Introduction

The United States has seen continued growth of electronic card payments (and a simultaneous decrease in check payments). From 2009 through 2012, debit card transactions have outpaced other payment forms.1 When a consumer uses a debit card in a transaction, the merchant pays a "swipe" fee, also known as the interchange fee. The interchange fee is paid to the consumer's bank that issued the debit card, covering the bank's costs to facilitate the transaction. Prior to 2010, the policy debate about interchange fees was motivated by concerns that the interchange fees received by banks were not being set by competitive market forces. A competitive market arguably would drive down swipe fees, which would benefit merchants and ultimately consumers. Alternatively, debit card issuers and networks had argued that a percentage of the interchange fees were being rebated to consumers in the form of consumer reward programs that were also beneficial to merchants.2

Section 1075 of the Consumer Financial Protection Act of 2010 (Title X of P.L. 111-203, the Dodd-Frank Wall Street Reform and Consumer Protection Act), known as the Durbin Amendment, authorizes the Federal Reserve Board to mandate regulations to ensure that any interchange transaction fee received by a debit card issuer is reasonable and proportional to the cost incurred by the issuer. The Durbin Amendment allows the Federal Reserve to consider the authorization, clearance, and settlement costs of each transaction when setting the interchange fee. The Durbin Amendment allows the interchange fee to be adjusted for costs incurred by debit card issuers to prevent fraud. By statute, debit card issuers with less than $10 billion in assets are exempt from the regulation, which means that smaller financial institutions may receive a larger interchange fee than larger issuers.3 The Durbin Amendment also prohibits network providers (Visa, MasterCard, etc.) and debit card issuers from imposing restrictions that would override a merchant's choice of the network provider through which to route transactions. On June 29, 2011, the Federal Reserve issued a final rule implementing the Durbin Amendment by Regulation II, which includes a cap on the interchange fee for large issuers. The final rule went into effect on October 1, 2011.4

H.R. 10, the Financial CHOICE Act of 2017, would repeal the Durbin Amendment. Specifically, Section 735 of the Financial CHOICE Act would repeal Section 1075 of the Consumer Financial Protection Act of 2010. On May 4, 2017, H.R. 10 was ordered to be reported by the House Financial Services Committee.

This report begins with a description of the debit payments process and network pricing for the four-party system and the three-party system. It summarizes the requirements of Regulation II, which implements the Durbin Amendment. The report concludes with a discussion of some implications of Regulation II for merchants, consumers, and banks as well as with some recent observations.

How Network Pricing Works

This section outlines the four-party and three-party network systems prior to implementation of the Durbin Amendment. The three-party system is explained for illustrative purposes, but implementation of the Durbin Amendment only applies to the four-party network where an interchange fee exists.

The Four-Party System

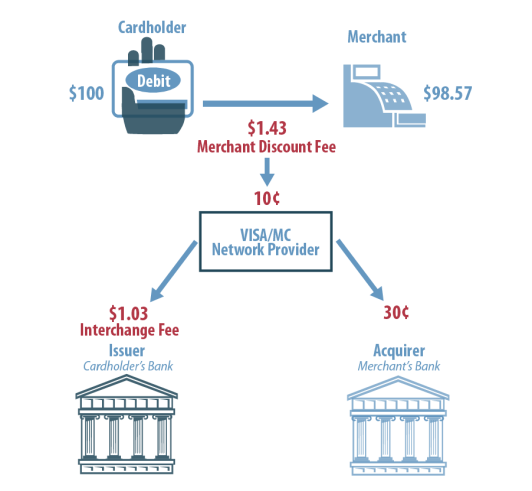

Network providers, such as MasterCard and Visa, facilitate the interactions of four parties under a business model referred to as a "four-party system," consisting of the cardholder, the merchant, the acquirer, and the issuer. (See Figure 1 below, which illustrates the payment distribution.5) When a debit card is used in a transaction, the merchant pays a fee that is collected by the merchant's bank (the acquirer). For example, a debit cardholder makes a $100 purchase, the merchant retains $98.57 and pays $1.43 (merchant discount fee) to process the transaction. The $1.43 is distributed among the acquirer, the cardholder's bank (the issuer) that issued the debit card, and the network provider that links the acquirer and issuer. Prior to the Durbin Amendment, the network provider might retain 10 cents, the acquirer might receive 30 cents, and the issuer could be paid $1.03.6 The $1.03 paid to the issuer is known as the interchange reimbursement or "swipe" fee. This fee may cover some or all of the costs to process the debit card transaction (authorization, clearing, and settlement); fraud prevention and investigation; and other fees, such as customer service, billing and collections, compliance, network connectivity fees, and network servicing fees. Any fee compensation received by the network provider, the acquirer, or the issuers in excess of their respective total costs would be considered profit.

|

|

Source: The Congressional Research Service (CRS). |

Network providers enter into contractual arrangements with issuers and acquirers rather than deal directly with merchants and customers. Network providers can set the interchange fees to encourage issuers' greater issuance of payment cards, which in turn generates more transactions over their networks.7 Issuers may choose to rebate some of their interchange fee profits to cardholders in the form of reward points, which may entice greater debit card use. Consequently, some financial institutions may have greater ability to negotiate interchange fees with the network providers, especially if they have a large number of customers who frequently use debit cards. Merchants' billing, however, suggests that acquirers may also influence the merchant discount fees. Some merchants may be billed by their acquirers, and such invoices would include the fees payable to the both issuers and acquirers; network providers may send separate invoices for their fees.8 Hence, determining how much price-setting influence over merchant discount fees that is ascribed to the network provider relative to the acquirer is challenging and may vary.

In addition to setting the interchange fees, merchants have historically had to abide by various association rules or contractual restraints; however, not all rules mentioned below necessarily appear in all merchant contracts.9 For example, no surcharge rules forbid merchants to levy surcharges when cardholders use debit cards, which prevents merchants from passing any of the merchant discount fees directly to cardholders.10 The honor-all-cards rules require merchants to take any cards that bear the network association's brand name, which means merchants cannot turn away credit or signature debit cards that may have higher merchant discount fees if the association's name appears on the card.11 Moreover, merchants are prohibited from offering discounts for the use of particular types of cards, which is known as the non-differentiation rule. Merchants are also required to accept these cards at all of their outlets, which is referred to as the all-outlets rule. Association rules prevent merchants from passing on to customers the costs to use cards, which arguably would discourage card use. The ability of merchants to pass such costs on indirectly to customers, however, may vary from product to product.12

The Three-Party System

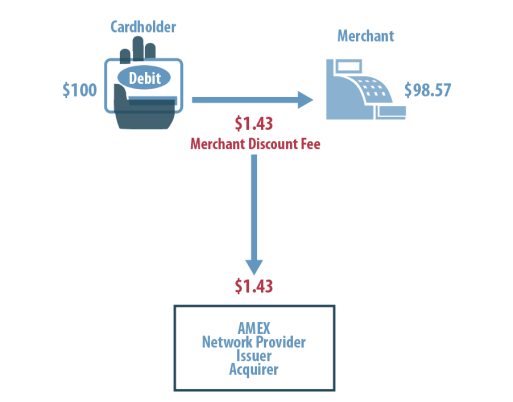

There is no explicit interchange fee in the three-party system. For example, American Express model is a three-party system that consists of the cardholder, the merchant, and the network provider, which serves as both the acquirer and issuer; the three-party system is illustrated in Figure 2 below. American Express enters directly into contractual arrangements with merchants and customers; in this arrangement, American Express is the network provider, acquirer, and the issuer.

|

|

Source: CRS. |

American Express links directly to the merchant and the customer, meaning that there is no explicit interchange fee paid to a customer's bank. This feature limits regulators' ability to enforce the interchange fee restrictions on firms that operate under a three-party system business model.13 The Federal Reserve acknowledged that, for purposes of the final rule, three-party systems are not payment card networks. Hence, the Durbin Amendment does not apply to the three-party model.

Implementation of Regulation II

On June 29, 2011, the Federal Reserve issued Regulation II, a final rule, which capped the interchange fee received by large issuers (with $10 billion or more in assets) to 21 cents plus 0.05% of the transaction. The Federal Reserve also allowed for a 1 cent adjustment if the issuer implements fraud-prevention standards.14 Regulation II was implemented after the Federal Reserve conducted a survey in the form of public comments to obtain transaction cost information.15 Although some merchants argued that the Federal Reserve had set the interchange fee cap at a level higher than allowed by statue, the final rule was upheld.16

Regulation II does not regulate the merchant discount fee charged to the merchant by the network provider or acquirer; it only limits the amount of the merchant discount fee that can be remitted in the form of interchange fee revenue to covered institutions. Consequently, a two-tiered interchange fee system exists, meaning that institutions exempted from Regulation II may receive revenues consistent with interchange fees set above the cap.17 Some network providers did agree to implement a two-tiered interchange pricing system.18

The final rule also gives merchants the ability to route transactions to multiple network providers. Every issuer regardless of size is required to link with at least two unaffiliated network providers, thereby allowing merchants to choose the network provider with the lowest fees to process their debit card transactions.19 Mandatory compliance dates for network providers and issuers were October 1, 2011, and April 1, 2012, respectively.

Implications and Recent Observations

Economists have questioned the sustainability of a two-tiered interchange pricing system over time.20 The ability to charge different prices for the same service usually occurs when the supplier of a service can separate its customers into different market segments. By contrast, Regulation II separates the suppliers (issuers) of the same service into separate groups rather than the customers (merchants). Because merchants now have more choice over the processing of debit transactions, network providers may be more responsive to merchant pressures to lower merchant discount fees instead of pressures by smaller issuers to remit higher interchange fees.21 Consequently, the increased competition for merchant business could undermine the two-tiered interchange system over time, resulting in lower debit interchange revenues for exempt issuers.22 Furthermore, if interchange revenues for smaller issuers were to decline over time, the losses could be material, especially if their processing costs are higher relative to those of large issuers.23 Hence, declining profit margins from this line of business could possibly result in greater financial distress particularly for depository institutions that are increasingly sensitive to noninterest or fee income.24 Numerous pricing arrangements among thousands of exempt institutions under $10 billion and data limitations increase the difficulty to monitor whether this trend is emerging.25

Debit card issuers covered by Regulation II had expected to lose interchange fee income under the regulated cap, but the evidence has been uneven particularly for those institutions that process large volumes of debit card operations. Some covered institutions initially experienced declines in debit interchange revenues shortly after rule implementation, but they have since seen some gradual increase over time, which is consistent with the reported growth of debit card transactions since 2009. By contrast, some covered institutions saw an initial increase in interchange revenues but have since seen some gradual decline over time.26 Generally speaking, the amount of interchange revenue also reflects the amount of transactions, which depends upon economic activity. In other words, lower revenues that would have been anticipated in light of the interchange fee cap may have been offset by a rise in the quantity of debit transactions as the economy continued its recovery from the 2007-2009 recession. Hence, comparisons of the interchange revenues pre- and post-implementation of Regulation II are challenging because both the interchange fees and debit transactions likely changed simultaneously over the period.

Many banks covered by the Durbin Amendment eliminated their debit card rewards programs after Regulation II's implementation; however, this response eliminates one mode for attracting (checking account) deposits to fund loans.27 Offering checking accounts with direct deposit, automated bill paying, and debit card services help depository institutions attract customers that are likely to use additional financial products, including loans. When customers use a variety of financial products and services, depository institutions may cross-subsidize their costs and financial risks more effectively. Hence, some financial institutions entered into partnerships with merchants sponsoring customer reward programs to help facilitate the attraction of deposits.28 Customers receive rewards for shopping with a particular merchant and paying for their purchases using electronic payment cards (i.e., credit, debit, or prepayment card) associated with participating banks.29

Merchants that were paying fees above the regulated interchange fee had expected to benefit from the rule.30 Evidence from a 2015 study, however, suggests that the regulation has had a limited and unequal impact in terms of reducing merchants' costs.31 Because algorithms consisting of multiple factors were used to set individual merchant discount fees prior to implementation of the final rule, the magnitude of influence associated with the interchange fee cap is less likely to be uniform across the vast array of merchant discount fees. Furthermore, whether any change in consumer prices occurred as a result of merchants rebating any lower merchant discount fee savings back to their customers is likely to be indeterminate. Merchant pricing strategies are generally designed to cover production costs, achieve marketing objectives, and increase profitability.32 Hence, the correlation strengths among changes in interchange fees, merchant discount fees, and consumer prices are difficult to isolate and observe.33

Over the long run, other factors aside from the allocation of swipe fee revenues would be expected to influence the structure of the payments system. For example, technological developments over time may allow consumers to submit payments directly to other consumers or small businesses via alternative payment systems.34 Greater competition from nonbank institutions may result in fewer financial transactions being processed by U.S. banking institutions.35 Hence, interchange fee revenues generated for issuers belonging to four-party network systems are constantly susceptible to future financial market innovations.