Background

The Obama Administration

In 2008—and again in 2012—the Canadian company TransCanada submitted to the U.S. Department of State an application for a Presidential Permit authorizing construction and operation of pipeline facilities to import crude oil across the U.S.-Canada border. The proposed Keystone XL Pipeline project (the project) would transport crude oil derived from Canadian oil sands1 deposits in Alberta, as well as crude oil produced from the Bakken region in North Dakota and Montana, to a market hub in Nebraska for further delivery to U.S. Gulf Coast refineries.

A decision to issue or deny any Presidential Permit for a pipeline project that would cross a U.S. border is conditioned on the State Department's determination that the proposal would serve the national interest. Whether or not a proposal would be deemed to serve the national interest depends on numerous factors. For the project, the State Department had indicated that it would look specifically at factors related to energy security; foreign policy; and environmental, social, and economic impacts, as well as whether the project, as proposed, would comply with relevant federal regulations.

With regard specifically to the assessment of the project's potential environmental impacts, the State Department prepared an environmental impact statement (EIS) as required under the National Environmental Policy Act (NEPA).2 A draft EIS (DEIS) was released for public comment on March 1, 2013, followed by a final EIS (FEIS) on January 31, 2014.3 The FEIS identifies anticipated direct and indirect impacts of the project, as proposed by TransCanada, as well as various project alternatives, including a "no action" alternative (i.e., impacts associated with denying TransCanada's permit application). Among the various environmental impacts identified in the FEIS are those involving greenhouse gas (GHG) emissions.

On June 25, 2013, President Obama announced a national "Climate Action Plan" to reduce emissions of carbon dioxide (CO2) and other GHG, as well as to encourage adaptation to climate change.4 During his speech, the President made reference to the proposed Keystone XL Pipeline, and stated that an evaluation of the project's impact on climate change would factor into the State Department's national interest determination:

Allowing the Keystone pipeline to be built requires a finding that doing so would be in our nation's interest. And our national interest will be served only if this project does not significantly exacerbate the problem of carbon pollution. The net effects of the pipeline's impact on our climate will be absolutely critical to determining whether this project is allowed to go forward.5

On November 6, 2015, the Obama Administration rejected TransCanada's application for a Presidential Permit. In a Record of Decision and National Interest Determination (2015 Determination), then-Secretary of State John Kerry wrote that granting a permit to the Canadian company would not serve the national interest for several reasons, including that it "would undermine U.S. climate leadership and thereby have an adverse impact on encouraging other states to combat climate change and work to achieve and implement a robust and meaningful global climate agreement."6

The Trump Administration

On January 24, 2017, the Trump Administration signed executive actions to revisit TransCanada's application for the border facilities of the proposed Keystone XL Pipeline.7 On March 23, 2017, the State Department issued a Presidential Permit for the project,8 having determined that issuing the permit "would serve the national interest." The Department announced that the Record of Decision and National Interest Determination (2017 Determination)9 for the Presidential Permit "is informed by" the 2014 FEIS. It cites no new documentation aside from fresh communications with the Canadian pipeline company. The Determination states:

The [F]EIS reflects the expected environmental impacts of the proposed Project. Certain topics examined therein such as greenhouse gas (GHG) emissions analysis and market analysis are dynamic, although ... the [F]EIS continues to inform the Department's national interest determination in respect to these topics.10

Further, in answer to the statement in the 2015 Determination that approval of the project would undercut the credibility and influence of the United States in urging countries to address climate change, the 2017 Determination states:

Since then, there have been numerous developments related to global action to address climate change, including announcements by many countries of their plans to do so. In this changed global context, a decision to approve this proposed Project at this time would not undermine U.S. objectives in this area.11

As the 2017 Determination does not add new data or analysis to the 2014 FEIS, this report examines the findings of the 2014 FEIS with respect to GHG emissions assessments of the proposed Keystone XL Pipeline project.

The State Department's GHG Emissions Assessment

The effects of the proposed Keystone XL Pipeline project on climate change may be analyzed, in part, by an assessment of the GHG emissions attributable to the project. Such an analysis could encompass a variety of activities and implications relative to the project, including the GHG emissions associated with the proposed pipeline's construction and operation. A broader scope could include an analysis of the GHG emissions attributable to the production and use of the crude oils that would be transported through the pipeline. Any assessment would depend on many factors, most notably the availability and quality of GHG emissions data for the industry, the scope of industry activities included within the assessment, and the assumptions made about how to model these activities. Many secondary considerations—for which projections have even greater uncertainty—may also impact an assessment. These include projections regarding global crude oil markets, refinery inputs and outputs, transport options, policy considerations, and the end-use consumption of petroleum products. Different values attached to these varying factors return different estimates for the GHG emissions attributable to the operation of the project, as well as the production and use of the crude oils transported through it.

Reported Findings

A number of publicly available studies have attempted to assess the GHG emissions attributable to the production and use of crude oils derived from Canadian oil sands deposits. The State Department, in the FEIS for the Keystone XL Pipeline project, has produced one such assessment. For a detailed analysis of these assessments, see CRS Report R42537, Canadian Oil Sands: Life-Cycle Assessments of Greenhouse Gas Emissions.

In addition to a general assessment of the oil sands resource, the FEIS includes an analysis of (1) the GHG emissions associated with the construction and operation of the proposed Keystone XL Pipeline (i.e., the impacts of issuing a Presidential Permit); (2) the GHG emissions associated with using other transport options (i.e., impacts of denying the permit application); and (3) the GHG emissions attributable to the production and use of the oil sands crudes that would be transported to market, regardless of the transport option assumed.

The State Department characterizes the GHG emissions attributable to the construction and operation of the project (as well as the alternatives to the project) as "direct and indirect GHG emissions." These values are generated by calculating GHGs emitted during fugitive releases, land use changes, and fuel use for construction, maintenance, and inspection vehicles (direct emissions), as well as off-site electricity generation for power purposes (indirect emissions). Further, the State Department defines the GHG emissions attributable to the production and use of the oil sands crudes that would be transported through the project as "indirect life-cycle GHG emissions." This value is generated by examining the full GHG emissions profile of oil sands crudes (i.e., the aggregate GHG emissions released by all activities from the extraction of the resource to the refining, transportation, and end-use combustion of refined fuels). In addition, the FEIS reports estimates for the "incremental indirect life-cycle GHG emissions" of the oil sands crudes. This value is generated by comparing the emissions profile of the oil sands crudes to those of other comparable crudes it may displace in U.S. refineries, and then estimating the difference between a scenario where the project is constructed and a scenario where it is not.

Based on a review of the available GHG emissions data, as well as an analysis of North American crude oil transport infrastructure and global crude oil markets, the FEIS concludes the following:12

- 1. The project would emit approximately 0.24 million metric tons of carbon dioxide (CO2) equivalents (MMTCO2e)13 during the construction period and 1.44 MMTCO2e per year during normal operations.

- 2. The total life-cycle GHG emissions attributable to the production, refining, and combustion of 830,000 barrels per day (bpd) of oil sands crude transported through the proposed pipeline are approximately 147 to 168 MMTCO2e per year.

- 3. The range of incremental life-cycle GHG emissions attributable to the oil sands crudes that would be transported through the proposed pipeline is estimated to be 1.3 to 27.4 MMTCO2e per year over and above the life-cycle GHG emissions attributable to the crude oils expected to be displaced in U.S. refineries.14

- 4. As projected in the market analysis, "approval or denial of any one crude oil transport project, including the proposed project, is unlikely to significantly impact the rate of extraction in the oil sands or the continued demand for heavy crude oil at refineries in the United States based on expected oil prices, oil-sands supply costs, transport costs, and supply-demand scenarios."

Overall, the reported findings in the FEIS are similar to those given in the DEIS released in March 2013. There are, however, a few changes in the methodology, the presentation of the data, and the emphasis on the key findings.15 For a detailed review of the DEIS, see CRS Report R43180, Keystone XL: Greenhouse Gas Emissions Assessments in the Draft Environmental Impact Statement.

Methodology

The range of incremental GHG emissions for crude oil that would be transported by the proposed project is estimated to be 1.3 to 27.4 MMTCO2e annually ...16

How does the State Department calculate this estimate, and what does it say about the climate change impacts of the project?

Life-cycle assessments. The State Department calculates the GHG emissions attributable to the production and use of the oil sands crudes transported through the proposed pipeline by developing a "life-cycle assessment" of the Canadian oil sands resource. Life-cycle assessment (LCA) is an analytic method used for evaluating and comparing the environmental impacts associated with supplying a useful product (in this case, the climate change implications of a petroleum resource). LCAs can be used in this way to identify, quantify, and track emissions of carbon dioxide and other GHG emissions arising from the entire life-cycle of the resource (i.e., from extraction through combustion), and to express them in a single, universal metric of carbon dioxide equivalent (CO2e) GHG emissions per unit of fuel or fuel use. This figure is commonly referred to as the "emissions intensity" of the fuel.

Emissions intensity of the oil sands. The State Department employs the results of a number of publicly available studies that have attempted to assess the life-cycle GHG emissions intensity of oil sands crudes, including four primary LCAs: Jacobs Consultancy 2009, TIAX LLC 2009, U.S. Department of Energy, National Energy Technology Laboratory (NETL) 2008, and NETL 2009.17 These four studies report generally that (1) oil sands are heavier and more viscous than lighter crude oil types on average, and thus require more energy- and resource-intensive activities to extract, and (2) oil sands are chemically deficient in hydrogen and have a higher carbon, sulfur, and heavy metal content than lighter crude oil types on average, and thus require more processing to yield consumable fuels by U.S. standards. However, the four studies use different design parameters, input assumptions, and industry data to model the GHG emissions intensities from the production and use of oil sands crudes. Thus, each returns different estimates. As one example, the U.S. Department of Energy's assessment (NETL 2009) looks at both oil sands mining and in situ production techniques,18 and examines the GHG emissions profiles for the extraction, transportation, refining, and use of these crudes into gasoline, diesel, and jet fuel products. NETL reports the average GHG emissions intensity of oil sands crudes to be equivalent to 106.3 grams of carbon dioxide equivalent for each megajoule of energy released by its combustion as gasoline (gCO2e/MJ LHV gasoline). NETL compares this result to a baseline value of 91 gCO2e/MJ LHV gasoline, which it reports as "the weighted average of transportation fuels sold or distributed in the United States in 2005."19

Overall, the four LCAs return emissions estimates for several different types of oil sands production techniques in the range of 101-120 gCO2e/MJ LHV gasoline. The State Department uses these results to report that oil sands crudes "are generally more GHG intensive than other heavy crudes they would replace or displace in U.S. refineries, and emit an estimated 17 percent more GHGs on a lifecycle basis than the average barrel of crude oil refined in the United States in 2005."20

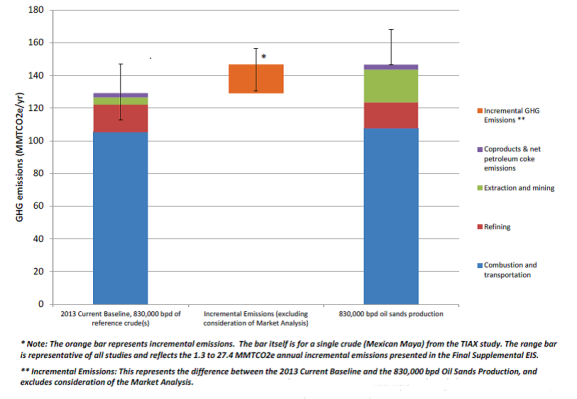

Figure 1 presents one estimate of the incremental GHG emissions attributable to oil sands crudes over emissions from a comparable reference crude.

Total emissions through the proposed pipeline. Using the emissions estimates from the four LCAs (with some additional calculations),21 the FEIS determines a value for the total, or "gross," GHG emissions that would be attributable to the crude oils transported through the proposed pipeline. The FEIS reports that "the total life-cycle emissions attributable to the production, refining, and combustion of 830,000 [barrels per day] of oil sands crude ... is approximately 147 to 168 MMTCO2e per year."22

Incremental emissions through the proposed pipeline. Assuming a scenario wherein the oil sands crudes transported through the proposed pipeline would displace an equivalent volume of other crude oils currently processed at the Gulf Coast refineries, the FEIS uses the emissions estimates from the four LCAs to compare the profiles of Canadian oil sands crudes against three reference crudes available to Gulf Coast refineries: Venezuelan Bachaquero, Mexican Maya, and Middle Eastern Sour. In each case, the GHG emissions profile for oil sands crudes is higher than that of the reference crude. Based on the data, the FEIS reports that "the range of incremental GHG emissions attributable to the oil sands crude that would be transported through the proposed pipeline is estimated to be 1.3 to 27.4 MMTCO2e per year" over and above the GHG emissions attributable to the crude oils expected to be displaced in U.S. refineries.23

GHG equivalencies of the incremental emissions.24 The FEIS reports that the incremental emissions are equivalent to "annual GHG emissions from combusting fuels in approximately 270,833 to 5,708,333 passenger vehicles, the CO2 emissions from combusting fuels used to provide the energy consumed by approximately 64,935 to 1,368,631 homes for one year, or the annual CO2 emissions of 0.37 to 7.8 coal-fired power plants."25 EPA reports total domestic GHG emissions for all sectors in 2012 to be 6,502 MMTCO2e, thus making the incremental emissions attributable to the project comparable to 0.02%-0.4% of U.S. annual emissions.26

Market analysis. The FEIS notes that the reported emissions do not consider the effects of market dynamics, stating that "the incremental emissions estimate represents the potential increase in GHG emissions attributable to the proposed pipeline if it is assumed that approval or denial of the proposed pipeline would directly result in a change in production of 830,000 bpd of oil sands crudes in Canada ... However, such a change is not likely to occur under expected market conditions."27 The FEIS examines several market scenarios and concludes that under the most likely conditions, "approval or denial of any one crude oil transport project, including the proposed project, is unlikely to significantly impact the rate of extraction in the oil sands or the continued demand for heavy crude oil at refineries in the United States."28

Operational emissions. The FEIS also calculates GHG emissions resulting from the construction and the annual operation of the project. It reports construction emissions of 0.24 MMTCO2e (due to land use changes, electricity use, and fuels for construction vehicles) and pipeline operation emissions of 1.44 MMTCO2e/year (due to electricity for pumping stations, fuels for maintenance and inspection vehicles, and fugitive emissions).29 Operational estimates are commonly included in many life-cycle assessments (including those referenced in the FEIS); thus, the State Department does not incorporate these reported values into the value for the total life-cycle GHG emissions for the project. However, given that the State Department investigates the potential impacts for various project alternatives—including a "no action" alternative—the FEIS compares the operational GHG emissions from the project to various transportation alternatives such as rail, rail and pipeline, and rail and tanker. The FEIS reports the annual operational emissions attributed to the no action alternatives to range from 28%-42% greater than for the proposed project.

Evaluation Considerations

Both the GHG emissions assessment and the crude oil market analysis in the FEIS are models. Each model must consider many variables and uncertainties in available data to arrive at an estimate. A review of some of these uncertainties is provided below.

The Life-Cycle GHG Emissions Assessment

Oil Sands Assessment. The State Department references third-party sources for the raw data on the GHG emissions intensities of oil sands crudes. Thus, the FEIS is less an independent and original assessment than a comparative analysis of multiple other studies, each presenting significant variations in both reported findings and input assumptions. Life-cycle assessment has emerged as an influential methodology for collecting, analyzing, and comparing the GHG emissions and climate change implications of various hydrocarbon resources. However, because of the complex life-cycle of fuels and the large number of analytical design features that are needed to model their emissions, LCAs retain many uncertainties. The NETL 2009 LCA—from which the State Department sources many of the estimates for oil sands crudes—has very specific design parameters and input assumptions. The LCA dates from 2009 and utilizes certain data that date from 2005 (e.g., GHG emissions intensities of the oil sands crudes are compared against a 2005 U.S. baseline). Opponents to the Keystone XL Pipeline are critical of many of the exclusions in the NETL 2009 LCA, including the tightly delimited system boundaries and the omission of co-product emissions (e.g., petroleum coke).30 The FEIS attempts to correct for some technical aspects to the NETL 2009 and other LCAs, but data gaps remain. Conversely, proponents of the Keystone XL Pipeline point to the many recent advances in energy efficiency and GHG mitigation technologies that Canadian oil sands producers have made.31 They note also that the government of Alberta has implemented policies to help mitigate and reduce the GHG emissions associated with oil sands production. These include (1) a mandatory GHG intensity reduction program for large industrial emitters,32 (2) a fund for clean energy investment that is capitalized by the reduction program, and (3) dedicated funding for the construction of large-scale carbon capture and sequestration (CCS) facilities.33 Proponents suggest that these and other advances may make the GHG emissions intensity of oil sands crudes more in line with other reference crudes going forward.

Reference Crudes Assessment. Similarly, assessing the life-cycle GHG emissions intensities of the reference crudes requires calculations similar to those performed on the oil sands, and thus harbors many of the same uncertainties. Complicating this analysis, the quality of the data and the transparency in presentation for many of the global reference crudes are not as robust as data on the oil sands. Some, even, have yet to be fully modeled (e.g., Bakken tight oil). This is primarily a function of changing conditions as well as the difficulty in accessing necessary data from the field. A lack of equivalence can impede the ability to make meaningful comparisons. Comparisons are also complicated by the fact that emissions factors for Canadian oil sands crudes and reference crudes will change over time, and it is not clear how these changes will impact their respective GHG emissions. On one hand, secondary and tertiary recovery techniques will become more common in conventional oil, increasing the GHG emissions of reference crudes. In contrast, oil sands surface mining is expected to have a relatively constant energy intensity for a long period of time, and in situ techniques may be expected to become more efficient. Exploration for new oil reservoirs will also continue (with the possibility of commercializing both greater and lesser emissions-intensive resources), while the location and extent of Canadian oil sands is generally well understood.

Displacement Analysis. A determination of which reference crudes would be displaced at Gulf Coast refineries is left open by the State Department's analysis, as the FEIS reports a range of values for several different scenarios. Different LCAs make different assumptions regarding the effects of Canadian oil sands development on the production of other global crudes. For example, NETL 2009 assumes that resources from Venezuela or Mexico may likely be the first displaced by Canadian oil sands crudes at U.S. refineries. However, to the extent that a crude like Saudi Light (i.e., Middle Eastern Sour) is the world's balancing crude, NETL also suggests that it may ultimately be the resource backed out of the global market by increased Canadian oil sands production. Many factors—from economics to geopolitics to trade issues—could influence the balance of global petroleum production. Incremental global GHG emissions would vary greatly depending upon this calculus.

The Market Analysis

The FEIS references several third-party market forecasts for current and future market conditions. These include analyses from the U.S. Department of Energy, Energy Information Administration (EIA), the Canadian Association of Petroleum Producers (CAPP), Canada's National Energy Board (NEB), and the International Energy Agency (IEA).34 Analysis focuses on crude oil prices, production volumes, refinery inputs, and consumer demand, and assesses how changes in these variables may impact oil sands development. The forecasts reach out to the period 2035-2040. In each, the "business-as-usual" scenario for Canadian oil sands producers is one in which "the industry and market react based on normal commercial incentives."35 Thus, each forecast generally assumes that projects currently proposed, approved, and under construction will go forward, and that adequate takeaway capacity (e.g., the proposed Keystone XL Pipeline project) will be available to oil sands producers over time. Estimating the effects of not constructing adequate pipeline takeaway capacity becomes the "counterfactual" scenario the FEIS must calculate. Thus, instead of modeling how the construction of the proposed pipeline might affect the short- to medium-term growth of the industry, the State Department models instead how industry and market forces may react to the denial of the project over the long term.

Using this approach, the FEIS models 16 different scenarios that combine various supply-demand assumptions and pipeline constraints, including ones wherein there is a potential higher-than-expected U.S. supply, lower-than-expected U.S. demand, and higher-than-expected oil production in Latin America. The FEIS finds generally that the most likely scenario for oil sands crudes is one of steady to rising global oil prices, diminishing transportation constraints, decreasing production costs, and continued demand in U.S. Gulf Coast refineries. With this analysis, the FEIS concludes that if the proposed pipeline is denied, the rate of development in the oil sands is unlikely to be substantially impacted because the market would respond by adding broadly comparable transport capacity over time. The State Department bases this conclusion on three projections: (1) the crude oil input mix at Gulf Coast refineries remains constant, (2) rail and other non-pipeline transport options would fully accommodate all projected growth in oil sands production, and (3) at no point would the global price of oil fall—or the marginal cost of production increase—such that investment in new oil sands projects would be deemed uneconomical (i.e., below the breakeven price for production).

The Demand Argument. The FEIS reports that "approval or denial of any one crude oil transport project, including the proposed project, is unlikely to significantly impact ... the continued demand for heavy crude oil at refineries in the United States."36 The State Department supports this analysis with several projections, including (1) no new capacity would be added or installed on the Gulf Coast to refine additional crude oils made available by increased North American supply,37 (2) oil refineries optimized for heavy crudes would process only heavy crudes, (3) oil sands imports would displace only other heavy imports, and (4) any growing domestic light oil production from tight oil plays—in the Bakken, the Eagle Ford, or others—would displace only light crude imports.38 Further, the FEIS determines that the projected drop-off in U.S. tight oil production by the mid-2020s would dissuade Gulf Coast refiners optimized for processing heavier crudes from switching.39

Other analysts argue that increased transport of oil sands crudes out of Canada would not simply displace other crudes but could serve to optimize operating capacity at Gulf Coast refineries or even encourage an expansion in investments. They maintain that any additional production capacity (of oil sands crudes or others) would not simply substitute for current levels, but add to them, increasing the incremental, or "net," GHG emissions attributable to the proposed pipeline. Similarly, some commentators have pointed to recent reports that suggest that domestic light oil production (e.g., Bakken, Eagle Ford) is not only backing out imported light crudes but also displacing the market for heavier crudes.40 Further, this displacement may traverse the entire supply chain for North American petroleum infrastructure, from refinery inputs to transport capacity to investment in production facilities. They contend that this switch, even in the short to medium term, could have substantial impacts on the use of oil sands crudes in U.S. refineries and the GHG emissions attributable to the sector.41

The Capacity Argument. The State Department reports that while no new pipeline capacity has been added from Canada into the United States since 2011, a number of projects are proposed or in development, specifically those entailing modifications and/or use of existing rights-of-way (e.g., Enbridge's Alberta Clipper expansion).42 Further, the FEIS points out that many interstate pipelines that do not cross international borders face less regulatory review (e.g., the Enbridge Flanagan South and Trunkline conversion, among others), and that their development "would directly support the export of [oil sands] crudes and/or move [oil sands] and Bakken crudes to destination markets."43 Nevertheless, for the purposes of its analysis, the State Department examines scenarios for transporting all new production of oil sands crudes by rail and other non-pipeline transport options. It surmises that scaling up transport is logistically and economically feasible, based on past and present evidence in the Powder River Basin and the Bakken,44 as well as the oil sands region itself.45 Given the identified commercial demand for oil sands crudes in Gulf Coast refineries, the FEIS concludes that "rail will likely be able to accommodate new production if new pipelines are delayed or not constructed."46

Other analysts, however, are skeptical of rail's ability to accommodate all new production in the oil sands. They contend that expansion would require significant infrastructure development, including loading and unloading facilities, rail network capacity, and specialized tank car availability.47 The International Energy Agency (IEA) has reported that the failure to build needed oil sands pipelines—particularly Keystone XL—could result in "persistent price discounts and slow expansion of the sector."48 A similar short- to medium-term reduction is supported by other market analyses of the oil sands (e.g., CIBC, TD Economics, and Goldman Sachs).49 Most of the third-party market analyses do not report conditions for the medium to long term, as some assume that transport logistics would be worked out by the market in the long term, and others do not speculate.

The Cost Argument. To assess the potential impact of increased supply costs on the oil sands production (whether transportation costs or others), the State Department reviews information regarding "breakeven prices" for different types of oil sands projects. The "breakeven price" is often expressed as the lowest price of a benchmark crude that is necessary to enable a potential oil sands project to cover all its costs and earn a commercial rate of return on capital employed—typically 10%-15%. A long-term increase in supply costs acts as an increase in the breakeven price for producers.50 The State Department posits that if the supply costs for new oil sands projects were to rise above the benchmark price for an extended period of time, conditions would lend themselves to a potential decrease in oil sands production and a dampening of future investment. To assess the likelihood of this scenario, the State Department references a range of third-party reports for new oil sands projects.51 The FEIS harmonizes these data, conjoins them with existing project costs, and reports supply costs at $65-$70 per barrel for in situ crude; $80-$85 per barrel for mining (without upgrader);52 and $90-$100 per barrel for mining (with upgrading).53 Comparing these supply costs to price projections of benchmark crudes, the State Department reports the following:

Above approximately $75 per barrel (West Texas Intermediate [WTI]-equivalent), revenues to oil sands producers are likely to remain above the long-run supply costs of most projects responsible for expected levels of oil sands production growth. Transport penalties could reduce the returns to producers and, as with any increase in supply costs, potentially affect investment decisions about individual projects on the margins. However, at these prices, enough relatively low-cost in situ projects are under development that baseline production projections would likely be met even with constraints on new pipeline capacity.54

Other analysts have argued that significantly increased supply costs, decreased oil prices, or changes to other market variables could have impacts on both oil sands development and GHG emissions. In recognition of these uncertainties, the FEIS models 16 different scenarios that combine various supply-demand assumptions and pipeline constraints. Certain scenarios show that delays in rail development could impact system capacity in the short term.55 Other scenarios indicate that pipeline constraints could reduce the prices received by oil sands producers by up to $8 per barrel.56 A final scenario estimates that benchmark crude oil prices of around $65-$75 per barrel, coupled with heightened transportation costs, "could have a substantial impact on oil sands production levels."57 In regard to these reported alternative scenarios, the spot price for WTI crude oil on January 31, 2014 (the date of the release of the FEIS), was $97.55 per barrel.58 On March 27, 2017 (the most current date reported by EIA at the publication of this report), the spot price for WTI crude oil was $47.02 per barrel. Several sources have forecasted a continued downward pressure on crude oil prices over the near term.59

The market analysis in the FEIS is presented separately from the GHG emissions assessment. Thus, the FEIS does not report numerical estimates for GHG emissions based on any of the examined market scenarios. By concluding that the most likely scenario is one in which oil sands production would be unaffected at expected market conditions, the FEIS implies that the incremental life-cycle GHG emissions attributable to the oil sands crudes transported through the proposed pipeline are negligible. In this scenario, the only differences in GHG emissions would arise from the choice of transportation (e.g., emissions attributable to the annual operation of pipelines, railways, trucks, or tankers). The FEIS reports that the annual operational emissions for the "no action" alternatives range are 28%-42% greater than for the proposed project. By comparison, the March 2013 DEIS reported numerical estimates for its competing scenarios, estimating the incremental cost of rail over pipeline as $5 per barrel, with a 2%-4% decrease in oil sands production levels, and an incremental GHG emission reduction of up to 5.3 MMTCO2e annually.60

Concluding Observations

Perhaps not since the Trans-Alaska Pipeline System debate during the Nixon Administration has international attention focused so heavily on the construction of a petroleum pipeline in the United States. In the case of the Keystone XL Pipeline, however, the debate has extended well beyond the direct environmental impacts of the project (e.g., spills, habitat, and, in this instance, the GHG emissions attributable to the construction and operation of a pipeline). For many, the impact of the proposed pipeline is tied explicitly to its effect on the rate of development of the Canadian oil sands, as well as the precedent its approval or denial may set for U.S. energy policy. Assessing these various perspectives involves complex technical analysis, which is complicated by an inherent uncertainty in future market projections.

The FEIS analyzes the incremental life-cycle GHG emissions attributable to the production and use of the oil sands crudes to be transported through the proposed Keystone XL Pipeline, and estimates them to be up to 27.4 MMTCO2e per year more than the crudes they are expected to replace in U.S. refineries (i.e., equivalent to the annual emissions from up to 5.7 million passenger vehicles or 7.8 coal-fired power plants). The FEIS also analyzes a variety of future market projections for oil sands crudes, and finds the most likely scenario to be one of stable to rising global oil prices, diminishing transportation constraints, decreasing production costs, and continued demand for heavy crudes in U.S. Gulf Coast refineries. Under this scenario, the FEIS concludes that approval or denial of the proposed pipeline is unlikely to have a substantial impact on the rate of development in the Canadian oil sands, as other transport options would fully accommodate all projected growth. This market scenario makes the technical GHG assessment in the FEIS less relevant, as the life-cycle GHG emissions from the production and consumption of oil sands crudes would occur regardless of the transportation method used to bring the crudes to market. While this view of market inevitability recognizes significant uncertainty, it concludes that no combination of reasonable market outcomes would be sufficient to cause delays or decreases in oil sands production. The only question regarding climate change impacts, in this view, is whether the alternative transportation methods (e.g., rail, truck, tanker) would contribute greater or lesser amounts of GHG emissions during operation.

Some analysts disagree with the FEIS assessment and argue that there is nothing presumed or inevitable about the rate of expansion for the Canadian oil sands.61 This skepticism arises from the observation that oil sands projects face a challenging financial environment, with upfront production costs and price differentials comparatively higher than for other crudes, making new investment sensitive to changes in market fundamentals. They stress that oil market projections and transportation options are rife with uncertainty, and that the proposed Keystone XL Pipeline could have a much more significant impact on expansion if a number of key variables differ from the State Department's projections. These variables include (a) lower global oil prices than projected; (b) higher rail costs than projected; (c) higher new project costs than expected; (d) greater competition from shale oil and tight oil plays; and (e) future carbon pricing or procurement policies in the United States or Canada. They note that several of these variables have already moved against the predictions in the FEIS, most notably a continued period of lower oil prices.62 They contend that any decrease or delay in development could significantly impact the rate of growth in global GHG emissions by allowing more time for the development of energy-efficiency strategies, the promulgation of climate policies, and the deployment of lower-carbon energy technologies.

Beyond the debate about the proposed Keystone XL Pipeline's impacts on oil sands production, some stakeholders have expressed a broader concern about whether the approval or denial of the project could set a precedent for U.S. energy policy.63 They argue that while many of the decisions that may affect the development of the oil sands will ultimately be made by the market and the national and provincial governments of Canada, the choice of whether or not to approve the permit for the project is an opportunity for the U.S. government to signal its future direction.

Some stakeholders have pushed for a national energy policy that moves the United States away from a reliance on fossil fuels. They see the decision to build the proposed pipeline as a 50-year-long commitment to a carbon-based economy and its resulting GHG emissions.64 Some observers contend that with meaningful action on climate policy slowed or stalled in Congress, the courts, and, to some extent, the regulatory agencies (i.e., local, state, and federal environmental and land-use agencies), the sole remaining outlet to leverage a low-carbon energy policy is single-action initiatives on such items as infrastructure permits. Many have actively opposed the permit for the project, believing that it may set a precedent; for if the pipeline is allowed to go forward, they contend, it may be the case that no future infrastructure project would be held accountable for its incremental contribution to cumulative GHG emissions.

Others recognize that the project could affect U.S. energy policy by setting a precedent and sending a signal, but they reach a different conclusion. Many regard the project as one element of a revitalized energy production sector in North America, and urge that U.S. policy should support investment in such infrastructure for economic and national security reasons.65 They endorse decisions and policies that help encourage U.S. "energy security," or at least shift U.S. supply to reliable allies and partners like Canada rather than unreliable sources in the Middle East and Venezuela. In this view, since Canadian oil sands will be developed regardless of the transportation mode used, the public policy interest lies in supporting North American energy suppliers rather than those overseas.

Members of Congress remain divided on the merits of the project, as many have expressed support for the potential energy security and economic benefits, while others have reservations about its potential health and environmental impacts. Though Congress, to date, has had no direct role in permitting the pipeline's construction, it has oversight stemming from federal environmental statutes that govern the review.