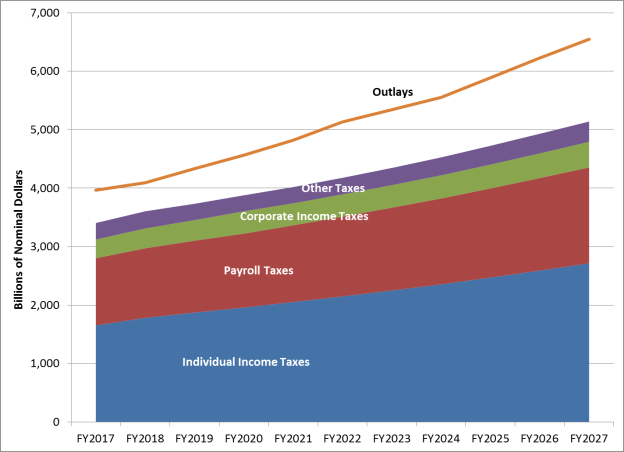

Figure 1. Federal Revenues and Outlays in the January 2017 CBO Baseline

(in billions of nominal dollars)

Source: CBO January 2017 baseline.

Notes: Totals not adjusted for inflation.

Tax reform remains an issue of interest in the 115th Congress. An open policy question is whether any proposed tax reform might increase the projected budget deficit, reduce the deficit, or leave the deficit unchanged (i.e., be revenue neutral). To inform this debate, this Insight provides information on the current revenue baseline as calculated by the Congressional Budget Office (CBO). This Insight also discusses how the enactment of changes in tax policy can potentially change the baseline, and implications of these changes for subsequent legislation, such as tax reform. This Insight does not discuss the implications of certain baseline levels on the enforcement of budget rules or on the use of the budget reconciliation process for tax reform.

A baseline is a projection of federal spending and receipt levels for the current fiscal year and 10 future years (also known as the budget window). A baseline provides a "neutral" benchmark that may be used to evaluate the budgetary effects of policy proposals. Congress generally uses budget baselines produced by the CBO. The CBO baseline is calculated using a variety of assumptions, including (1) an assumption that existing law will proceed as scheduled for most programs; (2) economic assumptions for measures such as growth and unemployment; and (3) other assumptions about demographic and technological changes, among others. Updated projections are typically issued two or three times per year, and reflect both changes in law and changes in economic conditions.

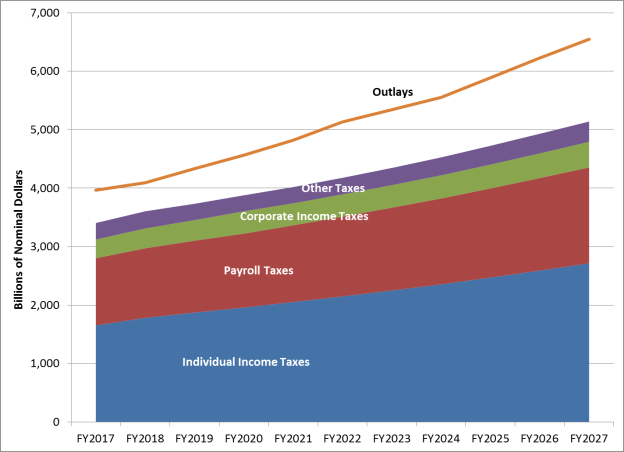

Detail on federal revenues and outlays (spending) in the January 2017 CBO baseline is presented in Figure 1. Much of the increase over time is attributable to economic growth. Total federal revenues are projected to increase from $3,404 billion in FY2017 to $5,140 billion in FY2027, on a nominal basis. Measured as a share of annual gross domestic product (GDP), which accounts for the effects of inflation, revenues are projected to rise from 17.8% of GDP to 18.4% of GDP over the same timeframe. Individual income tax revenues are projected to increase on both a nominal basis and as a share of GDP over the budget window, from $1,651 billion (8.6% of GDP) in FY2017 to $2,714 billion (9.7% of GDP) in FY2027. Individual income tax receipts are projected to increase as (1) incomes rise faster than prices, resulting in a larger portion of income being taxed at higher rates; (2) distributions from tax-deferred retirement accounts increase; and (3) the proportion of wages earned by higher-income taxpayers increases. Revenues attributable to payroll taxes, corporate income taxes, and other taxes rise on a nominal basis over the budget window (from $1,753 billion in FY2017 to $2,426 billion in FY2027) but fall when measured as a share of GDP (from 9.2% of GDP in FY2017 to 8.7% of GDP in FY2027). Changes in the anticipated distribution of income, expiring corporate tax preferences, and other trends are expected to contribute to the inflation-adjusted decline in revenues.

|

Figure 1. Federal Revenues and Outlays in the January 2017 CBO Baseline (in billions of nominal dollars) |

|

|

Source: CBO January 2017 baseline. Notes: Totals not adjusted for inflation. |

CBO also projects increases in nominal and inflation-adjusted outlays over the budget window, from $3,963 billion (20.7% of GDP) in FY2017 to $6,548 billion (23.4% of GDP) in FY2027. As outlays are projected to increase more quickly than revenues, the federal deficit is projected to grow from $559 billion (2.9% of GDP) in FY2017 to $1,408 billion (5.0% of GDP) in FY2027.

The Joint Committee on Taxation (JCT) estimates how much tax policy proposals will increase or decrease federal revenues, relative to CBO's projected baseline (the estimated change in revenue is the "score"). Assuming no change in outlays, tax reform that reduces federal revenues relative to the baseline will increase the deficit, while tax reform that increases federal revenues relative to the baseline will reduce the deficit. Tax reform that is revenue-neutral will raise the same amount of revenue as the current system.

The lower the revenue baseline, the less revenue a reformed tax system needs to generate for the reform to be scored as revenue-neutral. The baseline incorporates changes in tax policy enacted into law. For example, the Consolidated Appropriations Act, 2016 (P.L. 114-113) made permanent a number of temporary tax provisions that had previously been part of the "tax extenders." Extension of expired or expiring tax provisions reduces the revenue baseline, and a long-term or permanent extension reduces the revenue baseline more than a short-term extension. Specifically, provisions in P.L. 114-113 to extend temporary tax provisions were estimated to reduce federal revenues by $628.8 billion between FY2016 and FY2025.

One provision that was permanently extended in P.L. 114-113 is the tax credit for research and experimentation expenses. Modifying and making permanent the research credit was estimated to reduce federal revenues by $113.2 billion over the 10-year budget window. Thus, making the research credit permanent adjusted the revenue baseline. Assuming a permanent research credit is a desired feature of a reformed tax system, enacting a permanent research credit before considering tax reform legislation means that a revenue-neutral tax reform will not require revenues to offset the cost of a permanent research credit.

The American Health Care Act (AHCA) proposed a projected $999.5 billion dollar reduction in federal revenues between FY2017 and FY2026 (the AHCA also includes policies affecting outlays). Tax policies the AHCA proposes to repeal include (but are not limited to) annual fees imposed on certain health insurers, the Medicare Hospital Insurance surtax imposed on certain high-income taxpayers, and the tax on net investment income for certain high-income taxpayers. If the AHCA revenue provisions are enacted before tax reform legislation is considered, the projected reduction in federal revenues could be reflected in the baseline against which tax reform legislation is scored. With a lower revenue baseline, less revenue might then be needed to achieve revenue-neutral tax reform.