Introduction

U.S. pharmaceutical manufacturers spend billions of dollars annually on special assistance programs to defray the consumer cost of prescription drugs. Many manufacturers offer prescription drug discount coupons that reduce or eliminate required out-of-pocket payments for consumers, including insurance deductibles, co-payments, and coinsurance.1 Likewise, pharmaceutical manufacturers, along with some state governments and independent charities, operate patient assistance programs (PAPs) that provide free drugs or financial aid to help eligible individuals pay for prescription drugs based on factors including income, medical necessity, and health insurance status. Many PAPs are set up as 501(c)(3) nonprofit foundations or charities.2 Pharmaceutical companies may qualify for federal tax deductions for the donation of inventory through their own manufacturer PAPs or for making cash donations to independent charity PAPs.

Prescription drug assistance programs have increased in value and scope in recent years, even as the number of consumers with drug coverage has expanded. A study of retail pharmacy data found that enrollees in commercial insurance plans used co-payment coupons for one out of every five brand-name drug prescriptions in 2016.3 For some brands, coupon use was as high as two-thirds of filled prescriptions. Likewise, an analysis of Internal Revenue Service (IRS) data found that giving by 10 large manufacturer PAPs rose from $376 million in 2001 to $6.1 billion in 2014,4 accounting for 85% of all pharmaceutical giving and one-sixth of all U.S. corporate charity deductions in 2014. Giving by five of the main independent charity PAPs increased from $2 million in 2001 to $868 million in 2014, according to the study.5

Pharmaceutical manufacturers say their assistance programs are evidence of their commitment to ensure that prescription drugs remain affordable. They note that although more people have insurance, a growing number of insured consumers have difficulty meeting required prescription co-payments, deductibles, and other out-of-pocket costs. That is especially true for people prescribed high-cost specialty drugs. Manufacturers and drug marketers also view PAPs as a tool for creating brand loyalty and developing markets for new drugs.6

There is some evidence that coupons may be a useful tool in improving enrollee adherence to expensive prescriptions, thereby improving health outcomes. A 2014 Health Affairs study using data from Prime Therapeutics, a pharmacy benefit manager (PBM) owned by a group of Blue Cross and Blue Shield plans, found that coupons helped consumers save $6 of every $10 in out-of-pocket costs for specialty drugs, making the high-cost products more affordable for more patients and potentially improving adherence. However, the authors added that the increased use of coupons could increase costs for other beneficiaries in a health care plan if a payer decided to raise plan premiums, deductibles, or cost sharing to offset some of the expenses of the higher drug utilization.7

Health payers note that discount coupons can actually increase their costs by inducing individuals to use more expensive brand-name drugs in cases where generics or other lower-cost substitutes are available. Other studies by industry analysts and the Department of Health and Human Services' Office of Inspector General (HHS OIG) have found that although the assistance programs expand access to drugs, they also bolster prices of prescription products.8 A drug discount coupon may reduce the amount an insured consumer has to pay out of pocket for a drug, but it generally does not reduce the price an insurer or government program is charged for the drug. The same is true with cost-sharing assistance offered through certain PAPs.

More broadly, when consumers are relieved of cost-sharing obligations, there may be less market constraint on drug prices. A recent study of coupons for brand-name drugs for which generics were available found the coupons reduced the rate of generic substitution. The brand-name drugs with coupon offers had 12%-13% annual price growth, compared to 7%-8% price growth for those without coupons.9

There are restrictions on the use of pharmaceutical assistance. Drug coupons may not be used in conjunction with federal programs such as the Medicare Part D prescription drug benefit because the coupons may implicate federal anti-kickback law.10 Manufacturer-sponsored PAPs may not offer cost-sharing assistance to enrollees in Medicare Part D and other federal programs. However, PAPs operated by independent charities (which are allowed to receive cash donations from drug companies) may assist federal beneficiaries, if the PAPs comply with certain conditions.11

In the private sector, some health care payers and PBMs have barred enrollees from redeeming manufacturer coupons for certain drugs. Others have decided not to include certain pharmaceuticals on their formulary, or list of covered drugs, if the products have coupon discounts.12 This report provides an overview of consumer spending on prescription drugs; explains the difference between drug coupons and PAPs; and outlines federal laws and regulations and private-sector policies relating to coupons and PAPs.

|

Common Insurance Terms Brand-Name Drug: The Food and Drug Administration defines a brand-name drug as a drug marketed under a proprietary, trademark-protected name. Coinsurance: The percentage share that an enrollee in a health insurance plan pays for a product or service covered by the plan. An insurer could charge 10% coinsurance for a $100 prescription drug, meaning the consumer's out-of-pocket cost would be $10. Co-payment: A fixed dollar amount that an enrollee in a health insurance plan pays for a product or service covered by the plan. For example, an insurer could charge a $20 co-payment for a physician visit or a $5 co-payment for a prescription drug. Deductible: The amount an enrollee is required to pay for health care services or products before his or her insurance plan begins to provide coverage. An enrollee in an insurance plan with a $500 deductible would be responsible for paying for the first $500 in health care services. In some insurance plans, the deductible does not apply to certain services, such as preventive care. Insurance plans vary regarding whether beneficiaries must meet a deductible for prescription drug coverage. Formulary: A list of prescription drugs covered by an insurance plan. In an effort to control costs, insurers are imposing closed or partially closed formularies, which include a more limited number of drugs than traditional formularies. Generic: A generic drug is identical to a brand-name drug in dosage form, safety, strength, route of administration, quality, performance characteristics, and intended use. Although generic drugs are chemically identical to their branded counterparts, they are typically sold at substantial discounts from the branded price. Out-of-Pocket Costs: The total amount an insured consumer pays each year for covered health care services that are not reimbursed by an insurance plan. Out-of-pocket costs can include deductibles, co-payments, and coinsurance. Out-of-Pocket Maximum: The maximum amount an enrollee must pay before his or her health insurance plan covers 100% of health benefits. Certain costs, such as premiums, generally are not counted toward an out-of-pocket maximum, or cap. Pharmacy Benefit Managers (PBMs): Intermediaries between health plans and pharmacies, drug wholesalers, and manufacturers. PBMs perform functions such as designing drug formularies, negotiating prices, and administering prescription drug payment systems. Pharmacy Network: A group of retail, mail-order, and specialty pharmacies that contract with PBMs and health insurers to dispense covered drugs at set prices. Network pharmacies also may provide other services under contract, such as monitoring patient adherence to drugs. Premium: The amount an enrollee pays for health insurance coverage. Many plans charge monthly premiums, but premiums also can be assessed on a quarterly or annual basis. Specialty Drug: There is no one set definition of specialty drugs, although insurers and other health care payers often characterize them as prescription products requiring extra handling or administration that are used to treat complex diseases, such as cancer. High cost can trigger a specialty drug designation. Biologics, or drugs derived from living cells, often are deemed to be specialty drugs. Tiered Pricing: Insurers use tiered cost sharing for formulary drugs, meaning that patients are charged lower co-payments or coinsurance for less expensive generic drugs and certain brand-name drugs that are designated by the plan as preferred drugs, based on the price the plan has negotiated with the manufacturer and the effectiveness of the product. At the same time, patients are charged higher co-payments or coinsurance for more expensive drugs or drugs that the plan deems to be less effective. Underinsured: Refers to people who have insurance but still have financial difficulty paying for prescription drugs or medical treatments. |

Consumer Out-of-Pocket Prescription Drug Costs

Pharmaceutical assistance programs, in their current form, developed in the 1990s in response to public concern about high drug price inflation.13 The programs grew substantially in following decades despite a broad expansion of health insurance drug coverage and the widespread adoption of low-cost generic drugs.14 Millions of consumers gained prescription drug coverage through Medicare Part D (Medicare Prescription Drug, Improvement, and Modernization Act of 2003; P.L. 108-173) and the 2010 Patient Protection and Affordable Care Act (ACA; P.L. 111-148, as amended).15 The ACA, among other things, caps total annual out-of-pocket spending in many commercial health plans, including drug spending; eliminates cost sharing for contraceptives in many health plans; and reduces annual cost sharing for Part D enrollees. Generic drug use now accounts for about 89% of filled prescriptions and 27% of total drug spending, according to the Generic Pharmaceutical Association.16

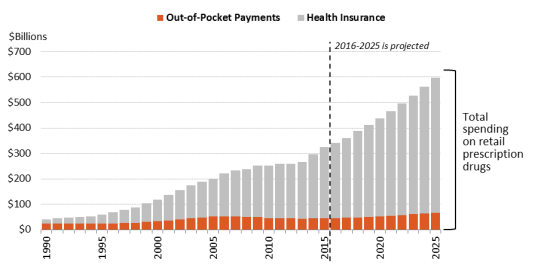

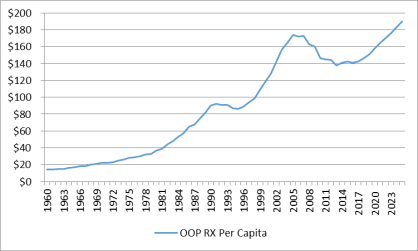

Largely as a result of these trends, consumer out-of-pocket spending—cash payments, health plan deductibles, coinsurance, and co-payments—declined from 57% of U.S. retail drug spending in 1990 to 14% in 2015. Spending by commercial payers and taxpayer-financed health programs rose from 43% to 86% of U.S. retail drug expenditures during this same period.17 (See Figure 1.) Likewise, per capita out-of-pocket spending declined from 56% of total out-of-pocket drug spending in 1990 to 14% in 2015.18 Looking forward, the National Health Expenditure (NHE) expects per capita out-of-pocket spending to rise by about 4% a year from 2016 through 2025. However, because cost sharing is not projected to increase as fast as total drug spending, out-of-pocket expenditures are expected to drop to 11% of per capita drug spending by 2025. (See Figure 2.)

It may seem paradoxical that manufacturer assistance has increased while out-of-pocket spending has moderated. There appear to be several reasons for continued growth of manufacturer aid.

- Individual consumers can face significant drug costs depending on the design of their health plan and their specific diagnosis. A small but rapidly growing share of individuals face high out-of-pocket spending for specialty drugs for hepatitis C, cancer, rheumatoid arthritis, and other serious ailments.19 Pharmaceutical deductibles have become more prevalent. (See "Distribution of Prescription Drug Cost Sharing.)"

- The development of independent charity PAPs in the early 2000s created a way for manufacturers to aid consumers enrolled in Medicare Part D without violating federal anti-kickback statutes. Part D enrollees with high drug costs can have difficulty affording their medications when they are in the deductible phase of the benefit and when they reach the coverage gap—the period in which they are required to pay a larger share of total drug costs.20 (See "Restrictions on Coupon Use.")

- Manufacturers and drug marketers often view PAPs and discount coupons as important tools for creating brand loyalty and developing markets for new drugs. (See "Financial Impact of Coupons and PAPs.")

|

Figure 2. Per Capita Out-of-Pocket Spending for Prescription Drugs (annual per person spending) |

|

|

Source: National Health Expenditure Data, Centers for Medicare & Medicaid Services. Notes: Figures from 2016 to 2025 are projected. Per capita out-of-pocket spending increased from $99 in 1998 to $173 in 2007. Per capita spending then declined to $138 in 2014 as the Patient Protection and Affordable Care Act (ACA; P.L. 111-148, as amended) and Medicare Part D expansions took effect and a number of best-selling brand-name drugs lost patent protection, paving the way for low-cost generics to enter the market. Per capita out-of-pocket drug spending is forecast to reach $190 by 2025. |

|

Coupon and PAP Assistance in Pharmaceutical Spending Data Manufacturer coupons and patient assistance program (PAP) assistance generally are not broken out in data sets on prescription drug spending, making it difficult to determine how the aid affects out-of-pocket costs and other measures of drug spending. For example, the National Health Expenditure (NHE) data compiled by the Centers for Medicare & Medicaid Services (CMS) are adjusted to account for pharmaceutical manufacturer rebates to private payers and government programs including Medicaid, the Children's Health Insurance Program, Medicare, and Department of Defense health programs. However, the NHE data only include manufacturer coupons and PAP payments when the source data from these entities captures that information. CMS does not make additional adjustments for discounts at the point of sale. Other comprehensive data sets, such as prescription drug claims data from Truven Health Analytics, include payments from patients, primary insurers, and secondary insurers, but they do not capture other discount information. Quintiles IMS releases some data that includes coupon and PAP assistance. Source: CRS April 2017 communication with CMS and Truven. |

Distribution of Prescription Drug Cost Sharing

As noted, the recent expansion of health coverage has improved consumer access to pharmaceuticals. Studies show that uninsured or underinsured consumers who have obtained drug benefits through Part D and the ACA are using more drugs and paying less, on average, to fill a prescription.21 Likewise, the share of consumers deciding not to fill a prescription, or to skip a required dose due to cost concerns, has declined since the ACA took effect.22

At the same time, consumer use of high-cost drugs, including specialty drugs, has been growing.23 Individuals prescribed high-cost drugs may face significant cost sharing as health payers shift a greater share of drug costs on to enrollees by increasing co-payments, coinsurance, and plan deductibles. For example, employer-sponsored health plans have expanded the use of tiered pricing, in which enrollees are charged lower co-payments for generic drugs and drugs that are more expensive or deemed less effective are put on higher tiers with greater co-payments or coinsurance.24 A 2016 survey of employer-based plans found that 38% had four or more drug tiers, commonly including a specialty drug tier, compared to 26% in 2012.25 The share of health plans imposing a prescription drug deductible also has been rising. From 2012 to 2015, the share of commercial health plans with a drug deductible jumped from 23% to 46%.26

The result of these parallel trends—expanded insurance coverage coupled with more stringent cost sharing—appears to have been a decline in average out-of-pocket spending but an increase in spending for enrollees who may have chronic conditions or be prescribed high-cost drugs.

A study of commercial health plan data found that mean out-of-pocket spending for specialty drugs (defined as those that cost $600 or more per month) rose from $41 in 2003 to $77 in 2014, whereas spending on non-specialty medications fell from $19 to $11 over the same time period.27 A second study of large employer-sponsored health plans found average out-of-pocket spending dipped to $144 in 2014 from a recent high of $167 in 2009.28 However, nearly 3% of enrollees had exceptionally high out-of-pocket costs (defined as more than $1,000) in 2014, accounting for one-third of drug spending and one-third of out-of-pocket spending. The share of people with high drug costs tripled from 2004.29

Manufacturer coupon offers and PAP assistance grants are designed to blunt health plan cost-sharing requirements by covering a portion of enrollee out-of-pocket payments. According to Quintiles IMS, as health plans have increased patient cost exposure in recent years, manufacturers have boosted coupons and other assistance.30 In 2016, manufacturer coupons were used for one out of every five brand-name prescriptions and for up to two-thirds of filled prescriptions for some specific drug brands.31

The following sections examine different forms of manufacturer assistance—discount coupons, manufacturer PAPs, and independent charity PAPs.

Manufacturer Co-payment Coupons

Pharmaceutical firms offer co-payment coupons or cards to help consumers reduce out-of-pocket costs. The coupons benefit consumers who otherwise might not be able to afford certain drugs. Coupons also benefit drugmakers by helping to create demand for newly introduced drugs, increase consumer adherence to existing prescriptions, and bolster the market for brand-name drugs that have lost patent exclusivity and face competition from lower-priced generics or other substitutes.32

For a sense of how a coupon works, consider a pharmaceutical manufacturer that sells a brand-name drug to a commercial payer for $1,000 for a 30-day supply.33 The payer places the drug on a price tier that imposes 25% enrollee coinsurance up to the plan's annual out-of-pocket maximum. To support sales of the drug, the manufacturer offers a coupon that limits out-of-pocket costs to $100 per 30-day refill for a 12-month period. In the absence of the manufacturer coupon, an enrollee would pay $250 out of pocket each time he or she went to a pharmacy to buy a 30-day supply of the drug (25% of the $1,000 price), until the annual out-of-pocket maximum was reached. With a coupon, the consumer would pay $100 per fill and the manufacturer would cover the remaining $150 of the required coinsurance up to the maximum subsidy amount.

Many co-payment coupons include disclaimers stating that they cannot be used by individuals enrolled in federal health programs, including Medicare, Medicaid, and the Veterans Health Administration. (See "Restrictions on Coupon Use.") Manufacturers build the cost of co-payment coupons into their budget and pricing strategies and use analytics to target the offers.34

Coupon Processing

Coupons can be printed in a magazine or specially distributed advertising supplement, offered electronically—such as a discount number sent as a text to a smart device—or presented as a debit-type card.35 Coupons loaded on smartphones can provide automatic reminders to a consumer to refill a prescription. Manufacturers may offer starter cards that patients can use to receive an initial fill of a prescription at no cost while they wait for a coverage decision from their health plan.36

When an insured consumer presents a prescription at a pharmacy, the pharmacist uses an electronic routing system37 to submit a claim to the PBM that manages the consumer's specific pharmacy benefit. The PBM processes the initial drug claim and determines the patient's cost-sharing obligation. The PBM's electronic processing system then submits secondary claims to other payers. Secondary payments can include another insurance policy held by the individual or a manufacturer coupon. If a coupon is presented, the PBM system, using special codes, will route a coupon to a manufacturer for payment.38 After all payments are processed, the consumer covers the remaining co-payment, if any.

In certain instances, manufacturer discounts are not processed through an electronic system. Some coupon offers take the form of a rebate or discount after the point of sale. In this case, a consumer may make the required co-payment imposed by his or her primary insurance plan when filling a prescription, then send the pharmacy receipt and rebate offer to the manufacturer to secure the promised discount.39 Consumers also may use a coupon and pay cash for a drug that is not covered by an insurance plan or if they do not have insurance.

Coupon Distribution and Market Impact

Industry data on co-payment coupon distribution and use are available from manufacturers, consulting firms, PBMs, and various websites that serve as online clearinghouses for coupon offers. According to data presented at an April 2016 industry meeting, the number of coupon programs had increased by more than a third during the previous two years to 600, at a cost to manufacturers of more than $5 billion a year.40 In January 2016, the average co-payment for coupon-using patients was more than $30, up from $15 in January 2013.

A separate analysis of retail pharmacy data found that co-payment coupons or vouchers were used by more than 14 million patients in the 12-month period ending in October 2012, of whom 90% used one program and 10% used multiple programs.41 Most of the coupons were used by patients with chronic conditions. The range of savings for the patients in this sample was wide, with coupons reducing costs by $40 on average.

While coupon offers may be for a limited time period, such as six months or one year, they are often renewed by manufacturers, who use them as a means to build loyalty to a brand.42 Manufacturers may use coupons as part of a marketing strategy to keep prices for brand-name drugs higher than they otherwise would be after a lower-cost generic substitute comes to market. Such a strategy was used when Pfizer blockbuster drug Lipitor was exposed to generic competition.43

Vendors that work with pharmaceutical companies to distribute pharmaceutical coupons say their internal data show that the programs increase drug adherence and the duration of therapy.44 Coupon programs also can generate data regarding patient income, age, and insurance status, which can be used by a company to develop pricing, marketing, and other strategies.45 Companies can use data on geographic differences in patient adherence to target coupon offers and other marketing efforts. One vendor found a $2 return for every $1 spent on coupon programs by a pharmaceutical client.46 A recent academic study of coupons for brand-name drugs with generic substitutes found a return on investment of at least 4:1 for the coupons and no higher than 7:1.47

The widespread adoption of electronic health records by physician practices is offering a faster, more efficient way for manufacturers and marketers to reach doctors and their patients. Physicians may be able to enter a prescription into an electronic system that is programmed to automatically call up information on co-payment coupon offers and send the offer to a pharmacy along with the prescription.48 When the consumer fills the claim, the pharmacy processes the coupon as it fills the prescription. Web-based platforms and software applications have been developed to help health care professionals locate coupons, distribute samples, or procure other discounts for their patients.49

Other Drug Discount Coupons

Some pharmacies, nonprofit organizations, and PBMs offer their own prescription drug cards or programs. These cards generally cannot be used with government benefits or private insurance.50 The offers have increased as health plans carrying high deductibles have become more prevalent and PBMs have taken a more direct approach to offering drug benefits.51 Consumer organizations say that drugstore discount cards can provide valuable benefits but that it can be hard to determine whether consumers are receiving the best price with the coupons given that retail drug prices can vary widely among pharmacies in the same geographic area.52 Although a card may show the price for a specific drug at participating pharmacies, it may not show the full range of prices at all area pharmacies. Websites such as Good Rx have been created to help consumers comparison shop for prescription drugs.53 In May 2017, PBM Express Scripts announced a new subsidiary, Inside Rx, which will offer discount cards and other offers on certain prescription drugs. The program is being offered in conjunction with Good Rx and a number of retail pharmacies and pharmaceutical firms.54

Restrictions on Coupon Use

Federal Programs

Co-payment coupons cannot be used in conjunction with federal health benefits, including Medicare, Medicaid, TRICARE military insurance, and Veterans Health Administration programs. The prohibition is based on federal anti-kickback statutes,55 which cover various types of remuneration—including kickbacks, bribes, and rebates—whether made directly or indirectly, overtly or covertly, in cash or in kind.56 Pharmaceutical companies may be liable under the anti-kickback statute if they offer coupons to induce the purchase of drugs paid for by federal health care programs.

Retailers and other entities that submit claims to federal agencies for items or services resulting from a violation of anti-kickback statutes may also face civil monetary penalties and damages under the False Claims Act.57

Federal Employees Health Benefit Program and ACA Qualified Health Plans

Private health plans sold to federal workers through the Federal Employees Health Benefit (FEHB) Program are not considered government programs. Enrollees in these plans may use drug discount coupons or pharmacy incentive programs in concert with their insurance benefits.58

Regarding qualified health plans sold under the ACA,59 former HHS Secretary Kathleen Sebelius in an October 2013 letter to Representative James McDermott and a February 2014 letter to Senator Charles Grassley said the HHS did not consider qualified health plans, as well as tax subsidies and cost-sharing assistance, to be federal programs.60

Purchases by Enrollees "Outside" a Government Benefit

There may be cases in which an individual covered by a federal health plan goes "outside" his or her benefit to purchase prescription drugs. A Medicare Part D beneficiary may pay cash for a drug at a retail pharmacy if doing so is cheaper than buying the drug through his or her Part D plan.

Although a Part D enrollee may use a coupon to purchase a drug outside the program, only the actual price paid for the drug—minus all discounts—counts toward Part D annual out-of-pocket spending limits.61 Drugmaker Pfizer has made coupons for Lipitor, a cholesterol-battling drug, available to Part D beneficiaries who agree not to use them in tandem with their Part D benefit.62 Pharmacists may be unwilling to redeem coupons for enrollees in federal programs, even if the enrollees pay outside of their benefits, due to concerns about possible violations of federal law.

HHS Office of Inspector General Report

A 2014 report from the HHS OIG said that pharmaceutical manufacturers did not have consistent, effective safeguards to prevent Medicare Part D beneficiaries from using co-payment coupons along with program benefits.63

According to the report, not all manufacturer offers carry a disclaimer stating that the coupons, rebates, or other incentives may not be used by individuals enrolled in federal health care programs or in conjunction with federal benefits. The report noted that manufacturers that redeem coupons through PBM electronic claims systems have set up edits at the point of sale designed to identify individuals who may be enrolled in federal programs such as Medicare. For example, when an enrollee submits a coupon with a prescription, and when it is submitted to a manufacturer as a secondary payer, the manufacturer may check for a patient's primary insurance, Part D benefit stage,64 and date of birth. (Actual Part D enrollment data is not available from CMS because it may contain sensitive personal information.)

However, the HHS OIG report found that the staged system for processing prescription drug claims can make it difficult for entities other than manufacturers to identify coupons as they move through the pharmacy transaction system. The report also noted that coupons redeemed after the point of sale, such as mail-in rebates, may not be detected by electronic safeguard systems.

HHS issued a special advisory bulletin warning manufacturers that they faced potential penalties if they failed to take appropriate steps to ensure that such coupons do not induce the purchase of federal health care program items or services.65

Private Insurance

Commercial payers have varying policies regarding coupon use. A 2015 Pharmacy Benefits Management Institute survey found that some large employers (or the insurers they contracted with) limited the ability of employees covered under health plans they offer to redeem coupons on the grounds that the coupons interfered with price tiers and other cost-control strategies. Some large employers increased required coinsurance for drugs if a coupon was available.66

UnitedHealthcare bars enrollees from using co-payment coupons for certain drugs.67 Express Scripts, the nation's largest PBM, also has dropped drugs from its preferred formulary due partly to the availability of manufacturer co-payment coupons for the drugs.68

Some manufacturers may help patients get around plan prohibitions by using debit cards and rebate offers. For example, one company uses a case study to market its prescription-drug debit card. The case study notes reports that a manufacturer risked losing thousands of patients after a payer decided to bar co-payment cards for a rheumatoid arthritis drug and instead recommended that its enrollees use a less expensive generic drug. In response, the manufacturer adopted a debit card system, where patients paid the required co-payment at the pharmacy and were reimbursed after the point of the sale—usually within a few days. The debit card vendor reported that this approach resulted in a high patient retention rate.69

Pharmaceutical Assistance Programs

Pharmaceutical manufacturers, state governments, and independent charities operate PAPs to help uninsured or underinsured individuals pay for prescription drugs. Many nongovernmental PAPs are set up as 501(c)(3) nonprofit organizations to provide prescription drugs or financial subsidies to qualified patients.70 501(c)(3) entities are exempt from federal income taxes and qualify to receive tax-deductible contributions.71 As such, pharmaceutical companies and other donors can deduct donations of inventory or cash to PAPs.72

Different types of PAPs include the following:73

- Pharmaceutical Manufacturer PAPs. Many pharmaceutical makers distribute prescription drugs to individuals through their own 501(c)(3) organizations, which often are set up as private foundations. According to the nonprofit Foundation Center, as of 2015, pharmaceutical PAPs accounted for 7 of the 10 largest U.S grant-making foundations, as ranked by annual giving.74 Manufacturer PAPs provide drugs to uninsured individuals and to people enrolled in private insurance and public health programs. Drug manufacturers may contract with outside companies in administering their PAPs.75

- Independent Charity PAPs. Independent charities operate PAPs that offer aid such as financial assistance to uninsured consumers or underinsured consumers who cannot meet their health plans' premiums or cost sharing, such as co-payments, coinsurance, and deductibles. One such PAP, the Patient Access Network Foundation, ranks 21st among the largest 100 U.S. charities.76 Other large, independent charity PAPs include the HealthWell Foundation, the Caring Voice Coalition, the Patient Advocate Foundation, Patient Services, Inc., and Good Days from the Chronic Disease Fund.77 Some of the independent charity PAPs were established by health care consulting firms that work with drug manufacturers.78

- State PAPs (SPAPs). As of 2014, 19 state governments operated SPAPs that met certain CMS criteria.79 The SPAPs generally serve uninsured residents or fill in the gaps in Medicare, Medicaid, and private insurance coverage.80 SPAPs are aimed at lower-income individuals and usually are the payer of last resort, meaning the SPAP will pay for drugs only after federal programs or any private insurance already has been billed. SPAP rules and coverage vary by state—some are targeted at seniors and some at specific disease groups, such as people with HIV/AIDs. This report mainly focuses on the other two types of PAPs and will refer to the state programs as SPAPs rather than PAPs for clarity.

What Is a 501(c)(3) Organization?

501(c)(3) organizations qualify for federal tax-exempt status.81 To qualify, a 501(c)(3) organization must be "organized and operated exclusively" for at least one of the exempt purposes listed in statute, which include charitable and educational purposes. Although the statute uses the term "exclusively," this actually means the organization's activities must primarily be for an exempt purpose.82 Furthermore, as part of the "organized and operated exclusively" requirement, the organization must serve a public, as opposed to private, interest.83 When an organization engages in activities that benefit private industry, the question may arise as to whether it provides the public benefit necessary for 501(c)(3) status. If such activities are a substantial part of the organization's activities, then the organization would appear to no longer qualify for 501(c)(3) status.84

Another requirement for 501(c)(3) status is that the organization's earnings may not be used to benefit any private shareholder or individual.85 Any level of private inurement may jeopardize the organization's tax-exempt status or, depending on the circumstances, may trigger a penalty tax.86

Charity vs. Foundation

A 501(c)(3) organization is either a public charity or a private foundation.87 Public charities have broad public support and tend to provide charitable services directly to the intended beneficiaries. Private foundations often are tightly controlled, receive significant portions of their funds from a small number of donors, and make grants to other organizations rather than directly carry out charitable activities. Because these factors create the potential for self-dealing or abuse of position by the small group controlling the entity, private foundations are more closely regulated than public charities. As such, private foundations are subject to penalty taxes for doing things such as failing to distribute a certain amount of their income each year; having excess business holdings; and failing to maintain expenditure responsibility over certain grants. 501(c)(3) organizations are presumed to be private foundations and, if they want to be treated as a public charity, must tell the IRS how they qualify for public charity status based on the support and control tests found in Internal Revenue Code (IRC) Section 509.

Consumer Eligibility for PAP Assistance

Although specific criteria vary among PAPs, consumer eligibility for assistance generally appears to be based on (1) annual income, (2) insurance status, (3) physician endorsement, (4) prescription information, and (5) proof of U.S. citizenship or legal residence.

Many manufacturer and charitable PAPs peg their annual income limits to the federal poverty level (FPL).88 In one case, in 2015, drugmaker Pfizer increased income eligibility limits for its PAP to 400% of the FPL, up from an earlier 200% cap.89

Income limits may vary for different drugs supported by a PAP. A PAP could set an income limit of 400% of the FPL for very expensive drugs, while imposing a 200% FPL limit for less expensive products. Most PAP support is provided for a limited time period, such as several months or a year. Individuals in many cases may reapply for assistance.90 PAPs may provide drugs or other aid directly to a patient or through a doctor, pharmacy, or other health care provider.

Legal Considerations Affecting PAP Giving

As is the case with manufacturer coupons, there are legal constraints on the use of PAP funding in conjunction with federal health care programs.

2005 HHS OIG Bulletin

In November 2005, just before Medicare Part D took effect, the HHS OIG issued a special advisory bulletin on PAPs.91 The OIG said that manufacturer-based PAPs that although subsidized Part D cost sharing presented heightened risks under the anti-kickback statute,92 cost-sharing assistance offered by truly independent charities should not raise anti-kickback concerns, even if the charities received cash donations from drugmakers.93 The bulletin affirmed that manufacturer-based PAPs could operate "outside" the Part D benefit, meaning that they could provide drugs to Part D enrollees but that no manufacturer donation could be filed with a Part D plan and the assistance would not count against Part D out-of-pocket spending requirements.94 Manufacturers that were operating PAPs before Part D was enacted had concerns about the legal implications of providing aid to Part D enrollees,95 and some companies took steps to limit programs. After release of the HHS OIG guidance and entreaties from members of Congress, manufacturers generally continued assistance through manufacturer PAPs.96 A number of independent charity PAPs were created in the early 2000s to aid Medicare enrollees and other consumers.97

The HHS OIG guidance also limits the dissemination of data from PAPs. Specifically, PAPs may not provide detailed data that would enable pharmaceutical firms to determine how much of any donated funds were being used to support prescriptions for the specific drugs they manufacture.98 The pharmaceutical manufacturer cannot solicit or receive data from the charity that would facilitate the manufacturer in correlating the amount or frequency of its donations with the number of subsidized prescriptions for its products.

2014 Update to HHS OIG Bulletin

In May 2014, the HHS OIG updated its 2005 bulletin. In its update,99 the HHS OIG said it would increase scrutiny of independent charity PAPs that established or operated funds that narrowly defined specific diseases or limited assistance to a subset of available products, such as covering co-payments only for expensive or specialty drugs. In an accompanying press release, the HHS OIG said it had seen a general tendency away from broad disease funds and toward narrower funds, such as a fund for a specific stage or complication of a disease. It also said charities had sought advisory opinions that would allow them to narrow the scope of the drugs that they covered to specialty or expensive pharmaceuticals. The HHS OIG said such restrictions could be harmful to patients, taxpayers, and federal programs. "If assistance is available only for the highest-cost drugs, patients may be steered to those pharmaceuticals rather than to equally effective, lower-cost alternatives. If, instead, assistance is available for a broader range of equally effective treatments, patients, and their prescribers, have greater freedom of choice."100

The update stated that the cost of a drug was not an appropriate stand-alone factor for determining need and that generous financial support, particularly for a PAP with a limited number of drugs or limited to the drugs of a major donor manufacturer, could be evidence of intent to induce use of particular drugs rather than to support financially needy patients.101 During 2015, a number of charitable PAPs agreed to changes in their operations in response to the HHS OIG's 2014 updated guidance.102 In early 2016, the HHS OIG issued advisory opinions approving new proposed operations of some charitable PAPs.103

Justice Department Inquiries into PAP Operations

The 2014 HHS OIG update came amid suggestions of improper links between some drugmakers and some charitable PAPs. The Chronic Disease Fund, now named Good Days, revamped its board and operations after 2013 news disclosures about its ties to Questcor Pharmaceuticals.104

Drugmaker Celgene has disclosed in filings with the Securities and Exchange Commission that it received a subpoena from the U.S. Attorney's Office for the District of Massachusetts regarding its relationship with independent charity PAPs in December 2015.105 Gilead Sciences said that in February 2016 it received a similar subpoena for documents related to its support of outside 501(c)(3) organizations,106 as well as for documents related to its own financial assistance to patients. Other companies have disclosed similar inquiries.107

Data Sources for Annual PAP Revenue and Giving

As previously noted, manufacturer and independent charity PAPs are now among the larger U.S. 501(c)(3)s. However, it is difficult to assess the total dollar value of PAP giving or the total number of consumers aided each year. There is no central PAP database and no uniform national patient eligibility criteria.

A primary source of PAP data is the annual information return (Form 990 series) that 501(c)(3) organizations generally are required to file with the IRS.108 On the form, the organizations must disclose information related to income, expenses, assets, and officers and employees, among other things.109 The form has several schedules that ask for information in such areas as the organization's substantial donors (Schedule B) and related organizations (Schedule R). Furthermore, an organization that conducts business activities unrelated to its exempt purpose must file a tax return (Form 990-T) and pay tax on the earnings.110

The organization and the IRS must make the organization's Form 990, accompanying schedules, and Form 990-T publicly available.111 Identifying information about the donors reported on the Schedule B is not subject to public disclosure unless the 501(c)(3) entity is a private foundation.112

The organization and the IRS must make the organization's Form 990, accompanying schedules, and Form 990-T publicly available.113 Identifying information about the donors reported on the Schedule B is not subject to public disclosure unless the 501(c)(3) entity is a private foundation.114

There is wide variation in the type and amount of information that the PAPs include in their Form 990s. Some Form 990s examined by CRS provided aggregate information about the value of donated drugs or cash, whereas others provided detailed data about the specific drugs or the type of patients supported.

How Are PAP Donations Valued?

Companies that donate cash or pharmaceuticals may be able to deduct the donation as a charitable contribution under IRC Section 170. Companies that donate cash or non-inventory property generally may deduct the amount of the cash donation or fair market value of the property, subject to various restrictions.115

If the company donates inventory, then a special valuation rule applies.116 The general rule for donations of inventory is that the taxpayer may only claim a charitable deduction that equals its basis in the inventory (which is typically its cost). However, there is a special valuation rule that applies for C corporations.117 Under it, C corporations donating inventory may deduct the lesser of (1) the taxpayer's basis in the property plus 50% of the property's appreciated value or (2) two times the basis.118 This is commonly referred to as an enhanced deduction.

To benefit from the enhanced deduction, the donation must be made to a qualified 501(c)(3) organization.119 The donee's use of the donation must be related to its tax-exempt purpose and be "solely for the care of the ill, the needy, or infants."120 Further, the donee may not exchange the donation for money, property, or services.121 The taxpayer must obtain a written statement from the donee stating it will comply with these restrictions.122 Finally, donated inventory such as food or drugs must comply with any applicable safety standards in the Federal Food, Drug, and Cosmetic Act on the date of the donation and for 180 days thereafter.123

PAPs Appear to Have Increased in Size and Scope

There is little comprehensive research on PAP giving, but based on rankings by nonprofit organizations, annual reports filed by independent charity PAPs, and an examination of certain annual Form 990s, PAP contributions and revenues appear to have increased in recent years.

A 2016 study of IRS information found that charitable expenditures by 10 leading manufacturer PAPS rose from $376 million in 2001 to $6.1 billion in 2014, and contributions by five independent charity PAPs increased from $2 million to $868 million during the period.124

Some of the largest manufacturer PAPs include the Abbvie Patient Assistance Foundation, with more than $1 billion in contributions and grants in 2015; the Johnson & Johnson Patient Assistance Foundation, with more than $662 million in contributions and grants in 2015; and the Bristol Myers Squibb Patient Assistance Foundation, with about $620 million in contributions and grants in 2015.125 The Patient Access Network Foundation, an independent charity PAP, increased its annual grants and donations from about $38 million in 2010 to $496 million in 2014 and $942 million in 2015.126 In 2015, giving by manufacturer PAPs declined slightly, whereas giving by charitable assistance PAPs grew.127

Information on Effectiveness of PAPs in Aiding Consumers

Researchers have attempted to measure the effectiveness of PAPs in helping patients gain access to drugs, with mixed results. A 2009 study said it was hard to assess the role of PAPs because of a lack of transparency.128 This and other studies have reported that certain PAP program features could limit their usefulness, including a complex application process, which is a larger impediment for patients with chronic conditions who use more than one drug; unexpected program changes; difficult income-documentation requirements for indigent patients; the need for frequent reapplication; and differences in PAP applications.129

A 2011 literature review found studies providing evidence that PAPs could improve patient outcomes and drug affordability but cautioned that the data were inconclusive and difficult to compare.130 A 2012 study evaluated PAP eligibility and availability for best-selling brand-name and generic drugs.131 It found that that manufacturer PAP income limits ranged from100% to 400% of FPL, that there were differences in eligibility requirements for generic vs. brand-name drugs, and that there were greater restrictions on applications from Part D enrollees.

Notably, several pharmaceutical firms have expanded patient assistance in response to consumer complaints about rising prices for certain drugs. For example, in August 2016, pharmaceutical manufacturer Mylan increased coupon discounts and expanded eligibility for its PAP after an outcry about the price of its EpiPen for treating allergic reactions.132

Financial Impact of Coupons and PAPs

A number of studies have looked at the impact of coupons on drug pricing and utilization, but relatively few studies have detailed the impact of PAPs.133

Regarding coupons, a targeted study of consumers using statins to control cholesterol levels found that the use of manufacturer coupons increased enrollee prescription adherence, but at the cost of higher out-of-pocket spending for consumers and higher costs to their insurance plans than for those using generic drugs or brand-name drugs that did not offer coupons.134 As noted, the 2014 Health Affairs study using data from Prime Therapeutics, a PBM owned by a group of Blue Cross and Blue Shield plans, found that coupons helped consumers save $6 of every $10 in out-of-pocket costs for specialty drugs.135 Likewise, a recent study found that co-payment coupons increased retail sales for brand-name drugs solely by reducing sales of lower-cost generics.136 According to the study, the co-payment coupons increased retail spending from 1.2% to 4.6% in the five years following the introduction of a generic, which corresponded to increased spending of $30-$120 million for the average drug studied.

Other studies have examined whether coupons are targeted at drugs for which lower-cost substitutes are available, thus inducing beneficiaries to use higher-priced drugs. A 2013 study looked at whether widely advertised coupons were being offered for drugs for which either a generic substitute or a therapeutically equivalent product was available.137 According to that study, which was based on 374 coupons for brand-name prescription drugs advertised on the website www.internetdrugcoupons.com, about 60% of the offers were for products with generic alternatives in the same drug class.138

Regarding PAPs, health care consultants tout their benefits in improving consumer loyalty to brand-name drugs, and increasing drug utilization and sales. It is not possible to independently assess their claims.

In market materials, Sonexus Health, a division of health care consulting and service firm Cardinal Health, calls manufacturer investment in PAPs a "key strategy for improving patient uptake" of drugs.139 Market research firm Kantar, in an article on optimizing brand performance, noted that an "oncologist will engage in more positive behaviors (i.e. write more prescriptions) if a company has a high PAP image ... it is important for marketing departments to ensure that professional guidelines permit sales representatives to talk about the programs."140

Some independent charity PAPs point to the potential financial returns from their operations when soliciting donations from drug manufacturers and other funders. The Chronic Disease Fund (before it revamped operations and was renamed Good Days) developed a formula to determine the return on investment from PAP donations.141 The HealthWell Foundation says in its literature that manufacturer donations to an independent charity PAP can have significant advantages over other strategies, including direct-to-patient manufacturer discounts or rebates.142