What Is High-Frequency Trading?

Broadly speaking, high-frequency trading (HFT) is conducted through supercomputers that give firms the capability to execute trades within microseconds or milliseconds (or, in the technical jargon, with extremely low latency). In practice, depending on the particulars of the trade, trading opportunities can last from milliseconds to a few hours.1 This is by contrast to traditional trading, often called pit trading, in which traders would meet at a trading venue called the floor or pit, and communicate buy and sell orders via open outcry; and by contrast to slower electronic trading. HFT is a catch-all term used to describe "ultra-fast electronic trading in which participants hold positions for short periods."2

The term HTF has no universal or legal definition. Neither the Commodity Futures Trading Commission (CFTC) nor the Securities and Exchange Commission (SEC) has issued regulations defining it. In a 2012 CFTC Technical Advisory Committee meeting, its Sub-Committee on Automated and High Frequency Trading, a working group to examine such issues, developed the following loose and nonbinding definition:

High frequency trading is a form of automated trading that employs:

(a) algorithms for decision making, order initiation, generation, routing, or execution, for each individual transaction without human direction;

(b) low-latency technology that is designed to minimize response times, including proximity and co-location services;

(c) high speed connections to markets for order entry; and

(d) high message rates (orders, quotes or cancellations).3

By most accounts, HFT has grown substantially over the past 10 years: it now accounts for roughly 55% of trading volume in U.S. equity markets and about 40% in European equity markets.4 In the futures markets, the percentages have also grown markedly. From October 2012 to October 2014, the CFTC found that algorithmic trading systems (ATS) were present on at least one side in nearly 80% of foreign exchange futures trading volume; 67% of interest rate futures volume; 62% of equity futures volume; 47% of metals and energy futures volume; and 38% of agricultural product futures volume.5 ATS has also risen to about 67% of trading in 10-year Treasury futures and 64% of Eurodollar futures markets.6

In general, traders that employ HFT strategies are attempting to earn small amounts of profit per trade. Some arbitrage strategies7 reportedly can earn profits close to 100% of the time. Earlier reports indicated that such strategies might make money on only 51% of the trades, but because the trades are transacted hundreds or thousands of times per day, the strategies may still be profitable.8

High-frequency traders employ a diverse range of trading strategies that may also be used in combination with each other. Some analyses broadly categorize these strategies into passive and aggressive trading strategies. Passive strategies involve the provision of limit orders—offers placed with a brokerage to buy or sell a set number of shares at a specified price or cheaper. An example of this is the market making strategy described in the next section. Aggressive strategies reportedly involve the provision of immediately executable trades such as market orders. Such strategies are said to include momentum ignition and order anticipation trading—also known as liquidity detection trading—further discussed in "HFT Strategies and Related Policy Issues," below.

The CFTC oversees any HFT, along with other types of trading, in the derivatives markets it regulates. These include futures, swaps and options on commodities, and most financial instruments or indices, such as interest rates. The SEC oversees HFT and other trading in the securities markets and the more limited securities-related derivatives markets in which it regulates. Although U.S. derivatives markets traditionally relied on human execution of trades, such as through open outcry trading pits, most trading today has moved to highly automated electronic systems that generate, transmit, manage, and execute orders through high-speed networks.

Some recent research has observed generally shrinking profits among those who employ HFT due to factors such as heightened competition. For example, a January 2016 academic study found "that a continuous increase in competition—between high-speed trading algorithms themselves through predatory strategies and from professional human traders adapting and building adequate responses—has made the business more difficult and has led to shrinking profits for HFT."9

HFT Strategies and Related Policy Issues

Much more attention has been paid to and written about HFT in an equity market context than in the futures market context. This section describes several major HFT equity market trading strategies. Some evidence, however, exists that these HFT strategies may also be employed in futures markets.10

Various observers, including SEC staff, have said that two related types of HFT, dubbed aggressive strategies in contrast to the other passive strategies should be a central focus of public policy concerns as they "… may present serious problems in today's market structure—order anticipation and momentum ignition."11 Although the SEC did not elaborate on its concerns, this may be because order anticipation strategies, discussed below, can potentially share some similarities with an illegal practice called front-running. Momentum ignition strategies can potentially share certain similarities with a practice called spoofing, which is also illegal in some markets.

Selected HFT Strategies

The major HFT trading strategies described below draws upon the findings in a unique 2014 SEC staff literature research survey on HFT, Equity Market Structure Literature Review Part II: High Frequency Trading, to provide a sense of the research landscape on HFT's pros and cons.

Going forward, however, the reader should be aware of a caveat in the SEC staff literature survey on its limitations: "The HFT [research] datasets [used in the literature survey] generally have been limited to particular products or markets, and the data time periods now are relatively outdated, particularly given the pace of change in trading technology and practices. Accordingly, while the recent economic literature has made great progress in beginning to fill in the picture of HFT, much of the picture remains unfinished."12 The following is not an exhaustive description of HFT strategies, but is meant to highlight several of the main strategies addressed in this report.

Passive HFT Strategies

Passive market making is when a firm provides liquidity by matching buyer and seller orders or by buying and selling through its own securities inventories if a market maker cannot immediately match buyers and sellers. In general, these market makers do so by submitting non-marketable resting orders (i.e., offers to buy and sell certain amounts of securities at threshold prices that are not immediately available) that provide liquidity to the marketplace. They profit on the difference between the bid prices buyers are willing to pay for a security and the ask prices sellers are willing to accept. Some of this kind of HFT market making is reportedly driven by the HFT firm's receipt of so-called liquidity rebates (usually a fraction of a penny a share) provided by Electronic Communication Networks (ECNs)13 and stock exchanges for the limit orders that they post to those trading centers. Some argue that the subsidies help to ensure sustained market participation regardless of market conditions.14 The profit-making opportunities for market making HFTs can be enhanced when markets are especially volatile.15

The SEC staff analysis found that on average primarily passive HFT strategies appear to have a beneficial impact on various market quality metrics by reducing bid-ask spreads and price volatility (significantly changing securities prices) during the trading day.16

It can be argued that high-frequency traders generally tend to be better informed than many non-high-frequency traders, an attribute that derives from their comparative speed in processing securities market data. Moreover, all things being equal, when better-informed traders interact with less-informed traders, the better-informed traders are apt to buy low and sell high, earning profits, whereas the less-informed traders are apt to buy high and sell low, generating losses. The phenomenon is called adverse selection because under this scenario less-informed traders tend to be disproportionately involved in unattractive trades.17

Other cited research in the SEC literature survey found that the entry of a high-frequency trader that primarily engaged in market making rather inexplicably resulted in a substantial decrease in adverse selection. This is the reverse of the outcome found for aggressive HFT strategies described in the next section.

Arbitrage trading is profiting from price differentials for the same or related securities. These price differences may occur between an exchange-traded fund (ETF) and an underlying basket of stocks, that are traded on different market centers, such as the London Stock Exchange and the New York Stock Exchange (NYSE), or the same stock and its derivatives, such as a specific stock and its stock's options.18 Within this context, various HFT firms also employ something called slow market arbitrage wherein the firms attempt to arbitrage small price differences for stocks between various exchanges resulting from infinitesimal time differences in the trading prices that they report on the same securities, a practice described in Flash Boys, the controversial 2014 book on HFT by Michael Lewis.19

The SEC staff survey indicated that the research that it reviewed did not "reveal a great deal about the extent or effect of the HFT arbitrage strategies."20

Aggressive HFT Strategies

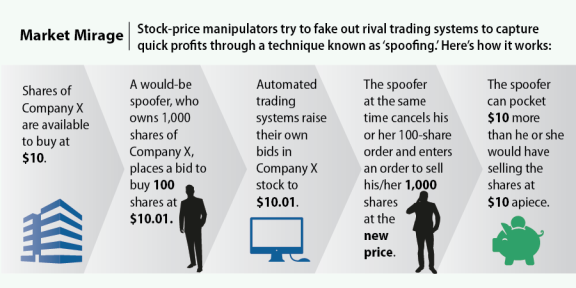

Momentum ignition is a strategy in which a proprietary trading firm initiates a series of orders or trades aimed at causing rapid up or down securities price movements.21 Such traders "may intend that the rapid submission and cancellation of many orders, along with the execution of some trades, will spoof22 the algorithms of other traders into action and cause them to buy (or sell) more aggressively. Or the trader may intend to trigger standing stop loss orders that would help facilitate a price decline."23 As such, by establishing an early position, the high-frequency trader is attempting to profit when it subsequently liquidates the position after it spurs an incremental price movement. (Figure 1 below gives a detailed example of spoofing.) However, the line between spoofing per se—which the Dodd Frank Act24 made illegal by amending the Commodity Exchange Act (CEA)25—and a momentum ignition strategy can be nuanced. Unlike the CEA, federal securities laws do not outlaw spoofing by name, although the SEC has attacked spoofing by characterizing it as a manipulative practice violating antifraud and anti-manipulation prohibitions elsewhere in securities laws.26

Order anticipation, also known as liquidity detection trading, involves traders using computer algorithms to identify large institutional orders that sit in dark pools or other stock order trading venues. High-frequency traders may repeatedly submit small-sized exploratory trading orders intended to detect orders from large institutional investors. The process can provide the high-frequency trader with valuable intelligence on the existence of hidden large investor liquidity, which may enable the trader to trade ahead of the large order under the assumption that the order will ultimately move the security's market pricing to benefit the HFT firm. The line between this strategy and front-running, which is not permitted, can be nuanced.

Front-running generally means profiting by placing one's own orders ahead of a large order based on knowledge of that impending order.27 However, the SEC's 2010 Concept Release on Equity Market Structure emphasized that illegal front-running may occur when a firm or person violates a duty—such as a fiduciary duty—to a large buyer or seller by trading ahead of that firm to benefit from an expected price movement.28 When such a duty existed, the SEC explained, there was already a violation. "The type of order anticipation strategy [which the SEC was discussing] involves any means to ascertain the existence of a large buyer (seller) that does not involve violation of a duty, misappropriation of information, or other misconduct. Examples include the employment of sophisticated pattern recognition software to ascertain from publicly available information the existence of a large buyer (seller), or the sophisticated use of orders to 'ping' different market centers in an attempt to locate and trade in front of large buyers and sellers."29 In other words, the SEC appeared to distinguish high-frequency order anticipation strategies as possibly distinct from front-running based on front-running involving violation of a duty to the large buyer or seller, but still expressed a desire to examine the effects of such order anticipation strategies further.

Policy Concerns Regarding Aggressive HFT Strategies

In the HFT literature survey, the SEC staff analysis characterized momentum ignition and price anticipation, the two aggressive HFT strategies, as having both "positive and negative aspects."30 For example, one study found that these aggressive strategies can improve certain aspects of price discovery in the short run, whereas another study found that while the positive impact of price discovery is significantly higher than that by non-HFT for large-cap stocks, it is inconclusive for mid-cap stocks and significantly lower for small-cap stocks. Meanwhile, another study found that although aggressive HFT had a greater effect on price discovery in the short run (up to 10 seconds), passive non-high-frequency traders had a consistently higher impact on price discovery in the long run (up to two minutes). The staff analysis also referenced a study that found aggressive HFT increases the adverse selection costs that non-high-frequency passive traders are subject to. The staff analysis noted two studies that collectively found aggressive HFT potentially worsened the market trading transaction costs for institutional investors and helped foster extremely volatile market conditions.

The SEC also flagged concerns with such strategies. For instance, in its 2010 Concept Release, the SEC cited research that referred to order anticipators as "parasitic traders" who "profit only when they can prey on other traders. They do not make prices more informative, and they do not make markets more liquid.... Large traders are especially vulnerable to order anticipators."31 The agency requested comments and public input on whether such order anticipation strategies significantly detract from market quality and harm institutional investors.

In addition, regulators have expressed concern over whether certain aggressive HFT strategies may be associated with increased market fragility and volatility, such as that demonstrated in the "Flash Crash" of May 6, 2010; August 24, 2015 market crash in which the Dow Jones Industrial Average fell by more than 1,000 points in early trading; and October 15, 2014 day of extreme volatility in Treasury markets, among others. In an October 2015 speech analyzing the October 14, 2015 Treasury market meltdown, CFTC Chair Timothy Massad noted that CFTC staff had analyzed the frequency of "flash" events in Treasury futures and in five of the most active futures contracts: (1) corn; (2) gold; (3) West Texas Intermediate (WTI) crude oil; (4) E-mini S&P futures, which represent an agreement to buy or sell the cash value of an underlying stock index (i.e., the S&P 500) at a specified future date; and (5) the EuroFX, which reflects changes in the U.S. dollar value of the European euro.32 CFTC staff found that, "Movements of a magnitude similar to Treasuries on October 15th were not uncommon in many of these contracts. In fact, corn, the largest grain futures market, averaged more than five such events per year over the last five years," Massad said.33 He noted there were more than 35 similar intraday flash events in 2015 alone just for WTI crude oil futures. Although the CFTC's analysis appeared to indicate an increase in such flash events, Massad did not postulate a specific cause for their increased frequency, concluding instead that regulators should "take a closer look at algorithmic—or automated—trading."34 Other regulators and researchers have also expressed concern over possible links between HFT and excessive market volatility or fragility.35

Recent CFTC Anti-Spoofing Efforts

Section 747 of the Dodd Frank Act (P.L. 111-203) amended the Commodity Exchange Act to expressly prohibit certain disruptive trading practices, including conduct that violates bids or offers and willful and intentional spoofing.36 This new provision in the CEA prohibits "any trading practice, or conduct on or subject to the rules of a registered entity that ... is, is of the character of, or is commonly known to the trade as, 'spoofing' (bidding or offering with the intent to cancel the bid or offer before execution)."37 This is the first U.S. provision in statute to specifically ban spoofing in commodity markets.38 Figure 1 provides an example of how spoofing works.

Applying such a provision on spoofing to the HFT world, however, can be challenging.39 Since high-speed computers and algorithms can automatically generate many bids and offers in a millisecond, and cancel them quickly, it can be difficult to ascertain at times whether such automated trading practices rise to the level of spoofing. The CFTC released additional guidance in 2013 clarifying that the agency must prove a trader intended to cancel his or her bid before execution, and that reckless trading practices alone would not be considered spoofing.40 However, the CFTC would not need to prove that a trader intended to move the market for such activities to rise to the level of spoofing, the guidance indicated.

The CFTC has used its new anti-spoofing authority in a number of recent enforcement actions. On November 3, 2015, Michael Coscia, the owner of New Jersey-based proprietary energy trading firm Panther Energy Trading, was convicted by a Chicago jury of six counts of spoofing and six counts of commodity fraud, and appears set to face jail time (sentencing is set for March 2016).41 The Department of Justice (DOJ) brought criminal charges against Coscia in October 2014 stemming from algorithmic trading strategies flagged by the CFTC. The CFTC in July 2013 ordered Coscia and Panther Energy to pay $2.8 million in fines, and imposed a one-year trading ban on them as the result of a CFTC enforcement action over algorithmic trading strategies Panther undertook in 2011. According to the CFTC, Panther placed orders with the intent to cancel them on a number of futures contracts traded on CME Group exchanges. These included contracts in crude oil, natural gas, wheat, and soybeans.42

In April 2015, the CFTC also accused U.K.-based trader Navinder Singh Sarao with unlawfully manipulating, attempting to manipulate, and spoofing—with regard to the E-mini S&P 500 futures contract.43 Sarao's trades allegedly contributed to the Flash Crash of May 6, 2010 when unusual market volatility caused major equity indices in both the futures and securities markets, each already down more than 4% from their prior-day close, suddenly plummeted a further 5%-6% in a matter of minutes before rebounding almost as quickly.44

In October, 2015, the CFTC filed a civil complaint charging Chicago-based proprietary trading firm 3Red Trading with spoofing and employing a manipulative and deceptive device while trading futures on energy, metals, equities, and stock-market futures on various futures exchanges.45

|

|

Source: The Wall Street Journal. |

The CFTC's "Regulation Automated Trading"

In more recent usage, the CFTC now often refers to HFT within the rubric of "automated trading." On November 24, 2015, the CFTC released a proposed rule, Regulation Automated Trading (Reg AT), governing certain HFT practices (without using the term HFT).46 In this regulation, the CFTC also refers frequently to algorithmic trading systems (ATS), which are computerized trading systems based on automated sets of rules or instructions used to execute a trading strategy.47 Much automated trading takes place now on futures exchanges.48 The largest two such exchange operators in the United States are (1) the CME Group, which owns the Chicago Mercantile Exchange, Chicago Board of Trade, and New York Mercantile Exchange; and (2) the Intercontinental Exchange (ICE). These exchanges have indicated in their public materials average order entry times of less than one millisecond in which trades can be electronically executed.49

The purpose of Reg AT broadly is to update the CFTC's rules on trading practices in response to the evolution from pit trading to electronic trading.50 According to the CFTC Chair Timothy Massad, the new regulation is aimed at minimizing the potential for disruptions and operational problems that may arise from automated trade order originations and executions, or malfunctioning algorithms.51 Reg AT mandates risk controls for the exchanges; large financial firms called clearing members of the exchanges; and firms that trade heavily on the exchanges for their own accounts. The rule also proposes requiring the registration of proprietary traders engaging in algorithmic trading on regulated exchanges through what is called direct electronic access.52 Direct electronic access generally refers to the practice of exchanges permitting, for a fee, certain trading customers to directly enter trades into the exchange's electronic trade matching system (rather than routing such trades through a broker). The apparent goal of Reg AT is to enhance CFTC oversight of such automated trading activities.

Regulation AT is part of a series of recent measures undertaken by the CFTC in response to ATS' growth and particularly financial regulators' concerns regarding the impact of such systems on market volatility and market fragility. These concerns, for instance, came about from incidents such as the extreme volatility of October 15, 2014, in the U.S. Treasury securities and futures markets.53 In the report on this incident and in other recent regulations, the CFTC and other regulators have expressed the view that automated trading may have caused or exacerbated market disruptions particularly in times of market stress and should thus be subject to some greater level of regulation. The CFTC has also implemented rules concerning its authority to prohibit manipulative and deceptive devices and price manipulation, codified at 17 CFR 180.1 and 180.2.

The majority of academic research and stated policy concerns over HFT in securities and derivatives have focused on whether it increases market volatility and diminishes trading liquidity.54 In Reg AT, for instance, the CFTC lists a number of policy concerns regarding risks from automated trading, such as

- operational risks, ranging from malfunctioning to incorrectly deployed algorithms reacting to inaccurate or unexpected data;

- market liquidity risks, stemming from abrupt changes in trading strategies even if a firm executes its trading strategy perfectly;

- risks that automated trading can provide new tools to engage in unlawful conduct (such as spoofing, discussed further below);

- market shocks risks , stemming from erroneous orders impacting multiple markets;

- the risk that, as more firms gain direct access to trading platforms, trades may not be subject to sufficient settlement risk mitigation; and

- the risk that increased speed of trade execution may make critical risk mitigation devices less effective.55

On the positive side, some research has found that HFT and automated trading can create a more efficient marketplace, by reducing bid-ask spreads56 (i.e., the spread or differential between the offered buying and selling prices) thereby lowering trading costs.57 Another study of HFT in the equities markets found that such activity lowers short-term volatility and has a positive effect on market liquidity, as well as narrowing bid-ask spreads.58

FINRA Registration for High-Frequency Securities Traders

On the securities front, in 2015, the SEC took steps toward a registration requirement for certain HFT broker-dealers, which requires them to register with the Financial Industry Regulatory Authority (FINRA). FINRA is a self-regulatory organization created after the merger of the National Association of Securities Dealers and the New York Stock Exchange's regulation committee, which acts as the front-line regulator for broker-dealers. The SEC has regulatory oversight of FINRA, and most broker-dealers must register with it. Among other things, FINRA's registrants are subject to examinations, various disclosure requirements, and rules governing various aspects of their conduct.

Under an existing SEC regulatory rule, Rule 15b9-1 of the Securities Exchange Act of 1934,59 many high-frequency traders who trade on other exchanges using a third-party broker-dealer, or trade on alternative trading systems, may be exempt from FINRA registration. In March 2015, the SEC voted for a proposal to limit this exemption so that previously exempt HFT broker-dealers would become subject to FINRA regulatory oversight as FINRA-registered entities. The SEC said that the regulatory change "would enhance regulatory oversight of active proprietary trading firms, such as high frequency traders."60 SEC Commissioner Luis Aguilar predicted that when the proposals become finalized they "will ensure that these [high frequency traders] can be held responsible for any potential misconduct."61

Recent SEC Enforcement Actions in HFT

The SEC recently brought enforcement actions involving HFT against several firms, including Barclays, Credit Suisse, Athena Capital Research, and Briargate Trading.

Barclays and Credit Suisse. In January 2016, Barclays Plc and Credit Suisse each settled allegations with the New York attorney general (NYAG) and the SEC that they had misled their investors in managing their private trading platforms known as dark pools.62 As part of its settlement, Barclays agreed to pay $70 million, to be evenly divided between the NYAG and the SEC. Specifically, Barclays was alleged to have made client misrepresentations on how it monitored its HFT dark pools.63 Separately, Credit Suisse agreed to settle its charges by paying a $30 million penalty to the SEC, a $30 million penalty to the NYAG, and $24.3 million in disgorgement and prejudgment interest to the SEC for a total of $84.3 million.64 The SEC charged that Credit Suisse failed to operate its dark pool and alternate trading systems as advertised.

Athena. In October 2014, the SEC reached a $1 million settlement with Athena Capital Research LLC, a HFT trader, which was charged with employing $40 million to rig prices of various stocks in 2009. Athena was charged with manipulating shares of Nasdaq-listed stocks, which weakened the exchange's end-of-day procedures for reducing stock price volatility, according to the SEC. More specifically, the agency charged that Athena "placed a large number of aggressive, rapid-fire trades in the final two seconds of almost every trading day during a six-month period to manipulate the closing prices of thousands of Nasdaq-listed stocks." 65 It did so through an algorithm that was code-named Gravy to engage in this practice known as marking the close in which stocks are bought or sold near the close of trading to affect the closing price.66

Briargate. In October 2015, the SEC reached a $1 million settlement with Briargate Trading LLP and co-founder Eric Oscher. Between October 2011 and September 2012, Briargate was charged with orchestrating a scheme that involved placing sham trades called spoof orders for the purpose of creating "the false appearance of interest in [New York Stock Exchange] stocks" to manipulate their prices.67 After it entered spoof orders, Briargate's trading protocol reportedly placed bona fide orders on the opposite side of the market for the same stocks, taking advantage of the artificially inflated or depressed prices—then immediately after the bona fide orders were executed, it canceled the spoof orders.68

Congressional Interest

The 114th Congress has seen the introduction of some legislation potentially impacting HFT and has held hearings touching on the subject of HFT practices and regulation as part of congressional oversight authority over the SEC and the CFTC.

Legislative Proposals

Although no legislation has been introduced in the 114th Congress directly impacting the regulation or oversight of HFT, several bills have been introduced imposing a tax on a broad array of financial transactions involving securities and derivatives. These include S. 1371, S. 1373, and H.R. 1464, which would each impose a tax rate that varies depending on the underlying security. Specifically, the bills would subject transactions involving stocks and interests in partnerships and trusts to a 50 basis-point-tax (0.5%), transactions involving bonds and other forms of debt (other than tax-exempt state and local bonds, and bonds with a maturity of less than 60 days) to a 10 basis-point-tax (0.10%), and derivative transactions to a half basis-point-tax (0.005%).69 It is unclear, however, if these proposals would have an impact on certain HFT strategies that involve issuing and then canceling a large volume of bid orders (strategies related to spoofing). This is because the bills impose "a tax on the transfer of ownership in each covered transaction with respect to any security."70 In HFT cases, such as spoofing, where no transfer of ownership actually occurs because bids are canceled prior to any ownership transfer, the proposal potentially might not apply.

In the 113th Congress, congressional interest in HFT was also reflected in legislation that would levy securities transaction taxes on securities trades, presumably raising the cost and thus reducing the incidence of conducting HFT, and there was also one bill aimed specifically at regulating certain HFT practices. In the 113th Congress, S. 410, H.R. 880, and H.R. 1579 would have levied taxes on various financial trades, including trades conducted by high-frequency traders. H.R. 2292 would have required the CFTC to provide a regulatory definition of HFT in the derivatives markets that the agency oversees. It would also have required high-frequency traders in derivatives to register with the CFTC, submit semiannual reports to the agency, and conform to business conduct requirements that the CFTC might issue. H.R. 2292 would also have granted the CFTC the authority to impose civil penalties under the Commodity Exchange Act for violations of a HFT regulation. The amount of the fine would have been based on the duration of the violation.

Hearings: SEC Division Head Outlines Potential Changes in 2016

A number of committee and subcommittee hearings in the 114th and 113th Congresses have touched on the subject of HFT as part of congressional oversight authority over the SEC and the CFTC.71 In the 114th Congress, a March 3, 2016 subcommittee hearing of the Senate Banking Committee discussed a number of issues related to the topic.72 In the hearing, Subcommittee Chair Senator Crapo and Subcommittee Ranking Member Senator Warner expressed concerns about increased market speed, complexity, and potential market fragility as a result of increased automated trading. They pressed the SEC's Division of Trading & Markets director, Stephen Luparello, and the chairman and CEO of FINRA,73 Richard Ketchum to speed up implementation of a number of pilot programs and proposals the SEC and FINRA have discussed for several years.74 These include implementation of a consolidated audit trail (CAT) aimed at improving surveillance and supervision of trading, including automated trading, and a possible pilot program aimed at temporarily eliminating rebates or inducements to brokers for routing client orders.

In his March 3, 2016 testimony, SEC's Luparello noted that his division was examining introducing greater transparency into the disclosures by brokers regarding how they decide to route institutional customers' orders, to improve the "best execution" of institutional investors' trades.75 He also said SEC staff was working on a recommendation for the SEC to strengthen recordkeeping requirements for algorithmic trading so that key elements of the algorithm itself would be encompassed, as well as a record or orders generated by the algorithm.76 In addition, Luparello said SEC staff was developing a recommendation for the SEC to consider addressing the use of aggressive, destabilizing trading strategies that could exacerbate price volatility.77 He noted that the SEC staff was also developing a recommendation for the SEC to consider in 2016 that would subject certain active proprietary traders not registered as broker-dealers to rules surrounding broker-dealers by the SEC and by self-regulatory organizations.78

In addition to the March 3, 2016 hearing, which dealt more explicitly with issues related to high frequency trading in securities, the Senate Agriculture, Nutrition and Forestry Committee also held a hearing May 14, 2015, on the CFTC and market liquidity, which discussed HFT.79 A number of additional hearings in the 114th Congress for oversight of the SEC and CFTC also touched upon HFT issues as part of a broader review of these agencies' missions and accomplishments.80