As shown in Table 2, in each of those years, one or both chambers employed at least one deeming resolution to serve as a substitute for a budget resolution.

|

Fiscal Year |

Date Adopted |

Fiscal Year |

Date Adopted |

|

1976 |

05-14-1975 |

1997 |

06-13-1996 |

|

1977 |

05-13-1976 |

1998 |

06-05-1997 |

|

1978 |

05-17-1977 |

1999 |

[none] |

|

1979 |

05-17-1978 |

2000 |

04-15-1999 |

|

1980 |

05-24-1979 |

2001 |

04-13-2000 |

|

1981 |

06-12-1980 |

2002 |

05-10-2001 |

|

1982 |

05-21-1981 |

2003 |

[none] |

|

1983 |

06-23-1982 |

2004 |

04-11-2003 |

|

1984 |

06-23-1983 |

2005 |

[none] |

|

1985 |

10-01-1984 |

2006 |

04-28-2005 |

|

1986 |

08-01-1985 |

2007 |

[none] |

|

1987 |

06-27-1986 |

2008 |

05-17-2007 |

|

1988 |

06-24-1987 |

2009 |

06-05-2008 |

|

1989 |

06-06-1988 |

2010 |

04-29-2009 |

|

1990 |

05-18-1989 |

2011 |

[none] |

|

1991 |

10-09-1990 |

2012 |

[none] |

|

1992 |

05-22-1991 |

2013 |

[none] |

|

1993 |

05-21-1992 |

2014 |

[none] |

|

1994 |

04-01-1993 |

2015 |

[none] |

|

1995 |

05-12-1994 |

2016 |

05-05-2015 |

|

1996 |

06-29-1995 |

2017 |

01-13-2017 |

Source: Legislative Information Service.

Table 2. Deeming Resolutions Pertaining to Those Fiscal Years for Which Congress Did Not Agree on a Budget Resolution

Legislative Vehicles and Dates of Adoption

|

Fiscal Year (Congress) |

House |

Senate |

|

FY1999 (105th) |

|

|

|

FY2003 (107th) |

|

|

|

FY2005 (108th) |

|

|

|

FY2007 (109th) |

|

|

|

FY2011 (111th) |

|

|

|

FY2012 (112th) |

|

|

|

FY2013 (112th) |

|

|

|

FY2014 (113th) |

|

|

|

FY2015 (113th) |

|

|

Notes: The Bipartisan Budget Act of 2015, Section 102 (P.L. 114-74) included a provision directing the Senate Budget Committee chair to file in the Congressional Record levels that would then become enforceable in the Senate as if they had been included in a budget resolution for FY2017. The Senate Budget Committee chair was directed to file such levels after April 15, 2016, but not later than May 15, 2016. Senate Budget Committee Chairman Enzi filed such levels on April 18, 2016. This provision did not prohibit the Senate from considering and adopting a traditional budget resolution for FY2017.

In What Ways Have Deeming Resolutions Varied?

As described below, deeming resolutions have varied in several ways.

Variations in Legislative Vehicle

Congress initially used simple resolutions as the legislative vehicle for deeming resolutions (which is why they are referred to as resolutions). As shown in Table 2, however, deeming resolutions have also been included as provisions in lawmaking vehicles, such as appropriations bills.13

Questions sometimes arise regarding whether the use of an alternative legislative vehicle has any impact on the enforceability of the budgetary levels. Article I of the Constitution, however, gives each house of Congress broad authority to determine its rules of procedure. The House and the Senate may include rulemaking provisions, such as enforceable budgetary levels, in any type of legislative vehicle. In each case, the rulemaking provisions have equal standing and effect. Further, under this constitutional rulemaking principle, each house has the authority to take parliamentary action that waives its own rules in certain circumstances if it sees fit. This power is not compromised by the fact that the rulemaking provision may be established in statute.

Variations in Timing

As shown in Figure 1, timing of congressional action on deeming resolutions has varied, since deeming resolutions may be initiated any time Congress regards it as necessary. Chambers have often agreed to deeming resolutions several months after they have separately agreed to a budget resolution but have not come to agreement with each other. Also, chambers have agreed to a deeming resolution on the same day as agreeing to a budget resolution in situations when one chamber foresees difficulty resolving differences with the other chamber. For example, the Senate agreed to a budget resolution for FY1999 on April 2, 1998, and, anticipating an impasse with the House, agreed to a deeming resolution the same day. Similarly, the House passed a budget resolution for FY2007 on May 18, 2006, and agreed to a deeming resolution the same day. Further, deeming resolutions have been provided for far in advance of potential action on a budget resolution. For example, the Bipartisan Budget Act of 2015 (P.L. 114-74, enacted in November of 2015) included a provision directing the Senate Budget Committee chair to file in the Congressional Record levels that would then become enforceable in the Senate as if they had been included in a budget resolution for FY2017.

Often, a chamber initiates action on a deeming resolution so that it can subsequently begin consideration of appropriations measures. In the House deeming resolutions are often included in the same resolution providing for consideration of the first appropriations measure for the upcoming fiscal year.14

Just as employing a deeming resolution does not preclude Congress from subsequently agreeing to a budget resolution, it also does not preclude Congress from acting on another deeming resolution that either expands or replaces the first deeming resolution. For example, in FY1999 the Senate agreed to a deeming resolution in April, and in October it agreed to a further deeming resolution that amended the previous deeming resolution. Likewise, the House agreed to a deeming resolution for FY2014 in June but in December passed the Bipartisan Budget Act, which included a deeming resolution that superseded parts of the initial deeming resolution.

Variations in Content

Deeming resolutions always include at least two things: (1) language setting forth or referencing specific budgetary levels (e.g., aggregate spending limits and/or committee spending allocations), and (2) language stipulating that such levels are to be enforceable as if they had been included in a budget resolution. Even so, significant variations exist in their content, as shown in Table 3.

Budget resolutions include budgetary levels in the form of explicit dollar amounts, and in some instances deeming resolutions have done the same. For example:

Pending the adoption by the Congress of a concurrent resolution on the budget for FY1999, the following allocations contemplated by section 302(a) of the Congressional Budget Act of 1974 shall be considered as made to the Committee on Appropriations: (1) New discretionary budget authority: $531,961,000,000. (2) Discretionary outlays: $562,277,000,000.15

Some deeming resolutions, however, have not included the budgetary levels themselves but have incorporated them by reference, particularly in situations when that chamber has already passed a budget resolution but has not come to agreement with the other chamber. For example:

Pending the adoption of a concurrent resolution on the budget for fiscal year 2003, the provisions of House Concurrent Resolution 353, as adopted by the House, shall have force and effect in the House as though Congress has adopted such concurrent resolution.16

In some cases, the deeming resolution has stated that the chairs of the House and Senate Budget Committees shall subsequently file in the Congressional Record levels that will then become enforceable as if they had been included in a budget resolution. The committee chairs are typically directed to file particular levels, such as those consistent with discretionary spending caps or those consistent with the baseline projections of the Congressional Budget Office. Such provisions have been used recently in both the Budget Control Act of 2011 and the Bipartisan Budget Act of 2013. For example:

For the purpose of enforcing the Congressional Budget Act of 1974 for fiscal year 2014... the ... levels provided for in subsection (b) shall apply in the same manner as for a concurrent resolution on the budget for fiscal year 2014.... The Chairmen of the Committee on the Budget of the House of Representatives and the Senate shall each submit a statement for publication in the Congressional Record as soon as practicable after the date of enactment of this Act that includes ... committee allocations for fiscal year 2014 consistent with the discretionary spending limits set forth in this Act.17

As stated above, deeming resolutions will sometimes reference a budget resolution that has been previously adopted by that chamber and will deem that budget resolution to be enforceable. Alternatively, mechanisms may include or reference only certain levels normally included in a budget resolution. For example, in some cases deeming resolutions have included only committee allocations to the Appropriations Committee, while in other cases they have included allocations for all committees, as well as aggregate spending and revenue levels. While content has varied, deeming resolutions that have not referenced a previously passed budget resolution have typically included only levels to be enforced by points of order, such as aggregate spending and revenue levels as well as spending allocations for each committee. Deeming resolutions generally do not include all of the levels required to be in a budget resolution by the Budget Act. For example, the Budget Act requires that the budget resolution include the corresponding deficit level and public debt level under the enforceable budgetary framework. These have not typically been included in deeming resolutions. In addition, deeming resolutions have often included other matter, such as points of order.

Table 3. Provisions Included in Deeming Resolutions Pertaining to Those Fiscal Years for Which Congress Did Not Agree on a Budget Resolution

|

|

Chamber |

Deeming Resolution |

Standard Provisions |

Other Provisions |

|

|

|

House |

Provides committee spending allocation to the House Appropriations Committee. |

— |

||

|

Senate |

Provides committee spending allocation to the Senate Appropriations Committee. |

— |

|||

|

Provides aggregate spending levels, aggregate revenue levels, and Social Security spending and revenue levels. Directs the Senate Budget Committee chair to file committee spending allocations. |

Strikes the text in S.Res. 209 (the deeming resolution previously agreed to). Allows the Senate Budget Committee chair to make revisions to levels in the resolution reflecting legislation enacted in the 105th Congress. Directs the Senate Budget Committee chair to make revisions to the congressional PAYGO. Includes effective date and expiration date. |

||||

|

FY2003 (107th) |

House |

References H.Con.Res. 353, the budget resolution for FY2003, as adopted by the House. Directs the House Budget Committee chair to file committee spending allocations. |

Provides that accounts identified for advance appropriations shall be those referred to in H.Con.Res. 353 (to be filed by the House Budget Committee chair). Provides estimated surplus in reference to the Contingency Fund for Additional Surpluses included in H.Con.Res. 353 (to be filed by the House Budget Committee chair). Provides committee allocations for Medicare, as required in H.Con.Res. 353 (to be filed by the House Budget Committee chair). |

||

|

Senate |

— |

— |

— |

||

|

FY2005 (108th) |

House |

References the conference report for S.Con.Res. 95, the budget resolution for FY2005, as adopted by the House. |

Notes that the deeming resolution shall not be construed to engage Rule XXVII (the former House rule known as the Gephardt rule that required the House clerk to engross and transmit public debt limit legislation to the Senate upon adoption of the budget resolution). |

||

|

Senate |

Provides committee spending allocation to the Senate Appropriations Committee. |

References certain adjustments and limits in S.Con.Res. 95 related to contingency procedures for surface transportation, discretionary spending limits in the Senate, supplemental appropriations for Iraq and related activities, and the extension of the emergency rule in the Senate. Revokes the budget resolution for FY2004. Includes definitions and effective date. |

|||

|

FY2007 (109th) |

House |

References H.Con.Res. 376, the budget resolution for FY2007, as adopted by the House. |

Notes that the deeming resolution shall not be construed to engage the Gephardt rule. |

||

|

Senate |

Provides committee spending allocation to the Senate Appropriations Committee. |

References certain adjustments and limits in S.Con.Res. 83—the budget resolution for FY2007, as passed by the Senate—related to emergency legislation. Alters certain sections of the budget resolution for FY2006 related to Senate discretionary spending limits and the unfunded mandates point of order. Includes effective date. |

|||

|

FY2011 (111th) |

House |

Provides committee spending allocation to the House Appropriations Committee. |

Extends provisions of the FY2010 budget resolution. Alters provisions of the FY2010 budget resolution and includes new provisions to reflect policies enacted in the Statutory Pay-As-You-Go Act of 2010. Includes "sense of the House" provisions related to the economy, investment, and deficit reduction. Includes a deficit-neutral reserve fund related to the recommendations of the National Commission on Fiscal Responsibility and Reform. Notes that the deeming resolution shall not be construed to engage the Gephardt rule. |

||

|

Senate |

— |

— |

— |

||

|

FY2012 (112th) |

House |

References H.Con.Res. 34, the budget resolution for FY2012, as adopted by the House. Provides committee spending allocations (in the committee report of H.Res. 287). |

Directs the House Budget Committee chair to adjust allocations to accommodate enactment of certain legislation. Includes expiration. |

||

|

Senate |

Directs the Senate Budget Committee chair to file committee spending allocations, aggregate spending levels, aggregate revenue levels, and Social Security spending and revenue levels. |

Directs the Senate Budget chair to make revisions to the congressional PAYGO scorecard. Includes expiration. |

|||

|

FY2013 (112th) |

House |

References H.Con.Res. 112, the budget resolution for FY2013 as adopted by the House, with modifications. |

— |

||

|

Amends H.Res. 614 (the previously agreed-to deeming resolution) by inserting committee spending allocations as included in the committee report of the budget resolution. |

— |

||||

|

Senate |

Directs the Senate Budget Committee chair to file committee spending allocations, aggregate spending levels, aggregate revenue levels, and Social Security spending and revenue levels. |

Directs the Senate Budget Committee chair to make revisions to the Senate PAYGO scorecard. Includes expiration. |

|||

|

FY2014 (113th) |

House |

References H.Con.Res. 25, the budget resolution for FY2014, as adopted by the House, with committee allocations as included in the committee report of the budget resolution. |

— |

||

|

H.J.Res. 59 |

Directs the House Budget Committee chair to file committee spending allocations, aggregate spending levels, and aggregate revenue levels. |

States that H.Con.Res. 25, the budget resolution for FY2014 as passed by the House, shall be enforceable to the extent that its levels are not superseded by the levels filed by the House Budget Committee chair. Allows the House Budget Committee chair to reduce levels to reflect enactment of legislation reducing the deficit. |

|||

|

Senate |

H.J.Res. 59 |

Directs the Senate Budget Committee chair to file committee spending allocations, aggregate spending levels, aggregate revenue levels, and Social Security spending and revenue levels. |

Allows the Senate Budget Committee chair to reduce levels to reflect enactment of legislation reducing the deficit. Creates a point of order for advance appropriations. Directs the Senate Budget Committee chair to make revisions to the Senate PAYGO scorecard. References provisions from S.Con.Res. 13, the budget resolution for FY2010 as passed by the Senate, that shall remain in effect (related to budgetary treatment of certain discretionary administrative expenses, application and effect of changes in allocations and aggregates, and adjustments to reflect changes in concepts and definitions). Includes a deficit-neutral reserve fund to replace sequestration and incorporates by reference many reserve funds included in S.Con.Res. 8, the budget resolution for FY2014 as adopted by the Senate. Notes that certain provisions shall expire if a budget resolution for FY2015 is agreed to by the House and Senate. |

||

|

FY2015 (113th) |

House |

H.J.Res. 59 |

Directs the House Budget Committee chair to file committee spending allocations, aggregate spending levels, and aggregate revenue levels (if a budget resolution for FY2015 has not been agreed upon by April 15, 2014). |

Allows the House Budget Committee chair to also file updated versions of certain provisions included in H.Con.Res. 25, the budget resolution for FY2014 (related to reserve funds, limits on advance appropriations, adjustments of discretionary spending levels, budgetary treatment of certain transactions, and a separate allocation for overseas contingency operations/global war on terrorism). Allows the House Budget Committee chair to reduce levels to reflect enactment of legislation reducing the deficit. Notes that if all levels have not been filed by the House Budget Committee chair by May 15, then on the next day of House session, the Budget Committee chair shall file a committee spending allocation for the House Appropriations Committee. Notes that certain provisions shall expire if a budget resolution for FY2015 is agreed to by the House and Senate. |

|

|

Senate |

H.J.Res. 59 |

Directs the Senate Budget Committee chair to file committee spending allocations, aggregate spending levels, aggregate revenue levels, and Social Security spending and revenue levels (if a budget resolution for FY2015 has not been agreed upon by April 15, 2014). |

Allows Senate Budget Committee chair to also file updated versions of a reserve fund to replace sequestration and those reserve funds incorporated by reference from S.Con.Res. 8, the budget resolution for FY2014 as adopted by the Senate. Notes that the levels filed will supersede levels filed for FY2014 (described above). Notes that certain provisions shall expire if a budget resolution for FY2015 is agreed to by the House and Senate. |

What Types of Budgetary Enforcement Exist Outside of the Budget Resolution?

In addition to the budget resolution, Congress employs other types of budget enforcement. Some of these enforcement mechanisms are procedural (which are enforced through points of order), and some are statutory (which are enforced through sequestration). In the absence of a budget resolution, these additional budget enforcement mechanisms remain intact. This means that even without a budget resolution, there are still prohibitions and restrictions on different types of budgetary legislation. For example, a limit on defense and non-defense discretionary spending currently exists in the form of annual discretionary spending caps and in addition can act as a guide to appropriators in crafting appropriations measures. In addition, limits on new direct spending and revenue legislation exist through points of order and statutory enforcement such as Senate PAYGO, House CUTGO, and Statutory PAYGO.

Budget Enforcement Through Points of Order

The House and Senate have many budget-related points of order that seek to restrict or prohibit consideration of different types of budgetary legislation. These points of order are found in various places such as the Budget Act, House and Senate standing rules, and past budget resolutions.

For example, for FY2017, Congress moved forward with appropriations in the absence of a budget resolution or deeming resolution. The House Appropriations Committee adopted "interim 302(b) sub-allocations" for some individual appropriations bills.18 Such levels did not act as an enforceable cap on appropriations measures when they were considered on the floor. A separate order adopted by the House as a part of H.Res. 5 (114th Congress), however, prohibited floor amendments that would increase spending in a general appropriations bill, effectively creating a cap on individual appropriations bills when they were considered on the floor.19

In addition, in the Senate there exists a pay-as-you-go (PAYGO) rule that prohibits the consideration of direct spending or revenue legislation that is projected to increase the deficit.20 Another example is the House cut-as-you-go (CUTGO) rule that prohibits the consideration of direct spending legislation that is projected to increase the deficit.21

Numerous other points of order exist. A summary of many of these can be found in CRS Report 97-865, Points of Order in the Congressional Budget Process, by [author name scrubbed].

Budget Enforcement Through Statutory Means

In addition to points of order, there are other types of budget enforcement mechanisms that employ statutory enforcement known as a sequester. A sequester provides for the automatic cancellation of previously enacted spending, making largely across-the-board reductions to non-exempt programs, activities, and accounts. A sequester is implemented through a sequestration order issued by the President as required by law.22

The purpose of a sequester is to enforce certain statutory budget requirements, such as enforcing statutory limits on discretionary spending or ensuring that new revenue and direct spending laws do not have the net effect of increasing the deficit. Generally, sequesters have been used as an enforcement mechanism that would either discourage Congress from enacting legislation violating a specific budgetary goal or encourage Congress to enact legislation that would fulfill a specific budgetary goal.

Sequestration is currently employed as the enforcement mechanism for three budgetary policies:

- 1. The Budget Control Act of 2011 (BCA; P.L. 112-25) established annual statutory limits on each defense discretionary and non-defense discretionary spending that are in effect through 2021. If legislation is enacted breaching either the defense or non-defense discretionary spending cap, then a sequester will occur, making cuts to non-exempt programs within the corresponding category to make up for the breach. In this situation, the sequester will either deter enactment of legislation violating the spending limits or—in the event that legislation is enacted violating these limits—automatically reduce discretionary spending to the limit specified in law.23

- 2. The BCA also created a Joint Select Committee on Deficit Reduction instructed to develop legislation to reduce the budget deficit by at least $1.5 trillion over the 10-year period FY2012-FY2021. The BCA stipulated that if a measure meeting specific requirements was not enacted by January 15, 2012, then a sequester would be triggered to enforce the budgetary goal established for the committee. In this situation the sequester was meant to either encourage agreement on deficit reduction legislation or, in the event that such agreement was not reached, automatically reduce spending so that an equivalent budgetary goal would be achieved. Because the agreement was not reached, this sequester is now in effect through 2024.24

- 3. Another enforcement mechanism was created by the Statutory Pay-As-You-Go Act of 2010 (P.L. 111-139). The budgetary goal of Statutory PAYGO is to ensure that new revenue and direct spending legislation enacted during a session of Congress does not have the net effect of increasing the deficit (or reducing a surplus) over either a 6- or 11-year period. The sequester enforces this requirement by either deterring enactment of such legislation or, in the event that legislation has such an effect, automatically reducing spending to achieve the required deficit neutrality.25